On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

On Saturday, March 2, the valuation of bitcoin cash witnessed a significant increase, climbing over 40% within a 24-hour span to reach a peak of $451 each. This upward trend is attributed to the anticipated halving event, set to happen in 16 days, and the forthcoming 2024 upgrade, which is expected to implement an adaptive […]

Source link

cash

Tornado Cash website, discord offline after community finds malicious code in protocol’s backend

Crypto mixer Tornado Cash has reportedly fallen victim to a significant backend exploit that has put user deposits and sensitive data at risk.

The security breach was revealed in a Medium post by Gas404, a community member, on Feb. 26.

The exploit represents a critical vulnerability for Tornado Cash, whose trading volume already suffered a dramatic decline following sanctions from the US Treasury Department’s Office of Foreign Asset Control (OFAC) in August 2022.

The sanctions, which were part of broader measures targeting the crypto sector, had significantly reduced the mixer’s operational scale even before the exploit.

Malicious code

According to the Medium post, malicious JavaScript code was discovered in the protocol’s backend. It was reported injected through a compromised governance proposal submitted by an individual posing as a Tornado Cash developer on Jan. 1.

The code surreptitiously redirects user deposit information to a server controlled by the attacker, posing a dual threat — the exposure of deposit data and the outright theft of the deposits themselves.

One such theft has been confirmed through transaction records on Etherscan, highlighting the exploit’s immediate impact.

The exploit’s technical details were discussed at length in the community post, illustrating the sophisticated nature of the attack.

Specifically, the malicious code was designed to encode and exfiltrate private deposit notes, effectively breaching the anonymity and security that Tornado Cash users depend on.

Proposed solution

In response to the crisis, Gas404 has proposed a solution to mitigate the damage: reverting Tornado Cash to a prior version of its IPFS deployment.

The move aims to secure the platform against the current vulnerability by utilizing a previously established and ostensibly secure infrastructure setup.

The proposed change emphasizes the urgency of addressing security flaws within decentralized platforms, where governance proposals can be manipulated for malicious purposes.

The Tornado Cash website and Discord channel were taken offline following the revelation and have yet to come back online — an indication of the exploit’s severity and the ongoing efforts to contain its repercussions.

A view from onboard the upper stage of rocket LV0009 during the company’s livestream on March 15, 2022.

Astra / NASASpaceflight

The space sector’s on the tail end of a boom-and-bust cycle. While many companies battened down the hatches to survive, a few publicly-traded names are running on fumes.

A flurry of about a dozen space companies went public over the last few years. Although each have had fairly dismal stock performances since their debuts, the majority are still moving forward and look to build momentum in the year ahead, with some closing in on coveted profitability milestones.

But a trio of names appear likely to go the way of Virgin Orbit, which flamed out last year. Here’s who’s most at risk of delisting, acquisition or even bankruptcy.

Sign up here to receive weekly editions of CNBC’s Investing in Space newsletter.

Momentus

Space tug operator Momentus has already warned shareholders that it’s running out of money, and earlier this month the company abandoned plans for its next mission.

Once valued at over $1 billion, Momentus has gone through a tumultuous couple of years. Despite a 1-for-50 stock split last year, its shares currently trade near 80 cents, putting the company at a depressed $7 million valuation.

The next few weeks will likely prove crucial for Momentus to find a major new backer or buyer, or else face bankruptcy.

Astra

Astra has been conducting piece-meal financing rounds from a handful of investors over the past couple months, as the company’s been nearly out of cash since October.

Its rocket-launching business has been on hiatus since June 2022, and its acquired spacecraft business is not driving meaningful revenue growth. And, while the company’s founders floated a take-private plan in November, there’s been no word from Astra’s board of directors on the proposal.

Once valued at over $2.5 billion, Astra’s valuation has been under $50 million for months.

Short of completing that take-private deal, it’s unclear how the company could climb out of its cash-desperate situation.

Sidus

Sidus Space is a little-known space company that went the traditional IPO route in late 2021 and began trading on the Nasdaq at a near $200 million valuation. Sidus has aimed to build its own satellite constellation as a testing or data platform for a variety of customers.

