A new Deutsche Bank survey found that over half of respondents expect cryptocurrencies to become an important asset class and a method of payment. In addition, 10% of respondents expect the price of bitcoin to be above $75,000 by year-end. Deutsche Bank’s Crypto Survey A recent Deutsche Bank survey of over 3,600 consumers, published this […]

A new Deutsche Bank survey found that over half of respondents expect cryptocurrencies to become an important asset class and a method of payment. In addition, 10% of respondents expect the price of bitcoin to be above $75,000 by year-end. Deutsche Bank’s Crypto Survey A recent Deutsche Bank survey of over 3,600 consumers, published this […]

Source link

class

Court rules in favor of Apple in class action over crypto payment policies

A California judge dismissed a class action lawsuit against Apple that accused the tech giant of imposing restrictions on third-party crypto payments on March 26.

District Judge Vince Chhabria said the complaint contained “several fatal problems,” including inadequately alleged agreements between Apple and other payment services.

He expressed doubts that the agreements restricted decentralized crypto transactions as alleged, asserting it is not clear that such an agreement would be unlawful under the Sherman Antitrust Act.

Meanwhile, the allegations of antitrust standing were found to be inadequate because any links between Apple’s alleged anticompetitive behavior and alleged injury were speculative. The plaintiffs claimed they paid overinflated fees to certain third-party apps because of Apple’s agreements.

Furthermore, the case had problems with its relevant market definition because Zelle — a payment app mentioned by the plaintiffs — was excluded from the definition.

The judge observed other issues and said an amendment to the case was unlikely to change the outcome of the lawsuit. However, the court has given plaintiffs 21 days to amend the case.

The case will be dismissed without prejudice if the plaintiffs fail to make amendments by the deadline.

Centralization vs. decentralization

Initially filed in November 2023, the lawsuit alleged that PayPal‘s Venmo, Google Pay, Cash App, and Apple Cash all agreed to Apple’s store guidelines, thereby agreeing to terms preventing each app from supporting decentralized crypto transactions.

Apple asked for the class action lawsuit to be dismissed in February. That request made most of the same points confirmed in the judge’s current dismissal.

Aside from their broader legal arguments, Apple’s defense asserted that the plaintiffs’ claims were factually incorrect, writing:

“There are apps in the App Store that facilitate decentralized [crypto] transactions.”

The defense added that a particular rule, App Store Guideline 3.1.5, requires third-party apps to handle transactions through an approved exchange and “does not apply to, much less categorically prohibit” apps that offer decentralized crypto transactions.

Plaintiffs initially argued that the same section undermines decentralization by requiring the involvement of intermediary exchanges.

Mentioned in this article

Qatar Airways to launch First Class, as airline courts Airbus and Boeing for new planes

Qatar Airways is developing a First Class concept and pursuing aircraft orders from aviation giants Boeing and Airbus, as part of a broader strategic overhaul under new group CEO Badr Mohammed Al Meer.

“This is a new era,” Al Meer told CNBC on Thursday, unveiling changes at the airline that follow a multi-month “war room” review. Formerly the chief operating officer of Qatar’s Hamad International Airport, Al Meer took over from long-time predecessor Akbar Al Baker as Qatar Airways CEO in November and seeks to refresh the airline’s strategy and reset supplier relationships.

Al Meer confirmed to CNBC that Qatar Airways is now developing a high-yielding First Class concept for its cabins.

“We wanted to combine the experience of flying commercial and flying on a private jet and develop something new,” he said. “We are 70% to 80% ready. We are only finalizing colors and small touches, but hopefully we will be able to announce it very soon.”

First Class seating typically offers a more spacious, premium quality and higher cost experience aboard an aircraft. Some airlines have abandoned, reduced or rebranded First Class seats in a bid to maximize aircraft space and offer more economic seating for budget-conscious travelers.

Along with preparing its First Class proposal, Qatar Airways is redesigning its premium “Q-Suite” class of seats, and the latest offering is set to debut at the Farnborough International Airshow in July.

New orders

The Gulf carrier has also submitted a Request for Proposal to Boeing and Airbus for a “big” new aircraft order, Al Meer said.

“We released an RFP to create some competition between both suppliers,” he noted, without disclosing specifics. “We will go through the process, and, with an order this big, we need to take our time.”

