Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Data shows that U.S. spot bitcoin exchange-traded funds (ETFs) experienced negative outflows on Friday, totaling $55.1 million, with Grayscale’s Bitcoin Trust (GBTC) seeing another notable decrease. Metrics from Thursday reveal GBTC held 316,193.43 bitcoins, but after a decline of 2,048.23 bitcoins, the fund’s holdings reduced to 314,145.2 bitcoins. Blackrock and Fidelity Absorb Bitcoin Despite GBTC’s […]

Source link

BTC

Kiyosaki Reacts to $200 BTC Crash Prediction, Miners Offload BTC Ahead of Halving, and More — Week in Review

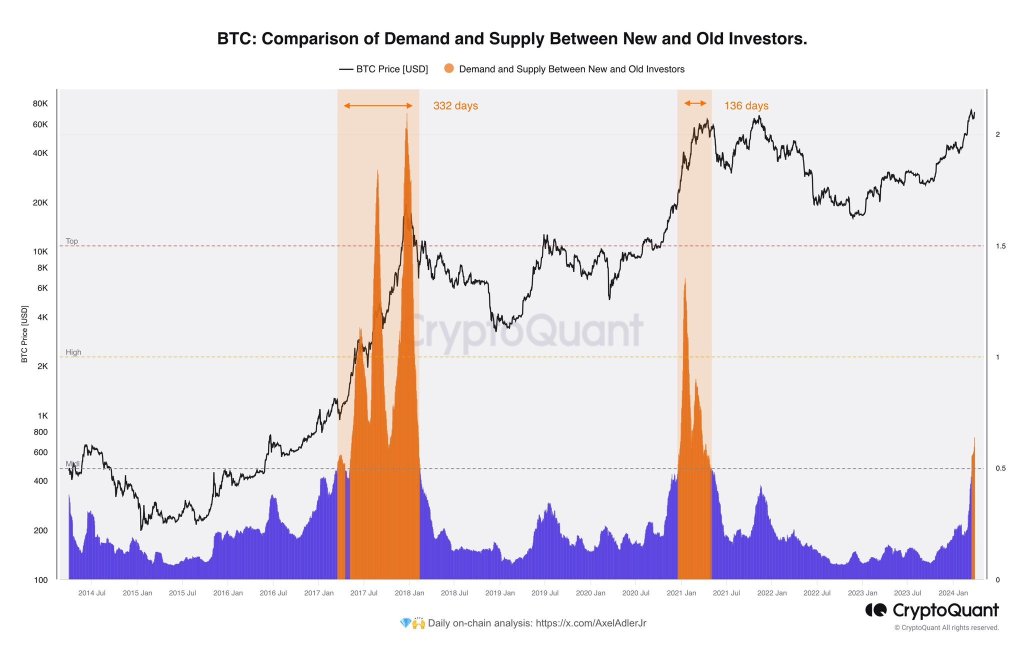

Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Robert Kiyosaki expressed his stance on potentially investing more in Bitcoin if its price plummets to $200, as economist Harry Dent has forecasted. Cryptoquant data reveals that Bitcoin miners are selling off their holdings in anticipation of the network’s upcoming halving event, which is expected to impact their rewards. JPMorgan has speculated that the SEC […]

Source link

Massive Bitcoin Market Turbulence Triggers $4,500 Crash; $167M in BTC Longs Erased in 1 Hour

The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

The price of bitcoin continued to decline over the weekend, dropping an additional 7.7% in the last 24 hours. It plummeted to a daily low of $61,384 per coin, prompting a significant wave of leveraged liquidations on Saturday. Bitcoin Value Declines Amid Market Instability; Extensive Liquidations Reported By 4:00 p.m. Eastern Time on Saturday, bitcoin’s […]

