Four months ago, a total of 179 decentralized autonomous organizations (DAOs) boasted treasuries exceeding $1 million or more each. As of today, this figure has climbed to 211 distinct DAOs meeting the same criteria. Furthermore, since Nov. 1, 2023, the collective value of DAO treasuries has expanded by more than $20 billion across a period […]

Four months ago, a total of 179 decentralized autonomous organizations (DAOs) boasted treasuries exceeding $1 million or more each. As of today, this figure has climbed to 211 distinct DAOs meeting the same criteria. Furthermore, since Nov. 1, 2023, the collective value of DAO treasuries has expanded by more than $20 billion across a period […]

Source link

Boom

The business of tires has historically been marked by tight competition, low growth and slow margins.

The total market value has remained around $50 billion in the past few years, and the overall market grows at a rate of about 2% per year, according to consultancy AlixPartners.

But electric vehicles are presenting a whole new set of opportunities.

With their heavy weight and quick acceleration, EVs tend to burn through tires about 20% faster than internal combustion vehicles do, according to AlixPartners. And the tires cost about 50% more.

Other technical challenges include dampening tire noise, which is a lot more noticeable in the cabin of an otherwise silent EV, and improving an EV’s range. Michelin research shows tire selection can impact an EV’s range by 10% to 15%.

The extent to which tire companies are able to distinguish themselves as innovators in these areas could determine whether, or how often, customers ask for their products by name. Currently only about half of buyers do, according to Northcoast Research estimates.

“If EV does kind of evolve and proliferate through the car population like some think, it may bring about what I call the gold rush for tire manufacturers,” said John Healy, an analyst with Northcoast Research.

Watch the video to learn more.

