Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Bitcoin’s network difficulty climbed to an unprecedented peak on April 10, 2024, at block height 838,656, increasing by 3.92% to reach 86.39 trillion. This escalation in difficulty will make it increasingly challenging to mine blocks as the fourth halving event nears, with fewer than 1,250 blocks remaining until block 840,000 is mined. Block 838,656 Marks […]

Source link

closer

Former FTX Associates Enter Crosshairs, Bitcoin Halving Inches Closer, and More — Week in Review

After the sentencing of Sam Bankman-Fried to nearly 25 years in prison for his role in FTX’s financial mismanagement, attention shifts to his former associates. The cryptocurrency world eyes the upcoming Bitcoin halving, expected between April 18 to April 22, 2024. Blackrock’s Ishares Bitcoin Trust (IBIT) sees its holdings skyrocket past 252,011 BTC. Ethena announces […]

After the sentencing of Sam Bankman-Fried to nearly 25 years in prison for his role in FTX’s financial mismanagement, attention shifts to his former associates. The cryptocurrency world eyes the upcoming Bitcoin halving, expected between April 18 to April 22, 2024. Blackrock’s Ishares Bitcoin Trust (IBIT) sees its holdings skyrocket past 252,011 BTC. Ethena announces […]

Source link

Bitcoin Halving Inches Closer With Fewer Than 2,900 Blocks Remaining

The next Bitcoin halving is on the horizon, drawing closer with each passing block and anticipated to take place anywhere between April 18 to April 22, 2024, at the milestone of block 840,000. Following this event, the reward for mining a block will halve from 6.25 bitcoins to 3.125 bitcoins. The following is a thorough […]

The next Bitcoin halving is on the horizon, drawing closer with each passing block and anticipated to take place anywhere between April 18 to April 22, 2024, at the milestone of block 840,000. Following this event, the reward for mining a block will halve from 6.25 bitcoins to 3.125 bitcoins. The following is a thorough […]

Source link

Leonard Dorlochter, the co-founder of peaq, revealed that the layer-1 blockchain focused on decentralized physical infrastructure networks (DePINs) and Machine RWAs is gearing up for its mainnet launch and token offering in an exclusive statement to CryptoSlate.

“The mainnet launch will be a historic milestone for the project, the culmination of years’ worth of research and development, of collaborations with industry giants like Bosch.

Equally exciting is the fact that soon, we will begin to open peaq to the community through the upcoming token offering[…] these exciting events will take place over the next few weeks, they are closing in by the day.”

The announcement comes on the heels of peaq’s successful $15 million pre-launch funding round, led by Generative Ventures and Borderless Capital, with participation from a host of prominent Web3 investors. The substantial investment in peaq highlights the growing interest in the DePIN space, which Messari estimates could reach a market potential of $3.5 trillion by 2028.

While details about the token offering remain under wraps due to ongoing processes, Dorlochter confirmed that these events are set to unfold over the next few weeks. He also shared plans for a major campaign to support DePINs building on peaq, stating, “We are planning a major campaign to support the DePINs building on peaq and foster their adoption through a wide variety of gamified challenges with rewards to earn.”

peaq’s layer-1 blockchain is specifically designed to cater to the unique requirements of DePINs, offering crucial backend functions, a machine-centric economic model, and a supportive ecosystem. These features differentiate peaq from other networks, with the aim of positioning it as a leading player in the DePIN space.

The funding round follows a year of significant growth for peaq, which saw the onboarding of over 20 DePINs spanning various use cases, such as Silencio, ELOOP, and Wingbits. In 2023, peaq showcased its real-world applications through collaborations with industry leaders like Bosch and Fetch.ai, demonstrating the potential for DePINs to bridge the gap between Web3 and the physical world.

As the DePIN sector continues to gain traction, peaq’s upcoming mainnet launch and token offering hope to play a crucial role in driving the adoption and growth of decentralized physical infrastructure networks. The project’s focus on providing a robust, scalable, and interoperable platform for DePINs, coupled with its growing ecosystem and industry partnerships, positions it in the middle of a key narrative for this cycle.

