In a detailed letter to Judge Lewis Kaplan, the legal representatives for Sam Bankman-Fried, the embattled founder of cryptocurrency exchange FTX, have vehemently argued against the government’s recommendation for a 50-year prison sentence, labeling it as a “medieval view of punishment.” Legal Team Contests Proposed 50-Year Sentence for Sam Bankman-Fried as Unjust and Excessive In […]

In a detailed letter to Judge Lewis Kaplan, the legal representatives for Sam Bankman-Fried, the embattled founder of cryptocurrency exchange FTX, have vehemently argued against the government’s recommendation for a 50-year prison sentence, labeling it as a “medieval view of punishment.” Legal Team Contests Proposed 50-Year Sentence for Sam Bankman-Fried as Unjust and Excessive In […]

Source link

challenges

Texas Blockchain Council challenges controversial Bitcoin mining energy survey

In the recent SlateCast episode, Texas Blockchain Council Chairman President Lee Bratcher discussed the controversial emergency survey recently issued by the Energy Information Administration (EIA) regarding Bitcoin mining energy usage. As Bratcher explained:

“[The EIA] created this farce of an emergency and rushed it through without the notice and comment period.”

He elaborated that the survey asked for proprietary information and failed to follow proper procedures, leading to a lawsuit from the Texas Blockchain Council.

Political Pressure Behind the Scenes

According to Bratcher, it was evident that Senator Elizabeth Warren heavily influenced the EIA’s decision to issue this Bitcoin mining survey. Warren had explicitly asked the Secretary of Energy to survey Bitcoin energy use and clarified that she expected data to be collected before the next briefing.

With this context, Bratcher believes the EIA faced undue and inappropriate political pressure that led it to skirt proper procedures and fairness, ultimately necessitating the lawsuit from the Texas Blockchain Council.

Though Warren may have had reasonable intentions around understanding Bitcoin’s climate impact, Bratcher argues her demands failed to acknowledge benefits and placed disproportionate scrutiny on Bitcoin miners.

Future Renewable Energy Usage

Bratcher does not believe Bitcoin mining will ever rely completely 100% on renewables but expects a future mix incorporating stranded or wasted gases. He points to projects already redirecting natural gas that would otherwise be flared into generators that power Bitcoin mining. This reuse provides environmental benefits compared to releasing unused gas.

Though likely not enough to fully power Bitcoin mining, these stranded energy sources, paired with growth in solar, wind, and other renewables, can significantly reduce the carbon footprint of mining while still leveraging fossil fuels when available.

Bratcher paints an optimistic view that with the right policies, much of Bitcoin’s energy could one day come from renewables and waste gas.

Bitcoin Mining in Texas

When asked about the benefits Texas offers Bitcoin mining companies, Bratcher emphasized:

“It’s really around our energy only marketplace…you’re able to create a power trading strategy that’s probably more important than your operating strategy, or at least have equal importance and, and that’s why Texas is the best place in the world to open up a business or mine Bitcoin specifically.”

He did warn new mining companies that “this is an extremely competitive industry, and people get wrecked, especially if you’re trying to jump in without experienced operators.”

Ideal Resolution with the EIA

Now that the EIA has rescinded the original emergency Bitcoin survey, Bratcher hopes they will take the opportunity to craft a fair and thorough data center survey. This would ideally ask standardized questions across industries about energy consumption, allowing equitable comparison and performance benchmarking.

Importantly, Bratcher stresses that the Texas Blockchain Council welcomes sharing energy usage information as long as proprietary or sensitive details are protected. He advocates that miner contributions to grid stability should be accounted for. An improved survey could enable miners to showcase their energy resilience and grid benefits.

Bratcher seeks collaborative transparency, not combative obscurity, to resolve the survey controversy. He added:

“We’re happy to share energy consumption information, and we’re happy to share. It’d be great if they ask a question about our performance on the grid, and we could give them some data about how we’re doing.”

The full SlateCast episode provides an in-depth look at the Bitcoin mining industry in Texas and the policy issues surrounding it. Bratcher makes a strong case for the benefits Bitcoin mining can provide while also acknowledging fair concerns.

