According to Shahaf Bar-Geffen, CEO of the privacy-centric Layer 2 network COTI, enterprises and mainstream organizations are not yet fully convinced of the benefits of complete privacy or true anonymity in any system. Bar-Geffen said the primary reason for this is that such systems often get exploited by individuals with dishonest intentions. Regulators’ Perceptions of […]

According to Shahaf Bar-Geffen, CEO of the privacy-centric Layer 2 network COTI, enterprises and mainstream organizations are not yet fully convinced of the benefits of complete privacy or true anonymity in any system. Bar-Geffen said the primary reason for this is that such systems often get exploited by individuals with dishonest intentions. Regulators’ Perceptions of […]

Source link

Cofounder

Michael Patryn, co-founder of the now-defunct Quadrigacx cryptocurrency exchange, has been compelled by Canadian officers to explain the origin of his wealth. Patryn must explain how he acquired a stash of 45 gold bars, more than $180,000 in cash, and a jewelry set with a diamond-studded Rolex watch. Quadrigacx Cofounder Must Explain 45 Gold Bar […]

Michael Patryn, co-founder of the now-defunct Quadrigacx cryptocurrency exchange, has been compelled by Canadian officers to explain the origin of his wealth. Patryn must explain how he acquired a stash of 45 gold bars, more than $180,000 in cash, and a jewelry set with a diamond-studded Rolex watch. Quadrigacx Cofounder Must Explain 45 Gold Bar […]

