South Korean authorities are reportedly planning to release updated guidelines for virtual asset trading. These guidelines will prohibit the listing or relisting of coins that have previously been hacked. Additionally, the guidelines will require issuers of “foreign” virtual assets to release a whitepaper or a technical manual specifically for the Korean market. Guidelines for ‘Foreign’ […]

South Korean authorities are reportedly planning to release updated guidelines for virtual asset trading. These guidelines will prohibit the listing or relisting of coins that have previously been hacked. Additionally, the guidelines will require issuers of “foreign” virtual assets to release a whitepaper or a technical manual specifically for the Korean market. Guidelines for ‘Foreign’ […]

Source link

Coins

As the weekend approaches, the crypto economy experienced a downturn, declining 4.38% in the past 24 hours to a total value of $2.42 trillion. Bitcoin saw a decrease of 5.5% against the U.S. dollar during this period, while ethereum’s value dropped by 5.3%. In contrast, fantom (FTM) enjoyed a 12% increase, and aptos (APT) rose […]

As the weekend approaches, the crypto economy experienced a downturn, declining 4.38% in the past 24 hours to a total value of $2.42 trillion. Bitcoin saw a decrease of 5.5% against the U.S. dollar during this period, while ethereum’s value dropped by 5.3%. In contrast, fantom (FTM) enjoyed a 12% increase, and aptos (APT) rose […]

Source link

Donald Trump’s Crypto Portfolio Soars to $7.5 Million, Fueled by TRUMP Coin’s Ascension and Ethereum Gains

After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

After the former 45th President of the United States, Donald Trump, saw his cryptocurrency holdings exceed $5 million, just ten days later, the value of Trump’s digital asset collection has escalated to $7.5 million. This increase is largely due to $4.66 million emanating from the cryptocurrency he holds called TRUMP, which has experienced a significant […]

Source link

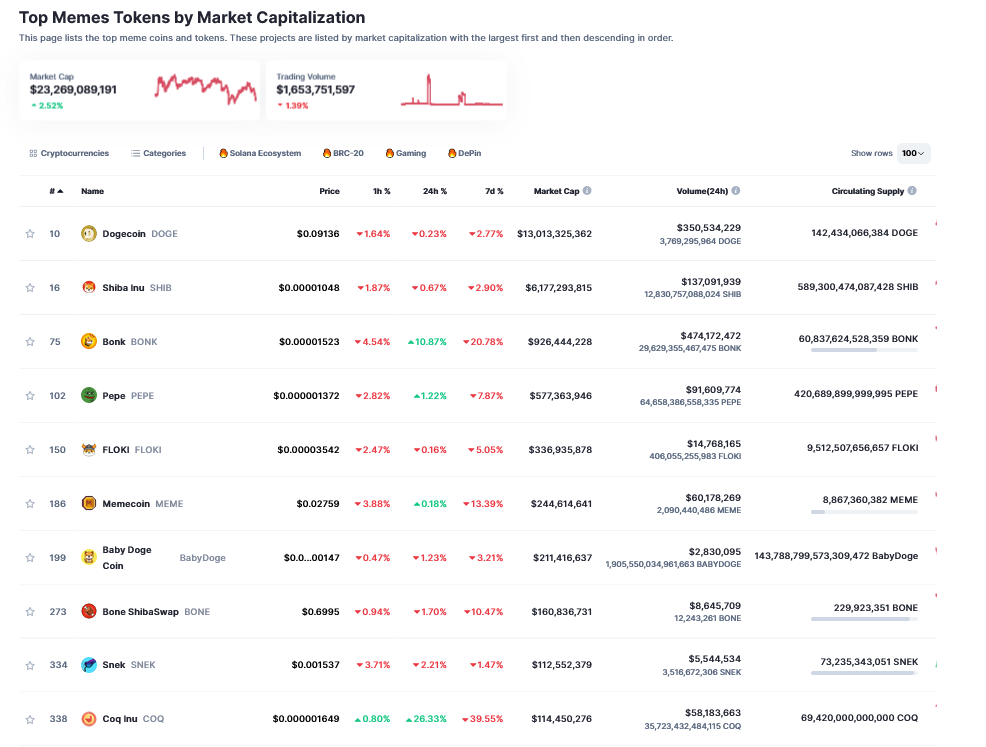

The meme coins market cap is currently hovering above $54 billion up by nearly 20% ion the past day. This surge is evident as roughly seven meme coins now rank among the top 100 crypto by market capitalization, marking a significant shift in investor interest towards these once ‘speculative assets.’

