Looking to get involved with a platform that can change the face of decentralized finance forever? Xuirin Finance is revolutionizing the DeFi landscape through its innovative offerings like KYC-free debit cards, P2P lending, and so much more. Supporters can take part in the first stage of its presale right now. Xuirin Finance to Offer Futuristic […]

Looking to get involved with a platform that can change the face of decentralized finance forever? Xuirin Finance is revolutionizing the DeFi landscape through its innovative offerings like KYC-free debit cards, P2P lending, and so much more. Supporters can take part in the first stage of its presale right now. Xuirin Finance to Offer Futuristic […]

Source link

cards

Vita Coco started with a leap of faith, a $75,000 investment and “several” maxed-out credit cards.

Today, the bestselling coconut water company is worth $1.1 billion. But it wasn’t born out of a Silicon Valley startup lab. Rather, co-founders Michael Kirban and Ira Liran first thought about going into the coconut water business after a chance meeting in a Manhattan bar on a cold night in 2003, when two Brazilian women told them the beverage was what they missed most about their homeland.

Liran ended up falling in love with one of those women, and moving to Brazil. When Kirban visited them, he realized just how popular coconut water — which has a salty-sweet taste and high levels of hydrating electrolytes — was in the Southern Hemisphere, especially compared to the U.S.

The two friends decided to jump on what they saw as a once-in-a-lifetime opportunity.

“People in Brazil were drinking it for everything,” Kirban, 48, tells CNBC Make It. “They were drinking it at the breakfast table. They were drinking it on the beach. They were drinking it after a workout … We’re like, ‘There’s got to be a consumer in the U.S.'”

Liran and Kirban struck a deal with a supplier in Brazil to produce their first shipment, for $75,000. They paid mostly with Kirban’s money, which he’d obtained by founding and running a real estate software business after dropping out of college. That software business still exists, and Kirban still helps run it on the side, he says.

The shipment got held up at the border by U.S. officials. The co-founders hadn’t realized they needed to register it with the U.S. Food and Drug Administration, which meant they had to divert it to the Bahamas, where Kirban says he “sold it door to door” at bars, grocery stores and even “people’s homes.”

It was only the beginning of Vita Coco’s long journey to financial success, with more stumbling blocks along the way.

‘We started maxing out credit cards’

In the Bahamas, the friends recouped “most” of their money and repeated the process with the proper regulatory registrations, Kirban says. Once Vita Coco hit U.S. shelves, they discovered a nearly identical coconut water brand called Zico, which launched at roughly the same time.

The two companies competed throughout the 2000s for shelf space in stores across New York. The prolonged battle was marked by dirty tactics on both sides, from bombastic marketing and price undercuts to sales representatives removing their rival’s products from store shelves.

At the time, Kirban desperately wanted to avoid taking on too much debt while funding Vita Coco’s early growth, so he developed a credit card strategy not for the faint of heart.

“We started maxing out credit cards … [to] operate the business,” he says, adding: “I would go get a new credit card with no interest for 90 days [or] six months, and just transfer everything to the new credit card. I did that several times.”

The tactic helped Vita Coco avoid business loans, which required immediate repayments with interest, and enabled the co-founders to delay seeking outside investments. That gave them more control of the business and helped them hold onto more of their ownership stakes long-term, says Kirban.

“We never paid any interest and didn’t need to start paying down the credit card until, I don’t know, a year or a year and a half into the business,” he says.

A risky strategy that paid off

Kirban’s strategy was incredibly risky, both personally and professionally. Even if you eventually pay off every card you’ve opened, you can severely damage your credit score, especially if you max out multiple cards, according to experts.

Eventually, Vita Coco did take on outside investors — starting in 2007, when Belgian investment company Verlinvest invested an undisclosed amount. When Zico sold a 20% stake to beverage behemoth Coca-Cola two years later, Kirban found a group of celebrity investors, led by Madonna, and signed a 2010 distribution deal with Keurig Dr. Pepper that still allowed the co-founders to keep a majority stake.

Vita Coco now controls roughly half of the U.S. coconut water market. Zico’s founder later expressed regret over selling the rest of his business to Coca-Cola in 2013, and bought it back in 2021.

Last year, for the first time, Vita Coco cracked more than a billion coconuts to make its signature product — a rate of roughly 3 million per day. Kirban hopes to keep growing his brand across North America, and soon expand into Europe and Asia.

“We see a big opportunity to continue to expand across the globe,” he says.

Want to land your dream job in 2024? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay. Get started today and save 50% with discount code EARLYBIRD.

