Carnival Corp.’s stock dropped Wednesday after the cruise operator reported an narrower-than-expected fiscal first-quarter loss but also provided an estimate for what the collapse of the Francis Scott Key Bridge in Baltimore would cost it this year.

Source link

bridge

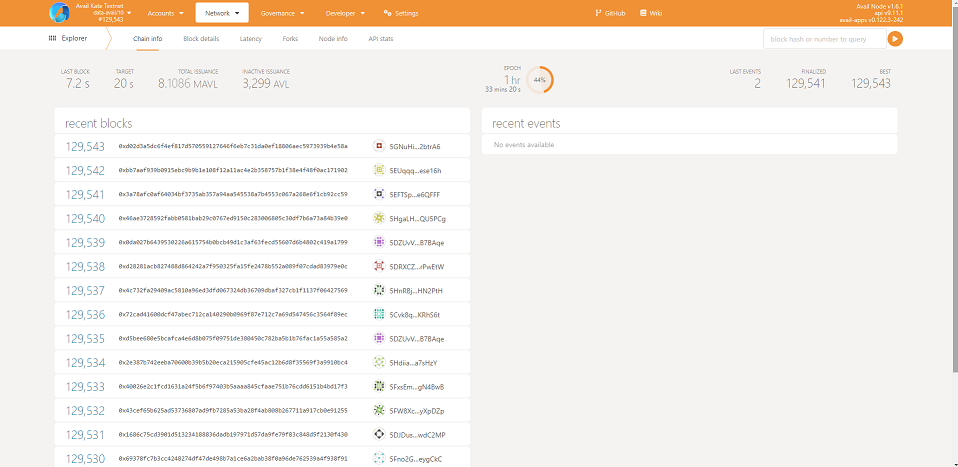

The HTX and the HECO Chain have been hacked again with reports suggesting between $85 million and $100 million in losses.

The crypto exchange HTX (previously known as Huobi) and the HECO chain have been hacked. On-chain security alerts platform Cyvers Alerts reported the news, stating that a suspicious address received about $85 million in multiple suspicious transactions from the HECO chain bridge, noting that the first transaction was 10,145 ETH. Cyvers Alerts founder and CTO Meir Dolev added that the total value of the transactions is $100 million.

We are detecting multiple suspicious transactions on @HTX_Global hot wallets and on @HECO_Chain bridge that were probably executed by the same entity, total value of $100M.

— Meir Dolev (@Meir_Dv) November 22, 2023

HTX advisor Justin Sun took to X to confirm the attack. In the post, Sun confirmed the attack, promising that all HTX funds are secure and adding that the “community can rest assured.” Sun added that all deposits and withdrawals on the platform are temporarily suspended until investigation is complete.

Blockchain security platform PeckShield initially posted a “suspicious huge withdrawal of 10,145 ETH, about $19 million. In a subsequent post, the platform noted that the total amount stolen was $86.6 million in ETH, LINK, TUSD, USDC, SUNI, SHIB, HBTC, and USDT. The largest was 42 million USDT.

HTX Hacked Again

The recent HECO Chain hack is the second hack this year. In September, HTX lost nearly $8 million to hackers who successfully stole 5,000 ETH from the company. At the time, Sun also quickly assured in an X post that HTX has covered the losses and resolved all related issues. At the time, Sun said it was a small amount in comparison to the $3 billion held by users of the HTX platform. He added that the amount is equivalent to only two weeks of revenue.

Sun also noted that HTX was willing to offer 5% of the amount ($400,000) to the hacker as a white hat reward if they returned the funds within seven days. Adding that HTX will hire the person as a white hat advisor. Days later, Sun announced that the hacker “fully returned all funds.” He also added that HTX paid the hacker “a white hat bonus of 250 ETH,” equivalent to $506,000 at current rates.

