The company is edging closer to a $2 trillion market value.

Source link

close

Nasdaq Composite flirts with record close after drought of more than two years

The Nasdaq Composite was briefly on track Friday for its first record close in more than two years, but the tech-heavy stock index remained shy of that as investors pondered the staying power of a rally fueled by optimism around artificial intelligence.

The Nasdaq Composite

COMP,

comprised of most of the stocks that trade on the Nasdaq stock exchange and one of the world’s most closely followed benchmarks, ended down nearly 0.3% Friday at 15,996.82. It had earlier traded as high as 16,134.22 — above its record close of 16,057.44, set on Nov. 19, 2021. The index had also been briefly on track for a record close Thursday before trimming its gain.

The Nasdaq Composite’s all-time intraday high was set on Nov. 22, 2021, at 16,212.23.

Through Friday, the Nasdaq has gone 566 trading days without a record close, according to Dow Jones Market Data. That’s the longest such stretch since a run of 3,801 trading days from March 2000 to April 2015, following the bursting of the dot-com bubble.

The other two major U.S. stock indexes — the large-cap benchmark S&P 500

SPX

and blue-chip Dow Jones Industrial Average

DJIA

— both ended at record highs Thursday, and extended their gains on Friday. The Dow has now notched 14 record finishes so far in 2024 through Friday, while the S&P 500 has seen 13.

Nvidia Corp.

NVDA,

shares surged more than 16% Thursday after reporting blowout earnings results late Wednesday that exceeded an already high bar for the maker of artificial-intelligence semiconductors.

Nvidia shares rose another 2% on Friday. They have rallied nearly 60% so far in 2024 and are up roughly 275% over the last 12 months, contributing to a rally led by a handful of megacap technology stocks seen as likely to benefit most from AI advances.

See: Nvidia makes Wall Street history as stock surge adds $277 billion in market cap

A close in record territory would largely put to rest any lingering doubts about the return of a bull market for the Nasdaq Composite.

The Nasdaq’s long drought after the bursting of the dot-com bubble in 2000 left many investors particularly wary of declaring a return of the bull market after the index’s most recent slide. After all, the Nasdaq saw three rallies of 40% or more over the course of the bear market that followed the dot-com bust, with none marking the beginning of a lasting bull run, analysts at Baird Private Wealth Management had noted previously.

