PRESS RELEASE. [Singapore, Mar 22, 2024] Yala, a project that enables the seamless transfer of Bitcoin liquidity through a meta yield stablecoin, is thrilled to announce a comprehensive brand upgrade. This reflects our commitment to making Bitcoin liquidity universally accessible across blockchain ecosystems, enhancing DeFi liquidity efficiency. The upgrade includes a refreshed branding message, a […]

PRESS RELEASE. [Singapore, Mar 22, 2024] Yala, a project that enables the seamless transfer of Bitcoin liquidity through a meta yield stablecoin, is thrilled to announce a comprehensive brand upgrade. This reflects our commitment to making Bitcoin liquidity universally accessible across blockchain ecosystems, enhancing DeFi liquidity efficiency. The upgrade includes a refreshed branding message, a […]

Source link

bring

How Chomps founders started a snack company that could bring in $500 million in 2024

Pete Maldonado turned his biggest vice into a multimillion-dollar business.

It all started with a late-night poker game — but this isn’t a story about gambling.

In 2011, Maldonado met his future business partner, Rashid Ali, at a friend’s apartment in Chicago. After a couple of betting rounds, their conversation turned to guilty pleasures.

Maldonado immediately thought of his favorite gas station snack, Slim Jims.

Growing up on New York’s Long Island, Maldonado spent countless afternoons biking up the street to the local 7-Eleven and buying a bundle of beef jerky sticks, as many as he could fit in his basket. “I’d finish all of them before I got home,” Maldonado, 42, recalls.

But after becoming a personal trainer in college, he started cutting Slim Jims — with ingredients that include mechanically separated chicken and corn syrup — out of his diet. Still, Maldonado craved his favorite gas station snack.

He told Ali that he wanted to create a “healthier” meat stick that was high in protein, low in calories and tasted just as good as the snack that defined his childhood.

Ali, who was working as a business operations consultant at the time, thought it was a smart pitch — and just a few weeks later, the pair launched Chomps, a “healthier” beef jerky, as a side hustle from Maldonado’s condo in Chicago.

Since then, Chomps has grown into a nationwide brand attracting more health-conscious consumers to the $17 billion meat snacks market, selling more than 350 million jerky sticks to date. Maldonado and Ali, 43, have stayed on as Chomps’ co-founders and co-CEOs.

Here’s how Maldonado and Ali built up Chomps from a side hustle into a company poised to bring in close to $500 million in sales over the next year.

Coming up with a ‘healthier’ jerky recipe

In 2012, after months of sampling hundreds of jerky sticks in stores across Chicago — and begging friends in other states to mail them their favorite meat snacks — Maldonado and Ali found Chomps’ base recipe at a small corner store six hours away in Greentop, Missouri.

One of their friends in Missouri had mailed them meat sticks made by Kevin Western, a Greentop local who made the snacks for fun and sold them around town.

Maldonado and Ali reached out to Western, who agreed to help them develop Chomps’ initial recipe. He also mentioned that his family ran Western Smokehouse, a local smokehouse operator in Greentop, and could help manufacture the products on a larger scale.

“We wanted to use grass-fed beef and remove a lot of ingredients jerky typically uses, like sugar and nitrates, which can create a lot of manufacturing challenges,” says Ali. “A lot of manufacturers didn’t want to deal with those challenges and do the old way of approaching it. But the Westerns were willing to work with us, and together we came up with a recipe that’s similar to the one we still use today.”

Chomps’ main ingredients include grass-fed beef, water, celery powder, sea salt and red pepper.

“I bought a $99 Photoshop Elements subscription and taught myself how to make packaging,” Maldonado says of Chomps’ original packaging. “It was terrible looking, it had a cowhide print on it.”

Photo courtesy of Chomps

The co-founders pooled about $6,500 of their own money to fund Chomps’ first production run, design packaging, build a website and run ads on Facebook.

“I bought a $99 Photoshop Elements subscription and taught myself how to make packaging,” says Maldonado. “It was terrible looking, it had a cowhide print on it.”

In December 2012, Maldonado and Ali started selling Chomps’ first product — the original beef jerky stick — on its website. At launch, the price point was about $2 a stick (now, the sticks cost about $2.49 each).

Much to their surprise, the company started turning a profit “within a month,” says Maldonado, all of which was reinvested into more product and social media marketing.

A side hustle turned instant success

At first, Maldonado and Ali had full-time jobs and ran Chomps in their spare time for the first couple of years it was in business.

Maldonado, who moved to Naples, Florida in 2013, worked as a real estate agent throughout his 20s and 30s, while Ali stayed in Chicago and continued consulting.

“We took turns hand-packing and shipping orders,” says Ali. “I remember working anywhere from 60 to 80 hours a week as a consultant, then waking up early in the morning or logging off work at 9 p.m. and immediately switching over to Chomps … looking back, I can’t even believe I was able to do that for as long as I did.”

They didn’t expect Chomps to amount to much more than a side hustle, but, as Maldonado jokes, “Chomps had other plans for us.”

