The post China’s economic shift and its implications for crypto appeared first on CryptoSlate.

Chinas

Evergrande’s affiliate Tianji Holdings and the company’s subsidiary Scenery Journey have also filed for Chapter 15 protection in the US court.

Evergrande Group, the Chinese second-largest property developer, has filed for Chapter 15 bankruptcy protection in the Manhattan bankruptcy court. The application would allow Evergrande to protect its assets in the US while it is working on a multi-billion dollar deal with creditors.

Evergrande’s Crisis

Evegrande is an investment-holding real estate company engaged in property development, property investment, property management, and property construction. With more than 1,300 projects in more than 280 cities in China, Evergrande has cooperated with more than 860 well-known companies around the world. The company was prospering until 2020 when Chinese authorities introduced new rules to control the amount that big real estate firms could borrow.

In 2020, the Chinese government imposed a “three red lines” policy to regulate the leverage taken on by developers, limiting their borrowing based on the following metrics: debt-to-cash, debt-to-equity, and debt-to-assets. Notably, by October 2021, those regulations were violated by 14 of China’s 30 biggest developers at least once.

The real-estate crisis began, as major property giants ran out of cash. It affected Evergrande Group, leading to its multiple debts and default. The company missed a crucial deadline and failed to repay interest on around $1.2 billion of international loans. In October 2021, Evergrande announced that it would raise $5 billion by selling a 51% stake in its property management unit to Hopson Development.

For 2021 and 2022, Evergrande suffered an $81 billion combined loss that was primarily attributed to write-downs of properties, return of land, losses on financial assets, and mounting finance costs. By the end of 2022, Evergrande’s total liabilities surged from $300 billion at the time of its default to $340 billion.

Filing for Chapter 15 Protection

Earlier this year, Evergrande revealed its plans to restructure around $20 billion in overseas debt. The filing for Chapter 15 in the US court is a part of the restructuring strategy. Within the filing, Evergrande Group is seeking the court’s approval to restructure more than $19 billion in the company’s offshore debts.

Later this month, Evergrande’s creditors will vote on the company’s restructuring proposal, with possible approval by Hong Kong and British Virgin Islands courts in the first week of September.

Chapter 15 is a new chapter added to the Bankruptcy Code by the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. In general, it aims to provide effective mechanisms for dealing with insolvency cases involving debtors, assets, claimants, and other parties of interest involving more than one country.

Once a foreign entity files for bankruptcy under Chapter 15, the US bankruptcy court can authorize the appointment of a trustee or examiner to act in the other country on behalf of the bankruptcy estate in the United States. Besides, Chapter 15 allows US courts to offer additional aid to foreign representatives, assistance to foreign companies filing bankruptcy cases when the laws of the foreign court may be lacking, and gives foreign creditors the right to participate in bankruptcy cases in the US.

Evergrande’s affiliate Tianji Holdings and the company’s subsidiary Scenery Journey have also filed for Chapter 15 protection.

next

Business News, Editor’s Choice, News

Darya is a crypto enthusiast who strongly believes in the future of blockchain. Being a hospitality professional, she is interested in finding the ways blockchain can change different industries and bring our life to a different level.

You have successfully joined our subscriber list.

Another sign of China’s tepid recovery came from German industrial conglomerate Siemens, which pinned disappointing sales on the lackluster economy.

Siemens said it swung to a fiscal third-quarter profit of €1.28 billion ($1.59 billion), as revenue rose 6% to €18.89 billion. A company-compiled consensus called for earnings of €1.41 billion on sales of €19.27 billion.

Orders rose by 10% to €24.24 billion, which topped the €22.19 billion expected by analysts.

Siemens shares

SIE,

slumped by 4% in afternoon trade in Germany.

“China’s market recovery in manufacturing is materializing slower than expected and we anticipate some further subdued development,” said CEO Roland Busch.

The company flagged that new orders in China deteriorated in the second half of the quarter, particularly in automation.

But the good news for Siemens is the problems in China have yet to translate to key exporters, either in its home market of Germany or in Italy. The company reiterated its organic sales growth guidance for the fiscal year even as it lowered its outlook in particular for the digital industries segment.

“China is clearly a lot weaker than expected, and while the execution looks stronger than peers such as Rockwell or Schneider, investor focus is expected to be on demand development into FY24,” said Bank of America analysts led by Alexander Virgo.

Quotable Christie says China’s Xi is gauging U.S. resolve in support of Ukraine’s democracy and independence

Chris Christie, the former New Jersey governor and current Republican presidential candidate, appeared intent on making news early Tuesday during an MSNBC interview.