Al Meer wants to enhance the service offering and capitalize on momentum following the Qatar World Cup, which helped the airline deliver a record net profit of $1.21 billion in the fiscal year 2022-23, as well as the highest yields and load factors in its history.

“The markets that we want to grow in are China, India, Australia, Japan, Korea, and a few others,” Al Meer said.

He separately flagged that regional demand for flying is high, and passenger numbers had picked up by more than 30% in the last four months, while forecasting growth is likely to “be more settled below 10%-15%,” for the rest of the year.

A Qatar Airways Boeing 777 In New York.

Leslie Josephs | CNBC

The new aircraft order proposal follows a major legal dispute between Qatar Airways and Airbus over safety concerns caused by paint degradation. It also comes amid an ongoing crisis of confidence at Boeing after the Max 9 door blowout in January raised concerns over safety, quality controls and production and delivery delays.

“We are affected when our aircrafts are not being delivered on time,” Al Meer said. “I know Airbus and Boeing have certain problems. We have full trust in both organizations and they’re strong enough to overcome those problems.”

Al Meer noted he expects to receive Qatar’s latest Boeing 777X order by the end of next year, adding he’s “110% confident” Boeing makes safe planes.

Al Meer also said Qatar Airways would halt Al Baker’s plans for a fast “phase-out” of the flagship Airbus A380. Rival Emirates also signaled it would hold onto the airliner, despite Airbus ending its production in 2021.

Next steps

Al Meer has taken steps to address criticism about the airline’s workplace practices, including relaxing a controversial night curfew rule for cabin crew and reversing a long-standing ban on Qatar Airways staff sharing workplace pictures on social media.

“It was very clear that we needed to do some changes there,” Al Meer said. “We want our staff, and we want the airline to be the people’s choice when it comes to working with us.”

The strategy update comes as Qatar Airways faces renewed pressure from rival Gulf carriers, such as Emirates and Etihad, as well as upstarts like Saudi Arabia’s Riyadh Air, which is also buying planes to compete on key routes in the coming years.

“Competition will help us raise the benchmark,” Al Meer said. “The way I see it, the pressure is Riyadh Air… they will have to compete with the best of the best.”

Al Baker played a key role in shaping Qatar Airways into a profitable global airline. He led the carrier through major events including the September 11 attacks, the global financial crisis, the Gulf diplomatic dispute, and the Covid-19 pandemic.

Now, his successor wants to bring the airline into a new era — dubbed “Qatar Airways 2.0” — during which he did not rule out the possibility of an initial public offering.

“We might consider it in the near future,” he said when asked if Qatar Airways could consider going public. He nevertheless stressed the decision would lie with Qatar Airways stakeholders and the Qatari Government.

Here’s How You Can Tell If You’ve Gone From ‘Middle Class’ To ‘Rich’ – It’s About More Than Just Your Bank Account And Salary

Transitioning from the middle class to a wealthier status involves more than just an increase in income; it encompasses a broad range of financial behaviors, assets and mindsets. Key indicators of this transition include diversifying income streams beyond a primary job, such as through rental income; dividends from investments; or side business profits. This diversification strategy is crucial for building wealth and suggests a move toward financial independence.

Investing In Long-term Assets For Financial Growth

Investing in assets like real estate or stocks that consistently contribute to your income signifies a departure from middle-class financial limitations. The reduction or absence of debt, coupled with the growth of assets that generate passive income, marks a significant step towards accumulating wealth. This transition is often evidenced by a substantial increase in net worth, sometimes reaching into the millions, as these assets grow over time.

Don’t Miss:

Net Worth As A Benchmark For Wealth

A net worth exceeding $2 million is frequently cited as a threshold for wealth, though this figure can vary based on individual circumstances and lifestyle choices. True wealth encompasses more than just a high income or substantial net worth; it includes financial freedom and the capacity to maintain a desired standard of living without compromising financial security.

Embracing Passive Income

Shifting towards passive income is a critical step for those moving from the middle class towards greater wealth. It involves creating income sources that do not require active daily effort, such as rental properties, dividends from investments or earnings from a business that does not demand constant hands-on management.

