An index tracking the strength of the U.S. dollar against a basket of rivals touched its highest level since mid-November on Tuesday, adding to the headwinds facing U.S. stocks.

Source link

Climbs

The ever-vibrant Shiba Inu community is thriving once more as SHIB gains widespread recognition surpassing top cryptocurrency assets in the market to become the second most sought-after digital asset in the entire European continent, securing its stance in the crypto landscape.

Shiba Inu Takes Europe By Storm

XRP enthusiast and market expert Marcel Knobloch, also known as Collin Brown, reported the coin’s latest milestone on X. According to Brown, Shiba Inu has seen significant growth in its long-term investor base, taking Europe by storm by becoming the second most search crypto in the continent.

Brown noted that the milestone is reminiscent of the peak of 2021, having rallied a startling 300% in just 8 days. SHIB’s interest is not limited to Europe, and it has taken the top spot on search charts all the way from Italy to Nigeria.

As a result of the development, WazirX’s poll has crowned SHIB the king of meme cryptos. Thus, Collin Brown has urged the cryptocurrency space to watch out for Shiba Inu, noting that the Shiba pack is at the forefront of the race.

The rankings were determined following a comprehensive analysis of Google Trends data in the past 1 year in order to ascertain the cryptocurrency that, based on searches, each nation in Europe desires to invest in. After gathering collective data, the findings showed a noteworthy pattern that indicated changes in people’s interest in the crypto market.

Shiba Inu went past notable coins like Ethereum (ETH) – the second largest crypto asset, Cardano (ADA), and Dogecoin (DOGE) – the largest meme coin, securing the top pick in about 7 European countries. These include Russia, France, Italy, the United Kingdom, and among others.

Meanwhile, Bitcoin (BTC) – the largest crypto asset remains the most searched coin in the continent acquiring top choice in about 21 European nations, such as Poland, Germany, Belgium, Romania, etc.

Latest Milestone Buttresses SHIB’s Price

SHIB’s recent achievement displays a constant rise in its interest, reflecting the trust of its community members around the world. In addition to bolstering SHIB’s standing, this ranking indicates that European investors are considering adopting the token even more.

Following the project’s landmark, the Ethereum-based memecoin has managed to secure gains of over 18% in the past week. SHIB has experienced a rebound to the $0.000030 threshold, after falling as low as $0.000025 during the start of the week. With the memecoin market demonstrating momentum presently, SHIB might be poised for more significant gains in the coming months.

Consequently, SHIB’s rise to the aforementioned price has taken advantage of the market’s general recovery and its seven-day upswing. As of the time of writing, Shiba Inu was trading at $0.0000305, indicating a decline of 1% in the past day. Meanwhile, its trading volume and market cap have decreased by over 1% and 16%, respectively.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