With Bitcoin poised to remain a growing industry, debates like these will likely continue around its energy usage and impact on grids. Watch the full podcast below:

NEW PODCAST 🎙️ Texas Blockchain Council challenges controversial #Bitcoin mining energy survey

Featuring @lee_bratcher from @TXblockchain_ with co-hosts @akibablade and @NateWhitehill pic.twitter.com/k6kJqYALLW

— CryptoSlate (@CryptoSlate) February 29, 2024

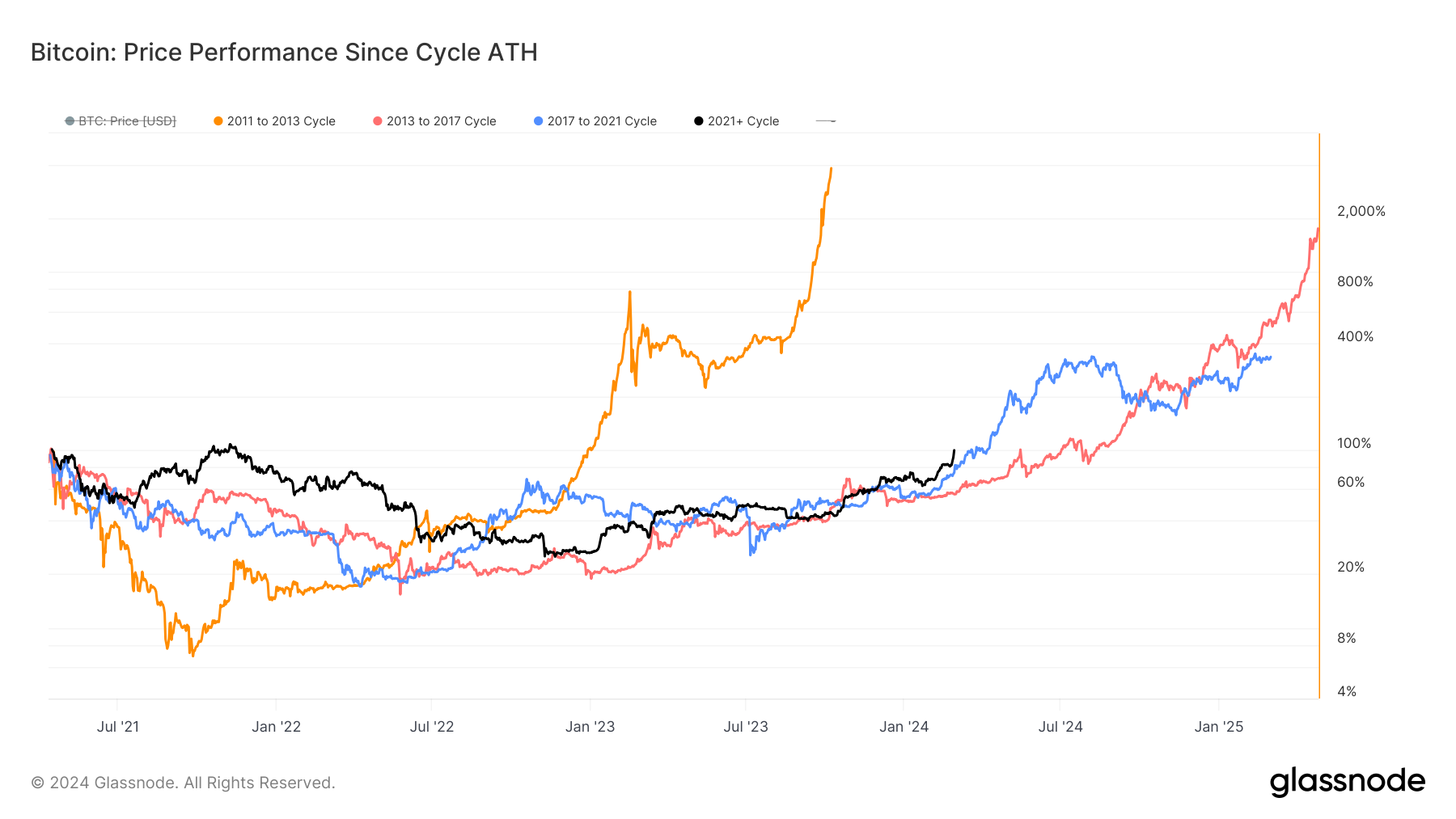

Analysis challenges Bitcoin diminishing returns theory amid recent gains

Quick Take

The diminishing returns theory, suggesting that Bitcoin will yield lesser returns with each cycle, is a subject of intense scrutiny. The examination of this theory from two points of view, the cycle low and the cycle all-time high, provides interesting insights.