But it’s seen minimal revenue growth and rising annual net losses. While its inaugural satellite was supposed to launch in late 2022, the company has yet to get the spacecraft in orbit, most recently targeting a March launch.

Sidus has raised small amounts of funding through public stock offerings of $5 million or less since its IPO. But it had less than $2 million in cash at the end of September, trading at a near $9 million valuation according to FactSet.

Last month, Sidus performed a 1-for-100 reverse stock split to regain compliance with Nasdaq listing rules.

Momentus, Astra and Sidus did not respond to CNBC requests for comment.

Elsewhere in space

A fourth space company in a potentially precarious spot is satellite imagery company Satellogic. Its most recent financial update only dates to the end of June. At the time, Satellogic disclosed it had substantial doubt of surviving through September 2024. The company’s stock currently trades near $1.50, at a $21 million valuation.

Despite some likely turbulence ahead, the space sector as a whole isn’t necessarily struggling and continues to attract interest from the private markets. Overall, investment in the space sector bounced back in 2023, with companies bringing in $12.5 billion in investment last year.

And while industry analysts predicted a fallout from the flurry of public debuts a couple years back, it hasn’t been as severe as forecast just yet. Many space stocks are below where they were when they came to market — and in many cases well behind original financial forecasts — but most are not on death’s door.

For example, Terran Orbital won’t be near the $411 million in 2023 revenue it forecast when it was going public three years ago. But, despite its stock price trading near 80 cents at a $156 million valuation, Terran Orbital appears to have a lifeline from a key customer.

Earlier this month, Terran announced receipt of a milestone payment from its biggest customer, Rivada, and, on the same day, said its cash at year-end was $70 million, up from $39 million at the end of the third quarter.

Tornado Cash developers to receive funding from new legal defense DAO

An activist group launched a legal defense fund for accused Tornado Cash developers Alexey Pertsev and Roman Storm on Jan. 22.

Roman Storm endorsed the fundraiser, stating:

“2024 is the year that will define the rest of my life. Honestly, I’m scared. But also hopeful that this community cares with a passion. Please donate towards my legal defense.”

The DAO was also announced by Ameen Soleimani, who is associated with various Ethereum and cryptocurrency projects. Soleimani wrote:

” … Roman & Alexey are fighting for all of us. The outcomes of these trials will have far reaching consequences for ETH devs & users, especially those working on privacy tools.”

The fund is organized by a group called Free Pertsev & Storm. The group stated that the fundraiser will run from Jan. 22 to Feb. 22 and noted that the defendants’ legal fees would range between $90,000 and $100,000 per month. It added that the “upcoming months will be crucial in shaping their defense strategy.”

Donations are possible through three fundraising platforms. As of 11:00 p.m. UTC on Jan. 22, Free Pertsev & Storm’s fundraiser page on JuiceBoxDAO had attracted 23 ETH ($53,300) through 78 donations.

Additionally, the group’s GoFundMe fundraiser raised $14,745 through cash donations. Another website at WeWantJusticeDAO.org appears to be accepting donations as well, though it does not report the raised amount publicly.

The U.S. is taking action against coin mixers

The U.S. initially took action against Tornado Cash in August 2022 as the Treasury blacklisted various on-chain crypto addresses linked to the service.

About one year later, the U.S. Department of Justice (DOJ) began to pursue charges against the platform’s developers. The agency charged Storm over his role in developing the coin mixer Tornado Cash in August 2023, alleging conspiracy charges around money laundering, sanctions violations, and the operation of an unlicensed money-transmitting business. The DOJ simultaneously charged another individual, Roman Semenov, who remains at large.

Alexey Pertsev was arrested in the Netherlands in August 2022, facing similar money laundering charges. He does not currently face charges in the U.S. but has been designated by the Treasury for his role in Tornado Cash.

U.S. authorities maintain that Tornado Cash and other coin mixers are used in money laundering and by cybercrime groups, including North Korea’s Lazarus Group. Crypto community members have largely countered this and asserted that coin mixers have legitimate privacy applications for general users.

