China needs a new economic plan that focuses on domestic services and private consumption.

Source link

broken

A golden rose and a broken heart. This is how ‘Golden Bachelor’ came to an end.

The “Golden Bachelor” finally gave away the inaugural golden rose.

(Warning, spoilers ahead.)

Gerry Turner, the 72-year-old first “golden bachelor” in the reality-TV dating franchise, picked the person he “can’t live without” during Thursday’s finale. It was down to two contestants: Theresa Nist and Leslie Fhima.

He ultimately proposed to Nist, a 70-year-old financial services professional who had been married to her late husband, Billy, for more than 40 years, beginning when she was 18 years old.

Turner said during the episode he asked his late wife, Toni, if this was the right thing to do, and he felt confident it would be OK. He and Toni were married for 43 years, before she unexpectedly died from an infection a month after they closed on their “dream” retirement home.

Nist said during the episode she thinks Toni and Billy would be happy for them. “I know how sometimes it feels like the whole world thinks that love is only for the young and, quite honestly, at the age of 70, I was beginning to feel that myself,” she told him before the proposal. “After Billy died, I was at the point where I thought I’m going to live the rest of my life alone, until I met you.”

The show had a live component to it, with past contestants and fans watching along. Host Jesse Palmer interviewed Fhima mid-episode about her experience during the finale, shortly after the episode showed Turner tell her the night before the rose ceremony that he had fallen in love with Nist. “I had this whole life planned for us,” Fhima told Palmer. She later said she had picked out her dress and written her vows.

During the live conversation between Fhima and Turner, she echoed what other contestants have said in the past: that she didn’t know she could love again, and this experience had shown her otherwise. Some of the previous contestants had been married multiple times, and others were in decades-long marriages that ended when their spouses died.

See: ‘The Golden Bachelor’ premieres: ‘How lucky would I be to find a second true love in my lifetime?’

During the live conversation, Palmer also asked Nist and Turner what they had to say to viewers who thought there might be an age limit on love. “If you’re 40, 50, 60 or 90, even if you have one day left to live, if you have love to give, do it.”

Turner was the center of attention on Wednesday, after an exclusive article by the Hollywood Reporter said Turner lied on the show about his dating history. According to the report, he dated numerous women since his wife’s death, and dated one woman for at least three years.

An “Entertainment Tonight” report following up on the bombshell said Turner was open about his dating past with the contestants, citing an unnamed source.

The pair are set to wed on Jan. 4 during a live ceremony on ABC.

The 60/40 stock-bond portfolio appears to be broken. Here’s how it could change.

The classic 60/40 portfolio, which consists of 60% bonds and 40% stocks, hasn’t performed well in the past few months, with the two assets mostly posting a positive correlation and investors worrying the Federal Reserve may keep interest rates higher for longer.

The S&P 500

SPX

has lost 3% for the past three months, while the 10-year Treasury

BX:TMUBMUSD10Y

yield added about 53.9 basis points during the same period, according to FactSet data. Bond yields and prices move in opposite directions.

For stocks and bonds to post a negative correlation again, there has to be a change in the inflation regime, Alexandra Wilson-Elizondo, the head of multi-asset funds and model portfolio management at Goldman Sachs

GS,

said in a roundtable discussion held by the bank.

“We do agree that you’re going to continue to see that disinflationary trend, which could take a little bit longer than expected, but ultimately, we should get down to that 2% [interest-rate] target with the current level of rates that we’re seeing,” said Wilson-Elizondo.

Still, the Treasury markets have been mostly driven by a large amount of leverage, which primarily comes from the U.S. federal deficit, Wilson-Elizondo noted. “Every time you see large funding announcements or expectations of issuance, it makes it very hard for the rate market to rally even with the disinflationary trend,” she said.

Investors have to watch a large election cycle across different economies to look for signs of changes, according to Wilson-Elizondo. “Ultimately, we do expect in particular the front end of the curve to perform quite well in a selloff,” she added.

Investors should also look at other assets, such as gold and commodities, for diversification and risk-management purposes, the analyst noted.

U.S. stocks ended Tuesday higher, with the Dow Jones Industrial Average

DJIA

up 0.2%. The S&P 500 rose 0.3% and the Nasdaq Composite

COMP

gained 0.9%, according to FactSet data.