A recent market report from QCP Capital has shed light on this phenomenon, disclosing what drives this meme coins surge.

What Is Driving The Meme Coins Surge

According to QCP Capital, the price appreciation in meme coins can be attributed to a “speculative buying frenzy” during the Asia trading session. Particularly, the firm report suggests that the rallying meme coins is driven by retail FOMO (Fear of Missing Out), indicating a significant shift in the dynamics of market participation.

The analysts from QCP Capital also observed an increase in leveraged buying activity, hinting at the “robust” momentum that could potentially pause should Bitcoin surpass its all-time high in dollar terms. The market report read:

Altcoins, especially memecoins, are rallying hard as retail FOMO really kicks in now. Leveraged buyers will likely not relent until we break all-time highs, which could be any time now.

So far, major meme coins such as Dogecoin, Shiba Inu, PEPE, and BONK have registered. massive gains, with increases of 27%, 57%, 46%, and 68% respectively over the last 24 hours. These gains reflect the growing investor interest in meme coins and underscore the broader trend of retail investment driving the crypto market.

Dogecoin and Shiba Inu, in particular, have solidified their positions within the top 15 global crypto market cap rankings, demonstrating the significant traction meme coins have gained among investors.

Retail Participation Fuelling The Crypto Rally

The surge in memecoins is part of a larger trend of increased retail participation in the cryptocurrency market. Analysts from JPMorgan have echoed the observations made by QCP Capital, noting that retail traders have played a crucial role in the cryptocurrency market rally observed throughout February.

The study carried out by the research group at JPMorgan, under the guidance of Managing Director Nikolaos Panigirtzoglou, highlighted the significant role of “small-scale investors,” commonly known as ‘mom-and-pop’ traders, in driving prominent cryptocurrencies like Bitcoin to a two-year high last month.

The researchers noted:

We find that the retail impulse into crypto rebounded in February, thus likely responsible for this month’s strong crypto market rally.

Meanwhile, over the past 24 hours, Bitcoin has reached new heights, trading above $66,000, marking a nearly 30% increase over the past week. This upward trajectory is also evident in the asset’s market cap, which currently exceeds $1.2 trillion.

Featured image from Unsplash, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Cardano (ADA) is among the few cryptocurrencies that are still observing loss-taking being the dominant behavior among investors.

