In the unfolding lawsuit between the Crypto Open Patent Alliance (COPA) and Craig Wright, three key witnesses who had early interactions with Bitcoin’s creator, Satoshi Nakamoto, provided their testimonies. Among them were early Bitcoin developers Martti Malmi and Mike Hearn, as well as Adam Back, the creator of Hashcash, the proof-of-work (PoW) algorithm integral to […]

In the unfolding lawsuit between the Crypto Open Patent Alliance (COPA) and Craig Wright, three key witnesses who had early interactions with Bitcoin’s creator, Satoshi Nakamoto, provided their testimonies. Among them were early Bitcoin developers Martti Malmi and Mike Hearn, as well as Adam Back, the creator of Hashcash, the proof-of-work (PoW) algorithm integral to […]

Source link

clash

Will Bitcoin Hit $1 Million By 2028? Experts Clash Over Bold Price Prediction

Tuur Demeester, a Bitcoin evangelist, has recently shared his views on Bitcoin’s potential to reach the $1 million mark by 2028. Demeester’s view on this topic presents a cautious contrast to some of the more bullish predictions in the crypto community.

This tempered perspective comes when others, such as Samson Mow, express strong confidence in Bitcoin’s ability to hit this milestone following its next halving.

$1 Million Bitcoin By 2028 Is Not Certain

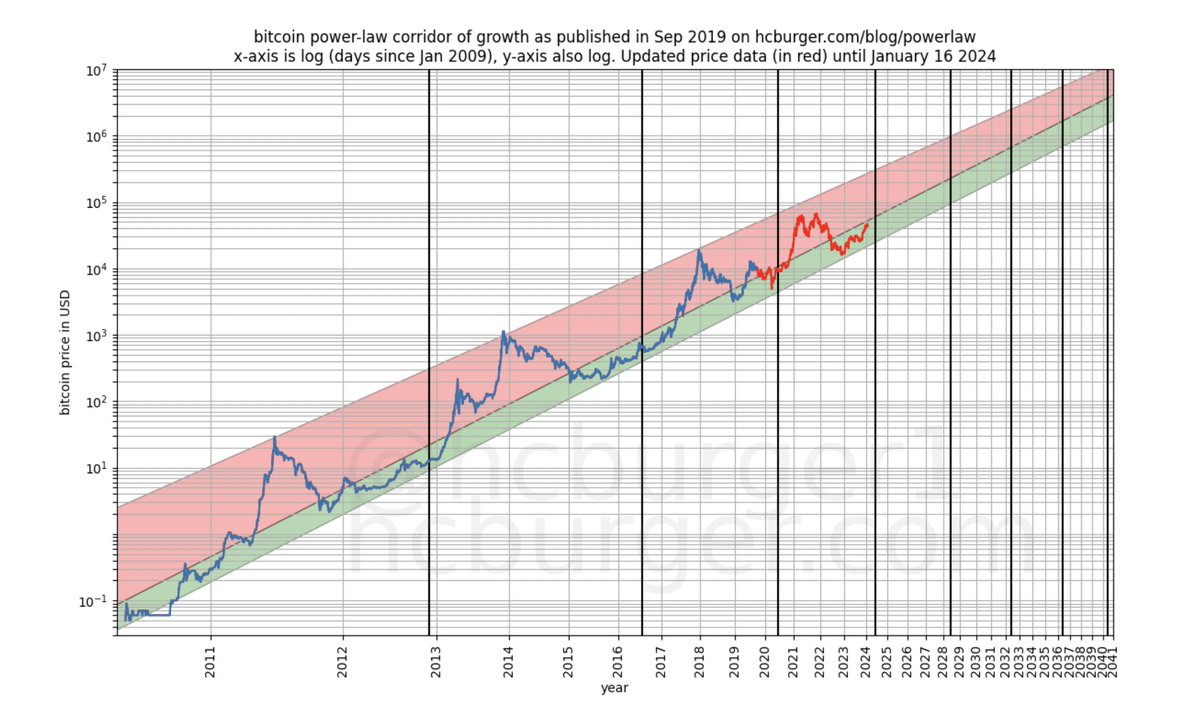

Demeester’s skepticism was articulated in response to a post sharing a graph by investor Fred Krueger, which suggested that Bitcoin might reach the $1,000,000 level by 2028.