‘We were broke, broken and stressed to the max.’ They sold their house for an RV

With the future of their startup, OME Gear, hanging in the balance, South Carolina entrepreneurs Jules Weldon and Stacey Pierce believed that they had to either give up their dream of owning and running a family business or “go all in” and sell their last substantial asset, their beloved house.

It was two days before Christmas 2020, and this was the hardest decision that they had faced in their 10-year, tightknit relationship, including five years as a married couple.

““I just never wanted to live in a should-a, would-a, could-a world.””

— Stacey Pierce, entrepreneur

After maxing out their credit cards, draining their bank accounts and closing their 401(k)s, they were low on options for raising capital needed to keep the business running. They asked each other how much they believed in OME; both answered 100%.

They were convinced of the importance of moving forward, “even when the dream or goal looks impossible,” explained Weldon. Added Pierce, “We always look at roadblocks as new opportunities to learn.”

Betting the house and its contents

Committing wholly to the outdoor-products company meant they had to downsize their lifestyle and lower their personal overhead, Weldon, 52, and Pierce, 51, sold, gave away or threw out 95% of their stuff, including furniture, clothes, kitchen items, a boat, a truck and a golf cart. They put the remaining 5% in storage.

The story of OME Gear began at the shore some 25 years ago when Weldon’s parents, Jerie and Paul, saw a single mom wrestling with her beach stuff while spending time with her three children on the sand.

Shortly afterward, her parents invented a two-in-one lounger/dolly initially intended for the beach. But despite their hard work, and success in securing a patent, they lacked sufficient capital to take the product to market. Her parents didn’t have the money to keep OME afloat while caring for their family needs and responsibilities. They didn’t have the know-how to make it happen, and her mom was busy operating her bakery.

Weldon and Pierce picked up the family dream and pursued it with more hard work, redoubled determination and four additional patents. They persisted despite many setbacks, including the COVID-19 pandemic, which made raising money and manufacturing products extremely difficult.

Plus: Don’t make these six common marketing mistakes with your small business

Trading down to an RV

The decision to downsize their personal lives came as a result of needing to rescue 2,500 units of their products that the manufacturer was holding in a warehouse in Utah and would not release until Weldon and Pierce came up with the money. “We were broke, broken and stressed to the max,” explained Weldon.

Once they made the decision to go “all in,” a buyer snapped up their single-family house in Charleston, South Carolina, four days after it went on the market. At the time, they did not even know where they were going to live.

They decided to hit the road for two years in an RV, leaving their three-bedroom home in a lovely neighborhood and moving into a 250-square-foot RV with one small closet. As further evidence of their commitment to the business, they wrapped the motor home in plastic printed with OME Gear branding to promote their outdoor furniture company.

Weldon settled in within a few weeks, but Pierce, a self-proclaimed nester, took a few months to consider the RV her new home.

Also see: These three tips help small-business owners make better money decisions

Stranded in ‘Nowhere, Arizona’

They also enjoyed the adventure of being on the open road for two years and learned to laugh at the pitfalls, like the time their car came off the hitch in “Nowhere Arizona” and slammed into the back of the RV they were driving…not once but twice.

They quickly learned about life on the road in an RV, such as the fact that everything has to be secure and you have to unhook the toilet and the power each time you pull away from a campsite, and you can’t run the microwave and the hair dryer at the same time or you will blow a fuse.

They also moved 55 times and slept in 63 beds in the two years while traveling an eye-popping 73,000 miles.

By being willing to put everything on the line and embrace the possibility of failure, they believe that they set themselves up for success.

While they were on the road, they made more than 200 “cold call pitches” to a variety of small and large companies. “There is no shame in this game,” said Pierce. “If people have ears, we are telling them about OME Gear and the Wanderr.”

The Wanderr is an innovative, transforming cart that holds up to 150 pounds of gear, rolls easily over any terrain, including soft sand, and can transform into a low beach chair, recliner/lounger, higher off-the-ground camping chair or camping cot. With three optional straps, it can be used as a “hauler” to transport kayaks, paddle boards and surfboards.