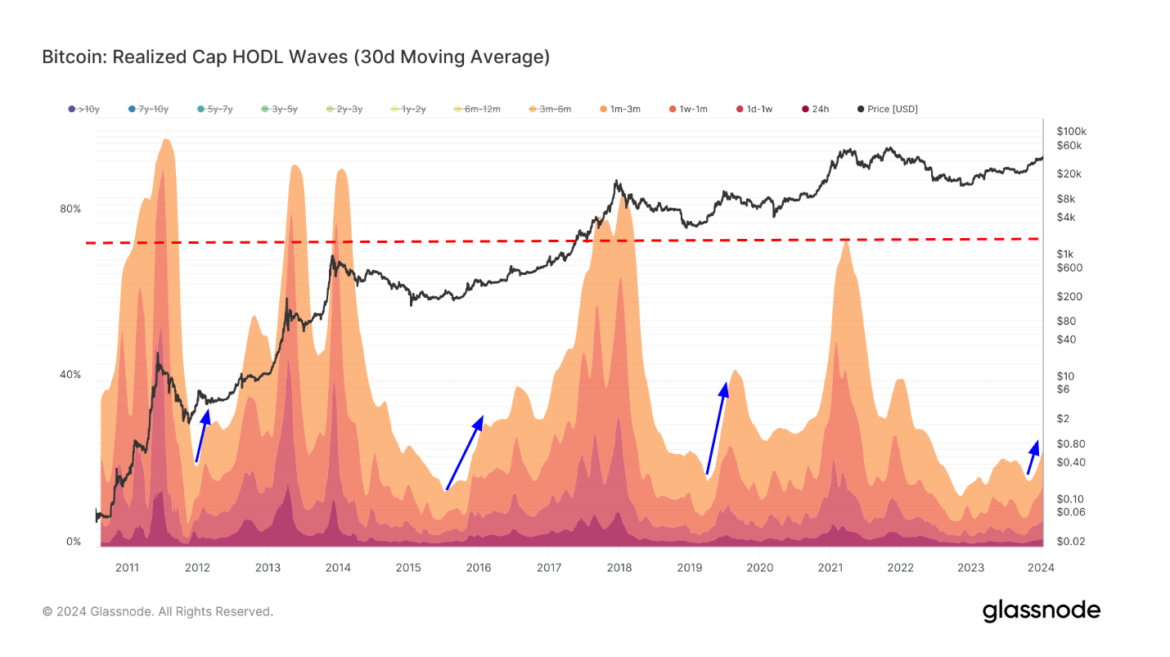

Bitcoin “HODL wave” patterns signal potential FOMO-driven price climbs

Quick Take

HODL waves, a visual depiction of Bitcoin’s supply based on when it last moved, are revealing a budding cohort in the digital asset domain.

Short-term holders, defined as those retaining Bitcoin for a maximum of 155 days. Looking specifically at investors who have held for three months or less are increasing in number and currently account for 14% of the Bitcoin supply. These investors, often speculative, hold the potential to either liquidate their positions after a few months or mature into long-term holders, retaining their Bitcoin for 155 days or longer.

An interesting trend emerges as we delve deeper into the HODL waves. When the short-term holder percentage reaches certain levels, these investors often metamorphose into longer-term holders, a pattern indicated by previous cycles. This transformation results in a larger proportion of Bitcoin supply being held by these investors.

Nevertheless, the cycle peak occurs when short-term holders become the dominant investors, controlling about 80% of the supply. This typically corresponds with market tops, as these investors tend to drive the price up in a ‘Fear of Missing Out’ (FOMO) euphoria, with long-term holders offloading their holdings.

The post Bitcoin “HODL wave” patterns signal potential FOMO-driven price climbs appeared first on CryptoSlate.

Bitcoin climbs the currency ranks, now 16th largest by market cap globally

Quick Take

Bitcoin (BTC), once viewed as a fringe digital asset, has ascended to claim the rank of the 16th largest currency worldwide when compared to various fiat currencies on a market capitalization basis. Measured by multiplying the total circulating supply of 19.5 million BTC by its unit price, Bitcoin’s market capitalization underscores its evolving role in the global financial sphere.

FiatMarketCap’s innovative methodology of expressing fiat currency market caps in Bitcoin terms offers an insightful viewpoint. It reveals the growing significance of digital asset like Bitcoin within a traditionally fiat-dominated space. China’s Yuan, the US Dollar, and the Euro occupy the top three ranks, with market caps calculated in Bitcoin exceeding Bitcoin’s finite supply limit of 21 million BTC.

