The smart contract platform, Monad Labs is in talks to raise over $200 million via a funding round that is likely to be led by venture capital firm Paradigm. A successful funding round will see Monad Labs’ valuation rocket to $3 billion. Monad Labs Building Platform to Challenge Ethereum Monad Labs, a smart contract platform, […]

The smart contract platform, Monad Labs is in talks to raise over $200 million via a funding round that is likely to be led by venture capital firm Paradigm. A successful funding round will see Monad Labs’ valuation rocket to $3 billion. Monad Labs Building Platform to Challenge Ethereum Monad Labs, a smart contract platform, […]

Source link

Challenger

Challenger exchanges look to compete with Binance as OKX, Bitget claim market share

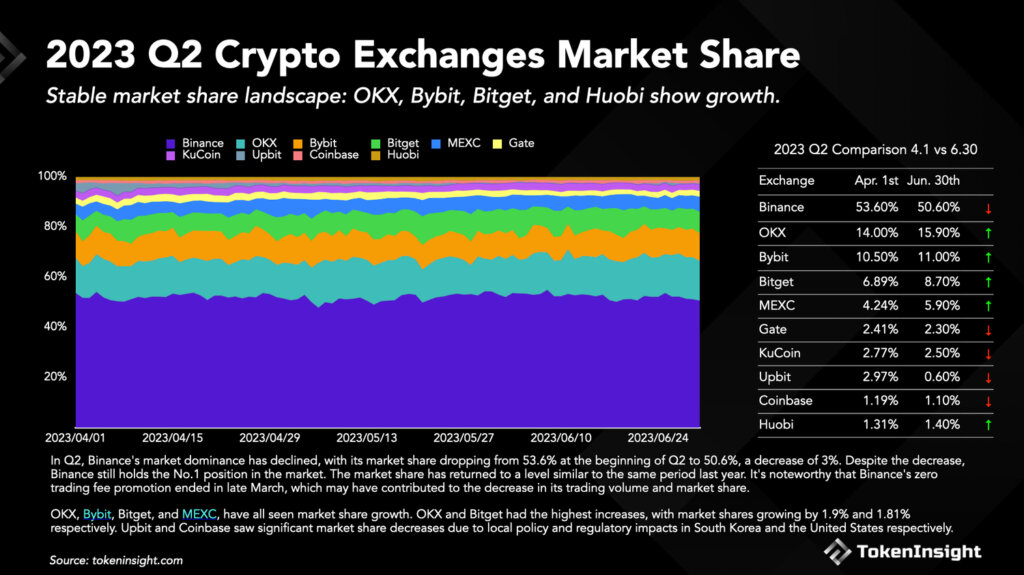

As reserves continue to decline across all major centralized exchanges (CEXs), Binance, the top exchange by trading volume, is beginning to lose market share to other competitors.

