Citigroup analysts predict gold will reach $3,000 within six to 18 months, with more buyers piling in amid Fed rate cut hopes and geopolitical tensions.

Source link

Bright

Tesla’s Future Looks Bright With AI — 2 Reasons I’m All In on the Stock

Artificial intelligence (AI) was certainly a popular trend during 2023. Since the start of the year through mid-December, the tech-heavy Nasdaq Composite Index has had a total return of more than 40% — handily beating the S&P 500.

While the advent of generative AI models developed by Microsoft, Alphabet, and Amazon have taken the world by storm, my sights are captured by another AI disruptor. Ark Invest CEO Cathie Wood recently referred to electric vehicle (EV) pioneer Tesla (TSLA -3.92%) as the biggest AI play in the world. I think she might be right.

Although demand for Tesla’s vehicles is strong, I see other reasons to own the stock. Let’s explore some of Tesla’s AI use cases and assess how these innovations could help the company evolve beyond being just a car manufacturer.

1. Robotics and Tesla Optimus

Like other car companies, Tesla produces its vehicles along assembly lines in gigantic factories all over the world. However, the company’s eccentric CEO Elon Musk has a big vision of how he’d like to transform these factories in the future.

On several occasions, Musk has stated that his goal for Tesla is to produce 20 million cars per year by 2030. In order to achieve this production milestone, Tesla is going to need some help. While you might think this translates to ratcheted-up hiring, think again.

Tesla has invested significantly into a secret artificial intelligence project dubbed Optimus, giving investors sparse details on earnings calls over the years. Well, just a few days ago, Musk took to social media platform X (formerly known as Twitter) to provide a glimpse into how Optimus is progressing.

Optimuspic.twitter.com/nbRohLQ7RH

— Elon Musk (@elonmusk) December 13, 2023

Investors can see that Optimus is a humanoid robot capable of walking upright and handling delicate objects. The long-term application of these robots is that they will be able to augment workforce output in Tesla’s factories. Unlike a human, Optimus can theoretically work around the clock, which can meaningfully impact production at scale. While this may seem a little far-fetched, consider Musk’s playbook here.

E-commerce giants Amazon and Alibaba both leverage robotics in warehouse operations. While humans are not fully replaced, robotics can help with manufacturing as well as fulfillment efforts in factories. These efficiencies can lead to massive cost savings over time as it pertains to labor efforts.

For Tesla, I see two obvious tailwinds from Optimus. The first is that as the robots become more sophisticated, the company can begin integrating Optimus bots throughout its global fleet to help bolster vehicle production. By producing more cars at a faster rate, Tesla can further separate itself from the competition by meeting demand backlog at an unprecedented pace.

The more subtle opportunity is that should this prove successful, Tesla can sell these robots to other companies to augment labor productivity — potentially disrupting a $154 billion market, according to research published by Goldman Sachs. In essence, the prospects of robotics represent a case for Tesla to move beyond cars as the company seeks additional revenue streams.

Image source: Getty Images

2. Autonomous driving and Tesla Dojo

The second AI opportunity for Tesla is autonomous driving. There are a number of companies participating in the self-driving car race. Notably, ride-hailing company Uber is working closely with Alphabet’s autonomous driving subsidiary Waymo.

Autonomous driving is considered to be potentially safer than human-operated vehicles, making the technology of interest to the likes of Tesla and other car companies. Moreover, as it relates to ride-hailing businesses or delivery services such as DoorDash or Instacart, robotaxi fleets represent enormous cost savings, as they eliminate the need for drivers. In fact, Wood estimates that robotaxis could generate $9 trillion in sales by 2030.

Like its lead in EV adoption, Tesla is thought to have the most sophisticated autonomous driving technology on the planet. The reason is that Tesla’s vehicles are collecting more data through cameras and sensors than any other car company.

