While bitcoin reached a 2024 high on Monday, rising above the $67,000 per unit range, Coinbase suffered an issue again where customers were seeing zero balances. The news follows the issues Coinbase suffered on Feb. 28, 2024, when customers saw zero balances that day as well. Coinbase Users Encounter Zero Balance Bug Again Coinbase’s trading […]

While bitcoin reached a 2024 high on Monday, rising above the $67,000 per unit range, Coinbase suffered an issue again where customers were seeing zero balances. The news follows the issues Coinbase suffered on Feb. 28, 2024, when customers saw zero balances that day as well. Coinbase Users Encounter Zero Balance Bug Again Coinbase’s trading […]

Source link

Coinbase

Not long after the value of Bitcoin surpassed $62,000, its highest level since 2021, Coinbase had severe disruptions and issues on Wednesday afternoon, preventing some customers from signing in at all and causing some user accounts to reflect a $0 balance.

Crypto aficionados were furious on social media because they are unable to access their money on the biggest cryptocurrency exchange in the United States. Furthermore frustrating, some customers have reported errors when buying and selling.

The continuous demand for Bitcoin is seen as main the reason behind the sudden crash of the Coinbase app. The leading cryptocurrency had a 40% price increase this month as a result of US bitcoin spot ETFs. This was the biggest monthly gain the digital asset had seen since December 2020, according to reports.

Bitcoin Price Action Today

With a ferocious start to March, Bitcoin’s unprecedented activity has positioned it for its biggest monthly gain in over three years on Thursday. Bitcoin is currently very close to reaching a new high due to the money flooding into listed bitcoin funds, which is driving a significant increase.

Bitcoin nearing the $63k level today. Source: Coingecko

The world’s leading cryptocurrency briefly touched $64,000 (the first rise above $60,000 since November 2021), before partially reversing the gains. According to Coingecko data, BTC was trading at $62,765. It was up 10% and 22% on a daily and weekly basis, respectively.

After plunging 64% in 2022, the value of bitcoin has more than tripled since the start of the year. That represents a remarkable comeback from a slew of scandals and bankruptcies that had raised concerns about the long-term viability of cryptocurrencies.

Bitcoin market cap currently at $1.2 trillion. Chart: TradingView.com

Are Coinbase Funds Safe?

Meanwhile, customers can now log back into the exchange, according to a statement from Coinbase, although users are still reporting issues with “certain payment methods” and issues with sending and receiving money.

I had $3.6 Million on Coinbase

and now it’s shows $0 lol

WTF IS HAPPENING ? pic.twitter.com/BaV4pWjFo6

— Ash Crypto (@Ashcryptoreal) February 28, 2024

While acknowledging that “some users may see a zero balance” on all of their Coinbase accounts and may run into problems while purchasing or selling, Coinbase reassured customers that their money was secure. Additionally, the exchange made it clear that there have been significant delays in money transfers via the Ethereum ERC-20 network.

Coinbase, Binance, and Kucoin all down!! WTF is going on!!

— Kyle Chassé (@kyle_chasse) February 28, 2024

There are rumors of similar crashes on other significant exchanges, such as KuCoin and Binance. But there is still no proof to support these allegations.

The situation comes at a difficult moment for Coinbase, as more inexperienced investors are returning to the market for cryptocurrency trading and discovering they appear to have no assets.

Disappointed in Coinbase for this man.

It’s 2024, we must have our shit together. pic.twitter.com/VioBxw8am5

— MASON VERSLUIS (@MasonVersluis) February 28, 2024

The disruption at Coinbase is not unprecedented; in every bull market, there are technical problems that arise when the platforms cannot handle the volume of buying and selling. As a result, the lack of technological safeguards on sites like Coinbase to handle such problems infuriates members of the cryptocurrency community.

Featured image from Pixabay, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Coinbase users see $0 balance after crypto-trading app suffers glitch

The Coinbase and bitcoin logos are displayed on a phone screen in San Anselmo, California, on Feb. 15, 2024.

Justin Sullivan | Getty Images

Coinbase‘s app suffered from glitches on Wednesday that led many users to see a balance of zero when opening their accounts.