Justin Sun’s Poloniex Also Breached

Unfortunately, Justin Sun’s crypto exchange Poloniex was also recently hacked. On November 10, Poloniex lost more than $126 million in a hack, as confirmed by transactions on the Ethereum blockchain explorer Etherscan. Peckershield revealed Etherscan transactions showing transfers from the “Poloniex 4” wallet to a wallet controlled by the hacker. Coins lost include ETH, TRON, USDT, TUSD, PEPE, SHIB, and FLOKI. In addition, blockchain data from crypto intelligence platform Arkham Intelligence shows that the hackers also made away with 865 Bitcoins and more than 288 million TRX. Poloniex suspended withdrawals when it happened.

Sun offered the hacker a 5% white hat bounty on the day, allowing 7 days to return the funds.

According to an official statement from the company, a few days after a few days, deposits and withdrawal services are restored. Nonetheless, Sun has raised the reward for the hack to $10 million, and threatened to involve law enforcement authorities if the hacker does not return the funds by November 25.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Lido DAO raise concerns over LayerZero unapproved wstETH bridge on Avalanche, BN, Scroll

Lido DAO has distanced itself from LayerZero’s rollout of a wstETH bridge on Avalanche (AVAX), BNB, and Scroll.

In an Oct. 26 statement, the staking protocol said the bridge was “not canonical and has not been audited or endorsed by the Lido DAO.”

“Please exercise extreme caution if you choose to interact with the bridge,” Lido added.

On Oct. 25, LayerZero announced the successful launch of wstETH as an omnichain fungible token (OFT), allowing users to move their tokens between Ethereum, Avalanche, BNB, and Scroll blockchain networks.

“Expanding wstETH access to these chains will enable their respective DeFi ecosystems to flourish while supporting Lido’s desire for chain expansion,” LayerZero added.

Lido is the largest liquid staking provider, with the total value of staked Ethereum on the protocol lued at more than $15 billion, according to DeFillama data.

Lido community concern

LayerZero’s unilateral action has sparked apprehensions within the Lido community, with some interpreting it as an attempt to pressure the staking protocol into consenting, while others perceive it as an aggressive marketing strategy.

Community contributor Hart Lambur contends that the wstETH designation appears to be a coordinated marketing effort involving Avalanche, BNB, and LayerZero. He also highlights the risk of potential abuse with the mint-and-burn feature of the OFT, which could lead to unlimited wstETH minting.

Hasu, a strategy advisor, said:

“By unilaterally deploying a bridge and marketing it in an official-seeming way, it feels like you are trying to pressure the DAO into accepting your proposal to avoid liquidity fragmentation and bad UX for users. Driving users to it through marketing makes accepting an alternate bridge proposal more painful. These actions put the DAO, Lido stakers, and participating chains in a difficult position.”

Similarly, TheDZhon, another community member, voiced concerns about liquidity issues, inadequate security assessments, and risk management. He concluded that:

“The current proposal suggests the simultaneous endorsement of three networks. I have reservations about this approach and believe a more measured, pilot-based strategy might be more prudent, especially when considering each network’s unique attributes and needs.”

Furthermore, several community members express dissatisfaction with including Scroll in the networks supporting wstETH.

In response, LayerZero has removed Scroll from the networks supporting wstETH. Additionally, they emphasize active engagement with the Lido Core team, community members, and independent security teams regarding the bridge’s deployment.

Nomic bridge paves way for Bitcoin’s seamless entry into the Cosmos ecosystem

Non-custodial Bitcoin (BTC) bridge Nomic revealed that it would soon allow the top cryptocurrency to be “universally accessible” within the Cosmos (ATOM) ecosystem through a planned upgrade scheduled for Oct. 27.

Cosmos, a prominent blockchain network boasting a market capitalization exceeding $2.5 billion, grapples with a notable challenge—the absence of a decentralized means to integrate Bitcoin into its ecosystem.

Nomic addresses this challenge through nBTC, an IBC-compatible token pegged to the top digital asset. The cross-chain bridge planned nBTC Interchain Upgrade aims to pave the way for a seamless and interoperable Bitcoin experience within the Cosmos ecosystem.