Plus: Ford is now making this off-roader just for those who want to live that #vanlife

Blueprint for a rich life

Their quest was about so much more than a product or a business. It became a blueprint for leading their richest and most productive lives, regardless of the obstacles.

“It is imperative that you figure out what you are willing to give up in order to reach those dreams,” said Pierce. “When the going gets tough — and it most definitely will — you’ve already made the decision to not quit. The words ‘give up’ are not in our vocabulary.”

These resilient entrepreneurs say having one another to lean on is the key to getting them through the tough times.

“There are many entrepreneurs who would have given up by now, but having a partner on this journey makes the tough times seem just a little easier,” Pierce explains. “One of our mottos is in having each other, our joys are multiplied and our sorrows are divided. This is so true in every aspect of our personal and entrepreneurial lives.”

Have a reliable partner

Their relationship is absolutely one of the top factors in their tenacity and perseverance levels.

“We embrace the theory of the ‘little red wagon,’ ” Weldon said. “I think having that support from Stacey is everything. Being in our position as an entrepreneur who invented a product is one of the loneliest places that you can be because people don’t understand how difficult it is to take a product to market.”

This helps them through the rough patches. “People have told us that they think we are crazy,” Weldon adds. “But the resilience of the human spirit is nothing short of amazing. We look at one another and wholeheartedly disagree. When you have someone else to validate the mission that you’ve been called to, it makes it so much easier. There have been so many times when we would have given up if we didn’t have each other.”

“My husband Paul and I and the entire family are immensely proud of these two women. It means the world to us,” said Jules’ mother, Jerie Weldon.

“When you look at the extreme struggles they have gone through, we are so proud that they keep persevering, and keep going like the Energizer Bunny,” she added. “They might bump or fall down, but it’s wonderful to watch their progress.”

Jerie Weldon took her own leap of faith when a friend invited her to learn how to decorate cakes early in her 59-year marriage. The mother of two learned a new skill and as her family increased to six children she grew her dreams into The Master’s Baker, a successful business now operated by one of her four sons, Chad, in West Chester, Pennsylvania.

In fact, she notes that five of her children are following in her entrepreneurial footsteps. “It’s exciting to watch Jules and Stacey step out of their comfort zone and thrive, especially when I know a lot of people would be too frightened to take that first plunge,” Jerie said. “How can I not admire their courage and tenacity?”

Also read: This couple traded their house for an RV and paid off $200,000 in debt — then the money started rolling in

A calling, not a product

OME stands for Oceans + Mountains = Earth, or Outdoors Made Easy. The idea was to have the company appeal to many outdoor activities. As a result, its products are made for a wide cross-section of nature lovers and adventurers, including those who frequent the beach or the lake, as well as those who enjoy camping, fishing, hunting, tailgating, soccer games and other sporting events.

What Pierce and Weldon love about OME Gear goes beyond the products for which they secured patents. These impassioned entrepreneurs say the major purpose of the company is to open the door to the outdoors for people who find it difficult or decide to avoid it because of all the “stuff” that is required to enjoy a day out in nature.

“We believe we’re supposed to have a global impact with our company,” Weldon explained. “When I am called to something it is impossible for me to give up.”

Check out: It’s one of the latest trends in camping—why drive an RV when you can have it delivered?

Sharing their story

Beyond building a successful company, these two inspirational women plan to create a platform of influence and positive change. They have won several prestigious innovation awards, are effective motivational speakers, and recently spoke at TEDx Wilmington in Delaware.

In building OME Gear, Weldon explains, “we have come up against some pretty significant obstacles and roadblocks, and our heartbeat is to help fill in the potholes so that those who come behind us, particularly women, will have an easier go at it,” she added. They want to grow their company so that they can give back in a big way.

“We have come through so much and persevered,” Pierce says. “We know it will be worth it, but even more so, it is worth it now. Who we are becoming as a result of this journey is what this is all about!”

They hope to buy a new home in South Carolina in the near future, after two and a half years of not having a permanent address, and have no regrets about gambling big on their business. Their beloved RV is on the market ready for the next owners to make their memories.