Bitcoin, which had just spiked to its highest level since November 2021, lost about $2,800, or over 4%, in a matter of minutes shortly after noon eastern time as reports of the outage spread on social media platform X and elsewhere.

“We are aware that some users may see a zero balance across their Coinbase accounts and may experience errors in buying or selling,” Coinbase said in a statement to CNBC. “Our team is investigating this issue and will provide an update shortly. Your assets are safe.”

Coinbase advised users to check on the system outage at its status page: https://status.coinbase.com/incidents/qlpwww1zsm2y

One user sent a screengrab to CNBC showing a balance of $0.00 in his account. He soon received a notice titled “Site Degraded Performance,” informing him that the company was investigating the matter.

Bitcoin has been surging of late, topping $60,000 on Wednesday for the first time since 2021, reaching a collective market cap of nearly $1.2 trillion.

Coinbase posted an update on X later in the day, informing users that “we’re beginning to see improvements in customer trading” though because of increased traffic, “some customers may still see errors in login, sends, receives and with some payment methods.”

WATCH: Bitcoin surges past $57,000

Don’t miss these stories from CNBC PRO:

Coinbase on Grayscale Ethereum Spot ETF Application: ‘ETH Is a Commodity, Not a Security’

Coinbase has answered the SEC request for comments on the proposed rule change to list the ETH Grayscale Fund as a spot ETF. Coinbase stated that ether was a commodity, and its status has been publicly recognized in a variety of circumstances by U.S. agencies and courts. Coinbase Supports Ethereum Grayscale Fund Conversion as a […]

Coinbase has answered the SEC request for comments on the proposed rule change to list the ETH Grayscale Fund as a spot ETF. Coinbase stated that ether was a commodity, and its status has been publicly recognized in a variety of circumstances by U.S. agencies and courts. Coinbase Supports Ethereum Grayscale Fund Conversion as a […]

Source link

Bitcoin euphoria phase far off, Coinbase data suggests more growth potential

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Coinbase Custody reportedly now holds over 90% of all Bitcoin ETFs in the United States. This development was revealed by the crypto exchange’s CEO, Brian Armstrong, while appraising the company’s performance in the fourth quarter (Q4) of 2023.

Coinbase Emerges As Major Player In Bitcoin ETF Market

In an X post on February 16, Brian Armstrong shared specific highlights of Coinbase’s achievement in Q4 2023. In particular, He noted that the American crypto exchange has played a crucial part in facilitating the adoption of cryptocurrencies by traditional financial firms (TradFi).

A major part of this adoption is the Bitcoin ETF market which is worth $37 billion, ranking as the second largest commodity ETF market after Gold. Armstrong noted that Coinbase has played a significant role in this development, serving as custodian for 90% of the investment funds in the Bitcoin ETF market.

A few thoughts on our Q4 Earnings yesterday:

2023 was a great year for Coinbase and we’re in a strong financial position. We cut costs by 45% y/y and shipped products faster with a leaner team driving $95 million of positive net income for 2023, $964 million in positive Adj.… pic.twitter.com/XK8f0EQBdP

— Brian Armstrong 🛡️ (@brian_armstrong) February 16, 2024

For context, a custodian is a regulated financial institution that holds customers’ securities and assets, providing protection against any form of loss or theft. Notably, Coinbase is listed as the custodian for eight of the 11 recently launched Bitcoin spot ETFs. These include BlackRock’s IBIT, Ark Invest’s ARKB, Bitwise’s BITB, and Grayscale’s GBTC, among others.

These statistics indicate that Coinbase is well placed to record larger milestones as the top traditional financial institutions are tipped to finally invest in Bitcoin ETFs, especially upon the proven success and stability of the Bitcoin spot ETFs.

According to Armstrong, other notable Coinbase achievements in Q4 2024 include the launch of the exchange’s international wing, and the layer-2 blockchain solution Base. The crypto exchange also claimed to slash its annual costs by 45% while generating a total income of $3.1 billion.

Looking Forward To 2024

In retrospect to 2024, Armstrong stated that Coinbase will maintain focus on its international expansion and new derivatives products. In addition, they will aim to promote the adoption of crypto payments by transforming the Coinbase wallet into a super app.