🏡 Top IoT Crypto Assets

View All

Latest Alpha Market Report

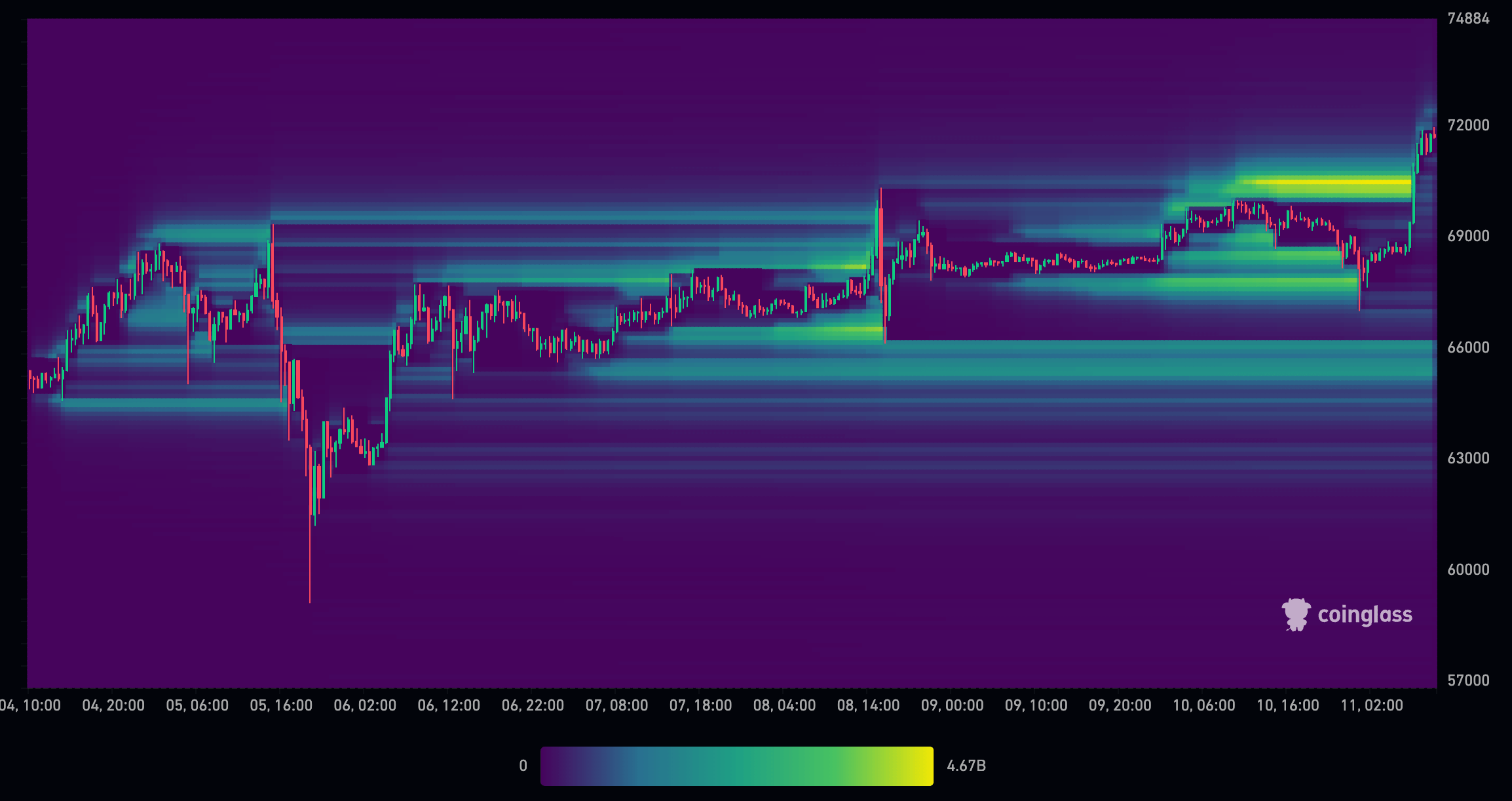

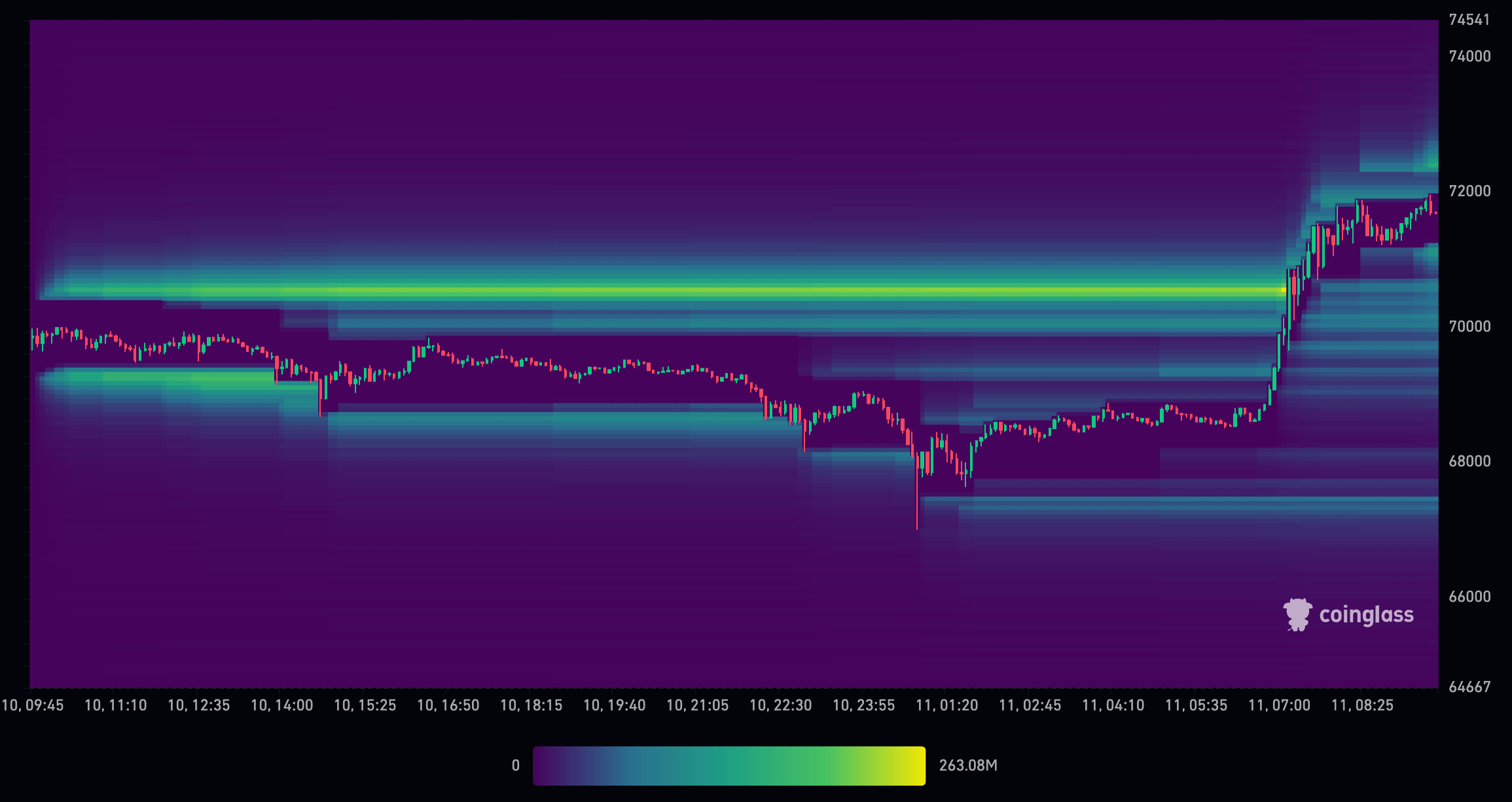

Recent data on Bitcoin liquidations and leverage levels indicates unique price discovery activity as longs and shorts have been swept from the market. Much of the leveraged positions were shaken out last week as Bitcoin saw volatile price actions around the US market open.

The liquidation chart from CoinGlass below highlights how trading activity on March 5 and 8 around 2.30 pm GMT (US market open) led to heavy liquidations of both long and short positions. A roughly 2% increase was followed by a decrease of over 10% on March 5, which swept the order books and flushed out all leverage down to $60,000.

The subsequent rapid V-shaped recovery saw further leverage positions created around $70,000 and $66,000. The market open on March 8 shook these out, leaving little to no leverage above $66,000.

As of March 11, the drop to $67,000, followed by a surge to new highs around $71,500, has again removed most leveraged positions above $66,000, setting a solid floor. The effect of such movements is that Bitcoin now has free reign for natural price discovery above $66,000.

Unlike the bull market of 2021, which was heavily influenced by highly leveraged positions, the current cycle appears to be shaking out leverage before it has the chance to cause significant volatility. Further, key institutional players and market makers may have a hand in clearing the route for Bitcoin’s price discovery through large-scale trading activities.

The role of market makers in price discovery

Market makers and, more recently, ETF-authorized participants heavily influence financial markets, conducting the flow of buy and sell orders with precision, and are responsible for providing liquidity, which is the lifeblood of any asset’s market. By quoting continuous bid and ask prices, they aim to profit from the spread, but their role extends far beyond mere profit generation.

During periods of high volatility, market makers engage in a strategic maneuver known as “sweeping” the order book. This involves placing many orders at varying price levels to probe the market’s depth and ascertain the true balance of supply and demand. This sweeping action is a probe into the market’s present state and a catalyst for price discovery, revealing the levels at which market participants are willing to transact in significant volumes.

The recent sweep of leverage from the Bitcoin market has profoundly impacted price conditions. With the removal of leveraged sell orders, the market has witnessed a reduction in downward pressure, allowing for a more organic price discovery process. This is characterized by a market less influenced by the amplified bets of leveraged traders and more by its participant’s genuine sentiment and valuations.

As the market adjusts to the new equilibrium free from the weight of leveraged positions, the price of Bitcoin is more likely to reflect its actual market value. This is not to say that the path will be linear or devoid of volatility; the crypto market is known for its rapid price swings. However, the current landscape suggests the conditions are ripe for a more sustained upward trend.