In 2013, Chomps’ first full year in business, the pair sold about $50,000 worth of meat sticks. The following year, their sales doubled to $100,000, and the numbers kept climbing from there.

Chomps closed out 2023 with nearly $245 million in retail sales.

Gene Woo Kim

Maldonado credits Chomps’ early success with the rising popularity of different diets including paleo, Whole30 and keto, all of which encourage eliminating ultra-processed foods and replacing them with whole foods like fresh vegetables, meat and fish.

He and Ali started marketing Chomps as a low-carb, sugar-free snack that fit these “healthier” lifestyles, even adding language like “Whole 30 approved” on its packaging.

During its first four years of operation, Chomps sold the snacks directly to consumers through its website, and also to some CrossFit gyms, independent specialty stores and doctor’s offices across the U.S.

Chomps started introducing new flavors in 2013, starting with jalapeno beef. Now, the company offers dozens of spins on the original meat stick, including taco-seasoned beef, pepperoni-seasoned turkey and Italian-seasoned beef.

“A lot of the time, we didn’t even have enough product available on our website because we sold through it so quickly,” says Maldonado. “We’d reach out to people and say, ‘Thank you so much for your purchase. We ran out of product. We’d love to send it to you after if you’ll wait for it. Or we could just refund your money.'”

The phone call from Trader Joe’s that changed everything

In 2016, Maldonado and Ali received a phone call that would change their careers — and Chomps’ trajectory.

Trader Joe’s wanted to start selling Chomps’ original beef sticks in all of their stores across the U.S.

“One of the executives’ daughters was doing the Whole 30 diet and discovered Chomps through researching Whole 30 compliant foods,” says Maldonado. “She quickly became a fan of the product and recommended it to the people she knew that were high up at Trader Joe’s, who then reached out to Rashid and me.”

Trader Joe’s placed an initial order for a million meat sticks to stock in over 400 stores. Maldonado and Ali were still running Chomps as a side hustle by themselves at the time, and felt unprepared — but ecstatic — to fulfill such a big order.

“When you grow that quickly, it blows up your entire infrastructure,” says Ali. “You have to think about the business completely differently, and it forced us to do that.”

Maldonado and Ali say their first big order from Trader Joe’s, which requested a million sticks to stock in their stores across the U.S., changed the trajectory of Chomps’ business.

Photo courtesy of Chomps

Up to that point, Maldonado says Chomps produced up to 10,000 pounds of meat each month “at most” to fulfill customer orders. But the Trader Joe’s order alone required at least 120,000 pounds of meat to be produced within weeks. To help them fulfill that massive order, Maldonado says he and Ali ended up renting additional storage space in Chicago and hiring temp workers to hand inspect the products before shipping them to Trader Joe’s.

Chomps started selling meat sticks in Trader Joe’s, its first national retailer, in July 2016. Maldonado quit his real-estate career soon after to work on scaling Chomps from Naples full time, while Ali waited until 2018, when Chomps opened an office in Chicago and hired its first employee, to leave consulting for good.

“I had people saying, ‘You really want to sell meat snacks for a living?'” Maldonado recalls. “We were passionate about it, though, and we had the conviction that this was going to work.”

Building a jerky empire

Once Chomps started selling its sticks in Trader Joe’s, other stores quickly followed, including Whole Foods, Target and Walmart.

Getting into those retailers has given the business a massive boost: In 2020, Chomps’ retail sales hovered around $45 million, but in 2023, it closed out with nearly $250 million in retail sales.

As Maldonado and Ali will tell it, Chomps’ success can be largely attributed to its commitment to attracting a consumer niche that might feel shut out by its competitors: women.

“The meat snacks market is very heavily male-dominated, and other companies are hitting younger male customers,” says Maldonado. “But we did a brand study in 2018 and found that over 70% of our customer base is female, which is not something Rashid and I were ready for, or expecting, by any means.”

Chomps’ strongest demographic, he adds, is women ages 25 to 45, who “really respond” to the snack’s low sugar content and diet certifications.

Chomps re-designed its packaging to appeal more to a female consumer: bright colors, “zero sugar” in large, bold text and an eye-catching slogan in the center (“All stick without the ick”).

Photo: Clint Boland for CNBC Make It

To strengthen that customer relationship, Chomps re-designed its packaging to appeal more to a female consumer: bright colors, “zero sugar” in large, bold text and an eye-catching slogan in the center (“All stick without the ick”).

In 2021, after bootstrapping the company for a decade, Chomps secured their first funding round — an $80 million minority investment — from private equity firm Stride Consumer Partners, which has also helped the business expand.

Chomps now has two offices, one in Naples and one in Chicago, and 78 employees.

Even though Chomps has been in business for more than 10 years, Ali and Maldonado still think of it as a startup, and say they aren’t taking its recent success for granted.

“Pete and I still run the business like it’s a $100,000 business,” Ali says. That means being careful not to overhire, or overexpand production too quickly. Right now, Chomps is available in the U.S. and Canada.

