Toncoin, a top 20 cryptocurrency project, will be used by Telegram, the messaging platform, as a payment tool for its new advertisement strategy. Pavel Durov, founder and CEO of Telegram, stated that toncoin would facilitate payments for customers of its advertising platform, announcing that it would share 50% of any profit from these ads with […]

Toncoin, a top 20 cryptocurrency project, will be used by Telegram, the messaging platform, as a payment tool for its new advertisement strategy. Pavel Durov, founder and CEO of Telegram, stated that toncoin would facilitate payments for customers of its advertising platform, announcing that it would share 50% of any profit from these ads with […]

Source link

center

Israeli security agencies note that the Tron network has become the preferred platform for crypto transfers by militant groups linked to Palestine, Hamas, etc.

In Israel’s ongoing battle against the financing of Iran-backed militant groups such as Hamas and Hezbollah, a previously less scrutinized crypto network Tron has emerged as a significant player.

Surpassing Bitcoin in terms of transaction speed and cost-effectiveness, the Tron network has become the preferred platform for crypto transfers associated with organizations designated as terror groups by Israel, the United States, and other nations.

Interviews with financial crime experts and blockchain investigations specialists, coupled with an analysis of Israeli security services’ crypto seizures since 2021, highlight a noticeable shift toward targeting Tron wallets. On the other hand, Bitcoin wallet seizures have declined.

Mriganka Pattnaik, CEO of the New York-based blockchain analysis firm Merkle Science, notes that this trend is influenced by Tron’s faster transaction times, lower fees, and overall stability.

Merkle Science reports that it serves as a provider for law enforcement agencies in the United States, Britain, and Singapore. During the period from July 2021 to October 2023, Israel’s National Bureau for Counter-Terror Financing (NBCTF), the entity responsible for asset seizures, identified and froze 143 Tron wallets. These wallets were most likely associated with a “designated terrorist organization” or utilized in connection with a “severe terror crime”, according to the analysis conducted by Reuters.

Tron Wallets Linked to Hamas

The attacks on October 7 by Hamas resulted in the death of approximately 1,200 people in Israel. Subsequently, Israel’s bombardment and ground invasion of Gaza led to the death of around 14,000 people. In response, Israel has intensified its scrutiny of Hamas’ financing.

Hayward Wong, a spokesperson for Tron, a British Virgin Islands-registered entity, emphasized these of all technologies, including Tron, for questionable activities, drawing a parallel with the use of US dollars for money laundering. Wong asserted that Tron does not control the actions of those using its technology. Besides, he also distanced any kind of association with the groups identified by Israel.

Of Israel’s Tron seizures, 87 occurred this year, including 39 wallets linked to Lebanon’s Hezbollah and 26 wallets associated with Palestinian Islamic Jihad. The seizures also encompassed 56 Tron wallets connected to Hamas, with 46 linked to a Gaza-based money exchange company named Dubai Co. For Exchange in March last year.

Following the Hamas assault, Israel made its most significant known seizure of crypto accounts. They froze approximately 600 accounts associated with Dubai Co., without specifying the crypto networks or coins used.

Individuals affected by the seizure, using Tron, denied any ties to Hamas or Islamic Jihad, stating that they engaged in crypto trading for business or personal finances. One individual mentioned the possibility of a one-time money transfer to someone associated with Hamas.

The armed wing of Hamas, which had previously raised crypto funds, announced in April that it would cease Bitcoin fundraising, without mentioning Tron in the statement.

