“We were told that the attorney had attempted to call Mary’s family but that none of the numbers worked.”

Source link

Changing

BlackRock to cut 3% of its staff amid a ‘rapidly changing’ market environment

Investment-management giant BlackRock Inc. plans to lay off around 3% of its staff, or around 600 employees, the company said on Tuesday, amid what executives described as a “rapidly changing” economic backdrop and shifts in client demands.

In a memo to employees, Chief Executive Larry Fink and President Rob Capito said they still expected the company’s workforce to be bigger by the end of the year “as we continue adding people and building capabilities to support key areas of growth.”

They also said more clients were turning to BlackRock

BLK,

to consolidate their portfolios, adding that clients were “re-risking” as interest rates level off.

“At the same time, we see our industry changing faster than at any time since the founding of BlackRock,” the executives said. “Thanks in large part to the outstanding work of our iShares team — ETFs are becoming ubiquitous as the preferred vehicle for delivering both index and active investment strategies.”

“Growth is coming from a wider range of markets around the world than ever before — across Europe, the Middle East, India, and other markets in Asia,” they continued. “And, perhaps most profound, new technologies are poised to transform our industry — and every other industry.”

No single team at BlackRock was focused on for this round of layoffs, according to a person familiar with the matter. The cuts follow a previous round of layoffs roughly a year ago, when Blackrock said it would dismiss less than 3% of staff. The company has around 20,000 employees.

News of the new round of layoffs was reported earlier Tuesday by Bloomberg. Shares of BlackRock were down 0.6% on the day.

Costco Posts Strong Q4 2023 Earnings despite Changing Shopping Patterns

Over the past three years, Costco has gained momentum, benefiting from trends such as increased home cooking, millennials moving into larger suburban homes, and inflation driving shoppers to seek value through memberships at warehouse clubs.

Membership-based retail giant Costco Wholesale Corp (NASDAQ: COST) recently announced its quarterly earnings and the results were nothing short of impressive.

Costco Earnings Surpasses Expectations

Costco’s fiscal fourth-quarter earnings have surprised analysts and investors alike. The company reported earnings per share of $4.86, surpassing the expected $4.79 per share. Additionally, Costco’s revenue for the quarter reached $78.9 billion, outperforming the expected $77.9 billion.

Costco’s net income for the fiscal fourth quarter also demonstrated remarkable growth. It reached $2.2 billion, or $4.86 per share, compared to $1.87 billion, or $4.20 per share, in the same period the previous year.

One of the key takeaways from Costco’s earnings report is the shift in shopping patterns among consumers. Chief Financial Officer Richard Galanti noted that while shoppers visited Costco stores more frequently, they spent less on high-priced items.

Costco’s success can be attributed to its ability to attract more shoppers to its stores. Worldwide, traffic increased by 5.2% year over year, with a 5% increase specifically in the United States. However, the average transaction amount dropped nearly 4% globally and 4.5% in the United States, indicating that customers were making more frequent but smaller purchases.

Costco’s comparable sales, which measure the performance of stores open for at least a year, rose by 1.1% year over year. However, the growth was more modest in the United States, with a 0.2% increase.

Excluding changes in gas prices, the metric saw more substantial growth, rising 3.8% overall and 3.1% in the United States. This suggests that the company’s core business remains strong and is less affected by external factors.

Costco’s Membership Growth and Value

Another standout feature of Costco’s recent success is the steady growth in its membership base. Over the past three years, Costco has gained momentum, benefiting from trends such as increased home cooking, millennials moving into larger suburban homes, and inflation driving shoppers to seek value through memberships at warehouse clubs.

During the reported quarter, Costco added nearly 8% more paid household members, bringing its total to a staggering 71 million. This growth outpaced the rate of new store openings, showcasing the ongoing appeal of Costco’s membership model.