As per information shared with CryptoSlate, this upgrade will empower users to conduct BTC transactions throughout the Cosmos network.

Furthermore, Nomic’s nBTC will debut on Osmosis, Cosmos’s leading decentralized exchange. This will allow users to deposit and withdraw Bitcoin within the Osmosis Zone app.

Sunny Aggarwal, a co-founder of Osmosis, has highlighted how Nomic addresses the long-standing challenge of moving Bitcoin from its native chain to another blockchain.

He emphasized that introducing Nomic Bitcoin would facilitate a symbiotic relationship between the two ecosystems, adding that Bitcoin requires a DeFi ecosystem, while Cosmos benefits from having a foundational asset for value storage.

In addition, Nomic’s nBTC will be accessible on widely used Cosmos applications such as Kujira and Levana.

Nomic bridge to be handed to DAO

Nomic’s core contributor, Turbofish, revealed that the bridge was undergoing a security audit to ensure the bridge’s safety before the upgrade.

Turbofish also outlined plans to hand control the bridge’s capacity and fee management to Nomic DAO. This move empowers the DAO to oversee the bridge’s BTC capacity limits, transaction fees, and overall development.

In a statement, Turbofish CEO Matt Bell emphasized that the Cosmos DeFi ecosystem needed secure and seamless access to BTC. Matt Bell, CEO of Turbofish, said, “With these forthcoming upgrades, Nomic is poised to be the most secure bitcoin bridge on the market today.”

The post Nomic bridge paves way for Bitcoin’s seamless entry into the Cosmos ecosystem appeared first on CryptoSlate.

Swingby Network has officially launched a V3 version of its Bitcoin bridge, designed to provide users with a better user experience, and enhanced interoperability. The Swingby Bridge allows its users to swap BTC to WBTC within a few clicks.

The smart contract has been upgraded with a new buyback function added, which allows for 25% of fees collected from the bridge to be used for buybacks. Moreover, the new smart contract also helps to facilitate upgrades to the network without the need of LPs or metanodes to move their liquidity.

Swingby Developers Add Buyback Feature

One of the key features of the aforementioned upgrades is the buyback feature. 25% of collected fees will be put towards buybacks of the $SWINGBY token, bought directly from the open market. Typically, buybacks are used to add buy pressure to a token or asset. The changes required to the smart contract were pushed by Swingby community developers over the past day or so.

“Skybridge V3.0 sets the ground for future growth for the Swingby ecosystem. This is designed to provide users and dApps the possibility to access further BTC DeFi opportunities, across a much larger variety of chains.” said the Swingby DAO.

Enhanced Interoperability

The upgrades are also designed to allow for an increased level of interoperability with the bridge, and project repositories. Additional chains can be added at a quicker rate as time progresses, which should help to increase volume on the bridge, and then reciprocally adding further fees to the buyback wallet. At present, the bridge allows for swapping of BTC assets across the Ethereum blockchain.

The front-end has also been improved, with a cleaner and more efficient swapping portal now being operational.

About Swingby

Swingby is one of the few decentralized bridging protocols that allows for the largest cryptocurrency asset by marketcap, Bitcoin, to enter the world of DeFi in a trustless manner.

Swingby Network remains hack-free at the time of writing, having accrued over two-and-a-half years of successful swaps, and over 7000 $BTC in total having been swapped since its inception. Swingby ecosystem security continues to be protected by its “Lock & Unlock” bridging system, architecture design, and its Chainlink Proof-of-Reserves feature.

- Media Contact: Swingby DAO – Contact@swingby.network

- Twitter:

- Telegram:

- Discord:

Disclaimer: This is a sponsored article brought to you by Swingby

The post Swingby Launches V3 iteration of its Bitcoin bridge appeared first on CryptoSlate.