Finally, the exchange CEO states that Coinbase will continue to advocate for a clear regulatory framework applicable to the crypto space. Armstrong says that Coinbase is committed to this course and is willing to explore all means, including legal processes as well as engaging the federal legislators.

COIN trading at $180.28 on the trading chart | Source: COIN chart on Tradingview.com

COIN trading at $180.28 on the trading chart | Source: COIN chart on Tradingview.com

Featured image from CNBC, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

4 Surprising Insights From The Coinbase Earnings Report, COIN Sees Bullish Surge

The foremost crypto exchange in the United States, Coinbase, released its earnings report on February 15th. As expected, there were major takeaways from the financial report, highlighting the crypto company’s performance in the fourth quarter of last year.

Coinbase’s Trading Volume Exceeds Expectations

Coinbase maximalist Coinbase Duck noted in an X (formerly Twitter) post how the crypto exchange defied expectations in the fourth quarter of 2023. Coinbase recorded $170.6 billion in spot trading volume, exceeding the estimated $168.

Specifically, a considerable influx of retail investors accounted for 18% of the total spot trading volume against the estimated 16% that the crypto exchange was projected to record. The return of these retail investors is believed to have been partly due to the resurgence that Bitcoin and the broader crypto market experienced towards the end of the year.

Meanwhile, consumer transaction revenue ($492.5 million) was way below the estimate of $570.9 million. However, Coinbase Duck noted that this wasn’t necessarily bad, as some investors started using advanced trading.

In a letter to its shareholders, the crypto exchange also revealed that some existing users traded significantly higher volumes, which could have necessitated the move to advanced trading.

Coinbase also recorded a total operating expense of $838 million, which happened to be below the projected estimate of $878 million. Specifically, the crypto exchange did a great job in its transaction expenses, recording an expense of $126 million compared to the estimate of $163 million.

However, the company’s sales and marketing expenses ($106 million) exceeded the estimate of $90 million. Coinbase revealed that this growth was “primarily driven by higher seasonal NBA spending, higher performance marketing spending due to strong market conditions, and increased USDC reward payouts due to growth in on-platform balances.”

Coinbase Had A Profitable Fourth Quarter

Coinbase recorded a net income of $273 million, beating the estimate of $104 million. Interestingly, going by figures from its Shareholder letter, the fourth quarter of 2023 was the only one in the year in which the crypto exchange didn’t record a loss for its net income. Meanwhile, the company also recorded its largest net revenue during that period.

Coinbase suggested that the excitement around the Spot Bitcoin ETFs and the expectations of more favorable market conditions in 2024 had contributed to its success in Q4 of 2023. Coinbase is a primary custodian for most Bitcoin ETFs, including BlackRock’s iShares Bitcoin Trust (IBIT).

Meanwhile, the crypto exchange earned $1.13 per share, beating the forecast of $0.43. This is without the crypto exchange accounting for the FASB change, which Coinbase Duck revealed could bring its earnings per Share (EPS) to $2.1.

Chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin ETFs Boosts Coinbase (COIN) Shares As JPMorgan Upgrades Rating

The recent Bitcoin rally, propelling its price to the $52,000 level, has positively impacted the stock of US-based cryptocurrency exchange Coinbase (COIN). After experiencing a notable dip to $115 at the start of February, Coinbase’s stock rose to $172 on Thursday, following a significant upgrade by a JPMorgan analyst.

Improved Prospects For Coinbase Amid Crypto Rally

According to a Bloomberg report, JPMorgan analyst Kenneth Worthington abandoned his bearish view on Coinbase weeks after downgrading the stock.

As Bitcoin traded higher, Coinbase shares gained as much as 7.8% following the upgrade. Worthington believes the exchange will likely benefit from the recent rally in digital asset prices, prompting him to shift his rating back to neutral.

This change in stance comes after Worthington’s January downgrade, where he predicted a potential deflation of enthusiasm for Bitcoin exchange-traded funds (ETFs).