In the battle to bring ousted founder Sam Altman back to OpenAI, Microsoft and Satya Nadella hold the trump cards

If Sam Altman is reinstalled as CEO of OpenAI, he will likely have one person to thank: Satya Nadella.

Some have faulted the Microsoft CEO for allowing the tech giant to become so dependent on Altman’s AI startup without guaranteeing it had at least one seat on OpenAI’s board. But Microsoft has a tremendous amount of leverage in the dramatic whirlwind of events this weekend—far more than any of OpenAI’s other backers.

On Saturday, Altman was reportedly in negotiations to return to OpenAI as CEO, with the OpenAI non-profit board possibly resigning as part of the deal, with much of the impetus coming from Microsoft, with support from other OpenAI investors and company employees. The company’s chief strategy officer Jason Kwon, in a memo obtained by The Information, told staff that the company was “optimistic” Altman and other senior staff who resigned in protest at his abrupt firing could be brought back to the company.

Microsoft’s whip hand, more than anything, else, comes down to cold hard cash.

Can OpenAI remain a going concern without Microsoft?

OpenAI commands a soaring valuation thanks to its tender offers with venture capital firms, but this is just paper money based on share sales from existing employees, founders, and earlier investors. (Technically, these were profit participation agreements; OpenAI, owing to its highly unusual capped-profit structure, doesn’t offer traditional equity or stock options.) Khosla Ventures and billionaire Reid Hoffman’s charitable foundation put undisclosed amounts into OpenAI’s holding company initially. But only Microsoft has given significant cash and resources directly to OpenAI. The software giant has committed at least $13 billion to OpenAI since 2019, when it signed its first partnership agreement with the AI startup. Microsoft has delivered just a fraction of this cash to OpenAI so far, a report in Semafor, giving the software giant significant power over the startup.

It is unclear if OpenAI could continue as a going concern without continual cash inflows from Microsoft. While OpenAI is, according to reports, making about $80 million per month currently and may be on track to make $1 billion in revenue in 2023—ten times more than it anticipated when it secured an additional $10 billion funding commitment from Microsoft in January—it is not known if the company is profitable or what its burn rate it is. But it is likely to be fast. The company lost $540 million dollars in 2022 on revenue of less than $30 million for the entire year, according to documents seen by Fortune. If its costs have also ramped up in line with revenues, the company would need continual support from Microsoft just to keep operating.

To make matters worse, OpenAI has been on a hiring spree all year, with reports that it has been offering the sort of seven-figure pay packages typical of professional athletes to lure top AI researchers away from Google, Meta, and other rival firms. Ilya Sutskever, the OpenAI co-founder and chief scientist, was paid $1.9 million in 2016, the first year of OpenAI’s operations, according to tax filings. He is certainly making many times that now. GPU costs are also likely stratospheric. Training GPT-4, OpenAI’s latest model, cost more than $100 million, according to Altman. One back of the envelope calculation put the cost of running ChatGPT, OpenAI’s popular chatbot, at $700,000 per day back in April. It may be more than that now as its user base has grown. (Although Altman has said that the company has been able to optimize its models to bring the cost of serving each ChatGPT query down.)

Furthermore, OpenAI is entirely dependent on Microsoft’s cloud computing datacenters to both train and run its models. The global shortage of graphic processing units (GPUs), the specialized computer chips needed to train and run large AI models, and the size of OpenAI’s business, with tens of millions of paying customers dependent on those models, mean that the San Francisco AI company cannot easily port its business to another cloud service provider.

Microsoft has what OpenAI needs

All of this gives Microsoft power. Nadella could threaten to cut off OpenAI’s access to computing power and suspend delivery of its next instalment of committed cash unless Altman is restored as CEO. While OpenAI might have legal recourse against Microsoft under the terms of its partnership agreement, Microsoft could do significant damage to OpenAI’s business before OpenAI’s lawyers could even get to the courthouse door if it wished.

Longer-term, Microsoft could choose to replace OpenAI’s technology with software from another leading AI startup, such as Cohere or a newer player, like Mistral, or even the new AI company that Altman and OpenAI’s co-founder, president, and former board chairman, who resigned from the company in protest over Altman’s firing, have been contemplating setting up. Nadella has, according to Bloomberg, told Altman he will support him in whatever steps he decides to take next.

OpenAI’s other inverstors, which include Khosla Ventures, billionaire Reid Hoffman’s charitable foundation, Tiger Global, Andreesen Horowitz, Sequoia Capital, Thrive, and K2 Global have far less potential influence on the company. The same goes for the venture firms that were negotiating to invest in a new tender of existing shares that would have valued OpenAI at $86 billion. But they still have some leverage—mostly through OpenAI’s employees. Those employees want to be able to continue to offer to sell their profit participation shares (which function essentially as stock options since OpenAI is not thought to be currently profitable) to investors at high valuations that could make many of them extremely wealthy. With these investors threatening to pull out of the latest tender offer for those profit participation agreements, the employees will see their own financial prospects damaged. That may give many of them an incentive to leave OpenAI—or at least threaten to do so—unless Altman is reinstalled.