Source link

10 US Bitcoin ETFs Amass Over 519,000 BTC, With Blackrock Leading at 50.81%

The latest data reveals that Blackrock’s spot bitcoin exchange-traded fund (ETF) has increased its bitcoin portfolio, now encompassing 263,937.48 bitcoins valued at $17.88 billion. Spot Bitcoin ETF Reserves Reach New Heights Several U.S. spot bitcoin ETFs have bolstered their bitcoin (BTC) holdings, bringing the total for ten ETFs, excluding Grayscale’s Bitcoin Trust (GBTC), to 519,440.22 […]

The latest data reveals that Blackrock’s spot bitcoin exchange-traded fund (ETF) has increased its bitcoin portfolio, now encompassing 263,937.48 bitcoins valued at $17.88 billion. Spot Bitcoin ETF Reserves Reach New Heights Several U.S. spot bitcoin ETFs have bolstered their bitcoin (BTC) holdings, bringing the total for ten ETFs, excluding Grayscale’s Bitcoin Trust (GBTC), to 519,440.22 […]

Source link

Bitcoin Technical Analysis: BTC Eyes Previous Zeniths With Renewed Vigor

On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

On April 8, 2024, bitcoin reached an impressive 24-hour peak of $72,573, marking a significant uptrend. With a 24-hour trading volume of $29.64 billion and a market capitalization soaring to $1.41 trillion, the cryptocurrency showcases strong market growth. Bitcoin Analyzing the daily chart, bitcoin (BTC) displays a bullish pattern with consistently higher lows and higher […]

Source link

Skybridge Founder: Bitcoin Halving Not Priced in — BTC Has ‘a Lot More’ Upside

Skybridge Capital founder Anthony Scaramucci remains bullish on bitcoin, dismissing the notion that the potential benefits of the upcoming halving are already priced in. He emphasized that bitcoin has significant room for further growth, noting that the crypto could “trade to half of the valuation of gold,” which translates to a potential six to tenfold […]

Skybridge Capital founder Anthony Scaramucci remains bullish on bitcoin, dismissing the notion that the potential benefits of the upcoming halving are already priced in. He emphasized that bitcoin has significant room for further growth, noting that the crypto could “trade to half of the valuation of gold,” which translates to a potential six to tenfold […]

Source link

Embattled crypto lender Genesis Global Capital has continued to ramp up efforts to pay up creditors after filing for bankruptcy protection in January 2023. As part of these efforts, Genesis has now reportedly sold off the entirety of its Grayscale GBTC holdings to acquire a substantial amount of Bitcoin in order to implement its repayment strategy.

Genesis Converts GBTC Shares To Bitcoin In Preparation For Debt Settlement

According to a Friday report by Bloomberg Law, Genesis finalized the sale of its 36 million GBTC shares, as revealed by the company’s lawyers in a court filing on April 2. Genesis had initially received legal approval to liquidate its GBTC holdings on February 2 with each unit share valued at $38.50. However, court documents showed that the current price of GBTC as at the time of sale on April 2 was $58.50 resulting in a total sale price of $2.1 billion.

Bloomberg’s report disclosed that the bankrupt crypto lender then used these proceeds to purchase 32,041 Bitcoin at a market price of $65,685, which will be distributed to creditors as part of its repayment plan, especially those who were previously enrolled in the Gemini Earn program.

These recent transactions align with Genesis’s bankruptcy plan which allows the conversion of GBTC shares to either Bitcoin or direct cash for the settlement of its existing debt. Currently, the crypto lender owes $3.5 billion to creditors and will commence repayment following court approval.

However, Genesis faces fierce opposition from its parent company, Digital Currency Group (DCG), over its proposed repayment plan. In a petition filed in February, DCG argues that its bankrupt subsidiary looks to settle creditors’ claims at amounts higher than their respective entitlement.

DCG believes such a repayment strategy violates the Bankruptcy Code and is “unfair” since it will only benefit senior creditors who will largely gain from an appreciation in Genesis’s crypto assets value while equity holders and company stakeholders are left in unfavorable positions.

Founded in 2013, Genesis is one of the prominent crypto firms to file for bankruptcy. Its insolvency is largely linked to the sudden collapse of the defunct crypto exchange FTX.