Quick Take

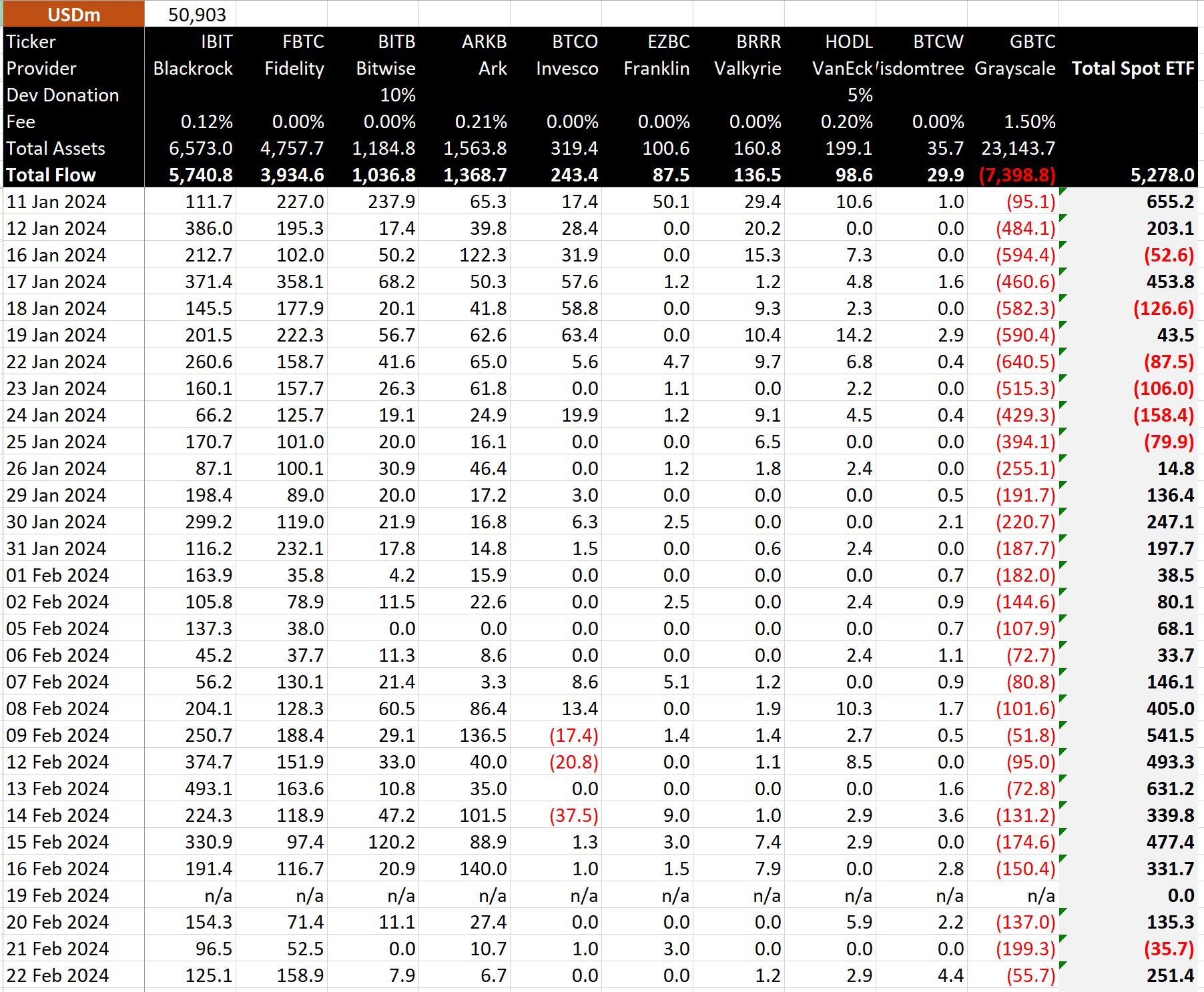

The landscape of Bitcoin ETFs witnessed significant activity on Feb. 22, according to BitMEX data, with a robust inflow of $251 million, the equivalent of 4,900 BTC.

BitMEX data shows that the spotlight was on Fidelity’s FBTC ETF, which reported a substantial inflow of $159 million, pushing its total inflows to the $4 billion mark. BlackRock’s IBIT was not far behind, absorbing $125 million to bring its total net inflow to an impressive $5.7 billion.