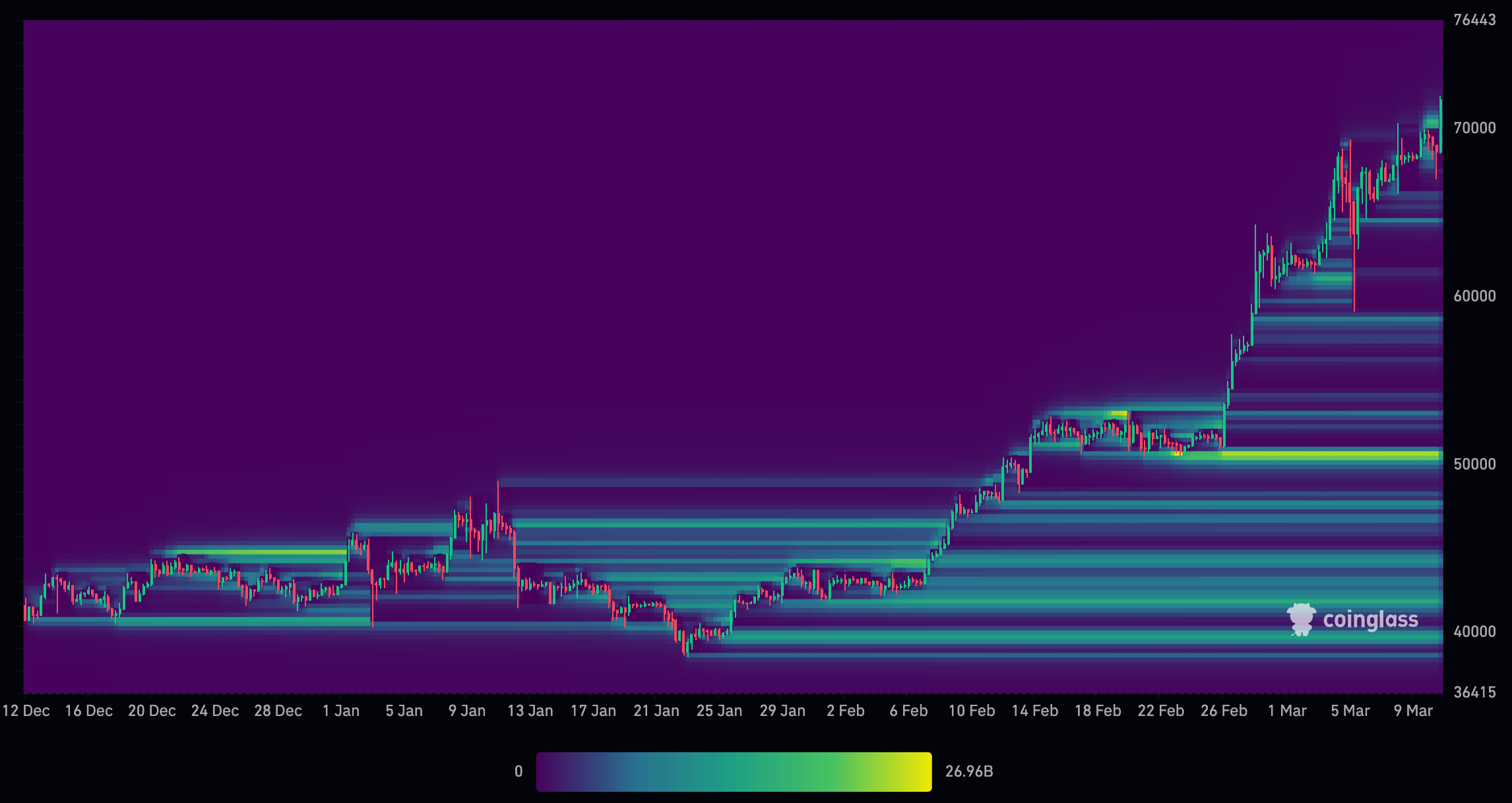

Leverage reduction and order book sweeping since December

A closer look at the market forces from December 2022 to March 2023 explains the route for further price discovery and a new $50,000 floor.

In December, the market witnessed substantial liquidations of leveraged positions, with many longs liquidated just above the $41,000 level and shorts liquidated around $45,000. As Bitcoin approached the ETF approval on January 11, many shorts were opened around the $45,000 level, which persisted as the price dropped to around $40,000. Interestingly, there were not many longs at this level, suggesting that the price was supported by holders and general price discovery rather than leveraged positions.

As Bitcoin rebounded from $40,000 and climbed toward $45,000 by early February, several shorts were liquidated along the way. As Bitcoin continued its upward trajectory, longs were positioned from $40,000 to $50,000. By the time Bitcoin reached $50,000, there were substantial leveraged positions, amounting to approximately $27 billion. However, as the price increased, the amount of leveraged positions above $50,000 diminished considerably.