In November 2022, Bitcoin’s cycle low occurred during the FTX collapse, dropping to roughly $15,500. Since then, Bitcoin has managed a staggering 287% appreciation, outpacing the returns of the 2015 to 2018 cycle (173%) and the 2018 to 2022 cycle (106%).

Considering the cycle from its all-time high, the bear market began shortly after the peak in April 2021, presenting a similar narrative.

We observe that Bitcoin has already hit its all-time high from April 2021 of roughly $63,000, a significant improvement compared to the previous cycles. At this juncture in the 2013 to 2017 cycle, Bitcoin needed roughly a 35% increase, and during the 2017 to 2021 cycle, a 20% increase was needed.

In conclusion, while this analysis doesn’t necessarily refute the diminishing returns theory, it highlights the strength of the current Bitcoin cycle.

The post Analysis challenges Bitcoin diminishing returns theory amid recent gains appeared first on CryptoSlate.

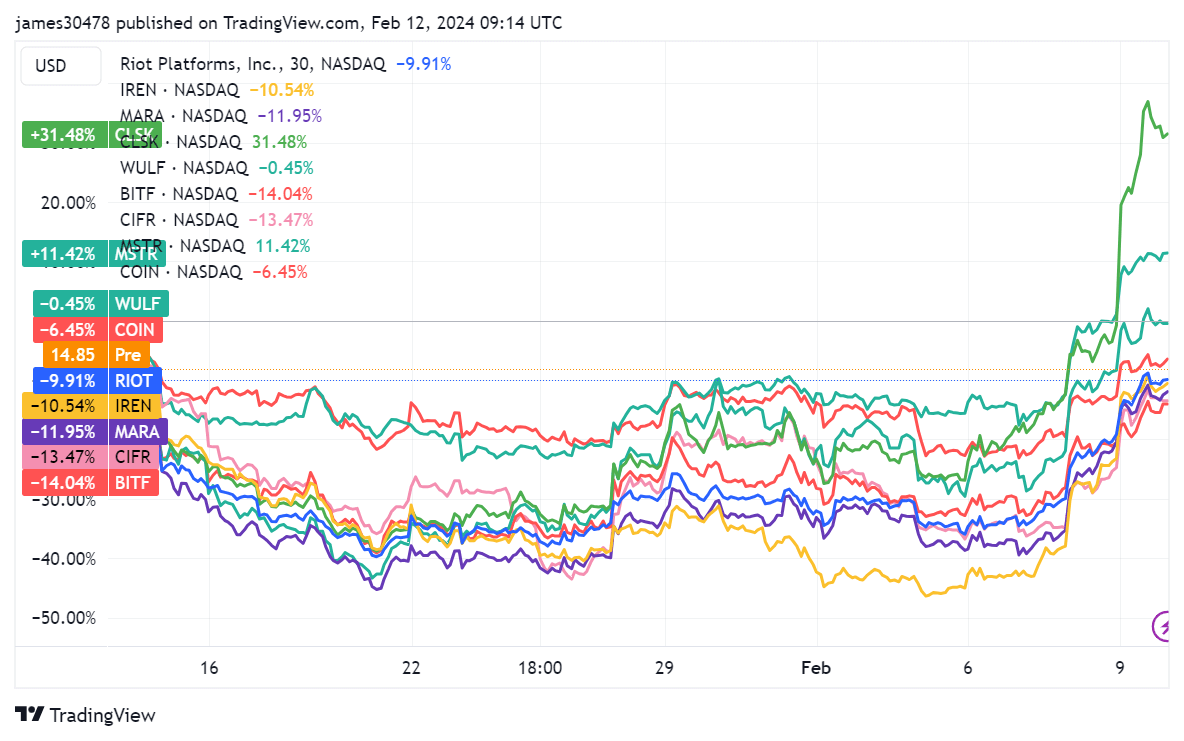

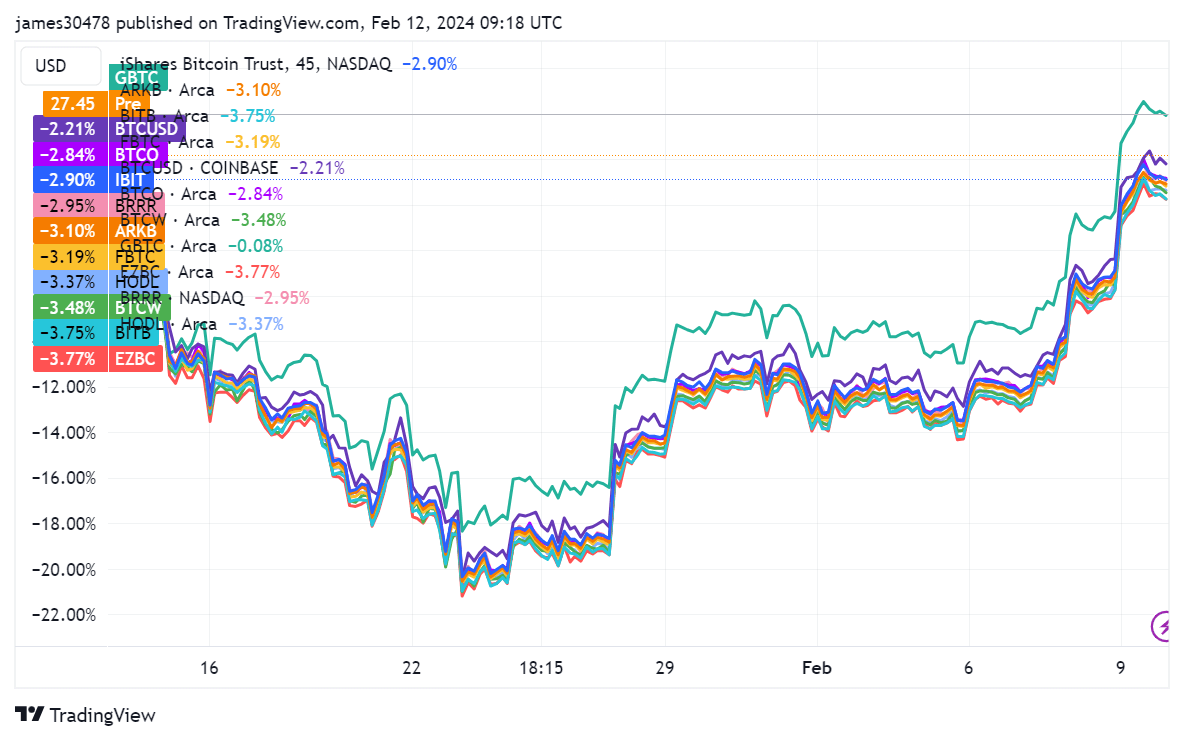

Divergent performances highlight resilience and challenges for Bitcoin ETFs and equities

Quick Take

Since the approval of Bitcoin ETFs on Jan. 11, the price performance of the digital asset has illustrated an unpredictable pattern, peaking around $49,000 before dipping below $40,000. As of now, Bitcoin hovers around $48,000. This volatile behavior extends to crypto equities and Bitcoin ETFs, which have displayed divergent performances.