Moreover, Costco has succeeded in encouraging more members to opt for its higher-tier Executive Membership, which costs $120 annually compared to the standard $60 membership. These executive members receive additional perks and benefits. As of the end of the quarter, Costco boasted 32.3 million paid executive memberships, making up over 45% of all paid memberships and accounting for approximately 73% of the company’s global sales.

However, in the US, Costco’s largest market, sales trends have somewhat slowed compared to the surge seen during the early days of the pandemic. Comparable sales in the past two quarters have been roughly flat compared to the prior year.

Despite these challenges, Costco remains proactive in its expansion plans. The company intends to open ten new stores in the next three months, including nine in the US and one in Canada. This follows the successful addition of 23 net new locations in the fiscal year, including stores in China, Japan, and Australia.

next

Business News, Market News, News, Stocks, Wall Street

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

Bybit’s approach is grounded in cooperation and compliance, seeking to create a harmonious relationship with UK regulators and authorities.

Bybit, a prominent crypto exchange remains steadfast in its commitment to stay in the United Kingdom with CEO Ben Zhou reiterating that “leaving the UK is not part of our current strategy”.

The New Regulatory Landscape in the UK

Crypto has been the subject of intense scrutiny by regulatory authorities around the world. The UK is no exception, and its Financial Conduct Authority (FCA) has been actively working to establish a regulatory framework for the crypto industry. One notable change on the horizon is the overhaul of rules governing financial promotions, which will take effect from October 8.

The FCA’s financial promotions rules will encompass crypto companies, potentially impacting their ability to reach local customers. To promote transparency and protect consumers, these rules necessitate that any company engaging with UK clients must be registered or authorized by the FCA.

The FCA’s new rules include a ban on crypto derivatives and Exchange-Traded Notes (ETNs) for retail consumers. These derivatives and ETNs are known for their high volatility and risk, and the FCA believes that banning them will protect retail investors from potentially catastrophic losses.

The enforcement of these rules has already influenced some companies, including Luno and American payments giant PayPal Holdings Inc (NASDAQ: PYPL) which extended its crypto trading services to the country a few years back to suspend specific crypto operations in the UK. The challenge lies in aligning their operations with the new regulations without compromising their service quality or withdrawing from the market altogether.

While this move is seen as a positive step towards reducing the risk of consumer harm, it has also raised concerns within the industry about the potential impact on crypto businesses.

Bybit Exchange’s Ongoing Commitment to Stay in the UK

Bybit’s initial comment about potentially withdrawing from the UK stirred discussions, but CEO Ben Zhou has since clarified the exchange’s stance. The exchange is determined to navigate these regulatory changes while staying operational in the country.

Zhou emphasized the exchange’s proactive engagement with regulators, underlining its efforts to identify the best path forward within the regulatory framework. Zhou stated, “There are still several avenues available for crypto exchanges to achieve compliance with UK regulators in the future, and we are actively exploring all options for this market.”

Bybit’s approach is grounded in cooperation and compliance, seeking to create a harmonious relationship with UK regulators and authorities. Such collaborations can help ensure the exchange’s full compliance with the evolving regulatory landscape.

These partnerships and consultations are strategic moves designed to align Bybit’s operations with local expectations and regulatory requirements.

By actively engaging with local businesses and assessing potential collaborations, Bybit aims to secure its position in the UK market and provide UK customers with a compliant and trustworthy platform for their cryptocurrency needs.

next

Blockchain News, Cryptocurrency News, News

Benjamin Godfrey is a blockchain enthusiast and journalist who relishes writing about the real life applications of blockchain technology and innovations to drive general acceptance and worldwide integration of the emerging technology. His desire to educate people about cryptocurrencies inspires his contributions to renowned blockchain media and sites.

You have successfully joined our subscriber list.

When it comes to passenger rail in the the U.S., Americans have one option — Amtrak, which is often plagued with high ticket prices and delays. But one Florida-based company is working on changing that. Brightline, which is owned by Fortress Investment Group, thinks that privatized passenger rail in the U.S. could be a better way.

