Grayscale Investments has removed cardano from its Digital Large Cap Fund. The crypto fund now holds bitcoin, ethereum, solana, XRP, and avalanche. The crypto asset manager also adjusted the holdings of its Smart Contract Platform Ex-Ethereum Fund. Cardano Removed From Grayscale’s Large Cap Fund Grayscale Investments, the world’s largest crypto asset manager, announced Thursday that […]

Grayscale Investments has removed cardano from its Digital Large Cap Fund. The crypto fund now holds bitcoin, ethereum, solana, XRP, and avalanche. The crypto asset manager also adjusted the holdings of its Smart Contract Platform Ex-Ethereum Fund. Cardano Removed From Grayscale’s Large Cap Fund Grayscale Investments, the world’s largest crypto asset manager, announced Thursday that […]

Source link

cap

Share prices of Micron Technology (NASDAQ: MU) took off big time following the company’s fiscal 2024 second-quarter results (for the three months ended Feb. 29), which were released on March 20. The stock rose over 14% in a single session thanks to outstanding growth in revenue and earnings. Micron’s metrics crushed Wall Street expectations, and its guidance was strong enough to confirm the company’s turnaround has finally arrived.

Over the past year, Micron stock is up 93%. Management’s projections for future revenue growth (see below) suggest this stock might just have more upside left in the tank. Let’s look at the numbers and see why investors should consider buying this chipmaker before its next set of elevated revenue projections reach their target dates.

Micron has stepped on the gas

In this most recent quarter, revenue shot up 58% year over year to $5.82 billion. That was well ahead of the $5.35 billion consensus estimate. Even better, Micron swung to an adjusted profit of $0.42 per share from a loss of $1.91 per share in the year-ago period. Analysts were expecting a loss of $0.25 per share last quarter.

A favorable supply-demand balance in the memory-chip market meant that prices headed higher last quarter, allowing Micron to significantly boost its margins. Management said that the prices of dynamic random-access memory (DRAM) shot up in the high teens last quarter, while the price of NAND flash storage chips was up 30%.

All this explains why the company’s adjusted gross margin increased to 20% in the previous quarter as compared to a negative 31.4% in the year-ago period. And an operating margin of 3.5% was a massive improvement compared to the negative 56% in the prior-year period.

CEO Sanjay Mehrotra credited the growing memory demand for artificial intelligence (AI) servers as a key reason behind its turnaround. He said on the latest earnings conference call:

This improvement in market conditions was due to a confluence of factors, including strong [artificial intelligence (AI)] server demand, a healthier demand environment in most end markets, and supply reductions across the industry. AI server demand is driving rapid growth in HBM [high-bandwidth memory], DDR5 [D5] and data center SSDs, which is tightening leading-edge supply availability for DRAM and NAND.

Mehrotra expects memory prices to head higher as the year progresses and forecasts Micron will generate “record revenue and much-improved profitability now in fiscal year 2025.” The company’s outlook for the current quarter turned out to be well ahead of what analysts were expecting.

Micron expects fiscal 2024 third-quarter revenue of $6.6 billion and adjusted earnings of $0.45 per share at the midpoint of its guidance range. Wall Street was looking for just $0.09 per share in earnings on revenue of $6 billion. Year over year, revenue is on track to increase by 76%, which would be a nice improvement over the growth the company posted last quarter.

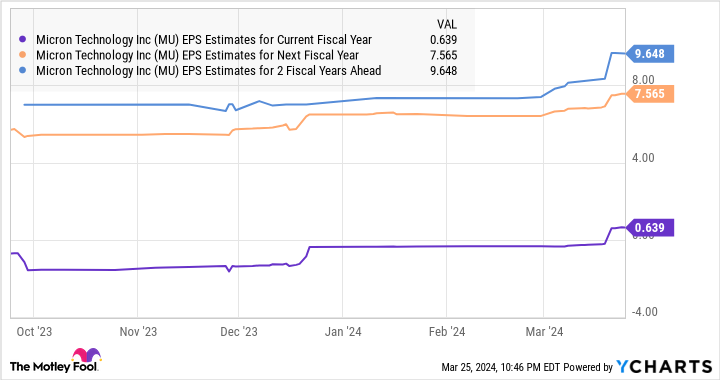

Micron recorded a loss of $1.19 per share in the same period last year, which means that the recovery in memory prices is all set to give its bottom line a big boost. This helps explain why analysts are raising their bottom-line growth expectations following Micron’s latest report.