Former CFTC chairman says stablecoins can be a bridge between two worlds

The former chairman of the United States Commodity Futures Trading Commission (CFTC), Timothy Massad, highlighted the importance of government attention being paid to the stablecoin ecosystem in an interview with CNBC.

On July 24, Massad told the CNBC interviewer that he sees stablecoins as a bridge between “the crypto world and the real world,” and that governments should not view them as a fad fated to disappear.

The ex-chairman said he is concerned that regulators are not properly addressing the risks of stablecoins; instead, they are kept out of the conversation due to the notion that they don’t work.

“I’m sympathetic to a lot of people in the government saying […] we’re not convinced of the use case here; we don’t really see what the value is in the real world,” he said, adding, “but sometimes it takes time to really discover that.”

Massad has been an outspoken advocate for crypto regulation and more cohesive collaboration between the CFTC and the U.S. Securities and Exchange Commission (SEC) when it comes to digital assets.

On July 24, the U.S. Government Accountability Office (GAO) — a national congressional watchdog agency — released a report on the use of blockchain in finance, echoing the sentiment for interagency cooperation on crypto regulations.

Related: Korean banks research stablecoin, CBDC alternative

In the same CNBC interview, he highlighted that stablecoins could hold the potential to create faster payment mechanisms in the U.S. and that if the U.S. were to develop a stablecoin, it could lead other countries to do the same.

“I think the competition from stablecoins could be useful, again, if we address the risks, and they are significant.”

In addition to faster payment systems, he argued that stablecoins are already causing banks to consider their current operating systems and how they can be improved.

Massad has previously criticized the U.S. for not creating a central bank digital currency (CBDC) fast enough.

These comments come as regulators in the U.S. continue to mull over regulations for the crypto industry, which include multiple bills that would affect stablecoin issuance and usage.

Magazine: Wolf Of All Streets worries about a world where Bitcoin hits $1M: Hall of Flame

Polygon spinoff launches testnet bridge to allow for low-cost layer 2s

Blockchain network Avail has launched a testnet data availability bridge to Ethereum, according to a July 7 announcement. Once testing is completed, the bridge will allow developers to easily create “validiums” or low-cost layer 2s that do not store full transaction data on Ethereum, the announcement stated.

Layer-2 rollup networks like Optimism, Arbitrum, Polygon zkEVM, and zkSync Era lower transaction fees by batching transactions into compressed “rollups” and periodically adding them to the base layer. However, because these networks must write all the transactions to the base layer, they often have higher transaction fees than layer-1 competitors.

To get around this problem, some networks have opted to write only the validation proofs of each transaction to the base layer, while storing the full transaction data off-chain. This produces a type of network called a “validium.” For example, StarkEx features a validium mode that stores data with a data availability committee (DAC) instead of on Ethereum. Polygon proof-of-stake may become a validium that stores its data on a proof-of-stake chain in 2024.

Related: Starknet’s Quantum Leap hits testnet with TPS reaching ‘triple figures’

According to the announcement, the new bridge allows developers to create custom validiums quickly and easily by storing their transaction data on the Avail network, eliminating the need to create their own DAC or proof-of-stake data availability network. When a user tries to withdraw cryptocurrency from layer 2 back to the base layer of Ethereum, the Avail bridge will transmit an attestation that the data is available on Avail, allowing the withdrawal to occur.

“Today’s launch of the Data Availability attestation bridge marks a major advancement in our mission to optimize blockchain scalability and efficiency,” said Arjun. “By enabling rollup constructions to run in validium, optimistic chains, and volition modes, we are not only reducing costs but also paving the way for a more inclusive and efficient layer-2 and layer-3 ecosystem.”

Arjun previously told Cointelegraph that data availability solutions would become essential to the Web3 space as zero-knowledge proof rollups are more widely used.

This “Crypto City” guide looks at Sydney’s crypto culture, the city’s most notable projects and people, its financial infrastructure, what retailers accept crypto and where you can find blockchain education courses — along with a history of its crypto controversies.

