The CEO of Blackrock, the world’s largest asset manager, Larry Fink, says he is “very bullish on the long-term viability of Bitcoin.” Noting that he is “pleasantly surprised” by the demand for Blackrock’s spot bitcoin exchange-traded fund (ETF), he emphasized that the Ishares Bitcoin Trust (IBIT) is “the fastest growing ETF in the history of […]

The CEO of Blackrock, the world’s largest asset manager, Larry Fink, says he is “very bullish on the long-term viability of Bitcoin.” Noting that he is “pleasantly surprised” by the demand for Blackrock’s spot bitcoin exchange-traded fund (ETF), he emphasized that the Ishares Bitcoin Trust (IBIT) is “the fastest growing ETF in the history of […]

Source link

bullish

Ethereum Price May Have Another Chance For A Bullish Streak: Here’s How

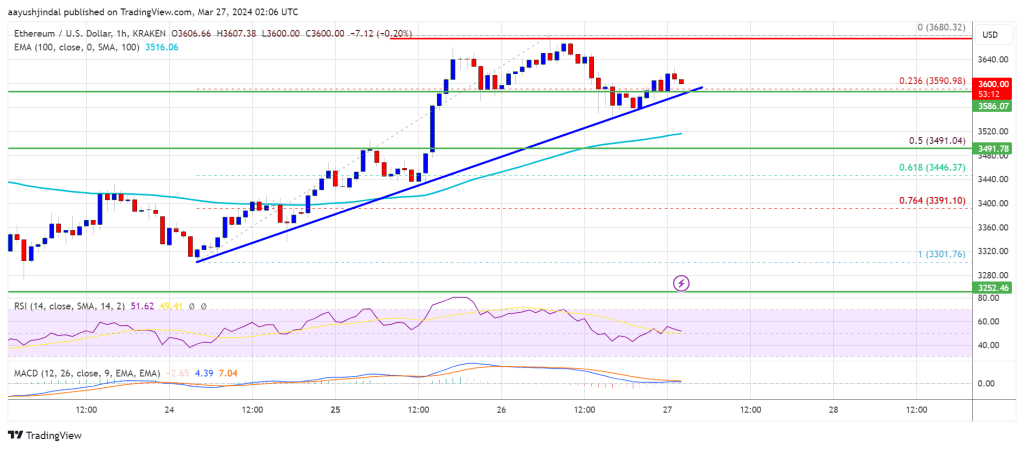

Ethereum price is showing positive signs above the $3,550 zone. ETH must clear the $3,680 resistance to continue higher in the near term.

- Ethereum started another increase above the $3,550 resistance zone.

- The price is trading above $3,550 and the 100-hourly Simple Moving Average.

- There is a major bullish trend line forming with support at $3,590 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could continue to rise if it settles above the $3,680 resistance zone.

Ethereum Price Remains In Uptrend

Ethereum price started another increase above the $3,500 resistance zone. ETH bulls were able to push the price in a positive zone above the $3,580 level, like Bitcoin.

ETH climbed above the $3,650 resistance zone. A high was formed at $3,680 before the price started a downside correction. There was a minor decline below the $3,600 level. The price declined below the 23.6% Fib retracement level of the upward move from the $3,302 swing low to the $3,680 high.

Ethereum is now trading above $3,580 and the 100-hourly Simple Moving Average. There is also a major bullish trend line forming with support at $3,590 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

On the upside, immediate resistance is near the $3,640 level. The first major resistance is near the $3,680 level. The next key resistance sits at $3,720, above which the price might gain bullish momentum. In the stated case, Ether could rally toward the $3,800 level. If there is a move above the $3,800 resistance, Ethereum could even climb toward the $3,880 resistance. Any more gains might call for a test of $4,000.

Are Dips Supported In ETH?

If Ethereum fails to clear the $3,640 resistance, it could start another decline. Initial support on the downside is near the $3,590 level and the trend line.

The first major support is near the $3,550 zone. The next key support could be the $3,500 zone or the 50% Fib retracement level of the upward move from the $3,302 swing low to the $3,680 high. A clear move below the $3,500 support might send the price toward $3,390. Any more losses might send the price toward the $3,250 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $3,590

Major Resistance Level – $3,680

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Costco Wholesale (COST 1.17%) is trading at close to 50 times its trailing earnings. Although not near its 52-week high anymore, the stock still looks expensive given its level of profitability. During the past 12 months, Costco shares surged 50%, soaring past the S&P 500 and its 32% gains over that time frame.