“There have been moments when Jules and I have been brought to our knees, but the wins have kept us going,” says Pierce. “I just never wanted to live in a should-a, would-a, could-a world. We believe this is so close to being a breakthrough for our future that if we stopped now and looked back, I think we would have regretted that for the rest of our lives.”

Weldon adds that, “the hard truth about our journey is that it has required us to give up more than we thought we could.”

“But,” she continues, “it goes back to the commitment we made during our wedding vows, to live a life with no regrets and one that is filled with lots of adventure!”

Debra Wallace is a multi-award-winning professional journalist, author, editor, social media/web content provider, and autism advocate with 20+ years of experience. She regularly contributes to Parade.com, Orlando Family Fun, South Jersey, Monsters & Critics, Delaware Today, and several other print and digital publications. Her expertise includes celebrity profiles, entertainment, local heroes, health/wellness, special needs parenting, and autism advocacy. Wallace is a devoted single mother to her 17-year-old son, Adam.

This article is reprinted by permission from NextAvenue.org, ©2023 Twin Cities Public Television, Inc. All rights reserved.

More from Next Avenue:

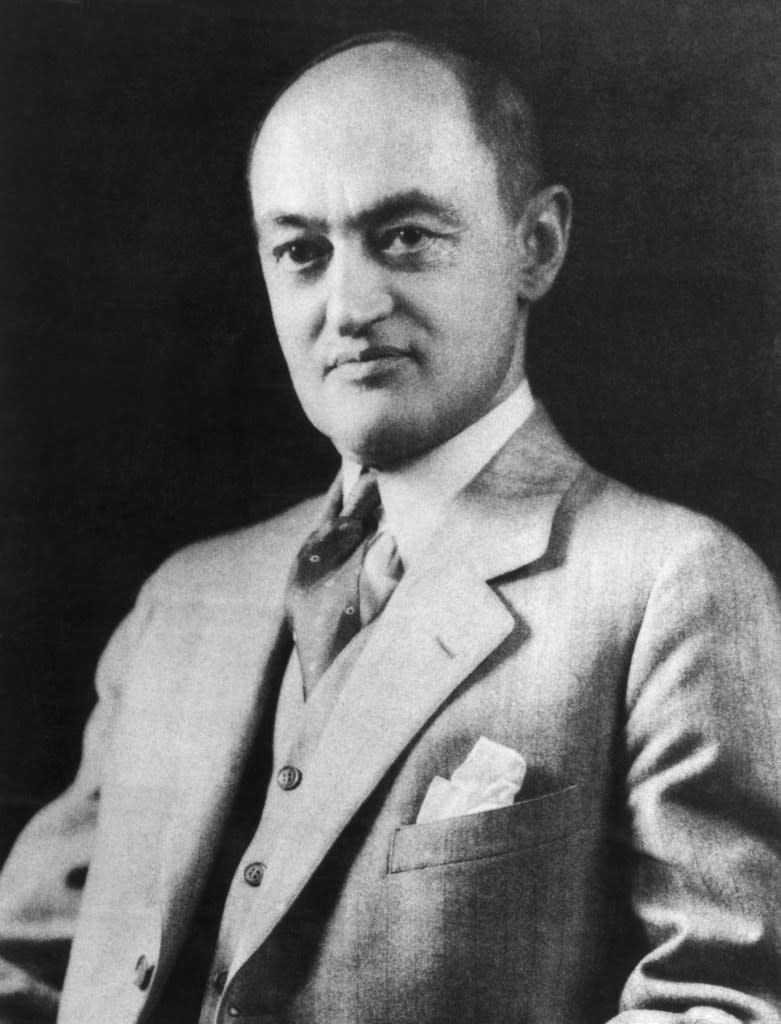

The Chicago school economist who warned years ago of America’s ‘business dynamism’ fading still sees ‘something broken in the background’

Ufuk Akcigit is a distinguished economist. He’s the Arnold C. Harberger professor of economics at the University of Chicago, one of the most influential departments in the discipline of the last century (the so-called “Chicago school”), and holds a PhD from MIT. The Turkish national has also won multiple awards for his research, including Germany’s Max Planck-Humboldt and Kiel Institute awards, as well as the prestigious Guggenheim Fellowship.