That corporate governance structure

The current mess at OpenAI ultimately shows how flawed OpenAI’s convoluted governance structure is. Microsoft is a minority investor in a limited liability corporation that is majority-owned by holding company that is in turn jointly owned by OpenAI’s non-profit board, its employees, and its other venture capital investors. But that holding company is controlled by OpenAI’s non-profit through another limited liability corporation. And OpenAI’s non-profit corporate board has just six seats, all of which must be held by people with no financial interest in the holding company or the LLC in which Microsoft invested. In other words, neither Microsoft, nor any of OpenAI’s other financial backers, have a seat at the table when it comes to the hiring and firing of OpenAI’s CEO. They have a right to any profits OpenAI earns until they earn back their initial investment plus an amount that is capped on a sliding scale, with the earliest investors able to earn up to 100 times their initial outlay and later investors entitled to smaller, but still substantial, pay-outs. After those thresholds have been hit, however, any additional profits revert to OpenAI’s non-profit.

This structure was designed to enable OpenAI to raise the tens or even hundreds of billions of dollars it would need to succeed in its mission of building artificial general intelligence (AGI), the kind of AI that is as smart or smarter than people at most cognitive tasks, while at the same time preventing capitalist forces, and in particular a single big tech giant, from controlling AGI. Altman himself was largely responsible for designing this attempt to square a circle. But it was also Altman who struck the deal—for just $1 billion initially—with Nadella in 2019. From that moment on, the structure was basically a time bomb. By turning to a single corporate entity, Microsoft, for the majority of the cash and computing power OpenAI needed to achieve its mission, it was essentially handling control to Microsoft, even if that control wasn’t codified in any formal governance mechanism. Ironically, if OpenAI’s non-profit board chooses to ask Altman to return and resigns, as they are contemplating, it will prove that Altman’s structure failed—OpenAI was not able to both raise billions of dollars from a big tech corporation while somehow remaining free from that corporation’s control.

Preventing a big tech company from monopolizing AGI had been the entire reason Altman, Brockman, Sutskever, and Elon Musk co-founded OpenAI in 2015. At the time, they were alarmed by the rapid progress in AI research being made by DeepMind, which Google had purchased for $600 million in 2014. If DeepMind succeeded in achieving AGI, the OpenAI co-founders feared the ultra-powerful technology would end up being monopolized by Google. They created OpenAI as a non-profit entity so that it could develop AGI “to benefit all humanity” and not just the shareholders of a single corporation. Elon Musk initially pledged $1 billion to the non-profit.

The problem was, the pursuit of AGI using ever-larger deep learning models is extremely expensive due to the huge datacenter resources needed. Altman has said he vastly underestimated the amount of money OpenAI would need to compete in the race for AGI. And OpenAI’s lack of funding became an existential challenge after Musk acrimoniously resigned from OpenAI’s board after a dispute with Altman and the other co-founders over control of the research lab and its agenda. Musk took his $1 billion pledge with him. (Musk has said he donated $40 million to OpenAI during his the time he was affiliated with it. The company has said that in its time as a non-profit it received $130.5 million in total donations. Not nothing. But not enough to compete successfully with Google DeepMind.)

With Musk’s backing gone, Altman had to find more money—fast. He realized that raising money from donors, who only get a tax write-off for their contributions, was extremely inefficient compared to venture capital, where investors expect a return. And a good way to get access to computing resources was to essentially cut a deal with a major cloud service provider that could give him both—cash plus compute.

It would be the ultimate irony if the flaws of the very structure Altman designed wind up saving his job at CEO and allowing him to outmaneuver the board that he established to safeguard AGI.

The mess at OpenAI will also have investors looking hard at the governance structure of its rival AI company Anthropic, which was started by researchers who broke away from OpenAI in 2021 because they were concerned that the commercial turn OpenAI had made following Microsoft’s investment jeopardized its AI safety mission. Anthorpic is B Corporation, which is a much more straight forward structure than OpenAI’s. A B Corporation is one in which the directors have a fiduciary duty to look after multiple stakeholders’ interests, not just the profits of shareholders. In Anthropic’s case, the board is supposed to look after the interests of society as well as the company. Venture investors in Anthropic have one seat on its board. But Anthropic also has a Long-term Benefit Trust, whose trustees are a panel of experts in AI safety and national security who have no financial interest in Anthropic. The Long-Term Benefit Trust has a special class of stock that allows it to install an increasing number of directors based on certain AI progress milestones. It also has the right to control the majority of the B Corp.’s board within four years.