But despite its high price tag, there are still many reasons for investors to remain bullish on the stock both for this year and the long haul. Here’s why Costco stock can be a great buy, even at its seemingly high valuation.

1. The business is still showing strong member growth

Revenue growth is important for businesses, but for Costco, membership growth may be even more crucial. Those are the customers who are signing up for one of its memberships and who are planning to spend at its warehouses on a regular basis. And with a high renewal rate, normally around 90% or better, odds are any new members are going to be customers for a long time.

On the company’s most recent earnings call, which was for the fiscal second quarter (ended Feb. 18), management said the number of paid household memberships rose by 7.8% year over year. Costco now has 73.4 million paid household members and 132 million cardholders. It’s an encouraging sign that even amid inflation and as budgets tighten up, consumers are seeing enough value in Costco’s membership to sign up. That bodes well for the company’s growth prospects this year and beyond.

2. Gross margin improved

Costco’s business has proven resilient, yet again, as the company’s gross margin was well protected. Last quarter, the company reported that its gross profit margin was up by 8 basis points compared to a year earlier. And even when factoring out gas deflation, gross margin was still higher by 4 basis points.

While those aren’t huge improvements in the grand scheme of things (10.8% versus 10.72%), for retailers with thin margins and where cost control is crucial, this too is an encouraging sign that the company should be able to grow its profits. As its member count increases and the company isn’t having to sacrifice gross margin for the sake of growth, Costco’s bottom line should continue to increase, which means that a high price-to-earnings multiple could come down in the future.

3. Costco is opening more stores

In the current fiscal year, Costco expects to open 30 new stores, with two being relocations. While many of its new locations will be in the U.S., Costco is also launching new stores in Asia, including Japan, Korea, and China. The company said there were 10,000 people at the opening of its sixth store in China.

The strong demand in China is an exciting indicator of the long-term potential Costco has in that market. With just six stores, China is an almost untapped market for the big-box retailer. Costco still has plenty of growth opportunities in the long run, which is what makes it an incredibly attractive long-term buy.

4. The e-commerce business is another big opportunity for Costco

In Q2, Costco reported 5.6% comparable sales growth. But what really stood out was e-commerce, where comparable sales were up 18.4% year over year. E-commerce is another area where Costco is just scratching the surface in terms of potential, as is evident with that much faster growth rate. The company also says it recently rolled out Apple Pay as a payment option online to all of its members, which can facilitate the buying process and appeal to a wider range of customers.

Costco stock may be expensive, but it can still make for a solid investment

Costco’s stock comes at a premium but odds are, this isn’t going to be a stock that trades at 20 times earnings anytime soon. The danger for long-term investors is that if you wait too long for it to come down significantly in value, you might miss out on gains. If you’re looking for a growth stock to buy and hold for the long haul, Costco can be a terrific investment to add to your portfolio.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Costco Wholesale. The Motley Fool has a disclosure policy.

Fool.com contributor Parkev Tatevosian discusses the factors that have ASML‘s (ASML 0.12%) management enthusiastic about its business.

*Stock prices used were the afternoon prices of March 14, 2024. The video was published on March 16, 2024.

Parkev Tatevosian, CFA has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML. The Motley Fool has a disclosure policy.

Parkev Tatevosian is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through his link, he will earn some extra money that supports his channel. His opinions remain his own and are unaffected by The Motley Fool.

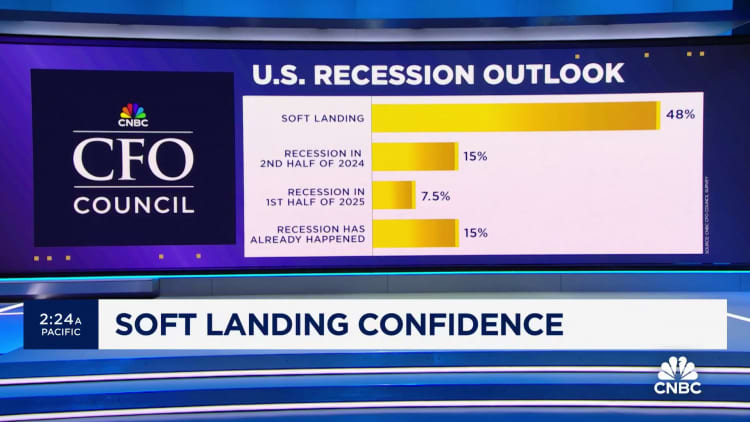

CFOs are as bullish on the Dow and Fed as they’ve been in a long time

Chief financial officers at large companies see a U.S. economy and equities market that can continue to grow, even as fears about sticky inflation and a potentially overextended, and concentrated, bull run in stocks weigh on investors.

