Blackrock has amassed nearly 110,000 bitcoins for its spot bitcoin exchange-traded fund (ETF), Ishares Bitcoin Trust (IBIT), since its launch about a month ago. The world’s largest asset manager’s bitcoin ETF has a total net inflow of nearly $5 billion, leading the pack among all spot bitcoin ETFs. Blackrock CEO Larry Fink has stated that […]

Blackrock has amassed nearly 110,000 bitcoins for its spot bitcoin exchange-traded fund (ETF), Ishares Bitcoin Trust (IBIT), since its launch about a month ago. The world’s largest asset manager’s bitcoin ETF has a total net inflow of nearly $5 billion, leading the pack among all spot bitcoin ETFs. Blackrock CEO Larry Fink has stated that […]

Source link

BTC

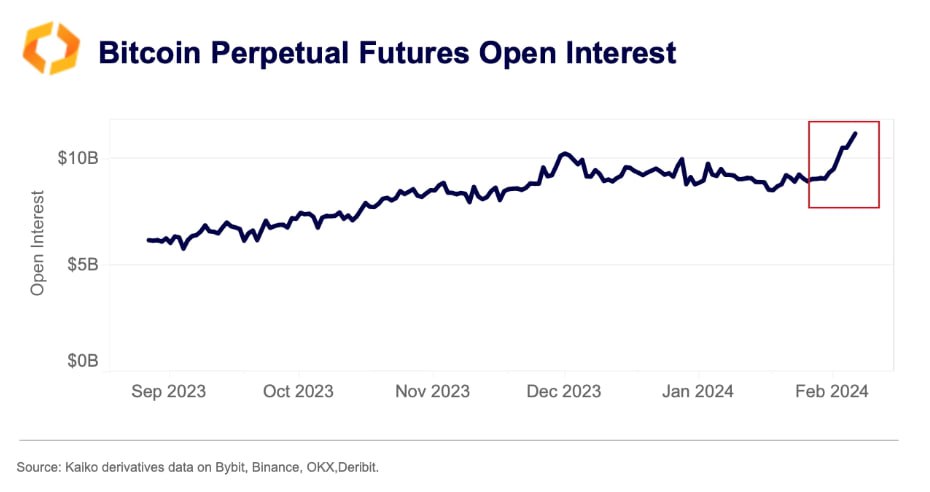

Bitcoin Open Interest Surges To A 2-Year High, BTC Breaks Above $51,000

Bitcoin’s open interest has surged past $11 billion for the first time in over two years. This uptick comes when the world’s most valuable coin surges, recently easing past $51,000, the highest level since December 2021.

