Costco saw a 9.4% sales boost the five weeks through April 7, driven by a surge in e-commerce activity. .

Source link

boosts

Binance just announced the listing of Dogwifhat (WIF), the Solana-based coin climbing up in the memecoins ranking. The price of the dog-themed coin positively reacted to the announcement news and reached a new all-time high.

WIF Now Trading On Binance

Today, Binance announced the highly anticipated listing of Dogwifhat. WIF has been experiencing a crazy bull run the past few weeks that has catapulted the coin even higher after the memecoin frenzy that started over the weekend.

The hat stays on, on #Binance$WIF will be live for trading at 14:00 UTC.

🐕 🧢

— Binance (@binance) March 5, 2024

The largest crypto exchange revealed that the listing and open trading of the supported Spot Trading Pairs would occur today at 14:00 (UTC). Additionally, withdrawals will be available on March 6 at 14:00 (UTC).

According to the announcement, the new Spot Trading Pairs available on Binance are WIF/BTC, WIF/USDT, WIF/FDUSD, and WIF/TRY.

The exchange warned users about the “higher than normal risk” of WIF’s price volatility. Due to its relatively new token status, it suggested that investors do their research before deciding to trade the token.

Moreover, Binance announced that the Seed Tag will be applied to WIF. This tag labels the coin as an “innovative project that might exhibit higher volatility and risks than other listed tokens.”

As a result of the Seed Tag, users will need to pass the corresponding quizzes every 90 days on the Binance Spot and Binance Margin platforms to gain trading access to WIF. The quizzes, as the Binance support page reads, are set up to ensure the user’s awareness of the risks of a token before trading it.

The Hat Stays On

Dogwifhat has gone on a “turbo parabolic” rally since late February. This rally has gained the dog-themed coin traditional media acknowledgment.

Recently, a Bloomberg host name dropped WIF, alongside PEPE, when discussing whether the “era of the memecoin is back” on live TV.

Undoubtedly, WIF’s performance has been notable after the memecoin market pullback from a few weeks ago, when WIF was experiencing a 30% price decrease in the 7-day timeframe.

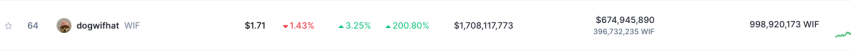

At the time, Dogwifhat was the 196th largest cryptocurrency by market cap, according to CoinGecko data. After investors wore several hats, the memecoin climbed to 64th in two weeks.

Dogwifhat ranks 64th among all cryptocurrencies. Source: CoinMarketCap

Following the announcement, WIF’s price of $1.51 skyrocketed to a new all-time high of $1.90. This price increase represented a 25.8% surge in an hour.

Consequentially, the market activity for the dog-themed coin increased 81.17% in the last 24 hours, with a trading volume of $657.2 million, according to CoinMarketCap Data.

At the time of writing, Dogwifhat has seen an 8.2% price drop from its new ATH mark in the past hour. With a market capitalization of $1.7 billion, 2.2% down from the day prior, WIF is the fifth largest memecoin by this metric. The current price of $1.74 still represents a 2% gain in a 24-hour timeframe.

WIF is trading at $1.7 in the hourly chart. Source: WIFUSDT on TradingView.com

Featured image from X.com, Chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin ETFs Boosts Coinbase (COIN) Shares As JPMorgan Upgrades Rating

The recent Bitcoin rally, propelling its price to the $52,000 level, has positively impacted the stock of US-based cryptocurrency exchange Coinbase (COIN). After experiencing a notable dip to $115 at the start of February, Coinbase’s stock rose to $172 on Thursday, following a significant upgrade by a JPMorgan analyst.

Improved Prospects For Coinbase Amid Crypto Rally

According to a Bloomberg report, JPMorgan analyst Kenneth Worthington abandoned his bearish view on Coinbase weeks after downgrading the stock.

As Bitcoin traded higher, Coinbase shares gained as much as 7.8% following the upgrade. Worthington believes the exchange will likely benefit from the recent rally in digital asset prices, prompting him to shift his rating back to neutral.

This change in stance comes after Worthington’s January downgrade, where he predicted a potential deflation of enthusiasm for Bitcoin exchange-traded funds (ETFs).