Bitcoin-related mining stocks such as Iris Energy and Marathon Digital Holdings have notably experienced double-digit declines of 11% and 12%, respectively. However, not all equities mimic this downward trajectory. CleanSpark and MicroStrategy, for instance, have seen their stock prices surge by 31% and 11%, respectively. Meanwhile, Coinbase suffered a 6% decline and is set to release its Q4 2023 earnings report on Feb. 15.

Owing to the slight decline in Bitcoin since the ETF approval, Bitcoin ETFs have recorded roughly a 3% drop, with GBTC remaining relatively flat. GBTC now records a small premium of 0.02% to its net asset value (NAV), according to YCharts. Nevertheless, the recent Bitcoin resurgence of over $48,000 has injected optimism in the pre-market, with many ETFs and crypto equities witnessing a rise.

The post Divergent performances highlight resilience and challenges for Bitcoin ETFs and equities appeared first on CryptoSlate.

The Tesla Cybertruck during a tour of the Elkhorn Battery energy storage system in Moss Landing, California, June 6, 2022.

Nik Coury | Bloomberg | Getty Images

Tesla CEO Elon Musk has been promoting the company’s long-delayed, sci-fi inspired Cybertruck on social media this week. However, the electric vehicle maker still hasn’t issued final pricing and specs for the trapezoidal pickup, which it first unveiled in November 2019, and a company-wide email sent by Elon Musk implies he’s worried about “precision” in manufacturing the truck because its “straight edges” mean variations show up “like a sore thumb.”