No doubt investors in Anthropic will now be giving this structure additional scrutiny following the destabilizing turmoil at OpenAI.

Read more:

This story was originally featured on Fortune.com

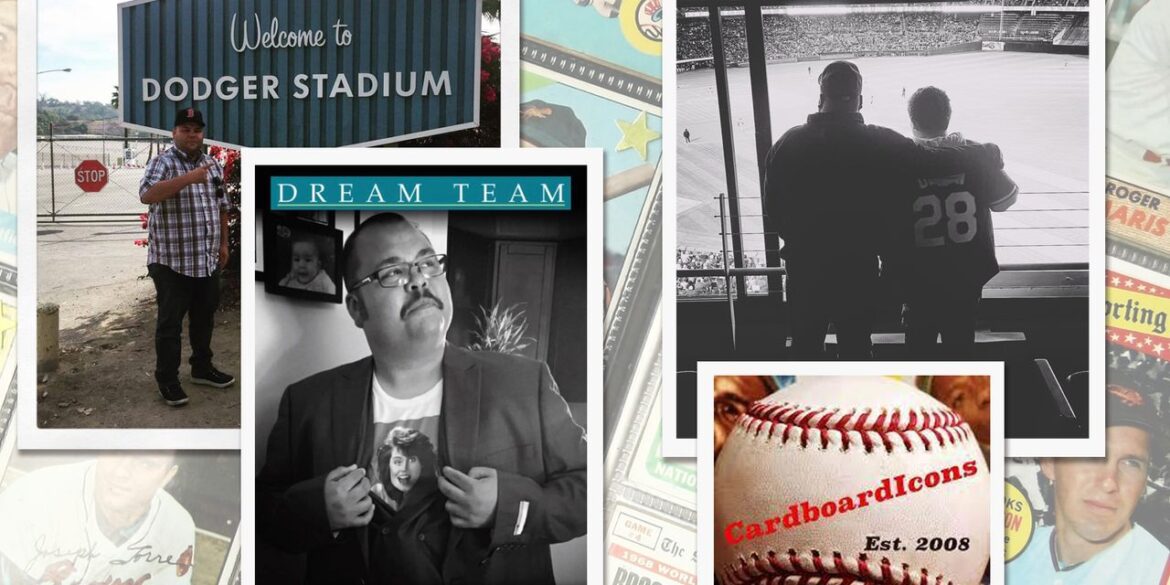

3 simple rules for collecting baseball cards, from one of the nicest guys The Hobby has ever known

In times of mourning, Ben Aguirre turned to baseball cards.

“Collecting has been [a] huge part of my journey — it’s been there through good and bad. It serves as a means of celebration, as well as a distraction during times of pain. We have to give ourselves permission in these times of grief and sorrow to enjoy the things that we like. Abandoning such activities would be a protest of our own personal joy.”

Ben’s family and friends are looking for their own distraction from pain after the 43-year-old father of two teenagers died suddenly of an unknown cause on Oct. 28. Ben had built a massive community in the baseball-card world as one of the pioneering bloggers in The Hobby, as he and other collectors refer to the trading-card industry.

I worked with Ben before he started writing about baseball cards, when he was a reporter for The Argus and I served as news editor for the then-daily newspaper in Fremont, Calif. We stayed connected after he left journalism to serve as a community service officer for the city of Fremont, which is when he delved further into blogging and writing about collecting cards to keep scratching his writing itch.

We talked more in recent years, as my son began collecting baseball cards during the COVID-19 pandemic, when a spike in interest amid the arrival of hot rookies across all the major sports made it hard to purchase packs of new cards. Ben was an amazing guide, instructing me to sign up for Target’s

TGT,

Redcard program — purchasing some boxes of cards online from the retailer required it — and pointing me to several social-media accounts that alerted followers when cards were available for sale, along with tons of other tips about collecting and storing baseball cards.

After he died, I realized I was far from alone in counting on Ben to help me understand the baseball-card-collecting landscape. Dozens of people posted remembrances of Ben last week on social media, recounting how he helped guide them on their collecting journey and remembering him as one of the nicest people to gain prominence in The Hobby.

“He’s always been a very kind, very gentle type of soul who cared for other people even to his own detriment sometimes,” said Mike Osegueda, a college classmate and longtime close friend of Ben’s who is well-known in baseball-card circles as “Mike Oz.” “If you needed him for something, he would spring to action and help in the kindest way and give you every bit of himself that he could in that moment.”