A pioneer in the field of Quantitative Economic Growth, Akcigit examines how market innovation and policy combine to optimize an economy’s expansion—or the opposite. Akcigit’s work on “business dynamism,” a hugely important metric that gauges an economy’s ability to sustain growth, has borne grim tidings for his adopted country of the United States. Simply put, he’s found that over time, the American economy has become a hostile environment for innovation.

In 2019, Akcigit and his co-author Sina T. Ates, of the Federal Reserve Board, released findings that pinned the blame for fading U.S. dynamism on “poor knowledge diffusion.” Four years later, he tells Fortune that the problems just haven’t gone away.

“For productivity to improve, we need to have ‘creative destruction’ and turnover,” Akcigit told Fortune. “Better firms should replace worse firms in the economy, and that turnover will push productivity forward.”

(Ates, a principal economist at the Federal Reserve Board, was unable to speak on the record due to his position. The researchers’ findings do not reflect the opinion of the Fed.)

Something’s broken

Business dynamism, measured by the rate of new firm creation in markets, is directly tied to innovation and productivity. In Akcigit’s field, researchers have known that it’s been declining in the U.S. since the 1980s, the cause of which has prompted various theories. This decline in dynamism is significant because it’s linked to a general slowing of productivity and creative momentum, which need to be strong for the U.S. to remain the world’s dominant economy in the long term.

The majority of U.S. markets have become more concentrated, and thus less competitive due to the slowing firm turnover rate, the co-authors argued. The result has been markets increasingly dominated by big players who don’t drive their sectors forward, and higher barriers for new businesses to enter markets. The dip in new entrants is a hit to the economy, as new entrepreneurs are the engines of growth under capitalism.

“Creative destruction,” a phrase coined in 1942 by the great Austrian economist Joseph Schumpeter, is the process where unproductive firms are cyclically edged out of a market as the natural result of healthy competition and as new, more productive companies surge ahead. It therefore bodes ill that, according to Akcigit, the number of new firms launching the U.S. economy has been declining for the past several decades in tandem with a productivity slowdown.

The 2020s are providing evidence of green shoots for dynamism. In the three years since the pandemic, there’s been a well-reported rise in new business formation, while productivity has largely declined as CEOs nationwide weather remote and hybrid work, only for a surprise uptick in the second quarter of 2023. Still, the U.S. has seen a steady secular decline in establishment births for decades. This is especially troubling, Akcigit says, because the U.S. has been greatly increasing its investments in research and development. The government’s investment in R&D was an estimated $792 billion in 2021, nearly double the $407 billion it spent in 2010.

“There’s something broken in the background, these are the indicators according to the textbook definition,” says Akcigit, who is also a researcher at Germany’s Halle Institute for Economic Research. “Normally as we invest more in R&D and innovation, we should grow faster, but that’s not happening…and the amount of knowledge that diffuses from market leaders to followers seems to be the dominant factor to explain all these facts together.”

Akcigit and Ates modeled various “alternative horse races” to test which factors—including potentially corporate taxes, inflation, or subsidies—could be causing the decline in dynamism. They worked with quantitative data on firm entry rate, job reallocation, productivity dispersion, and other vectors, building on previous research with new models. Ultimately, their research indicates that the key to sustained economic growth may be a democratic distribution of great ideas.

“Knowledge diffusion” is the dispersion of innovation across an industry. If one firm makes a breakthrough, the spread of its ideas can supercharge productivity across the sector, but siloing that information only benefits the original business. Knowledge diffusion is crucial for economic productivity, because productivity aggregates all firms and can’t be accelerated by just a few strong leaders. For a whole society to benefit from new knowledge, it has to be shared with as many potential users of that knowledge as possible.

But right now, Akcigit and Ates found, new breakthroughs are getting more concentrated. The existing big players across markets are becoming more entrenched, and the turnover rate among market leaders is declining. This means that firms that historically would be replaced by newer, more creative firms are remaining in power and dragging down the market’s productive potential.

“Firms are experimenting less, they are entertaining less radical ideas over time,” Akcigit told Fortune. “They are trying to go for safer things.”

What broke?