The acknowledgment of Bitcoin as the 16th largest currency highlights the digital asset’s swift ascent and its burgeoning recognition as a potential store of value. It’s a testament to Bitcoin’s resilient market presence, challenging the conventionality of established national currencies.

| # | Currency | Market Cap | Price | Circulating Supply |

|---|---|---|---|---|

| 1 | CNY | 964,464,514 BTC | 331 sats | 291,200,000,000,000 CNY |

| 2 | USD | 885,730,966 BTC | 2,354 sats | 37,618,765,569,000 USD |

| 3 | EUR | 385,664,938 BTC | 2,614 sats | 14,751,875,000,000 EUR |

| 4 | JPY | 267,109,023 BTC | 16 sats | 1,597,004,000,000,000 JPY |

| 5 | GBP | 104,478,044 BTC | 3,007 sats | 3,473,701,000,000 GBP |

| 6 | KRW | 95,227,269 BTC | 1 sats | 5,207,204,000,000,000 KRW |

| 7 | INR | 68,028,626 BTC | 28 sats | 240,337,000,000,000 INR |

| 8 | CAD | 63,344,794 BTC | 1,784 sats | 3,549,553,000,000 CAD |

| 9 | BRL | 51,340,427 BTC | 486 sats | 10,552,680,000,000 BRL |

| 10 | HKD | 50,722,042 BTC | 301 sats | 16,833,762,000,000 HKD |

| 11 | AUD | 47,420,988 BTC | 1,611 sats | 2,942,000,000,000 AUD |

| 12 | TWD | 46,213,992 BTC | 76 sats | 60,296,879,000,000 TWD |

| 13 | CHF | 31,922,437 BTC | 2,818 sats | 1,132,535,000,000 CHF |

| 14 | RUB | 24,087,950 BTC | 26 sats | 91,135,000,000,000 RUB |

| 15 | MXN | 21,811,869 BTC | 139 sats | 15,666,762,864,000 MXN |

| 16 | BTC | 19,582,968 BTC | 100,000,000 sats | 19,582,968 BTC |

Source: fiatmarketcap.com

The post Bitcoin climbs the currency ranks, now 16th largest by market cap globally appeared first on CryptoSlate.