While appreciating the graph’s model, Demeester expressed uncertainty, acknowledging the unpredictable nature of the market and its capacity to defy even the most well-constructed models.

Will it take BTC until after summer 2028 to reach $1M? I don’t know, but I do know that every beautiful model (as is this one 🤌) is destined to be broken by Mr. Market.

— Tuur Demeester (@TuurDemeester) February 2, 2024

The anticipation surrounding BTC’s price of $1 million is closely tied to its halving events, which occur approximately every four years. After this year’s halving, the next halving is set to occur in 2028. These events reduce the number of new BTC mined per block by half, limiting the supply and potentially impacting the price.

The upcoming halving, set for April this year, will see the daily minting of Bitcoin slashed from 900 to 450 coins. Such supply changes have historically led to significant price movements, lending credibility to the various models predicting substantial future price increases.

Amid these predictions, an X user, claiming ownership of the growth plot referenced by Demeester, chimed in with insights. They argued that some market laws, like the time value of money in the stock market, are less likely to be broken.

Similarly, the natural adoption rate of Bitcoin might constrain its “explosive” growth, providing room for market movements without breaking the underlying model.

Hi Tuur, this plot is mine. Some laws are not broken by Mr Market, e.g. the stock market grows by ~7% p.a. This cannot be broken to the upside because of the time value of money (essentially).

The time-based power-law likewise is hard to break to the upside because that would go…— hcburger (@hcburger1) February 2, 2024

Diverse Views On Bitcoin’s Future

Other Bitcoin enthusiasts, like Samson Mow, CEO of Jan3, are more optimistic. Mow envisions Bitcoin reaching $1 million, potentially in a sudden surge causing “max pain” for several market players.

This dramatic increase, he suggests, could happen swiftly, within “days or weeks,” though the precise starting point remains uncertain.

My main prediction is the run up to $1M happens in days to weeks. Starting point TBD.

— Samson Mow (@Excellion) January 14, 2024

In analyzing potential triggers for a Bitcoin rally, Mow considers various factors. These include Bitcoin-specific metrics like exchange-traded inflows (ETF), the BTC hashrate, and whale activity on Bitfinex. Additionally, Mow looks at broader economic indicators such as Tether’s USDT assets under management, government debt payments, and Debt-to-GDP ratios.

These are the #Bitcoin macro indicators I’m looking at:

⬆️ ETF inflows

⬆️ Hashrate

⬆️ Finex whale accumulation

⬆️ 200 WMA trend

⬆️ Tether USDt AUM

⬆️ Govt interest payments on debt

⬆️ Debt GDP ratios

⬆️ Nation-state Bitcoin adoption

⬆️ Real inflation

⬆️ M3 money— Samson Mow (@Excellion) January 28, 2024

Mow believes these factors, combined with nation-state adoption, real inflation rates, and the M3 money supply, could significantly influence Bitcoin’s performance.

Amid the debate, Bitcoin saw quite a surge in the past 24 hours, reclaiming the $43,000 mark with a current trading price of $43,123.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Ryanair narrows profit guidance following clash with travel agents, says Boeing delays will hit growth

Ryanair on Monday lowered its full-year profit guidance, as it said higher fuel and staffing costs, and a decision by online travel agents to stop listing its flights, had hit profits in the final three months of 2023.

The Irish airline also told investors that delays of Boeing aircraft deliveries are set to impact its growth over the coming year.

The low-cost airline

RYA,

RYAAY,

said the decision by “pirate” travel agents — including Kiwi, and Booking Holdings

BKNG,

owned websites Kayak and Booking.com — to stop listing Ryanair flights on their websites in early-December led to a 1% drop in its passenger numbers in the final quarter of 2023.

Online travel agents removed Ryanair flights from their listings late last year, after facing pressure from consumer protection watchdogs and Ryanair itself.

Ryanair had previously raised concerns about unauthorized websites marking up its ticket prices and providing incorrect passenger details, before introducing a new set of customer verification measures for all passengers booking their flights via third-party websites.

The airline said it has now struck deals with both Kiwi and Love Holidays, which will see the online agents sell flights directly through Ryanair’s website, in a shift intended to prevent any markups on seat price or any other ancillary products.

The Irish air carrier added that 35% higher fuel prices and agreements with pilots’ unions in Belgium, Italy and the U.K. had also raised its operating costs by 26%, to €2.7 billion, which offset a 21% uptick in revenues driven by a 13% rise in ticket prices.