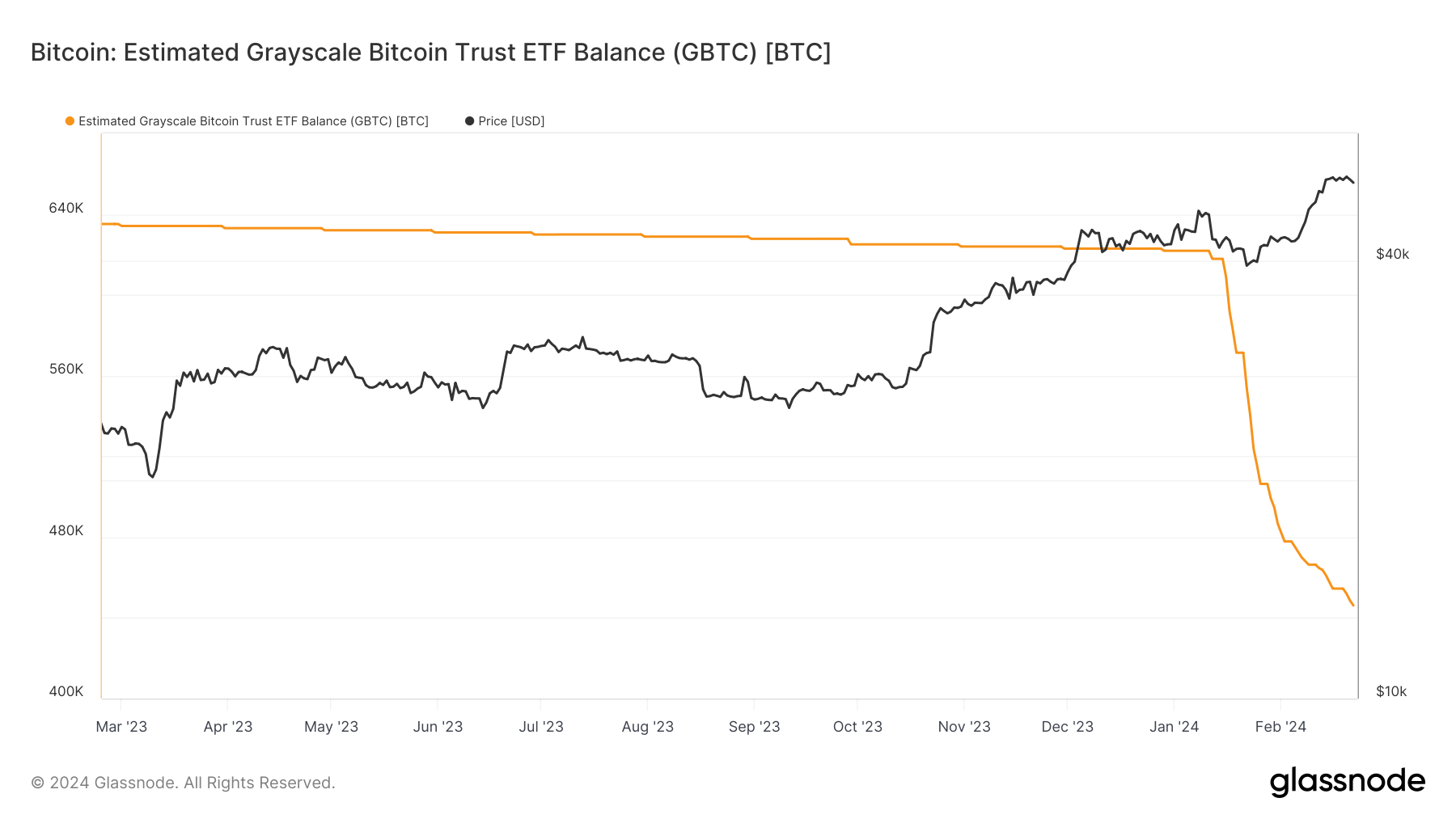

As BitMEX reported, on the opposite side of the spectrum, GBTC experienced more outflows, but they were subdued. The ETF recorded a $56 million outflow, albeit less than the $199 million outflow observed the previous day, Feb. 21; with an aggregate outflow of $7.4 billion to date, GBTC has witnessed a 33% departure from their total Bitcoin holdings, since the Bitcoin ETFs’ commencement on Jan. 11, according to Glassnode.

This surge reaffirmed the overall strength of the Bitcoin ETF market, taking the total net inflow for all Bitcoin ETFs to $5.3 billion, or the equivalent of 110k Bitcoin.

The post Fidelity’s FBTC ETF hits $4 billion mark amid Bitcoin ETF boom appeared first on CryptoSlate.

Jensen Huang, CEO of Nvidia, arrives for the Inaugural AI Insight Forum in the Russell Building on Capitol Hill on Sept. 13, 2023.

Tom Williams | CQ-Roll Call, Inc. | Getty Images

Nvidia surpassed Amazon in market capitalization on Tuesday. It’s a sign of strong demand for semiconductors that run cutting-edge artificial intelligence and the investor appetite for the companies that make the chips.

Nvidia closed at $721.28 per share, giving it a market value of $1.78 trillion to Amazon’s $1.75 trillion market cap. While Nvidia also briefly passed Amazon on Monday, this is the first since 2002 that Nvidia is worth more after the market close.

Nvidia’s main products in 2002 were graphics cards for gaming PCs. But Nvidia shares are up over 246% in the last 12 months on robust demand for its server AI chips that can cost more than $20,000 each. Companies such as Microsoft, OpenAI and Meta need tens of thousands of them to run products such as ChatGPT and Copilot.