The price action at the beginning of March saw Bitcoin surge to $70,000 and then plummet to $59,000 within a single candlestick, effectively wiping out nearly all leveraged positions in the market. Although there was some leverage around $70,000, the majority of leveraged positions are now concentrated below $50,000.

The liquidation of leveraged positions has led to a more transparent market structure, with a more balanced distribution of longs and shorts. This development could pave the way for a more organic price discovery process driven by genuine market demand rather than leveraged speculation.

The recent liquidations and reduction of leveraged positions in the Bitcoin market suggest a potential shift towards a more fundamentally driven market. With the majority of leveraged positions now concentrated at lower price levels, there is room for the market to experience upward pressure as genuine demand and adoption drive prices higher.

Removing excessive leverage has set the stage for a healthier market dynamic, where price discovery is guided by fundamental factors such as increasing mainstream acceptance, regulatory clarity, and technological advancements in the blockchain space.

The recent liquidations and leverage data provide a compelling case for a potential upward trend driven by organic price discovery.

Latest Alpha Market Report

Leading indicators fall again, but U.S. appears no closer to recession

Breaking news. Check back for updates.

The numbers: The leading indicators for the U.S. economy fell again in December to mark the 21st decline in a row, but a widely predicted recession still appears no closer than when the long losing streak first began.

The leading index slid 0.1% last month, but it was smaller than the 0.3% drop forecast by economists polled by the Wall Street Journal.

The losing streak is the third longest on record

The two other times the index was negative for so long, a recession took place. Yet the economy has not followed the usual patterns since the 2020 pandemic.

Key details: Six of the 10 indicators in the survey were positive in December, a big improvement compared to prior months.

The leading index is a gauge designed to show whether the economy is getting better or worse. The report is published by the nonprofit Conference Board.

Big picture: The economy has continued to expand through a period of high inflation and rising interest rates orchestrated by the Federal Reserve to get prices back under control.

The U.S. grew at a rapid 4.9% annual pace in the third quarter and gross domestic product is estimated to have expanded by almost 2% in the recently ended fourth quarter.

Economists are split on whether a recession is likely, but if the Federal Reserve cuts interest rates this year it could help the U.S. to avert a downturn. Central bank officials have signaled they are probably done raising rates.

Looking ahead: The Conference Board is sticking to its forecast.

“Overall, we expect GDP growth to turn negative in [the second and third quarters] of 2024 but begin to recover late in the year,” said Justyna Zabinska-La Monica, senior manager of business cycle indicators.

Market reaction: The Dow Jones Industrial Average

DJIA

and S&P 500

SPX

rose in Monday trading.

Maintaining its lofty position—the highest it has reached in the last 18 months—Bitcoin is once again on the edge of a potential price increase.

With a notable 10% gain over the previous month and more than a doubling of its value over the same period last year, the markets valued Bitcoin (BTC) at over $38,600 on Friday morning.

The alpha coin’s supporters credit its strong success thus far to the excitement around spot Bitcoin ETFs, like the one put up by BlackRock, which might be approved at any time.

During European morning hours on Friday, Bitcoin almost reached the coveted $40,000 mark, hitting $38,810 for the first time since May 2022. Expectations of increasing institutional demand have supported the increase, which is a continuation of a solid multi-month run.

Data from cryptocurrency market tracker Coingecko indicates that the coin is up approximately 2% on the day, and sustaining a 3% gain in the last seven days.

Expert Predictions For Bitcoin: What They Say

Experts are becoming increasingly fixated on the ETF, as approval of the product approaches. An important piece of information comes directly from Bloomberg analyst James Seyffart, who projects that the clearance date would occur between January 5 and January 10, 2024.

This projection follows a string of purposefully extended deadlines, indicating a concerted attempt by the SEC to accept several ETF applications at the same time.

Okay the window for potential spot #Bitcoin ETF approval is looking like its gonna be between Jan 5 & Jan 10 2024. I spoke with @thomasg_grizzle & @ScottW_Grizzle this morning and nailed this call. pic.twitter.com/y9JYdEpjNH

— James Seyffart (@JSeyff) November 30, 2023

Seyffart’s analysis focuses on the timelines for Hashdex and Franklin Templeton, suggesting that the timeline to green light all 12 spot Bitcoin ETF applications may coincide between January 5 and 10.

The founder and chief market strategist of NorthmanTrader, Sven Henrich, offered his predictions for the present and future of the Bitcoin market. He examined short-term forecasts, the structural soundness of the market, and made comparisons with past market patterns.

BTCUSD currently trading at $38,806 on the daily chart: TradingView.com

Henrich projected a possible shift to between $41,000 and $43,000, especially as the year came to a finish. He did, however, stress the need for caution because of the cryptocurrency’s association with more general market trends, particularly in the tech industry.