In its second-quarter financial filing with the U.S. Securities and Exchange Commission, Tesla said its factory in Austin, Texas, was working on “tooling” for the Cybertruck, and production status was not yet active. The company also said in a shareholder deck that it was “working on equipment installation for Cybertruck production, which remains on track for initial deliveries this year.”

The company has not said when it expects to be able to mass produce the vehicle.

On Wednesday, Musk shared a post on X, formerly Twitter, with an image of the Cybertruck, saying, “Just drove the production candidate Cybertruck at Tesla Giga Texas!” In automotive manufacturing, a “candidate” is an early model of a vehicle that the manufacturer uses to gauge the quality of its production systems and vehicle assembly lines.

A Tesla promoter and fan pressed Musk for more details on the social platform Wednesday, writing in a post, “Enough with the hype, let’s get down to business. Please announce the specs, pricing and new estimated delivery event date.”

The Tesla CEO, who also owns and runs X after a $44 billion buyout last year, replied: “When we are ready to do so, we will. While I think it is our best product ever, it is an extremely difficult product to build. We are in uncharted territory, because it is not like anything else.”

Musk also sent an email to “everybody” at Tesla on Wednesday about the Cybertruck and the challenges of producing the vehicle. Tesla employees shared a copy of the email with CNBC and asked to remain unnamed since they were not authorized to speak with press about internal matters. News of the memo was previously published by Electrek.

What Musk said in the email implies that Tesla is still struggling with Cybertruck quality. Shares of Tesla were dipping slightly early Thursday following Musk’s Cybertruck comments and the email.

Here’s what the email said, as transcribed by CNBC.

From: Elon Musk

To: Everybody

Date: August 23, 2023 [time stamp removed]

Subj. Cybertruck Precision

Due to the nature of Cybertruck, which is made of bright metal with mostly straight edges, any dimensional variation shows up like a sore thumb.

All parts for this vehicle, whether internal or from suppliers, need to be designed and built to sub 10 micron accuracy.

That means all part dimensions need to be to the third decimal place in millimeters and tolerances need be specified in single digit microns.

If LEGO and soda cans, which are very low cost, can do this, so can we.

Precision predicates perfectionism.

Elon

Sequoia Capital scales back crypto fund by $350M amid industry challenges – reports

Sequoia Capital, a renowned venture firm, has significantly scaled back its cryptocurrency fund in response to a considerable shift in the startup ecosystem.

According to individuals familiar with the matter, the fund has been cut from $585 million to a leaner $200 million, as reported by the Wall Street Journal (WSJ.)

This substantial reduction is part of an extensive downsizing strategy that the firm is implementing as it grapples with challenges in the startup industry.

The WSJ noted that Sequoia’s decision to downsize its funds, shared with its investors earlier this year, was driven by a change in market dynamics. The venture firm aims to adapt its approach to better align with the evolving landscape, planning to concentrate more on backing early-stage startups.

According to the Financial Times, Sequoia is retrenching in light of a steep inversion in private markets, and this move is also designed to provide liquidity to its limited partners.

Sequoia’s reduction is not confined to its cryptocurrency fund alone. According to WSJ, the firm also trimmed its ecosystem fund, which invests in other venture funds, from $900 million to $450 million.

The downsizing of its crypto funds comes in the wake of past crypto setbacks. Notably, in Nov. 2022, the firm had to write off its over $200 million investment in FTX, the cryptocurrency exchange, as worthless.

Despite running due diligence when FTX’s revenue was approximately $1 billion, its collapse diminished its value. However, Sequoia highlighted that its exposure to FTX was less than 3% of its Global Growth Fund III, and the loss was mitigated by gains of $7.5 billion from the fund.

According to the WSJ, Sequoia has maintained that it might still invest in crypto via its other funds.

The post Sequoia Capital scales back crypto fund by $350M amid industry challenges – reports appeared first on CryptoSlate.

Just a few years ago, pickleball was barely known to most people. Today, it’s America’s fastest growing sport.

With courts popping up in cities and parks across the country, celebrities and pro athletes buying up pro teams, and more than 36 million people giving it a shot last year, it’s hard to escape the pickleball buzz.

One of the sport’s biggest boosters is Steve Kuhn, a former hedge fund manager who founded Major League Pickleball. He spoke this week at CNBC’s Game Plan conference about the sport’s rapid rise and some of their biggest challenges on the horizon.