Amazon isn’t slowing down, either. The company reported better-than-expected quarterly earnings Feb. 1 that showed it successfully reined in expenses after laying off 27,000 employees. Amazon shares are up about 78% in the past 12 months. Still, it shows there’s an ongoing shuffle among the world’s most valuable companies.

In January, for example, Microsoft surpassed Apple to become the most valuable U.S. company by market capitalization, largely on the strength of its cloud partnership with OpenAI and new AI features in Windows and Office.

Nvidia reports quarterly earnings Feb. 21. Analysts expect 118% annual growth in sales to $59.04 billion.

Don’t miss these stories from CNBC PRO:

Michael van de Poppe, a prominent crypto analyst, recently outlined three key factors that could herald a bullish phase for Ethereum, the second-largest crypto by market capitalization. One crucial factor he identifies is Bitcoin’s current behavior.

The analyst pointed out that as the market leader, Bitcoin’s recent signs of bottoming out tend to precede altcoin rallies, hinting at a potential upswing for Ethereum. Moreover, Van de Poppe highlights the growing anticipation surrounding spot Ethereum exchange-traded funds (ETFs).

According to Van de Poppe, the increasing buzz about these spot ETFs is a significant catalyst that could drive Ethereum’s value over the coming weeks.

Additionally, Ethereum is on the cusp of rolling out critical network upgrades. These updates, aimed at reducing transaction costs by up to 90%, are expected to improve the network’s efficiency and scalability significantly.

The momentum towards $ETH is probably going to come in the next few weeks.

Arguments:

– #Bitcoin bottoming out is a trigger for altcoins to make a new run.

– Ethereum Spot ETF hype.

– Ethereum launching new upgrades to reduce 90% of the costs. pic.twitter.com/N8bDi52F8M— Michaël van de Poppe (@CryptoMichNL) January 25, 2024

Latest Update On Ethereum Deacon Upgrade

Regarding updates, Ethereum’s development team is making strides with the upcoming Dencun upgrade, a significant “hard fork” that aims to enhance the blockchain’s efficiency.

Tim Beiko, a core Ethereum developer, updated the community earlier today on the progress. Dencun, which incorporates “proto-danksharding,” is set to reduce transaction costs on layer 2 solutions, making Ethereum more accessible and affordable for users.

According to the developer, the upgrade is scheduled to activate on the Sepolia testnet on January 30 and the Holesky testnet on February 7, with mainnet implementation following if these tests succeed.

More testnet blobs on the way .oO

Dencun will activate on Sepolia Jan 30, and on Holesky Feb 7. If running a node on either network, now’s the time to update it!

Assuming both of these go smoothly, mainnet is next ✅

— timbeiko.eth ☀️ (@TimBeiko) January 25, 2024

Brighter Future Ahead

Despite these positive developments, Ethereum’s market performance mirrors the overall bearish sentiment in the crypto market, led by Bitcoin. ETH has seen a 13.7% decline in the past week, currently trading at $2,216.

However, analysts like Van de Poppe urge caution, particularly regarding the impact of the Bitcoin spot ETF. While there may be short-term selling pressure, Van de Poppe remains optimistic about the long-term prospects.

The analyst suggests that the influx of new capital from diverse market participants could propel Bitcoin, and by extension, Ethereum, to new heights.

The markets need to be more accurate with the impact of the ETF.

There’s some selling pressure in the short term, but in the long term, a massive amount of new money flows into the markets from new participants.

As a result, #Bitcoin might push higher this cycle than we think.

— Michaël van de Poppe (@CryptoMichNL) January 25, 2024

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Nvidia earnings: What to expect from the chip maker riding the AI boom

No company thus far has been able to capitalize on the artificial-intelligence revolution quite like Nvidia Corp., and Wall Street is once again about to see how that AI frenzy has translated into serious money.