Akcigit and Ates’ research posits three main reasons for the dynamism decline. First, the U.S. has outsourced more and more of its production over the past four decades. When production is concentrated in the same area, various firms have the benefit of learning from each other through interacting in the region. Increased offshoring of production abroad means communication—and thus cross-pollination of ideas—between firms has naturally declined.

Second, the rise of data as a form of capital interfered with traditional means of knowledge diffusion. In decades past, a smaller rival could better compete against an entrenched player by studying its production facilities: they could see what kind of machines were used and reverse-engineer them. But now, machines and data capital are not easily studied in person to be reverse-engineered.

“Today, one of the main ingredients for production is data, customer data, or A.I.,” Akcigit says. “Firm data is not something that you can replicate unless you share it and make it publicly available, which obviously firms don’t do. So as a result, whoever has managed to collect enough information on the largest possible customer base gets a disproportionate advantage.”

Data primacy, of course, favors established firms with larger, richer databases and customer bases from which to extract new data.

The third reason to which Akcigit and Ates attribute weak U.S. dynamism is the most significant: intellectual property hogging. They measure the growing concentration of intellectual property by patent ownership. In the early ’80s, 30% of patents were produced by the largest 1% of firms. By 2019, that number had doubled to 60%.

Not only are more than half of all new inventions owned by the economy’s largest firms, but those same firms are always vying to purchase more patents invented by other firms, to essentially monopolize new ideas. In the ’80s, 35% of the patents on the secondary market were purchased by the largest firms, but now it’s around 65%.

“There’s a massive concentration of intellectual property within the hands of the market leaders,” Akcigit says. “You buy these patents to build a wall around yourself so that competition is harder, and followers cannot leapfrog your boundaries. And whenever they try to leapfrog you, you threaten them, you sue them, you take them to court.”

How do we fix it?

There are some listening to this—including in the White House. President Joe Biden has made what he calls pro-competitive reforms a priority of his administration, particularly with regard to antitrust policy, where he’s actively seeking to break with 40 years of precedent and practice. Notably, he nominated Lina Khan, flagbearer of the populist, hard on Big Tech “New Brandeis” movement in antitrust, as chairwoman of the FTC, and as chair of the agency she has formed a triumvirate of likeminded pro-competition regulators, with Jonathan Kanter at the Justice Department and Tim Wu at the White House’s National Economic Council, although Wu resigned in late 2022 to return to teaching at Columbia University.

Khan is known for her anti-monopolism and goal of reforming federal merger guidelines. She’s taken on several big players in the tech industry, and endured many setbacks in her efforts to block mergers. While at Yale Law School, she published the influential article “Amazon’s Antitrust Paradox,” which takes aim at the retail behemoth and similar big players, calling for increased anti-monopoly, pro-competition policy.

Biden has also created a White House Competition Council and issued an executive order in July calling for the deconsolidation of American industries.

“[T]he answer to the rising power of foreign monopolies and cartels is not the tolerance of domestic monopolization, but rather the promotion of competition and innovation by firms small and large,” the executive order reads.

For his part, Akcigit says policies to bolster knowledge diffusion may be most effective in the intellectual property realm. Right now, most patent authorities monitor the amount of original patents being produced, but they should also be keeping a close eye on the secondary market. The leap in large firms purchasing patents on the secondary market, buying competitors’ inventions, is a primary contributor to idea-clogging in markets.

“The secondary market for technologies has to be watched,” Akcigit says. “Instead of having patent resale in a productive way, the secondary market is being used for so-called killer acquisitions. So the market leaders are buying out other firms or their intellectual property, not to use them, but to put them to sleep so that they don’t compete.”

The economist told Fortune that competition policymakers and authorities should keep a “dynamic and forward-looking” mindset. Small companies can be hugely important idea crucibles and become quickly successful, but are the most vulnerable to macroeconomic headwinds. If authorities don’t know which startups to keep watch over, important breakthrough firms can easily fail due to their fragility.

Akcigit compared young firms to children in the economic family, who fall ill easily and have to be carefully protected. “We should look at their future potential,” he advised.“Whenever there’s some macro-turbulence, small firms get affected very easily—but, they are the future of the economy.”

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Looking to make extra cash? This CD has a 5.15% APY right now

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home