Surging Open Interest And Order Book Imbalance

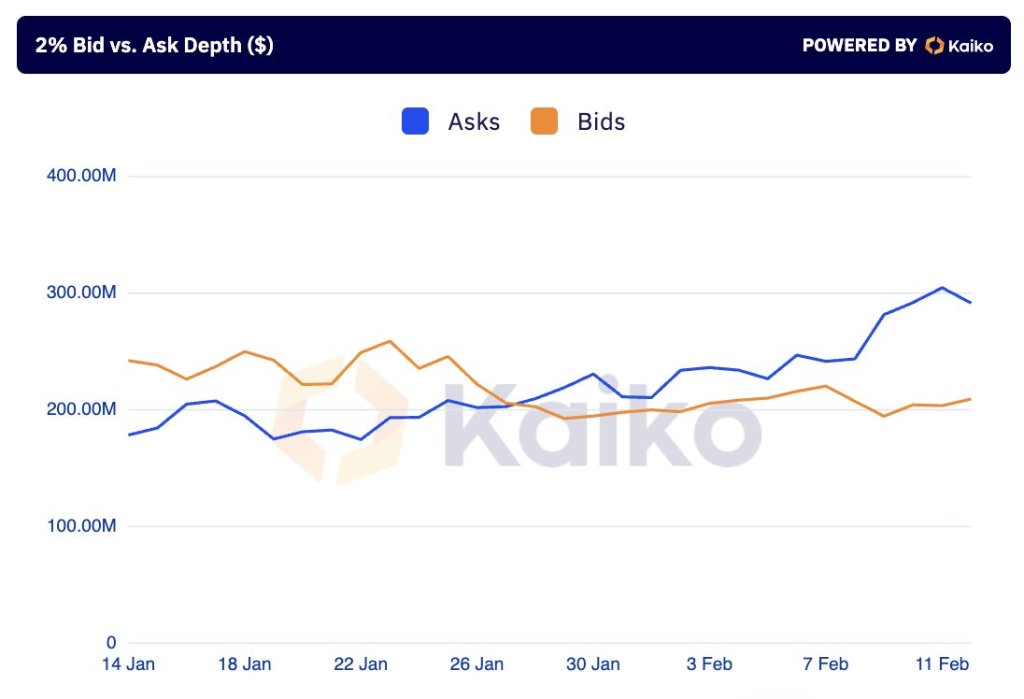

According to Kaiko, a leading crypto analytics provider, this upswing in open interest comes at a critical time for the coin. When prices zoomed past $48,000 on February 11, there was an order book imbalance. Then, Kaiko observed there were $100 million more bids than asks.

Technically, whenever there is an order book imbalance with more bids than asks, it suggests that buyers are more willing and enthusiastic to purchase at spot rates than sellers are willing to liquidate. Following this imbalance, prices shot higher the following days, breaking above the $50,000 psychological number to over $51,500 when writing on February 14.

Surging open interest, especially as the market trends higher, is bullish. It means that more people are willing to participate in the market, hopeful of riding the trend. Subsequently, their participation translates to a more liquid market, charging the upside momentum.

Bitcoin is racing higher at the back of strong inflows into spot Bitcoin exchange-traded funds (ETFs). Over the past few weeks, spot Bitcoin ETF issuers have been rapidly accumulating the coin. The largest so far is BlackRock’s IBIT, owning over 70,000 BTC.

As a result, prices are edging higher, reflecting the high demand pinned directly to institutional participation. This positive sentiment and expectations of even more price gains, translating to higher open interest, is despite the continued liquidation of the Grayscale Bitcoin Trust (GBTC). Following court approval, GBTC is converted into an ETF, joining others like Fidelity, who also offer a similar product.

Genesis Looking To Sell GBTC; Will Bitcoin Rally In March?

Even with the high optimism, a potential cloud hangs over the Bitcoin market. Genesis, a crypto lender under bankruptcy protection, wants the court to allow them to sell over $1.4 billion of GBTC.

If the court green-lights this move, BTC could have more liquidation pressure, possibly unwinding recent gains. So far, the FTX estate sold their GBTC, estimated to be worth over $1 billion, coinciding with Bitcoin dropping to as low as $39,500 in January.

Besides these Bitcoin-specific events, the market is closely watching how the monetary policy scene in the United States will evolve in the next few weeks. The United States Federal Reserve is expected to slash rates in March, a potentially beneficial move for BTC.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Billionaire Peter Thiel’s VC Firm Bought BTC and ETH Worth $200 Million in Latter Half of 2023

Founders Fund, a venture capital (VC) firm founded by the billionaire Peter Thiel, is believed to have acquired bitcoin and ethereum worth $200 million sometime in the second half of 2023. The VC firm reportedly began purchasing bitcoin when its price was still under $30,000. Founders Fund’s Renewed Interest in Crypto In the latter half […]

Founders Fund, a venture capital (VC) firm founded by the billionaire Peter Thiel, is believed to have acquired bitcoin and ethereum worth $200 million sometime in the second half of 2023. The VC firm reportedly began purchasing bitcoin when its price was still under $30,000. Founders Fund’s Renewed Interest in Crypto In the latter half […]

Source link

As of Feb. 12, 2024, bitcoin displays a robust upward momentum across several charts, underscored by its sharp ascent from $47,593 to $48,814 on Sunday. On the subsequent Monday, bitcoin’s market value reached $939 billion, with a trading volume of $21.57 billion for the day. Currently, the upward trend pauses, with the price dipping below […]

As of Feb. 12, 2024, bitcoin displays a robust upward momentum across several charts, underscored by its sharp ascent from $47,593 to $48,814 on Sunday. On the subsequent Monday, bitcoin’s market value reached $939 billion, with a trading volume of $21.57 billion for the day. Currently, the upward trend pauses, with the price dipping below […]

Source link

Quick Take

The rapid growth and success of Bitcoin ETFs, specifically the group termed the ‘Newborn Nine,’ excluding GBTC, is reshaping the dynamics of Bitcoin holdings. In just one month since their inception, according to Bitcoin website Apollo, these ETFs have outpaced MicroStrategy by acquiring 192,000 Bitcoins compared to MicroStrategy’s 190,000 in its corporate treasury. This remarkable growth signifies a shift in Bitcoin ownership from individual entities to ETFs.

