Mortgage applications dipped 0.7% in the last week, the Mortgage Bankers Association said. The average rate for a 30-year mortgage is 6.93%.

Source link

buyers

Recent Bitcoin buyers show unyielding optimism, pushing cost basis upward despite price surges

Quick Take

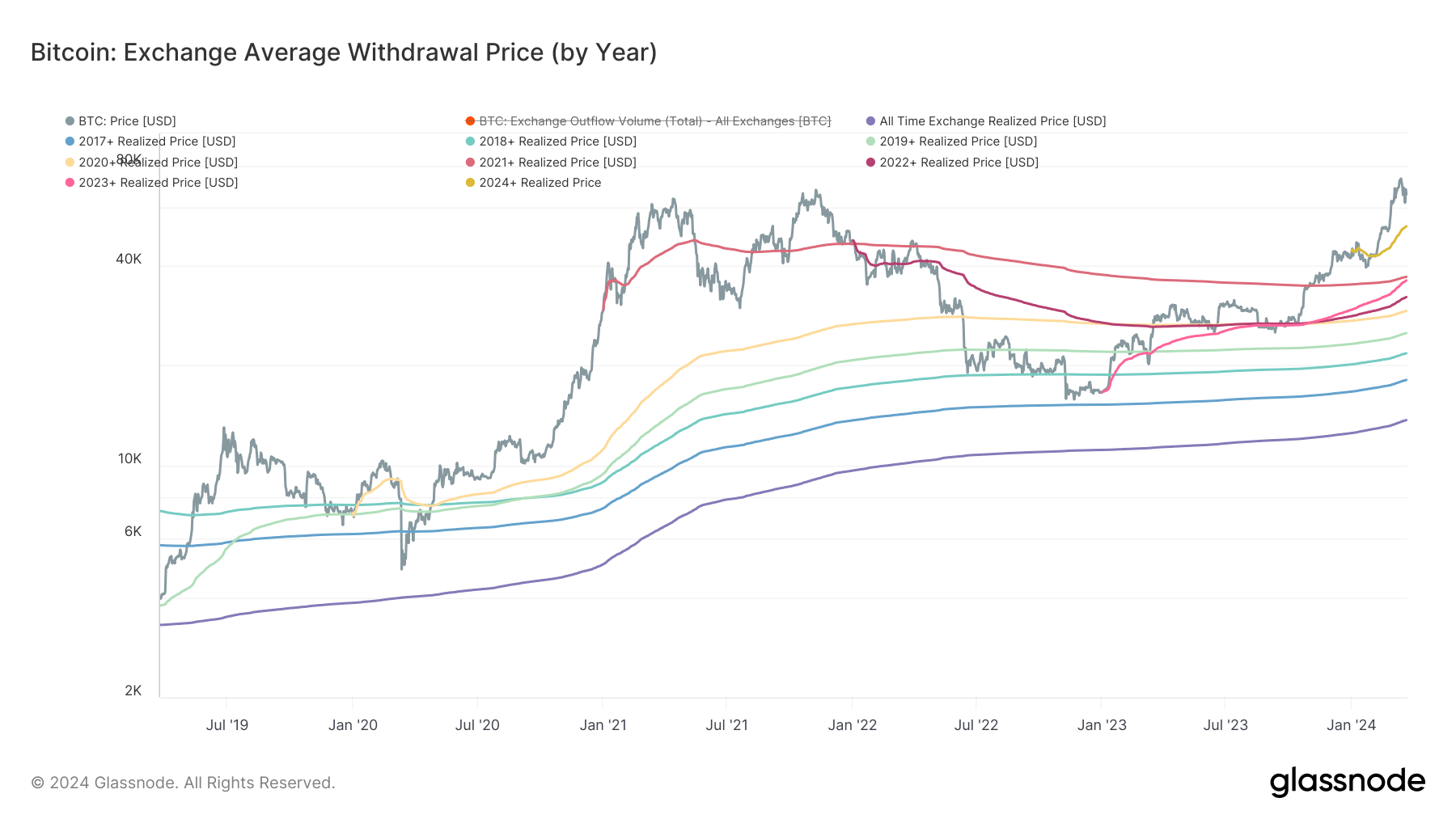

Utilizing data from Glassnode to estimate a market-wide cost basis reveals intriguing trends in the average price at which coins are withdrawn from exchanges. The information, segregated into cohorts, uncovers an upward trajectory on a cost basis, indicating a trend of purchasing Bitcoin at incrementally higher prices.

Most notably, the 2024 cohorts experienced a significant upswing, seeing an average profit margin of about $10,500, which translates to an approximately 20% gain from their initial cost basis ($52,478), according to data from Glassnode.

