Customer interest seems healthy and new products could soon start to contribute financially, according to a new bull.

Source link

Climb

Bitcoin’s Swift Climb Triggers Soaring Premium in South Korea During Worldwide Rally

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

On Wednesday, bitcoin’s value ascended past the $60K threshold, peaking at a 24-hour high of $61,389 by 10:45 a.m. (ET). Concurrently, South Korea observed a pronounced premium over the international exchange rate, with local platforms such as Upbit and Bithumb displaying prices that are $2,251 higher. In a Worldwide Bitcoin Frenzy, South Korea and 30+ […]

Source link

Quick Take

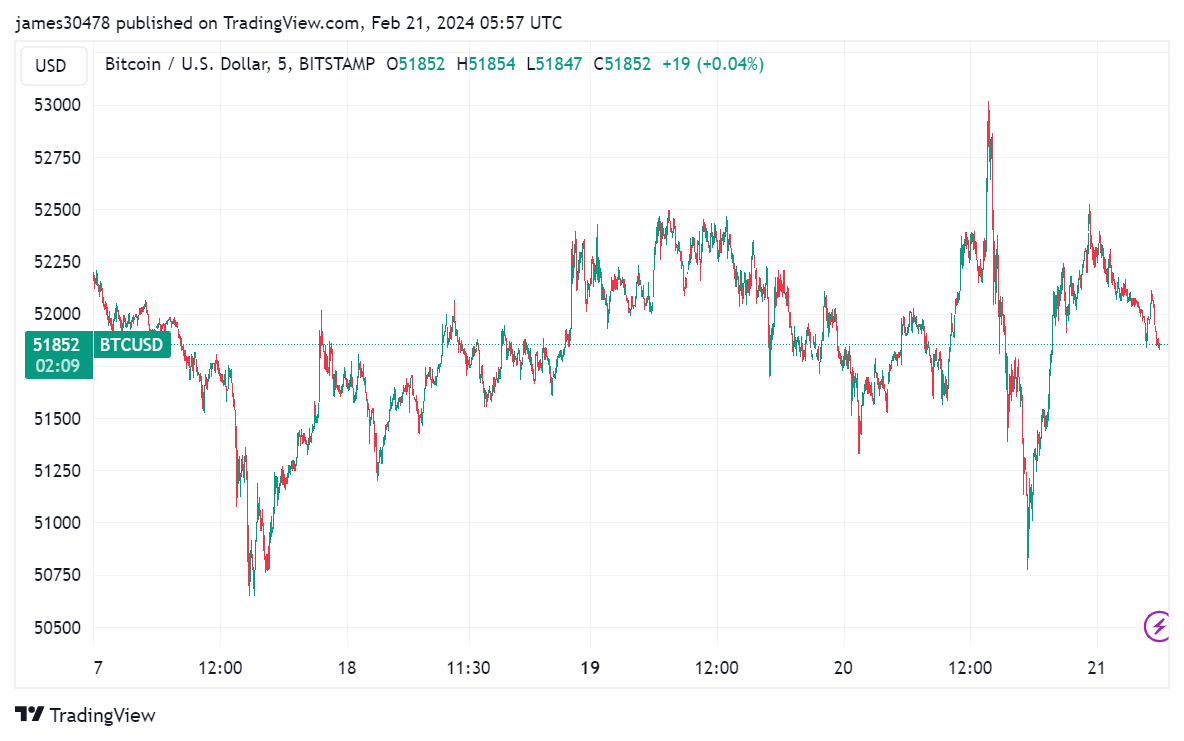

On Feb. 20, just before the US market opened, Bitcoin reached a yearly peak of $53,000, only to retreat into the $50k-$52k range shortly thereafter.