Bitcoin & Ethereum See Profit-Taking, While Cardano Is Seeing Capitulation

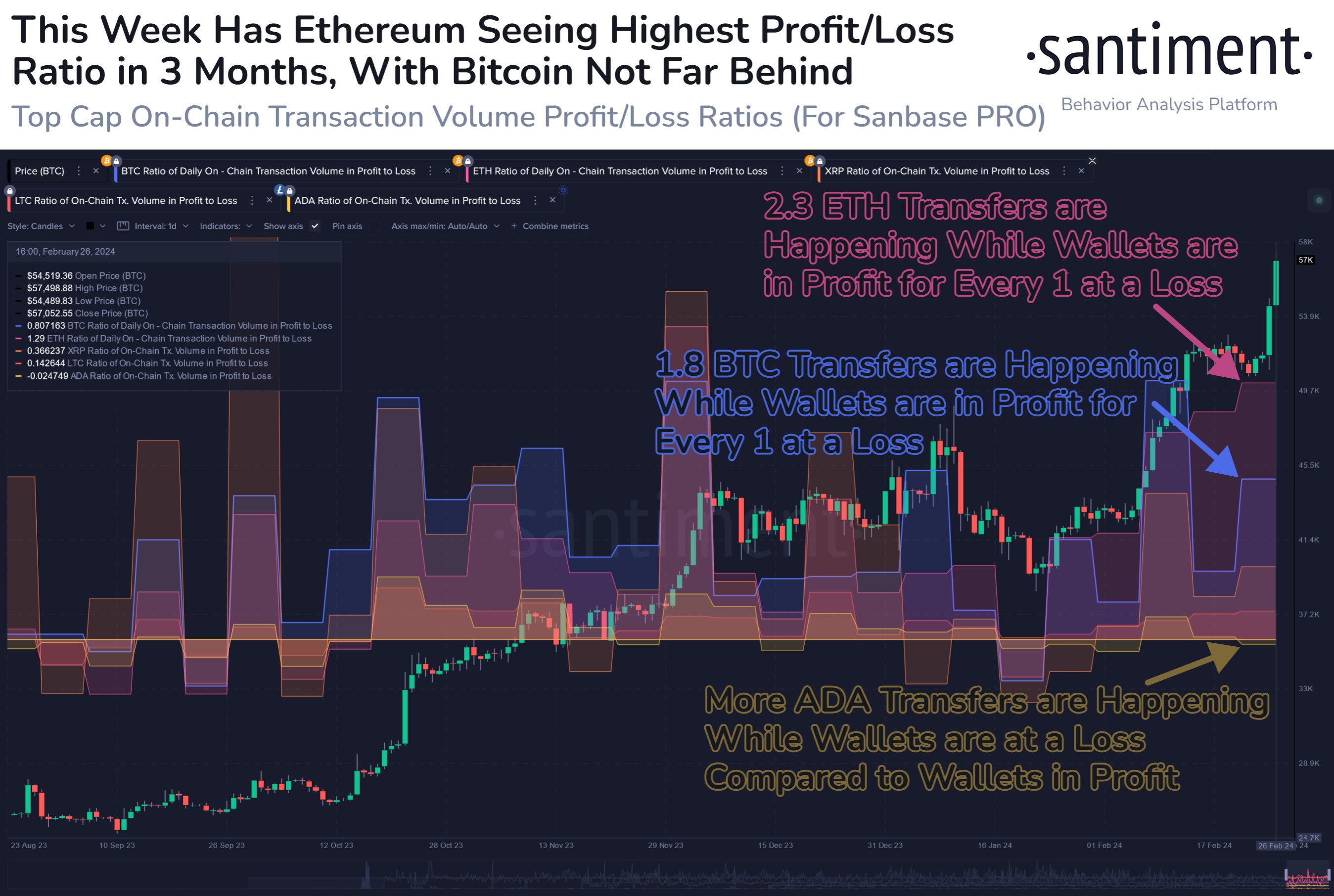

According to data from the on-chain analytics firm Santiment, Bitcoin (BTC) and Ethereum (ETH) have both been seeing the investors majorly selling at profits, while Cardano has seen the loss-taking outweigh the profit-taking.

The indicator of interest here is the “Ratio of Daily On-Chain Transaction Volume in Profit to Loss,” which, as its name already suggests, tells us about how the loss-taking volume of any asset compares against its profit-taking volume.

This metric works by going through the transaction history of each coin currently being moved on the blockchain to see what price it moved at before this. If the previous transfer price for any coin was less than the spot value it is being sold at now, then its sale is contributing towards the profit-taking volume.

Similarly, the coins of the opposite type (that is, those with last price higher than the latest transfer price) add to the loss-taking volume. The indicator takes the total volume of each type and outputs their ratio.

Now, here is a chart that shows the trend in this ratio for a few different top cryptocurrencies over the last few months:

The value of the metric seems to have been greater than one for most of these assets recently | Source: Santiment on X

As displayed in the above graph, all of these assets, except for Cardano, have their Ratio of Daily On-Chain Transaction Volume in Profit to Loss sitting at positive values right now.

Such values of the metric imply the profit-taking volume is currently greater than the loss-taking volume for these assets. Ethereum, in particular, seems to have been observing the most aggressive profit-taking spree recently, as the cryptocurrency has been seeing about 2.3 green transactions for every underwater movement.