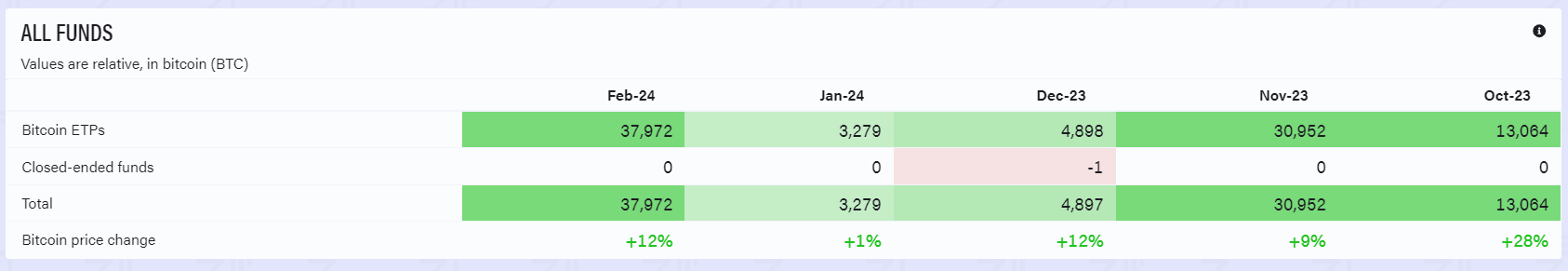

February’s Bitcoin ETP net inflows close to total of previous three months

Quick Take

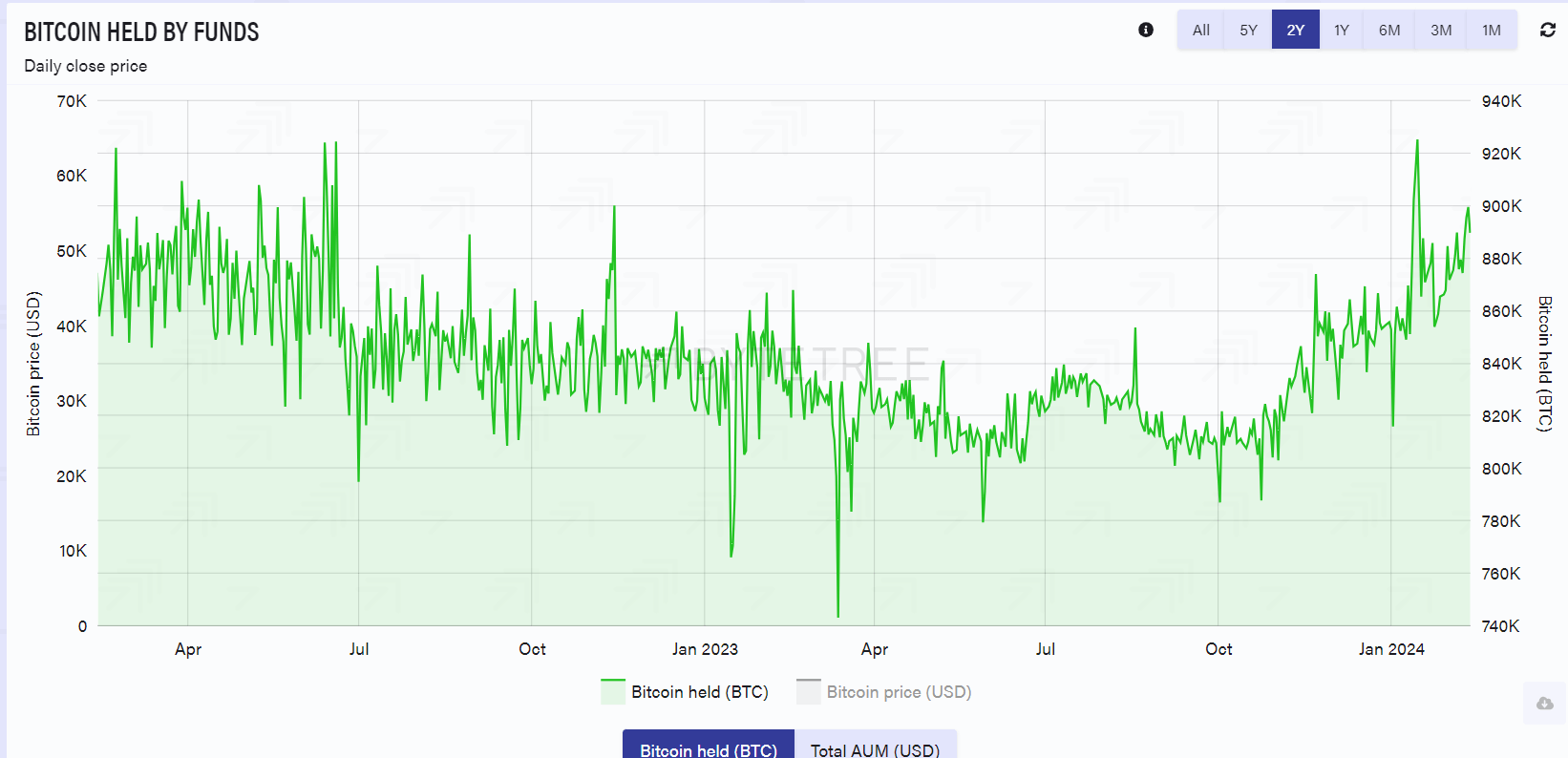

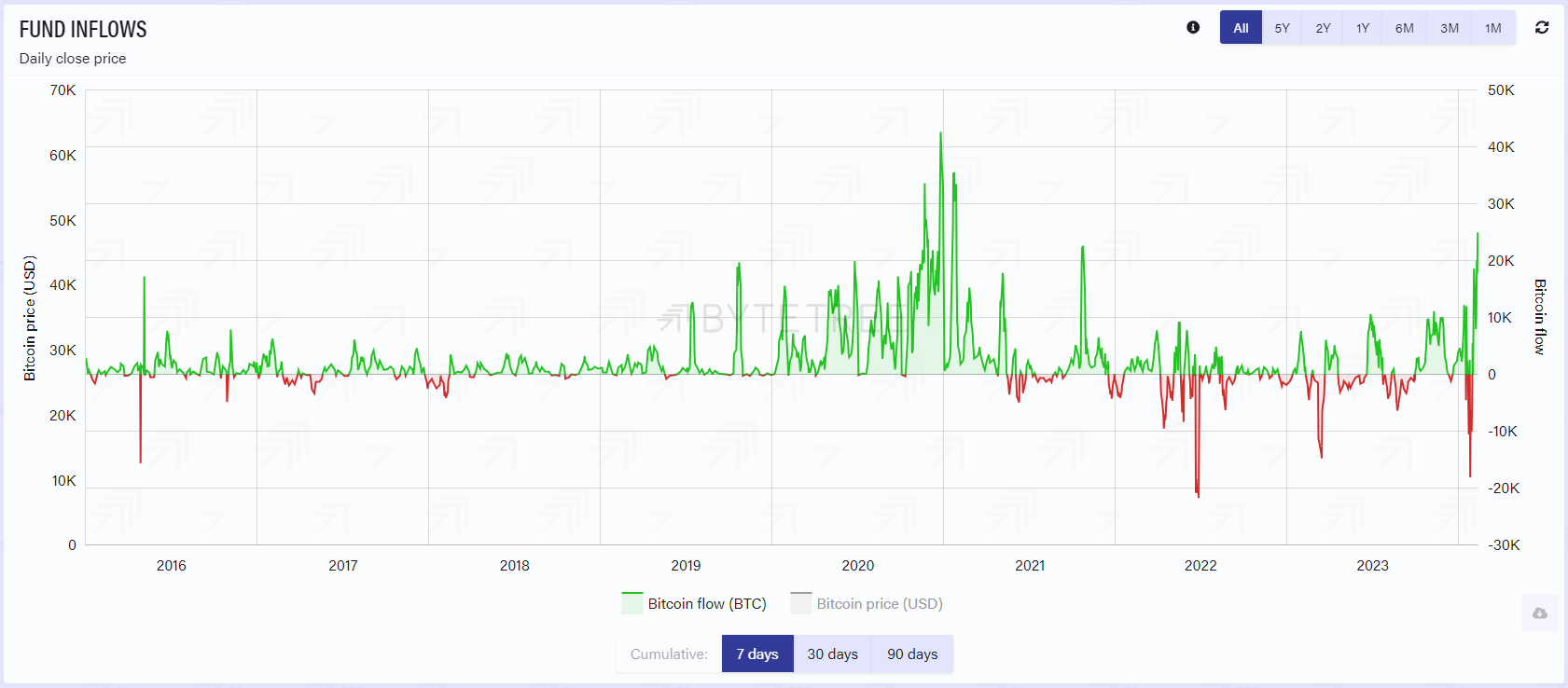

ByteTree has reported a massive influx in the global allocation of Bitcoin among exchange-traded products (ETPs) since October 2023, adding roughly 100,000 BTC.

According to ByteTree data, approximately 890,000 BTC are currently held in varying ETPs worldwide, which is about 4.56% of the circulating supply of Bitcoin. Interestingly, the start of 2024 has seen an increase of about 80,000 BTC in the ETP space, primarily attributed to US-based Bitcoin ETFs.

Within the last seven days alone, global Bitcoin ETPs underwent an influx of roughly 25,000 BTC, marking the most significant weekly increase since the early part of 2021.

February alone contributed an impressive 38,000 BTC net inflow into ETPs, roughly equal to the combined flow for November, December, and January.