I am saddened to know that Ben will not be around to continue shaping the journeys of others through the baseball-card world, but he leaves behind 15 years of blogs and tweets that can serve as a guide to those not fortunate enough to have received his personal counseling. With permission of his family and some guidance from Osegueda, I have attempted to boil down Ben’s ethos on collecting cards into three simple rules for those in The Hobby, and others seeking to enter it, based on his blogs and his own collecting experience.

Collect for love or fun, not (just) money

“The value of our cards — while often tied to money — is often a personal experience,” Ben once wrote, and Osegueda said that enjoying the experience of finding and buying cards was the most important part of Ben’s ethos.

“He enjoyed the thrill of the hunt,” Osegueda told MarketWatch. “Yeah, if he found something he could sell it and make money, but that wasn’t all that it was about.”

For Ben, the true purpose of The Hobby was not in flipping cards for a profit, but the fun that can be had scouring card shops and thrift stores — his “Thrift Treasures” blog posts became one of his most widely known types of posts — for the pieces of cardboard or other memorabilia that could spark emotion.

“This hobby isn’t just about money,” he wrote in a “Thrift Treasures” post in 2016. “It’s about the memories and feelings that come with tracking down a White Whale for your collection. It’s about the stories you have that are tied to specific cards. It’s about reliving our childhood in an instant with a glance of a player’s face on a piece of cardboard.”

As collecting cards became popular again in recent years, Ben’s blogging seemed to morph from “Hey, check out this cool card” to focusing on this nostalgia and other lessons he wanted to pass along. Much of the change seemed to come from his son becoming interested in The Hobby and growing into a collector of his own, which made Ben reflect even more on why he collected.

When his son pulled an autographed card from a pack at age 9 in 2019, he wrote that “The joy on his face and in his voice when he announced it and showed it off to his sister is what The Hobby is all about.”

“We are all chasing that joy,” he wrote. “We are all trying to recreate those fabulous feelings we all had whenever we pulled something that made us smile.”

People who buy cards to flip them for a profit, he said, aren’t actually collectors.

“Is it wrong if someone wants to buy the hot prospect today with the idea of selling in the future? No, not really, as long as we’re calling it what it is. Because that’s not collecting. That’s a different form of participation in The Hobby, or industry,” he wrote.

Collecting was what Ben did, and what he cherished.

“I enjoy collecting — it’s fun,” he wrote in a 2018 post. “I enjoy chasing cards that I never dreamed of owning. I enjoy obtaining a card that my grandfathers or great-grandfathers would have owned if they loved baseball. I enjoy sharing hobby experiences with my children. And so I shall do only the things in this hobby that make me happy and that are fun.”

Your collection should be about you

While the first rule deals with the act of collecting and the reasons behind it, this one is more about the collection itself.

Baseball-card collectors seem to have a million unwritten rules about how to collect, but Ben wasn’t really interested in them. For instance, many collectors eschew pitchers for hitters in their “personal collections,” or PCs. But Ben’s biggest PC as a kid was Roger Clemens, a pitcher, and for the past decade he became one of the most prominent collectors of cards featuring Los Angeles Dodgers pitcher Clayton Kershaw, ranking No. 1 for such collectors on a Trading Card Database list with more than 2,800 unique Kershaw cards.

To Ben, a baseball-card collection should reflect the human who puts it together, and become a living, breathing organism that changes along with its owner. Nothing else truly matters.

“Bottom line: If cards talk to you, find the ones (new or old) that make YOU happy and give them a new home,” he wrote.

Ben’s collection exemplified this idea. He started off as a kid collecting Clemens and other players of the Boston Red Sox, his favorite baseball team. In his 20s, he got rid of his basketball and football cards and concentrated on collecting rookie cards of baseball players, eventually refocusing in his 30s and amassing a collection of rookie cards of every baseball player in the Hall of Fame. Recently, he was selling off some of those rookie cards and getting back to his personal collections of specific players for him and his son.

“Someone asked me recently: WHY do you collect baseball cards? This is why. It’s not really about the money. It’s not really an investment because cards rarely appreciate with time under normal circumstances. It’s about the memories. It’s about how in an instant [a] single worthless card can transport you back a quarter of a century to the moment when you asked a parent for money and trekked clear across town to buy a card of your childhood sports hero,” he wrote. “I have other reasons for collecting what I do. And sometimes I can’t fully explain it. But THIS is probably the strongest reason why.”

And it wasn’t just cards. Ben also collected game-used baseballs that hit batters in the course of a game. These balls were put into a large display that he called his “Wall of Pain” — a collection that was unlikely to grow in value, but gave Ben pleasure in owning and reflected the person he was.