The data that Tesla’s cars take in include constantly monitoring roads, weather conditions, traffic levels, and more. Tesla then feeds this data into a supercomputer called Dojo. The basic explanation is that as Tesla’s cars collect more data, the Dojo software becomes more intelligent — a process called machine learning.

One of Tesla’s longest-tenured investors is a mutual fund manager named Ron Baron. During a recent conference, Baron proclaimed that Tesla’s self-driving software could reach $100 billion in revenue per year, making it a trillion-dollar business in itself.

So is Tesla a buy for the AI?

Although Tesla is often affiliated with EVs, it’s clear that the company is investing in more complicated technology. While the commercialization of robotics and self-driving vehicles is still years away, the current preview of each is quite stunning.

For these reasons, I think Tesla is underappreciated when it comes to AI stocks and could be overlooked. Long-term investors should seriously consider Tesla as part of their broader AI portfolio allocation. Given the institutional support and the size of the addressable markets for robotics and autonomous driving, Tesla looks well-positioned to replicate its leading position in EVs and dominate these emerging AI applications.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, DoorDash, Goldman Sachs Group, Microsoft, Tesla, and Uber Technologies. The Motley Fool recommends Alibaba Group. The Motley Fool has a disclosure policy.

It’s been one challenge after another lately for Applied Materials (AMAT -0.06%). Between a demand slowdown caused by COVID-19, disruption of neon gas supplies (crucial for chip manufacturing) caused by the war in Ukraine, and rising production costs caused by inflation, 2022 was a terrible year. The stock slumped 38%.

Although many conditions from 2022 still exist in 2023, the stock is off to a great start, rising 39% compared to the S&P 500‘s return of 12%. With the stock sitting near its 52-week high of $138.80, should you buy it today or wait for a pullback in this terrible economic environment? Here’s why long-term investors should see it as an excellent time to buy.

A bright, long-term future on several fronts

Several industry analysts predict the semiconductor industry will see robust secular growth until the end of the decade when the market could exceed $1 trillion. Research firm Fortune Business Insights projects the global semiconductor market will reach $1.4 trillion by 2029 from $573 billion in 2022, reflecting a compound annual growth rate of 12.2%. Demand for the Internet of Things (IoT), communications, and automotive should drive much of this growth.

IoT refers to physical objects such as buildings, vehicles, and devices equipped with software, sensors, and network connectivity to collect and share data. With the rapid rise of IoT applications, semiconductor demand should increase materially since each connected device will require distinct semiconductor components like memory, processors, and sensors.

The communications industry should also produce growing demand thanks to new technologies such as 5G and Wi-Fi 6, advancements that drive massive demand for new and advanced semiconductor components. 5G is the latest cellular network technology, offering faster speeds and lower latency than 4G. Wi-Fi 6 is next-generation Wi-Fi that enhances the performance and speed of connected devices.

The significance of semiconductors in the automotive industry has increased considerably with the advent of connected and autonomous vehicles. Vehicle manufacturers equip connected cars with sensors and software that facilitate communication with other vehicles, infrastructure, and the cloud. Autonomous vehicles require even more advanced semiconductor components than connected vehicles as they can operate independently of human intervention.

Despite the downturn in the semiconductor market over the past year, Applied Materials CEO Gary Dickerson observed that the market he refers to as ICAPS (IoT, communications, automotive, power, and sensors) is hot. During the second-quarter 2023 earnings call, he announced that the company is revising its 2023 ICAPS estimates higher.

But consumer electronics demand is still weak

Demand for consumer electronic devices such as personal computers (PCs) and smartphones has declined in recent years due to a slowing economy and lower consumer spending — crushing demand for memory chips. Dickerson observed on the company’s latest earnings call:

Weakness in PCs and smartphones is a key factor for memory customers who have significantly reduced their investments in 2023. Measured as a percentage of total wafer fab equipment, memory spending is tracking at its lowest level in more than a decade …. We see these changes as timing adjustments as these companies remain fully committed to their long-term roadmaps to win the race for technology leadership.