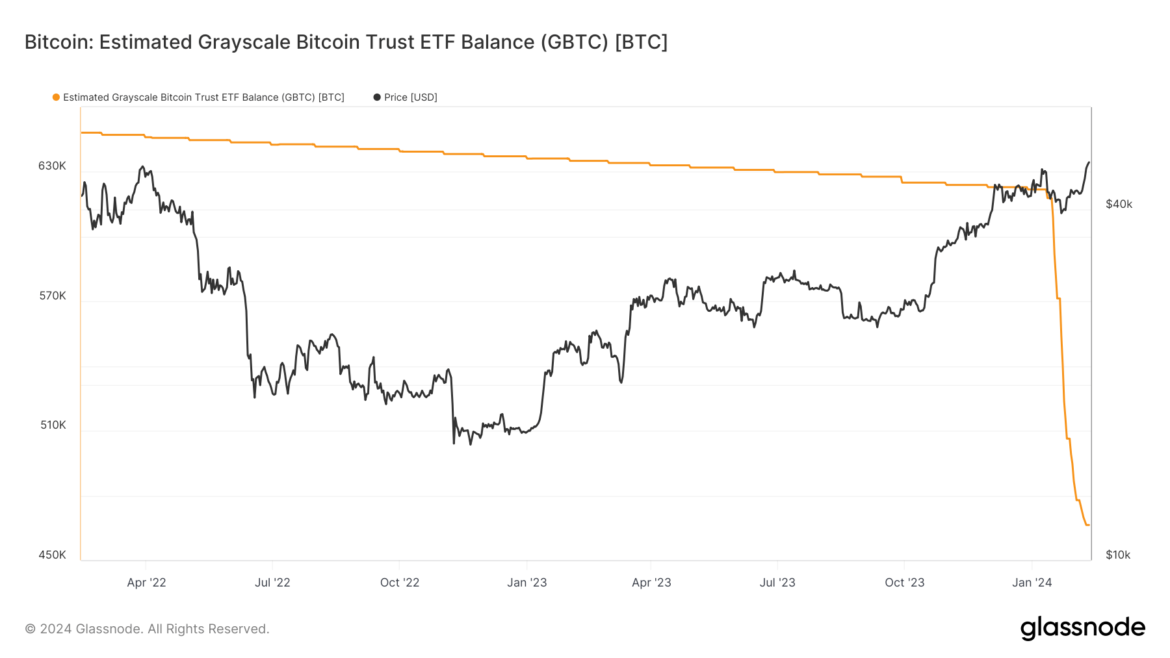

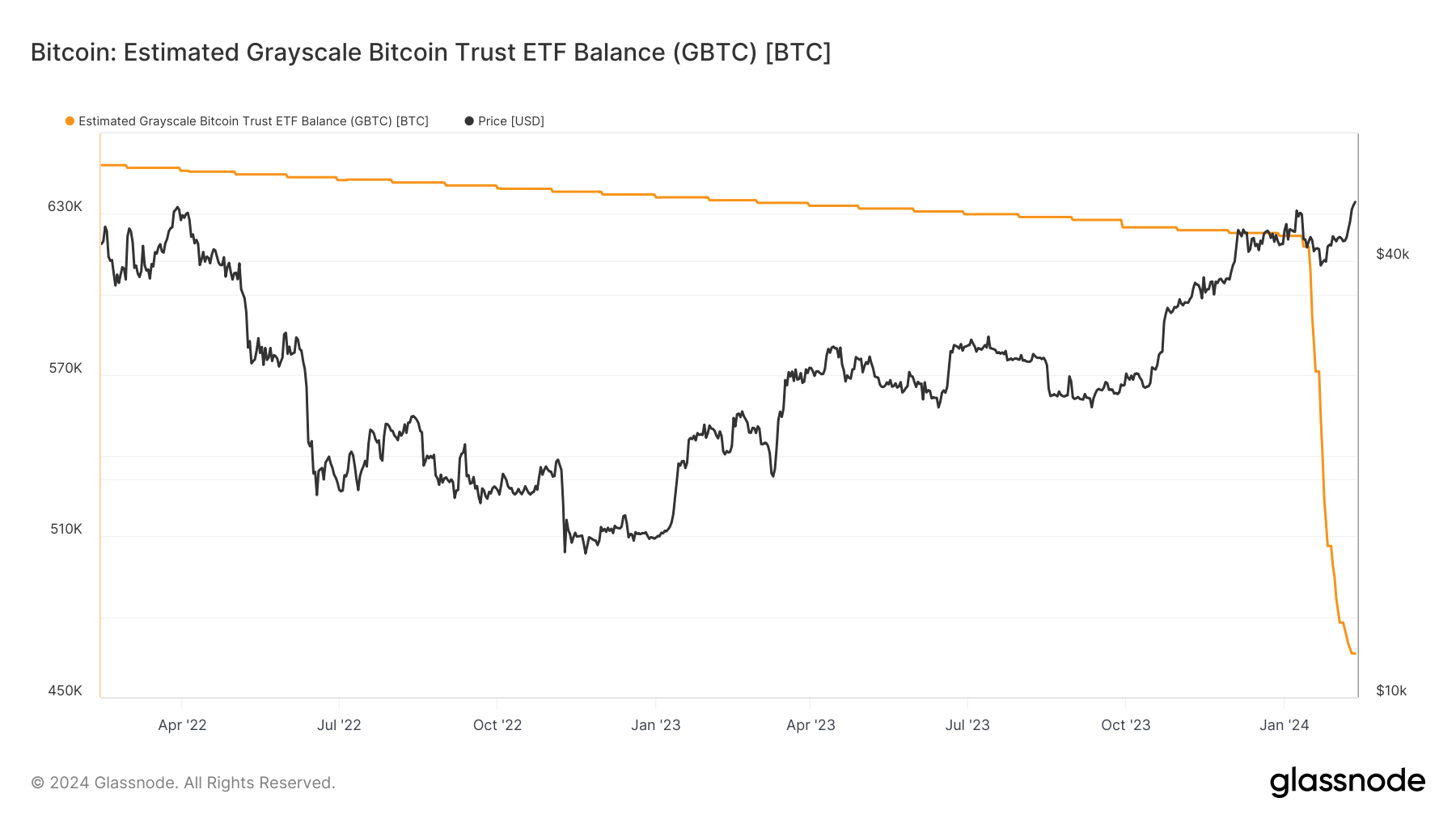

Glassnode data reports that Grayscale Bitcoin Trust (GBTC) currently holds approximately 466,000 Bitcoin, a significant 30% decline from its peak holdings of about 622,000 Bitcoin before Bitcoin ETFs began trading.

The post February’s Bitcoin ETP net inflows close to total of previous three months appeared first on CryptoSlate.

Will Medicare Cover 100% of Your Healthcare Needs in Retirement? Not Even Close

Medicare is an important program that gives millions of older Americans access to healthcare coverage. But it’s important to understand the ins and outs of Medicare, not just as an enrollee, but prior to reaching enrollment age. That’s because the more you know about Medicare and what it will cost and cover, the better you can plan financially for retirement as a whole.

Recent TIAA data reveals that among current retirees, 10% expect Medicare to cover 100% of their healthcare costs. Among those not yet retired, 12% anticipate Medicare picking up 100% of their healthcare tab.

But Medicare won’t come close to paying for 100% of your medical needs. And the sooner you recognize that, the sooner you can begin to plan accordingly.

Image source: Getty Images.

Know what to expect

There are various out-of-pocket costs Medicare enrollees are likely to grapple with. First, under Part A, which covers hospital care, you have to pay a deductible on a per-admission basis, the exact amount of which can change from year to year.

In 2024, you’re looking at a whopping $1,632 per hospital admission. You should also know that this year, you’ll pay a daily hospital coinsurance rate of $408 if your hospital stay extends beyond 60 days, up to the 90-day mark.

Meanwhile, under Medicare Part B, which covers outpatient care, there’s a $240 annual deductible you’ll have to meet. Otherwise, you should expect to pay for a portion of each specific service or treatment you receive. In most cases, Medicare Part B pays 80%, and you cover the remaining 20%. But that could be a significant amount of money if there’s a year in which you end up needing lots of care.