This strategy is not merely about augmenting your income; it’s a fundamental change in how you generate wealth, indicating a move towards financial independence. Passive income allows for the accumulation of wealth over time, offering a buffer that can lead to a more secure financial future and is indicative of a strategic approach to achieving long-term financial goals.

Entrepreneurship And The Creation of Wealth

Creating a successful business or venture that consistently generates income is a clear indication of moving towards greater wealth. This success is usually supported by consistent growth in savings and investments, underscoring the importance of a solid financial foundation and the strategic accumulation of wealth.

—

Trending: Can you guess how many Americans successfully retire with $1,000,000 saved? The percentage may shock you.

—

The Role Of Professional Support In Wealth Management

Having a team of financial advisers, accountants and legal advisors is crucial for those transitioning from the middle class to richer statuses. These professionals provide strategies to optimize investments and minimize tax liabilities, facilitating greater wealth accumulation and offering guidance on navigating the complexities of financial growth.

Lifestyle And Mindset Shifts: Indicators Of Wealth

A significant change in lifestyle and mindset towards prioritizing financial success, viewing money and time from a different perspective and the ability to enjoy leisure without financial concern are hallmarks of this transition. Such shifts reflect a deeper, strategic approach to wealth management, focusing on long-term security over immediate gains.

Leveraging Tax-Efficient Strategies And Investments

Understanding and employing tax-efficient strategies, along with investments in additional real estate beyond a primary residence, showcase financial sophistication. Entrepreneurial initiatives and the creation of multiple income streams further signal a proactive approach to wealth building, demonstrating a comprehensive shift in managing and sustaining wealth.

Meeting Your Personal Goals

The journey from middle class to a wealth is marked by a series of strategic decisions and changes in financial behavior, asset management and mindset. This transition reflects not just an improvement in financial standing but a fundamental shift in the approach to accumulating and managing wealth, emphasizing the importance of diversification, investment and strategic planning in achieving financial independence and security.

Even if you’re not yet rich by societal standards, consulting with a financial adviser can be an important step in reaching your own personal financial goals. A financial adviser can provide tailored advice that aligns with your unique circumstances, aspirations and risk tolerance. Whether it’s building an emergency fund, planning for retirement, investing in the stock market or saving for a home, a financial adviser can help you navigate the complexities of financial planning, ensuring you’re on the right path to achieving your personal version of financial success.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article Here’s How You Can Tell If You’ve Gone From ‘Middle Class’ To ‘Rich’ – It’s About More Than Just Your Bank Account And Salary originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vanguard decided not to offer clients access to Bitcoin ETFs because the flagship cryptocurrency is an “immature asset class” that does not align with its company philosophy, according to the firm’s executives.

Vanguard Global Head of ETF Capital Markets and Broker and Index Relations Janel Jackson made the statement during a QA session, where she clarified the investment firm’s stance on Bitcoin and digital assets.

According to Jackson:

“While crypto has been classified as a commodity, it’s an immature asset class that has little history, no inherent economic value, no cash flow, and can create havoc within a portfolio.”

No plans for Bitcoin ETF

Jackson said that Vanguard would not launch a Bitcoin ETF or any crypto-related products, considering the current state of cryptocurrencies as an asset class.

She highlighted that the decision-making process for introducing new investment products at Vanguard is rigorous and prioritizes long-term investment merit and client needs. Despite the growing discourse around Bitcoin and cryptocurrencies, Vanguard does not view them as suitable for inclusion in long-term investment portfolios.

Meanwhile, the company’s Head of Brokerage & Investments, Andrew Kadjeski, emphasized that Vanguard’s investor base primarily consists of long-term, buy-and-hold investors, and the firm’s offerings reflect these clients’ interests.

He added that despite the ease of allowing full access to crypto products, such a move would not align with Vanguard’s mission to serve the best long-term interests of its investor-owners.

Both Jackson and Kadjeski reflected on Vanguard’s history of forgoing short-term trends for long-term stability. Vanguard had steered clear of internet funds in the 1990s and more recently removed access to leveraged and inverse funds and ETFs in 2019 and over-the-counter stocks in 2022 due to their high risk and potential for misuse.

