The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

Source link

BTCs

Bitcoin (BTC)’s Price Faces Threat As Analyst Foresees $54.73 Million Liquidation

According to data from CoinMarketCap, Bitcoin (BTC) has maintained its upward price trajectory over the last day, gaining by 4.04% to briefly trade above the $48,000 mark. As BTC now hovers around the $47,100 price zone, investors and market experts remain highly speculative about the token’s next action. On that note, popular analyst Ali Martinez has called a major prediction that could spell weighty losses for many investors.

Liquidity Hunters Target $45,810 In Potential Bitcoin Price Manipulation Plot

In an X post on Friday, Martinez predicted an incoming dip in Bitcoin’s price driven by a planned liquidation. Using data from the cryptocurrency futures trading platform, CoinGlass, the analyst stated the Bitcoin liquidation heatmap indicated that there is potential strategic liquidation in play.

According to the #Bitcoin liquidation heatmap, there’s a potential strategy unfolding where liquidity hunters could drive the price of $BTC down to $45,810. This move is aimed at triggering liquidations amounting to $54.73 million! pic.twitter.com/monFlZmvQ6

— Ali (@ali_charts) February 9, 2024

Martinez stated that liquidity hunters in the BTC market could be looking to push the token’s price as low as $45,810 for personal benefits. For context, liquidity hunters are traders or investors who actively seek opportunities in the financial markets to exploit changes in liquidity.

This set of market players often targets specific price levels where there is a concentration of stop-loss orders or where market liquidity is expected to be thin. By triggering liquidations or capitalizing on price movements, liquidity hunters aim to profit from short-term market inefficiencies.

According to Martinez, the liquidity hunters in the BTC market are currently looking to induce an estimated 3% decline in the token’s price. While this change may seem minimal, it represents an astounding $54.73 million in liquidations. Based on these numbers, BTC traders and investors should be wary of potentially significant losses in the coming days.

BTC Price Overview

The premier cryptocurrency has recently taken flight, gaining by 8.6% in the last two days after a flat period of consolidation stretching to the beginning of February. Interestingly, the asset’s pathway to higher gains appears more confident with recent developments in the Bitcoin spot ETF market, which recorded a total net flow of $403 million on February 8 – the highest value of that metric since January 17.

At the time of writing, Bitcoin trades at $47,238, with a 0.26% gain in the last hour. Meanwhile, the coin’s daily trading volume has soared by 56.33% and is now valued at $39.42 billion. In addition, BTC maintains its top spot in the crypto market with a total market cap of $924.67 billion.

BTC trading at $47,229 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from Nairametrics, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin miners outshine the BTC’s 165% rally with astonishing triple-digit gains

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

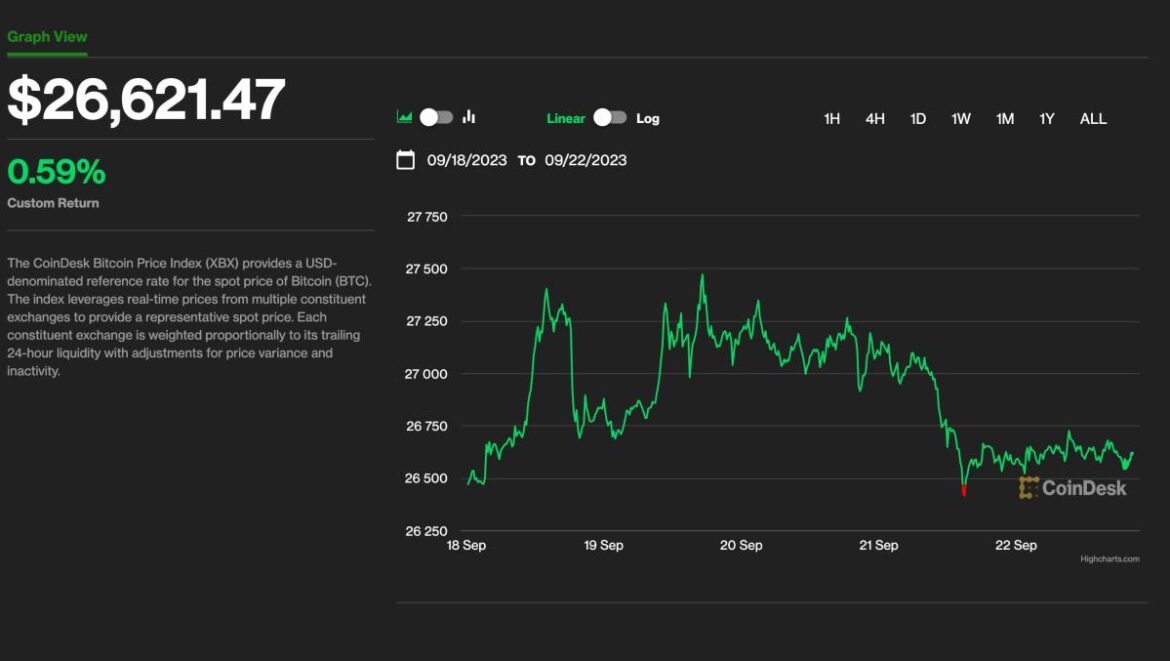

Bitcoin Holding Above $26K Is ‘Remarkable’ as Equities Take a Hit. What’s Next for BTC’s Price?