Data from Applo shows that the new challenge for the ‘Newborn Nine’ is GBTC, holding 469,000 Bitcoins. Furthermore, BlackRock’s IBIT, with 78,000 Bitcoins, indicates potential competition for MicroStrategy in the upcoming months. These trends underscore the strong performance of Bitcoin ETFs.

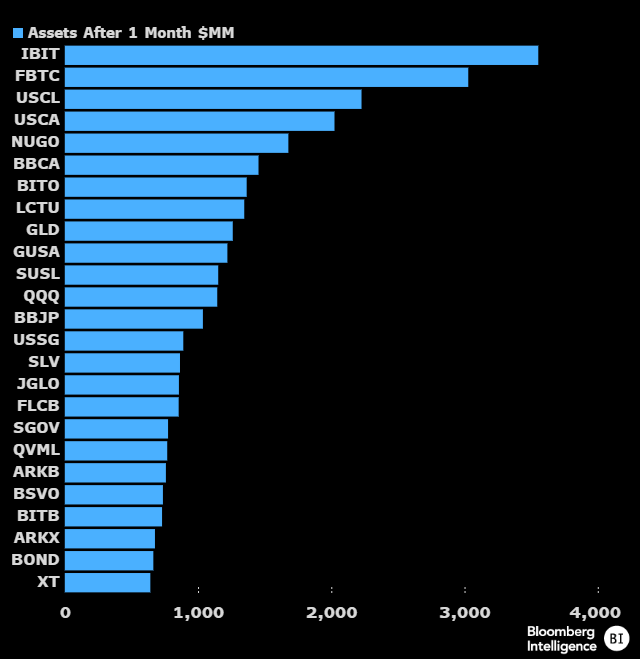

In addition, Bloomberg Analyst Eric Blachunas highlighted the impressive standing of these ETFs, with IBIT and FBTC leading the ETF pack with assets of around $3 billion each within a month of their launch. This places them at the top of the league of the top 25 ETFs by assets, among 5,535 launches in 30 years. ARKB and BITB also made the list, Balchunas goes on further to say.

The post Bitcoin ETF newcomers surpass Microstrategy in BTC holdings appeared first on CryptoSlate.

Bitcoin price struggled to continue higher above the $43,800 resistance. BTC is moving lower and might decline heavily if it breaks the $41,800 support.

- Bitcoin price is declining from the $43,800 resistance zone.

- The price is trading below $42,800 and the 100 hourly Simple moving average.

- There is a key bearish trend line forming with resistance near $42,850 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could continue to decline if there is a clear move below the $41,800 support.

Bitcoin Price Takes Hit

Bitcoin price made another attempt to gain pace above the $43,000 and $43,200 resistance levels. However, BTC struggled to extend its gains and recently started another decline below $42,800.

There was a move below the $42,500 support. A low is formed near $42,232 and the price is now consolidating losses. There is also a key bearish trend line forming with resistance near $42,850 on the hourly chart of the BTC/USD pair.

Bitcoin is now trading below $42,800 and the 100 hourly Simple moving average. Immediate resistance is near the $42,750 level. It is near the 50% Fib retracement level of the downward wave from the $43,250 swing high to the $42,232 low.

The next key resistance could be $42,850 and the trend line. The trend line is close to the 61.8% Fib retracement level of the downward wave from the $43,250 swing high to the $42,232 low, above which the price could start a decent increase.

Source: BTCUSD on TradingView.com

The next stop for the bulls may perhaps be $43,250. A clear move above the $43,250 resistance could send the price toward the $43,800 resistance. The next resistance is now forming near the $44,200 level. A close above the $44,200 level could push the price further higher. The next major resistance sits at $45,000.

More Losses In BTC?

If Bitcoin fails to rise above the $42,850 resistance zone, it could start another decline. Immediate support on the downside is near the $42,250 level.

The first major support is $41,800. If there is a close below $41,800, the price could gain bearish momentum. In the stated case, the price could dive toward the $40,500 support.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $42,250, followed by $41,800.