Backlash

Vanguard’s stance toward Bitcoin ETFs has sparked significant reactions in the investment community. The firm’s stance, focused on traditional asset classes like equities, bonds, and cash, has led to frustration among some of its clients, particularly those who advocate for including cryptocurrencies in investment portfolios.

Industry experts have suggested that Vanguard might lose credibility and assets due to its stance on Bitcoin ETFs, as it appears to be a move contrary to the current market trend where many investors are seeking exposure to digital assets.

Notably, other major players in the asset management space, like BlackRock, have embraced Bitcoin ETFs, highlighting a divergence in strategies within the industry.

Despite Vanguard’s resistance to Bitcoin ETFs, some analysts believe the company might eventually soften its stance. The growing popularity of digital assets and pressure from competitors could be influential factors in such a potential shift.

However, Vanguard remains committed to its traditional investment approach, focusing on asset classes that it considers foundational for long-term investment success.

Berkshire Class B Stock Is a Relative Bargain as Spread to A Stock Widens

Berkshire Hathaway’s Class A stock is trading at a wider-than-usual 2.5% premium to the company’s Class B stock after moving more than a half percentage point Monday.

Continue reading this article with a Barron’s subscription.

Bitcoin Has Been In A Class Of Its Own For The Last 10 Years, Expert Says

Bitcoin vs. Gold: The Digital Currency’s Journey to $40,000

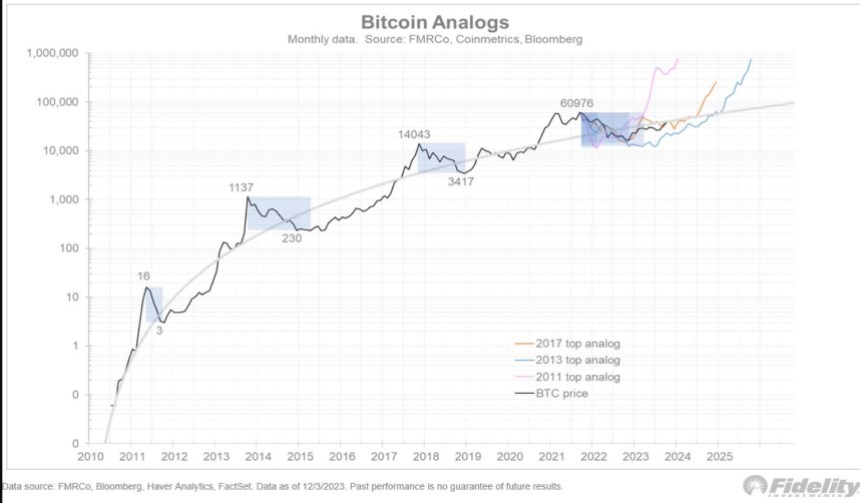

His thesis suggests that Bitcoin, much like its elder counterpart, gold, holds value in times of structural inflation, yet it boasts an added venture twist. In that sense, Timmer believes both assets are prime to capture attention from investors looking to protect themselves from “reckless monetary inflation.”

As seen in the chart below, if Bitcoin follows a similar trajectory to the previous, its price could target $100,000 and $1,000,000 by early 2025.

2020 was pivotal for Bitcoin and gold, with fiscal and monetary stimulus bolstering their appeal. However, Bitcoin differentiates itself with its capped supply of 21 million coins, contrasting gold’s continual but modest annual supply growth.

This limited supply has propelled Bitcoin’s “stock-to-flow” (S2F) ratio significantly higher than gold’s. Moreover, Bitcoin’s journey reflects the classic S-curve path of technological innovations. Its exponential growth trajectory mirrors historical trends in technology from railroads to cell phones.

However, predicting Bitcoin’s future based on these S-curves is complex, as slight deviations in these growth phases can “dramatically” alter outcomes, the expert claims.

SEC Deliberations And Institutional Interest Shape Bitcoin’s Future

Timmer’s observations include a potential impact of the SEC’s anticipated decisions on the Bitcoin spot Exchange Traded Fund (ETF). He theorizes that pending product applications could attract new investors, yet he remains cautious about whether this will trigger a “sell-the-news” event and a large drawdown.