However, contrary to his previous forecast, Bitcoin ETFs have been successful in terms of trading measures, and the price of Bitcoin has surged beyond $52,000, reaching its highest level since 2021. In a note to clients on Thursday, Worthington explained:

Given the acceleration in recent days of flows into Bitcoin ETFs and the significant price appreciation of Bitcoin and now Ethereum, we are returning to a Neutral rating on Coinbase as we see the higher cryptocurrency prices not only sustaining but improving activity levels and Coinbase’s earnings power as we look to 1Q24.

Coinbase’s stock experienced an 8% dip at the beginning of the year, following an impressive 400% surge in 2023. Analyst opinions on the stock remain divided, with buy, hold, and sell recommendations being roughly evenly split.

Worthington maintained his $80 price target on the stock ahead of the company’s earnings report, which is scheduled to be released after the market closes on Thursday.

Worthington emphasized that Coinbase’s business is closely tied to token prices, with its core revenue being transaction-based. As the value of tokens increases and trading activity gains momentum, fees based on the value traded are expected to drive higher trading volumes, ultimately contributing to improved revenue for Coinbase.

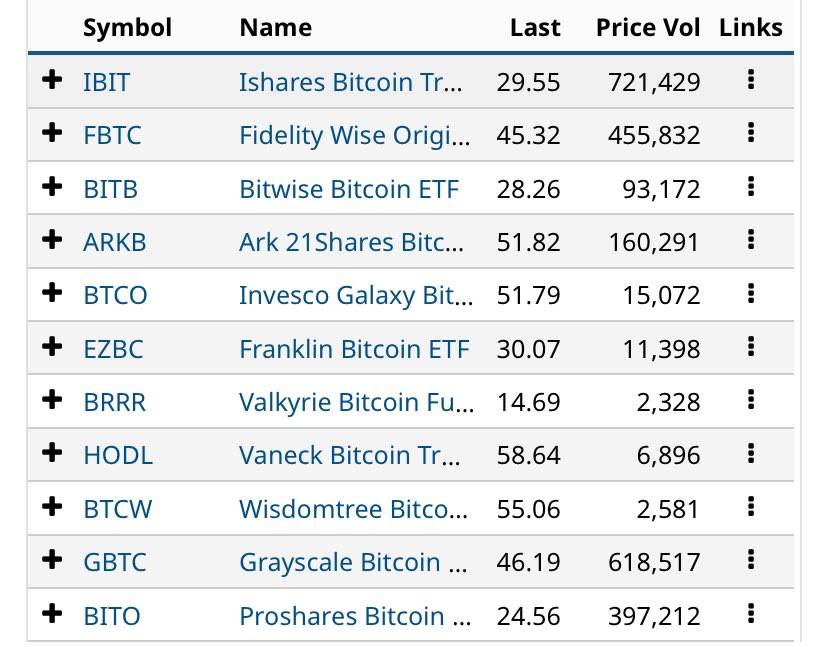

Bitcoin ETFs Witness Significant Trading Volume

On February 14th, the trading volume of Bitcoin ETFs showcased notable figures, with Blackrock’s IBIT recording the lead with $721 million in volume.

Grayscale’s Bitcoin Trust (GBTC) followed closely with $619 million, while Fidelity’s FBTC secured the third spot with $456 million. On the other hand, Ark Invest accumulated a volume of $169 million.

The nine ETFs’ total trading volume amounted to approximately $1.5 billion. Notably, the largest ETFs experienced higher trading volume than the previous day, with IBIT surpassing $700 million and GBTC exceeding $600 million.

Intriguingly, before the trading session, GBTC sent less than half of the Bitcoin it sent to Coinbase the previous day. Despite this decrease, GBTC’s total trading volume was 50% higher.

As the demand for Bitcoin continues to surge, ETFs play a crucial role in facilitating institutional and retail investors’ participation in the cryptocurrency market. The increased trading volume of Bitcoin ETFs highlights investors’ growing interest and confidence in digital assets.

Currently, Bitcoin is trading at $51,900 and encountering a critical resistance level at $52,000.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Web3 developer Thirdweb boosts bounty to $50,000 in light of fresh smart contract security risks

Thirdweb, a Web3 software development kit (SDK) provider, confirmed the presence of a security vulnerability in a widely used open-source library, impacting numerous Web3 smart contracts, according to a Dec. 4 statement on social media platform X (formerly Twitter).