That’s according to the CNBC CFO Council Survey for the first quarter of 2024, which shows a dramatic year-over-year change in the view from CFOs about the Federal Reserve’s inflation battle. The percentage of CFOs who think the Fed will be able to achieve a soft landing has reached a five-quarter high, at 48%. It’s a marked change from where CFOs were a year ago in Q1 2023, with expectations of a soft landing tripling since the first quarter of last year.

For the first time in five quarters, not a single CFO rated the Fed’s efforts to bring inflation down as “poor,” while those who described the central bank’s policy as “good” edged higher again quarter over quarter to 55%.

The latest forecast of long-term inflation expectations came in higher than expected this week, but the market reacted positively to Tuesday’s CPI reading, and stocks closed at a new record after some days of selling. This bullishness despite continued jitters on inflation lines up with the view from CFOs on the council.

CFOs have been consistent across our surveying in their view that inflation will not return to 2% any time soon, and that’s the case again in the Q1 survey, with nearly 80% of CFOs saying inflation won’t hit the Fed’s 2% target before 2025 at the earliest.

This view of inflation remaining above the Fed’s target for considerably longer plays into a CFO outlook that the Fed will not move as quickly as the market thinks to cut interest rates. In recent months, the market has gotten the Fed’s message that March is out of the picture for the start of rate cuts, but CFOs remain more cautious on the Fed. According to the Q1 survey, the largest percentage of CFO respondents (44%) do not expect a rate cut until September. The CME FedWatch tool shows a majority of traders still betting on June as a likely target. In the Q1 CFO survey, equal groups of just under 25% of CFO respondents think the cuts will begin in June or July.

Despite CFOs expecting a slower moving Fed than traders, the latest quarterly view represents an increase in dovish expectations. The greatest swing in the survey’s interest rate outlook comes from CFOs who in the previous quarterly survey had not expected rate cuts to begin before November 2024 at the earliest.

Jerome Powell, chairman of the U.S. Federal Reserve, smiles during a press conference following the Federal Open Market Committee (FOMC) meeting in Washington, D.C., U.S. on Wednesday, May 1, 2019.

Anna Moneymaker | Bloomberg | Getty Images

CFOs don’t see rate anxiety as being a major short-term hurdle for stocks. Over 80% of CFOs believe the Dow Jones Industrial Average is more likely to continue its run up to the 40,000-point mark, with technology continuing to lead the way among sectors, than slip into a bear market.

CFO Council members, as a group, have expressed consistent concerns since the Fed began raising interest rates almost exactly two years ago, in March 2022, in keeping with a typically cautious mindset among chief financial officers and referencing recent economic history and expectations it would be repeated — restrictive monetary policy ultimately leads to a large drop in consumer credit quality and demand that damages the economy and, even if in the short-term the labor market remains solid, ultimately layoffs spiral across sectors before the Fed can reverse course and avoid a recession. Even if unemployment and consumer debt are up, and consumer demand is down, the severity of the damage that CFOs were expecting has obviously not come to pass.

The quarterly CFO survey is a snapshot of views from a select number of chief financial officers at large companies comprising the 100 member-plus council, with 27 members providing responses in Q1.

Some of the C-suite economic confidence may be playing into plans for corporate cash. Buybacks are booming again in 2024 and could reach $1 trillion next year, but there is also evidence of more appetite for deal making to start the year, despite the significant regulatory headwinds and antitrust stance of the Biden administration. Nearly one-third of CFO respondents say strategic M&A will be the top capital spending priority this year, which was the most popular response among CFOs for 2024 capex planning.

The Q1 CFO survey doesn’t come without warning signs for an economy and market that have proven more resilient than many, including CFOs, expected throughout the last year. But the biggest risk cited by CFOs this quarter is also a perennial one for major corporations. Throughout the history of CFO Council polling, consumer demand has most consistently ranked as the No. 1 external risk to business, and it is back at the top of the list now (37%), and at its highest level among risk factors in five quarters.