Nvidia NVDA has stunned Wall Street with the sheer growth of its business this year and it’s set up to post more staggering numbers after the closing bell Tuesday. The company’s data-center business is expected to log a near 240% jump in revenue relative to a year earlier, while overall revenue is projected to more…

Master your money.

Subscribe to MarketWatch.

Get this article and all of MarketWatch.

Access from any device. Anywhere. Anytime.

Already a subscriber?

Log In

1 Hidden Stock That Could Benefit From the Chip Manufacturing Boom — Is It a Buy Now?

There is buzz surrounding all sorts of semiconductor businesses. The world woke up to the need for more chip manufacturing during the pandemic’s height, and governments are now pouring tens of billions of dollars into bolstering their supply chains as a result.

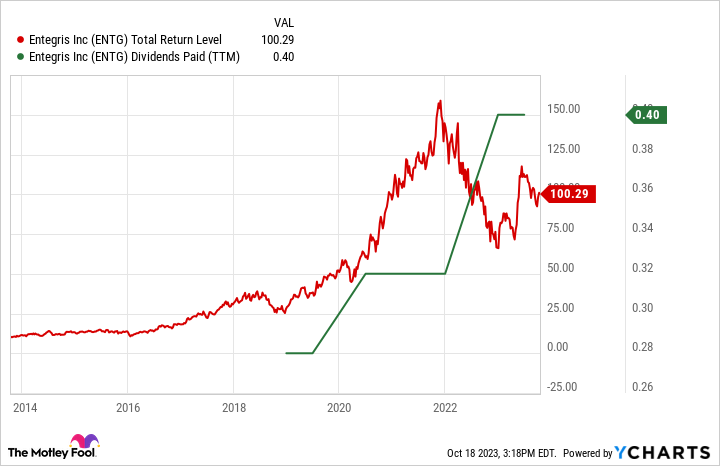

One company that could be a big beneficiary is Entegris (ENTG -1.27%), a top supplier of materials and manufacturing processes for tech — including the chip industry. Entegris is actually one of the 30 stocks in the iShares Semiconductor ETF.

The stock has been in rally mode this year. It’s up nearly 50% as of this writing as Entegris manages the integration of its big $5.7 billion acquisition of peer CMC Materials, completed the summer of 2022. Is Entegris a buy now?

Squeezing synergies from a giant chemicals specialist

Entegris’ tie-up with CMC Materials created a giant in specialty chemicals, materials, and handling (like trays and boxes for transporting silicon wafers and chips and related semiconductor equipment) for high tech.

Manufacturing chips and computing systems is a complex process involving hundreds of steps and dozens of chemicals (besides the silicon chips are made of), and with parts needing to be transported in bulk to various locations spanning multiple continents. Entegris is deeply integrated into the global supply chain.

This is just the type of diversified industrial products company that could benefit from things like the U.S. CHIPS Act, European Chips Act, and related semiconductor manufacturing funding taking place elsewhere, like Taiwan, Japan, and China.

Entegris has been a solid long-term stock, increasing more than 900% in the last 10-year stretch, and shelling out a rising dividend since initiating a quarterly payout in 2017.

Data by YCharts.

However, a key to Entegris’ long-term success going forward will be realizing synergies from its operation following the takeover of CMC.

In the last year, operating profit margins have contracted from well over 20% to at times just a single-digit percentage, and free cash flow has dipped into the red (negative $68 million in the last reported 12-month stretch). Long-term debt sat at nearly $5.5 billion, and cash and short-term investments at just $566 million, at the end of June 2023.

Such is how it often goes when big mergers and acquisitions take place.

A long-term value in the making?

The work toward paying down debt and streamlining operations is well underway. This year, Entegris offloaded multiple segments it deemed non-strategic to its focus on tech manufacturing, including the recent $700 million sale of its “electronics chemicals” business to Japan’s Fujifilm Holdings in early October. That cash will go toward paying down debt, a good thing given that the U.S. Federal Reserve is poised to keep interest rates higher for longer.