Major Resistance Levels – $42,750, $42,850, and $43,250.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

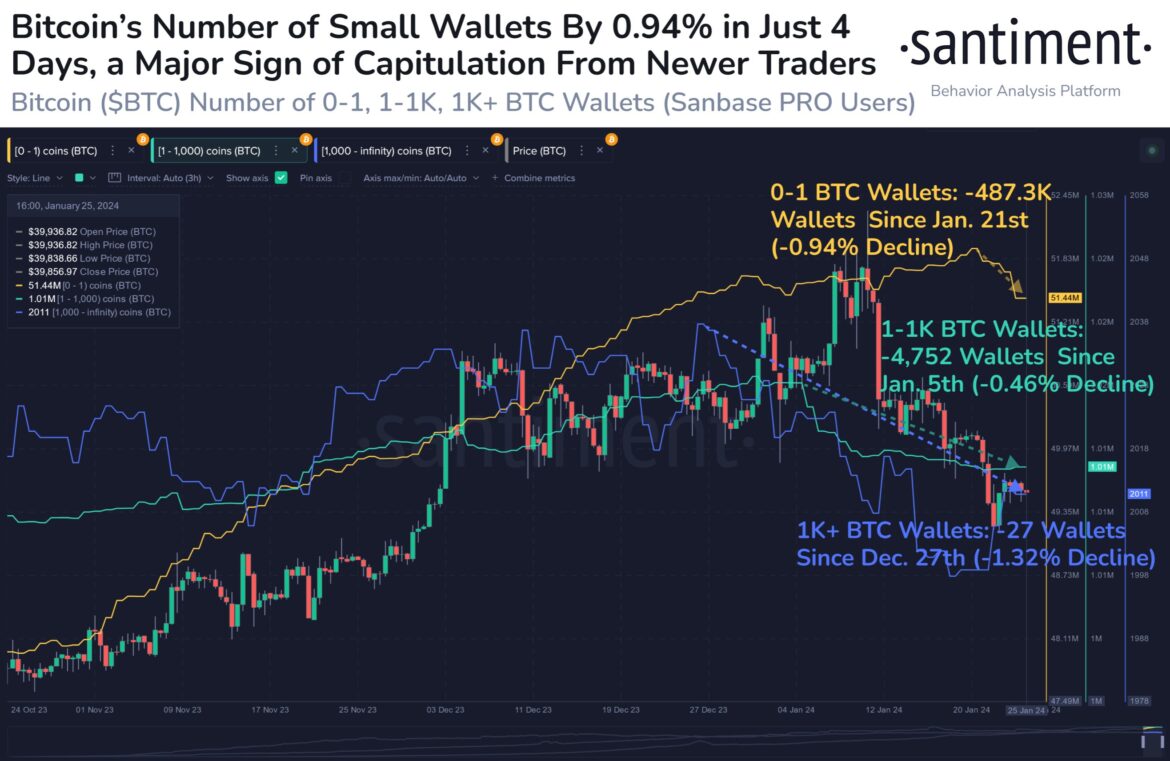

On-chain data shows that Bitcoin investors have been clearing out their wallets recently as the asset continues to be disappointing in this post-ETF era.

