The U.S. dollar has strengthened its grip on the global financial system since Russia invaded Ukraine two years ago, defying expectations of “de-dollarization.”

Source link

Charts

3 Charts That Show How the Crypto Bull Market Is Just Getting Started

Finally, after two long years, things are picking back up in the crypto world. Since the beginning of the year, the total crypto market has grown by 35%, just 20% off from eclipsing its all-time high of $2.8 trillion in late 2021.

With such a significant jump, it’s reasonable to worry that crypto’s momentum may sputter, making an investment today too risky. However, when looking at the data, it appears crypto’s bull market has yet to hit a local peak.

In other words, while some gains may be behind us, there’s still plenty of potential in the crypto market. Let’s look at three charts showing how crypto’s best days remain ahead.

Breaking down Bitcoin

Since it makes up around half of the value in crypto, evaluating Bitcoin‘s (BTC -0.84%) current position can provide context on the market’s overall position. This is a chart of Bitcoin’s Market Value to Realized Value, better known as MVRV. Developed by analysts David Puell and Murad Muhmudov, MVRV divides Bitcoin’s market value by its realized value.

Market value is calculated by multiplying Bitcoin’s circulating supply by its current price. It is the same as the market capitalization. On the other hand, realized value is calculated by determining the price of each Bitcoin the last time it was involved in a transaction. This can provide a more granular insight into market dynamics, as it removes the generalization that every Bitcoin in circulation was purchased at the most recent price.

By dividing the two, we get the MVRV value and a better glimpse into Bitcoin’s current position. In fact, MVRV has historically proven to be a timely indicator of when the crypto market as a whole has topped or bottomed. With its current value at just 2.3, Bitcoin is far from levels of around 3.5 when bull markets tend to start losing steam.

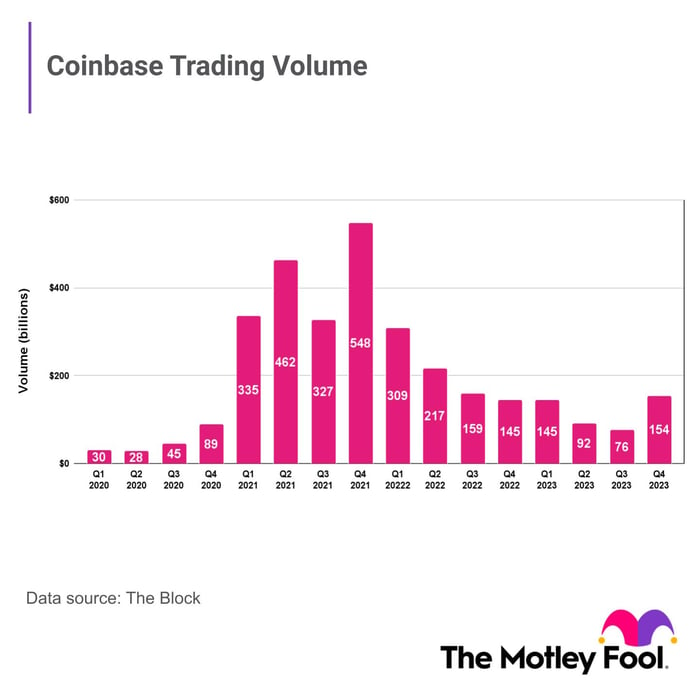

Analyzing Coinbase trading volume

As one of the most popular crypto platforms in the world, we can extrapolate trading data from Coinbase Global (COIN 1.38%) to better understand the state of affairs in crypto. Similar to Bitcoin’s MVRV, trading volume on Coinbase shows there is still room for the crypto market to grow.

Based on the graph, it’s abundantly clear that investors have yet to make their way back to crypto. We can see that during the last bull market of 2021, trading volume on the platform surpassed more than $548 billion in Q4 alone. As of the most recent earnings report, total trading volume sits at just $154 billion, levels last seen when crypto was in the middle of a brutal crypto winter.

Data source: The Motley Fool.

Until these numbers get closer to that of the last bull market, there’s little reason to believe crypto’s recent surge is just scratching the surface. Even then, since crypto has historically notched new all-time highs with each bull-market cycle, don’t be surprised if the total volume in this cycle outdoes previous records.

Checking in on DeFi

Still in its beginning stages, decentralized finance (DeFi) is one of the most prominent use cases of cryptocurrencies and blockchain technology. Composed of non-fungible tokens (NFTs), stablecoins, lending protocols, and much more, the DeFi economy is brimming with innovative applications pushing the boundaries of finance.