As for free cash flow, besides whittling down redundant expenses, Entegris will also be working through elevated capital expenditures as it expands into key areas in support of its chip fab partners.

For example, Entegris recently broke ground on a new manufacturing facility in Colorado Springs, Colorado. The facility is near chip company fabs and design centers operated by Analog Devices, Broadcom, Microchip Technology, and others. As that project winds down in early 2025, free cash flow should jump higher.

At this point in its transformation, it’s difficult to stick a fair value on Entegris. The stock’s valuation using trailing 12-month earnings and free cash flow isn’t meaningful, and insight into the newly merged company’s profitability in 2024 and beyond is limited.

Shares currently trade for about 27 times analysts’ expectations for 2024 earnings per share, but take that with a grain of salt. Management will need to prove it can pay down debt and boost profit margins again after full integration of CMC Materials, as well as that recent sale to Fujifilm.

For now, I’m content to watch Entegris from the sidelines while its future earnings power becomes more clear. However, the company has a solid track record of market outperformance, and could return to its long-term winning streak.

Entegris is on my watchlist as semiconductor and computing technology manufacturing gets a big boost from federal governments all over the world in the next few years.

Meta’s stock joins Apple, Microsoft and Nvidia shares in correction territory as tech-stock boom fizzles

The so-called Magnificent Seven grouping of technology stocks is looking less magnificent lately, with Meta Platforms Inc. joining several of its peers in correction territory.

Meta

META,

on Thursday followed Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

and Nvidia Corp.

NVDA,

into correction, meaning their shares have fallen at least 10% from their recent peaks. Meanwhile, Tesla Inc.’s

TSLA,

stock is in a bear market, down more than 20% from its recent high.

Read: Have AI stocks like Nvidia reached bubble territory? Here’s what history can tell us.

Only Amazon.com Inc.

AMZN,

and Alphabet Inc.

GOOG,

GOOGL,

shares remain in bull-market territory.

See also: U.S. stocks pare losses as rising bond yields weigh on ‘Magnificent 7’ stocks

The retreat in Meta shares looks like “somewhat of a mean reversion” given their strong run this year, according to Matt Stucky, senior portfolio manager for equities at Northwestern Mutual Wealth Management.

Even with recent declines, Meta’s stock is the second-best performer in the S&P 500 so far this year, up 137% during 2023.

“When the overall market pulls back, you start to see some of the winners mean-revert more aggressively,” Stucky told MarketWatch.

Apple entered correction Wednesday upon falling more than 10% from its July 31 peak of $196.45. The company sells mainly discretionary products, and right now “consumers are still being pinched” and thinking more carefully about where they spend their money, he noted.

Don’t miss: Walmart customers’ household budgets still under pressure, CEO says

Additionally, the company does about 20% of its business in China, where recent economic signals have been concerning, he added.

| Stock | Correction status | Details |

| Alphabet | Bull market | Would need to close below $119.45 to enter correction |

| Amazon | Bull market | Would need to close below $128.00 to enter correction |

| Apple | Correction | Entered correction Wednesday when it fell from its July 31 peak of $196.45. It will enter a bear market at $157.16. |

| Meta Platforms | Correction | Entered correction Thursday when it fell from its July 28 peak of $325.48. |

| Microsoft | Correction | Entered correction Aug. 9 when it fell from its July 18 peak of $359.49. Will enter bear market at $287.59. |

| Nvidia | Correction | Entered correction Aug. 9 when it fell from its July 18 peak of $474.94. Will enter a bear market at $379.95. |

| Tesla | Bear market | Entered a new bear market on Aug. 15 |

The Magnificent Seven had been beneficiaries of three key investment trends for most of 2023, according to Stucky, as the market was upbeat about easing inflation, an end to interest-rate hikes and the potential of artificial intelligence.