Coinbase looks to raise $1 billion via bond offering amid bullish market trend

Coinbase announced plans to launch a $1 billion bond offering to raise funds for its growth and expansion, according to a March 12 filing.

The bonds, designated as unsecured convertible senior notes, are set to mature in 2030, offering investors the option to convert their holdings into Coinbase shares or cash at that time. The offer also includes a 30-day option to buy an additional $150 million principal amount of notes to cover over-allotments.

The strategy is seen as a savvy maneuver to capitalize on the crypto market’s positive momentum while safeguarding shareholder value.

Coinbase has also introduced “negotiated capped call transactions” as part of the bond offering. This measure is designed to mitigate the dilutive impact on shareholders when the debt is converted into equity.

The proceeds from the bond offering are earmarked for a variety of uses, including debt repayment, funding for the capped call transactions, and potential acquisitions, indicating Coinbase’s ambitious agenda for growth and consolidation within the crypto economy.

Coinbase stock surging with crypto

This announcement comes on the heels of a significant upsurge in the value of Bitcoin, which recently hit a record high, crossing the $73,000 mark.

The bullish trend in the crypto market has been paralleled by a 48% increase in Coinbase’s stock price this year to levels last seen in December 2021 — a rally that has prompted some Wall Street analysts to revise their previously cautious outlooks on the company’s stock.

Financial giants like Raymond James and Goldman Sachs have shifted from bearish to more optimistic views, buoyed by the sector’s robust performance.

As of press time, COIN was trading at $256.14, up 11.91% over the past week and 82.45% over the previous month.

Coinbase previously offered $1.25 billion in senior convertible notes in May 2021, which instead took place following a market crash related to the collapse of the TerraUSD stablecoin. The firm has regularly repurchased its outstanding debt.

The post Coinbase looks to raise $1 billion via bond offering amid bullish market trend appeared first on CryptoSlate.

Ethereum Technical Analysis: Bullish Market Sentiment Keeps ETH Above $3,500

Ethereum’s price experienced a turbulent trading session on March 4, 2024, with significant intraday fluctuations marking the landscape. Despite the short-term volatility, underlying indicators and moving averages suggest a strong bullish trend over the long term. Ethereum The last 24 hours saw ethereum’s (ETH) price swing from $3,411 to $3,537, encapsulating the volatile nature of […]

Ethereum’s price experienced a turbulent trading session on March 4, 2024, with significant intraday fluctuations marking the landscape. Despite the short-term volatility, underlying indicators and moving averages suggest a strong bullish trend over the long term. Ethereum The last 24 hours saw ethereum’s (ETH) price swing from $3,411 to $3,537, encapsulating the volatile nature of […]

Source link

According to data from Lookonchain, an on-chain analytics platform, Ethereum (ETH), whales have withdrawn roughly $64.2 million worth of ETH from major exchanges.

This significant movement of funds coincides with a notable uptick in the price of ETH, indicating an increasing interest in the asset.

Ethereum Whales Movement Signals Confidence

According to Lookonchain’s findings, much of the ETH supply has been shifted from exchange wallets to custodial wallets. The on-chain analytics platform reported that an Ethereum address labeled 0x8B94 had withdrawn an amount of 14,632 ETH, valued at approximately $45.5 million, from Binance.

Lookonchain states these funds have been actively staked within six days, indicating a deliberate move towards adopting long-term investment strategies.

The analysis from the platform also points out that another two fresh whale wallets have transferred 6,000 ETH, amounting to $18.7 million, from Kraken to undisclosed wallet addresses over the last two days.

Whales are accumulating $ETH!

0x8B94 withdrew 14,632 $ETH($45.5M) from #Binance and staked it in the past 6 days.

2 fresh whale wallets withdrew 6K $ETH($18.7M) from #Kraken in the past 2 days.https://t.co/0kEvOmiv3hhttps://t.co/90fqjJXsSu pic.twitter.com/J0ewl8S3OX

— Lookonchain (@lookonchain) February 26, 2024

This trend suggests an increase in major investors to secure substantial amounts of Ethereum away from exchange platforms, potentially as a means of positioning for long-term asset appreciation.