Buying the stock is a no-brainer move

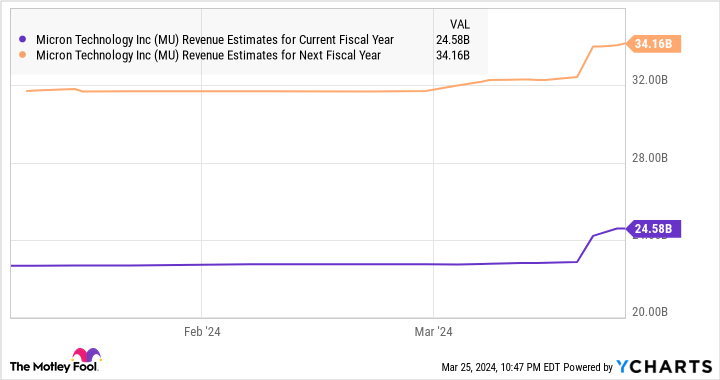

Micron stock trades at 6.4 times sales, lower than the U.S. technology sector’s price-to-sales ratio of 7.3. According to consensus estimates, Micron could end the current fiscal year with $24.6 billion in revenue. That would be a 58% jump from last year. And it is expected to sustain an impressive growth rate next year as well.

Assuming Micron does hit $34 billion in revenue in fiscal 2025 and maintains its current price-to-sales ratio, its market cap could jump to $217 billion. That would be a 67% jump from current levels. So investors are getting a good deal on Micron stock right now, making it a good idea to buy it before it soars further following its latest earnings report.

Should you invest $1,000 in Micron Technology right now?

Before you buy stock in Micron Technology, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Micron Technology wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Incredible Growth Stock to Buy Before Its Market Cap Jumps 67% was originally published by The Motley Fool

Bitcoin Market Cap Hints at Potential Price Surge After Retesting 2021 Highs

A crypto analyst on X is confident that Bitcoin has bottomed and is poised for major gains in the sessions ahead. Interestingly, the bullish outlook hinges on the Bitcoin market cap retesting all-time highs at press time.

Will BTC Rally? Market Dynamics Changing

So far, the Bitcoin price is around 2021 highs in USD terms but recently broke all-time highs, peaking at around $73,800. This fluctuation is also reflected in its market cap. It currently stands at $1.25 trillion, down 5% in the past 24 hours.

Notably, it is at the same price level as in 2021, when Bitcoin prices peaked, recording new all-time highs.

While optimism abounds and the trader expects more sharp price expansions in the days ahead, it is not immediately clear whether the coin will rip higher, aligning with this forecast. Bitcoin is volatile and has remained so despite changing market dynamics.

At the same time, unlike in the past, Bitcoin prices are driven not only by retail forces but by institutions. These institutions are regulated by the United States Securities and Exchange Commission (SEC), which also approved the spot Bitcoin exchange-traded fund (ETF).

This Bitcoin derivative product has been the primary driving force in the past ten weeks. This is from looking at how prices have evolved since its approval in mid-January 2024.

However, since BlackRock and Fidelity are regulated by the United States SEC, unlike retailers, they cannot act as they wish. Considering the millions and billions of dollars at play, their comments or assessments on the coin, now and in the future, can greatly impact sentiment.