Now, Medicare enrollees can sign up for Medigap, or supplemental insurance, which could help cover the aforementioned deductibles and co-insurance costs. But there are certain services that Medicare won’t pay for at all, like eye exams, hearing aids, and dental cleanings. Those are expenses you’ll need to pay for completely on your own. And a Medigap plan won’t help there, since it doesn’t pay for services not covered by Medicare itself.

Save accordingly

Clearly, you might incur your share of out-of-pocket costs as a Medicare enrollee. Read up on those costs ahead of retirement and pad your savings accordingly.

You may also want to consider putting money into a health savings account, or HSA, if you’re eligible to do so. You’ll need to be enrolled in a high-deductible health insurance plan to fund an HSA. But if that option is on the table, take advantage.

Not only that, but do your best to reserve as much of your HSA balance for retirement as you can. You might really need it once your Medicare coverage begins.

All told, there’s lots of confusion about Medicare. But don’t wait until you’ve enrolled to start learning about how the program works. Instead, set yourself up with that information ahead of retirement so you can make smart savings choices that result in less financial stress when you’re older.

A wave of strong earnings from big tech players proves once again beating the quarter is only as good as your guidance — or lack of it.

Intel

INTC,

beat expectations in its most recent earnings report, but provided guidance that was well-short of expectations. The stock sold off as investors tried to understand why the guidance was so soft. With all the hype over artificial intelligence and improvement in operations at Intel, why wasn’t the company’s result more robust, and the guidance more optimistic?

There were some obvious reasons. One is that Mobileye Global

MBLY,

saw its forecast get slashed, and the stock got pummeled. Intel’s significant investment and position in Mobileye certainly impacted its own guidance. Plus, both network and internet-of-things spending has declined.

While those reasons were noted by investors and analysts, make no mistake, the data-center business is where the alarm bells went off. The growth this quarter was OK, but meanwhile rival Nvidia

NVDA,

is expanding its margin at a breakneck pace, surpassing revenue records and effectively being declared the undisputed champion of AI infrastructure. Intel’s lack of a more optimistic, positive outlook for its data-center solutions built around AI was met with absolute disdain.

“Intel can grow into an AI leader and take customers from Nvidia and AMD”

Against these challenges, is there a bull case for Intel or has it missed the mark on AI?

Let’s start with AI: 2023 was the year of the graphics-processing unit (GPU), and the undisputed, unquestioned winner was Nvidia. With AI training in demand and the largest cloud providers all investing big on infrastructure to support AI, Nvidia was the only option. Some estimate that Nvidia’s market share of the GPU is as high as 98%, which actually looks Intel-esque from its most successful years when AMD

AMD,

was on the ropes and Intel enjoyed almost a complete monopoly in both the data center and the PC.

Read: Is it a bubble? ‘Magnificent 7’ market cap equals the GDP of 11 major cities.

AI on your PC

But the data center isn’t the only place where AI is going to play a role. A new generation of personal computers is being developed with the intent of creating a brand new supercycle. Many analysts, including myself, expect these to hit the market in the second half of 2024. These PCs will run large-language models that enable data to stay private on the device and be used for generative AI applications without having to interact with the cloud — delivering less latency, more security, and efficiency and putting AI at the fingertips of PC users, much like we’ve become accustomed to with our mobile devices.

The other question is whether the AI market is really that mature, and the answer is: of course, not. These are early days for AI. While the training infrastructure that saw Nvidia stock go parabolic in 2023 was certainly exciting, 2024 will see a focus on implementation. This will be much more about AI inference and applications that are able to combine both generative AI and more traditional machine-learning tactics and techniques to maximize the value of data, whether for consumer applications or enterprise apps.

Intel sits in an excellent position around AI because the company still commands around 75% of the data-center computing market and about the same percentage of the PC market. With the company likely a couple of years out from having a GPU that can compete with what Nvidia and AMD are building, Intel could grow into the AI market and look to take a double-digit percent market share from Nvidia.

Reasons for optimism

Here are specific reasons supporting the bull case for Intel, and the stock’s low valuation, plus the market conditions and the growing need for computing of all types sit well for the company’s long-term prospects.

1. CEO Pat Gelsinger, who has brought back a confidence, a spirit, and a leadership style that bodes well for Intel. He’s made hard decisions; moving the company away from its less-profitable businesses and focusing on strategic alignments as well as mobile. At the same time, he’s worked diligently to make Intel the national fab for the United States — in other words, Intel makes its own chips, and is also aiming to use its facilities to make other companies’ chips too.

2. Long-standing relationships with the channel. This is twofold. First, the channel is highly dependent on Intel from both a design distribution and implementation standpoint. Intel has been one of the most successful companies in terms of building strategic marketing, co-op, and MDF programs that have made partners codependent on Intel to deliver products and margin to the business that is required to be successful.

So long as Intel can deliver competitive products, there is a slow-to-change situation that will remain intact for the time being that I do not see being completely disrupted. Given the company is more on track than it’s been in a long time, the company ceded massive market share to AMD and Nvidia through operational deficiencies and a lack of presence in critical markets. But it seems that over the next few years, most of these items will be course-corrected.

Lastly, and my personal favorite bull case for Intel, is its growing foundry business. Yes, there are reports of delays in multi-year fab construction, but I think those delays are to be expected.