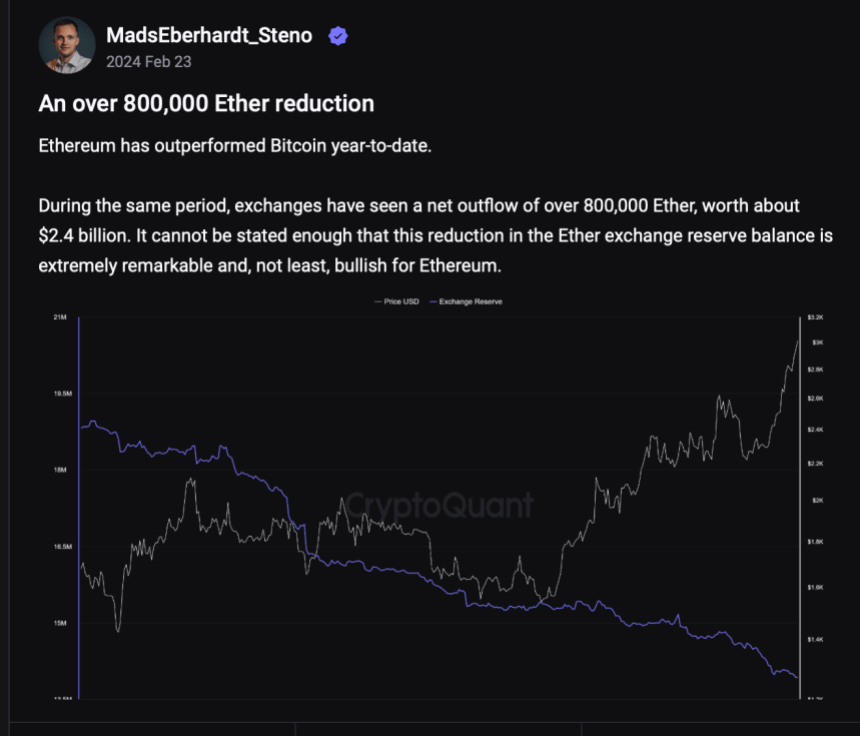

Further echoing this is a recent analysis from CryptoQuant’s Quicktake, which underscores a notable trend regarding Ethereum withdrawals from exchanges over the past few weeks. This observation relies on the “Exchange Reserve” metric, which monitors the quantity of ETH tokens held in the wallets of all centralized exchanges.

When the value of this metric increases, it signifies that investors are depositing more assets than withdrawing them from centralized exchanges, indicating a buildup of Ethereum reserves. Conversely, a decline in the metric suggests a net outflow of assets from these platforms.

According to data from CryptoQuant, over 800,000 ETH, equivalent to roughly $2.4 billion, has exited cryptocurrency exchanges since the beginning of the year. Such substantial outflows from these platforms typically indicate a surge in investor confidence in the Ethereum network and its native token.

Ethereum’s Price Momentum And Potential For A Significant Breakout

Meanwhile, Ethereum’s price has displayed bullish momentum, witnessing a 5.5% increase in the past week and reclaiming the crucial $3,000 mark.

Financial guru Raoul Pal has drawn attention to Ethereum’s potential for a major breakout, pointing to a “dual-chart pattern” observed on the ETH/BTC chart.

The ETH/BTC chart is an absolute stunner…and ready for the next big move the break of the mega wedge…lets see how is pans out… pic.twitter.com/5x4tJLjtJy

— Raoul Pal (@RaoulGMI) February 25, 2024

Pal highlights a “mega wedge” pattern alongside an inner descending channel, indicating a consolidation phase with bullish potential.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cardano Poised For Massive Rally As Key Indicators Signal Bullish Reversal, ADA Surges 14%

ADA, the native token of the Cardano ecosystem, has experienced a notable surge in price, taking advantage of Bitcoin’s (BTC) stagnation above the $52,000 level. With gains of 20% and 14% over the past thirty and fourteen days, respectively, ADA has reignited bullish sentiment among investors.

The token’s recent performance has not gone unnoticed, as crypto analyst “Trend Rider” makes a bold price prediction, highlighting key indicators that suggest a potential long-term bull run for ADA.

ADA’s Potential Bull Run Ahead

In a social media post on X (formerly Twitter), Trend Rider emphasized that ADA is striving to consolidate above the crucial $0.600 mark, which holds significant prospects for the token’s future.

The analyst drew attention to an indicator called Impulse colors, which tracks the price distance from key moving averages. During the bear market, opposing trends were predominantly indicated by fuchsia and pink hues as seen in the chart below.