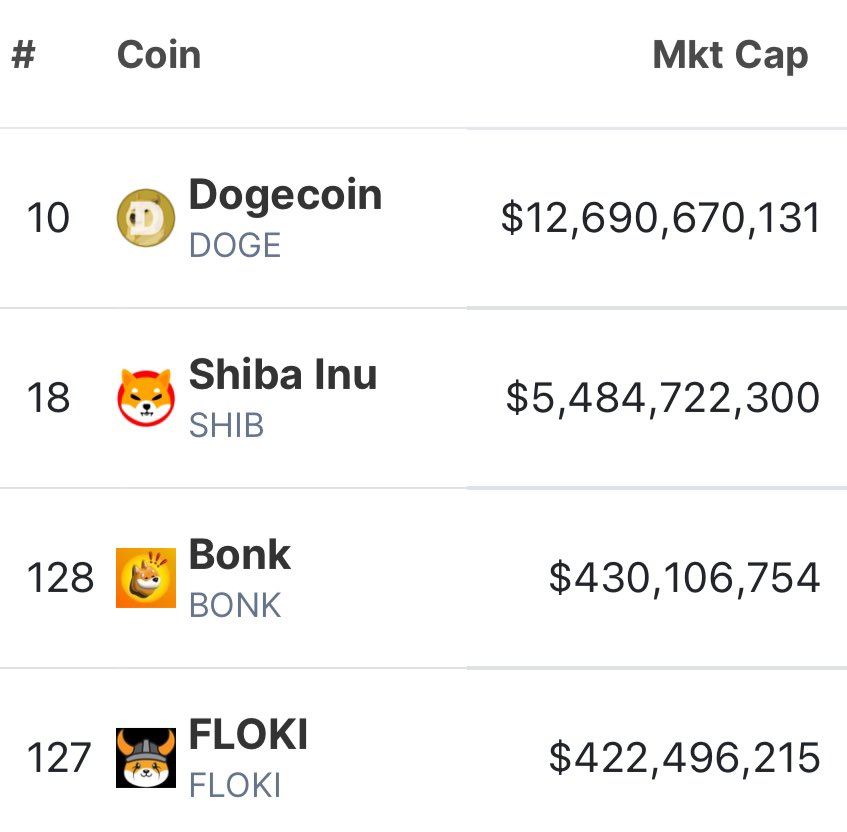

Solana’s BONK Climbs To 3rd Place In Dog Coin Market Cap, Leaving FLOKI Behind

In recent weeks, the Solana (SOL) blockchain has been making waves in the crypto world, with its native token SOL experiencing a remarkable uptrend of 46% over the past 30 days. Alongside this surge, Bonk Inu (BONK), the first Solana-based meme coin, has gained significant traction, solidifying its position as the third-largest dog coin by market capitalization, surpassing Floki Inu (FLOKI).

BONK Rockets To New Heights With 845% Surge In 30 Days

The staggering growth of Bonk Inu is evident in its recent performance, achieving an impressive 845% gain over the past 30 days. The meme coin’s remarkable ascent has propelled it to new yearly highs, while SOL experienced a slight pullback from its peak of $65 on December 2.

Despite the temporary setback for SOL, the bullish momentum and renewed interest in Bonk Inu have caught the attention of market participants.

As of now, BONK is trading at $0.0000069712, outperforming the broader crypto market with a remarkable 22.4% uptrend in the past 24 hours, aligning with the positive sentiment surrounding Bitcoin (BTC) and the overall market.

With a market capitalization of approximately $430 million, Bonk Inu currently sits in third place among dog coins, trailing behind the likes of Shiba Inu (SHIB) and Dogecoin (DOGE), which boast market caps of $5 billion and $12 billion, respectively.

CoinGecko data reveals that BONK has witnessed a significant 24-hour trading volume of $65,235,205.16, indicating strong investor interest and active participation in the market.

The future trajectory of Bonk Inu’s uptrend and its potential for further gains remains uncertain. However, should BONK continue to attract investors, it has the potential to dethrone Pepecoin (PEPE) in terms of market capitalization. As of the latest update, PEPE has achieved a market cap of $592 million.

However, it is important to note that Bonk Inu still has a significant gap to bridge to catch up with the largest dog coins in the market in terms of market capitalization, namely SHIB and DOGE. SHIB and DOGE have demonstrated substantial gains and already possess staggering market capitalizations.

Dog Coins Make Strong Push For Year-End Gains

The altcoin SHIB, built on the Ethereum platform and known for its Shiba Inu mascot, continues to demonstrate consistent gains across various time frames.

Notably, SHIB has seen a 14% increase over the past fourteen days and an 18% surge over the past thirty days. These positive trends have allowed the dog coin to achieve a slight year-to-date profit of 0.2% after experiencing a significant downturn in 2022.

Presently, SHIB is trading at $0.00000946, representing a decline of more than 89% from its all-time high (ATH) of $0.00008616, reached in October 2021.

Meanwhile, the meme coin DOGE, which has the backing of Elon Musk, is currently trading at $0.09058. It has witnessed an 18% rise over the past fourteen days and nearly 30% growth over the past thirty days, following a sustained upward trend that began on November 21.

However, in contrast to SHIB’s price action, DOGE has experienced a 12% decline year-to-date and an 87% drop from its ATH of $0.731578 reached in May 2021.

It remains to be seen whether the dog coins will continue to experience further gains throughout the remainder of the year or if a healthy pullback will occur to surpass upper resistance levels for another upward movement.

Featured image from Shutterstock, chart from TradingView.com

The LINK price seems to be intensifying its bullish momentum again after cooling off over the past few weeks. Despite the recent sluggishness in Chainlink’s price action, the cryptocurrency has maintained most of its profit and managed to stay above the $14 level in the past weeks.

Interestingly, the LINK price recently made its way above the $16 mark for the second time in less than a month. But here is the question – what is driving the latest surge?

On-Chain Data Reveals Catalyst For Chainlink’s Jump To $16

The latest on-chain revelation from Santiment has offered insight into the catalyst behind LINK’s price jump to $16. According to data from the crypto analytics firm, Chainlink’s richest wallets have made a substantial amount of token purchases in the past few days.