Bitcoin Small Wallets Have Been Displaying Signs Of Capitulation

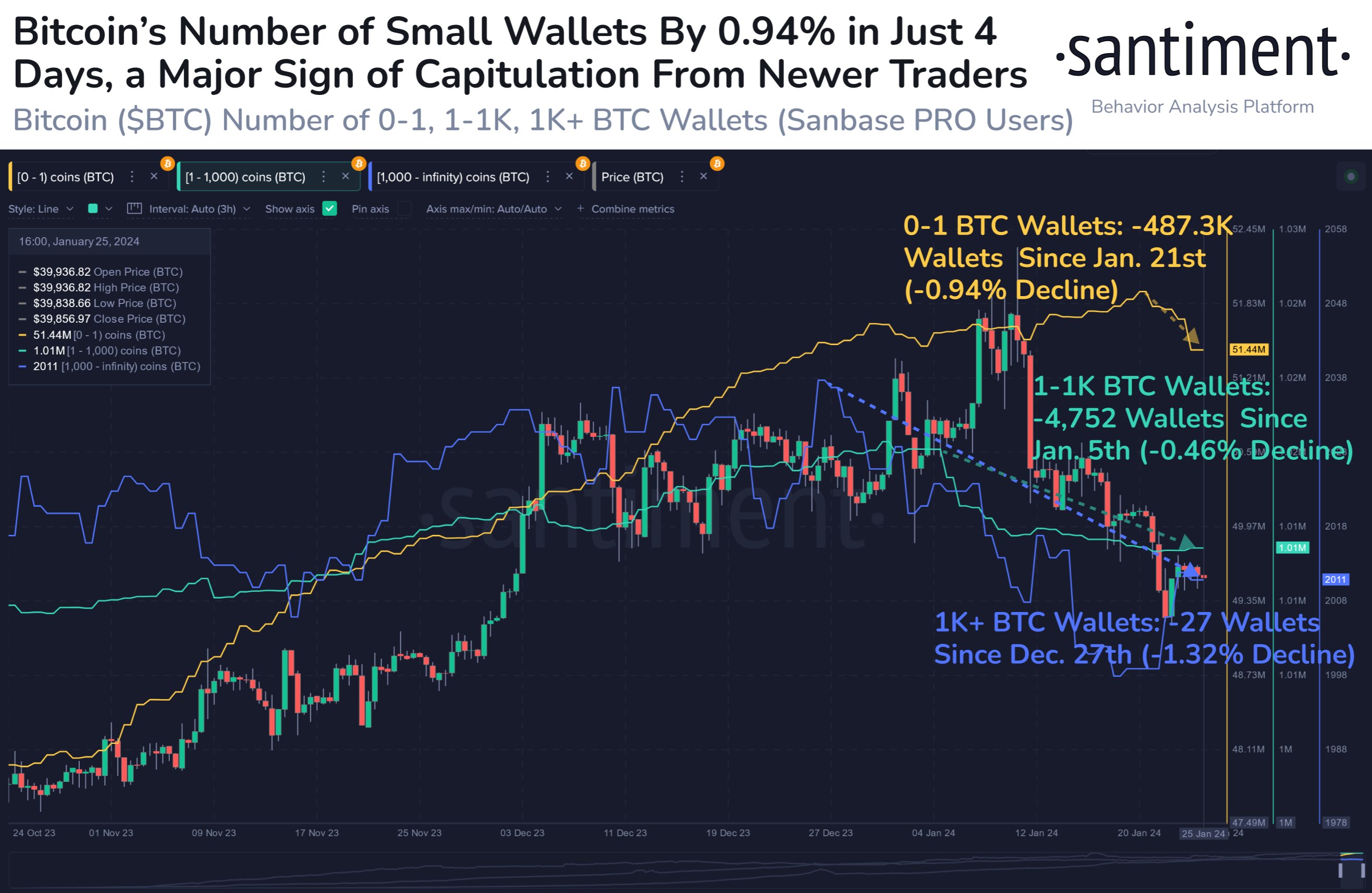

According to data from the on-chain analytics firm Santiment, the number of small BTC wallets has seen a sharp decline during the last few days. The indicator of relevance here is the “Supply Distribution,” which tells us about the amount of wallets that currently belong to the different holder groups on the Bitcoin network.

The addresses are divided into these groups based on the number of coins they are carrying in their balance right now. A wallet carrying 0.5 BTC, for instance, would belong inside the 0 to 1 BTC cohort.

Now, here is a chart that shows the trend in the Supply Distribution for three different Bitcoin wallet groups over the last few months:

The trend in the wallets of the small, mid, and large BTC holders | Source: Santiment on X

The first wallet group on the chart is the “0 to 1” coins cohort. The owners of such small wallets are usually the retail investors, popularly known as the “shrimps.”

From the graph, it’s visible that these small hands have seen the total number of their wallets go down in the last few days. To be more specific, around 487,300 shrimps have cleared out their wallets in this selloff, a decline of almost 1%.

“History tells us that this is typically a sign of capitulation, which can lead to a market price bounce until smaller traders begin to get optimistic toward crypto as an investment vehicle once again,” explains the analytics firm.

“The disappointment of market performances since the 11 ETF approvals over 2 weeks ago is largely attributed as the cause for these wallet liquidations,” Santiment adds.

The spot ETFs have been one of the main topics in the cryptocurrency community during the last few months, and the price rally in Bitcoin was in part driven by anticipation around them. Unlike what some investors had imagined, though, the market sold at the news, and BTC has been unable to recover so far.

The shrimps aren’t the only ones that have capitulated recently, though, as the 1-1,000 coins group has seen a decline of 4,752 wallets since January 5th, while the 1,000+ BTC entities have shed 27 addresses since December 27.

The former group includes the mid-sized Bitcoin holder groups like the “sharks,” while the latter cohort includes the largest of the hands on the network: the “whales.”

Clearly, however, these larger entities had started selling ahead of the spot ETF approvals, while the shrimps had still been optimistic about the event. And interestingly, since the smallholders have started their latest capitulation, the whales have, in fact, seen some growth in their addresses.

BTC Price

Bitcoin has seen some sharp recovery push in the past day as the asset’s price has now bounced back to the $40,800 mark.

Looks like the price of the coin has shot up over the last 24 hours | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, charts from TradingView.com, Santiment.net

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

In a surprising turn of events, the approval of spot Bitcoin (BTC) exchange-traded funds (ETFs) has not yielded the anticipated immediate upside impact on the Bitcoin price.