Source link

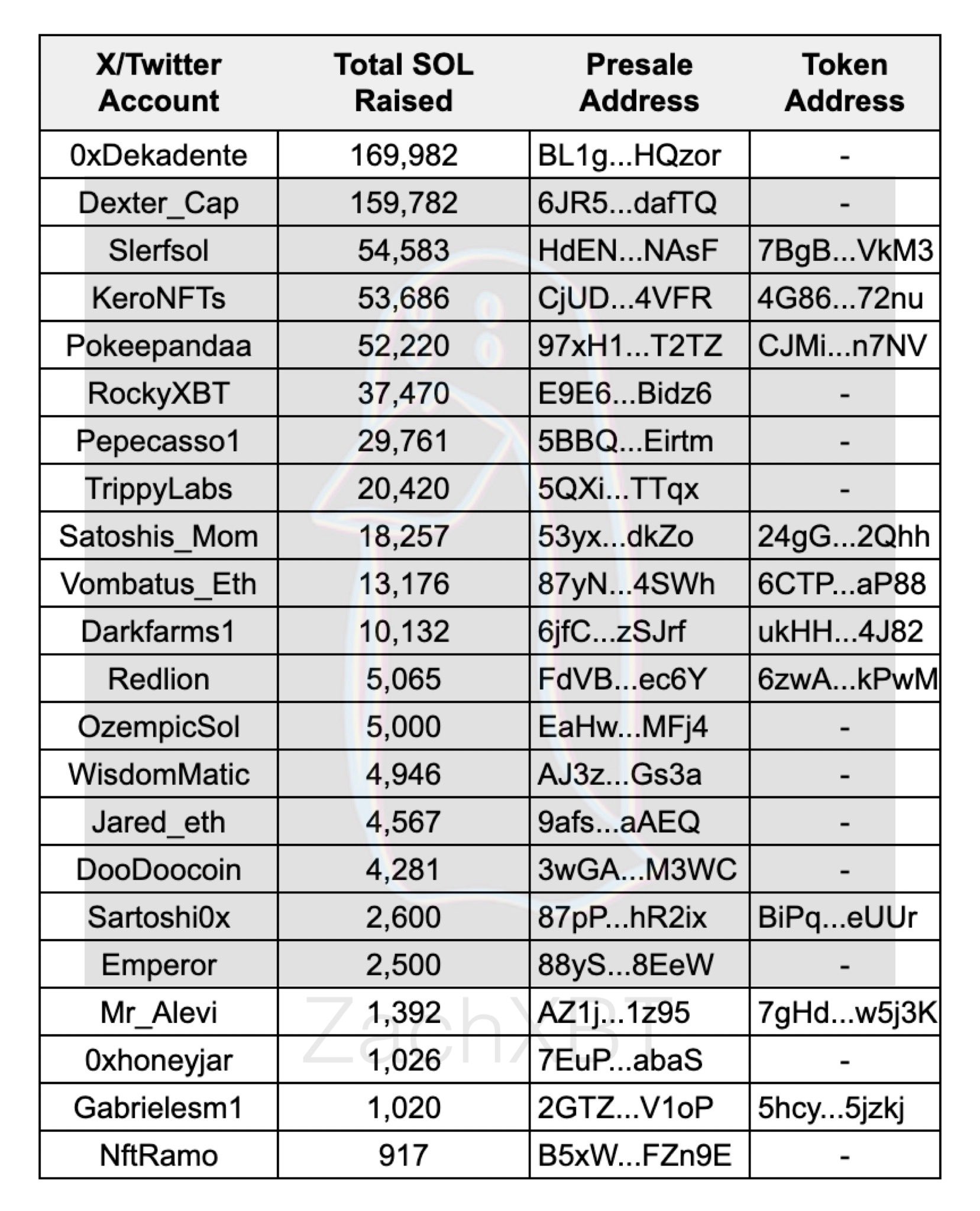

Solana co-founder Anatoly tells community to stop investing in memecoin pre-sales

Solana Labs Co-Founder Anatoly Yakovenko has seemingly taken a stand against Solana-based memecoins, calling for investors to “stop doing this” in relation to data showing the high volume of SOL being sent to memecoin pre-sale contracts.

On-chain sleuth ZachXBT shared the image below detailing a list of social media accounts that had recently raised significant funding for memecoins on Solana. Top of the list 0xDekadente raised 169,982 SOL, approximately $30.5 million, while the lowest value project, NftRamo, raised roughly $165,060.

Anatoly quoted the above image and the phrase “stop doing this” with no other comment. Memecoin fervor recently helped drive SOL prices over $200 for the first time since the last bull market and mark a new all-time high market cap.

As of press time, 0xDekedente is attempting to airdrop tokens to pre-sale investors but is struggling due to network congestion. As a result, the account suggested launching the token before airdropping tokens to investors.

“The smolana network is extremely congested and it is impossible to airdrop at the same time as the LP in this moment… we try, but it’s impossible

So, you choose: Launch now and receive the $smole airdrop in the next few hours…

Launch the airdrop and the LP at the same time, this will take a few hours for the network to decongest… We don’t know how much exactly it will take due to the congestion, but we will do it ASAP whatever your decision.”

Currently, the online vote suggests the token will launch before the airdrop happens, meaning investors who contributed to the pre-sale will not have tokens available to sell when the token launches.

As of press time, SOL is down 15% from its local high to trade around $179. Memecoins, seen by some as exit liquidity gambling and important community innovation by others, potentially drive interest in Solana for the wrong reasons.

The memecoin demand is at least acting as a stress test for the network, showcasing the pressure points for network congestion on high demand. Memecoins are struggling to launch liquidity pools and airdrop tokens, while tokens and dApps with actual utility have little to no exposure.

The post Solana co-founder Anatoly tells community to stop investing in memecoin pre-sales appeared first on CryptoSlate.

BitMEX co-founder believes this stablecoin could flip Tether one day

Ethena, the protocol powering the USDe synthetic dollar, raked in $6.53 million in fees over the last 24 hours, cementing its position as the top fee-generating decentralized application (dApp) in the crypto space, according to data from DeFillama.

Seraphim Czecker, Ethena Labs’ Head of Growth, shared insights from Token Terminal, affirming the project’s remarkable milestone. Czecker’s data indicates that Ethena amassed approximately $6.8 million in fees over the past week, outpacing competitors like MakerDAO and Arbitrum.

Yet, compared to leading blockchain networks, its revenue pales in comparison. Tron and Ethereum, for instance, boasted revenues of $38.6 million and $182.5 million, respectively.

What exactly is USDe?

USDe is a token pegged to the dollar’s value, offering lucrative yields. Though often labeled as a stablecoin, the team eschews this term, instead favoring “synthetic dollar.”