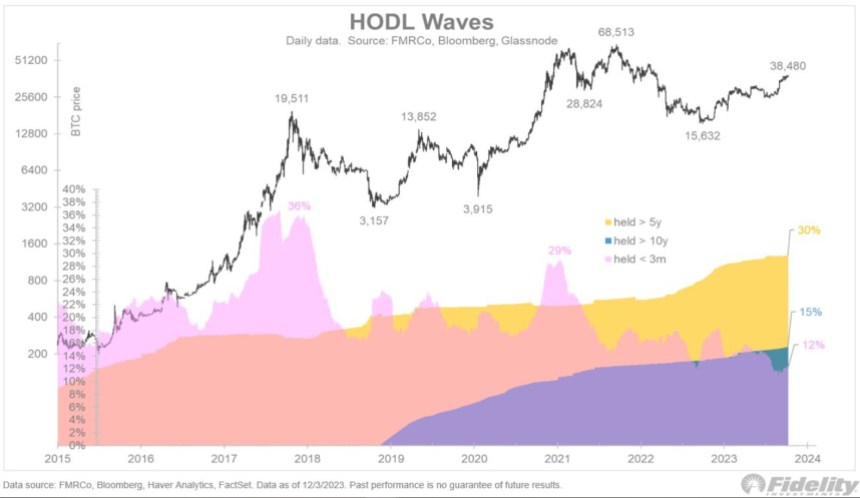

Interestingly, a small percentage of Bitcoin is held for under three months, suggesting that the recent price surge is not merely “speculative,” offering support for a longer bullish trend.

The true believers in Bitcoin, as indicated by the growing percentage held for over five or ten years, are unlikely to be swayed by short-term news. However, there is notable activity in the Bitcoin futures market, particularly among asset managers, which could suggest anticipation of the SEC movement.

Any updates from the SEC would arrive in a transformed macroeconomic environment. Unlike the liquidity-rich period of 2020-21, the US Federal Reserve’s (Fed) recent policy shifts have reversed the surge in monetary inflation.

This shift aligns the current situation more with the post-World War II era than the inflationary 1970s, impacting the urgency of the value proposition for gold and Bitcoin.

As BTC matures, its relationship with traditional financial markets and global economic trends becomes increasingly intricate. With the SEC’s decision and a shift in the macro-arena, the coming months are poised to exercise influence over the premier cryptocurrency and the nascent sector.

Cover image from Unsplash, chart from Tradingview

Elon Musk’s Lawyer Files Second Motion To Dismiss Dogecoin Class Action Lawsuit

In a continued legal battle over a class action lawsuit alleging Dogecoin insider trading, attorney Alex Shapiro, representing Tesla CEO Elon Musk, has once again requested the dismissal of the case.

This motion marks the second attempt by Musk’s legal team to put an end to the ongoing litigation, and as the legal battle escalates, drawing attention to the intricate interplay between cryptocurrency, high-profile figures, and legal accountability.

Strategic Move Amid Escalating Battle

The decision to file a second motion for dismissal underscores the determination of Elon Musk’s legal team to swiftly put an end to the protracted litigation. The lawsuit was initiated by a group of Dogecoin investors who claim Musk orchestrated market manipulation and insider trading to inflate the value of the popular meme cryptocurrency.

Attorney Alex Shapiro’s response to the investors’ complaint was sharp and pointed. He framed the latest filing as an example of lawyers overstepping their boundaries and utilizing aggressive litigation tactics. So in the filing, he moved a motion to disqualify sanctions.

In one of his statements, Shapiro stated ” Enough is enough” as the case has been a long-standing one. Musk’s legal team also emphasized the legality of his crypto-related statements, while the case has delved into the nebulous realm of social media influence in financial markets.

Evan Spencer, the lead attorney for the class action lawsuit, has relentlessly pursued Musk and the allegations against him. Spencer has now made a total of three amendments to the lawsuit since its initial filing in June of the previous year, seeking a staggering $258 billion in damages for investors claiming to have been defrauded by the Tesla CEO with his Dogecoin Pyramid Schemes.

DOGE price trading 90% lower than its all-time high price | Source: DOGEUSD on Tradingview.com

Musk’s Relationship With Dogecoin

Dogecoin was designed originally in 2013 as a joke to tease Bitcoin but went from a “meme” to a substantial valuable asset in the cryptocurrency space during 2020 and 2021 especially.