Intel has embraced the opportunity to be the United States and the West’s national foundry. Effectively, of course, the company is committed to its integrated manufacturing strategy. But it is also being looked at by more fabless chip designers here in the U.S. for both nationalistic and strategic reasons to provide supply, and the company has successfully expanded to more than being a process foundry but also a packaging foundry, which has propelled that part of the business to record revenues over the past few quarters.

With uncertainty around China and the need for more supply-chain diversity, there is no other bet for a company that can deliver AI chips partnering with Marvell Technology, Nvidia, Qualcomm, AMD, and others than Intel — not to mention demand for non-AI chips that largely caused the shortage of 2021 and 2022.

It’s easy to make the bear case for Intel, and there are analysts that will never see a positive for the company. I also could argue every one of these points from the other side. But having said that, there is a bull case. Intel stock is not valued even close to its competition. And the company does still have a really substantial market share and deep ties in its channel that are hard to break. At the very least, this calls for optimism.

Daniel Newman is the CEO and chief analyst at The Futurum Group, which provides or has provided research, analysis, advising or consulting to ServiceNow, Intel, NVIDIA, Microsoft, Amazon, IBM, AMD and other technology companies. Neither he nor the firm have any positions in any of the companies cited in this article. Follow him on X @danielnewmanUV.

More:

Nvidia is ‘clear beneficiary’ of Meta’s AI spending rush. Its stock is climbing.

Apple just did something unusual. Can it help the stock amid growth woes?

Opinion: Intel has big plans for AI-capable PCs, but that may take time to catch on

Greece has been struggling with forest fires that could not be controlled for 10 days on July 27, 2023 in Rhodes, Greece.

Dia Images | Getty Images News | Getty Images

Scientists on Tuesday confirmed 2023 as the hottest year on record and warned that the planet is now within touching distance of smashing through the critical warming threshold of 1.5 degrees Celsius.

The European Union’s Copernicus Climate Change Service (C3S) said 2023, a year in which one researcher described temperature anomalies as “absolutely gobsmackingly bananas,” was the warmest calendar year in global temperature data stretching back to 1850.

The 12-month period ended with a global average temperature of 14.98 degrees Celsius, almost 0.2 degree Celsius higher than the previous record set in 2016.

Extreme heat is fueled by the climate crisis, the chief driver of which is the burning of fossil fuels.

Scientists at C3S said 2023 was the first time on record that every day within a year surpassed 1 degree Celsius above the preindustrial reference period of 1850 to 1900, while nearly 50% of days were over 1.5 degrees Celsius.

What’s more, the EU’s climate change service said two days in November were found to have surpassed 2 degrees Celsius for the first time ever.

Samantha Burgess, deputy director of C3S, said in a statement Tuesday that 2023 was “an exceptional year with climate records tumbling like dominoes.”

The findings come after repeated warnings in recent years about the likelihood of the world climbing above the aspirational goal of the landmark Paris Agreement.

The 2015 accord aims to “limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels” and calls for countries to take concerted climate action to reduce greenhouse gas emissions to limit global warming.

The importance of the 1.5 degrees Celsius threshold is widely recognized as an indicator of the point at which climate impacts become increasingly harmful for people and the planet.

The world has already warmed by around 1.1 degrees Celsius after over a century of burning fossil fuels as well as unequal and unsustainable energy and land use. Indeed, it is this temperature increase that is fueling a series of extreme weather events around the world.

The Dow Jones Industrial Average scored both an intraday high and a record close on Wednesday after the Federal Reserve signaled a pivot to rate cuts was likely in 2024.

The Dow

DJIA

went up 512.30 points, or 1.4%, to close at 37,090.24, marking the first time the index has risen above 37,000 intraday, according to Dow Jones Market Data. It traded as high as 37,094.85 on Wednesday.

Bigger picture: Including Wednesday’s record Dow close, it has been 531 trading days since the Dow’s last 1,000-point milestone, the longest time between milestones since 14,000 to 15,000.

The U.S. central bank on Wednesday kept its key policy rate unchanged at the range of 5.25% to 5.5%, a 22-year high, while officials penciled in three rate cuts in 2024, according to its revised dot-plot forecast.

In an afternoon press conference, Fed Chair Jerome Powell said the central bank was “very focused” on not making the mistake of keeping rates restrictive for too long. His comments propelled all three of the major equity benchmarks up at least 1.3% on Wednesday.

The S&P 500 index

SPX

finished up 1.4%, while the Nasdaq Composite Index

COMP

ended 1.4% higher. That marked their biggest daily increases in about a month, according to Dow Jones Market Data.

The Russell 2000 index

RUT

of small-cap stocks outperformed with a 3.5% increase, according to FactSet data.

The stock-market rally means investors are discounting that the Fed has beaten inflation without causing a recession, achieving a so-called “soft-landing,” according to Kathryn Rooney Vera, chief market strategist at StoneX Group.

Powell sounded “remarkably dovish” in his press conference on Wednesday, Rooney Vera said in a call.