Investors who became less worried “about the Fed continuing to hike rates into oblivion” wanted quality companies that were growing, protecting margins and delivering good shareholder returns, even if their stocks carried richer multiples, Stucky said. However, it’s a “normal function of markets to ebb and flow” when sentiment is elevated, as it was in July.

The declines in Big Tech names mirror weakness in the sector more broadly after a sharp run-up to start the year. As of late July, the Nasdaq-100

NDX

was trading 26% above its 200-day moving average — “a statistical extreme,” according to CFRA chief investment strategist Sam Stovall.

Tech stocks were “like an army that had gotten well ahead of its supply lines,” he told MarketWatch. In that scenario, an army “has to either retreat or let supplies catch up.”

The current quarter is the most challenging of the year, Stovall said, and August is one of the most challenging months. In addition, there is uneasiness on Wall Street as investors wait to see what the Federal Reserve will do with interest rates.

“There’s so much uncertainty as it relates to interest rates with yields on the 10-year note continually climbing,” Stovall said. “Investors are saying it’s time to take profits, and the greatest profits were seen in tech.”

There could be more room to fall for tech stocks on the whole, according to Stovall. While the S&P 500

SPX

may not drop 10% from its recent peak, the Nasdaq

COMP

could see a “fairly mild correction” as this period of seasonal weakness continues through the end of September.

Still, he sees some encouraging signs in a hawkish-leaning Fed, which could raise rates in September but make that hike the last for this cycle.

“That would set us up quite nicely for a typically favorable fourth quarter,” Stovall said.

Sui network’s persistent growth propelled it into the league of the top 100 cryptocurrencies by market capitalization, but the value of the SUI token has been on a downward trajectory. Sustaining this heightened market position presents difficulties, as demonstrated by the recent performance of the Sui token’s value.

Sui token is currently priced at $0.591478, according to CoinGecko, with a 0.3% drop in the past 24 hours and a 6.0% decrease over the past seven days.

The Sui network experienced a big surge, reaching unprecedented heights before undergoing a sharp decline recently. Have other indicators and the token’s valuation borne the impact of this plunge?

Sui Network’s Transaction Surge And Diverging Trends

A recent report indicates an interesting pattern in the Sui network’s daily transaction block numbers, which commenced in early July. Starting at around 200,000, the transaction count surged to 500,000 and dramatically jumped to over 6 million within a day.

This peak brought the total transactions to an impressive 65.8 million, accompanied by an all-time high for the platform and its blockchain.

SUI is currently trading at $0.59 according to the daily chart on TradingView.com

However, the excitement was short-lived as the transaction count quickly settled at approximately 720,000. Interestingly, the network’s activity volume showed a minor decline, stabilizing at about $2 million.

The Total Value Locked (TVL) took a different trajectory. Despite the transaction surge, the TVL demonstrated a subtle upward trend, currently at around $14 million, according to DefiLlama.

Assessing Sui Token’s Stability And Prospects

The Volatility Gauge evaluates recent trends, allowing it to form a score that reflects the current market dynamics rather than being skewed by isolated fluctuations. This methodology provides a more comprehensive understanding of the token’s price behavior.

SUI total value locked. Source: Defillama

As noted in a separate analysis, the SUI token demonstrates a moderate level of volatility. A low score on the Risk/Reward Gauge complements this average volatility.

This pairing indicates that while the token experiences moderate price swings, it is also safeguarded against undue price manipulation. This confluence of factors presents a balanced perspective on the token’s risk and potential rewards.

Related Reading: Shiba Inu Price Poised To Reach $0.01 With Shibarium Upgrade, These CEOs Say

Looking ahead, the Sui token’s price is favorably poised. The support level is thoughtfully established at $0.568754, which signifies a point where downward pressure could find a halt.

On the other hand, the resistance level is strategically set at $0.606822, indicating the end at which selling pressure might increase.

This positioning offers Sui token an advantageous space to navigate before encountering significant selling pressures. It suggests that the token has room to flourish within this range, indicating a positive trajectory soon.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Ethereum World News