Euronext Dublin listed shares of Ryanair fell around 1% on Monday.

Ryanair narrowed its profit guidance for the full year ending in March, from €1.85 billion – €2.05 billion to €1.85 billion – €1.95 billion, as it fell short of analysts’ estimates in reporting post-tax profits worth €15 million for the final three months of 2023, down 93% year on year.

Company watchers had previously expected Ryanair would generate €73 million in post-tax profits in the final quarter of 2023, according to seven analysts polled by Factset.

The airline noted that its ability to achieve its new guidance will also be “heavily dependent” on the world avoiding any “unforeseen events,” including a possible worsening of the Israel-Hamas conflict, further Boeing delivery delays, or an escalation of the Ukraine war.

Ryanair, which was first set up in 1984, noted that delays in Boeing’s

BA,

deliveries are now constraining its growth. The airline said it expects Boeing will have completed just 50 deliveries by June 2024, of a total 57 planes that were initially due to be delivered by April 2024.

The airline warned these delays mean its own passenger numbers will drop from 205 million this year to 200 million in 2025.

Ryanair, however, signaled that it remains confident in Boeing and continues to work closely with the plane manufacturer following a meeting with the company’s senior management at its Seattle headquarters in January.

The airline on Monday also said it would be willing to buy any Boeing MAX-10’s that have been rejected by the manufacturer’s U.S. customers, following the Federal Aviation Administration’s decision to ground Boeing’s MAX-9s after a panel blew off an Alaska Airlines flight in January.

UAW’s clash with Big 3 automakers shows off a more confrontational union as strike deadline looms

DETROIT (AP) — A 46% pay raise. A 32-hour week with 40 hours of pay. A restoration of traditional pensions.

The demands that a more combative United Auto Workers union has pressed on General Motors, Stellantis and Ford — demands that even the UAW’s own president calls “audacious” — are edging it closer to a strike when its contract ends Sept. 14.

The automakers, which are making billions in profits, have dismissed the UAW’s wish list. They argue that its demands are unrealistic at a time of fierce competition from Tesla and lower-wage foreign automakers as the world shifts from internal combustion engines to electric vehicles. The wide gulf between the sides could mean a strike against one or more of the automakers, which could send already-inflated vehicle prices even higher.

A potential strike by 146,000 UAW members comes against the backdrop of increasingly emboldened U.S. unions of all kinds. The number of strikes and threatened strikes is growing, involving Hollywood actors and writers, sizable settlements with railroads and major concessions by corporate giants like UPS.

Shawn Fain, who won the UAW’s presidency this spring in the first direct election by members, has set high expectations and assured union members that they can achieve significant gains if they are willing to walk picket lines.

In a speech to a Labor Day parade crowd in Detroit on Monday, Fain said that if the companies don’t come up with a fair contract, “come Sept. 14, we’re going to take action to get it by any means necessary.”

Fain has characterized the contract talks with Detroit automakers as a form of war between billionaires and ordinary middle-class workers. Last month, in an act of showmanship during a Facebook Live event, Fain condemned a contract proposal from Stellantis as “trash” — and tossed a copy of it into a wastebasket, “where it belongs,” he said.

Over the past decade, the Detroit Three have emerged as robust profit-makers. They’ve collectively posted net income of $164 billion over the past decade, $20 billion of it this year. The CEOs of all three major automakers earn multiple millions in annual compensation.

Speaking last month to Ford workers at a plant in Louisville, Kentucky, Fain complained about one standard for the corporate class and another for ordinary workers.

“They get out-of-control salaries,” he said. “They get pensions they don’t even need. They get top-rate health care. They work whatever schedule they want. The majority of our members do not get a pension nowadays. It’s crazy. We get substandard health care. We don’t get to work remotely.”

UAW members have voted overwhelmingly to authorize its leaders to call a strike. So, too, have Canadian auto workers, whose contracts end four days later and who have designated Ford as their target.

The UAW hasn’t said whether it will select one target automaker. It could strike all three, though doing so could deplete the union’s strike fund in under three months.

On the other hand, if a strike lasted even just 10 days, it would cost the three automakers nearly a billion dollars, the Anderson Economic Group has calculated. During a 40-day UAW strike in 2019, GM alone lost $3.6 billion.

Last week, the union filed charges of unfair labor practices against Stellantis and GM, which it said have yet to offer counterproposals. As for Ford, Fain asserted that its response, by rejecting most of the union’s demands, “insults our very worth.”