Bitcoin (BTC) has held firmly above the $26,000 level this week despite sharp sell-offs in equity markets and the surging U.S. dollar – a victory of sorts given the bearish signals those other moves could’ve portended.

The largest crypto asset by market capitalization changed hands Friday afternoon at around $26,500, slightly up 0.3% since the start of the week.

Meanwhile, the benchmark for U.S. stocks, the S&P 500, and the tech-heavy Nasdaq Composite Index plunged 2.7% and 3.2%, respectively.

IntoTheBlock said in a report that the steady price action was “remarkable” in light of the stock market taking a hit. The analytics firm noted among the potential reasons behind the stability that BTC’s correlation with the Dollar Index (DXY) hit zero, meaning there’s no relationship at all between them.

The number of long-term holders – HODLers in crypto slang – are near an all-time high, IntoTheBlock said, which could be a sign that they are refusing to sell before a potential approval of a spot BTC exchange-traded fund in the U.S.

“Historically, these long-term investors have helped sustain price during bear markets and take profits as new all-time highs are set in bull markets,” the report said.

“This trend appears to signal a bullish cycle for bitcoin may be approaching,” it added. “Though it’s unclear how long bitcoin’s outperformance will last in a worsening macro environment, on-chain data shows that its long-term investors continue to accumulate regardless.”

Resistance above $27,000

BTC climbed to as high as $27,400 ahead of the Federal Reserve meeting on Wednesday, but turned lower “witnessing strong selling pressure,” Rachel Lin, CEO of derivatives decentralized exchange SynFutures, noted in an email.

“Both the 200-weekly moving average and the 200-daily moving average are in the 27,800 level, likely acting as strong resistance in the coming week,” she said, adding that the range between $26,000 and $26,500 acts as a support for prices.

In the options market, $24,000 puts and $35,000 call options have the largest open interest, according to Lin.

“This suggests the market still believes BTC will stay in that range for the foreseeable future,” she said.

Bitcoin energy value metric puts BTC’s ‘fair value’ at $47K — Analyst

Bitcoin’s price is trading in a frustratingly tight range between $25,500 and $26,500, leaving traders unsure of the next direction that the asset could take.

However, Charles Edwards, founder of Capriole Investments, believes that Bitcoin’s (BTC) current price presents a low-risk long-term buying opportunity. Edwards’ view is based on Bitcoin’s production cost and energy value.

Capriole Investments energy value theory gives a fair value price of $47,200, and Edwards reiterated his bullish stance by saying that Bitcoin’s production cost gives a floor price estimation of around $23,000 with a 100% hit ratio.

The trade has a risk-reward ratio of 1:5, with the potential for even higher price targets, but Edwards added it is based on the assumption that the rally price “would stop at fair value, which it never has.”

My favorite Bitcoin chart right now. The relative distance between Bitcoin’s price, the historical price floor (Bitcoin Electrical Cost) and fair value (Bitcoin Energy Value). That’s a 5:1 risk-reward assuming no-hype and that price would stop at fair value, which it never has. pic.twitter.com/J2yuGcNX9q

— Charles Edwards (@caprioleio) September 7, 2023

Bullish energy value theory

Edwards proposed Bitcoin’s energy value theory in December 2019. According to the theory, the fair value of Bitcoin can be estimated by the amount of energy it takes to produce it.

The model assumes that the more work that has been put into something, the more valuable it is.

In 2023, the amount of energy spent in Bitcoin mining has been on the rise as mining companies increased their capacity and share of hash rate with the installation of new ASICs and by preparing for the halving in April 2024.

According to Edwards, the Bitcoin energy value reflects its fair value.

Bitcoin’s energy value has shown a strong correlation with Bitcoin’s spot price and this suggests that the theory is at least somewhat valid. However, there are some caveats to the theory.

One limitation is that Bitcoin’s energy value is not always accurate. This is because the mining energy efficiency can vary over time.

Related: Cambridge Bitcoin Electricity Consumption Index updated to reflect hardware distribution and hash rate increases

Additionally, the theory does not take into account other factors that can affect the price of Bitcoin, such as the market’s current demand and supply and the steps taken by miners ahead of the halving next year.

Bitcoin looks primed for further downside

Bitcoin’s spot liquidity data on Binance indicates that buyers are looking at the $24,600 level for support. However, the bullish momentum appears to be fading as most traders are crowding around the yearly low levels and hoping that these hold.

The liquidation levels of futures orders from CoinGlass show that buyers are expecting downside to $24,600, with smaller liquidations extending toward $23,000.

Notably, the price range between $25,000 and $25,500 has the most leveraged orders in significantly high volumes, making them hot targets for traders.

Should the price drop down to the $23,000 level, the buyer’s conviction will be tested. A drop below $23,000 would target the $21,451 and $19,549 levels from 2022.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.