next

Altcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

South Korean crypto trading volumes soar with altcoins taking center stage

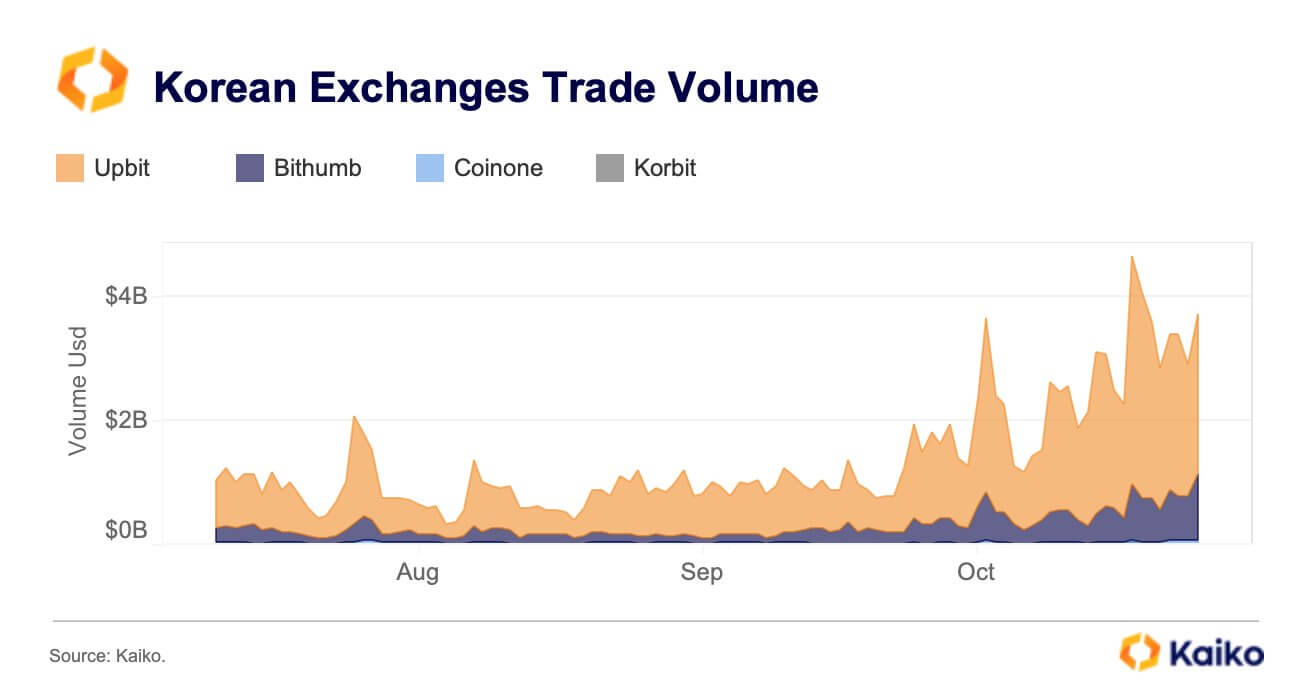

Daily trading volumes on South Korean exchanges have hit their highest point since August last year, with altcoins dominating the transactions, according to data from blockchain analytical firm Kaiko.

Trading activities on major South Korean platforms, including Upbit, Bithumb, Coinone, and Korbit, surged to an average of more than $4 billion towards the end of October and the beginning of November before dropping to more than $3 billion.

Data from CCData, as reported by Bloomberg, also corroborates these upward trading activities on South Korean exchanges. According to the report, crypto trading platforms in the Asian country saw their market shares rise to around 13% from the 5.2% recorded in January.

Around this period, the crypto market saw flagship digital assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) rally to new yearly highs driven by the market optimism surrounding the possible approval of a spot exchange-traded fund (ETF) in the United States.

However, South Korean crypto traders heavily trade altcoins, according to CryptoQuant analysts.

Upbit dominates

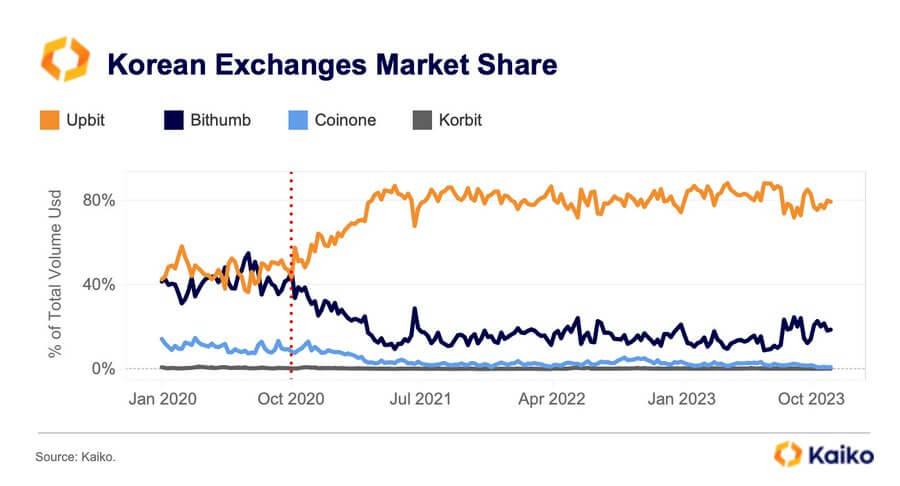

Meanwhile, the Kaiko data restates Upbit’s South Korean crypto market dominance, as the exchange accounts for most trading activities.

Kaiko noted that Upbit’s market dominance had soared to as high as 90% in May last year before slightly declining to around 80% in October 2023. Altcoins account for 88% of all trading activities on Upbit.

On the other hand, its rival, Bithumb, controls around 20% of the market. During the past year, the crypto exchange’s leadership has faced various challenges, with its majority shareholder, Kang Jong-hyun, being arrested for allegedly embezzling roughly $50 million.

This has resulted in its latest efforts to rebuild public trust by planning an Initial Public Offering (IPO) for 2025 and removing transaction fees.

Report Reveals Crypto Whale Center With Majority Of Transactions Crossing $1 Million

A report from blockchain data analytics platform Chainalysis has revealed that the majority of crypto transactions in the United Arab Emirates (UAE) from July 2022 to June 2023 have been whale transactions, crossing over $1 million each.