In a December 2 post on X, Santiment revealed that LINK whales bought about 3.9 million tokens (worth more than $62 million) in the past three days. This data point highlights an increase in the total amount of tokens held by the 200 largest Chainlink addresses.

🔗🐳 #Chainlink is moving ahead of the #altcoin field once again, aided by the top whales continuing to accumulate. The 200 largest wallets have added just over $50M $LINK in ~5 weeks. In 5 months, its market cap is +143% overall, and +93% vs. #Bitcoin. pic.twitter.com/oAPl9SQaJ5

— Santiment (@santimentfeed) December 2, 2023

This recent market activity underscores the current accumulation trend amongst Chainlink whales. According to data provided by Santiment, the top 200 wallets have loaded up more than $50 million worth of LINK tokens in approximately five weeks.

Furthermore, the on-chain analytics firm also revealed that the 200 largest Chainlink addresses currently hold a combined 746.57 million tokens (equivalent to a massive $11.84 billion). This figure represents nearly 75% of LINK’s total supply.

This accumulation trend is a positive sign for LINK and its price trajectory, as it suggests that large investors are keeping their faith in the asset and banking on the token’s price growth.

Is LINK Outperforming Bitcoin?

As of this writing, the LINK token is valued at $16.11, reflecting a nearly 2% price increase in the last 24 hours. According to data from CoinGecko, the cryptocurrency has jumped by more than 7.5% in the past week.

With its market capitalization rising by more than 143% in the last five months, Chainlink’s performance over the past few months is even more remarkable. Moreover, the altcoin has held its own against the premier cryptocurrency, Bitcoin.

Based on data provided by Santiment, LINK has outperformed the market leader by over 93% – in terms of market cap – in the past five months. This is especially impressive considering that Bitcoin has also been on a positive run, recently breaking above $39,000 for the first time in over a year.

Nevertheless, Bitcoin maintains its position as the top cryptocurrency with a market cap of $772 billion. Comparatively, LINK ranks as the 12th-largest asset with a $9 billion market capitalization.

LINK price resumes upward trend on the daily timeframe | Source: LINKUSDT chart on TradingView

Featured image from Adobe Stock, chart from TradingView

Dow Jones climbs, S&P 500 aims to exit correction on hopes the Fed is finished raising rates

U.S. stocks climbed Monday to begin a holiday-shortened week, with the S&P 500 trading above the level needed to exit correction territory, as investors remained cheered by expectations that the Federal Reserve has finished raising rates.

What’s happening

Stocks closed higher Friday, with the Dow, S&P 500 and Nasdaq Composite each rising for a third straight week. The S&P 500 surged 9.6% over the past three weeks, its largest three-week percentage gain since June 2020, according to Dow Jones Market Data.