There are several blockchains that make up DeFi. As of today, Ethereum (ETH -0.95%) dominates the space, but dozens of others are vying for market share.

With so many blockchains contributing to the DeFi economy, tracking its value can be a meaningful proxy to measure the crypto market’s progress and position. Currently in an uptrend due to the recent resurgence, the collective value of DeFi currencies is around $85 billion today.

Yet, this is still considerably off of its all-time high hit during the last bull run that peaked in November 2021. At the time, DeFi amassed a whopping value of more than $175 billion.

In a similar vein to trading volumes, it is safe to assume that due to DeFi’s burgeoning potential, it should surpass previous records. Should this prove to be the case, then there is plenty of catching up to do before we can even begin to consider crypto’s bull market to have peaked.

RJ Fulton has positions in Bitcoin, Coinbase Global, and Ethereum. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, and Ethereum. The Motley Fool has a disclosure policy.

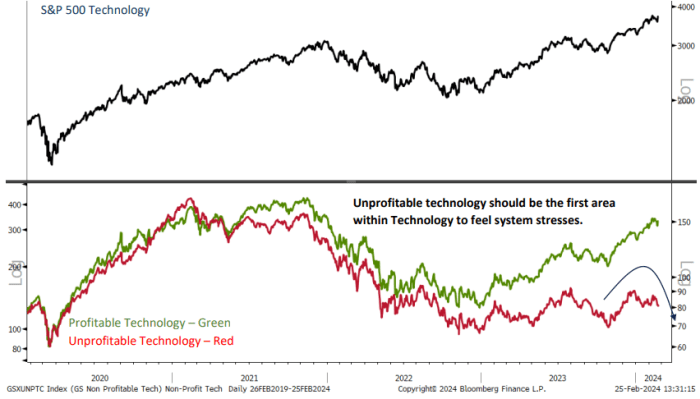

Technology stocks are riding high following Nvidia Corp.’s latest blockbuster earnings report, which helped push the Nasdaq-100 and the S&P 500 technology sector to fresh record highs last week.

But after looking past the index-level performance, there are signs that the momentum that has propelled the sector higher over the past year is starting to fade.

Unprofitable technology companies have started to roll over. Popular momentum gauges show the pace at which the average tech stock has outperformed the average S&P 500 stock has slackened. And the share of tech stocks trading above their medium-term averages has declined from its recent highs, although it remains well above 50%.

Meanwhile, valuations for the average technology stock have returned to their peak from November 2021, according to JC O’Hara, chief market technician at Roth MKM.

See: more stocks are joining the market’s rally — even as Big Tech still gets the most attention

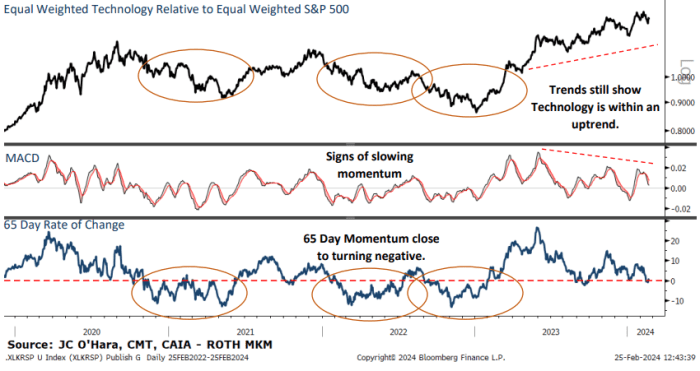

The average tech stocks’ relative momentum is starting to slow

While technology stocks remain firmly in an uptrend, their outperformance relative to the average S&P 500

SPX

stock has started to slow.

This is evidenced by a gauge of the average technology stocks’ outperformance compared with the average S&P 500 stock over the past 65 days, depicted in the chart below.

Such a shift has portended periods of underperformance for tech stocks in the past, not only in 2022, but in 2020 as well.