Brightline opened a line from Miami to West Palm Beach in 2018. It was the first privately funded passenger rail built in the U.S. in over 100 years. It will open up an expansion line to Orlando in late August. The total project cost $6 billion, according to Brightline.

“When you look at all the city pairs that exist, the places around the country that would be attractive to you, Miami to Orlando jumps off the top of the page,” said Wes Edens, co-founder and principal of Fortress Investment Group and the mastermind behind Brightline. “It’s kind of a lousy drive between them. It’s this 230 mile trip between the two places with lots and lots of trouble in between.”

The company expects to transport 8 million people per year in Florida once it is fully operational.

“At those levels of ridership, we’re going to be a very profitable organization,” said Mike Reininger, CEO of Brightline.

Brightline is also making strides to create the first dedicated high-speed passenger rail line in the U.S. connecting Los Angeles to Las Vegas. It’s hoping to break ground later this year.

“We are planning to make our project, as I call it, the blueprint for America’s high-speed rail industry. And so what that means is we are building in America, we are utilizing American union labor, and we’ll create about 35,000 construction related jobs and 1,000 permanent jobs that are localized within the region that we’re building in,” said Sarah Watterson, president of Brightline West.

Brightline is aiming to finish the line before the LA 2028 Olympics. The project is expected to cost $12 billion. It’s looking to cover about a third of the cost, $3.75 billion, with a federal grant requested in partnership with the Nevada Department of Transportation.

“It is possible for private companies to deliver high speed rail and also to do it well. It seems less possible on the basis of the evidence we have, which generally show that private companies also are not able to make high-speed rail financially viable. So there needs to be a subsidy somewhere,” said Bent Flyvbjerg, co-author of “How Big Things Get Done.”

Watch the video to learn more.