With the positive momentum, it appears stocks will also see a “Santa Claus rally,” she said. The Santa Claus rally refers to the stock market’s tendency to push higher in the last five trading sessions of a calendar year and the first two sessions of the next year.

Still, Rooney Vera said concerns remain about whether the rally is sustainable in the next 12 to 18 months, as risks of a recession aren’t eliminated.

Wednesday’s rally is “all about the Fed,” said Peter Cardillo, chief market economist at Spartan Capital Securities, pointing to rate cuts now penciled in for 2024.

“The question is when do the rate cuts begin? That is still the unknown,” Cardillo told MarketWatch. “But what Powell said was sweet to the markets’ ears.”

Fed fund futures traders are now pricing in a 58% likelihood that the Fed will deliver its first rate cut in March 2024, according to CME FedWatch tool.

Cardillo also said he expects the year-end rally in stocks to continue through 2024, but perhaps not to be as “vivacious” as on Wednesday.

“Powell was understandably hesitant to declare victory with regard to avoiding a recession,” Josh Jamner, investment strategy analyst at ClearBridge Investments, wrote in emailed comments. “But the lack of pushback on easing financial conditions as inflation continues its trend lower should be enough to continue to support the Santa Claus rally for the time being,” Jamner said.

Dow tops 36,000 as stocks end with gains following remarks by Fed’s Powell, S&P 500 clinches highest close since March 2022

U.S. stocks ended higher Friday, with the Dow Jones Industrial Average scoring a fifth straight week of gains, as Treasury yields fell even after Federal Reserve Chairman Jerome Powell said it was too soon to begin talking about rate cuts.

How stock indexes traded

-

The Dow Jones Industrial Average

DJIA

rose 294.61 points, or 0.8%, to close at 36,245.50. -

The S&P 500

SPX

gained 26.83 points, or 0.6%, to finish at 4,594.63, scoring its highest close since March 30, 2022. -

The Nasdaq Composite

COMP

climbed 78.81 points, or 0.6%, to end at 14,305.03.

For the week, the Dow gained 2.4%, the S&P 500 rose 0.8% and the Nasdaq increased 0.4%. All three major U.S. stock indexes booked a fifth straight week of gains, according to Dow Jones Market Data.

What drove markets

U.S. stocks advanced Friday, with the S&P 500 seeing its highest close of the year and the Dow breaking above 36,000 for the first time since January 2022, according to Dow Jones Market Data.

Falling bond yields are helping to lift the U.S. equities market, with the Dow rising for a fifth straight week in its longest winning streak since Nov. 5, 2021, FactSet data show.

The 10-year Treasury yield has come down “pretty substantially” over the past month and that decline is continuing, said Josh Jamner, investment strategy analyst at ClearBridge Investments, in an interview Friday. “The lower 10 year is what’s driving the stock market higher.”

Treasury yields have declined on investor expectations that the Federal Reserve may begin cutting interest rates next year.

See: Dow near record high because traders are calling bluff on ‘higher-for-longer’ Fed

Yet Fed Chair Jerome Powell said Friday in remarks at Spelman College in Atlanta that “it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance, or to speculate on when policy might ease. We are prepared to tighten policy further if it becomes appropriate to do so.”

Despite Powell’s tough talk on rates, Treasury yields continued to fall, while the S&P 500 swung higher after in November booking its biggest monthly gain since July 2022, FactSet data show.

The yield on the 10-year Treasury note

BX:TMUBMUSD10Y

fell 12.4 basis points on Friday to 4.225%, the lowest rate since Sept. 1 based on 3 p.m. Eastern Time levels, according to Dow Jones Market Data. That’s down from around 5% in October.

Markets viewed Powell’s comments on Friday as “inching toward the dovish camp,” said Jeffrey Roach, chief economist at LPL Financial, in emailed commentary. “A few weeks ago, Powell said policy is restrictive but today, he believes policy is ‘well into restrictive territory.’ I think it’s fair for markets to latch on to that subtlety.”

Read: Dow near record high because traders are calling bluff on ‘higher-for-longer’ Fed

Earlier in the week, encouraging inflation data and comments from Fed Gov. Christopher Waller helped fuel investor hopes for rate cuts in the first half of next year.

Investors also weighed a fresh reading of business conditions at American factories, with the Institute for Supply Management saying Friday that economic activity in the manufacturing sector contracted in November for a 13th straight month.

See: Manufacturers still treading water, ISM survey shows: ‘Demand remains soft.’

“I think investors feel more confident that a soft landing is definitely a possibility” for the U.S. economy, said Anthony Saglimbene, chief market strategist at Ameriprise Financial, in a phone interview Friday. “The hard-landing scenario is kind of coming off the table.”

Next week investors will be watching for the U.S. employment report, due out on Dec. 8, for jobs growth data in November.

Markets had a memorable November, with big rallies in stocks and bonds. Ten of the S&P 500’s 11 sectors finished the month in the green, with energy being the sole to fall amid a drop in crude-oil prices.

“We had a very strong November,” with stock-market breadth improving, said Saglimbene. “If the rally is going to build steam, you want to see more areas of the market start to participate.”