The firm stated that the vulnerability was initially identified on Nov. 20 and impacted a variety of smart contracts across the web3 ecosystem, including some of its pre-built smart contracts.

However, it clarified that the vulnerability has yet to be exploited and refrained from disclosing the open-source library to prevent potential exploitation. The firm wrote:

“Based on our investigation so far, this vulnerability has not been exploited in any thirdweb smart contracts. However, smart contract owners must take mitigation steps on certain pre-built smart contracts that were created on thirdweb prior to November 22nd, 2023 at 7pm PT.”

Affected smart contracts

Thirdweb identified 13 affected smart contracts, including AirdropERC20, ERC721, ERC1155, and others, impacted by the vulnerability.

Smart contract owners are advised to take proactive mitigation steps to prevent exploitation. Additionally, Thirdweb assured ongoing efforts with security partners to develop tools for easy identification and execution of necessary mitigation measures.

Depending on the contract’s nature, these steps might involve contract locking, snapshot creation, and migration to a new contract. Additionally, users of these contracts are encouraged to revoke approvals on all Thirdweb contracts.

Thirdweb is also increasing the bounty rewards for its platform to $50,000 and is implementing a more rigorous auditing process.

Meanwhile, 0xngmi, the pseudonymous developer of DeFillama, urged the community to revoke their approvals to thirdweb contracts because people might have interacted with them without knowing as they are white-labeled.

NFT projects respond

Several NFT projects, including OpenSea, have responded to concerns raised by the vulnerability.

OpenSea confirmed discussions with Thirdweb regarding security concerns in specific NFT collections. The NFT platform hinted at forthcoming support for affected collection owners and anticipated changes related to contract migration on their platform.

Some NFT collections like CoolCats and ApesRare have reassured their holders they are not affected by these vulnerabilities.

However, Thirdweb’s disclosure approach has received criticism within the community.

Bitcoin (BTC) ranged around the key $26,800 mark for a second day on Oct. 13 with a decision due in United States regulators’ battle with crypto investment giant Grayscale.

Bitcoin lurks between major liquidity clouds

Data from Cointelegraph Markets Pro and TradingView confirmed that the BTC price barely changed from the day prior, acting in a narrow corridor.

Bitcoin market analysts weighed potential catalysts, among these the U.S. Securities and Exchange Commission (SEC) choosing whether or not to appeal a court ruling over its refusal to allow a Bitcoin spot exchange-traded fund (ETF).

“Today is an important day with the SEC Appeal on the Grayscale ruling,” Michaël van de Poppe, founder and CEO of MN Trading, wrote in part of an X (formerly Twitter) post.

“If nothing happens, we might be seeing a case where Bitcoin reverses upwards in the coming weeks. I’m positioned long.”

Macro data prints were due to take a break following a series of releases throughout the week, which all showed inflation more persistent than market expectations had predicted.

Summarizing possible BTC price trajectory from here, popular trader and analyst Credible Crypto saw cause for modest optimism.

“We have a very clear and seemingly controlled ‘stairstep’ down on price here. Clear low timeframe breakdowns, retests, and continuation,” he explained alongside a chart.

“We are leaving behind equal lows right below us, so ideally I’d like to see these cleaned up before a reversal. Considering we have bids stacked above and below us, a push to the local highs into asks followed by a rejection and sweep of our lows into the waiting bids and local demand seems like the perfect way to form a reversal here. Let’s see how things develop.”

Fellow trader Daan Crypto Trades noted BTC/USD moving within a zone between two liquidity clouds, with a reaction more likely should the spot price reach either one.

#Bitcoin Liquidation Map

Big zones at $26.5K & $27K. Would expect some sort of ssqueeze to occur at those areas. pic.twitter.com/VW6YYPkMe4

— Daan Crypto Trades (@DaanCrypto) October 13, 2023

Trader and analyst Rekt Capital meanwhile placed a target of $25,000 on Bitcoin should bulls fail to reclaim exponential moving averages (EMAs) lost through the week.

Needs to reclaim at least one of these EMAs as support to avoid a drop into the $25k-$26k area$BTC #Crypto #Bitcoin pic.twitter.com/ywRkdM07uw

— Rekt Capital (@rektcapital) October 12, 2023

GBTC claws back more lost ground

Ahead of the appeal deadline, Grayscale’s flagship investment fund, the Grayscale Bitcoin Trust (GBTC), continued to outperform.