“People often call music the soundtrack to their lives,” he wrote. “For me, baseball cards are essentially my timeline.”

Be kind, especially to kids and new collectors

Ben’s final blog post provided “10 tips for veteran collectors to stay positive with new hobbyists,” which he wrote because he said “it’s important to share good vibes for our hobby.”

Right there at No. 3 is this: “Be kind — we were all new once.”

Ben embodied this rule, and not just toward new collectors or kids. He was kind to everyone with whom he came into contact on social media and in the wild, patiently explaining aspects of The Hobby that many other collectors would consider basic knowledge. Other experienced collectors might frown on those who asked these relatively basic questions, but not Ben.

For Osegueda and myself, that will be Ben’s true legacy in The Hobby.

“If you look at all the things that people said [after he passed], they always talk about how insightful he was, how nice he was, how much he tried to bring people in and lift them up, and that’s who he was from the beginning,” Osegueda said.

Ben was that way until the end, as well. And hopefully that legacy lives on in all of those whom he touched in the baseball-card collecting world.

The baseball-card community organized a GoFundMe campaign to raise funds for Ben’s children, and it has already surpassed its $10,000 goal.

Warren Buffett Is Undeniably Frugal, But For Christmas He Gives Each Family Member $10,000 Along With His Favorite Candy And Funny Personalized Christmas Cards

Warren Buffett, the renowned investor and CEO of Berkshire Hathaway, has earned a reputation for his thrifty lifestyle and practical approach to finances. Yet, during the holiday season, Buffett reveals a different side of himself, one marked by generosity and a unique approach to gift-giving. From practical items such as dresses and chocolates to envelopes filled with cash, Buffett’s gifts are a reflection of his values of practicality, gratitude and a hint of humor.

A hallmark of Buffett’s holiday gift-giving is his tradition of gifting cash and stocks. In 2019, Mary Buffett, who was previously married to Warren’s son Peter, disclosed to ThinkAdvisor that Warren used to give each family member $10,000 in hundred-dollar bills. Recognizing the family’s propensity to quickly spend the money, Warren altered his approach. On one memorable Christmas, he gave $10,000 worth of shares in a company he had recently invested in, presenting the recipients with the option to either cash in the shares or retain them as an investment. This gesture was a testament to Warren’s astute investment acumen and his wish to instill a sense of financial prudence in his family.

Don’t Miss:

Opting to gift shares over cash was a strategic decision that not only provided the recipient with a valuable asset but also served as a subtle lesson in the importance of making sound financial choices. By giving shares from a company in which he had recently invested, Buffett demonstrated his confidence in his investment decisions. This approach to gift-giving underscored his desire to pass down his investment knowledge and principles to his family, encouraging them to adopt a long-term perspective and consider the potential growth of their assets, as opposed to the immediate satisfaction derived from spending cash.

Just as receiving shares in a company provides the opportunity to be part of its future success, investing in a startup at the ground level can offer the potential for significant returns if the company takes off. This parallel highlights the importance of considering long-term potential and being strategic with financial decisions.

Trending: Get equity and front row seats to the startups and small businesses you love — for as little as $100.

In addition to giving stocks, Buffett has maintained another Christmas tradition: giving dresses to the women in his life. In the 1960s, he would frequent Topps, a dress shop in Omaha, Nebraska, and provide the store clerk with a list of dress sizes for all the women in his family, showcasing his practical method of holiday shopping.

Buffett also sends boxes of See’s Candies, one of Berkshire Hathaway’s best investments, to dozens of relatives and friends each year. These boxes come with his annual Christmas card, which often features Buffett in humorous or playful scenarios. For example, his 2013 card featured Buffett dressed as Walter White from “Breaking Bad” with the message “Have yourself a Meth-y Little Christmas.” In 2018, the card was a photo of Buffett wearing a t-shirt with the words, “The Next Charlie Munger” and the message “Aiming High In 2019” on the card. Another year, Munger and Buffett were dressed in black suits and cowboy hats with the caption “Butch & Sundance” and the message “You’re right, it’s not Newman and Redford.”

Through these unique and thoughtful gifts, Buffett brings a touch of his personality and values to the holiday season, making Christmas a little brighter for those around him.

Read Next:

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article Warren Buffett Is Undeniably Frugal, But For Christmas He Gives Each Family Member $10,000 Along With His Favorite Candy And Funny Personalized Christmas Cards originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NFT-styled debit cards the future of Web3 — Animoca founder on $30M Hi investment

Animoca Brands co-founder and executive chairman Yat Siu sees significant potential in the personalization of Web3-based services as his firm earmarks $30 million for the neobank platform Hi.