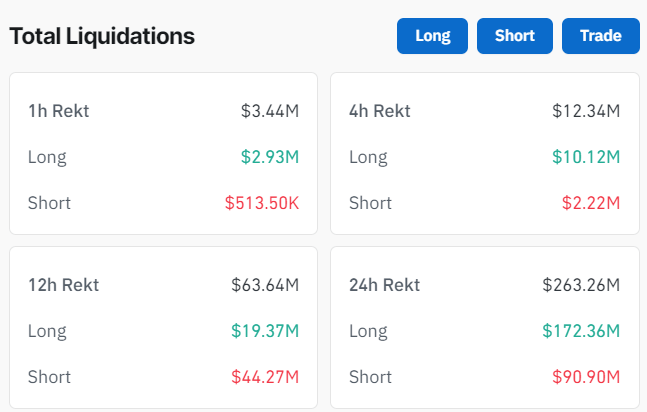

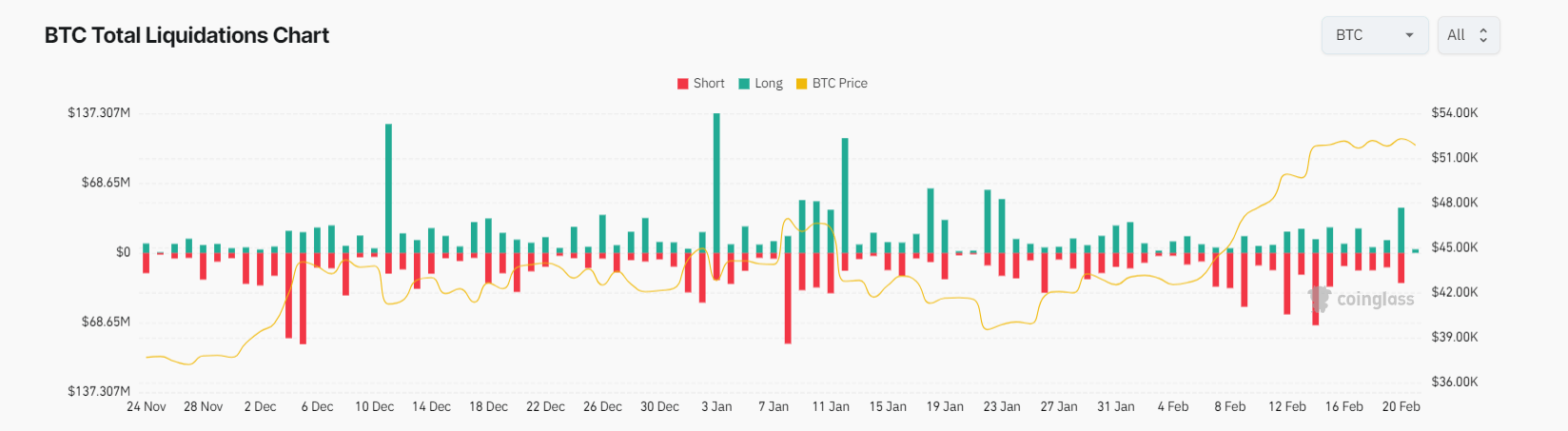

CryptoSlate reports indicate that approximately $1 billion worth of market liquidations were concentrated around Bitcoin’s $53,000 mark. Interestingly, during its short-lived surge to this value, Bitcoin experienced an estimated $70 million worth of these liquidations. While some of these liquidations happened during the rise, the majority are still impending.

In the broader digital asset market, Coinglass reported that the past 24 hours have seen an estimated $260 million in liquidations, with approximately $170 million from longs and $90 million from shorts. Bitcoin bore the brunt of these liquidations, accounting for around $70 million. While, Binance saw the majority of the liquidations from an exchange at approximately $117 million.

Out of Bitcoin’s $70 million liquidation, approximately $40 million was derived from long positions. This accounts for the largest long liquidation since Jan. 23, when Bitcoin was trading around the $40,000 mark.

The post Bitcoin’s climb to a yearly high triggers market shakeup appeared first on CryptoSlate.

Jobless claims climb to nearly 3-month high of 224,000, Layoffs creeping higher?

Developing story. Check back for updates.