Most of the meme coin’s growth was driven by billionaire Elon Musk, who actively promoted the altcoin to his over 100 million Twitter (Now X) followers at the time.

His initial tweet in April 2019, playfully endorsing Dogecoin as a potential favorite cryptocurrency, ignited a chain reaction that saw subsequent tweets by Musk triggering substantial price fluctuations.

“Dogecoin might be my fav cryptocurrency. It’s pretty cool” Musk tweeted at the time. Musk’s many tweets following this would continuously push DOGE’s price high, reaching as high as $0.7 before the bear market hit.

Since then, DOGE’s price has fallen over 90%, and the class action lawsuit emerged as a result of investors who believed they had fallen victim to a pyramid scheme after buying for high prices.

The elongated legal struggle holds significant implications for the cryptocurrency community and the broader financial world. With Musk’s legal team emphasizing the dismissal of the lawsuit, the outcome could set a precedent for legal battles involving influential figures in the cryptocurrency domain.

Musk appears to be unmoved as he promotes his newly acquired innovation, Twitter, now rebranded as X.

Featured image from Bitcoinist, chart from Tradingview.com

A class action complaint, recently filed on Aug. 7, implicates several venture capital firms, painting a grim picture of alleged gross financial mismanagement and deceptive practices.

The plaintiffs, representing a class of impacted investors, allege that the group assured customers that their assets belonged solely to them and would not be transferred to FTX.

Multinational VCs implicated

The litigation implicates multinational venture capital defendants, including SoftBank, Sino Global Capital, Temasek, SkyBridge, Multicoin, and others, for their alleged complicity in the fraud.

These firms purportedly had access to non-public information through their due diligence processes, which included investments of hundreds of millions of dollars from FTX Group into some of the firms’ own funds or partnerships.

The complaint underlines the direct correlation between the alleged fraud and the involvement of the multinational VC defendants, stating that they were instrumental in its occurrence and alleging that the fraud would not have occurred without the multinational VC defendants.

While these defendants are said to have profited from the inappropriate use of customer assets, the plaintiffs’ assets remain missing or inaccessible due to FTX bankruptcy proceedings.

The plaintiffs seek a wide range of reliefs from the court, including class certification, compensatory damages, and restitution.

Alongside this, they demand declaratory and injunctive relief to declare the practices of the multinational VC defendants unlawful, to prevent them from continuing these activities, and to rectify the situation under court supervision.

Defendant countersuits and financial struggles

Amid these allegations, defendant Sino Global Capital recently clarified its position regarding its role in the FTX bankruptcy proceedings. The firm, via a post on X, stated that it had filed a bankruptcy claim of $67M against FTX.

The claim pertains to FTX’s stake in the SGC fund. Sino Global Capital emphasized that FTX’s estate is selling investment fund LP stakes at auction. The firm further clarified that this action would not reduce the pool of money available to creditors, contradicting implications from some media reports.

Meanwhile, SoftBank, another defendant in the class action, reported a surprising net loss on Aug. 7 attributable to owners of the parent amounting to $3.3 billion, a figure considerably below a Refinitv analyst’s estimate that anticipated a $523 million profit.

However, despite the net loss, SoftBank’s technology-focused Vision Fund reported an investment gain of $1.1 billion, marking its first gain after five consecutive quarters. The growth signifies a potential turnaround for Masayoshi Son’s beleaguered Vision Fund, which has witnessed losses in the billions due to unsuccessful tech bets in a high-interest rate environment in the past year or so.

The news comes on the same day that a further class action was filed against former FTX lawyers asserting their role in the FTX’s alleged crimes.

I’m seeing middle class homebuyers take on $7,000 mortgages thinking they can ‘always refinance when rates come down in the future’

In December 2021, when the 30-year fixed mortgage rate still averaged 3.1%, a borrower could get $700,000 mortgage that required monthly payments of principal and interest of just $2,989.

Fast-forward to Wednesday, and a $700,000 mortgage taken out at the current average mortgage rate of 6.90% would equal a $4,610 per month payment, which is $583,000 more over 30 years than that mortgage issued at a 3.1% rate. When adding on insurance and taxes, that monthly payment could easily top $6,000. Not to mention, that calculation doesn’t account for the fact that U.S. home prices in June 2022 were 12% above December 2021 levels and 39% above June 2020 levels.