Incidentally, the DeFi Education Fund submitted a comment opposing a federal proposal to treat coinmixers as a special money laundering concern.

Spirit Airlines looks to reassure investors with update on cash, revenue

Spirit Airlines Inc.’s stock soared Friday as the discount air carrier gave an upbeat revenue outlook and looked to reassure investors amid concerns that the failed merger with JetBlue Airways Corp. could result in a bankruptcy.

Spirit said in a filing with regulators that it had $1.3 billion of liquidity at the end of 2023, including unrestricted cash and cash equivalents, short-term investment securities and $300 million of liquidity under the company’s revolving-credit facility.

The stock

SAVE,

ended 17% higher on Friday, after gaining more than 25% earlier in the session. The close in the black snapped a five-day losing streak for the shares, which closed at a record $5.70 low on Thursday.

Spirit said it “took several steps to shore up its liquidity” in the fourth quarter so it could work on “necessary strategic shifts” to better compete and return the business to profitability.”

It raised $419 million in cash and repaid $465 million in debt from sale-leaseback transactions on aircraft in January and December.

The company was addressing concerns about its balance sheet after a federal judge on Tuesday moved to block the merger with JetBlue

JBLU,

due to competition concerns. The stock plunged 47.1% that day, and has fallen nearly 62% in the three days since the merger was blocked.

A number of analysts have raised the possibility that the blocked merger could result in a bankruptcy filing, with credit rating agency Fitch Ratings being the latest to cast doubt on Spirit’s prospects as a standalone airline.

On Friday, however, Raymond James analyst Savanthi Syth said that a bankruptcy filing is not “a foregone conclusion,” although variables include Spirit’s work in addressing fixed costs to support a smaller operation and how the domestic air travel market shapes up to be this year.

Moreover, “it is clear to us that Spirit is pressing JetBlue to appeal the anti-trust ruling, but we continue to believe the chances of success are low,” Syth said in a note.

Read: JetBlue dodged a bullet after judge blocked Spirit acquisition, J.P. Morgan says.

Spirit said it expects fourth-quarter revenue of $1.32 billion, as bookings during the peak travel period over the Christmas and New Years holidays were “strong.” FactSet consensus calls for fourth-quarter revenue of $1.305 billion.

Lower fuel and airport costs helped push operating expenses for the quarter below expectations, and the guidance range for operating margins was improved to negative 12%-to-13% from negative 15%-to-19%, the company said.

Citi analyst Stephen Trent said in a note that Friday’s filing “brings at least some better view around 4Q’s guide itself,” but kept his sell rating on Spirit’s stock.

Spirit said it expects a “significant source of liquidity over the next couple of years” from negotiations with Pratt & Whitney on compensation for financial damages related to geared turbofan (GTF) neo-engine availability issues.

Spirit Airlines said it’s weighing options to refinance its 2025 debt maturities, including the $1.1 billion of aggregate principal amount of 8.00% senior secured notes.

Spirit’s stock has tumbled 59.1% over the past three months, while the U.S. Global Jets ETF

JETS

has climbed 16.6% and the S&P 500 index

SPX

has rallied 11.9%.

—Tomi Kilgore and Claudia Assis contributed to this article.