Contrary to expectations within the crypto community, BTC has experienced a sharp drop of over 16% since the ETF approval on Wednesday, January 11, dipping below the key $40,000 level. The failure of BTC bulls to hold the support level has led to a testing phase at the $38,000 level, accompanied by a 4.5% price drop within the past 24 hours.

Bitfinex Whales Buck The Trend

Amidst the market volatility, according to Datamish, Bitfinex whales have accumulated Bitcoin long positions since November 2023. This accumulation of approximately 4,230 BTC since January 17 marks the first sustained increase in Bitfinex BTC long positions following a sharp decline in November last year.

However, the recent downturn in the BTC price can be partly attributed to increased selling pressure from miners and asset manager Grayscale. Grayscale has notably increased its BTC sell-off since the ETF trading commenced.

Transferring a significant amount of BTC from the Grayscale Trust address to Coinbase, totaling 69,994 BTC ($2.9 billion), has influenced the market dynamics.

Additionally, reports indicate substantial sell-offs of Grayscale’s Bitcoin Trust GBTC shares, including a notable sale of 22 million GBTC shares by the FTX estate, worth nearly $1 billion.

Bitcoin Liquidation Zones Wiped Off

The impact of Grayscale’s sell-off is evident in CoinGlass’ liquidation heatmap, which shows notable liquidation zones being wiped off in the 1-week chart.

While Grayscale’s BTC dump has contributed to the price drop, the increased accumulation of BTC long positions on Bitfinex indicates a potential change in sentiment. A price reversal could occur if the $38,000 support line holds, pushing BTC back above $40,000.

Furthermore, excluding Grayscale, institutional investors and asset managers involved in the ETF market have collectively acquired over 86,320 BTC at an average price of $42,000, representing a substantial $3.63 billion investment.

Market experts such as Ali Martinez suggest that these institutions are likely to adopt a strategic, long-term view rather than engage in peak purchases. This level of institutional investment underscores the growing recognition of Bitcoin as a legitimate asset class and signifies confidence in its long-term growth potential.

Currently, the Bitcoin price is at $38,800, reflecting a substantial year-to-date decline of over 12% and a 9.7% drop in the past seven days. The duration and extent of the selling pressure caused by Grayscale’s BTC dump remain uncertain, leaving the question of how much further the BTC price may decline.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin ETFs buy 95,000 BTC as assets under management hit $4 billion

The “Newborn Nine” Bitcoin ETFs have collectively amassed 95,000 BTC, with collective assets under management (AUM) nearing $4 billion, according to available data.

According to Bloomberg ETF analyst Eric Balchunas, this remarkable inflow of capital highlights the growing investor appetite for digital assets and the increasing acceptance of cryptocurrencies in mainstream finance.

Balchunas pointed out that most ETFs typically experience a drop in trading volume each day after launch. However, the Newborn Nine have continued to post record volume, with the fifth day of trading seeing a 34% increase in volume.

$1B club

BlackRock’s IBIT and Fidelity’s FBTC have led the pack in growth. Both funds have seen substantial inflows of over $1.2 billion each within this short period and each of them holds a little over 30,000 Bitcoin.

While Fidelity’s FBTC has slightly higher inflows, BlackRock’s IBIT leads in AUM, holding $1.4 billion compared to Fidelity’s nearly $1.3 billion.

Other notable ETFs include Invesco’s ETF, which had its best day on Jan. 19, attracting over $63 million, though its total AUM hasn’t surpassed $200 million. VanEck’s ETF has shown similar performance and broke the $100 million mark in AUM on day six of trading.

Meanwhile, Valkyrie Investments and Franklin Templeton’s AUM stood at $71.7 million and $48.6 million, respectively, on Jan. 19. WisdomTree has yet to break the $10 million mark.

Grayscale outflows

This substantial capital influx into the newly launched Bitcoin ETFs has outpaced the outflows from the Grayscale Bitcoin Trust (GBTC), which saw its AUM decrease by $2.8 billion in the same period.

GBTC has seen a reduction in its spot Bitcoin shares, amounting to a loss of $1.62 billion in the first four days. This suggests a shift in investor preference towards the new ETFs, which offer regulatory clarity and ease of access.

Despite the volatile nature of Bitcoin, which saw a sell-off in the same period, these ETFs have been successful. This success is partly attributed to redirecting outflows from GBTC to these new spot Bitcoin ETFs.