Jump to: Crypto culture, Projects and companies, Financial infrastructure, Where can I spend crypto? Controversies and collapses, Education, Notable figures.

Fast facts

City: Sydney

Country: Australia

Population: 5.2 million

Established: 1788

Sydney is Australia’s first, oldest and second-most populous city (just), world-famous for its harbor views and iconic landmarks, such as the Opera House and Harbor Bridge — affectionately nicknamed “The Coathanger” by locals. The Harbor City’s second-most notable feature is 100 beaches across the metropolitan area with Bondi Beach the best known.

Located on Australia’s east coast, Sydney was established as a penal colony for the British Empire, which needed somewhere to transport criminals after losing control of its colonies in the American Revolution. It’s probably no surprise then it earned the moniker “Sin City” in the second half of the 20th century due to rampant organized crime that corrupted judges, the top brass of the police and, maybe less surprisingly, politicians.

On a global scale, Sydney is fairly young and architecturally contemporary, which saw it play backdrop to The Matrix, as a major location in Mission Impossible 2 and a starring role in the plot of Finding Nemo (no, 42 Wallaby Way, Sydney doesn’t exist). Sydney is Australia’s financial hub, has the third largest immigrant population globally, and boasts the second most unaffordable housing in the world behind Hong Kong.

Sydney’s crypto culture

Sydney saw an early interest in cryptocurrencies that still carries on today. Blockchain Sydney has been consistently getting together since 2013, and it currently meets twice a month at various pubs around the city. Blockchain Professionals, formed in 2014, also still meets up about once a month.

The Australian DeFi Association, while only launching in early 2022, has become a highly attended and consistent monthly hangout for local crypto industry players and enthusiasts.

Co-founder Mark Monfort originally created it for online discussions but says it soon morphed into an IRL meetup held between the larger “one-off” blockchain events, such as those by Blockchain Australia.

“We wanted to be the ‘gap filler’ between other meetups because what we saw was that there wasn’t really a place for direct conversation apart from Crypto Twitter.”

Monfort maintains a calendar of Web3 events and meetups going on around Sydney and Australia. Other popular meetups include Bitcoin Sydney, Hyperledger Sydney and Sydney AI Web3 (which added artificial intelligence in line with the recent AI boom), while NFT Sydney and Metaverse Sydney typically don’t meet as often.

As the country’s financial hub, Sydney boasts a thriving startup culture. Many crypto-related events are held in the various co-working offices around the city that also serve as a base for numerous crypto and fintech startups. One provider, Stone & Chalk, runs a Web3 Innovation Centre within the government-supported Sydney Startup Hub, and local exchange Independent Reserve has run a blockchain business accelerator since 2018.

Blockchain Week, the flagship event of Blockchain Australia, invariably holds at least one day of the program in Sydney, typically at the Exchange Centre — the home of the Australian Stock Exchange (ASX).

Read also

Features

Bitcoin 2023 in Miami comes to grips with ‘shitcoins on Bitcoin’

Features

Play2Earn: How Blockchain Can Power a Paradigm Shift in Building Game Economies

Sydney’s crypto projects and companies

Sydney’s crypto players are diverse, and there’s likely a company involved in every niche of the market. “There’s a lot of innovation that’s coming out of this town — much more than you see on a global stage,” says Monfort, who also is a co-founder of the Web3 advisory firm NotCentralised.

NFT horse racing and betting game Zed Run was created here by Virtually Human Studios (before it moved to Melbourne) and so was Find Satoshi Labs’ move-to-earn app StepN. Fellow NFT gaming companies Illuvium and Immutable are also in Sydney (as much as a decentralized organization can be). Sigma Prime, is behind Lighthouse, the widely adopted Ethereum client.

Compared to Melbourne, there aren’t as many exchanges or trading platforms based in the city. Sydney plays host to significant parts of the Ethereum-based token trading platform Synthetix, the DeFi-backed fintech Block Earner is based here along with the centralized exchanges Independent Reserve and CryptoSpend.