Interestingly, the 2021 cohort managed to significantly reduce their cost basis from $47,000 to a more conservative $36,971, as highlighted by recent CryptoSlate data analysis. Despite the reduction, the cost basis for all cohorts has risen in recent months, showing an unwavering dedication to buying Bitcoin regardless of increasing prices.

| Year | Price |

|---|---|

| All-time | $13,689 |

| 2017+ | $18,082 |

| 2018+ | $21,758 |

| 2019+ | $25,018 |

| 2020+ | $29,173 |

| 2021+ | $36,971 |

| 2022+ | $32,139 |

| 2023+ | $36,058 |

| 2024+ | $52,478 |

Source: Glassnode

The 2023 cohort, exhibiting the most bullish behavior, showcased a dramatic rise in cost basis from roughly $26,500 in October 2023 to a present figure of $36,058, suggesting a potential to surpass the 2021 cohort.

The post Recent Bitcoin buyers show unyielding optimism, pushing cost basis upward despite price surges appeared first on CryptoSlate.

Galaxy Digital Sees ‘Tremendous Global Demand for Bitcoin’ — CEO Says ‘There’s a New Army of Buyers’

Galaxy Digital CEO Mike Novogratz sees “a tremendous global demand for bitcoin,” emphasizing: “This is probably the first time in the history of bitcoin that we have true price discovery.” Noting that there is “a new army of buyers” and there is also “an army of salespeople,” he expects the price of bitcoin to be […]

Galaxy Digital CEO Mike Novogratz sees “a tremendous global demand for bitcoin,” emphasizing: “This is probably the first time in the history of bitcoin that we have true price discovery.” Noting that there is “a new army of buyers” and there is also “an army of salespeople,” he expects the price of bitcoin to be […]

Source link

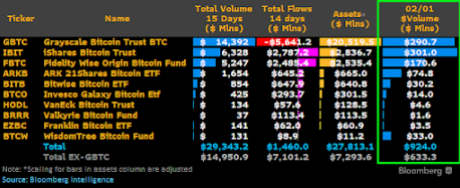

The Spot Bitcoin ETFs have lived up to the hype, as these funds have ramped up institutional adoption of the flagship cryptocurrency, Bitcoin. This is further evident in a recent analysis that captured how much Bitcoin BlackRock and other issuers amassed in this week alone.

Spot Bitcoin ETF Issuers Purchased Over 19,908 BTC This Week

Data from the on-chain analytics platform Lookonchain shows that the Spot Bitcoin ETF issuers combined to purchase over 19,908 BTC ($860 million) this week. Meanwhile, it is worth mentioning that Lookonchain’s data didn’t capture WisdomTree’s BTC purchases in its analysis, suggesting that the figure could be way higher when the asset manager’s purchases are also factored in.

Further data obtained from Arkham Intelligence provided insights into how much Bitcoin Wisdom Tree obtained for its Bitcoin fund this week. 74 BTC is shown to have gone into the asset manager’s wallet address for its Spot Bitcoin ETF. The addition of these crypto tokens means that all Spot Bitcoin ETF issuers combined to purchase almost 20,000 BTC this week alone.

Interestingly, Bitcoin ETFs were recently reported to hold 3.3% of Bitcoin’s circulating supply, underscoring their success since launching. Data from Lookonchain shows that these ETFs currently hold over 657,000 BTC (excluding WisdomTree).

Matt Hougan, Bitwise’s Chief Investment Officer (CIO), also revealed how these funds have seen flows of $1.7 billion after their first 14 trading days. This is more impressive as he made a comparison to Gold ETFs, which saw $1.3 billion in a similar time frame. In another X post, he mentioned how these Spot Bitcoin ETFs have taken $700 million in net inflows this week alone.

BTC price recovers above $43,000 | Source: BTCUSD on Tradingview.com

BlackRock Finally Trumps Grayscale

Bloomberg analyst James Seyffart mentioned in an X post that BlackRock’s IBIT looks to have become the first ETF to trade more than Grayscale’s GBTC in a single day. Before now, Grayscale had continued to record the most daily trading volume, although IBIT had come close on a couple of occasions.

From the data that Seyffart shared, IBIT looks to have recorded $301 million in trading volume on February 1, while GBTC saw $290 in trading volume. However, he further stated that the total trading on the day “was kind of a dud,” with all Spot Bitcoin ETFs combined recording $924 million in trading volume.

Interestingly, that happened to be the first day that the daily volume for Spot Bitcoin ETFs was under $1 billion. The Bloomberg analyst didn’t, however, give any opinion as to what could have caused this relatively sub-par performance.

Featured image from U.S. Global Investors, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin dips to lowest level since Dec. 12 before bouncing as buyers hold $40k threshold

Bitcoin slumped to as low as $40,280 on Jan. 19, its lowest level since Dec. 12, 2023, before rebounding to $41,979 after four hours of consistent sell pressure that liquidated most long positions on major exchanges.

As of press time, Bitcoin traded at $41,609 after failing to breach $42,000. Meanwhile, long liquidations stood at roughly $30 million and made up 85% of all liquidations over the period, based on CoinGlass data.

Most major cryptocurrencies saw similar price movements and are trading in the red for the day. However, the rebound from a crucial support level indicates resilience as investors continue to buy at that key price level.