A massive problem for the company is that it relies heavily on the memory market. For example, in 2022 the memory business accounted for 34% of its total revenue, enough to be vulnerable to declining growth in the memory market.

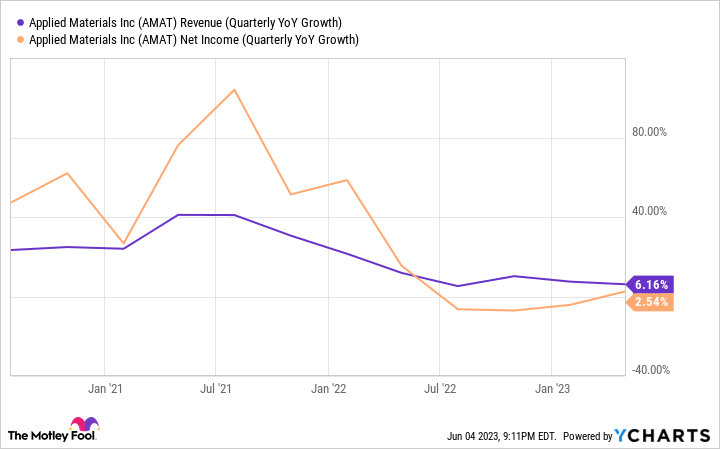

If you look at the company’s quarterly year-over-year revenue and net income growth over the last three years on the chart below, you can see it starting to drop in late 2021, coinciding with the decline in the memory chip market.

AMAT Revenue (Quarterly YoY Growth) data by YCharts

Until the downdraft in the PC and smartphone market ends, the company will face a drag on its performance.

So is it a buy?

Investors may have little appetite to push the stock much higher in the short term. It sells at a price-to-earnings ratio of 18, only slightly below its median ratio of 18.6 over the past 10 years. Meanwhile, according to analysts’ consensus estimates, the company will produce little earnings growth through 2025.

Many investors are concerned about Applied Materials’ business performance in a weak memory market. Gartner analysts predict that memory demand will continue to weaken through much of 2023, with a recovery not expected until 2024. So, short-term investors have little incentive to buy the stock.

However, Applied Materials is a fantastic long-term investment. It is a leading semiconductor equipment supplier with a strong track record of innovation. As a result, it’s well-positioned to profit from the secular growth of the chip industry. It has a great balance sheet and a history of generating strong cash flow, which means it’s a financially sound company that can invest in its future growth.

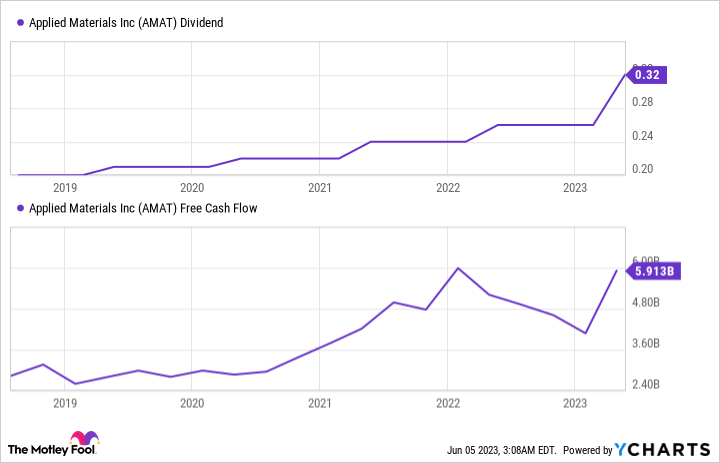

Finally, Applied Materials has a history of growing its dividend, providing investors with a steady income stream and making it attractive to investors who desire a blend of growth and income.

AMAT Dividend data by YCharts

Suppose you’re a patient investor with an investing timeline of three to five years and can withstand temporary drops in this volatile market. In that case, Applied Materials is an excellent stock to buy for the long term.