MKM ROTH

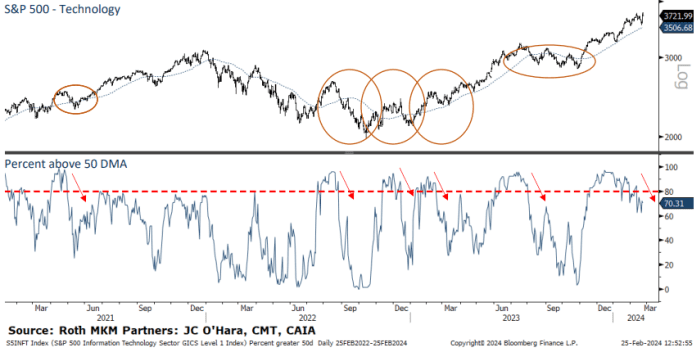

The share of technology stocks trading above their moving average is declining

Taken together, the S&P 500 technology sector is still trading well above its intermediate-term average. But more individual technology stocks have started to lag theirs.

By O’Hara’s count, roughly 70% of the tech sector’s 64 constituents are trading above their 50-day moving average as of Friday. By comparison, late last year, that number was 90%.

MKM ROTH

Valuations are looking stretched

Investors are paying a heavy premium for the average technology stock, evidenced by the trailing 12-month price-to-earnings ratio.

The ratio recently hit 35 times, a level that preceded the market peak from late 2021.

A version of the S&P 500 technology sector that assigns an equal weighting to each constituent stock only just took out those highs after more than two years. And during the interim, the gauge experienced a drawdown of more than 30%, according to O’Hara.

MKM ROTH

Options traders are getting greedy

Traders piled into bullish options ahead of Nvidia Corp.’s

NVDA,

earnings report last week. This pushed the 10-day put-call ratio, which measures demand for bullish options compared with demand for bearish options, firmly into greed territory.

However, history shows that options demand tends to mean revert, according to O’Hara. As of Friday, there was still plenty of room for options traders to shift from one side of the boat to the other.

MKM ROTH

Unprofitable technology stocks are fading fast

Even technology companies that haven’t posted steady profits saw their shares rocket higher as the broader market rallied furiously in November and December. Some analysts described it as a “dash for trash.”

But since the beginning of 2024, many of these companies that have struggled to post steady profits have seen their shares lurch lower. Case in point: The ARK Innovation ETF

ARKK,

seen as a proxy for unprofitable technology companies, is down 5.3% since the start of the year following a gain of more than 48% between Nov. 1 and Jan. 1, FactSet data show.

In the past, these companies have acted as a canary in the coal mine, O’Hara said.

“When market stresses start to develop, the unprofitable companies are normally sold first, as they are extremely far out on the risk curve and have the largest downside potential,” he added.

MKM ROTH

To be clear, O’Hara isn’t recommending that his clients rush to dump their technology stocks.

“We are still very much overweight Technology in our sector rankings,” O’Hara said.

But a recent spike in inquiries from clients asking for investment ideas outside of the tech piqued his curiosity.

He now expects a modest pullback that could carry the sector back below its 50-day moving average. This would equate to a drop of more than 4% for the XLK, according to FactSet data. The ETF was recently trading at $206.35 a share on Monday.

With that in mind, investors might want to consider buying some downside protection for their portfolios, he said. The lopsided put-call ratio means investors can purchase portfolio insurance relatively cheaply.

The tech-heavy Nasdaq-100

NDX,

which has the heaviest weighting toward the biggest megacap technology stocks like Nvidia Corp., hit its latest record close of the year on Thursday, while the Nasdaq Composite

COMP

came within a hair of its first record close since Nov. 19, 2021.

Meanwhile the S&P 500 and Dow Jones Industrial Average

DJIA

finished last week with their 13th and 14th record closing levels of the year, respectively.

All three of the main indexes — the S&P 500, Dow and Nasdaq Composite — were trading in the red early Monday afternoon.

Cardano Price Stagnant at $0.48, But Charts Point to Potential Upswing

Cardano (ADA), the eighth-largest cryptocurrency, finds itself in a perplexing situation as it grapples with a battle between bullish and bearish forces, leaving investors deciphering mixed signals in a turbulent market.

The optimism that briefly emerged on January 29th, as ADA’s market structure turned bullish, proved short-lived, unable to overcome the critical $0.50 support level, and remaining stuck in the $0.48 territory.

Social media sentiment, often a precursor to price movements, has not provided solace either. Santiment’s “weighted social sentiment” metric has steadily declined over the past ten days, reflecting tepid investor confidence.

Source: Coingecko

ADA’s Metrics: Confusion Amidst Bullish Signals

The confusion deepens when examining on-chain metrics. While the negative MVRV ratio suggests ADA might be undervalued, the sustained presence in negative territory raises concerns. Conversely, the increasing number of active addresses, signaling heightened network activity, offers a glimmer of hope for bullish investors.