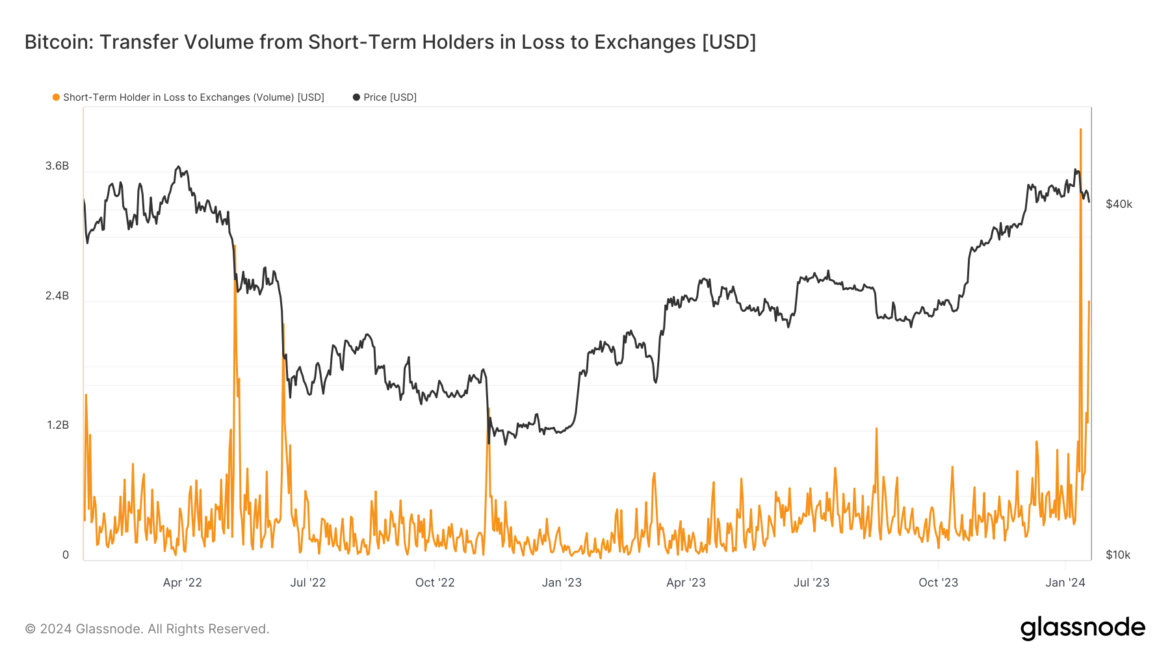

Long-term Bitcoin holders start to cash in as short-term investors face losses

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

(Bloomberg) — The US economy is set for an unexpected fiscal boost if lawmakers back a potential deal for $70 billion worth of tax breaks for businesses and families.

Most Read from Bloomberg

Congressional negotiators are locked in talks over renewing expired business tax breaks and boosting the child tax credit, evenly split between both. The proposal will need to pass through a Congress that is deeply divided over the nation’s fiscal trajectory, as some Republican lawmakers push for deep spending cuts as a condition for averting another government shutdown on Jan. 19 and Feb. 2, when temporary funding expires.

If passed, the tax breaks offer a double-edged sword for an economy that appears on course for a soft landing.

While the extra cash would boost consumer spending, it would also risk reigniting inflation pressures — complicating prospects for the Federal Reserve to lower interest rates this year, economists warned. Data for December show that inflation picked up at the end of 2023, fueled by services costs while a decline in goods prices petered out. The consumer price index increased 3.4% in the year through December, the most in three months. Prices for clothing and cars continue to increase.

Mickey Levy, a visiting scholar at the Hoover Institution, said the tax measures would add fuel to an economy that is already growing faster than estimates for its long run potential. The legacy of pandemic-era fiscal stimulus continues to juice growth, he said.

“There’s already substantial fiscal stimulus driving up economic activity,” he said.

Analysts say much will depend on the final details of any agreement and how the tax breaks will be structured. The draft deal would extend breaks through 2025.

The talks were still in flux as lawmakers left for the long weekend Friday. After halting progress earlier in the week, several potential roadblocks to a bipartisan agreement emerged, including differences over the state-and-local tax deduction cap, an expansion to the low-income housing tax credit and a more robust child tax credit.

If a deal does come together, money could start flowing to households as soon as March, said Marc Goldwein, senior policy director for the Committee for a Responsible Federal Budget, which advocates for reducing deficits and debt. He cautions the proposal will do little to encourage additional corporate investment.

Business Breaks

The proposed deal would revive tax breaks for research and development spending, boost the deductibility of investment, such as in equipment, and business loans. Lawmakers are discussing restricting benefits for foreign research investments in order to target the benefits to companies conducting such activities in the US.

“This is going to be a decent amount of fiscal cost with very little of it going to encourage new investment in a time when there are still inflation pressures,” Goldwein said.