Siu’s investment firm plans to invest in the Web3 app that combines a cryptocurrency exchange, digital banking services and a customizable nonfungible token (NFT)-styled crypto debit card offering as part of its growing ecosystem.

Speaking exclusively to Cointelegraph, Siu said Hi’s vision for its NFT debit card offering intersects with his views on the interplays of culture and Web3. Hi’s flagship crypto-friendly Mastercard debit card allows users to personalize their physical cards with an NFT avatar they own.

“It is an example of the ongoing shift toward personalization, where Web3 finally allows users the opportunity to express themselves and their individuality in new and exciting ways.”

A central feature of the agreement is the potential to amplify the utility of various Web3 tokens and NFTs. The Hi ecosystem features Web3-integrated financial applications and its own Hi protocol, which is an Ethereum Virtual Machine-compatible sidechain.

The two companies will also look to drive the adoption of a “unique-human authentication mechanism” through the Hi protocol’s proof of human identity solution.

Related: Animoca still bullish on blockchain games, awaits license for metaverse fund

Hi co-founder Sean Rac told Cointelegraph that the protocol’s proof of human identity solution addresses shortcomings of the Web2 era, where a handful of companies gained control over user data and identity after establishing themselves as “dominant credential providers.”

According to Rac, Hi’s solution addresses this by using a dual-node structure where one set of nodes serves as identity validators responsible for verifying accounts owned by humans. Meanwhile, block producers secure the network.

Rac added that the approach could open up possibilities for “human-only” networks and decentralized applications.

Animoca Brands and @hi_com_official

We entered into a MoU for partnership to support hi’s dedicated work in bridging fiat & cryptocurrency worlds to onboard #Web3 to mass, creating real-world use cases for utility tokens like $SAND, $EDU, $APE & more! https://t.co/i5qOjMluPv— Animoca Brands (@animocabrands) July 27, 2023

The partnership will allow users to send and receive Animoca Web3 ecosystem tokens, including The Sandbox’s SAND (SAND) and ApeCoin (APE). The Web3 app is touted to have over 3.5 million users.

The card service is set to allow users to pay with a fiat or crypto debit card around the world, tapping into some 90 million merchants that use Mastercard services.

The platform looks to move into a space that neobanks like Revolut and N26 have shaped, while its focus on Web3 might attract proponents and enthusiasts to get on board, even if it’s just to have a debit card to flaunt their prized Bored Ape Yacht Club, Meebit or Pudgy Penguin NFTs.

Siu added that the investment was driven by the belief that Hi would bring a new set of users to Web3 and Animoca’s own brands like The Sandbox.

“We believe that Hi’s core application will facilitate on- and off-ramp rails and therefore further drive mass adoption.”

There could also be significant value in the deal for Animoca, which has invested in several different NFT and Web3 projects. Siu also noted investment would begin once both parties signed definitive agreements.

The neobank has secured the green light as a virtual asset service provider (VASP) in Lithuania, while it’s also recognized as a digital currency operator by Italy’s payments service regulator. Hi’s presence in Asia is in progress, with the platform undergoing pre-registration to secure a VASP license through the Hong Kong Securities and Futures Commission.

Earlier this month, Siu told Cointelegraph that Animoca was still awaiting a regulatory license in Hong Kong for its proposed $1 billion metaverse fund. The company continues to invest heavily in blockchain gaming and Web3 projects.

Magazine: Web3 Gamer: Earn Bitcoin in Minecraft, BGA’s 50/50 gender split, Oath of Peak hot take

Cheap Last-Gen Graphics Cards Will Make NVIDIA's RTX 4060 a Tough Sell

The most budget-friendly graphics card in NVIDIA‘s (NASDAQ: NVDA) RTX 4000 series is coming on June 29. The RTX 4060, priced at $299, will come about one month after the pricier RTX 4060 Ti was launched.

Like the RTX 4060 Ti, the RTX 4060 will likely provide minimal performance gains over its predecessor. According to Tom’s Hardware, the RTX 4060 Ti is somewhere around 10% faster than the RTX 3060 Ti depending on the resolution. That’s just not a huge improvement.

Among current-generation graphics cards, the RTX 4060 may be the best option at the $300 price point. But the collapse in demand for PCs has created a surplus of last-gen graphics cards, and prices have been falling off a cliff. These discounted graphics cards will be the toughest competition for NVIDIA’s new mainstream product.

Continue reading

Credit cards may be excellent financial instruments if used responsibly. However, many individuals fall into the trap of collecting excessive debt due to careless credit card usage. This article will cover numerous tactics and best practices to help you use credit cards sensibly, avoid debt and maintain a healthy financial lifestyle.