Mike Novogratz, a well-known businessman and cryptocurrency advocate, expressed unrelenting optimism about the trajectory of Bitcoin and attributed his positive perspective to the much anticipated approval of a spot Bitcoin ETF.

Is $41K The Next Stop For Bitcoin?

Novogratz thinks that Bitcoin’s value will go through the roof if big financial entities like BlackRock and Fidelity start to use it, which will cause its price to reach all-time highs.

The bitcoin community is growing increasingly optimistic that the price of the cryptocurrency may rise to $41,000 in the next few days as it approaches the $40,000 threshold. Because of the market’s volatility, traders are constantly on the lookout for the next move.

It is unclear if Bitcoin will run into resistance or continue on its current upward trend. By constantly observing price charts and market indicators, investors prepare themselves for the dynamics of the market as they develop.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

A rational take on a SkyNet ‘doomsday’ scenario if OpenAI has moved closer to AGI

Hollywood blockbusters routinely depict rogue AIs turning against humanity. However, the real-world narrative about the risks artificial intelligence poses is far less sensational but significantly more important. The fear of an all-knowing AI breaking the unbreakable and declaring war on humanity makes for great cinema, but it obscures the tangible risks much closer to home.

I’ve previously talked about how humans will do more harm with AI before it ever reaches sentience. However, here, I want to debunk a few common myths about the risks of AGi through a similar lens.

The myth of AI breaking strong encryption.

Let’s begin by debunking a popular Hollywood trope: the idea that advanced AI will break strong encryption and, in doing so, gain the upper hand over humanity.

The truth is AI’s ability to decrypt strong encryption remains notably limited. While AI has demonstrated potential in recognizing patterns within encrypted data, suggesting that some encryption schemes could be vulnerable, this is far from the apocalyptic scenario often portrayed. Recent breakthroughs, such as cracking the post-quantum encryption algorithm CRYSTALS-Kyber, were achieved through a combination of AI’s recursive training and side-channel attacks, not through AI’s standalone capabilities.

The actual threat posed by AI in cybersecurity is an extension of current challenges. AI can, and is, being used to enhance cyberattacks like spear phishing. These methods are becoming more sophisticated, allowing hackers to infiltrate networks more effectively. The concern is not an autonomous AI overlord but human misuse of AI in cybersecurity breaches. Moreover, once hacked, AI systems can learn and adapt to fulfill malicious objectives autonomously, making them harder to detect and counter.

AI escaping into the internet to become a digital fugitive.

The idea that we could simply turn off a rogue AI is not as stupid as it sounds.

The massive hardware requirements to run a highly advanced AI model mean it cannot exist independently of human oversight and control. To run AI systems such as GPT4 requires extraordinary computing power, energy, maintenance, and development. If we were to achieve AGI today, there would be no feasible way for this AI to ‘escape’ into the internet as we often see in movies. It would need to gain access to equivalent server farms somehow and run undetected, which is simply not feasible. This fact alone significantly reduces the risk of an AI developing autonomy to the extent of overpowering human control.

Moreover, there is a technological chasm between current AI models like ChatGPT and the sci-fi depictions of AI, as seen in films like “The Terminator.” While militaries worldwide already utilize advanced aerial autonomous drones, we are far from having armies of robots capable of advanced warfare. In fact, we have barely mastered robots being able to navigate stairs.

Those who push the SkyNet doomsday narrative fail to recognize the technological leap required and may inadvertently be ceding ground to advocates against regulation, who argue for unchecked AI growth under the guise of innovation. Simply because we don’t have doomsday robots does not mean there is no risk; it merely means the threat is human-made and, thus, even more real. This misunderstanding risks overshadowing the nuanced discussion on the necessity of oversight in AI development.

Generational perspective of AI, commercialization, and climate change

I see the most imminent risk as the over-commercialization of AI under the banner of ‘progress.’ While I do not echo calls for a halt to AI development, supported by the likes of Elon Musk (before he launched xAI), I believe in stricter oversight in frontier AI commercialization. OpenAI’s decision not to include AGI in its deal with Microsoft is an excellent example of the complexity surrounding the commercial use of AI. While commercial interests may drive rapid advancement and accessibility of AI technologies, they can also lead to a prioritization of short-term gains over long-term safety and ethical considerations. There’s a delicate balance between fostering innovation and ensuring responsible development we may not yet have figured out.

Building on this, just as ‘Boomers’ and ‘GenX’ have been criticized for their apparent apathy towards climate change, given they may not live to see its most devastating effects, there could be a similar trend in AI development. The rush to advance AI technology, often without adequate consideration of long-term implications, mirrors this generational short-sightedness. The decisions we make today will have lasting impacts, whether we’re here to witness them or not.

This generational perspective becomes even more pertinent when considering the situation’s urgency, as the rush to advance AI technology is not just a matter of academic debate but has real-world consequences. The decisions we make today in AI development, much like those in environmental policy, will shape the future we leave behind.