Still, the plan could be a boon for President Joe Biden, whose poll numbers have slumped amid voter anxiety over the economy. Asked how the White House is weighing the potential inflationary impact of any proposal, Biden’s top economic adviser instead emphasized benefits of the bill.

“We are very much hoping that we can see a balanced package,” National Economic Council Director Lael Brainard said Thursday. “But what is critical for the president is that the child tax credit be extended and particularly be made available for low and moderate income families, because it is so powerful in reducing child poverty.”

Child Credit

The child tax credit boost on the table as of last week wouldn’t be nearly as much as the Covid-era version, which took the maximum credit from $2,000 to $3,600 per child. It’s also not fully refundable for those without tax burdens, nor would it be paid monthly. Those details could change, as many Democrats vow to block the current deal.

Nancy Vanden Houten, a lead economist at Oxford Economics, said the overall size of the tax package wouldn’t be enough to derail her view that the Fed will cut rates in May.

“The impact on the broader economy would be relatively small, and probably not enough to change our forecast for inflation and the Fed,” Houten said.

At the very least, the tax negotiations underscore that lawmakers remain a long way from entering an era of austerity even amid warnings from ratings firms and investors that the US fiscal trajectory is unsustainable.

Tax Season

Moody’s Investors Service in November warned it could downgrade the sovereign US rating because of wider budget deficits and political polarization. It lowered the outlook to negative from stable while affirming the grade at Aaa. Fitch Ratings downgraded the US in August.

If the tax proposal is agreed, negotiators are aiming for Congress to enact it before the Jan. 29 start of the annual tax-filing season.

“If it passes, it just becomes another shot in the arm for an economy that maybe does, or maybe doesn’t, need it,” said Owen Tedford, a senior research analyst at Beacon Policy Advisors LLC.

–With assistance from Erik Wasson.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