Ethena Labs launched the synthetic dollar on the public mainnet on Feb. 19 to widespread investor interest. At the time, the project debuted with a staggering 27.6% annual percentage yield (APY), surpassing the 20% yield offered by Anchor Protocol on the TerraUSD (UST) algorithmic stablecoin before its collapse in May 2022.

USDe’s unique model attracted $14 million in investments from prominent players such as Arthur Hayes, Brevan Howard, Franklin Templeton, Galaxy Digital, and Binance Labs.

In a recent update, Hayes, the co-founder of the BitMEX exchange, predicted that the project could flip Tether’s USDT dominance in the industry.

Hayes said:

“I believe that Ethena can eclipse Tether as the largest stablecoin. [However,] it will take many years for this prophecy to manifest itself.”

Rapid growth

Since its mainnet launch, USDe has experienced exponential growth, witnessing a staggering 44% surge in total value locked over the past week and an impressive 409% surge over the last month, reaching $838 million, according to DeFillama data.

This rapid growth has contributed to USDe’s development into one of the top 10 stablecoins by market capitalization, achieving this milestone in less than three weeks.

Market analysts have attributed this remarkable growth to the project’s enticing staking yield. Ethena, as stated on its website, offers a substantial 67.2% yield on its USDe synthetic dollar.

Furthermore, USDe now commands a significant portion of the global ether perpetual futures open interest, comprising nearly 8.69%. Notably, its average funding rate stands at an impressive 58.35%, as per data available on its website.

Mentioned in this article

Latest Alpha Market Report

Leveraging Web3 to Incentivize Fitness Behavioral Changes — Co-Founder of Sweat Economy Oleg Fomenko

The start of every year presents an opportunity for new beginnings. Many people set out with ambitions to hit the gym, exercise regularly, or walk more instead of driving. Sadly, it’s estimated that it takes the average American just seven weeks to lose motivation and abandon their New Year’s health goals. The following is an […]

The start of every year presents an opportunity for new beginnings. Many people set out with ambitions to hit the gym, exercise regularly, or walk more instead of driving. Sadly, it’s estimated that it takes the average American just seven weeks to lose motivation and abandon their New Year’s health goals. The following is an […]

Source link

Non-Fungible Items; Picking up Where NFTs Left off — COZ Co-Founder Tyler Adams

Many have already pronounced the death of NFTs, and in part, they are correct. Amidst the fervor of the NFT hype cycle, we saw huge valuations and sales such as Beeple’s ‘The 5000 Days’ collection selling for a staggering $69.3 million. However, not substantiated by anything beyond the hype, the market came crashing down with […]

Many have already pronounced the death of NFTs, and in part, they are correct. Amidst the fervor of the NFT hype cycle, we saw huge valuations and sales such as Beeple’s ‘The 5000 Days’ collection selling for a staggering $69.3 million. However, not substantiated by anything beyond the hype, the market came crashing down with […]

Source link

George Soros’s Former Co-Founder Sounds Economic Alarm Saying, ‘The Next Problem Has To Be The Worst In My Lifetime’ — Waiting For Right Time To Go Short

The Quantum Fund’s historical performance is most often associated with Co-Founder George Soros. The fund achieved an average annual return of 30% from 1970-2000.

Perhaps Soros’s most famous bet came against the pound in 1992 when it netted his fund about $1 billion in one trade, considered by some to be the greatest currency trade of all time.

However, Soros didn’t start the Quantum Fund alone. Instead, he founded it alongside another now-famous investor, Jim Rogers. While Rogers left the fund in 1980 to “retire” and travel around the world on his motorcycle to search for international investment ideas, eventually turning his travel experiences into a best-selling book called “Investment Biker,” he continued to share his thoughts on the market.

Don’t Miss:

Seemingly, the best thing he can say about stocks at the moment is that it’s not the right time to short them … yet.

In a recent interview, Rogers shared that the world essentially is in an everything bubble, telling Soar Financially, “Bonds are a bubble, property in many countries is a bubble, stocks are getting ready for a bubble.”

Even with his bearish conviction, he points out that he’s “not shorting yet because often at the end there’s a blowoff and things get really crazy.”