However, contrary to his previous forecast, Bitcoin ETFs have been successful in terms of trading measures, and the price of Bitcoin has surged beyond $52,000, reaching its highest level since 2021. In a note to clients on Thursday, Worthington explained:

Given the acceleration in recent days of flows into Bitcoin ETFs and the significant price appreciation of Bitcoin and now Ethereum, we are returning to a Neutral rating on Coinbase as we see the higher cryptocurrency prices not only sustaining but improving activity levels and Coinbase’s earnings power as we look to 1Q24.

Coinbase’s stock experienced an 8% dip at the beginning of the year, following an impressive 400% surge in 2023. Analyst opinions on the stock remain divided, with buy, hold, and sell recommendations being roughly evenly split.

Worthington maintained his $80 price target on the stock ahead of the company’s earnings report, which is scheduled to be released after the market closes on Thursday.

Worthington emphasized that Coinbase’s business is closely tied to token prices, with its core revenue being transaction-based. As the value of tokens increases and trading activity gains momentum, fees based on the value traded are expected to drive higher trading volumes, ultimately contributing to improved revenue for Coinbase.

Bitcoin ETFs Witness Significant Trading Volume

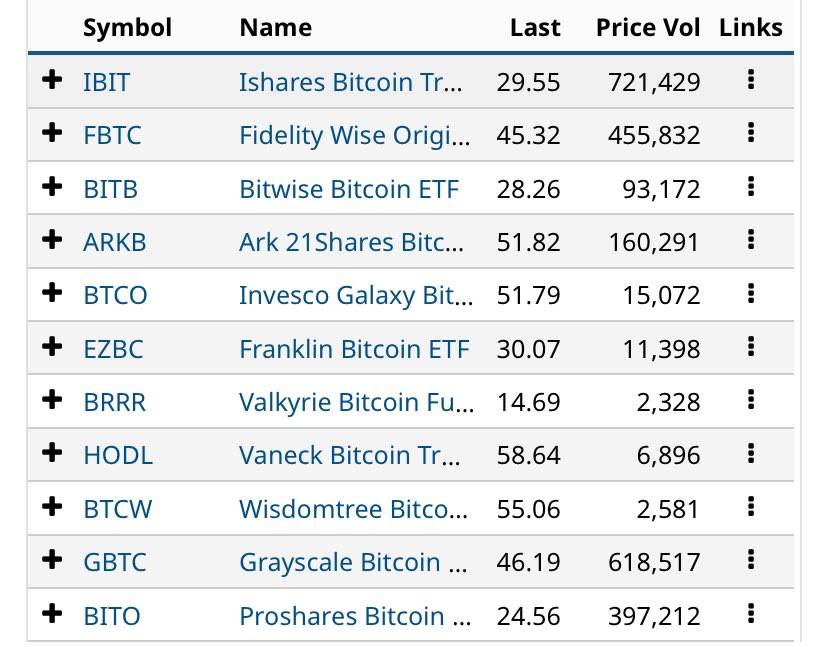

On February 14th, the trading volume of Bitcoin ETFs showcased notable figures, with Blackrock’s IBIT recording the lead with $721 million in volume.

Grayscale’s Bitcoin Trust (GBTC) followed closely with $619 million, while Fidelity’s FBTC secured the third spot with $456 million. On the other hand, Ark Invest accumulated a volume of $169 million.

The nine ETFs’ total trading volume amounted to approximately $1.5 billion. Notably, the largest ETFs experienced higher trading volume than the previous day, with IBIT surpassing $700 million and GBTC exceeding $600 million.

Intriguingly, before the trading session, GBTC sent less than half of the Bitcoin it sent to Coinbase the previous day. Despite this decrease, GBTC’s total trading volume was 50% higher.

As the demand for Bitcoin continues to surge, ETFs play a crucial role in facilitating institutional and retail investors’ participation in the cryptocurrency market. The increased trading volume of Bitcoin ETFs highlights investors’ growing interest and confidence in digital assets.

Currently, Bitcoin is trading at $51,900 and encountering a critical resistance level at $52,000.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Coinbase has lifted the freeze on Debt Box’s assets after discovering discrepancies in the Securities and Exchange Commission’s (SEC) representation of its case against the firm.