The Redbelly Network operates the blockchain of the same name, which was originally birthed at Sydney University alongside government researchers. Smart Token Labs, creator of the open-source wallet AlphaWallet and crypto wallet creator Verida, both have their HQs in Sydney.

The city also hosts Block8, which helps develop blockchain products, Soulbound token development and advisory business Soulbis, Filecoin-powered data storage provider Holon, along with the Tide Foundation, which offers a cybersecurity solution that’s based on blockchain.

Comparison site Finder operates a crypto exchange, and its founder, Fred Schebesta, dabbles with his blockchain investment fund Hive Empire, also Finder’s holding company. Schebesta owns the Crypto Castle in Coogee, which he bought for $11.5 million (17 million AUD) in May 2021 — it’s rented out for photoshoots and events and listed on Airbnb for an exorbitant nightly price.

Exchange-traded fund manager Global X ETFs AU has a local entity providing funds investing in Bitcoin and Ether and has another one for publicly traded crypto and fintech companies. Bitcoin mining firms Iris Energy and Arkon Energy are Sydney-based, although they have no local operations with their mines in Canada, Texas and Norway.

Haymarket HQ and BlockathonDAO have created incubator pathways in Sydney for crypto start ups, often running events and meet ups. The former also helps accelerate crypto companies into Australia.

Venture firm Airtree VC has partnered with its share of Web3 firms and is based in the inner-city suburb of Surry Hills, while the Web3 recruitment business CryptoRecruit is out in Bondi. Web3 data platform Itheum made a home in Sydney. Stirling & Rose and Piper Alderman both have specialist crypto lawyers.

Sydney’s financial infrastructure

Sydney was home to Australia’s first-ever Bitcoin ATM, which went live inside a mall in the city center on April 15, 2014. The ATM was purchased from RoboCoin, the firm responsible for setting up the world’s first Bitcoin ATM in Canada around six months earlier. Sydney’s ATM was the 11th from RoboCoin to launch worldwide.

Today, over 100 Bitcoin ATMs, nearly a fourth of the roughly 500 in Australia, are dotted around the central business district and outer suburbs of Sydney according to Coin ATM Radar and are operated by a handful of companies. Users can only sell crypto at 14 of them, however, and those are predominantly based in the city center.

Sydneysiders, like all Australians, have access to multiple local exchanges as well as international ones with local entities in the country. A handful — namely CoinJar, Crypto.com, CoinSpot, Wirex and CryptoSpend — provide debit cards, offering crypto “cashback” or allowing crypto to be spent directly.

Crypto isn’t widely used for payments or sending funds. Sending smaller monetary amounts through TradFi rails in Australia is typically instant and free, operates 24/7, and only needs a phone number or email thanks to the New Payments Platform, which everyone just calls PayID. The Australian central bank governor Philip Lowe has even said in the past he’s “skeptical” on the need to issue a retail central bank digital currency: “How could we offer digital tokens which would be better than that?”

The relationship between crypto companies and banking or payment providers is still tenuous. In May 2023, Binance Australia’s payments provider Zepto was forced to offboard the exchange by its payments enablement partner Cuscal.

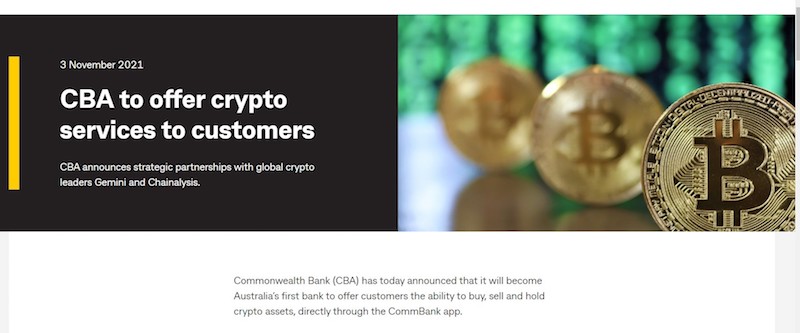

Westpac, one of the country’s “Big Four” banks, also began blocking payments to crypto exchanges on the same day Binance was debanked. Shortly after, the Sydney-based Commonwealth Bank (Australia’s largest bank) said it would begin declining or temporarily holding payments to crypto exchanges and impose a $10,000 monthly cap on the amount of money its customers could send to exchanges.