To the question of whether he believed Donald Trump — with whom he was aligned from the February day in 2016 on which Christie endorsed his then-rival through Jan. 6, 2021, when Christie of late insists the bond was permanently broken — had broken the law, as now formally alleged by both state and federal prosecutors, Christie responded: “Oh, yeah.”

Most definitively, in Christie’s view, in the case of the classified government documents taken to, and stored at, Trump’s membership club and personal residence in Palm Beach, Fla., followed up by an alleged attempt to destroy surveillance footage. Christie’s characterization of that latter episode: “Abbott and Costello meets the Corleones.”

But the quotable Christie’s return to an assessment of the geopolitical import of the U.S.’s continued support for Ukraine’s bid to reverse the full-scale Russian invasion launched in February 2022 was the interview’s central takeaway:

“‘Ukraine is the undercard.’”

By extension, the featured match, in Christie’s view, would be China vs. Taiwan.

And Xi Jinping is, said Christie, watching closely from Beijing to gauge Western resolve in the defense of democracy and independence in Ukraine, in the assumption that lessons can be drawn about how far Washington and its allies would go in backing Taiwan.

From the archives (March 2023): Tucker Carlson questionnaire reveals a fault line among Republicans: U.S. support for Ukraine’s defense against Russian invasion

How Bad Is China’s Economy? Millions of Young People Are Unemployed and Disillusioned

HEFEI, China—More than one in five young people in China are jobless. The government casts much of the blame on the job seekers themselves, insisting that their expectations have gotten too high.

Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

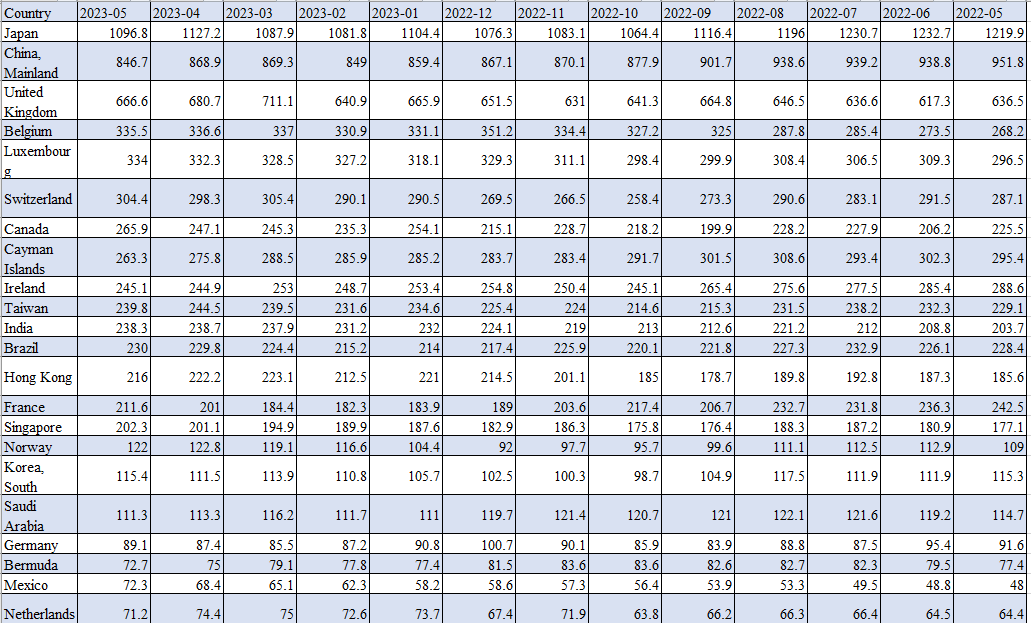

Shifting sands: Japan and China’s decreasing holdings in U.S. treasury securities

Quick Take

The U.S. Department of the Treasury publishes a monthly report known as the Treasury International Capital (TIC) report, which provides information on the holdings of U.S. Treasury securities by foreign countries.

Japan and China are traditionally the largest foreign holders of U.S. Treasury securities. These holdings are significant because they indicate these countries’ confidence in the U.S. economy. When Japan and China buy U.S. Treasury securities, they effectively loan money to the U.S. government and show confidence in the U.S. economy’s stability.

However, both Japan and China are continuing to decrease their holdings in U.S. Treasury securities, it could indicate various economic scenarios. It could be a sign that these countries are diversifying their foreign reserves away from the U.S. dollar or a signal of their decreasing confidence in the U.S. economy. It could also indicate domestic economic changes within Japan and China, causing them to sell off foreign reserves.