Complicating the outlook is the liquidation heatmap from Hyblock. Two prominent zones add complexity: the $0.45-$0.48 region, hosting an estimated $300 million in liquidation levels, and the $0.52-$0.54 zone, carrying similar selling pressure. A drop to the former could trigger buying activity as long positions close, while the latter’s fate hinges on Bitcoin’s (BTC) movement, given ADA’s tendency to follow its lead.

ADA currently trading at $0.4809 on the daily chart: TradingView.com

Industry experts remain divided on Cardano’s future. Santiment suggests that the increased bearish sentiment might hint at an impending price bounce, while others exercise caution, citing the lack of definitive follow-through after the initial bullish market structure shift.

🐻 With #crypto market caps ranging and lacking the usual growth traders have been accustomed to since the #bullcycle began in October, there is a notable #bearish sentiment that has taken hold of #crypto discourse this week. #Bitcoin, #Ethereum, #BinanceCoin,

(Cont) 👇 pic.twitter.com/c3M4bPxlhi

— Santiment (@santimentfeed) February 5, 2024

Source: Santiment

Cardano Dips Amidst Stability: Mixed Signals

Cardano (ADA) is currently navigating a bearish trend, experiencing a 2.93% decrease in the past 24 hours and declines of 1.13% and 10.33% over the past week and month respectively. Despite this dip, it maintains its position as the 8th largest cryptocurrency by market cap, suggesting some underlying stability.

While the short-term technical picture appears bleak, longer-term indicators offer potential for cautious optimism. The increasing number of active addresses hints at growing network activity, a potential bullish sign.

Additionally, the negative MVRV ratio, although concerning in its extended presence, could indicate undervaluation. However, this needs to be balanced against the crucial resistance zones identified around $0.54-$0.56, which could hinder upward momentum.

Overall, ADA’s future trajectory remains uncertain. Further analysis would benefit from exploring the reasons behind the recent price decline, potential catalysts for recovery, and a deeper dive into long-term fundamentals like development progress and adoption rate.

Featured image from Freepik, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

CZ, Buterin, Dorsey top crypto social media popularity charts as SBF clings to 10th place

A mix of highly influential and controversial characters make up the latest list of the 10 most popular crypto entrepreneurs based on their social media presence, with Binance CEO Changpeng “CZ” Zhao leading the pack in first place and convicted fraudster Sam Bankman-Fried trailing in 10th.

The top 10 list was compiled by CoinLedger after shortlisting CryptoWeekly’s 30 most influential people in cryptocurrency in 2023, combined with their respective social media followings to determine the most widely followed crypto personality worldwide.

Sitting at the cool kids’ table with CZ are Ethereum co-founder Vitalik Buterin and Twitter co-founder and Block CEO Jack Dorsey, occupying the top three spots, in that order. In CoinLedger’s study, CZ emerged as the most popular personality in cryptocurrency, with nearly 9.1 million followers on X (formerly Twitter) and Instagram combined.

Buterin and Dorsey followed CZ with combined Twitter and Instagram followers of 7.7 million and 6.4 million, respectively.

MicroStrategy co-founder Michael Saylor and ARK Invest founder and CEO Cathie Wood sit in fourth and fifth place, respectively. Saylor has around half of Dorsey’s following at nearly 3.25 million, while Wood has just over 1.6 million followers.

Venture capitalists Chamath Palihapitiya and Marc Andreessen reached the sixth and seventh places, with 1.6 million and 1.3 million followers, respectively. Digital Currency Group CEO Barry Silbert and Coinbase CEO Brian Armstrong nabbed the next two spots with 1.25 million and 1.2 million followers.

Related: Slumdog billionaire 2: ‘Top 10… brings no satisfaction’ says Polygon’s Sandeep Nailwal

The 10th spot on the list was bagged by Sam “SBF” Bankman-Fried, the founder and former CEO of the defunct crypto exchange FTX. SBF still has a following of 1.06 million across X and Instagram, a year after the FTX collapse.

During the FTX implosion, SBF’s overall followers increased from roughly 780,000 to over 1.1 million and have settled at the one million mark ever since, according to Socialblade data.

Magazine: Breaking into Liberland: Dodging guards with inner-tubes, decoys and diplomats

Wall Street’s biggest bear is standing by his call for stocks to slump 10% by January. Here are 4 charts that support his point.