“Running a snack business is a challenge … I describe it as a house of cards,” says Ali. “Like, anything could happen at any point, you could plateau or you could start losing market share. So we have a healthy amount of stress to make sure that we can continue the pressure on moving forward.”

Maldonado has a bit of a sunnier perspective on the future of Chomps. “This whole thing has become so much bigger than we ever imagined … it’s given us a newfound passion for the business,” he says. “Especially after Rashid and I have gotten older, we’re both married now with kids, we’re even more driven now to make a difference in snacking for families like ours … that’s what we’re here to do.”

DON’T MISS: Want to be smarter and more successful with your money, work & life? Sign up for our new newsletter!

Dogecoin (DOGE), the meme-driven cryptocurrency, remains confined within a narrow trading range of $0.075-$0.088 since the beginning of 2024, leaving investors grappling with its future trajectory. While activity has dwindled compared to early 2023, a significant portion of DOGE addresses remain profitable, fueling cautious optimism.

Profitable Addresses Offer Glimmer Of Hope

Approximately 60% of DOGE addresses, totaling roughly 1.34 million, currently hold their tokens at a profit, implying they bought at lower prices. This data, gathered by blockchain analytics firm IntoTheBlock, suggests underlying bullish sentiment despite declining market engagement.

Technical Support And Resistance Levels

Analysts highlight key support levels around $0.077-$0.079, where a large number of investors entered the market. This zone could act as a buying floor, preventing further price depreciation.

However, breaching this support could trigger a dip to $0.07, offering potential entry points for bargain-seeking investors. Conversely, overcoming the $0.088 resistance level could pave the way for a price climb towards $0.094.

BTCUSD trading at $50,093 on the daily chart: TradingView.com

Dwindling Activity Raises Concerns

A closer look at network activity paints a less rosy picture. Both transaction volume and whale activity, signifying large-scale investments, have decreased significantly, indicating reduced trading interest. This lack of enthusiasm could hamper Dogecoin’s upward momentum.

#Dogecoin is experiencing a decrease in transaction volume and whale transaction count, which typically indicates lower trading activity. This could be a sign that fewer people are buying, selling, or transferring #DOGE, possibly due to reduced interest or confidence in it! pic.twitter.com/SiKNxx4FhN

— Ali (@ali_charts) February 12, 2024

Technical analysis reveals a stalemate between the 50-day Exponential Moving Average (EMA) acting as support and a falling trendline acting as resistance. This pattern signals a lack of clear direction in the near term. Flipping the trendline to support could be a positive indicator, but achieving that requires renewed buying pressure.

Valentine’s Day Prediction Offers Modest Hope

Crypto exchange Changelly offers a moderate prediction for Valentine’s Day, forecasting a 1.12% price increase to $0.082591. While this could bring temporary cheer to DOGE holders, it also underlines the currency’s sensitivity to market sentiment and overall volatility.

Dogecoin: Long-Term Concerns Linger

Meanwhile, Dogecoin’s recent fall from the top 10 cryptocurrency rankings raises concerns about its long-term viability. Unlike competitors offering real-world applications, DOGE primarily relies on celebrity endorsements and internet trends. This raises questions about its ability to compete in the rapidly evolving crypto landscape.

The future of Dogecoin remains uncertain. While a short-term price rise is possible, concerns about its utility and competitive edge compared to other projects persist. Investors should approach DOGE with caution and conduct thorough research before making any investment decisions. Remember, price predictions are merely educated guesses, and the cryptocurrency market remains inherently unpredictable.

Featured image from Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In the battle to bring ousted founder Sam Altman back to OpenAI, Microsoft and Satya Nadella hold the trump cards

If Sam Altman is reinstalled as CEO of OpenAI, he will likely have one person to thank: Satya Nadella.

Some have faulted the Microsoft CEO for allowing the tech giant to become so dependent on Altman’s AI startup without guaranteeing it had at least one seat on OpenAI’s board. But Microsoft has a tremendous amount of leverage in the dramatic whirlwind of events this weekend—far more than any of OpenAI’s other backers.

On Saturday, Altman was reportedly in negotiations to return to OpenAI as CEO, with the OpenAI non-profit board possibly resigning as part of the deal, with much of the impetus coming from Microsoft, with support from other OpenAI investors and company employees. The company’s chief strategy officer Jason Kwon, in a memo obtained by The Information, told staff that the company was “optimistic” Altman and other senior staff who resigned in protest at his abrupt firing could be brought back to the company.

Microsoft’s whip hand, more than anything, else, comes down to cold hard cash.

Can OpenAI remain a going concern without Microsoft?