All three automakers have countered that the union’s charges are baseless and that they’re seeking a fair deal that would allow them to invest in the future.

Marick Masters, a business professor at Wayne State University in Detroit, suggested that the strong U.S. job market and the companies’ outsize profits have given Fain leverage in negotiations. In addition, he noted, the automakers are poised to release a slew of new electric vehicles that would be delayed by a strike. And they have only a limited supply of vehicles to withstand a prolonged walkout.

“They are vulnerable,” Masters said.

“The question really is,” he said, “are the parties willing to move on some of these things at the table? That hasn’t been evident yet.”

Even Fain has described the union’s proposals as “audacious” in demanding the restoration of traditional defined-benefit pensions for new hires; an end to tiers of wages; pension increases for retirees; and — perhaps boldest of all — a 32-hour week for 40 hours of pay.

Currently, UAW workers who were hired after 2007 don’t receive defined-benefit pensions. Their health benefits are less generous, too. For years, the union gave up general pay raises and lost cost-of-living wage increases to help the companies control costs. Though top-scale assembly workers earn $32.32 an hour, temporary workers start at just under $17. Still, full-time workers have received profit-sharing checks ranging this year from $9,716 at Ford to $14,760 at Stellantis.

At Detroit’s Labor Day Parade, workers said a strike appears likely now.

Jason Craig, a worker at a Stellantis parts warehouse near Detroit, said his company appears most likely to be the strike target, but he said the union might go to Ford because it seems more family-oriented. Fain reiterated Monday that all three companies remain strike targets.

Perhaps the biggest issue blocking a contract agreement is union representation at 10 EV battery plants that the companies have proposed. Most of these plants are joint ventures with South Korean battery makers, which want to pay less.

“These battery workers deserve the same wage and salary standards that generations of auto workers have fought for,” Fain told members.

The union fears that because EVs are simpler to build, with fewer moving parts, fewer workers will be needed to assemble them. In addition, workers at combustion engine and transmission plants will likely lose jobs in the transition; they’ll need a place to go.

Fain, a 54-year-old electrician who came out of a Chrysler factory in Kokomo, Indiana, is among several labor leaders across the economy who have been escalating their demands and flexing their muscles. So far this year, 247 strikes have occurred involving 341,000 workers — the most since Cornell University began tracking strikes in 2021, though still well below the numbers during the 1970s and 1980s.

Masters suggested that the automakers wouldn’t be able to quickly replace striking workers. The tight job market, diminished interest in manufacturing jobs and comparatively modest wages would make it difficult to hire enough workers.

Some auto workers regard the UPS contract, with a $49-an-hour top wage for experienced drivers, as a benchmark for their negotiations. Others say they’re just hoping to get near that figure.

But automakers say a generous settlement would stick them with costs far above their competitors’ just as they start producing more EVs. The inability to bring Hyundai-Kia, Nissan, Volkswagen, Honda and Toyota factories into the union has weakened the UAW’s leverage, said Harry Katz, a labor professor at Cornell.

If you include the value of their benefits, workers at the Detroit 3 automakers receive around $60 an hour. The corresponding figure at foreign-based automakers with U.S. factories is just $40 to $45, Katz said. Much of the disparity reflects pensions and health care.

If the Detroit companies end up with higher labor costs, they’ll pass them on to consumers, making vehicles more expensive, said Sam Fiorani, an analyst with AutoForecast Solutions, a consulting firm.

“More than half of the vehicles built in the U.S. are in nonunion plants,” he said. “So if you raise the price to build a unionized vehicle, you could price yourself out of competition with vehicles already built in North America.”

A strike of more than a couple of weeks would reduce still-tight supplies of vehicles on Detroit automakers’ dealer lots. With demand still strong, prices would rise.

The UAW’s members are “reminding management that management can’t operate those factories without a settlement,” Katz said.

Masters and Katz say there’s still time to settle without a strike. Katz predicts a settlement short of UPS numbers, possibly with 3% general pay raises plus cost-of-living adjustments, increased company contributions to 401(k) accounts for newer workers and faster transitions to top pay.

That said, Katz suggested, Fain has to back up his tough talk: “He’s got to prove himself.”

____

AP Writers Bruce Schreiner in Louisville, Kentucky, and Christopher Rugaber in Washington contributed to this report.