The numbers: The number of Americans who applied for unemployment benefits at the end of January rose to a nearly three-month high of 224,000, possibly a sign of some softening in what’s been an incredibly strong labor market.

Initial jobless claims increased by 9,000 in the seven days ended Jan. 27 from 215,000 in the prior week, based on seasonally adjusted figures.

New jobless claims are starting to become more normal again after the usual fluctuations during the holiday season stretching Thanksgiving until Martin Luther King Jr. Day.

While they still show a surprisingly resilient labor market characterized by low layoffs and low unemployment, new claims appear to have wafted higher in the new year.

Key details: New jobless claims rose in 29 of the 53 states and territories that report these figures to the federal government. The biggest increases were in California, Oregon and New York.

New claims fell slightly in 24 other states.

The number of people collecting unemployment benefits in the U.S., meanwhile, rose by 70,000 to 1.9 million. That’s the highest level since mid-November.

A gradual rise in these so-called continuing claims over the past year is a sign it’s taking longer for people to find new jobs.

Looking at actual or unadjusted figures, initial jobless claims might be even weaker than it appears. They totaled 261,029 last week, compared to 225,026 in the same week a year earlier.

Unadjusted claims bear close watching in the next few weeks to see if they subside again. A spate of companies have announced layoffs in the new year and it remains to be seen how widespread they become.

Big picture: Business are hiring at a slower pace compared to last year, but they have been reluctant to lay off workers because of a tight labor and steadily growing economy.

The labor market could get a boost later in the year if the Federal Reserve cuts interest rates as widely expected.

What is unclear is whether wages would start to rise faster under that scenario and complicate the Fed’s job to fully tame inflation.

Market reaction: The Dow Jones Industrial Average

DJIA

and S&P 500

SPX

were set to rise in Thursday trading.

Crypto Analyst Predicts Cardano Price Will Climb 2,000% To Reach $11

Popular Crypto YouTuber Ben Armstrong has shared his bullish prediction for the Cardano (ADA) price. While giving his prediction, Armstrong also alluded to a recent ADA price prediction that crypto analyst Ali Martinez made.

Armstrong’s Bull Case For Cardano Is $11

In a video posted on his YouTube channel, Ben Armstrong mentioned that his bull case prediction for ADA is $11. However, the crypto YouTuber didn’t share any analysis to back up his bullish sentiment. Instead, he only referred to an earlier ADA analysis that Martinez had shared as part of his prediction of ADA hitting $7.

In his analysis, Martinez highlighted how ADA was currently mirroring its “late 2020 behavior.” He further elaborated on how ADA could hit $7 if history were to repeat itself. According to him, if that were to happen, then ADA would resume an upward trend in April, while a pattern continuation will ultimately lead to the crypto token hitting that price level.

Meanwhile, Armstrong isn’t the only one who believes that the Cardano price could rise to as high as $11. Dan Gambardello, the founder of Crypto Capital Venture, had previously predicted that ADA would hit this price level at the peak of the next bull market. Unlike Armstrong, Gambardello provided deeper insights as to why he holds this belief.

He explained how Cardano has more functionalities now, unlike in the previous bull run. This includes the features that have allowed the DeFi landscape on the network to grow since 2021. The analyst also highlighted similarities between Ethereum and Cardano’s development while hinting that ADA could mirror the run that ETH enjoyed in the last bull run.

ADA Getting Ready For The Next Bull Run

Gambardello, who once hinted that the next bull run was going to begin after the Bitcoin Halving, recently noted in an X (formerly Twitter) post that the bottoming out structure for Cardano was getting reading for this event. He highlighted how ADA cools off prior to the Halving event. According to him, this is “so bullish for ADA” as it possibly prepares for a move to the upside.

In the meantime, he hinted that ADA could experience a 30 to 40% move to the downside as it looks to consolidate with Bitcoin and the broader crypto market. Gambardello had previously mentioned that he wasn’t concerned by ADA’s price action and still wouldn’t be even if ADA were to drop below its current price level.