OpenAI commands a soaring valuation thanks to its tender offers with venture capital firms, but this is just paper money based on share sales from existing employees, founders, and earlier investors. (Technically, these were profit participation agreements; OpenAI, owing to its highly unusual capped-profit structure, doesn’t offer traditional equity or stock options.) Khosla Ventures and billionaire Reid Hoffman’s charitable foundation put undisclosed amounts into OpenAI’s holding company initially. But only Microsoft has given significant cash and resources directly to OpenAI. The software giant has committed at least $13 billion to OpenAI since 2019, when it signed its first partnership agreement with the AI startup. Microsoft has delivered just a fraction of this cash to OpenAI so far, a report in Semafor, giving the software giant significant power over the startup.

It is unclear if OpenAI could continue as a going concern without continual cash inflows from Microsoft. While OpenAI is, according to reports, making about $80 million per month currently and may be on track to make $1 billion in revenue in 2023—ten times more than it anticipated when it secured an additional $10 billion funding commitment from Microsoft in January—it is not known if the company is profitable or what its burn rate it is. But it is likely to be fast. The company lost $540 million dollars in 2022 on revenue of less than $30 million for the entire year, according to documents seen by Fortune. If its costs have also ramped up in line with revenues, the company would need continual support from Microsoft just to keep operating.

To make matters worse, OpenAI has been on a hiring spree all year, with reports that it has been offering the sort of seven-figure pay packages typical of professional athletes to lure top AI researchers away from Google, Meta, and other rival firms. Ilya Sutskever, the OpenAI co-founder and chief scientist, was paid $1.9 million in 2016, the first year of OpenAI’s operations, according to tax filings. He is certainly making many times that now. GPU costs are also likely stratospheric. Training GPT-4, OpenAI’s latest model, cost more than $100 million, according to Altman. One back of the envelope calculation put the cost of running ChatGPT, OpenAI’s popular chatbot, at $700,000 per day back in April. It may be more than that now as its user base has grown. (Although Altman has said that the company has been able to optimize its models to bring the cost of serving each ChatGPT query down.)

Furthermore, OpenAI is entirely dependent on Microsoft’s cloud computing datacenters to both train and run its models. The global shortage of graphic processing units (GPUs), the specialized computer chips needed to train and run large AI models, and the size of OpenAI’s business, with tens of millions of paying customers dependent on those models, mean that the San Francisco AI company cannot easily port its business to another cloud service provider.

Microsoft has what OpenAI needs

All of this gives Microsoft power. Nadella could threaten to cut off OpenAI’s access to computing power and suspend delivery of its next instalment of committed cash unless Altman is restored as CEO. While OpenAI might have legal recourse against Microsoft under the terms of its partnership agreement, Microsoft could do significant damage to OpenAI’s business before OpenAI’s lawyers could even get to the courthouse door if it wished.

Longer-term, Microsoft could choose to replace OpenAI’s technology with software from another leading AI startup, such as Cohere or a newer player, like Mistral, or even the new AI company that Altman and OpenAI’s co-founder, president, and former board chairman, who resigned from the company in protest over Altman’s firing, have been contemplating setting up. Nadella has, according to Bloomberg, told Altman he will support him in whatever steps he decides to take next.

OpenAI’s other inverstors, which include Khosla Ventures, billionaire Reid Hoffman’s charitable foundation, Tiger Global, Andreesen Horowitz, Sequoia Capital, Thrive, and K2 Global have far less potential influence on the company. The same goes for the venture firms that were negotiating to invest in a new tender of existing shares that would have valued OpenAI at $86 billion. But they still have some leverage—mostly through OpenAI’s employees. Those employees want to be able to continue to offer to sell their profit participation shares (which function essentially as stock options since OpenAI is not thought to be currently profitable) to investors at high valuations that could make many of them extremely wealthy. With these investors threatening to pull out of the latest tender offer for those profit participation agreements, the employees will see their own financial prospects damaged. That may give many of them an incentive to leave OpenAI—or at least threaten to do so—unless Altman is reinstalled.

That corporate governance structure

The current mess at OpenAI ultimately shows how flawed OpenAI’s convoluted governance structure is. Microsoft is a minority investor in a limited liability corporation that is majority-owned by holding company that is in turn jointly owned by OpenAI’s non-profit board, its employees, and its other venture capital investors. But that holding company is controlled by OpenAI’s non-profit through another limited liability corporation. And OpenAI’s non-profit corporate board has just six seats, all of which must be held by people with no financial interest in the holding company or the LLC in which Microsoft invested. In other words, neither Microsoft, nor any of OpenAI’s other financial backers, have a seat at the table when it comes to the hiring and firing of OpenAI’s CEO. They have a right to any profits OpenAI earns until they earn back their initial investment plus an amount that is capped on a sliding scale, with the earliest investors able to earn up to 100 times their initial outlay and later investors entitled to smaller, but still substantial, pay-outs. After those thresholds have been hit, however, any additional profits revert to OpenAI’s non-profit.