Mortgage planners like John Downs, a senior vice president at Vellum Mortgage, have the hard job of breaking this new reality to would-be homebuyers. However, unlike last year, Downs says most 2023 buyers aren’t surprised. The sticker shock, the loan officer says, is wearing off.

Just before speaking with Fortune, Downs wrapped up a call with a middle-class couple in the Washington D.C. area, who told him they were expecting a mortgage payment of around $7,000.

“The call I just had was a typical area household. One person makes $150,000, the other makes $120,000. So $270,000 total and they said a payment goal of $7,000. I’m still not used to hearing people say that out loud,” Downs says.

Even before these borrowers speak to Downs—who operates in the greater Baltimore and Washington D.C. markets—they’ve already concluded that these high mortgage payments will be “short-lived,” and they’ll simply refinance to a lower payment once mortgage rates, presumably, come down.

To better understand how homebuyers are reacting to deteriorated housing affordability (and scare inventory levels), Fortune interviewed Downs.

This conversation has been edited and condensed for clarity.

Fortune: Over the past year, mortgage rates have spiked from 3% to over 6%. How are buyers in your market reacting to those increased borrowing costs?

John Downs: I must say, the reaction today is quite different from last year. It’s almost as if we have lived through the “7 stages of grief.” We appear to have entered the “acceptance and hope” phase.

With all the reports pointing to home prices stabilizing, one might think that buyers are comfortable with these rates and corresponding mortgage payments. The reality is quite different. Many would-be homebuyers have been pushed out of the market due to affordability challenges through loan qualifications or personal budget restraints. Move-up buyers also find themselves in the same predicament.

As a result, my market (Baltimore-DC Metro Region) has 73% fewer available homes for sale than pre-pandemic, 57% fewer weekly contracts, and an 8% increase in properties being relisted. (Information per Altos Research) As a result, prices have remained relatively stable due to the balance of buyers outweighing sellers.

I’m seeing buyers today taking the payments in stride for various reasons. Their incomes have risen dramatically, upwards of 25-30% since 2020, and the income tax savings through the mortgage interest deduction is now a meaningful budget item to consider. Many also say, “I can always refinance when rates come down in the future,” which leads to a sense that this high payment will be short-lived.

When I say buyers are comfortable with these payments, I know there are also two to three times more buyers who run payments using online calculators who opt out of having conversations in the first place! To prove this, our pre-approval credit pulls (a measure of top-of-funnel buyer activity) are running about 50% lower than pre-pandemic.

Among the borrowers you’re working with, how high are monthly payments getting? And how do they react when you give them the number?

For the better part of the last decade, most of my clients would enter a pre-approval conversation with a mortgage payment limit of no more than $3,000 for a condo and $4,500 for single-family homes. It was rare to see numbers higher than that, even for my higher-income wage earners. Today, those numbers are $4,000 to $6,500 respectively.

To my earlier comment, active buyers today seem to expect it. It’s as if they are comfortable with this new normal. Surprisingly, the debt-to-income ratios of today (in my market) are very similar to where they were five years ago. Income is ultimately the great equalizer. Yes, the payments are dramatically higher today, but the buyers’ residual income (post-tax income minus debt) is still in a healthy range due to local wages.

Remember, we are still talking about a much smaller pool of buyers in the market today so this conversation is skewed towards those with more fortunate lifestyles.

Tell us a little bit more about what you saw in the second half of 2022 in your local housing market, and how that compares to the first half of 2023?

There are dramatic differences between those two periods. In the second half of 2022, there was nothing but fear. The stock market was under stress, inflation was running wild, and housing began to stall. Across the country, inventory began to rise, days-on-market pushed dramatically higher, and price decreases were rampant. The safest bet then was to do nothing, and that’s just what buyers did. The mindset was, “I will wait until prices fall and rates push lower before I buy.”

The start of 2023 sparked a reversal in many asset classes. The stock market found a footing and pushed higher, mortgage rates rebalanced, property sellers adjusted their prices, and employers began pushing out significant wage increases. As a result, housing stabilized, and in some areas, aggressive contracts with multiple offers, price escalations, and contingency waivers became the norm.