Most of the S&P 500’s sectors climbed higher on Friday, except for communication services

XX:SP500.50,

which finished with a modest decline of 0.2%, according to FactSet data.

Companies in focus

-

Tesla Inc.

TSLA,

-0.52%

shares slipped 0.5% following Thursday’s Cybertruck delivery event. -

Salesforce Inc.

CRM,

+3.22%

shares climbed 3.2% a day after they helped propel the Dow’s rise on Thursday. The blue-chip gauge also benefited from gains in Walgreens Boots Alliance Inc.

WBA,

+4.26%

and Nike Inc.

NKE,

+3.26%

shares. -

Shares of Fisker Inc.

FSR,

+9.49%

jumped 9.5% after the electric-vehicle maker said it decided to cut December production to free up more than $300 million of liquidity. -

Ulta Beauty Inc.’s

ULTA,

+10.81%

stock surged 10.8% after the beauty company’s latest earnings report beat third-quarter consensus estimates. -

Pfizer Inc.

PFE,

-5.12%

shares dropped 5.1% after the company said it would not move to a Phase 3 trial of a twice-daily formulation of a weight-loss drug after patients in an earlier study had a lot of side effects.

Steve Goldstein contributed to this article.

Year-end Bitcoin options poised for bullish close with $5.7 billion expiry

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

SOL Price (Solana) Close Below $50 Could Spark Larger Degree Correction

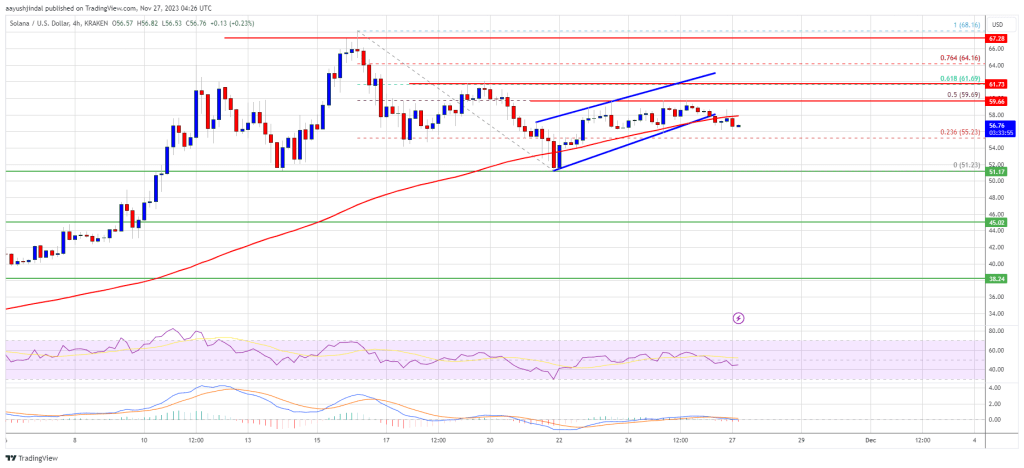

Solana rallied above the $65 resistance against the US Dollar. SOL price is now correcting gains and might even slide below the $50 support.

- SOL price started a major rally above the $60 resistance before the bears appeared against the US Dollar.

- The price is now trading below $60 and the 100 simple moving average (4 hours).

- There was a break below a short-term rising channel with support near $58.00 on the 4-hour chart of the SOL/USD pair (data source from Kraken).

- The pair could accelerate lower below the $55.00 support zone in the coming sessions.

Solana Price Starts Downside Correction

In the past few days, Solana saw a major rally above the $60 level. SOL gained bullish momentum after it settled above $60, outperforming Bitcoin and Ethereum.

The bulls even pumped the price above the $65 level. A high was formed near $68.16 and the price recently saw a downside correction. It traded below $60 and tested $52. A low was formed near $51.23 and the price is now consolidating in a range.

There was a break below a short-term rising channel with support near $58.00 on the 4-hour chart of the SOL/USD pair. SOL is now trading below $60 and the 100 simple moving average (4 hours).

On the upside, immediate resistance is near the $59.50 level. It is close to the 50% Fib retracement level of the downward move from the $68.16 swing high to the $51.23 low. The first major resistance is near the $60.00 level.

Source: SOLUSD on TradingView.com

The main resistance is now near $62 or the 61.8% Fib retracement level of the downward move from the $68.16 swing high to the $51.23 low. A successful close above the $62.00 resistance could set the pace for a larger increase. The next key resistance is near $68.50. Any more gains might send the price toward the $72.00 level.

More Losses in SOL?

If SOL fails to recover above the $60.00 resistance, it could continue to move down. Initial support on the downside is near the $55.00 level.

The first major support is near the $51.20 level, below which the price could test $50. If there is a close below the $50 support, the price could decline toward the $45 support in the near term.

Technical Indicators

4-Hours MACD – The MACD for SOL/USD is losing pace in the bullish zone.

4-Hours RSI (Relative Strength Index) – The RSI for SOL/USD is below the 50 level.

Major Support Levels – $55.00, and $51.20.

Major Resistance Levels – $60.00, $62.00, and $68.50.