Majority Of UAE Crypto Transactions Exceeds $1 million

The report from Chainalysis reveals that institutional investments accounted for the majority of cryptocurrency transactions in the UAE with over 67% from July 2022 to June 2023.

The Institutional investments in the country range from $1 million, followed by professional investments ranging from $10,000 to $1 million, and retail investments which accounted for just 4.63% of cryptocurrency transactions in the country up to $10,000.

Kim Grauer, the Director of Research at Chainalysis shed more light on this significant trend noting that the report marks a significant interest among organizations and high-net-worth individuals in the UAE to add cryptocurrency to their investment portfolios.

“The fact that by far the larger portion of crypto investments in the UAE is for institutional and professional-sized transactions, indicates an eagerness from organizations and high-net-worth individuals to add cryptocurrency to their investment portfolios. This market confidence is validation of the efforts being made by the country’s leadership to offer commendable regulatory clarity, and establish the nation as a global crypto hub,” the director said.

The report shows that UAE was one of the only countries in the MENA (Middle East and North Africa) region to spot a higher share of crypto activity within the decentralized exchanges than centralized exchanges. The country’s decentralized exchanges activity was over 48% with centralized exchanges accounting for 46%.

So far, the country’s crypto market value dropped by 17% over the past year accounting for over $34 billion in crypto market value this year. However, the country still managed to outperform other countries in the MENA region.

The Decentralized Finance (DeFi) sector has also seen tremendous popularity in the country since 2022. This further proves that the country has been successful in passing innovation-friendly regulatory frameworks that allow the development of innovative cryptocurrency platforms in the country, with a direction that keeps consumers safe.

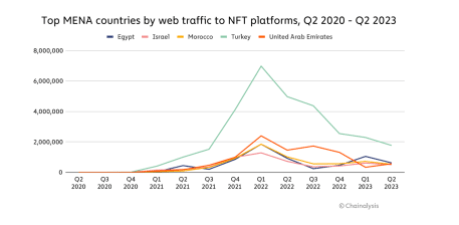

The country also displayed its interest in Non-Fungible Tokens (NFTs) over time. The report revealed that the country had an impressive number of over 4 million web traffic visits across NFT sites from July 2022 to June 2023, despite the fast declination of NFTs since 2022.

Interest in NFT also increased | Source: Chainalysis

Chainalysis Cryptocurrency Adoption Ranking

On September 12, 2023, Chainalysis released an excerpt based on a variety of parameters to determine the grassroots crypto adoption. The excerpt revealed that most of the countries leading the charge are from the Central & Southern Asia and Oceania (CSAO) region.

According to the excerpt, six countries from the CSAO region are among the top 10 leading countries. These include India, Vietnam, the Philippines, Indonesia, Pakistan, and Thailand.

The lower middle-income (LMI) countries were identified to be leading the way in grassroots crypto adoption around the world since last year.

The excerpt was released following the data analysis of 154 countries across five sub-indexes around the world. The rankings were then determined by each country’s geometric mean in all five areas, crypto purchasing power, and population strength.

Total market cap sitting at $1.037 trillion | Source: Crypto Total Market Cap on Tradingview.com

Featured image from Coincu News, chart from Tradingview.com

After failing to reach a contract resolution with the studio association, more than 11,000 film and television writers remain on strike. Of the many topics under consideration in this year’s Writers Guild of America contract discussions, one nascent technology has fueled dissent among the negotiators: artificial intelligence.

“I hope I’m wrong, but I do think that the use of AI is going to take over the entertainment industry,” said Justine Bateman, a member of the writers, directors and actors guilds. “And I think it’s going to be really bad.”

The implementation of generative AI could mean sweeping changes for the entertainment industry. Advocates for AI technology see it as a tool that will uplift content creators and break down the barriers to entry.

“It’s going to be very soon until we can literally just type in a prompt and see something as a consumer,” said AI filmmaker Caleb Ward. “And you don’t have to have any sort of skills as a visual effects artist or as someone in the entertainment industry.”

Since the last writers’ strike in 2007, widespread consumer adoption of video streaming has exemplified how novel technologies can upheave the entertainment industry. Now, however, the leaders in the streaming space are dealing with the ballooning costs of high-output, high-quality content.

“Today, the only one we know of that is cashflow positive is Netflix,” said Dan Rayburn, a streaming media analyst. “Every other company out there is losing money—Disney, Warner Bros. Discovery, losing billions and billions and billions of dollars a year.”

As streaming companies scramble to save their bottom lines, content is being removed from platforms, cutting off creators from being compensated.

“Every time a content deal is done with a streaming platform or distribution, it has a direct impact on those who created the content — distributors, producers, writers, actors — because they’re getting royalties based on that,” said Rayburn.

As the entertainment industry faces another disruptive technology in the form of AI, the Writers Guild of America is demanding that regulatory standards around the technology ensure fair labor conditions and compensation for Hollywood professionals.

Watch the video above for more on how AI is fueling the WGA’s fight for a fair contract.