This structure was designed to enable OpenAI to raise the tens or even hundreds of billions of dollars it would need to succeed in its mission of building artificial general intelligence (AGI), the kind of AI that is as smart or smarter than people at most cognitive tasks, while at the same time preventing capitalist forces, and in particular a single big tech giant, from controlling AGI. Altman himself was largely responsible for designing this attempt to square a circle. But it was also Altman who struck the deal—for just $1 billion initially—with Nadella in 2019. From that moment on, the structure was basically a time bomb. By turning to a single corporate entity, Microsoft, for the majority of the cash and computing power OpenAI needed to achieve its mission, it was essentially handling control to Microsoft, even if that control wasn’t codified in any formal governance mechanism. Ironically, if OpenAI’s non-profit board chooses to ask Altman to return and resigns, as they are contemplating, it will prove that Altman’s structure failed—OpenAI was not able to both raise billions of dollars from a big tech corporation while somehow remaining free from that corporation’s control.

Preventing a big tech company from monopolizing AGI had been the entire reason Altman, Brockman, Sutskever, and Elon Musk co-founded OpenAI in 2015. At the time, they were alarmed by the rapid progress in AI research being made by DeepMind, which Google had purchased for $600 million in 2014. If DeepMind succeeded in achieving AGI, the OpenAI co-founders feared the ultra-powerful technology would end up being monopolized by Google. They created OpenAI as a non-profit entity so that it could develop AGI “to benefit all humanity” and not just the shareholders of a single corporation. Elon Musk initially pledged $1 billion to the non-profit.

The problem was, the pursuit of AGI using ever-larger deep learning models is extremely expensive due to the huge datacenter resources needed. Altman has said he vastly underestimated the amount of money OpenAI would need to compete in the race for AGI. And OpenAI’s lack of funding became an existential challenge after Musk acrimoniously resigned from OpenAI’s board after a dispute with Altman and the other co-founders over control of the research lab and its agenda. Musk took his $1 billion pledge with him. (Musk has said he donated $40 million to OpenAI during his the time he was affiliated with it. The company has said that in its time as a non-profit it received $130.5 million in total donations. Not nothing. But not enough to compete successfully with Google DeepMind.)

With Musk’s backing gone, Altman had to find more money—fast. He realized that raising money from donors, who only get a tax write-off for their contributions, was extremely inefficient compared to venture capital, where investors expect a return. And a good way to get access to computing resources was to essentially cut a deal with a major cloud service provider that could give him both—cash plus compute.

It would be the ultimate irony if the flaws of the very structure Altman designed wind up saving his job at CEO and allowing him to outmaneuver the board that he established to safeguard AGI.

The mess at OpenAI will also have investors looking hard at the governance structure of its rival AI company Anthropic, which was started by researchers who broke away from OpenAI in 2021 because they were concerned that the commercial turn OpenAI had made following Microsoft’s investment jeopardized its AI safety mission. Anthorpic is B Corporation, which is a much more straight forward structure than OpenAI’s. A B Corporation is one in which the directors have a fiduciary duty to look after multiple stakeholders’ interests, not just the profits of shareholders. In Anthropic’s case, the board is supposed to look after the interests of society as well as the company. Venture investors in Anthropic have one seat on its board. But Anthropic also has a Long-term Benefit Trust, whose trustees are a panel of experts in AI safety and national security who have no financial interest in Anthropic. The Long-Term Benefit Trust has a special class of stock that allows it to install an increasing number of directors based on certain AI progress milestones. It also has the right to control the majority of the B Corp.’s board within four years.

No doubt investors in Anthropic will now be giving this structure additional scrutiny following the destabilizing turmoil at OpenAI.

Read more:

This story was originally featured on Fortune.com

In a recent speech at the DC Fintech Week conference, Ripple CEO Brad Garlinghouse addressed the company’s regulatory hurdles. He expressed his views on the cryptocurrency landscape in the United States.

Ripple CEO Warns Of US Risking Market Share Loss

According to a Fortune Magazine report, Garlinghouse acknowledged during his speech that despite Ripple’s success in court against the SEC, some US banks must be more cautious about engaging meaningfully with cryptocurrencies.

Garlinghouse attributed this reluctance to the perception that the US government and the Office of the Comptroller of the Currency (OCC) are “hostile to the crypto industry.”

While Ripple’s court victory in July was seen as a positive development, Garlinghouse believes that the SEC’s overall approach, coupled with Chairman Gary Gensler’s characterization of crypto as the “Wild West,” is hindering the industry’s growth in the US.

Garlinghouse emphasized that while the US has hostility towards crypto, other countries actively welcome crypto companies and investments by providing clear regulatory policies.

As a result, the US risks losing its market share and failing to capitalize on its early advantage in the crypto space. Garlinghouse expressed his belief that the US can still become a leader in the industry but highlighted the urgency for clear and constructive regulatory frameworks to be established.

CEO Vows To Escalate Legal Battle With SEC To Supreme Court

Given the challenges faced in the US, Garlinghouse announced that Ripple would continue to expand its operations in other countries. He revealed that 80% of Ripple’s hiring in the current year will be conducted outside of the US, reflecting the company’s need to operate in more favorable regulatory environments.