To play out his thesis as he waits for his planned short, Rogers is happy to sit in hard assets such as gold and silver, explaining “everybody should have some silver and gold under the bed.”

Trending: Copy and paste Mark Cuban’s startup investment strategy according to his colorful portfolio.

Investors who don’t want the stress of storing the actual physical metal in their possession could consider an exchange-traded fund (ETF) such as the SPDR Gold Trust (NYSE:GLD) or the iShares Silver Trust (NYSE:SLV).

It should be noted, however, that Rogers has not been accurate with his predictions in recent years.

In 2011, he shared that there was a 100% chance of a crisis worse than in 2008. If investors heeded his advice then and never got back into a market-tracking index fund such as the SPDR S&P 500 ETF Trust (NYSE:SPY) they would have missed out on about 290% returns. Of course, these impressive returns came despite there being wars, a pandemic, flash crashes and inflation scares.

As the old expression goes, even a broken clock is right twice a day. However, to completely dismiss the advice of one of the world’s most legendary investors might not end up looking wise if Rogers is right about a serious crash being around the corner — especially if it is the worst in his lifetime, given how much he’s seen in his 81 years.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article George Soros’s Former Co-Founder Sounds Economic Alarm Saying, ‘The Next Problem Has To Be The Worst In My Lifetime’ — Waiting For Right Time To Go Short originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

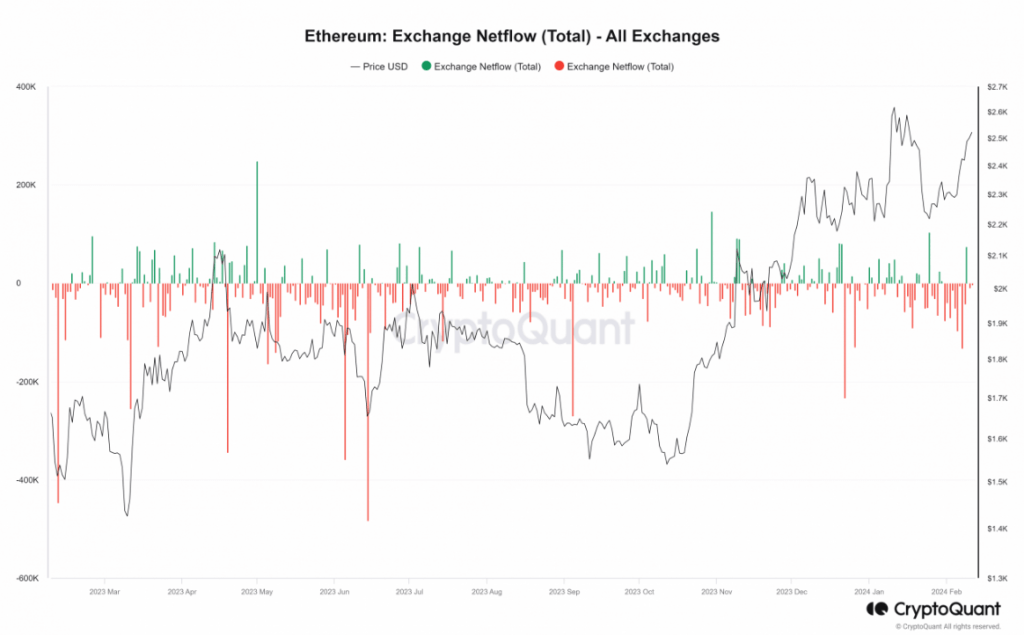

In a recent development, Ethereum [ETH] co-founder Jeffrey Wilcke’s wallet has made a notable deposit of 4,300 ETH to a cryptocurrency exchange.

The deposit made by Wilcke amounts to 22,000 ETH, valued at approximately $41.1 million at the time. With Ethereum’s current price standing at $2,500, this deposit has injected renewed interest and excitement into the market.

Ethereum Co-Founder Transfers 22K ETH: Impact On Price

Despite this substantial deposit, the overall trend of Ethereum’s netflow remains unaffected. This deposit comes after a considerable hiatus, with the last recorded transaction from this wallet dating back to June 2023.