The post Shifting sands: Japan and China’s decreasing holdings in U.S. treasury securities appeared first on CryptoSlate.

Hong Kong would not go crypto without China’s approval — Animoca exec

Hong Kong’s rapid adoption of cryptocurrencies and Web3 is a sign of some “big moves” happening in mainland China, a co-founder of the local game software firm Animoca believes.

The current crypto trend in Hong Kong is “not really just about” the city-state, but about wider China, despite mainland China banning crypto, according to Animoca co-founder Yat Siu.

Speaking at the Ethereum Community Conference (EthCC) on July 19, Siu mentioned that China released its Web3 white paper in May, in which the government “basically indicated that Web3 is the future of the internet.” It should not be underestimated that the news came just a few days after Hong Kong officially announced plans to allow retail crypto investments, the exec stressed.

Although China’s Web3 white paper did not mention crypto, it’s still important that mainland China is putting out a budget toward progressing with Web3, Siu said.

He claimed that the news about Hong Kong’s crypto developments was ubiquitous in China, including in a notice on the national TV channel, China Central Television.

“So every Chinese person basically in China got to see this,” Siu noted, adding:

“This is interesting because it’s not really just about what’s happening in Hong Kong. It’s really a message that’s coming from, you could say, high above. And Hong Kong wouldn’t do anything without the approval of China.”

In his keynote speech, Siu also argued that Web3 is a powerful tool to “push a new technology paradigm” away from United States’ tech hegemony. He specifically referred to potentially detrimental security risks of nations’ dependence on tech giants like Google, Apple and Facebook, stating:

“That’s actually another big agenda item, which is why Japan, Korea, China, all these places are pushing Web3 in a really big way because they see that as an opportunity to break away from basically U.S.-dominant technologies.”

Siu said that challenging the U.S. hegemony is particularly important for places like China, which is focused on de-dollarization.

“It’s another reason why Web3 is being pushed in these places. Less dependency on the dollar. The dollar is, of course, as we know, the global currency of the world,” Siu stated.

Related: Advocates call for Hong Kong govt stablecoin to compete with Tether and USD Coin

As previously reported by Cointelegraph, the People’s Bank of China officially announced another ban on virtually all crypto activity in September 2021. It’s worth noting, however, that mainland China remained one of the world’s largest crypto-mining hubs despite the ban.

With the news about Hong Kong proactively adopting crypto-friendly regulations, many crypto observers expressed hope that China could potentially lift its years-long ban on crypto.

However, several state-related executives, including CPIC Investment Management CEO Chenggang Zhou, have recently reiterated that China remains and will remain anti-crypto in the near future.

Magazine: Asia Express: China expands CBDC’s tentacles, Malaysia is HK’s new crypto rival

A timeline of China’s 32-month Big Tech crackdown that killed the world’s largest IPO and wiped out trillions in value

Chinese authorities initiated a regulatory storm against the country’s Big Tech firms in late 2020 out of concerns that the country’s major internet platforms were becoming too large and powerful.

Beijing’s discipline of the tech sector wiped out trillions of dollars in market value from Chinese tech companies, kneecapped one of the most dynamic sectors in the world’s second largest economy, and accelerated US-China decoupling. As a result, China’s large tech companies, which once rivalled their US counterparts in size, are now much smaller.

Here are the major milestones of China’s Big Tech crackdown that kicked off 32 months ago.

Do you have questions about the biggest topics and trends from around the world? Get the answers with SCMP Knowledge, our new platform of curated content with explainers, FAQs, analyses and infographics brought to you by our award-winning team.

November 2020

An initial public offering from Ant Group, which would have been the world’s largest on record, was called off at the last minute in Shanghai and Hong Kong, sending shock waves through the global investment community. The IPO was quashed after a controversial speech the previous month from Alibaba Group Holding co-founder Jack Ma. Ant is the fintech affiliate of Alibaba, owner of the South China Morning Post.

China’s financial watchdogs rushed to bring Ant’s operations under the purview of conventional financial regulations, forcing the tech giant to undergo internal restructuring.

Later in the month, Chinese authorities summoned 27 major internet companies, including Tencent Holdings, food delivery giant Meituan, as well as TikTok owner ByteDance and Alibaba, lecturing them to correct alleged monopolistic practices, unfair competition and counterfeiting. China’s antitrust watchdog, the State Administration for Market Regulation (SAMR), rushed an antitrust guideline to rein in internet-based monopolies.