accWhat’s driving

…

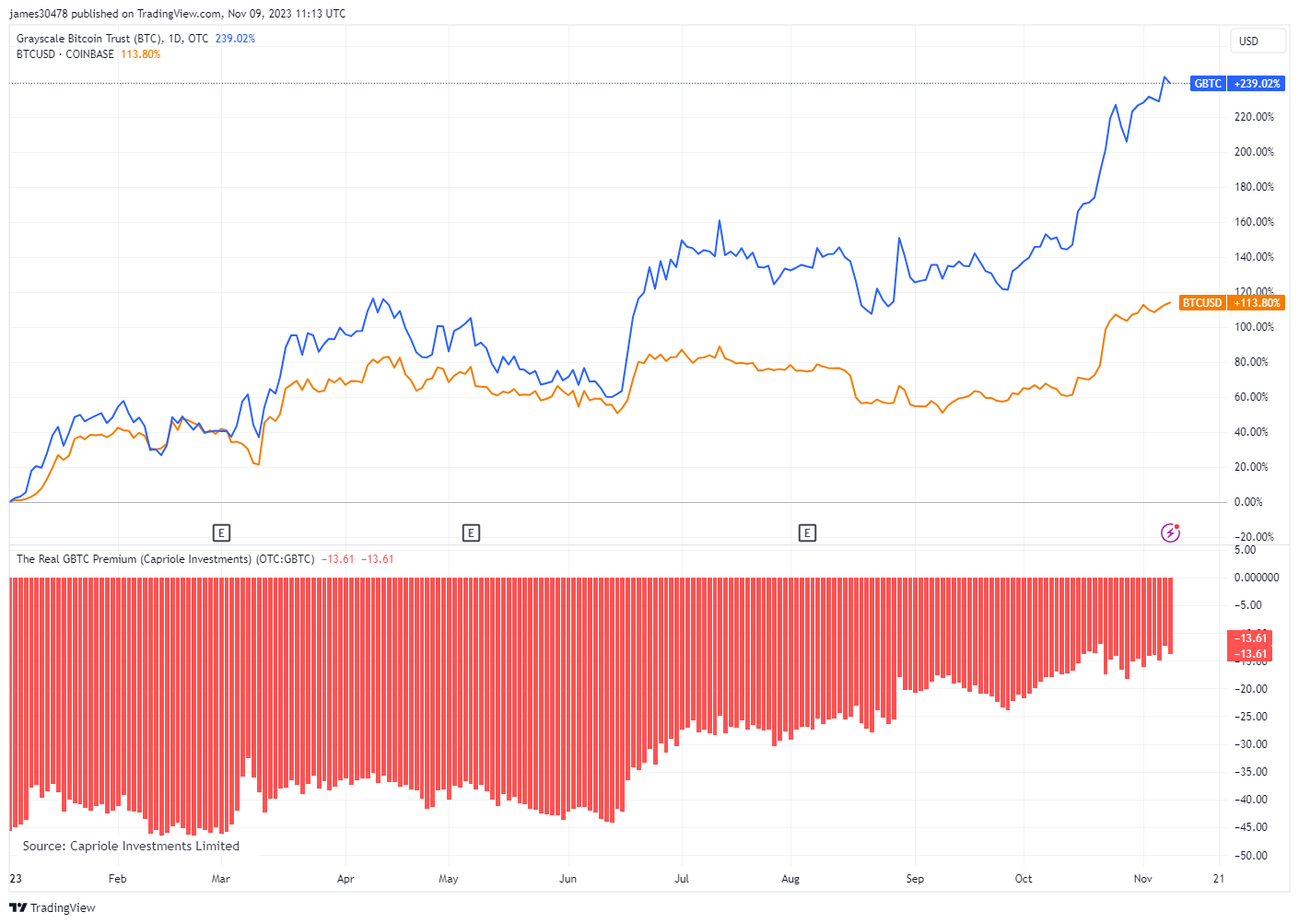

Grayscale’s GBTC climbs 239% in 2023 as market eyes spot ETF approval

Quick Take

The Grayscale Bitcoin Trust (GBTC) is riding a surge of growth in 2023, with its value climbing by over 239% since January. Concurrently, the discount to its Net Asset Value (NAV) is contracting, currently standing at 13.6% – among the year’s lowest. These market dynamics suggest an anticipation of the approval of a spot Bitcoin ETF, which appears to be imminent in the coming weeks.

GBTC’s value has continued to rise even after market hours, with a 1% increase bringing its price to $28.15. Notably, Bloomberg analysts have pinpointed an eight-day window commencing today, Nov. 9, during which several spot ETFs could potentially be greenlit. This period is expected to serve as a critical observation phase for GBTC’s price action, providing valuable insights into the market’s expectations and responses to regulatory decisions.

As the crypto industry awaits an official announcement, it’s evident from the GBTC’s performance and the shrinking NAV discount that the market is starting to price in the possibility of the approval of a spot Bitcoin ETF, which could dramatically influence the future of the digital asset market.