In a Feb. 13 post on social media platform X (formerly Twitter), Paul Grewal, Coinbase chief legal officer, highlighted the SEC’s flawed actions, saying the temporary restraining order (TRO) against Debt Box was “tainted by SEC’s misinterpretations” and criticized the regulatory body’s lack of immediate rectification upon acknowledging its deceptive stance.

According to Grewal, Coinbase challenged the SEC’s order because the regulator “sat silently” instead of “immediately pulling its order after admitting that it deceived the Court.” The exchange attempts to get an explanation from the authorities proved futile as it was met with “more silence.”

Consequently, Coinbase opted to unfreeze the assets, correcting the error while awaiting clarity from the SEC, which has remained silent.

“We have now righted that wrong by unfreezing the assets,” Grewal said.

Grewal furthered that the SEC’s move to dismiss the case without prejudice and mandatory training was insufficient redress for its actions.

SEC vs. Debt Box

The SEC’s pursuit of Debt Box has ignited a firestorm of critique regarding its handling of the emerging crypto industry.

Controversy flared when revelations surfaced about the SEC’s attorneys presenting false and misleading evidence in their bid for a TRO against DEBT Box. US District Judge Robert Shelby demanded explanations from the lawyers on why they shouldn’t face sanctions for their actions.

Following scrutiny, the SEC acknowledged its error and pledged to prevent such lapses. They sought the court’s acceptance of a motion to dismiss the action without prejudice as their sole penalty.

Yet, criticism of the SEC’s handling of the Debt Box case didn’t relent. Several crypto stakeholders and US lawmakers, including JD Vance, Thom Tillis, Bill Hagerty, Cynthia Lummis, and Katie Boyd Britt, condemned the regulator’s conduct as “unethical and unprofessional.”

“Regardless of whether Commission staff deliberately misrepresented evidence or unknowingly presented false information, this case suggests other enforcement cases brought by the Commission may be deserving of scrutiny. It is difficult to maintain confidence that other cases are not predicated upon dubious evidence, obfuscations, or outright misrepresentations,” the lawmakers wrote.

Coinbase has donated $25M to crypto super-PAC Fairshake; Ripple has given $20M

Coinbase and Ripple are among the largest donors to a super PAC that aims to support pro-crypto politicians, Bloomberg reported on Jan. 31.

Coinbase has contributed $24.5 million to Fairshake, PAC spokesperson Josh Vlasto told Bloomberg. Coinbase CEO Brian Armstrong has also personally given $1 million to the PAC. Those donations make up about one-third of the $85 million that Fairshake has raised to date, according to the report.

Vlasto additionally told Bloomberg today that Ripple has donated $20 million to Fairshake. Two VC firms — Andreessen Horowitz (a16z) and Electric Capital — have donated $20 million and $500,000 respectively.

Bloomberg said that more information about Fairshake’s donors will be revealed in an upcoming filing with the U.S. Federal Election Commission.

Firms have not confirmed donation amounts

Though none of the above companies have confirmed their donation amounts publicly, Coinbase acknowledged that both it and Armstrong had contributed to Fairshake in a blog post published in December.

Coinbase said that Fairshake had raised just $78 million at the time. It added that Circle, Kraken, Ark Invest, and Gemini founders Cameron and Tyler Winklevoss were among the super-PAC’s numerous other donors.

Bloomberg also obtained a comment from Collin McCune, head of government affairs at Andreessen Horowitz today. McCune said that supporting bipartisan candidates with long views is an “important part of ensuring that clear rules of the road are developed for blockchain technology and digital assets.” The representative did not confirm the reported donation amount, however.

Fairshake supports both major parties

Fairshake supports pro-cryptocurrency political candidates on both sides of the political aisle but has slightly favored Democratic candidates so far.

Current data from OpenSecrets indicates that Fairshake has spent $700,000 on 13 Democratic candidates and $551,000 on eight Republican candidates.

Bloomberg noted that Fairshake’s largest spending to date has gone toward Republican Representative Patrick McHenry, a lawmaker extensively involved in crypto legislation who is set to retire in January 2025. Other funding has notably gone toward Republican Representative Tom Emmer and Democratic Representatives Josh Gottheimer and Ritchie Torres.