Holding $40,000

Bitcoin has held above the $40,000 threshold despite facing significant sell pressure over the past week after spot ETFs for the flagship cryptocurrency were approved on Jan. 10, resulting in a “sell the news” event.

The ETFs initially caused the price to surge to $49,000 before investors began taking profit on short-term positions, causing the price to dip back to levels seen in mid-December.

Initial speculation blamed the downward pressure on Grayscale, dumping tens of thousands of its Bitcoin on the market. However, data shows that the nine new ETFs — led by BlackRock and Fidelity — have bought up more Bitcoin than GBTC dumped.

Based on available data, Grayscale has sold roughly 60,000 Bitcoin since the ETF began trading, while the “Newborn Nine” have bought roughly 72,000 BTC over the same period. This means that the downward pressure is unrelated to the ETFs, as the newer issuers seem to be actively holding the $40,000 price line.

The nine newly issued spot Bitcoin ETFs are experiencing sustained interest from investors. BlackRock and Fidelity’s ETF have already hit $1 billion in assets under management, equating to more than 25,000 BTC.

Whales taking profit

Crypto Quant Head of Research Julio Moreno said the selling has mainly come from short-term traders who got into positions specifically based around the ETF approval to “buy the rumor” and Bitcoin whales taking profit after a year of gains.

Meanwhile, the dynamics between long-term and short-term Bitcoin investors are becoming increasingly distinct, as evidenced by recent market activities, according to CryptoSlate research.

Long-term holders — typically those who have held Bitcoin for over 155 days, which includes whales — have been observed moving their assets to exchanges to realize profits. This trend emerged around July 2023, when Bitcoin’s value experienced a significant dip from $30,000 to $26,000.

Specifically, on Jan. 17 and Jan. 18, these long-term investors transferred an estimated 25,000 BTC, valued at roughly $1 billion, to exchanges, a move interpreted as cashing in on their investments without suffering losses.

Conversely, short-term Bitcoin holders, those holding their investments for less than 155 days, have shown a more erratic pattern. On Jan. 18, they transferred a substantial amount of Bitcoin, valued at $2.4 billion, to exchanges at a loss.

This indicates a higher activity level among these investors and decreased profits. Particularly, those who had hoped to leverage Bitcoin’s surge to $49,000 seem to have already taken their profits or are facing losses.

When it comes to the baby boomers’ run of investing luck, timing has been on their side.

Decades of stellar stock-market returns produced by a series of bull markets that began in 1982 coincided with boomers’ prime working years and made their nest eggs grow.

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Feds make it easier for home buyers to buy houses with accessory dwelling units

PHILADELPHIA — A new federal housing policy will make it easier for some home buyers to qualify for a mortgage by allowing them to include rental income from accessory dwelling units as part of their application.

The Federal Housing Administration announced Monday that under a new policy, it will allow lenders to count income from accessory dwelling units when underwriting a mortgage. The rental income from the ADU will be included in the borrower’s qualifying income.

The change in policy will “allow more borrowers to qualify for FHA financing for properties with ADUs,” the FHA said in a press release.

“This not only helps more people qualify for a mortgage and build wealth, it also helps to boost the supply in neighborhoods where housing is least available,” Assistant Secretary for Housing and Federal Housing Commissioner Julia Gordon said during the Mortgage Bankers’ Association’s annual press conference on Monday.

An ADU is generally thought of as a smaller housing unit on the same lot where the main house is located, such as a granny flat. ADUs can be rented out to short- or long-term tenants, which can provide a source of income similar to if an owner of a multi-family unit lives in one unit and rents out the others to pay for the mortgage.

For homeowners looking to add an ADU, 50% of the estimated rental income from the unit will be used to qualify for a mortgage under the FHA’s Standard 203(k) Rehabilitation Mortgage Insurance Program. “This will enable more homeowners with limited incomes to build ADUs, helping them sustain homeownership and expanding the production of ADUs as rental housing,” the FHA said.

For homeowners who would like to buy a property with an existing ADU, the new FHA policy allows 75% of the estimated ADU rental income to count toward their ability to qualify for an FHA-insured mortgage.

The FHA also said that it would include ADU-specific appraisal requirements, so that appraisers can capture estimated rents that the unit can generate.

“FHA-approved lenders may begin offering borrowers mortgages on properties with ADUs under the new policies effective immediately,” the agency said.

Mark Fleming, chief economist at First American, said that the FHA’s decision to include rental income from an ADU is similar to what borrowers face when taking on a mortgage for a multi-family unit. “Why would an accessory dwelling unit be in a way treated any differently? It’s a source of income to that homeowner,” he said.

Shaina Mishkin

Oct 08, 2023, 2:00 am EDT

Share

Higher mortgage rates are likely to drive home sales back to a 13-year low as more buyers put their searches on hold—but they aren’t scaring everybody away.

Continue reading this article with a Barron’s subscription.