The post Grayscale’s GBTC climbs 239% in 2023 as market eyes spot ETF approval appeared first on CryptoSlate.

While still recording some profits, the Bitcoin price shows signs of exhaustion, at least on low timeframes. When zooming out, recent data shows the massive rally experienced by cryptocurrencies over the past few months and the sector’s potential for additional gains.

As of this writing, the Bitcoin price trades at $34,800 with sideways price action in the last 24 hours. Over the previous week, BTC recorded a 2% profit, while the altcoins market trends much higher, retaining more gains.

Bitcoin’s 110% Year-To-Date Leap Signals A New Era BTC?

According to a report from Bitfinex, This year has marked a significant milestone for cryptocurrencies as Bitcoin (BTC) and Ether (ETH) have shown remarkable growth, leaving traditional assets like gold behind. Bitcoin has soared by 93% and Ethereum by 3%, indicating a solid performance correlation that has remained consistently tight.

BTC, in particular, has enjoyed the spotlight with its first-mover advantage, earning the moniker of ‘digital gold’ and garnering broad institutional support.

While these digital assets reach new heights, traditional stock indices such as the S&P 500 and NASDAQ are navigating through a correction phase. This contrast hints at a shifting investment landscape, with cryptocurrencies emerging as a dominant force capable of outperforming established markets, the report suggested.

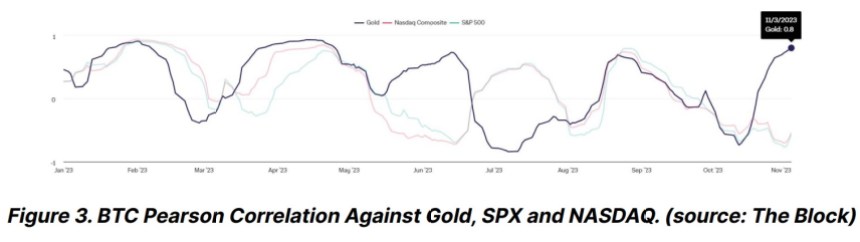

As seen in the chart below, data hints at the Bitcoin price outperforming other assets and Gold “playing catch up” with a 0.8 correlation with the cryptocurrency.

Bitcoin’s price rally of over 110 percent since the start of the year signals a “transition” for holders from unrealized losses to profits.

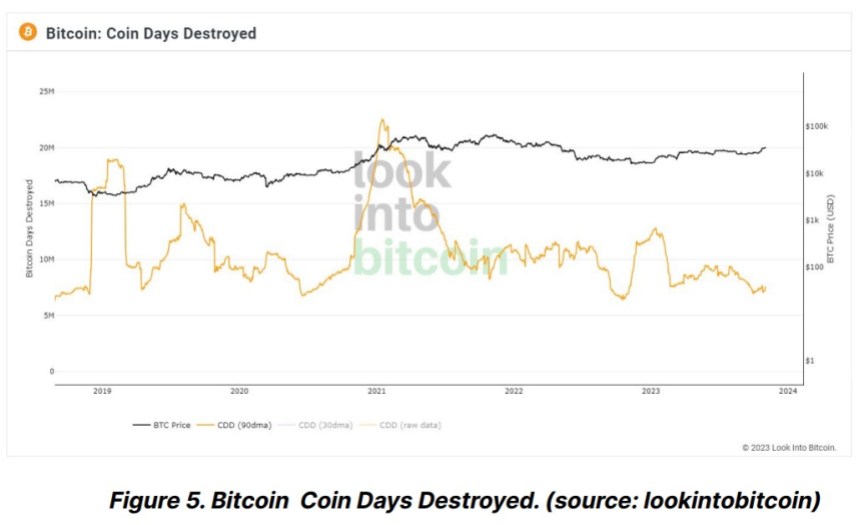

Typically, such surges lead to market consolidation or sharp pullbacks. Yet, the current trend of declining Coin Days Destroyed, a metric used to gauge market activity and sentiment, suggests that long-term investors remain steadfast, the chart below shows.