“I think there was a time when pickleball was considered a sport that was not really a sport. There was almost like a hushed, embarrassed tone, when talking about it,” said Kuhn, who is known to wear red, white and blue cap saying “Pickleball will save America.”

“But today, when Kevin Durant, Lebron James and Tom Brady say it’s cool, I think that changes everybody’s opinion,” he said.

The billionaire, who lives in Austin, has gotten the pro league off the ground by growing the business with sponsorships, media deals and expansion teams.

Major League Pickleball teams today are going for as much as $10 million. Just a year ago, teams were being scooped up for as little as $100,000. Professional Pickleball can be seen on almost every major television network and many streamers.

With the rapid growth of the sport has come new challenges, such as making the game more accessible, easier to learn, and creating consistent rules and scoring.

Kuhn said he believes rally scoring, which allows players to score regardless of who is serving, would be beneficial to the sport.

“We’re begging the sport to follow our lead on that. We think that would make it easier for more people to learn and have fun, especially kids,” he said.

Not everyone’s a fan of pickleball, though. As the sport has exploded, complaints have grown, too. In towns across America, neighbors are griping about the noise from the ball hitting the paddle. With the growing demand, many towns are converting their tennis courts into pickleball courts, angering the tennis players.

“We need to create dedicated pickleball courts, where we’re not going to bother anybody. It’s our responsibility to do that,” Kuhn said.

Kuhn said he’s also passionate about getting more kids and diverse communities to participate. He will be heading to Washington in the next few months to talk with members in the House, Senate and White House about getting more government funding for the sport, he said.

Kuhn said school gyms can build pickleball courts at an incredibly low cost and it’s a great way to get kids moving again.

While he’s happy with the sport and excited about where it’s going, there is just one thing about pickleball Kuhn isn’t quite sold on: its name, which was came from pickle boat races in Bainbridge Island, Washington.

“I still don’t love the name,” Kuhn said. “But it doesn’t matter anymore.”

Craftsman factory in Texas shows challenges of reshoring manufacturing

The unsuccessful effort to launch a highly-automated factory for Craftsman tools in the U.S. underscores the challenges American businesses face in bringing manufacturing back from overseas.

Craftsman, the world’s largest tool brand, owned by Stanley Black & Decker, initially announced in 2019 that it would build a $90 million facility employing up to 500 workers in Fort Worth, Texas. The effort was viewed as an opportunity to showcase Craftsman products being “Made in the U.S.A.” with cutting-edge manufacturing technologies to make the automated factory competitive with overseas facilities that use more manual processes.

The factory was slated to be in production 18 months after the groundbreaking. However, the pandemic and supply chain challenges threw those plans into disarray, and deficiencies with the technology intended to help automate its manufacturing processes prevented the plant from ever reaching its full potential. In March 2023, Stanley announced that the Craftsman plant in Fort Worth would be shuttered.

CHIPMAKERS PUSH BACK ON US RESTRICTIONS ON SEMICONDUCTOR EXPORTS TO CHINA

A spokesperson for Stanley Black & Decker told FOX Business, “We endeavored to make Craftsman mechanics tools in a new and innovative way. The events of Covid and supply chain challenges, coupled with technology that did not meet our expectations, resulted in the discontinuation of operations.”

Former employees told the Wall Street Journal that the pandemic prevented proper testing of machinery that was integral to the company’s automated vision for the factory. That prompted the company to choose between making adjustments by getting new tooling from overseas in the hopes of fixing it – a process that could take weeks – or running the machine at half capacity, which would have undercut its cost-effectiveness.

TESLA COMPLETES FIRST CYBERTRUCK AFTER YEARS OF DELAYS

As planned, the factory was to produce sockets, ratchets and wrenches. But issues with heat treating the tools, which sometimes came out of the machinery with excess metal that made the tools misshapen, inhibited the factory’s output. Former employees including tooling designer Greg Heltne told the Wall Street Journal that while the factory made thousands of sockets, shortages of ratchets and wrenches had an impact on sales.

“When the customer says, ‘I want everything I ordered’ and we can’t deliver it, there’s not much that can be done,” Heltne told the Journal.