Jeffrey Wilcke, the Co-founder of #Ethereum, deposited 4,300 $ETH($10.7M) to #Kraken 7 hours ago. pic.twitter.com/ROG0evjirh

— Lookonchain (@lookonchain) February 10, 2024

Source: Lookonchain/X

According to an analysis of the Netflow metric on CryptoQuant conducted by NewsBTC, there has been a continued outflow of ETH from exchanges. In fact, more than 9,800 ETH left the exchanges at the end of trade on February 10th. However, it is worth noting that the previous day witnessed a significant inflow of over 75,000 ETH.

In the midst of these market movements, Ethereum’s price has been on an upward trajectory over the past three days. As of the time of this report, ETH is trading at over $2,500, indicating a strong positive trend.

Ethereum Bulls Gain Momentum: $3,000 Milestone?

The Short Moving Average and Relative Strength Index (RSI) further validate this bullish sentiment. The RSI has crossed the 60 mark and is moving towards the overbought zone, while the price remains above the yellow line, acting as a support level.

Furthermore, Ethereum has been making waves in the crypto world, surpassing even Bitcoin and signaling a robust bullish trend. All eyes are now on ETH, with growing expectations that it may soon hit the $3,000 milestone.

Ethereum currently trading at $2,501.5 on the daily chart: TradingView.com

Speculation is also building about a potential climb to $5,000, with rumors circulating about an upcoming upgrade referred to as “Dencun” next week. However, it is important to note that information regarding this specific upgrade is limited, and further research is required to verify its impact on Ethereum’s potential price surge.

As the market eagerly anticipates the future trajectory of Ethereum, investors and enthusiasts are advised to exercise caution and stay informed. Tracking official Ethereum community channels, developer blogs, and reputable cryptocurrency news sources will provide valuable insights into the latest developments and upgrades affecting ETH’s price movements.

Wilcke’s recent deposit, combined with Ethereum’s positive trend and the anticipation surrounding the rumored Dencun upgrade, has created an atmosphere of excitement and speculation within the cryptocurrency market. With ETH surpassing Bitcoin and eyeing new all-time highs, the future of Ethereum holds immense potential for investors and traders alike.

Featured image from Adobe Stock, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

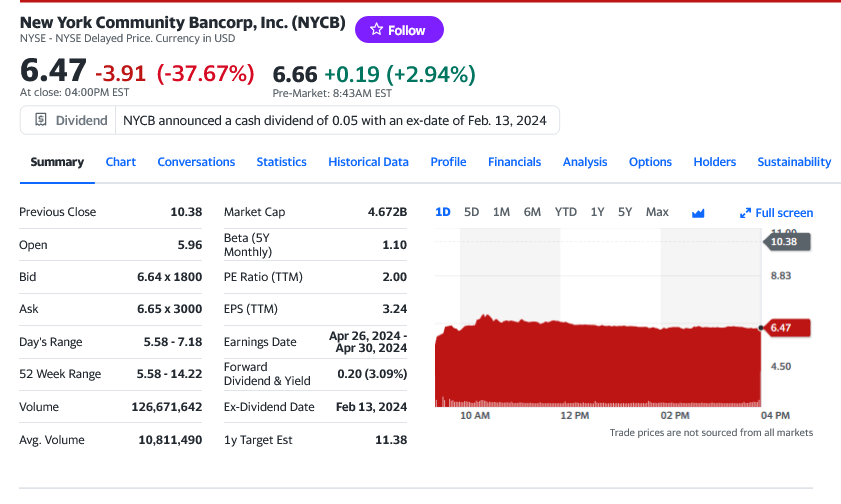

BitMEX Co-Founder Backs Solana Amidst Fears of Another US Bank Collapse

In a post on X, Arthur Hayes, the co-founder of the derivatives crypto exchange BitMEX, said it might be time for traders to double down on Solana (SOL) and altcoins in general. Hayes’s comments come at a time of heightened volatility in the broader crypto market, with Bitcoin (BTC) struggling to regain its footing and altcoins, including Ethereum (ETH), posting mixed results.

Time To Switch To Solana?