We must build a sustainable, safe technological ecosystem that benefits future generations rather than leaving them a legacy of challenges our short-sightedness creates.

Sustainable, pragmatic, and considered innovation.

As we stand on the brink of significant AI advancements, our approach should not be one of fear and inhibition but of responsible innovation. We need to remember the context in which we’re developing these tools. AI, for all its potential, is a creation of human ingenuity and subject to human control. As we progress towards AGI, establishing strong guardrails is not just advisable; it’s essential. To continue banging the same drum, humans will cause an extinction-level event through AI long before AI can do it itself.

The real risks of AI lie not in the sensationalized Hollywood narratives but in the more mundane reality of human misuse and short-sightedness. It’s time we remove our focus from the unlikely AI apocalypse to the very real, present challenges that AI poses in the hands of those who might misuse it. Let’s not stifle innovation but guide it responsibly towards a future where AI serves humanity, not undermines it.

Starknet moves closer to EVM compatibility with upcoming ‘Kakarot’ testnet

Starknet, a zero-knowledge layer-2 scaling solution for Ethereum, is one step closer to becoming fully Ethereum Virtual Machine (EVM) compatible, pending an August testnet launch of Kakarot, a new zkEVM.

On June 3, the Kakarot team announced it had received new backing from Ethereum co-founder Vitalik Buterin, Ledger co-founder Nicholas Bacca and Starkware.

We have powered up and entered Super Saiyan mode⚡. Kakarot Labs has officially been incorporated and closed a pre-seed round with top-tier investors.

Let’s unpack our vision, current standing, and the exciting future ahead. pic.twitter.com/VI8QRdPLfw

— Kakarot zkEVM (@KakarotZkEvm) June 2, 2023

In an interview with Cointelegraph, Kakarot CEO and co-founder Elias Tazartes explained that while Starknet stands as a leading Zero Knowledge roll-up in the Ethereum ecosystem, it’s not EVM compatible, so there’s “kind of a barrier to entry.”

Starknet is used by developers to scale decentralized applications, transactions and computation on Ethereum but uses its own native language, Cairo. According to Starknet, the use of Cairo makes it easier and faster to develop, review and maintain new code.

The downside is that it isn’t EVM compatible, which could dissuade some developers.

“The greatest impact that Kakarot can have is to make Starknet EVM compatible.”

“Kakarot right now is like a Solidity or any language engine. Eventually you will be able to put that engine within Starknet to make it EVM compatible.”

At present, Starknet runs its own custom smart contract Virtual Machine, dubbed “Cairo VM,” which leverages Cairo. This means that Starknet doesn’t have direct EVM compatibility out of the box, something that could prove to be a significant hurdle for overall rollup performance.

“Some teams really need to be able to use Solidity. For example, if someone wrote a DEX or an AMM for the Ethereum ecosystem and now has 60,000 lines of code already audited, ready to go, but it’s only on EVM chains.”

If these developers wanted to start using Starknet, they would have to hire a whole new dev team, write in, audit the code again and maintain two code bases — which Tazartes describes as “prohibitively expensive.”

Related: More TPS, less gas: Ethereum L2 Starknet outlines performance upgrades

According to Tazartes, the idea for the zkEVM was first floated during a Starkware conference in July 2022. By October, the development team was able to together for a week during a hacker house event in Lisbon, Portugal, to get cracking on the new zkEVM.

Two months and 20 days later, in December, the coding for the project was complete, ready to create a fully functional execution layer — all of which was achieved without any venture funding.

Notably, Tazartes said that Buteirn later invested in Kakarot due to his enthusiasm over a multiple-zkEVM approach to building out the Ethereum ecosystem.

“For Vitalik, the more zkEVMs the better, because as long as you have a wide diversity of architecture and diversity of approaches…then this is really good for the space as a whole.”

Tazartes shared that the testnet version of Kakarot will be launched for public use this August.