One of Wall Street’s biggest bears is standing by his call for the S&P 500 index to finish 2023 at 3,900. That would represent a more than 10% drop from current levels.

In his latest note to clients shared with MarketWatch on Monday, Morgan Stanley’s U.S. equity strategist Michael Wilson rattled off a list of reasons why he thinks the turnaround in stocks that started in early August likely isn’t finished yet. Since markets opened on Aug. 1, the S&P 500 has fallen 4.4% through Monday’s close, according to FactSet data. However, the index remains up 13.9%, according to FactSet data.

Market breadth remains abysmal. Consumer confidence as reflected by survey data produced by the University of Michigan is waning. And equity analysts on Wall Street have begun to slightly temper their expectations for corporate earnings growth in the quarters and year ahead, Wilson said, even as optimism builds about the third-quarter earnings season that has just begun.

Technical factors also played into his reasoning. Wilson noted that the S&P 500 appears “stuck” between two key support and resistance levels: it’s 50-day moving average at roughly 4,420 and its 200-day moving average at roughly 4,240.

Whichever way the index ultimately breaks, Wilson noted that Morgan Stanley’s clients still expect the market to rally in the fourth quarter. Many are clinging to the notion that stocks historically have rallied during the fourth quarter.

MORGAN STANLEY

However, this optimism could be easily shaken, sparking another round of selling which could feed on itself as portfolio managers scramble to lock in year-to-date gains.

“Our sense from speaking with investors is that a majority still believe a 4Q rally is more likely than not. While that confidence level may have waned a bit this past week, many are still leaning more long than they would like to reduce the probability of missing out in a year in which narrow mega cap strength has driven benchmarks,” Wilson said.

“As mentioned above, this sentiment is contingent on price holding up in the short term; if it doesn’t, we could see positioning quickly shift to locking in profits and/or relative performance into year-end.”

Although the S&P 500’s technical setup appears healthy enough, beneath the surface, the situation for the average stock included in the index looks much more dire. That’s one reason Wilson is skeptical of the notion that U.S. stocks have entered a new bull market.

See: Stocks hit a bear-market low 1 year ago. Time to celebrate?

“…[A] more holistic view of the YTD price action suggests this is likely not a new

bull market/cyclical impulse with the S&P 500 Equal Weight Index and Russell 2000

down on the year and closer to the bear market lows last year than the bull market highs in 2021,” Wilson said.

“The high in July for the average stock is looking like a classic double top, at least

tactically. Furthermore, with only 39% of S&P 500 stocks above their 200-day moving average, it’s no wonder it has been a challenging year in terms of keeping up with the high quality large cap benchmark influenced so heavily by the handful of mega cap outperformers—a group that is also seeing a narrowing in leadership and fading of momentum.”

To wit, the average S&P 500 stock is down year-to-date based on the performance of the equal-weighted S&P 500 index. The equal-weighted index also recently endured a “death cross” as its 50-day moving average dipped below its 200-day moving average, signaling that momentum could continue to carry it lower.

MORGAN STANLEY

Breadth for both S&P 500 and the Nasdaq has broken down as well, while the percentage of stocks below their 200-day moving averages has continued to deteriorate.

MORGAN STANLEY

To be sure, Wilson isn’t the only bear who is concerned about weak performance outside of the market-leading technology stocks and the energy sector which has benefited over the past couple of months from rising oil prices.

Jonathan Krinsky, chief market technician at BTIG, highlighted the fact that the S&P 500 excluding the “Magnificent Seven” megacap technology names recently touched its lowest level of the year, while the ratio of the S&P 500 excluding the Mag Seven vs. the entire index has fallen to its lowest level since late 2021.

BTIG

Wilson has stood by his 3,900 year-end target all year even as the S&P 500 climbed roughly 20% to its 2023 highs in late July. Although he did acknowledge over the summer that his bearish call hadn’t panned out. Wilson earned plaudits in 2022 for anticipating the inflation-driven selloff that led to the worst year for stocks since 2008.

U.S. stocks looked set to open lower on Tuesday as Treasury yields continued to climb. The yield on the 30-year Treasury bond

BX:TMUBMUSD30Y

was nearing 5%, while S&P 500 index futures

ES00,

were down 0.6%.

A deepening confrontation between the U.S. and China is eroding trade ties between the world’s two largest economies, with goods from China accounting for the smallest percentage of U.S. imports in 20 years.

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8