AVAX, the native currency of Avalanche, a high throughput blockchain, is rising, adding an impressive 9% from May 15 lows. Buyers are taking over after weeks of lower lows. While the expansion of Bitcoin prices could explain these gains, there could be more.

Fine Wine Investment Fund Tokenized On Avalanche

Avalanche has announced tokenizing a fine wine investment fund, a move that would see the platform ride on the wave of tokenization. In a statement, Avalanche said the Wine Capital Fund has been tokenized by Oasis Pro and listed on ATS via the Avalanche C-Chain, where smart contracts are deployed.

Related Reading

The ATS is Oasis Pro’s trading platform registered by the United States Securities and Exchange Commission (SEC). Meanwhile, the capital fund is a “closed-end investment vehicle.” Specifically, it specializes in fine wines and is overseen by WIVX Asset Management.

The decision to tokenize on Avalanche is a step forward in creating a tokenized asset ecosystem, mirroring progress made in Ethereum, among other chains.

By making inroads into the fine wines market, estimated to be worth over $400 billion, the platform aims to democratize access, making it available to more investors. Analysts claim tokenization removes barriers common in traditional finance. Notably, Avalanche will play a huge role since the network is scalable, boosting a high throughput with sub-second finality.

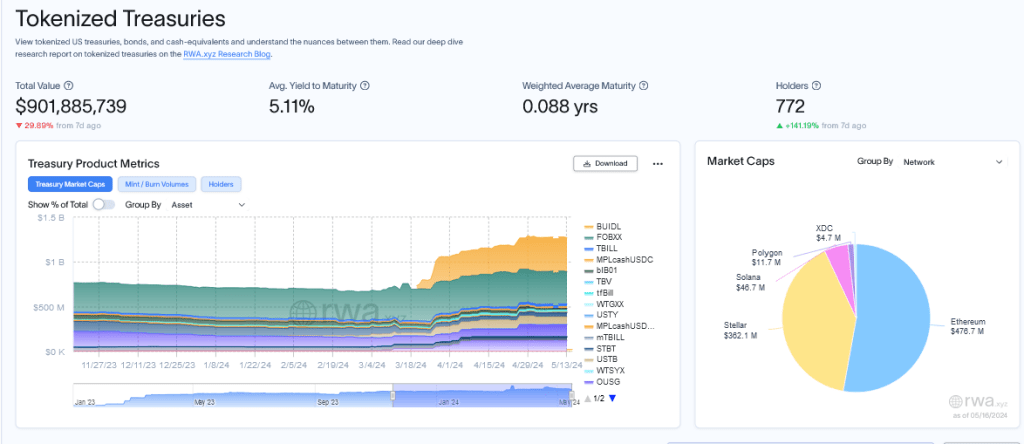

The number of real-world assets (RWA) being onboarded is rising. When writing, data from RWA.xyz reveals that over $7.6 billion worth of private credit has been tokenized. At the same time, months after announcing the deployment of the BUIDL fund on Ethereum, it manages over $381 million of tokenized United States treasuries.

Efforts On Meme Coins, DeFi: Will AVAX Break $40?

Avalanche is not only making progress in tokenization; earlier, they announced efforts to encourage meme coin activity on-chain. To do this, the Avalanche Foundation launched Memecoin Rush, a $1 million liquidity mining incentive program.

Related Reading

The model follows the Avalanche Rush program. The number of decentralized finance (DeFi) solutions deploying on the high throughput chain rapidly grew through this program.

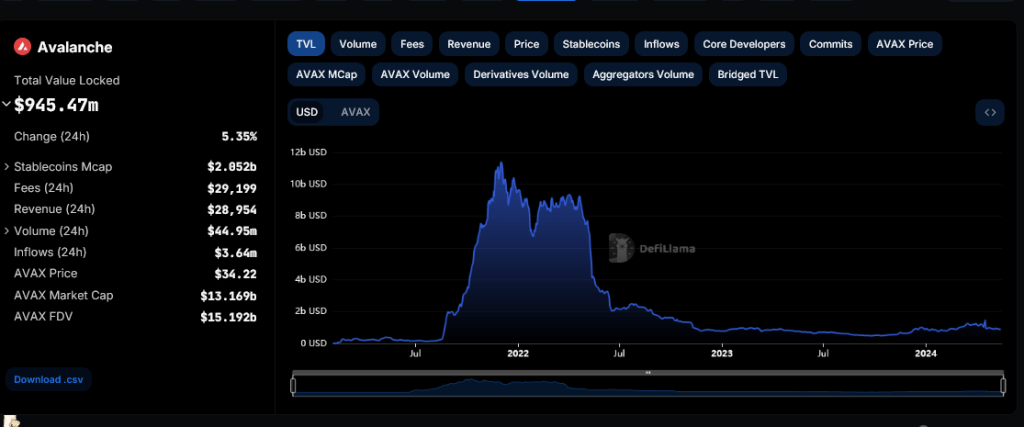

As of mid-May 2024, DeFiLlama data shows that Avalanche DeFi protocols manage over $945 million. The number has shrunk by over 90% since November 2021, at over $10.9 billion.

AVAX prices are stable at spot rates. However, with the coin finding support at $30 and printing a triple bottom, the path of least resistance appears northward toward $40 or higher.

Feature image from UnSplash, chart from TradingView

Skybridge Capital founder Anthony Scaramucci has advised bitcoin investors to act like they are dead with their coins and not sell them. “Don’t do anything with it,” he recommended, emphasizing: “The dead people at Charles Schwab do far better than the living people.” Anthony Scaramucci’s Bitcoin Investing Advice Skybridge Capital founder Anthony Scaramucci offered some […]

Skybridge Capital founder Anthony Scaramucci has advised bitcoin investors to act like they are dead with their coins and not sell them. “Don’t do anything with it,” he recommended, emphasizing: “The dead people at Charles Schwab do far better than the living people.” Anthony Scaramucci’s Bitcoin Investing Advice Skybridge Capital founder Anthony Scaramucci offered some […]

Microstrategy’s executive chairman, Michael Saylor, sees bitcoin as “the strongest asset.” He believes that capital is going to keep flowing from other asset classes, such as gold and real estate, into bitcoin because the cryptocurrency is “technically superior to those asset classes.” He emphasized that bitcoin is an exit strategy and Microstrategy has no plan […]

Microstrategy’s executive chairman, Michael Saylor, sees bitcoin as “the strongest asset.” He believes that capital is going to keep flowing from other asset classes, such as gold and real estate, into bitcoin because the cryptocurrency is “technically superior to those asset classes.” He emphasized that bitcoin is an exit strategy and Microstrategy has no plan […]

On Friday, Ethena Labs, the creators of the stablecoin USDE, secured $14 million in funding from key investors. Following this recent influx of funds and a previous $6.5 million investment from Maelstrom, overseen by Arthur Hayes, in July 2023, the company’s post-valuation has risen to $300 million. USDE Issuer Ethena Labs Raises $14M Ethena Labs, […]

On Friday, Ethena Labs, the creators of the stablecoin USDE, secured $14 million in funding from key investors. Following this recent influx of funds and a previous $6.5 million investment from Maelstrom, overseen by Arthur Hayes, in July 2023, the company’s post-valuation has risen to $300 million. USDE Issuer Ethena Labs Raises $14M Ethena Labs, […]