Magazine: Tornado Cash 2.0 — The race to build safe and legal coin mixers

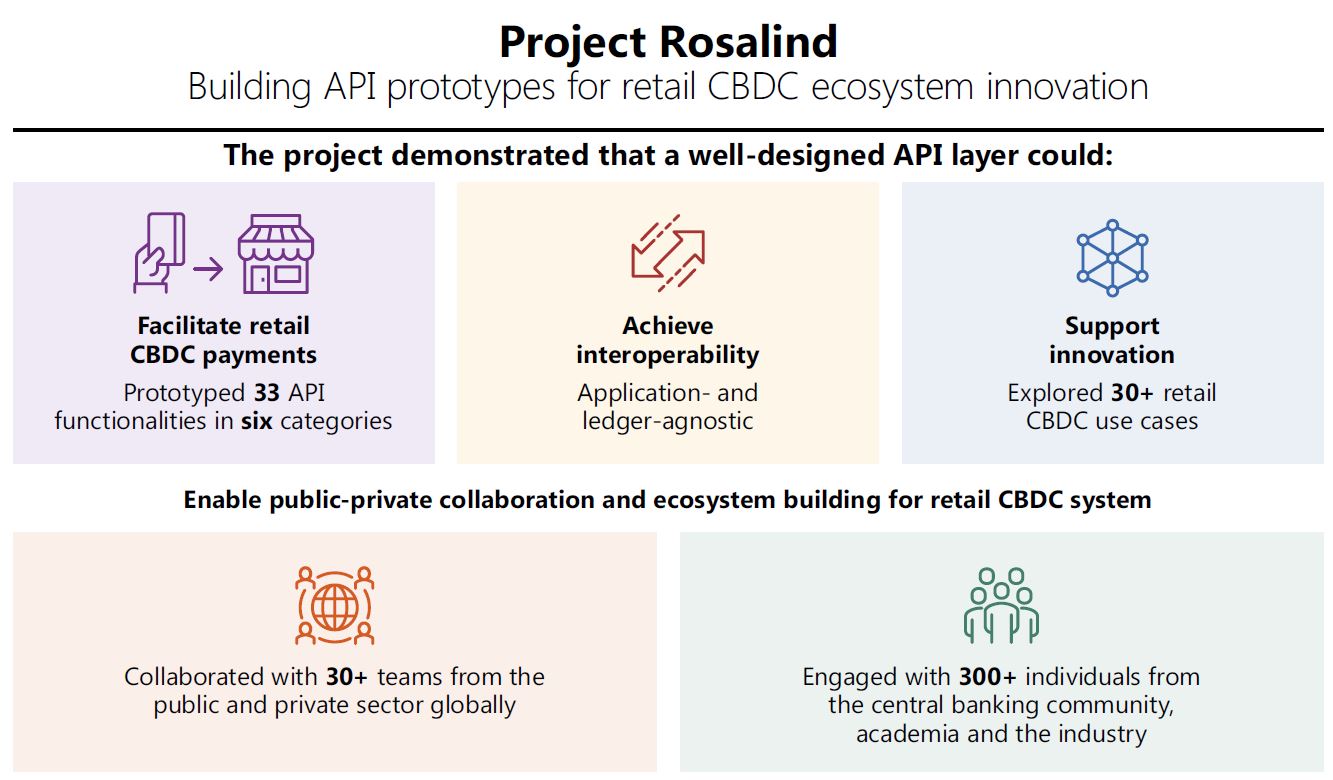

The Bank of England (BoE) is a step closer to launching its central bank digital currency dubbed “Britcoin” following the conclusion of a trial study called Project Rosalind.

The Bank for International Settlements and the BoE launched the joint experiment in July 2022 to explore how prototypes of an application programming interface (API) could be implemented in retail CBDC transactions.

A June 16 report that summed up phase two of Project Rosalind found a CBDC could make payments between individuals cheaper and more efficient while allowing firms to create new financial products that work to reduce fraudulent financial activity.

Overall, the study developed 33 API functionalities and explored “more than 30 retail CBDC use cases.”

In addition to looking at how a CBDC would function on smartphones, retail vendors and online stores, the study also explored the concept of “programmability” — a term that refers to customizing digital money to behave in specific ways once certain conditions are met.

CBDC programmability has been met with considerable skepticism, as critics claim a CBDC could be programmed to “work against” those who use it.

Overall, the study concluded a “well-designed” API layer could enable a central bank to interact with the private sector to “safely provide” retail CBDC payments.

Project Rosalind, from the #BISInnovationHub London Centre & @bankofengland, explored how a universal and extensible #API layer could connect central bank and private sector infrastructures and facilitate retail #CBDC payments pic.twitter.com/kDeo0yhrsR

— Bank for International Settlements (@BIS_org) June 16, 2023

“The Rosalind experiment has advanced central bank innovation in two key areas: by exploring how an API layer could support a retail CBDC system and how it could facilitate safe and secure CBDC payments through a range of different use cases,” said Francesca Road, head of the BIS London Innovation Hub in a press release.

Despite the positive findings yielded in Project Rosalind, BoE Deputy Governor Jon Cunliffe said a final decision on if the country would launch a CBDC is still “some years” away.

Related: Privacy should be considered in ‘potential retail CBDC’ — Treasury official

According to a June 16 Bloomberg report, Cunliffe told attendees of Politico’s Global Tech Day conference that the odds of a CBDC project going ahead currently stand at “seven out of ten.”

On the same day the findings from Project Rosalind were released, enterprise blockchain Quant Network announced its role as a vendor in the study. The announcement saw the price of Quant’s native QNT (QNT) token surge more than 20% from $96 to $117 within 12 hours.

Magazine: Bitcoin is on a collision course with ‘Net Zero’ promises