The banks vaguely cited issues with scams when asked to explain their respective actions.

Where can I spend crypto?

There are only a handful of places in Sydney left where you can spend crypto. Coinmap claims there are roughly 25 venues that take digital currency payments near the city, which get even more sparse when traveling to the outer suburbs (in total there are about 40).

The majority of venues appearing on Coinmap have shut down, and of those still standing, many no longer take crypto payments. A lack of uptake by customers was the consensus for getting rid of crypto payments as explained by multiple venue owners.

Of those still around that accept crypto, you can grab a brew at Cat and Cow Coffee in Clovelly. The aptly named Bitcoin Rocket Cafe in Redfern takes Bitcoin over the Lightning Network for its coffees and Bánh mìs. The cafe’s owner, Samantha Ho, said she charges a higher fee for those spending under $13 (20 AUD) when paying by Lightning and estimated around five in 100 customers actually pay using Bitcoin.

There are a variety of stores that accept crypto when ordering online. You can order a new skateboard from Boardworld, which has shops in the inner west suburbs of Newtown and St Peters. Retro Girl will accept Bitcoin for their vintage wares, or you can grab some (very expensive) lingerie at Babylikestopony, which also has a shop in Paddington.

Under the bridge is Bar Lulu, which operates CryptoLulu, an NFT-gated membership club that claims to offer private lounges, networking events and other benefits at the venue for NFT holders. While you can of course pay for the NFT membership using crypto, the bar itself doesn’t take crypto payments right, now but that’s apparently coming soon.

Controversies and collapses

For many years, there was much excitement about the ASX implementing a blockchain-backed solution for its clearing and settlements system. It first announced the plans in 2017, but it suffered multiple delays. Five years on and $170 million later, the ASX canned the project in late 2022 to much scorn from the central bank and the securities regulator.

The Australian Securities and Investments Commission (ASIC) has undertaken its share of enforcement actions in the crypto space against Sydney businesses. It sued Block Earner in November 2022, claiming the latter offered crypto-based yield products without a license. ASIC hit comparison website Finder with a similar suit a month later, and the regulator claims Finder shut down its crypto-yielding products a month earlier because of its concerns.

In April 2022 after a “targeted review,” ASIC canceled the financial license of Binance Australia Derivatives (Oztures Trading), the futures business of the exchange. ASIC also claims it was sniffing out the Sydney-headquartered Australian entity for FTX months before the global company collapsed in November 2022. FTX Australia was able to gain a local financial license by taking over a company that already had one, a loophole that ASIC chair Joe Longo wants to close.

Holon was similarly whacked by ASIC in October 2022, which put a stop to crypto ETFs investing in Bitcoin, Ether and Filecoin. Holon later bailed on the idea altogether.

In late 2020, ASIC also unleashed a raft of charges against John Biggaton, a promotor of the infamous BitConnect Ponzi scheme. Conspiracy theories about Biggaton have been spun up after his wife, Madeline Bigatton, mysteriously disappeared in March 2018. She was suspected to have committed suicide at The Gap, a location infamous for such acts, but it’s a narrative that her family doubts.

Sydneysider Kathryn Nguyen is widely believed to be the first person charged with the theft of crypto assets in Australia. She was sentenced to two years in jail after stealing around 100,000 XRP in January 2018. The alleged Sydney-based Ponzi scheme Metafi Yielders is said to have stolen $135 million, but after it collapsed, the chief executive of the business, Michael Daher, claimed he was just a fall guy, and the real schemers were in Nigeria.