At the time of writing, ADA is trading at around $0.49, down over 3% in the last 24 hours, according to data from CoinMarketCap.

ADA price struggles at $0.49 | Source: ADAUSD on Tradingview.com

Featured image from The Cryptonomist, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The past week has been a triumphant one for Lido DAO, with its LDO token surging an impressive 22%, leaving a sluggish broader crypto market in its dust. This notable feat mirrors the 18% ascent of Ethereum, its underlying blockchain, showcasing a deep synergy between the leading liquid staking platform and its technological foundation.

But the good news doesn’t stop there. A staggering 87% of Lido DAO token holders are reaping the rewards of their investment, according to data from IntoTheBlock. This solid figure underscores the strong performance of LDO, attributed largely to its stellar weekly performance, as the crypto trading analytics platform noted.

Lido Holders Get Good Returns From Their Investment

Following a strong price move by $LDO this week, ~87% of LDO addresses are now in profit. pic.twitter.com/3rLodKvK21

— IntoTheBlock (@intotheblock) January 10, 2024

Furthermore, Lido’s Total Value Locked (TVL), a crucial metric reflecting the amount of cryptocurrency deposited in its protocol, has also ballooned a remarkable 19% in tandem with the price hike.

Analysts attribute LDO’s ascent to a potent cocktail of factors. First and foremost, its symbiotic relationship with Ethereum. As the leading smart contract platform enjoys renewed momentum, projects built on its infrastructure – like Lido – relish the rising tide that lifts all boats.

Furthermore, Lido’s recent bounce back from a critical support level at $2.80 appears to have ignited a bullish fervor. Technical indicators whisper of a potential retest of the $3.60 resistance barrier, suggesting further upward potential.

Lido TVL. Source: Defillama

Adding fuel to the fire is the skyrocketing demand for Ethereum staking. Lido’s user-friendly model allows investors to earn rewards on their ETH without locking them up for extended periods, a flexibility that resonates deeply with yield-hungry crypto enthusiasts. This, coupled with Lido’s robust platform and proven track record, is attracting new users at a steady pace.

Strong TVL Numbers Put Lido In Contention

The surging TVL is a testament to this burgeoning trust. As more users deposit their ETH on Lido, the total value locked in the protocol increases, further validating its platform and potentially attracting even more participants. This positive feedback loop could propel Lido towards solidifying its position as the premier Ethereum staking solution.

LDO market cap currently at $3.3 billion. Chart: TradingView.com

However, a note of prudent caution remains. Lido’s recent upswing hasn’t been entirely organic. The absence of major platform-specific developments raises questions about the rally’s long-term sustainability. Additionally, a large token sale earlier triggered a temporary dip, highlighting the potential for volatility.

Technical analysis also suggests that breaking the $3.60 resistance is crucial for continued upward momentum. Failure to do so could lead to a pullback, and investors should be prepared for such a scenario.

Ultimately, while Lido DAO is riding a wave of momentum, fueled by its association with Ethereum, its robust platform, and the ever-growing demand for liquid staking solutions, investors should approach with cautious optimism.

Featured image from Freepik

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Can The ADA Price Climb Above $20 In The Bull Market? Analyst Provides Answers

The ADA price has always performed incredibly well in the bull market cycles with price rallies that have put millions of holders in profit in the past.

However, like any other cryptocurrency, it can be hard to pinpoint how high the price will climb in the next bull market. Nevertheless, one crypto analyst is taking the bull by the horns to reveal where they expect the altcoin’s price to reach in the next bull market.

ADA Price Could Rise As High As $24

In an analysis posted to TradingView, crypto analyst masoud_paydarsani outlines how the ADA price could rise to double-digits. First, the analyst points to Cardano’s ADA token being a long-term upward channel on the weekly time frame, albeit a rather slow uptrend.

However, this does not invalidate its bullish tendencies, especially when it comes to ADA repeating its previous bull market cycles. Masoud points to the fact that the past crypto market cycles saw approximately 108 weeks of the bear market before 66 weeks of the bull market, and it is within these 66 weeks that ADA shines.