Bitcoin is seeing the second-highest ratio, with 1.8 profit-taking transactions taking place for every loss-taking transfer. It’s much more balanced for the altcoins, however, as XRP (XRP) and Litecoin (LTC) have only been witnessing minimally higher dominance of profit selling.

Cardano has outright been seeing the loss-taking volume pulling ahead of the profit-taking one, implying that the investors have been going through capitulation. These loss sellers may be ditching the asset in favor of Bitcoin and others, who have offered greener pastures recently.

Historically, the dominance of profit-taking has been something that has led to tops for cryptocurrencies. Loss-taking, on the other hand, has often facilitated bottoms to form as weaker hands flush out in such events and stronger, more resolute investors take their coins.

As such, Cardano has been behind the other top coins in this metric recently may mean that the coin could still have the potential to rise, whereas the others may be nearing possible tops.

ADA Price

While Cardano has performed worse than the likes of Bitcoin and Ethereum recently, its returns have still not been that bad as the asset is up 8% over the past week and trading around $0.63.

Looks like the price of the asset has been surging recently | Source: ADAUSD on TradingView

Featured image from Shutterstock.com, Santiment.net, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Markets Experience Minor Setback as Major Coins Dip, While Select Tokens Buck the Trend

On Wednesday, the crypto market experienced a modest downturn, with a 1% decrease in its overall value across the board, as bitcoin and ethereum saw declines of 0.51% and 0.45%, respectively. Bitcoin momentarily reached the $53,000 mark the day prior, while ether soared past the $3,000 threshold on Tuesday, though both cryptocurrencies traded significantly lower […]

On Wednesday, the crypto market experienced a modest downturn, with a 1% decrease in its overall value across the board, as bitcoin and ethereum saw declines of 0.51% and 0.45%, respectively. Bitcoin momentarily reached the $53,000 mark the day prior, while ether soared past the $3,000 threshold on Tuesday, though both cryptocurrencies traded significantly lower […]

Source link

Adding to the woes of the cryptocurrency market, Dogecoin, the prominent memecoin with the highest market value, has experienced a notable setback with a over 10% drop in its price over the last 24 hours. This downturn follows a trend of significant declines witnessed by the dog-themed altcoin in the previous week.

The current trajectory of DOGE’s price decline raises concerns among investors and market observers, as it points to potential challenges and uncertainties surrounding the memecoin’s stability.

Whale Moves: Dogecoin Uncertainty Peaks

Compounding this situation is the recent activity of large holders, colloquially referred to as “whales,” who have moved substantial amounts of Dogecoin – exceeding 600 million DOGE – to major trading platforms like Binance and Robinhood.

🚨 300,000,000 #DOGE (24,629,096 USD) transferred from unknown wallet to #Binance

— Whale Alert (@whale_alert) January 4, 2024

The transfer of such significant volumes by influential holders to popular trading platforms introduces an element of uncertainty in the market, with the potential to exacerbate the ongoing decline in Dogecoin’s value.

Some 82 million and 102 million DOGE, or more than $15 million, came from two secret addresses to Robinhood at the start of the movement.

DOGE currently trading at $0.0824541 territory. Chart: TradingView.com

A little while later, a reversal occurred when 151 million meme coins, or almost $12 million, went from Robinhood to an unidentified wallet.

The culmination took place when the most substantial transfer, 300 million Dogecoin valued at $24 million, was transmitted from an unidentified location to Binance.

At the time of publication on Thursday, the price of DOGE had dropped by 10%, trading at $0.08. Furthermore, the coin’s value has decreased by roughly 12% over the past seven days. Furthermore, even with the early gains, the 30-day losses have now reached about 11%.

DOGE 30-day price action. Source: Coingecko

DOGE Plunge: Market Drop, Trading Surge

When Dogecoin dropped from $0.09 to its current price in less than two hours on Wednesday, the decline in value grabbed traction. The market value of the meme coin fell by 9.95% to $11.77 billion as a result of this decline.