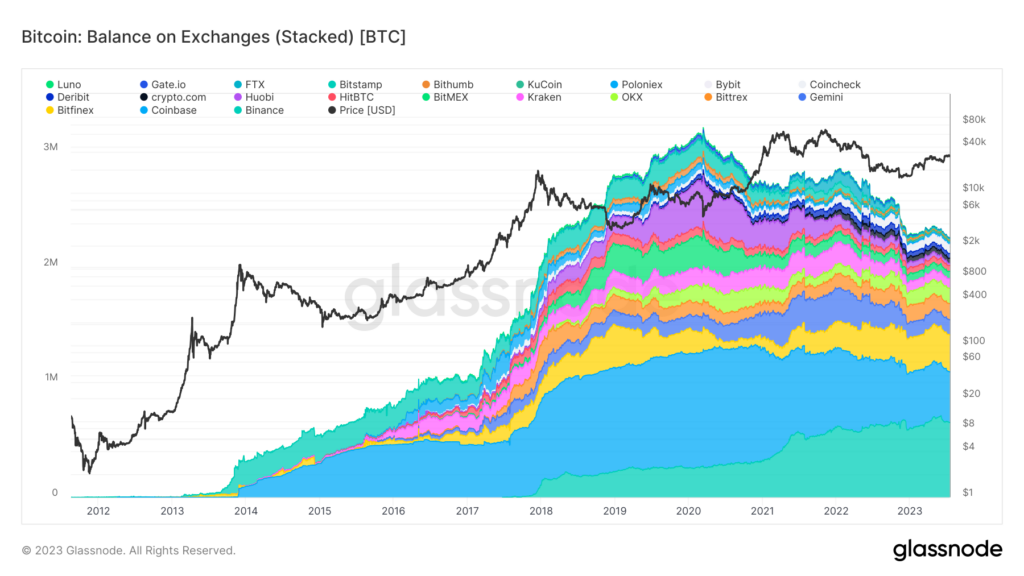

Data provided by Glassnode shows the peak for CEX Bitcoin reserves was hit in 2020, reaching 3 million BTC. Since then, levels have fallen to just over 2 million BTC.

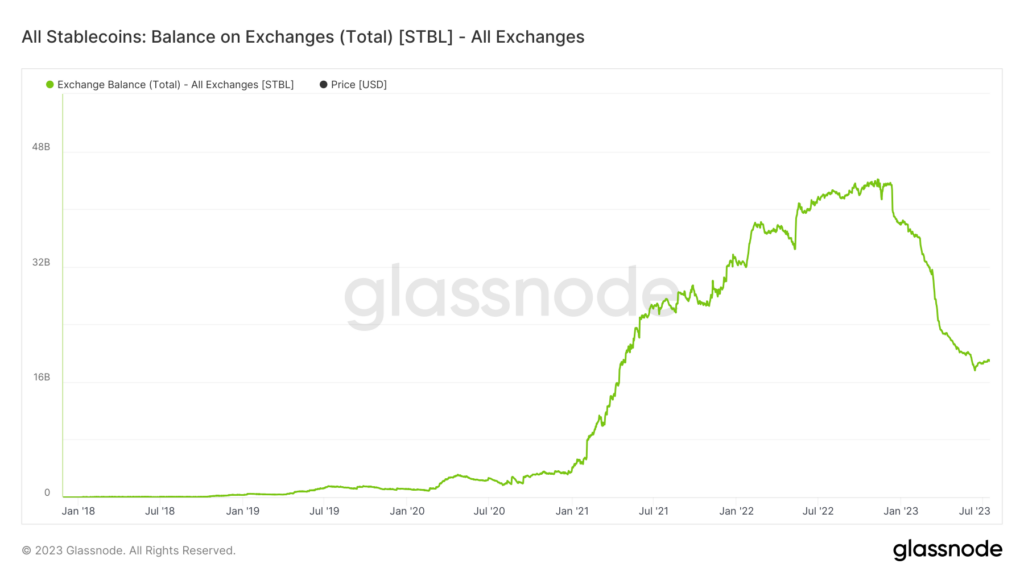

A similar trend can be seen for other digital assets, such as stablecoins which peaked later, toward the end of 2022. Stablecoin balances on exchanges have begun a small revival since June 2023 but are still only at levels last seen in 2021.

Challenger exchanges gain market share.

Within the evolving landscape, Bitget, a crypto derivatives exchange, has emerged as a notable contender, cementing its position as a top four CEX by market share. According to Bitget’s Q2 2023 Transparency Report, seen by CryptoSlate, the exchange saw significant growth in market share and a dramatic surge in the volume of its native token, BGB.

Adding to Bitget’s positive trajectory, the platform’s native token, BGB, surged by 80% in trading volume, making it the best-performing CEX token in 2023.

Bitget achieved a trading volume of over $60 billion for spot trading and $606 billion for futures trading, outperforming most centralized exchanges, as reported by the TokenInsight Crypto Exchange Report Q2 2023.

Bitget’s market share rose to 8.7% from 6.89%, while Binance’s market share by quarterly accumulated trading volume fell 3% to 50.6% from 53.6%.

However, OKX led challenger exchanges over the period with market share growth of 1.9% to reach 15.9%, narrowing the gap to Binance. Following updates to regulations in Hong Kong, OKX onboarded over 10,000 new customers in its first month of trading in the region.

These changes come amidst a challenging period for the crypto industry, with Bitcoin prices fluctuating and legal issues plaguing major players like Binance and Coinbase.

Changes to the CEX landscape.