Source: Tradingview.com

The analyst believes that if the upward channel is validated, then the next ADA bull run could turn out like the rest. Using the previous performances of the altcoin, eg, the run-up in the year 2021, the ADA price could rise to as high as $24 following the same trend. Also, going by historical performance, the crypto analyst reveals that this could happen sometime in the next 66 weeks. So it could lead up to 2025 before this rally is complete.

Being Bullish For ADA Above $20

Interestingly, the expectation for the ADA price to cross the $20 mark is not unique to Masoud alone. Another crypto analyst, @LucidCiC on X (formerly Twitter) also believes that this double-digit level is possible for ADA.

Lucid actually has an even higher price target for the altcoin compared to Masoud. Where Masoud sees the ADA price reaching $24, Lucid’s forecast goes as high as $30. Lucid compares Cardano to the Ethereum network which was able to reach a $500 billion market cap despite going through multiple hurdles. Given this, the analyst believes Cardano will also be able to rise as well while expecting the crypto market cap to cross $10 trillion in a decade.

Cardano is also seeing a good amount of interest from institutional investors. Grayscale Investments, the company behind the largest Bitcoin trust in the world, recently announced new crypto indices featuring ADA in response to this rising interest. If these large investors continue to double down on their investments, this newfound inflow could drive the price to the double-digit mark predicted by the analysts.

ADA recovers above $0.34 | Source: ADAUSD on Tradingview.com

Featured image from VOI, chart from Tradingview.com

Bitcoin’s surge past $35,000 on the 24th and 25th of October took the crypto world by surprise, as it indicated what might be the beginning of a new bullish sentiment. Trading volumes for the world’s largest cryptocurrency hit their highest levels since March, showing that interest in Bitcoin is booming once more.

The entire crypto market saw an inflow of funds during the week, leading to a surge in market cap. Data from CoinGecko shows that the entire market cap increased from $1.184 trillion on Sunday, October 22, to $1.312 trillion on Wednesday, October 25. Most of this inflow went into Bitcoin, which saw its share of the cryptocurrency market increase from 49.58% to 51.47 % during this same time period.

Chart From CoinGecko

Daily Crypto Exchange Volumes Reach 8-Month High

The recent boom in Bitcoin and cryptocurrency prices pushed Bitcoin daily trading volumes on crypto exchanges to their highest level since March. According to The Block’s data dashboard, the seven-day moving average for spot exchange volumes across multiple exchanges hit $24.12 billion on Thursday and $23.98 billion on Friday, respectively. In comparison, Bitcoin trading volume on exchanges was at $11.02 billion on the first day of the month.

Chart from The Block

A similar metric from IntoTheBlock shows Bitcoin transactions reaching 1.4 million BTC as bulls looked to push Bitcoin to $35,000.

Chart from IntoTheBlock

Trading volumes are an important metric because higher volumes suggest greater interest and activity in a market. It means more people are actively buying and selling, leading to more liquidity and volatility.

Whale activity also increased during this time period, as indicated by on-chain trackers. Whale transaction tracker Whale Alerts has shown various BTC transactions amounting to millions of dollars to and from crypto exchanges.

🚨 🚨 🚨 2,000 #BTC (68,255,228 USD) transferred from #Coinbase to unknown wallet

— Whale Alert (@whale_alert) October 26, 2023

🚨 🚨 🚨 2,000 #BTC (68,560,116 USD) transferred from unknown wallet to #Coinbase

BTCUSD trading at $34,187 on the weekend chart: TradingView.com

— Whale Alert (@whale_alert) October 26, 2023

🚨 🚨 🚨 1,499 #BTC (51,276,429 USD) transferred from #Binance to #Coinbene

— Whale Alert (@whale_alert) October 27, 2023

What’s Next? More Bitcoin Movement?