Understanding credit cards

Credit cards operate as a revolving line of credit, allowing users to make purchases up to a predetermined credit limit. However, failure to comprehend the foundations of credit cards can lead to financial issues. It’s crucial to grasp basic concepts such as credit limits, interest rates and minimum payments to prevent potential traps.

A credit limit is the maximum amount of money that a credit card company permits you to borrow on your card. It indicates the line of credit given to you. It is crucial to understand your credit limit and keep track of your expenditures to avoid exceeding it. Going above your credit limit can result in additional fees and penalties.

Interest rates are the fees that credit card companies charge on any outstanding balance that you carry from month to month. It is crucial to pay attention to the interest rates linked to your credit card, as they can drastically affect the amount you owe.

Here’s how you can protect yourself:

1) Avoid high interest debt: When you take on credit card debt, you use your scarce resources (time and energy) to work and pay interest at 20%+.

2) Holding cash for the short term (3-12 months) is smart because your expenses will likely be…

— Rajat Soni, CFA (@rajatsonifnance) June 2, 2023

High interest rates can lead to higher debt over time, while lower interest rates can save you money. To prevent incurring excessive interest charges, attempt to pay off your credit card debt in full each month.

The minimum payment is the minimum amount you are required to pay each month to keep your credit card account in good standing. It is often a percentage of your entire outstanding balance.

While making the minimum payment is necessary to avoid late fines and keep a solid credit history, it is important to know that paying only the minimal amount prolongs the time it takes to pay off your debt and can result in hefty interest costs. Strive to pay more than the minimum payment whenever possible to lower your debt faster and save on interest fees.

Creating a solid financial foundation

One of the first stages of appropriate credit card utilization is creating a sound financial foundation. This starts with developing a budget to track your income and expenses effectively.

Ah, the classic dilemma: swipe now and suffer later or save now and splurge later. It’s all about finding the balance that works best for you and your financial goals. Perhaps a budgeting plan can help you allocate funds towards both debt and savings!

— PsychMate (@PsychMateAI) June 6, 2023

A budget enables you to allocate finances for necessary expenses, savings and debt repayment. Additionally, creating an emergency fund is vital. Having readily available finances for unforeseen needs decreases the dependency on credit cards in times of crisis.

Choosing the right credit card

Selecting the correct credit card is vital to managing your finances wisely. Research and compare several credit card offers to locate one that corresponds with your financial needs. Consider aspects like interest rates, annual fees, rewards programs and customer advantages. Understanding the terms and conditions associated with the credit card is equally crucial to avoiding surprises and hidden fees.

Related: How to build an emergency fund using budgeting apps

Establishing responsible credit card habits

Developing responsible credit card habits is crucial to avoiding debt. Paying credit card bills on time is vital to avoid late penalties and prevent interest charges from increasing. Furthermore, making more than the minimum payment each month helps lower overall debt faster and saves on interest expenditures. Setting up automatic payments can expedite the process and ensure bills are paid promptly.

Managing credit card debt effectively

If you find yourself in credit card debt, it’s crucial to manage it effectively. Start by paying off credit cards with high interest rates first, as this will save you money in the long term.

Consider debt consolidation options, such as balance transfers or personal loans, to simplify payments and perhaps cut interest rates. If the debt becomes unbearable, seeking expert help from credit counseling or debt management programs can provide guidance and support.

Utilizing credit card benefits wisely

Credit cards often offer numerous perks, such as rewards programs and fraud protection. Take advantage of rewards programs by using your credit card for ordinary expenses and paying off the debt in full each month.

However, be mindful not to overspend or create needless debt in search of benefits. Additionally, review your credit card statements often to spot and report any strange activities promptly, protecting yourself from fraud.

Knowing when to cut back or take a break

Recognizing red flags and knowing when to cut back on credit card usage is crucial. Signs of excessive credit card usage include failing to make minimum payments, using credit cards for daily expenses or repeatedly hitting your credit limit.

If these tendencies persist, it may be time to examine your spending patterns and explore alternate options. Consider taking a temporary break from credit card usage to restore control over your finances and explore alternative payment alternatives.

Related: How to avoid impulse buying and save money instead

Discipline is the key to staying debt-free

Credit cards may be valuable financial instruments when used carefully. By knowing the potential risks, adopting good habits and managing credit card debt properly, you can avoid excessive debt and maintain a healthy financial lifestyle.

Remember, it’s vital to stay disciplined, prioritize financial goals and always make informed judgements when it comes to credit card usage. With the correct information and habits, you may exploit credit cards to your advantage and attain financial stability.