Sentiment Is Dented, BTC Facing Headwinds

Sentiment has been dented when writing. Even with the United States Federal Reserve (Fed) ‘s decision to hold rates at 5.5%, the highest in 2023, lifting prices, there has been no solid follow-through in price action. The coin remains steady below $70,000.

Whether prices will rally over the weekend remains to be seen. However, for now, there are some headwinds to consider.

First, there has been a slowdown in inflows to spot BTC ETFs. At the same time, outflows from the Grayscale Bitcoin Trust (GBTC) have increased. Second, after rallying sharply from October 2023, a cool-off before halving might see the coin trend lower.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Shiba Inu, the meme coin sensation, is making headlines once again. With its sights set on a major achievement – a staggering $100 billion market cap – Shiba Inu has captured the attention of the crypto community.

This audacious ambition has been fueled by data from IntoTheBlock, shedding light on the coin’s potential. Additionally, renowned investor Jake Gagain has made a bold prediction, further igniting excitement within the crypto community.

$SHIB Will Be The First 100 Billion MC Memecoin. pic.twitter.com/YogeSb2E7q

— JAKE (@JakeGagain) March 15, 2024

Shiba Inu: Growing Interest, Volatile Trading

According to analysis from IntoTheBlock, SHIB has witnessed a surge in the number of addresses holding the token. This surge indicates a growing interest and adoption of Shiba Inu among retail investors, who are eager to partake in the meme coin revolution.

Moreover, there has been a notable increase in the number of large transactions involving Shiba Inu tokens, suggesting institutional investors and whales are actively engaging with the coin.

SHIB market cap currently at $14.5 billion. Source: CoinMarketCap

IntoTheBlock’s data reveals a concentration of wealth among the top holders of Shiba Inu. Approximately 50% of the total supply is held by the top 100 addresses, indicating the potential influence these large holders may have on the market dynamics and price movements of Shiba Inu. This concentration of wealth can play a significant role in shaping the future trajectory of the coin.

Total crypto market cap is currently at $2.4 trillion. Chart: TradingView

Trading activity surrounding the memecoin has also been a focal point of the analysis. The data highlights the volatility of Shiba Inu’s trading volume, with periods of intense fluctuations followed by relative stability. This volatility can be attributed to various factors, including market sentiment, news events, and overall market conditions.

SHIB $100 Billion Milestone

In the midst of this excitement, renowned investor Jake Gagain has made a bold prediction: He firmly believes that Shiba Inu has the potential to surpass Dogecoin and reach a remarkable $100 billion market cap. This prediction has sparked both enthusiasm and skepticism, as the rivalry between Shiba Inu and Dogecoin intensifies.

SHIB 30-day price action. Source: CoinMarketCap

Taking all these factors into account, the journey towards the billion-dollar market cap for Shiba Inu is not without its challenges. While the recent surge in market cap and the accumulation by large holders are positive indicators, the volatility and concentration of wealth present potential risks that need to be navigated.

Nevertheless, the resilience and determination exhibited by the memecoin, coupled with the growing interest from retail and institutional investors, provide a strong foundation for its pursuit of the $100 billion milestone.

Shiba Inu’s quest for a $100 billion market cap represents a paradigm shift in the world of meme coins. Backed by data from IntoTheBlock, which highlights growing adoption, concentration of wealth, and trading activity, as well as the bold prediction from Jake Gagain, SHIB has positioned itself as a formidable contender in the cryptoverse.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Solana defies overall market trend to hit new all-time high market cap

Solana (SOL) broke new ground on March 15 after an 11% rally brought its market capitalization to a new all-time high of $82.5 billion at a price of $186.77 per token despite the overall downtrend, which saw the market contract by 4%.

This achievement surpasses its prior peak market cap of approximately $77.9 billion — observed in November 2021 at its all-time high of $259.96 — signaling strong investor confidence and a growing interest in the digital asset.

SOL was trading at $181.35 as of press time — up 9.29% over the past 24 hours, with a market cap hovering just above $80 billion, according to CryptoSlate data.