The co-founder noted that it could be time to get back on the Solana “train.” With this preview, Hayes is convinced that Solana and other altcoins could outperform Bitcoin in the days ahead.

The outlook could be anchored on the possibility of altcoins and Bitcoin rising in the coming sessions. Specifically, Hayes warns that a “few” major banks in the United States could “bite the dust.”

This comment also comes at a critical position in the United States banking landscape. On January 31, market analysts noted that NY Community Bancorp’s stock price plummeted 45% following a surprise quarterly loss and dividend reduction.

NY Community Bancorp is crucial in the United States regional banking sector. It also acquired assets from Signature Bank when it collapsed in March 2023.

Analysts say the bank’s decision to expand harmed its balance sheet. The acquisition of Signature Bank increased its regulatory capital requirements, impacting its dividends and provisions, as seen in its latest earnings report.

A Bank Crisis Is A Boon For Bitcoin, Altcoins

While Hayes’ comments are likely to fuel further speculation about the potential for another banking crisis in the United States, it is not immediately clear whether this might spark a crypto rally.

However, reading from past events, if indeed a major bank in the United States collapses and files for bankruptcy in the next few days, Bitcoin will likely rally. In March 2023, following the collapse of Signature Bank, among others, Bitcoin initiated a crypto rally that saw Ethereum and Solana record gains.

Considering the significant shift in Solana investor sentiment over the past few months, it is likely that SOL might snap back to trend. In that case, the altcoin might break above $125, extending 2023 gains.

When writing, SOL is pinned below $100 and under pressure. The local resistance is at $105. A break out might lift the coin towards $125 in a buy trend continuation pattern.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

XRP experienced a significant price drop early Wednesday amidst rumors of a potential exploit. The XRP price dropped more than 4% to $0.4853 but later recovered to $0.500 following a clarification from one of Ripple’s co-founders.

Personal XRP Accounts Impacted, Not Ripple’s

Initial reports suggested that Ripple had suffered a significant security breach, which was brought to light by decentralized finance (DeFi) investigator ZachXBT. These reports raised concerns about the overall security of the Ripple protocol.

According to investigations, the breach resulted in the theft of more than 213 million XRP tokens, valued at over $112 million. The stolen funds were reportedly laundered through cryptocurrency exchanges, including MEXC, Gate, Binance, Kraken, OKX, HTX, and HitBTC.

However, Ripple co-founder Chris Larsen took to X (formerly Twitter) to clarify the situation. In a recent post, Larsen stated:

Yesterday, there was unauthorized access to a few of my personal XRP accounts (not Ripple) – we were quickly able to catch the problem and notify exchanges to freeze the affected addresses. Law enforcement is already involved.

XRP Price Analysis

Despite the recent security concerns, XRP is trading at $0.5085, marking a 3.4% decrease in the past 24 hours. However, beyond the Ripple co-founder’s personal account exploit, the XRP price has experienced a significant decline over the past month.

Over the last seven days, the token has seen a minor 1.3% drop. The decline has deepened in the previous fourteen days with a 10% decrease. This is more problematic for XRP enthusiasts because the price has lost significant ground over the past 30 days, with an 18% dip.

Nevertheless, XRP bull and crypto analyst EGRAG Crypto provides an intriguing price analysis that could potentially encourage investors toward a price recovery if the token manages to hold and consolidate above the $0.500 level.

According to EGRAG, a handful of chart analysts have noted that after wave 1 of the Elliott Wave theory, wave 2 could retrace up to 90% of wave 1. The initial targets of $0.85 to $1 were successfully reached during the July pump, with the price reaching around $0.93 after Ripple’s partial victory against the SEC in its ongoing legal battle over XRP classification.

Currently, EGRAG suggests that a “wicking event” down to $0.41 is possible, considering a 10%-15% fluctuation due to the volatile nature of the crypto markets.

However, the analyst points out that the upside lies in the upcoming Wave 3, which is influenced by Wave 1 and typically has a ratio of 1.618 compared to Wave 1.

If all of this plays out, EGRAG ultimately sees the next short-term target for XRP being the all-time high (ATH) at $5. If the original wave count is adjusted, the range could be between $2.2 and $2.8.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.