However, recent weeks have witnessed a return to dark blue, the most bullish color on this scale. Notably, this shift in momentum last occurred in 2020 when ADA’s price surged from $0.03 to $1.4 before the re-emergence of pink hues.

Furthermore, Trend Rider highlighted another positive development— the Wave Oscillator has re-entered the positive zone after 20 months. According to the analyst, this shift indicates growing bullish momentum for ADA.

The pivotal level identified in this context is the $0.60 mark. To solidify this shift, ADA’s price must hold and close above $0.60, which may catalyze a bullish long-term breakout.

It is worth noting that this analysis is based on the 1-month timeframe, which significantly influences long-term market movements.

These indicators suggest that ADA may be poised for a sustained uptrend, potentially paving the way for a long-term bull run.

Cardano Sustained Bullish Trend

According to the one-day ADA/USD chart below, Cardano’s token reached a 21-month high of $0.679 on December 28, which marked the beginning of a period of volatility in ADA’s price. Following a price correction, ADA dropped to $0.449 on January 23.

However, in line with the overall market trend, ADA has regained bullish momentum. Nonetheless, this upward movement may face resistance from bears as it encounters various obstacles.

If the current uptrend continues in the coming weeks, ADA must overcome significant resistance levels that have hindered its growth above the $0.679 mark.

Successful consolidation above the critical $0.600 level will be crucial. ADA will face the $0.637 obstacle soon before potentially surging above $0.670, the last hurdle before reaching $0.700. Reaching this milestone would position Cardano’s native token favorably to target the $1 mark, benefiting from the overall market growth expected in the coming months of 2024.

Adding to the bullish prospects for Cardano, ADA has been establishing higher lows and higher highs during its price surge, indicating a healthy price action and a sustained bullish trend. However, it remains to be seen whether this trend can be sustained or if bears will dictate ADA’s future price direction.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

4 Surprising Insights From The Coinbase Earnings Report, COIN Sees Bullish Surge

The foremost crypto exchange in the United States, Coinbase, released its earnings report on February 15th. As expected, there were major takeaways from the financial report, highlighting the crypto company’s performance in the fourth quarter of last year.

Coinbase’s Trading Volume Exceeds Expectations

Coinbase maximalist Coinbase Duck noted in an X (formerly Twitter) post how the crypto exchange defied expectations in the fourth quarter of 2023. Coinbase recorded $170.6 billion in spot trading volume, exceeding the estimated $168.

Specifically, a considerable influx of retail investors accounted for 18% of the total spot trading volume against the estimated 16% that the crypto exchange was projected to record. The return of these retail investors is believed to have been partly due to the resurgence that Bitcoin and the broader crypto market experienced towards the end of the year.

Meanwhile, consumer transaction revenue ($492.5 million) was way below the estimate of $570.9 million. However, Coinbase Duck noted that this wasn’t necessarily bad, as some investors started using advanced trading.

In a letter to its shareholders, the crypto exchange also revealed that some existing users traded significantly higher volumes, which could have necessitated the move to advanced trading.

Coinbase also recorded a total operating expense of $838 million, which happened to be below the projected estimate of $878 million. Specifically, the crypto exchange did a great job in its transaction expenses, recording an expense of $126 million compared to the estimate of $163 million.

However, the company’s sales and marketing expenses ($106 million) exceeded the estimate of $90 million. Coinbase revealed that this growth was “primarily driven by higher seasonal NBA spending, higher performance marketing spending due to strong market conditions, and increased USDC reward payouts due to growth in on-platform balances.”

Coinbase Had A Profitable Fourth Quarter

Coinbase recorded a net income of $273 million, beating the estimate of $104 million. Interestingly, going by figures from its Shareholder letter, the fourth quarter of 2023 was the only one in the year in which the crypto exchange didn’t record a loss for its net income. Meanwhile, the company also recorded its largest net revenue during that period.

Coinbase suggested that the excitement around the Spot Bitcoin ETFs and the expectations of more favorable market conditions in 2024 had contributed to its success in Q4 of 2023. Coinbase is a primary custodian for most Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT).

Meanwhile, the crypto exchange earned $1.13 per share, beating the forecast of $0.43. This is without the crypto exchange accounting for the FASB change, which Coinbase Duck revealed could bring its earnings per Share (EPS) to $2.1.

Chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.