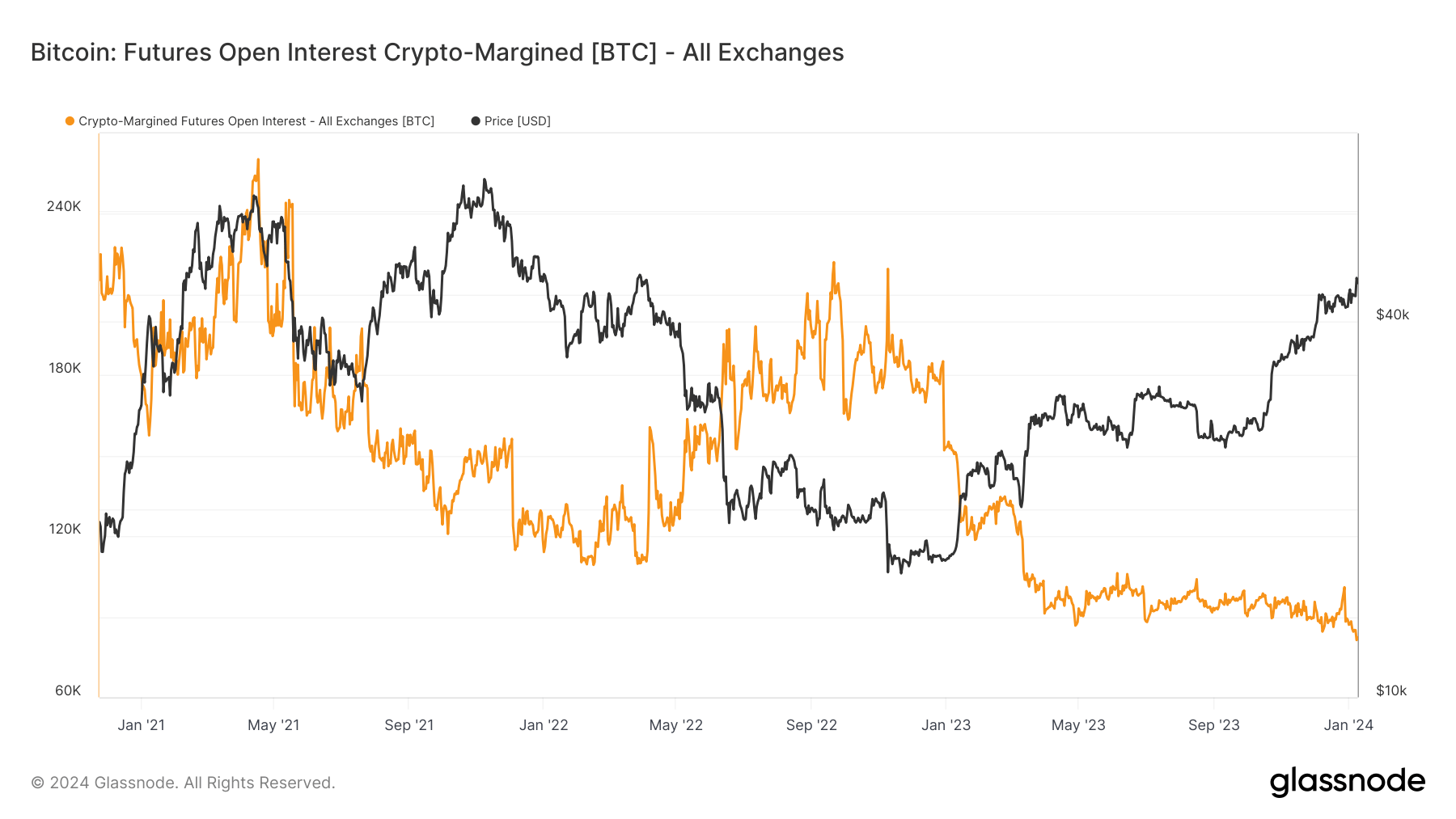

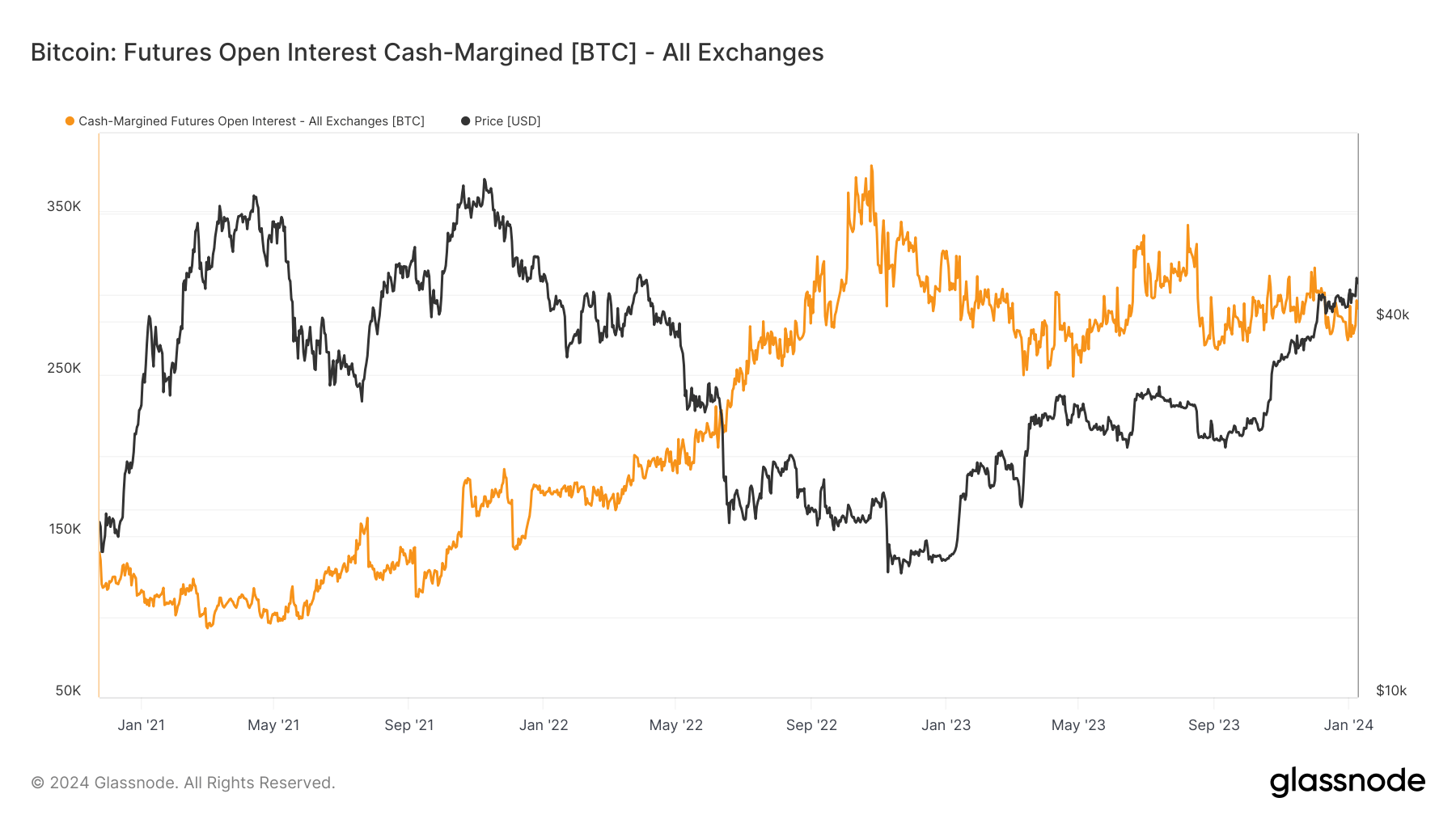

Bitcoin futures margined in BTC hit historic lows as cash options prevail

Quick Take

A noteworthy shift is visible in the landscape of Bitcoin futures contracts, as evidenced by the current state of open interest margined in native Bitcoin (BTC). There has been a significant fall in BTC-margined futures contracts, down from a peak of 240,000 BTC during the 2021 bull market to an all-time low of 82,000 BTC. Multiple exchanges mirror this trend. Binance currently holds 21,500 BTC, nearing a new low.

Similarly, Bitmex and Bybit are at all-time lows with holdings of 6,000 and 14,500 BTC, respectively. Deribit, while not at its lowest, has seen a significant reduction from its December high of 34,000 BTC, now sitting at 22,000 BTC. OKX’s holding has stagnated at 15,000 BTC since April 2023, while Kraken and Huobi hold a few thousand BTC each.

The Bitcoin futures market sees fewer contracts margined in native coins; roughly 22% of all futures contracts use crypto-margin. Meanwhile, cash-margin remains steady at around 300,000 Bitcoin. Bitcoin’s shift from volatile futures to more stable cash margins could signal reduced market volatility.

The post Bitcoin futures margined in BTC hit historic lows as cash options prevail appeared first on CryptoSlate.

On-chain data shows the Bitcoin miners have participated in a 3,000 BTC selloff recently, something that may explain the asset’s latest pullback.

Bitcoin Miner Reserve Has Taken A Plunge Recently

As pointed out by analyst Ali in a new post on X, the BTC miners have participated in some selling recently. The indicator of interest here is the “miner reserve,” which keeps track of the total amount of Bitcoin sitting in the wallets of all miners.

When the value of this metric goes up, it means that the miners are receiving a net number of coins in their addresses right now. Such a trend suggests that these chain validators are choosing to accumulate the asset currently, which can naturally have bullish effects on the price.

On the other hand, a decline implies that this cohort is transferring coins out of their wallets at the moment. Generally, the miners make such outflows when they are looking to sell their BTC, so this kind of trend can have bearish implications for the cryptocurrency.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past month:

The value of the metric seems to have sharply dropped in recent days | Source: @ali_charts on X

As displayed in the above graph, the Bitcoin miner reserve has registered a sharp drop during the past couple of days. During this withdrawal spree, these chain validators transferred out more than 3,000 BTC from their wallets, worth around $128 million at the current exchange rate.