Quick Take

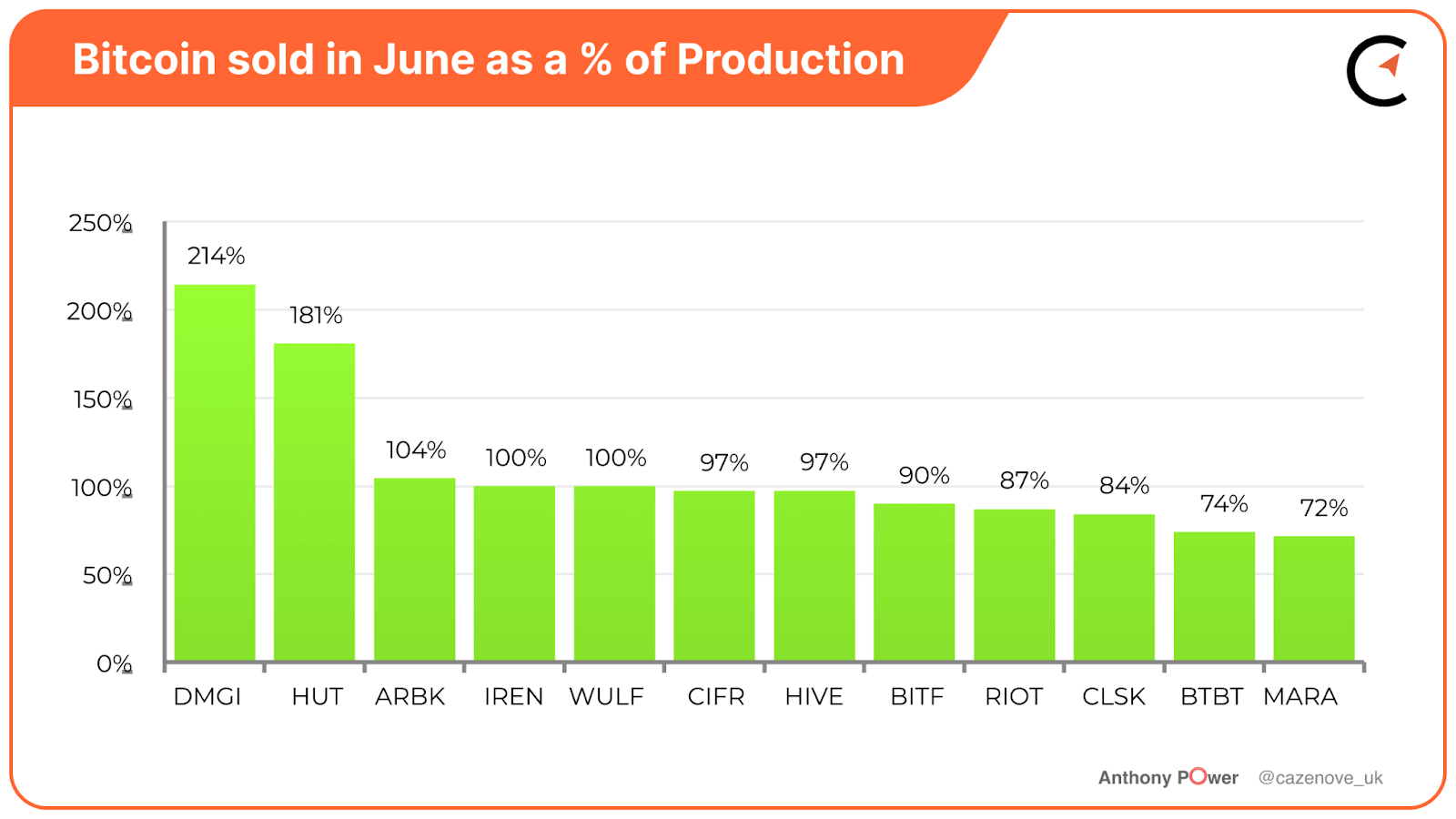

According to Accountant and Bitcoin Mining Analyst at Compass Mining, Anthony Power, throughout 2021, we saw a trend of Bitcoin miners retaining most of their Bitcoin production as the cryptocurrency’s price experienced significant growth.

However, the subsequent decrease in Bitcoin’s price in 2022 forced a number of miners, burdened with substantial debt, to liquidate their holdings. Marathon Digital and Hut 8, in particular, were committed to maintaining their Bitcoin assets for as long as feasible, according to Power.