Sol ecosystem thriving

Adding to Solana’s impressive week, the network saw a record-breaking number of new addresses, with a daily average of 738,040 new addresses based on a seven-day moving average.

This uptick in new addresses highlights the growing community and interest in the Solana ecosystem, which saw a green day of trading, with most tokens recording significant gains.

DEX native tokens — including Raydium and the recently launched Jupiter and Jito — saw double-digit gains over the past day.

RAY and JUP were up more than 30%, while JITO recorded gains 10%.

Meanwhile, the largest Solana-based memecoins like WIF and BONK saw a drawdown mimicking the wider market as investors turned to smaller cap tokens on DEXs amid renewed memecoin frenzy.

Memecoin fever

The current enthusiasm surrounding Solana is largely fueled by the vibrant trading activity related to newly launched memecoins on the network following a dramatic surge in memecoins this year.

Noteworthy gains were observed in memecoins like Dogwifhat, Popcat, and Bonk, which have posted gains ranging from 117% to 554% over the past 30 days. This surge in memecoin activity has drawn considerable attention to Solana, highlighting its utility and growing relevance in the crypto space.

The appeal of memecoins on the Solana network has been attributed to their accessibility and entertainment value. The trend reflects a broader interest in engaging with the crypto market in a fun and accessible manner.

The post Solana defies overall market trend to hit new all-time high market cap appeared first on CryptoSlate.

The meme coins market cap is currently hovering above $54 billion up by nearly 20% ion the past day. This surge is evident as roughly seven meme coins now rank among the top 100 crypto by market capitalization, marking a significant shift in investor interest towards these once ‘speculative assets.’

A recent market report from QCP Capital has shed light on this phenomenon, disclosing what drives this meme coins surge.

What Is Driving The Meme Coins Surge

According to QCP Capital, the price appreciation in meme coins can be attributed to a “speculative buying frenzy” during the Asia trading session. Particularly, the firm report suggests that the rallying meme coins is driven by retail FOMO (Fear of Missing Out), indicating a significant shift in the dynamics of market participation.

The analysts from QCP Capital also observed an increase in leveraged buying activity, hinting at the “robust” momentum that could potentially pause should Bitcoin surpass its all-time high in dollar terms. The market report read:

Altcoins, especially memecoins, are rallying hard as retail FOMO really kicks in now. Leveraged buyers will likely not relent until we break all-time highs, which could be any time now.

So far, major meme coins such as Dogecoin, Shiba Inu, PEPE, and BONK have registered. massive gains, with increases of 27%, 57%, 46%, and 68% respectively over the last 24 hours. These gains reflect the growing investor interest in meme coins and underscore the broader trend of retail investment driving the crypto market.

Dogecoin and Shiba Inu, in particular, have solidified their positions within the top 15 global crypto market cap rankings, demonstrating the significant traction meme coins have gained among investors.

Retail Participation Fuelling The Crypto Rally

The surge in memecoins is part of a larger trend of increased retail participation in the cryptocurrency market. Analysts from JPMorgan have echoed the observations made by QCP Capital, noting that retail traders have played a crucial role in the cryptocurrency market rally observed throughout February.

The study carried out by the research group at JPMorgan, under the guidance of Managing Director Nikolaos Panigirtzoglou, highlighted the significant role of “small-scale investors,” commonly known as ‘mom-and-pop’ traders, in driving prominent cryptocurrencies like Bitcoin to a two-year high last month.

The researchers noted:

We find that the retail impulse into crypto rebounded in February, thus likely responsible for this month’s strong crypto market rally.