December 2020

China’s top leaders highlighted at the annual Central Economic Work Conference that the country must prevent the “disorderly expansion of capital”, a goal used to curb the influence and size of Big Tech. The message to investors and entrepreneurs was that the “barbaric” growth of China’s internet industry was over.

On Christmas Eve, the SAMR announced that it had officially launched an antitrust investigation into Alibaba.

In a speech at the Bund Summit in Shanghai on October 24, 2020, Alibaba co-founder Jack Ma Yun compared Chinese banks to pawnshops. Photo: WEIBO alt=In a speech at the Bund Summit in Shanghai on October 24, 2020, Alibaba co-founder Jack Ma Yun compared Chinese banks to pawnshops. Photo: WEIBO>

April 2021

China’s market regulator fined Alibaba a record 18.2 billion yuan (US$2.8 billion), equivalent to 4 per cent of its 2019 revenue, for abusing “its dominant market position in China’s online retail platform service market since 2015”.

The antitrust authority then summoned 34 technology companies, including Alibaba, Tencent and Meituan, for a meeting and demanded they “pay full heed to the warning of Alibaba’s case”.

July 2021

China’s market regulator started to look into merger cases dating back to the early 2000s and fined Big Tech firms for failing to report certain deals for an antitrust review. It issued at least 22 fines of 500,000 yuan each – the maximum penalty allowed under China’s anti-monopoly law – against Alibaba, Tencent and ride-hailing giant Didi Global.

As a result, Big Tech mergers and acquisitions plummeted, and companies started to divest previous investments to downsize their balance sheets.

China’s powerful internet regulator, the Cyberspace Administration of China (CAC), also launched an unprecedented probe into Didi for violations of data and national security, two days after it launched a US$4.4 billion IPO on the New York Stock Exchange. The move opened a new front in the Big Tech crackdown, bringing Chinese IPOs in the US to a halt.

Didi was ordered to stop registering new users on its main app. Two months later, China’s Data Security Law came into force.

Signage at the Didi Global offices in Hangzhou on August 2, 2022. Photo: Bloomberg alt=Signage at the Didi Global offices in Hangzhou on August 2, 2022. Photo: Bloomberg>

October 2021

China fined Meituan 3.4 billion yuan for abusing its dominant market position using what it referred to as a “pick one from two” practice that forced merchants into exclusive deals. The fine was equivalent to about 3 per cent of Meituan’s total domestic revenue of 114.7 billion yuan in 2020.

January 2022

China’s regulatory storm started to ebb when authorities released a guideline promoting the “healthy and sustainable development” of the platform economy. It reaffirmed Beijing’s commitment to cracking down on monopolies, unfair competition and abuse of data, but the document also struck a more positive tone by recognising the role Big Tech firms play in the economy and encouraging their development.

May 2022

Vice-Premier Liu He told a few tech executives that the government would support the development of the sector and public listings, giving tech stocks a shot in the arm and raising hopes that the worst of Beijing’s regulatory scrutiny was over.

July 2022

The CAC imposed a fine of 8 billion yuan on Didi Global for data violations, ending the year-long investigation.

December 2022

President Xi Jinping addressed the Central Economic Work Conference in Beijing. The meeting concluded that internet platforms will be supported to “fully display their capabilities” in boosting the economy, job creation and international competition.

January 2023

Didi Global said it had resumed new user registrations for its ride-hailing app, after getting approval from the CAC.

The same month, Ant Group and 13 other platform companies said they “have basically completed business rectification” under the guidance and supervision of financial regulators after being ordered to address various compliance issues in late 2020.

July 2023

Two-and-a-half years after the government killed Ant Group’s IPO, financial regulators fined the fintech giant a total of 7.1 billion yuan for breaking rules related to “corporate governance and financial consumer protection”. The move was seen by industry experts as the end of China’s crackdown on the tech sector.

Chinese Premier Li Qiang later offered support to major tech companies at a symposium while China’s powerful economic planning agency praised Alibaba, Tencent and Meituan for their contributions to the country’s growth and technological progress.

This article originally appeared in the South China Morning Post (SCMP), the most authoritative voice reporting on China and Asia for more than a century. For more SCMP stories, please explore the SCMP app or visit the SCMP’s Facebook and Twitter pages. Copyright © 2023 South China Morning Post Publishers Ltd. All rights reserved.

Copyright (c) 2023. South China Morning Post Publishers Ltd. All rights reserved.