Bitcoin has since formed a resistance level around $35,000 and is now trading in a range. At the time of writing, Bitcoin is trading at $34,150, still up by 14.47% in a 7-day timeframe. While price action seems to be moving sideways at the moment, there are still hopes of continued momentum from the bulls to push BTC past $35,000 in the new week.

Matt Hougan, CEO of crypto index fund manager Bitwise, has hinted at a further inflow of money into Bitcoin. Hougan makes this prediction on spot Bitcoin ETFs to project an inflow of around $50 billion within the first five years of its launch. Others like crypto financial services platform Matrixport have made more optimistic claims.

Data from analytics platform mempool.space has shown a sustained increase in activity on the BTC network. If bulls continue to maintain a strong push, we could see Bitcoin reach as high as $45,000 in the early days of November.

Featured image from Shutterstock

These 2 $1 Trillion Stocks Could Still Climb More Than 40%, According to Wall Street

Almost Half of Warren Buffett’s $337 Billion Portfolio Is Invested in Only 1 Stock

This Forecasting Tool Hasn’t Been Wrong Since the 1960s, and It Offers a Very Clear Picture of What’s Next for Stocks

Cathie Wood’s Ark Invest Is Selling Tesla and Nvidia, and Buying 1 Little-Known Artificial Intelligence (AI) Growth Stock

1 Stock-Split AI Growth Stock to Buy Now Before It Soars 860%, According to Cathie Wood’s Ark Invest

The recent drop in the price of Cardano (ADA) has raised concerns among investors as it breached the combined support of $0.3 and a crucial support trendline. However, a closer analysis of the daily chart reveals a twist that might offer a glimmer of hope for the cryptocurrency’s recovery.

Technical analysis of Cardano’s price movement suggests that the apparent breakdown from the rising support trendline might be a fake one.

A fake breakdown, also known as a false breakdown or a bear trap, occurs when a price temporarily drops below a support level or trendline but quickly rebounds, trapping bearish traders who sold during the dip.

This deceptive move often leads to a rapid reversal and upward momentum.

Cardano: Fake Breakdown Or True Bearish Signal?

On the flip side, a decisive breakout from the overhead trendline could set the stage for a substantial 26% upswing in Cardano’s price, as per recent price analysis. This would not only mark a significant price recovery but also instill renewed optimism among traders and investors.

Providing insights into the current market dynamics, it’s important to acknowledge the broader context surrounding Cardano’s performance.

Despite the recent price turmoil, Cardano has demonstrated remarkable growth in terms of its total value locked (TVL). Crypto analytics firm Messari’s latest report reveals that Cardano’s TVL has surged by nearly 200% since the start of the year.

Quarter-over-quarter (QoQ), the TVL increased by 9.7%, and year-to-date (YTD), it soared by an impressive 198.6%.

This surge in TVL propelled Cardano from the 34th to the 21st position in terms of overall TVL among all blockchain networks. This remarkable feat underscores the growing adoption and utility of Cardano’s ecosystem.

Setback Due To Regulatory Pressure

However, the journey to this achievement has not been without its challenges. The report points out that Cardano’s TVL experienced a dip in June, triggered by regulatory turbulence.

The US Securities and Exchange Commission (SEC) charged cryptocurrency exchange Coinbase for allegedly offering unregistered securities, with ADA being specifically mentioned in the lawsuit. This development led to a sell-off of ADA and resulted in liquidations on Cardano-based decentralized finance (DeFi) platforms.

ADA market cap currently at $10.4 billion in today's chart: TradingView.com

As of the latest data from CoinGecko, Cardano is currently trading at $0.299138. While the cryptocurrency has seen a 3.1% rally in the past 24 hours, it has also endured a 3.8% slump over the last seven days.

Cardano’s recent price movement may appear bearish due to a seemingly significant breakdown from key supports. However, a careful analysis suggests the possibility of a fake breakdown, providing some ounce of optimism for a potential recovery. Amidst challenges, Cardano’s impressive TVL growth reflects its resilience and adoption within the crypto ecosystem.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Flickr