Garlinghouse emphasized the importance of creating a hospitable environment for innovation and growth, suggesting that the current hostility in the US hinders Ripple’s ability to operate effectively within the country.

During the conference, Garlinghouse expressed his willingness to escalate Ripple’s legal battle with the SEC to the Supreme Court.

Garlinghouse stated that Ripple is prepared to pursue legal avenues until a resolution is reached. This firm stance underscores Ripple’s commitment to addressing regulatory uncertainties surrounding XRP.

Brad Garlinghouse’s remarks at the DC Fintech Week conference shed light on the ongoing regulatory challenges faced by Ripple and the wider cryptocurrency industry in the United States.

Despite recent court victories, Ripple encounters obstacles due to perceived hostility and a lack of clear policy guidance. Garlinghouse’s readiness to escalate the legal battle to the Supreme Court demonstrates Ripple’s determination to seek a resolution and establish a constructive regulatory framework.

As Ripple expands its operations globally, the hope remains that the US will adopt more welcoming and supportive regulations to foster innovation and maintain its competitive edge in the evolving cryptocurrency landscape.

As of the current market update, XRP is trading at $0.6902, indicating sideways price movement over the past 24 hours. However, in the fourteen-day timeframe, the token has experienced a notable gain of 13%.

Featured image from Shutterstock, chart from TradingView.com

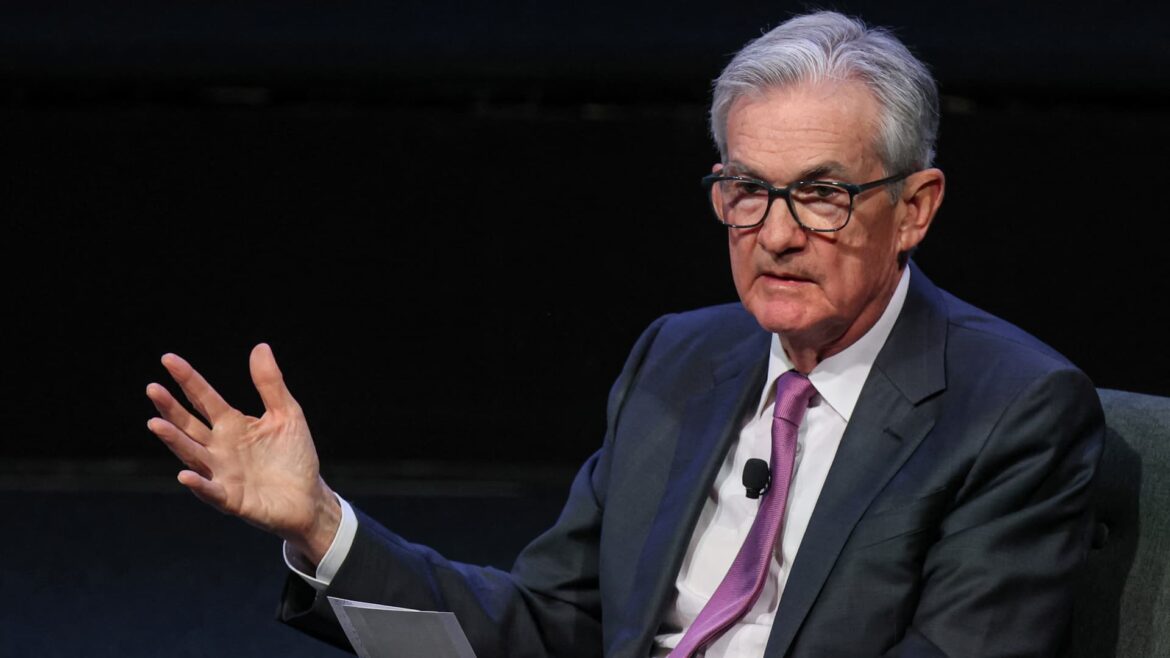

Powell says inflation is still too high and lower economic growth is likely needed to bring it down

Federal Reserve Chairman Jerome Powell acknowledged recent signs of cooling inflation, but said Thursday that the central bank would be “resolute” in its commitment to its 2% mandate.

In a widely anticipated speech delivered to the Economic Club of New York, Powell evaded committing to a specific policy path but gave no indication that he was leaning toward a push higher for interest rates.

As Powell spoke, futures market traders erased any possibility of a rate hike in November and decreased the chances of a move even in December. He acknowledged the progress made toward bringing inflation back down to a manageable level but stressed vigilance in pursuing the central bank’s goals.

“Inflation is still too high, and a few months of good data are only the beginning of what it will take to build confidence that inflation is moving down sustainably toward our goal,” Powell said in prepared remarks. “We cannot yet know how long these lower readings will persist, or where inflation will settle over coming quarters.”

“While the path is likely to be bumpy and take some time, my colleagues and I are united in our commitment to bringing inflation down sustainably to 2 percent,” Powell added.

The speech comes with questions over where the Fed heads from here after a succession of interest rate hikes aimed at cooling inflation. Stocks turned higher after Powell spoke and the 10-year Treasury yield backed off its highs for the session.