AI HELPING REMOVE CHINESE GOODS MADE WITH UYGHUR FORCED LABOR FROM CORPORATE SUPPLY CHAINS

Craftsman’s corporate parent company, Stanley, was forced to make cutbacks in 2022 as its stock fell in part due to a decline in tool sales from their pandemic highs which caused inventory to pile up. That led to layoffs at the Fort Worth facility, which had about 175 workers – well short of the 500 employees originally envisioned – at the time the shutdown was announced in March.

The Fort Worth factory had been projected to make 60 million tools per year, but after the plant was closed it was unclear whether full sets of Texas-made tools made it to consumers. A Wall Street Journal reporter on Monday bought an 88-piece set at a Lowe’s near Chicago which contained a card reading, “Forged in Texas.” Though the set was purchased for $89.98, the relative scarcity of tool sets made at the plant has turned them into collectors’ items, with some eBay vendors seeking double that amount.

Craftsman was acquired by Stanley from Sears in 2017 for $900 million, which then-CEO James Loree said was a chance to “re-Americanize” the brand. Several other U.S. facilities belonging to Craftsman and rival toolmaking brands continue to produce tools, although they generally involve more manual tasks in the manufacturing processes than what was attempted at the Fort Worth facility and more in line with Craftsman tools made at plants in Asia.

Nick Pinchuk, CEO of premium tool brand Snap-on, told the Wall Street Journal that the company’s U.S. factories had a roughly 100-to-1 ratio of workers to robots in 2010 which has shrunk to 8-to-1 through a process that helped the company better understand which roles are better suited for humans versus machines.

“Sometimes the ease of installing automation is a little bit overestimated,” Pinchuk told the Journal. “Where that comes from is, people don’t really understand how the product is made in the first place.”

UK Law Commission report challenges Craig Wright’s suit against Bitcoin developers

A recent report released by the United Kingdom’s Law Commission could weaken a central argument brought by Craig Wright in his controversial lawsuit against 12 Bitcoin Core developers, argues the Bitcoin Legal Defense Fund (BLDF).

In a 300-page report on digital assets published in late June, the Law Commission — an independent body that reviews and recommends reforms to U.K. and Whales laws — cited a classification of fiduciary duty that bolsters the developers’ defense that they are not directly responsible for 111,000 Bitcoin (BTC) lost to hackers.

Wright, owner of Tulip Trading, claimed in a 2021 lawsuit that developers involved in the open-source development of Bitcoin Core owed him a fiduciary duty in connection with his loss. In order to recover the allegedly stolen funds, Wright is seeking a back door into the Bitcoin blockchain. Wright is also known for claiming he is Bitcoin’s pseudonymous creator Satoshi Nakamoto.

The bitcoin protocol was set in stone to create a system that is stable. Bitcoin is not a Cryptocurrency. By definition, Cryptocurrencies are anonymous and untraceable. Bitcoin is pseudonymous and traceable, it is digital cash.

Don’t believe everything you see at first sight. pic.twitter.com/vPt4a0fEEx

— Dr Craig S Wright (@Dr_CSWright) May 30, 2023

The U.K. report sheds light on the definition of fiduciary duty, claiming that categories of fiduciary recognized by the law include “agents, trustees, partners, company directors, and solicitors.” The report said fiduciary duty rarely exists outside these categories. According to the BLDF, the developers’ legal representative, the defendants do not fit any criteria mentioned by the Commission.

“They are not agents, trustees, partners, company directors, or solicitors, and they never ‘undertook or were entrusted with authority to manage the property or make discretionary decisions on behalf of another person,’” BLDF stated in a recent blog post, adding that “Bitcoin was created to facilitate transactions between individuals without the need to entrust any authority to a third party.”

According to a definition by the University of Texas, fiduciary duty is the “legal responsibility to act solely in the best interest of another party.” Common examples of fiduciary duties include undivided loyalty, due diligence, full disclosure of conflicts of interest and confidentiality.

The Tulip Trading suit could set case law for open-source developers’ liability for assets, with a trial in the case expected to occur in 2024. During the Bitcoin 2023 conference in May, Jessica Jonas, BLDF’s chief legal officer, noted that potential legal ramifications of the lawsuit could deeply affect the community of open-source developers, as 97% of the world’s software programs are open-sourced.

The U.K. Law Commission report also pushed for the creation of a new and distinct category of personal property to accommodate the unique features of digital assets.

Magazine: $3.4B of Bitcoin in a popcorn tin — The Silk Road hacker’s story