Meanwhile, over the past 24 hours, Bitcoin has reached new heights, trading above $66,000, marking a nearly 30% increase over the past week. This upward trajectory is also evident in the asset’s market cap, which currently exceeds $1.2 trillion.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Meme Tokens Skyrocket: Market Cap Hits $61.5 Billion Amidst Crypto Frenzy

As bitcoin edges closer to its peak historical value, the meme token domain is outperforming many within the crypto economy, boasting a more than 38% increase over the last day. Just four days prior, the meme coin market’s valuation stood at $34.32 billion, only to soar to $61.59 billion today. From Dogecoin to Shiba Inu: […]

As bitcoin edges closer to its peak historical value, the meme token domain is outperforming many within the crypto economy, boasting a more than 38% increase over the last day. Just four days prior, the meme coin market’s valuation stood at $34.32 billion, only to soar to $61.59 billion today. From Dogecoin to Shiba Inu: […]

Source link

Solana’s Memecoin BONK Reaches $1.6 Billion Market Cap, Witnesses Explosive 100% Price Rally

Solana (SOL) has reached a new 22-month high, demonstrating a remarkable 28% uptrend over the past month. However, the Solana-based meme coin, Bonk Inu (BONK), has captured investors’ attention with its explosive performance last month.

Bonk Inu Outperforms PEPE

According to CoinGecko data, BONK has achieved a staggering 102% price uptrend in the last 7 days and an impressive 103% increase in the past month, reaching a trading price of $0.00002510 and attaining a 3-month high.

In addition, the meme coin has experienced significant growth in market capitalization, reaching $1.6 billion and surpassing renowned tokens such as Pepe Coin (PEPE) to secure the 66th position among all cryptocurrencies, highlighting the growing interest in BONK as the cryptocurrency market experiences a resurgence of bullish sentiment fueled by Bitcoin’s (BTC) price uptrend.

Accumulating data from blockchain company Lookonchain shows the growing interest in Bonk Inu. In addition to the 50% increase in a single day, one wallet reportedly accumulated 98 billion BONK ($1.54 million) from the centralized crypto exchange (CEX) Binance just before the price increase.

According to Lookonchain, the SmartMoney wallet currently holds 319.44 billion BONK tokens worth approximately $7 million, enjoying a profit of $2.9 million, which could have further contributed to the price surge in the past 24 hours.

As of the latest update, the trading volume of Bonk Inu stands at $794,842,219 in the last 24 hours, demonstrating a substantial 74.30% increase compared to the previous day. This surge in trading volume indicates a recent rise in market activity surrounding the meme coin, reflecting growing investor participation and attention.

Potential Pullback Ahead?

As the token enjoys one of its best trading months since its launch, crypto analyst Altcoin Sherpa expressed positive sentiment towards Bonk Inu, highlighting its potential for further growth.

Altcoin Sherpa stated that Bonk Inu looks promising due to its relative underperformance compared to other meme coins, coupled with a notable uptrend pattern. The analyst wouldn’t be surprised to see Bonk Inu target previous highs and make further gains, although he suggested that a potential pullback may occur.

As the analyst suggests, the $0.00001940 price level may serve as a crucial support level for the BONK token in the event of a potential pullback or price correction. This level is significant as it would help maintain the current uptrend pattern observed on its daily chart.

However, suppose this support level fails to hold. In that case, it’s possible that BONK could see a further price decline towards the $0.00001500 level, which acts as the ultimate support before a potential drop to the $0.00001350 mark, key for the token’s prospects as it represents the last line of defense to prevent a fully formed downtrend in the cryptocurrency’s performance.

On the other hand, when analyzing the BONK/USD 1-W chart, it is important to note that there are no prominent resistance levels. The chart above shows thin lines known as “wicks” above the candlesticks of the token since its launch on December 15th.