The lack of movement in wallets containing significant Bitcoin sums further points to a bullish outlook or a defensive strategy against economic uncertainties.

Amidst this crypto resilience, the Federal Reserve’s latest decision to maintain interest rates between 5.25 and 5.50 percent reflects a cautious but non-restrictive economic approach, the report claims.

Crypto Stands Firm In Economic Uncertainty

Despite the Fed’s updated, confident view of the U.S. economy, the manufacturing sector experienced a downturn in October, mainly due to strikes in the automotive industry. This suggests a significant impact of labor disputes on the sector.

The broader U.S. economy is feeling the effects, with a slowdown in job creation and the slowest wage growth since mid-2021, indicating a shift in labor market conditions. This data supports a continuation of the current bullish trend.

However, as mentioned, traders should be looking for spikes in volatility, which could create obstacles, especially for those speculators taking leverage positions.

Cover image from Unsplash, chart from Tradingview

Bitcoin (BTC) broke the $35,000 resistance level early morning on Nov. 5 and has maintained its value above that level in the ensuing hours, pointing to positive market sentiment despite the weekend lull.

The flagship crypto is currently trading at $35,155, with bears failing to force a retracement for now, according to CryptoSlate data.

Bitcoin had retraced some of the gains made last week in anticipation of the U.S. labor report, which showed that both bond yields and the labor market had started to cool off. However, it did not have a significant impact on Bitcoin during the week.

Bulls struggled to push past the $34,000 to $35,000 channel with only minor breakouts over the week. The flagship crypto has been sitting comfortably above the previous week’s resistance level for more than 12 hours now, with signs of consolidation.

The rally is likely a delayed effect of positive news about Bitcoin, specifically related to BlackRock’s spot exchange-traded fund (ETF). The market is eagerly awaiting the regulatory greenlight for multiple Bitcoin ETF applications submitted by some of the largest asset managers in the world.

Experts predict that these ETFs will lay the foundation for institutional money to pour into crypto due to their fully regulated nature. Valkyrie Chief Investment Officer (CIO) Steven McClurg recently said in an interview that the SEC is expected to approve the ETF within November.

Altcoins rallying

Altcoins began to rally last week when Bitcoin prices retraced as investors turned to other opportunities. Most of the top 100 tokens posted significant gains over the week.

According to crypto analysis firm Santiment, altcoins are making up for lost time as profits from Bitcoin’s surge are moving into other large and mid-cap projects. The firm highlighted that multiple mid-cap tokens are up more than 100% weekly.

NEO has been one of the best-performing crypto over the past 24 hours and the past seven days, posting blistering gains of 32.04% and 59.3%, respectively. The token is up more than 100% on a 30-day basis. The momentum from the initial market rally was sustained by further positive news about the ecosystem working on an Ethereum-compatible sidechain.

Meanwhile, many multiverse and gaming-related tokens also posted significant spikes over the last 24 hours, including MultiversX (EGLD), Immutable X (IMX) and Illuvium (ILV).

EGLD has performed on par with NEO. The token is up 36.41% over the past 24 hours and 58.34% over the past seven days. IMX and ILV also surged over the weekend but posted more subdued gains of 18.25% and 17.54%, respectively, over the past 24 hours.

PancakeSwap’s native token CAKE is also up significantly over the past month, with an 83.54% surge — 77.68% of which occurred over the past week. The token has performed well since and is up 16.67% over the last 24 hours.

At the time of press, Bitcoin is ranked #1 by market cap and the BTC price is up 0.56% over the past 24 hours. BTC has a market capitalization of $682.01 billion with a 24-hour trading volume of $10.49 billion. Learn more about BTC ›

Market summary

At the time of press, the global cryptocurrency market is valued at at $1.31 trillion with a 24-hour volume of $32.72 billion. Bitcoin dominance is currently at 52.02%. Learn more ›