Bitcoin Price Overview

In other news, Bitcoin gained by 2.55% in the last day to reach a price of $69,339. Such price gain would be encouraging to investors especially following the token’s overall negative performance in the past week. On higher timeframes, BTC largely remains largely bullish as anticipation continues to build ahead of the halving event on April 19. The fourth halving in Bitcoin’s history is expected to reduce the mining reward from 6.25 BTC to 3.125 BTC.

BTC trading at $69,314 on the daily chart | Source: BTCUSDT chart on Tradingview.com

BTC trading at $69,314 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured Image from Nairametrics, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Banks Seek to Purchase Bitcoin Directly From BTC Mining Firm Hut 8, Says CEO

Per the CEO of Hut 8, a bitcoin mining company listed on the Toronto stock exchange, major financial institutions have made inquiries to purchase bitcoin directly from the firm. Additionally, the Hut 8 executive emphasized the forthcoming halving event’s “big impact,” noting a surge in demand juxtaposed with a reduction in available bitcoins. Financial Giants […]

Per the CEO of Hut 8, a bitcoin mining company listed on the Toronto stock exchange, major financial institutions have made inquiries to purchase bitcoin directly from the firm. Additionally, the Hut 8 executive emphasized the forthcoming halving event’s “big impact,” noting a surge in demand juxtaposed with a reduction in available bitcoins. Financial Giants […]

Source link

Bitcoin Technical Analysis: BTC Consolidation Points to Potential Shifts Ahead

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

On March 29, 2024, with a trading price of $70,075, and oscillating within a 24-hour range of $68,362 to $71,754, bitcoin’s current market behavior reveals significant consolidation and neutrality. Bitcoin Bitcoin’s 1-hour chart reveals recent volatility, with a significant bounce from a low of approximately $68,362, suggesting a strong support level. Conversely, the resistance near […]

Source link

Are Old Bitcoin Whales Selling Or Mitigating Risks Using Spot BTC ETFs?

Ki Young Ju, the founder of CryptoQuant, a blockchain analytics firm, has noticed a curious trend. In a post on X, the founder shared a snapshot suggesting that Bitcoin “old whales” might be shifting their holdings to “new whales,” mainly traditional finance heavyweights like Fidelity and BlackRock.

The United States Securities and Exchange Commission (SEC) recently approved these new whales to list spot Bitcoin exchange-traded funds (ETFs) for all investors.

“Old Whales” Moving Coins: Selling Or Risk Mitigation?

While a definitive sell-off isn’t confirmed, commentators replying to the founder’s post believe these “old whales” could be mitigating risk. In their assessment, moving their Bitcoin stash from self-custody to a regulated investment vehicle like spot Bitcoin ETFs is a better measure of covering unexpected eventualities.

If this is the approach, then it could prove strategic. Bitcoin holders can transact without depending on a third party. Notably, this development coincides with a significant drop in BTC inventory on major exchanges like Coinbase and Binance, as well as at GBTC.

The decline has accelerated since the introduction of spot Bitcoin ETFs, hinting at a potential departure from exchanges. Meanwhile, the operators of GBTC are unwinding the product and converting it to a spot Bitcoin ETF following a court decision.

Will Spot BTC ETFs Gain Traction?

Even so, that “old whales” are moving their coins to centralized products like ETFs contradicts the core philosophy of BTC as a tool for financial self-sovereignty. Whether more users, mainly retailers, will choose to own spot Bitcoin ETF shares rather than the underlying coins directly remains to be seen.

Institutions might be obliged by law to use a regulated product if they need to be exposed to BTC. However, retailers can choose to buy directly from exchanges or mine. This freedom might lead to more retailers opting to buy BTC.

This trend emerges ahead of the highly anticipated Bitcoin halving. This event is set for mid-April 2024 and will further reduce BTC’s circulating supply, potentially driving higher prices. Before then, BTC prices are firm, steady above $70,000 at the time of writing.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.