The Commonwealth Bank has seemingly done a 180 on its crypto stance in a relatively short time. In November 2021, it was gearing up to ship crypto trading within its banking app. At the time, its CEO, Matt Comyn, said the bank saw “bigger risks in not participating” in crypto and, in May 2022, was still seemingly trying to squeeze the product past regulators. But just over a year and a half later, the bank began censoring payments to crypto exchanges.

The controversial Satoshi claimant Craig Wright used to live in Sydney, and his house was notoriously raided by federal police in 2015 due to a warrant issued by the tax authorities, but he now lives in the United Kingdom.

Read also

Features

A new intro to Bitcoin: The 9-minute read that could change your life

Features

How to stop your crypto community from imploding

Crypto education in Sydney

A few higher-ed institutions offer courses or units of study on blockchain and Web3. Sydney’s first university, the University of Sydney, offers a unit on “Cryptocurrency Markets and Investments.” It also does a course on blockchains and cryptography as part of its Master of Cybersecurity.

Sydney Uni along with the CSIRO (a federal government scientific research agency) developed the Redbelly blockchain, which aimed to create a “fork-proof” network. The project was spun out of the uni into its own commercial entity in December 2021.

The University of Technology Sydney (UTS) offers a free two-hour online course on the basics of blockchain tech, while the University of New South Wales (UNSW) offers postgraduate and undergraduate courses on “Web3 and Blockchain Applications.” UNSW’s course on cryptocurrency and DeFi is a core course as part of its postgraduate major in fintech.

For those willing to pay $235 (350 AUD) to sit in a classroom for nine hours to learn the basics of crypto, blockchain and how to trade, then the Sydney Community College has a course aimed at introducing you to crypto and blockchain — although this carries no accreditations like the others.

UNSW and Sydney Uni have a student-led society that semi-regularly hosts events and meetups called the University Network for Cryptocurrency and Blockchain.

In May 2022, UNSW received $4 million worth of USDC from Ethereum co-founder Vitalik Buterin for the development of a pandemic-detection tool.

Notable figures

Synthetix founder Kain Warwick; Illuvium co-founders (and Kain’s brothers) Aaron and Kieran Warwick; Finder co-founder and Crypto Castle owner Fred Schebesta; Block Earner co-founder Charlie Karaboga; Australian DeFi Association co-founders Mark Monfort and Arturo Rodriguez; Kraken Australia managing director Jonathon Miller; Web3 blogger Joan Westenberg; KPMG director of metaverse Alyse Sue; StepN creator Jerry Huang; Algorand Foundation governance manager Adriana Belotti; Haymarket HQ CEO Duco Van Breeman; Immutable co-founders Robbie and James Ferguson, Independent Reserve co-founder Adrian Przelozny ; Virtually Human co-founder and Zed Run creator Chris Laurent; Global X ETFs AU CEO Evan Metcalf; Block8 co-founders Kim Bartlett, Alan Burt and Tim Bass; CryptoRecruit founder Neil Dundon; Koinly head of tax Danny Talwar; Coinbase APAC managing director John O’Loghlen; Arkon Energy co-founder and CEO Joshua Payne; Smart Token Labs co-founder and CEO Victor Zhang; Holon co-founder Heath Behncke; Crypto lawyers Nick Abrahams and Michael Bacina (the latter is also the Blockchain Australia chairperson), Ethereum Smart Contract developer and community educator Bokky Poobah.

Cointelegraph team members and contributors based in Sydney: Felix Ng, Brayden Lindrea, Ciaran Lyons and Jesse Coghlan.

If you have suggestions for additions to this guide, please email: jesse.coghlan@cointelegraph.com.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Jesse Coghlan

Jesse is a Sydney-based crypto journalist and the Deputy Editor on Cointelegraph’s Australian newsdesk. His first writings were on non-crypto crime, conflicts and protests but he now focuses on crypto exploits, policy and the impending AI dystopia.