Bitcoin had recovered to the $43,800 level earlier after news had come out about Microstrategy completing another substantial purchase. As the miners made these outflows, though, the cryptocurrency witnessed a drawdown towards the $42,000 mark.

Given the timing, it would appear possible that the miners had made these transfers to cash in on the recovery and this extra selling pressure may have contributed to the decline that the asset ended up seeing.

Miners are a group that has to pay constant operating costs in the form of electricity bills, so they regularly sell some of the BTC they mine and earn from transaction fees in order to cover these expenses.

More often not, though, the miners only participate in relatively low levels of selling, which is readily absorbed by the market and the cryptocurrency doesn’t feel too much impact

This time around, though, these chain validators have sold a sizeable amount inside a narrow window, which is potentially why Bitcoin has appeared to have been affected.

In some other news, the market intelligence platform IntoTheBlock has revealed the average holding time on the Bitcoin blockchain and how it compares against other networks.

The average holding time across three networks | Source: IntoTheBlock on X

As is visible above, Bitcoin holders carry their coins for 4.3 years on average, which is far greater than what Cardano (ADA) and Avalanche (AVAX) blockchains observe.

While miners don’t tend to HODL because of their running costs, it would appear that the normal investors on the BTC network are more than making up for it by holding for very extended periods.

BTC Price

The market doesn’t seem to be too discouraged after the drop due to the selling pressure from the miners, as Bitcoin is now once again making a recovery push. So far, BTC has climbed back to the $42,900 level.

Looks like BTC has been overall moving sideways recently | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com, IntoTheBlock.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin is currently witnessing a decline in price, with its value dropping below the $42,000 mark. This movement comes on the heels of a significant uptick in the circulating supply of profitable Bitcoin, prompting a wave of profit-taking among investors.

ETC Group’s Head of Research, André Dragosch, highlights this trend, noting an increase in Bitcoin being moved to exchanges for potential sale. Dragosch noted, citing data from Glassnode:

Overall exchange balances for bitcoin have clearly picked up, implying a net inflow of coins to exchanges over the past week. More specifically, around +14k BTC have flown into exchanges on a net basis according to data provided by Glassnode. This will likely exert some downside pressure on prices in the short term.

Bitcoin Short-Term Holders Drive Selling Pressure

According to the ETC Group, the current market scenario presents a landscape where a substantial portion of Bitcoin and Ethereum addresses are profitable. Data from the firm indicates that 88.3% of BTC addresses and 77.6% of ETH addresses are currently profitable, figures hovering near the highest for the year.

This environment of a high percentage of BTC and ETH addresses being in a state of profit has seemingly encouraged a segment of investors, particularly those with a short-term investment perspective, to capitalize on their gains, as indicated by the ETC Group’s analysis.

The ETC group further revealed that these short-term investors, defined as those who have held Bitcoin for less than 155 days, have been transferring their profitable assets to exchanges at a rate not seen since July of this year.

This surge in selling pressure is attributed to a key factor restraining the Bitcoin rally as the market adjusts to the increased availability of the cryptocurrency.

Further illustrating the market’s reaction, the past week marked the first instance of “net outflows” from crypto asset exchange-traded products (ETPs) since early October.

The total amount of these outflows was approximately $18.2 million, with Bitcoin ETPs experiencing the majority of these withdrawals, totaling $13.1 million. In contrast, Ethereum ETPs saw a “net inflow” of $5.8 million, suggesting a diverging investor interest between the two leading crypto.

Market Impact And Trader Liquidations

The recent decline in Bitcoin’s price from its previous high of around $44,000 has impacted investor sentiment and resulted in significant trader liquidations. According to data from Coinglass, over the last 24 hours, there have been 115,873 trader liquidations, culminating in roughly $424.67 million in total liquidations.

Bitcoin has led these liquidations, with $105.51 million in long liquidations and $14.95 million in short liquidations. Ethereum follows closely, accounting for $78.53 million in long and $7.41 million in short liquidations.

It is worth noting that these liquidations and the fluctuating market dynamics underscore the division of trader’s fate in the crypto market. While some investors seize the opportunity to realize profits, others face the challenges of rapid market shifts.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.