Powell said he doesn’t think rates are too high now.

“Does it feel like policy is too tight right now? I would have to say no,” he said. Still, he noted that “higher interest rates are difficult for everybody.”

Powell noted the progress made toward the Fed’s twin goals.

Federal Reserve Chairman Jerome Powell speaks during a meeting of the Economic Club of New York in New York City, U.S., October 19, 2023.

Brendan Mcdermid | Reuters

In recent days, data has shown that while inflation remains well above the target rate, the pace of monthly increases has decelerated and the annual rate has slowed to 3.7% from more than 9% in June 2022.

“Incoming data over recent months show ongoing progress toward both of our dual mandate goals —maximum employment and stable prices,” he said.

The speech was delayed at the onset by protesters from the group Climate Defiance who charged the dais at the club’s dinner and held up a sign saying “Fed is burning” surrounded by the words “money, futures and planet.”

After a short delay, Powell noted the labor market and economic growth may need to slow to ultimately achieve the Fed’s goal.

“Still, the record suggests that a sustainable return to our 2 percent inflation goal is likely to require a period of below-trend growth and some further softening in labor market conditions,” Powell said.

Fed officials have been using interest rate hikes in part to try to level out a supply-demand imbalance in the jobs market. The Fed has raised rates 11 times since March 2022 for a total of 5.25 percentage points. Coming from the near-zero level for the fed funds rate, that has taken the benchmark rate to its highest level in some 22 years.

“We’re very far from the effective lower bound, and the economy is handling it just fine,” Powell said.

The comments come the same day initial jobless claims hit their lowest weekly level since early in 2023, indicating that the labor market is still tight and could exert upward pressure on inflation.

Robust job creation in September and a slow pace of layoffs could put progress on inflation at risk.

“Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy,” he said.

In recent days, other Fed officials have said they think the Fed can be patient from here. Even some members who favor tighter monetary policy have said they think the Fed can halt rate hikes at least for now while they watch the lagged impact the rate hikes are expected to have on the economy.

Markets widely expect the Fed to hold off on additional rate hikes, though there remain questions over when officials might begin cutting rates.

Powell was noncommittal on the future of policy.

Given the uncertainties and risks, and how far we have come, the Committee is proceeding carefully. We will make decisions about the extent of additional policy firming and how long policy will remain restrictive based on the totality of the incoming data, the evolving outlook, and the balance of risks,” he said.

OKX exec says KYC will ‘raise the bar,’ bring real capital into crypto: Blockchain Economy Dubai 2023

While some areas of the crypto space focus on privacy and anonymity, others focus on raising the standards within the space and on bringing in traditional players and more capital in the world of digital assets.

At the recent Blockchain Economy Summit held in Dubai, Cointelegraph spoke with Lennix Lai, the global chief commercial officer at crypto exchange OKX. During the interview, the executive discussed several topics, including the differences between working in traditional finance and crypto, how OKX handled the wave of exchanges implementing mandatory Know Your Customer (KYC) checks and how the exchange navigates the rapidly changing regulatory landscape.

Lai and Cointelegraph’s Ezra Reguerra at the Blockchain Economy Summit in Dubai. Source: Joanna Alhambra

According to Lai, crypto is “a lot more fun” than traditional finance. Lai, who previously worked in traditional firms, said there are many processes in the old finance world that he believes are inefficient. He explained:

“It’s relatively difficult to innovate in traditional finance. In crypto, it’s a lot better and more efficient. And in terms of cost, it is a lot more cheap. So, you can see the pace is a lot faster, and we can serve an even bigger audience than traditional finance right now.”

When problems arose, the executive said that there was lots of internal and external friction before being able to fix problems in traditional finance, even when the solutions were obvious. Furthermore, Lai said there are also regulatory aspects to consider before coming up with solutions.

When it comes to crypto, Lai told Cointelegraph that regulators share almost the same guidelines and expectations as they share the goal of protecting the consumer. The executive said that navigating different regulations from various jurisdictions across the world requires extensive research and mapping out the different requirements.

Lai delivering his keynote speech at the Blockchain Economy Summit Dubai event. Source: Cointelegraph

“Different level of requirement, different level of regulation. But I think all the regulators share similar guidelines and expectations. For example, they want to protect the customer, they want to monitor the trade, they want customer segregation,” he said.

Related: How OKX convinced F1 star Daniel Ricciardo it’s safe to promote crypto

When asked about OKX following the trend of bringing mandatory KYC to its exchange, Lai said there is a need to “raise the bar” in crypto, similar to traditional finance. According to the executive, this will bring what he described as “the real capital and the main money” to the space. He explained:

“That’s how we grow the real market, because if ever your compliance standard cannot meet or somehow talking in the same language with traditional finance, they can never, despite of their interest, despite of our innovation, invest or bring in capital to the space.”

According to Lai, KYC is the first level and the first step to trying to raise the compliance standard in the space so that it can welcome other players in the world of finance.