The strength in housing was not as universal as it was in 2021. There were very hot and cold segments, depending on location and price point. The affordable sector (<$750,000 in my market) and higher-end (>$1.25 million) seemed to perform very well with heightened competition. The mid-range segment is where we noticed some struggles. One common theme is that buyers at every price point seem much more sensitive to the property’s condition. When the housing payments are this elevated, it doesn’t take much for the buyers to walk away!

What do you make of the so-called “lock-in effect”— the idea that existing market churn will be constrained as folks refuse to give up those 2-handle and 3-handle mortgage rates?

I believe the “lock-in effect” is very real. My opinion is based on countless conversations I’ve had in the past 6-9 months with homeowners who want to move but can’t. Some cannot afford to buy their current home at today’s value and rate structure. Others just cannot stomach the significant jump in payment to justify the increase in home size or the preferred location.

I believe the reason we are seeing struggles in the mid-range home is that the traditional move-up buyer is stuck. In my market, that would be the person who sells the $700,000 home to purchase at $1 million. They currently have a PITI housing payment of $2,750; the new payment would be $6,000 rolling their equity as a down payment. That jump is too much for most, especially those with a median income. That payment would have been $4,500 a couple of years ago, which was much more manageable.

Based on what you’re seeing now, do you have any predictions on what the second half of 2023 might look like? And any thoughts on the spring of 2024?

Despite high rates, the desire to buy a home is still high for many. Given the lag effects of Fed tightening (raising interest rates) coupled with an overall improvement in inflation, one can assume mortgage rates have topped out and will continue to improve from here. Think of playing with a yo-yo on a down escalator, up-and-down movement but generally pushing lower. As rates improve, affordability and confidence will shift, bringing out more buyers and sellers.

I believe this will be supportive for home values and give buyers more choice as inventory increases. Keep in mind, most sellers become buyers, so the net impact on inventory will be negligible. Knowing that some sellers will keep their current home as a rental, one could argue that inventory will worsen. At least buyers will have more house options each week, a stark difference from today.

When discussing strength in housing, thinking through local dynamics is crucial. The DC Metro area has a diverse, stable job market which I do not see reversing if an economic slowdown occurs. We didn’t have a tremendous push towards short-term rentals as many other areas and the “work-from-home” (WFH) environment had most people stay within commuting distance to the cities.

One thing I expect is an unwinding of WFH in 2024. In fact, I’m already experiencing that. Many clients are being called back to the office, either through employer demands or fear they will be exposed to corporate downsizing efforts. As a result, I expect underperforming assets (D.C. condos and single-family rentals in transitional areas of the city) to catch a bid while single-family rentals in the commuting neighborhoods plateau from their record-setting appreciation over the past few years.

Housing market affordability (or better put the lack thereof) is at levels unseen since the peak of the housing bubble. Do you have any advice on how would-be buyers can ease that burden?

This may be the most complex question because everyone is at a different place in life. For the better part of the last 20 years, my consultation calls were 20 to 30 minutes long, and we could formulate a great plan. Today, that pushes over an hour and usually requires a detailed follow-up call. If I had to sum up all my conversations, I would say it comes down to forecasting life and patience.

Forecasting is a process where you map out life over the next two to three years—discussing job stability, income projections, saving and investment patterns, debts rolling off (or being added), kids, schools, tuition, etc. From there, talking about local market dynamics such as housing supply, population growth, and interest rate cycles and projections. This helps formulate a solid budget to use for a home purchase.

Patience can mean several things. For some, it means renting for a period of time to save more money or ride out periods of uncertainty. For others, it could be looking for the right sale price mix and seller concessions for rate buy-downs, closing costs, etc. Sometimes it means being patient with your desired location. Maybe you just can’t have that specific house in that specific area for a few years and settling for the next best location is good enough for now. Housing used to be a stepping stone for many but the low-rate environment of the past few years allowed everyone to get what they wanted right away. We seem to have lost the art of having patience in life.

This story was originally featured on Fortune.com

More from Fortune:

5 side hustles where you may earn over $20,000 per year—all while working from home

Looking to make extra cash? This CD has a 5.15% APY right now

Buying a house? Here’s how much to save

This is how much money you need to earn annually to comfortably buy a $600,000 home