This suggests that no significant obstacles prevent the token from reaching its all-time high of $0.0005487. The ability to maintain its current uptrend or potentially experience renewed bullish sentiment after a pullback will determine whether BONK can surpass this previous high.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

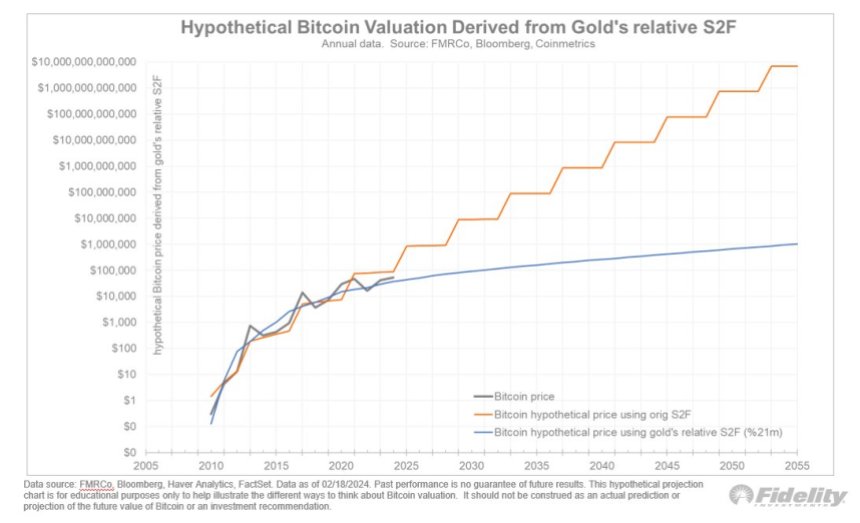

In recent years, the debate surrounding Bitcoin’s (BTC) potential market share relative to gold has garnered significant attention, as recently approved Bitcoin Exchange-Traded Funds (ETFs) can bring Bitcoin significantly closer to gold in key metrics.

Jurrien Timmer, Director of Global Macro at Fidelity Investments, has put forward an analysis that sheds light on this subject. By examining the value of “monetary gold” and Bitcoin’s market capitalization, as well as considering the impact of halvings on Bitcoin’s supply, Timmer presents insights into the future dynamics of these two assets.

Gold Vs Bitcoin

Timmer’s analysis begins by estimating the share of gold held by central banks and private investors for monetary purposes, excluding jewelry and industrial usage. While this estimation is not exact, based on data from the World Gold Council, Timmer suggests that monetary gold accounts for approximately 40% of the total above-ground gold.

Drawing upon his previous calculations, Timmer posits that Bitcoin has the potential to capture around a quarter of the monetary gold market, with monetary gold valued at around $6 trillion and Bitcoin’s market capitalization at $1 trillion.

Timmer further delves into the impact of Bitcoin halvings on its price. Historically, halvings have had a substantial effect on Bitcoin’s value. However, Timmer raises the hypothesis that diminishing returns may occur in the future as the incremental supply of new Bitcoin decreases.

By comparing the outstanding supply and incremental supply of Bitcoin with those of gold, Timmer demonstrates that the diminishing impact of the halvings is likely to be more pronounced in the future.

As the number of coins available for mining dwindles, the influence of each subsequent halving event on Bitcoin’s price may diminish. This insight prompts Timmer to explore alternative ways to project Bitcoin’s price trajectory.

BTC’s Price Projections

To account for the diminishing impact of halvings, Timmer introduces the concept of a modified Stock To Flow (S2F) curve. This curve is derived by overlaying an asymptotic supply curve, representing the percentage of coins mined relative to the final supply cap, onto the original S2F curve.

Timmer proposes using a regression formula incorporating PlanB’s original S2F curve and the asymptotic supply curve as independent variables. This modified S2F curve aligns more closely with the supply dynamics of gold, reflecting a scenario in which Bitcoin’s scarcity advantage continues, but its impact on price gradually diminishes over time.

Using the modified S2F model and considering the supply characteristics of gold, Timmer generates hypothetical price projections for Bitcoin that place the cryptocurrency at approximately $100,000 by the end of 2024.

According to Timmer, if Bitcoin were to capture a quarter of the monetary gold market, it would represent a remarkable shift in the global distribution of wealth, which would gradually drive up the cryptocurrency’s price over the coming years.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Nvidia sets stock market record with $247 billion addition to market cap in one-day – Bloomberg

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.