Magazine: $3M OKX airdrop, 1-hour due diligence on 3AC, Binance AI — Asia Express

Bitcoin will bring global payments out of the ‘fax era’ — Ex-PayPal boss

While information today can be easily transferred over the internet via email or text, global payments have remained in the “fax era,” according to the former president of PayPal.

David Marcus, the former PayPal executive and co-founder of Bitcoin Lightning-focused payment service Lightspark, sayhe believes Bitcoin’s Lightning Network could solve the cumbersome process of sending money across jurisdictions.

“If you were to stop [someone] and wanting to communicate with them you could ask them for an email address and you can email them easily the next minute [and] you could text them,” Marcus told CNBC in a Sept. 11 interview.

However, there’s no universal protocol when it comes to transferring money over the internet, he said:

“If you were to send them money [but] they were not a U.S citizen here using one of the same fintech apps you’re using then you wouldn’t be able to do that. So we’re still in the fax era of global payments.”

Marcus explained that a money transfer to non-U.S. residents in this case would involve obtaining their bank account number and walking to the local bank to pay $50 for an international wire.

“If it’s after Friday at 5 pm, tough luck,” Marcus added.

David Marcus on #bitcoin as base settlement layer for “Trillions of dollars of transactions”pic.twitter.com/L21fmiwxyZ

— Alex Stanczyk ∞/21m (@alexstanczyk) September 11, 2023

Marcus, who co-founded Lightspark in May 2022 and serves as CEO, said his company is now in a race to solve that using the Bitcoin Lightning network.

Related: Bitcoin price dips below $25K — Opportunity, or sign of incoming disaster?

The former PayPal president however believes that ultimately, Bitcoin Lightning won’t be used so much for everyday purchases, and instead be mainly used for overseas transfers.

“Our view is actually that Bitcoin is not the currency that people will use to buy things,” he said. Instead, Bitcoin will be used to send U.S. dollars to someone who ultimately receives it in the form of a Japanese yen or euro on the other side of the world, the Lightspark boss explained.

Marcus said Bitcoin’s settlement layer combined with Lightning’s real-time payments enables cash finality at a very low cost.

Magazine: Magazine: Recursive inscriptions — Bitcoin ‘supercomputer’ and BTC DeFi coming soon

Overstock to bring back Bed Bath & Beyond’s loyalty program after asset purchase

Bed Bath & Beyond’s stores might be disappearing, but the home-goods retailer will survive in online form, following Overstock.com Inc.’s deal announced Wednesday to acquire and revive the bankrupt chain’s website and loyalty program.

Overstock

OSTK,

on Wednesday said it had it had acquired Bed Bath & Beyond’s brand and intellectual property, in a deal that would reportedly meld both companies’ e-commerce platforms into one, under the name bedbathandbeyond.com. Overstock announced the deal a day after a bankruptcy judge approved the online furniture site’s $21.5 million bid to buy the assets.

Overstock said it would hold a conference call on Thursday to offer more details on the deal.

The deal will hand Bed Bath & Beyond’s website and domain names, customer database, loyalty program data, and trademarks and patents to Overstock. The deal does not include stores or inventory, or Buy Buy Baby, a baby-merchandise retailer that Bed Bath & Beyond bought in 2007.

Overstock said that within the next week, it will relaunch the Bed Bath & Beyond domain in Canada. And it said that “weeks later,” it would set up a new website, mobile app and loyalty program in the U.S.

The online furniture retailer said customers of both Overstock and Bed Bath & Beyond would be able to shop online at bedbathandbeyond.ca in Canada and bedbathandbeyond.com in the U.S.

The New York Times reported that beginning in August, shoppers in the U.S. who visit overstock.com would be routed instead to bedbathandbeyond.com. The Times reported that Overstock also planned to bring back Bed Bath & Beyond’s wedding registry, and was weighing whether to rename the combined business entirely — potentially going with Bed Bath & Beyond.

Overstock snapped up the assets after Bed Bath & Beyond filed for bankruptcy protection in April, following the chain’s struggles with cash burn, miscalculations on product mix and online competition. E-commerce demand over the past year has also slowed, after prices rose for basics and left customers with less flexibility to spend on things like home goods and electronics.

A separate auction for Buy Buy Baby had been set for Wednesday morning. But CNBC reported on Wednesday that Bed Bath & Beyond had split that process up into two parts — one for the baby-products chain’s intellectual property; the second for offers to keep its physical stores afloat, set possibly for Thursday.

Shares of Overstock were up 3.4% after hours. Over-the-counter trading of Bed Bath & Beyond

BBBYQ,

stock was quiet after hours, with shares up fractionally.

Overstock on Wednesday also said it would re-brand its Club O loyalty program as Welcome Rewards.

The company said that for the second quarter so far, sales were likely down in the “low-20% range” when compared to last year.

“The promotional and marketing environment has remained highly competitive due to the weak consumer sentiment within a challenging economic backdrop and changes in consumer spending preferences,” executives said.