Related: Did SBF really use FTX traders’ Bitcoin to keep BTC price under $20K?

The focus of the legal proceedings, GBTC will end up as a spot ETF, Grayscale has said, with an early victory for the firm seeing its fortunes turn around through Q2.

On Oct. 11, GBTC hit its smallest discount to net asset value — the Bitcoin spot price — since December 2021.

The discount, technically a negative premium, reached -16.44% before dipping slightly lower, per data from monitoring resource CoinGlass.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

In a strategic move to bolster its European expansion, cryptocurrency exchange Kraken has announced its intention to acquire Coin Meester B.V. (BCM), a Netherlands-based digital asset broker. The planned acquisition follows the recent implementation of the European Union’s Markets in Crypto-Assets (MiCA) regulatory framework, which governs the operations of crypto exchanges in the region, including […]

In a strategic move to bolster its European expansion, cryptocurrency exchange Kraken has announced its intention to acquire Coin Meester B.V. (BCM), a Netherlands-based digital asset broker. The planned acquisition follows the recent implementation of the European Union’s Markets in Crypto-Assets (MiCA) regulatory framework, which governs the operations of crypto exchanges in the region, including the Dutch market.

Kraken’s Commitment to European Growth

In a blog post dated October 5, the United States-based exchange stated that the planned acquisition is a testament to its commitment to expanding its footprint across the European market. The company aims to leverage its robust financial position and highly competitive product offerings to achieve this goal.

While the financial specifics of the acquisition remain undisclosed, Kraken has already secured virtual asset service provider (VASP) licenses to operate in other European regions, including Ireland, Italy, and Spain. The company has also expressed its active pursuit of operational licenses from other European jurisdictions.

Establishing a Strong Presence in the Dutch Market

Kraken’s CEO, David Ripley, attributed the decision to expand into the Netherlands to the country’s thriving economy, high crypto adoption rate, and culture of innovation.

“This makes it a key market for us in our European expansion plans. The acquisition of BCM will give Kraken a sizable position in the Dutch market and will allow BCM’s clients to benefit from an even more robust product offering,” said Kraken CEO.

Ripley further emphasized that acquiring the crypto brokerage firm BCM would give Kraken a significant presence in the Dutch market and grant BCM’s customers access to various product offerings.

BCM’s co-founder and CEO, Mitchell Zandwijken, highlighted the company’s mission of making cryptocurrencies accessible to all. He noted that this acquisition would enable BCM’s customers to benefit from the extensive range of crypto options available on Kraken.

“We founded BCM because we wanted to make crypto accessible to everyone. Kraken is the pioneer in this field with a track record spanning well over a decade, making it the perfect steward for our business going forward. Our clients will benefit from all that crypto offers through Kraken’s continuous investment and innovation.”

Kraken Steps into the Netherlands as Binance and Gemini Depart

Kraken’s expansion into the Netherlands comes following the exit of two other prominent crypto exchanges from the market due to mounting regulatory pressure.

In September, Gemini, a leading digital asset trading platform founded by Cameron and Tyler Winklevoss, announced its withdrawal from the Netherlands. The company cited regulatory requirements imposed by the country’s central bank as the primary reason for its exit, urging Dutch users to withdraw their assets or transfer them to alternative wallets before November 17, 2023.

Another rival exchange, Binance, departed the Netherlands in June after its application for registration under the Dutch crypto authorization regime was rejected. Binance attributed its departure to its inability to obtain registration as a virtual asset service provider (VASP) with the Dutch regulator.

Nevertheless, both Binance and Gemini have expressed their intentions to re-enter the Dutch market in compliance with the new regulatory guidelines outlined in the MiCA regulation.

next

Blockchain News, Cryptocurrency News, News

Chimamanda is a crypto enthusiast and experienced writer focusing on the dynamic world of cryptocurrencies. She joined the industry in 2019 and has since developed an interest in the emerging economy. She combines her passion for blockchain technology with her love for travel and food, bringing a fresh and engaging perspective to her work.

You have successfully joined our subscriber list.

Roku Inc. plans to lay off 10% of its staff as it looks to slow the growth of its operating expenses, the company said Wednesday.

The streaming-media company had about 3,600 employees as of the end of 2022, according to its most recent annual filing. Roku announced prior plans to lay off 200 workers back in March.

Roku ROKU expects to take…