As per data from Glassnode, the aftermath of the FTX collapse led to a significant divergence between Bitcoin deposits and withdrawals, indicating a decreased trust in crypto exchanges. Additionally, a review of exchanges holding fewer than 20,000 Bitcoin shows a general downward trend in Bitcoin storage, with Huobi seeing a dramatic decline.

Despite this trend, Binance remains dominant, holding over 652,000 Bitcoin- over 3.2% of the total Bitcoin supply. However, Binance CEO Changpeng Zhao (CZ) anticipates that decentralized finance (DeFi) will outgrow centralized finance (CeFi) in the next six years,

“More people will use DeFi products and interact directly with blockchains. This also offers financial access to people where TradFi (or banks) have no penetration. It is my strong belief that DeFi will become bigger than CeFi in the next 6 years or so.”

Supporting CZ’s thesis, the platform has recently faced heightened regulatory scrutiny, leading to investigations and exits from specific markets. While CZ is optimistic about the future of Binance, the potential of DeFi, mixed with regulatory uncertainty, and the rise of challenger exchanges, poses an interesting challenge for the pillar of the crypto world that is Binance.

Nike Is Falling, but This EV Challenger Is Giving Tesla a Run for Its Money

Wall Street appeared ready to end the first half of 2023 on a high note. Stock indexes climbed just after the opening bell Friday morning, as the Nasdaq led the way with a move higher of more than 1%. Some investors have been surprised at the extent of the rebound from 2022’s bear market, particularly as many of the macroeconomic and geopolitical concerns that prevailed last year remain firmly in place.

Indeed, some of the same concerns remain problematic for particular companies. Shares of Nike (NKE -2.65%) fell early Friday after the athletic footwear and apparel giant reported its latest quarterly results. However, in the electric car realm, XPeng (XPEV 13.44%) climbed sharply as it responded to Tesla by making a key strategic move. Read on to learn more about both of these stocks, and find out what the future might hold for them.

Nike slows down

Shares of Nike were down about 2% early Friday. Fiscal fourth-quarter results for the period ended May 31 showed continuing signs of sluggishness in the consumer sector, which could bode poorly for retailers more broadly.

Nike’s numbers showed many of the challenges it keeps facing. Revenue was up 5% year over year to $12.8 billion, as the company saw its sales growth take a hit of 3 percentage points due to adverse currency moves. Nike got a good result from its direct-to-consumer segment, where sales jumped 15% on a 24% rise in revenue from company-owned retail store locations. However, gross margin fell due to higher input and shipping costs, as well as greater use of markdowns. As a result, net income dropped 28%, and earnings came in at $0.66 per share.

CEO John Donahoe maintained an upbeat attitude, pointing to Nike’s efforts to invest in innovation and building out its digital capabilities. Nike also indicated that it believes that the coming 2024 fiscal year should continue to build momentum toward sustainable and profitable sales growth.

Yet investors weren’t satisfied with calls for fiscal first-quarter sales results to be flat to up low single-digit percentages compared to the year-earlier period. Moreover, if other areas of the economy start to perk up, it’ll be hard for Nike’s stock to keep pace with the rest of the market if it can’t follow suit with bottom-line gains.

XPeng heads into the passing lane

Elsewhere, shares of XPeng climbed 8% on Friday morning. The Chinese manufacturer of electric vehicles (EVs) made a competitive play that it hopes will undercut Tesla in a key part of China’s EV market.

XPeng launched its G6 Ultra Smart Coupe SUV in China on Thursday. The vehicle features XPeng’s latest technological platform, along with other new features designed to improve the customer experience for EV drivers and passengers.

However, the big news from the release was that XPeng chose to price the G6 starting below $29,000. That’s roughly 20% below the price of the Tesla Model Y, which is arguably the most closely aligned Tesla vehicle to the XPeng G6. Between low prices and a significant tax break for electric vehicle purchases, analysts believe that XPeng could see a substantial rise in unit EV sales resulting from the launch.

With Tesla delivery figures due out in the next few days, it’ll be interesting to see how the two companies end up comparing. China’s EV market is more than large enough to offer both automakers chances at success.

Dan Caplinger has positions in Nike. The Motley Fool has positions in and recommends Nike and Tesla. The Motley Fool recommends the following options: long January 2025 $47.50 calls on Nike. The Motley Fool has a disclosure policy.