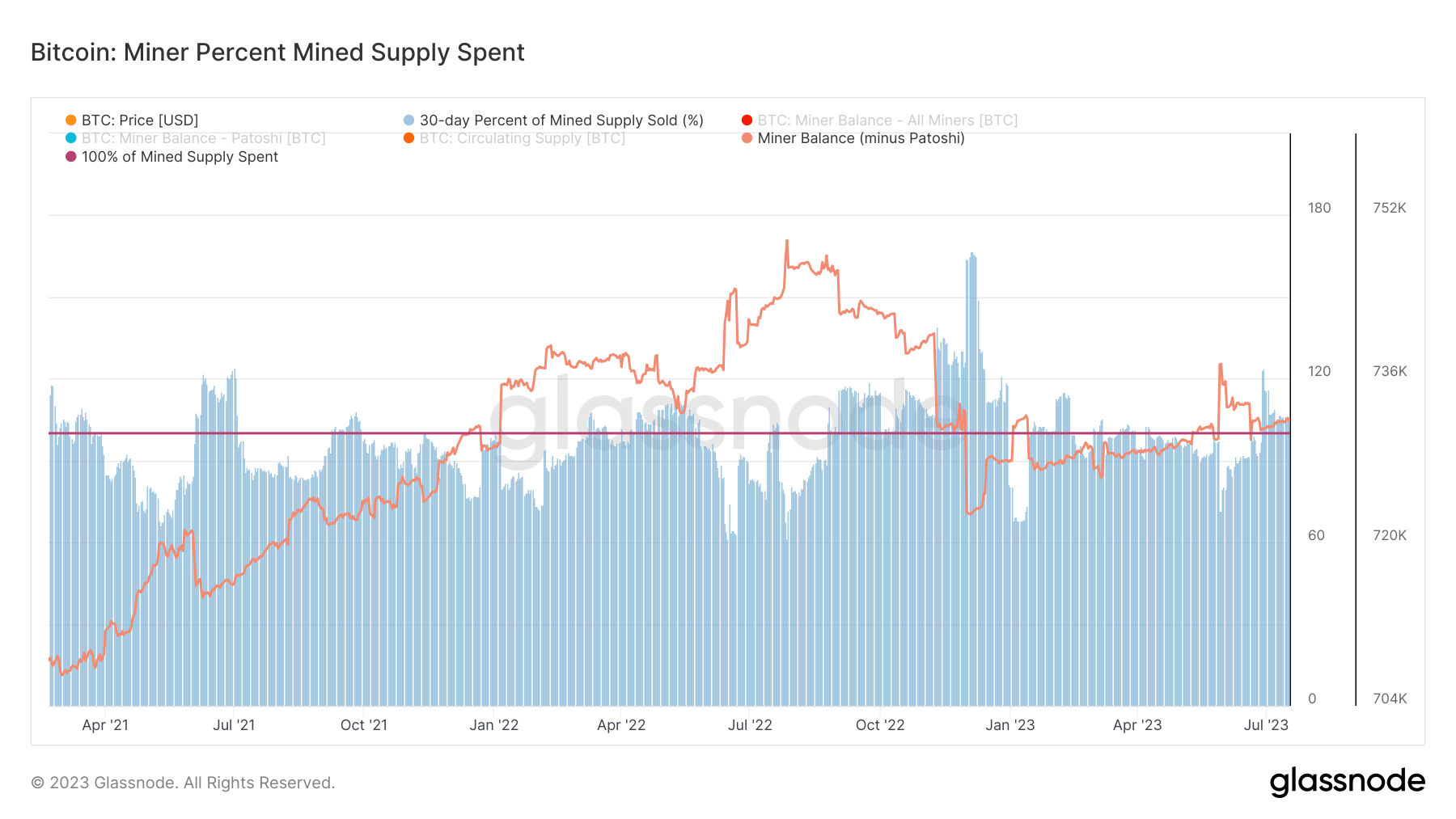

Data from Glassnode support this; as we can see throughout 2021, miner balance on aggregate continued to increase, but as 2022 continued, miners were offloading to cover debts and obligations from a lowering Bitcoin price.

Fast forward to the current year, it’s noticeable that all miners have begun to liquidate some, if not all, of their Bitcoin production in response to the rebound in Bitcoin’s price, according to Anthony Power.

The graph provided below underlines the adopted strategy by 58% of miners. They’re not only liquidating a part of their Bitcoin production but also increasing their cryptocurrency reserves in anticipation of the halving event next year, according to Anthony Power.

The post Bitcoin miners’ changing strategies: from hoarding to selling appeared first on CryptoSlate.

Graphic design has been dominated by Adobe (ADBE 3.41%) for decades, but AI threatened that lead. The company’s most recent AI announcements show it’s here to stay, and that’s what Travis Hoium and Jon Quast discuss in this video.

*Stock prices used were end-of-day prices of May 31, 2023. The video was published on June 6, 2023.

Jon Quast has positions in Adobe and Intuit. Travis Hoium has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adobe and Intuit. The Motley Fool recommends the following options: long January 2024 $420 calls on Adobe and short January 2024 $430 calls on Adobe. The Motley Fool has a disclosure policy.

Travis Hoium is an affiliate of The Motley Fool and may be compensated for promoting its services. If you choose to subscribe through their link they will earn some extra money that supports their channel. Their opinions remain their own and are unaffected by The Motley Fool.