Its trading volume increased significantly in the last day, rising 165% to a little over $1 billion, despite the price decline.

These sudden movement come at a pivotal moment for Dogecoin. The much-anticipated DOGE-1 mission, funded entirely by the Dogecoin community, is set to launch this winter.

The CubeSat mission, developed by Geometric Energy Corporation, marks a historic step for the cryptocurrency, aiming to collect “lunar-spatial intelligence” with onboard sensors and a camera.

The National Telecommunications and Information Administration (@NTIAgov), a Department of Commerce (@CommerceGov) agency, approved DOGE-1 X-Band (0083-EX-CN-2022 on https://t.co/b6iEAYdTPV) 📜

We have yet to get the FCC license grant which will address X-Band and S-Band 🛰$XI pic.twitter.com/YSJoyLclQk

— SΔMUΞL RΞIÐ (e/acc) (@SamuelReidGEC) November 28, 2023

While the DOGE-1 mission brings a wave of excitement and publicity, the recent whale activity casts a shadow of uncertainty. The price drop sparked by the massive token transfers could be interpreted in multiple ways.

Some see it as shrewd market maneuvering, capitalizing on a temporary dip. Others worry it may signal a loss of confidence in Dogecoin’s long-term potential.

With the launch date approaching, the interplay between the whale activity, the DOGE-1 mission, and broader market trends will be crucial to watch.

Can the launch generate enough positive momentum to counteract the price decline? Or will the whales’ actions continue to hold the currency hostage?

Featured image from Shutterstock

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

The Avalanche Foundation is expanding its support of meme coins. This move could further boost the popularity of Avalanche, a low-fee and high-throughput blockchain, and even support its native coin, AVAX.

Avalanche Foundation To Support Meme Coins

Taking to X on December 29, the foundation said it would continue its Culture Catalyst initiative to encourage meme coin activity, among others, including Real-World Assets (RWAs), non-fungible tokens (NFTs), and more. This campaign, they continue, aims to foster innovation and propel the adoption of blockchains by supporting the creation of “new forms of creativity, culture, and lifestyle.”

The Avalanche Foundation believes that meme coins have carved out a significant niche in crypto, representing the collective spirit and shared interests of diverse crypto communities. By recognizing and encouraging this culture, the foundation hopes to develop and expand the Avalanche ecosystem, attracting new users.

As they resume Culture Catalyst, the foundation will start by purchasing select Avalanche-based meme coins to create a collection. The selection process will be based on several critical criteria, including the number of holders, liquidity thresholds, project maturity, principles of a fair launch, and overall social sentiment.

This move is a significant step for the Avalanche Foundation, as it indicates a growing recognition of the potential of meme coins to drive innovation and growth. It is because meme coins have become increasingly popular in recent years, often attracting large communities and generating significant trading volume. According to CoinMarketCap data on December 29, meme coins have a cumulative market cap of over $23 billion.

Will AVAX And COQ Extend Gains In 2024?

The foundation’s support for meme coins could further boost the popularity of Avalanche, as it will bring more attention to AVAX, a coin used for paying network fees. Thus far, AVAX remains in an uptrend, adding nearly 400% from October 2023 lows. Though there has been a cool-off, buyers have the upper hand. With rising demand triggered by more meme coins deploying on Avalanche, AVAX prices will likely float even higher.

One of the Avalanche-based meme coins, COQ, is among the top 10 most liquid. According to DEX Tools data, there are over 34,000 COQ holders when writing. As of December 29, Dogecoin (DOGE) is the largest and most valuable meme coin, with over $13.2 billion in market cap. However, the launch and subsequent stellar performance of COQ propelled it to command a market cap of $114 million.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

OKX delisting triggers price fall for privacy coins Zcash and Monero

The price of several privacy-focused cryptocurrencies, including Zcash (ZEC) and Monero (XMR), fell the past day after crypto exchange OKX said on Dec. 29 that it would delist them on Jan. 5 because they do not align with its listing criteria.

Data from CryptoSlate shows that the entire ‘privacy cryptos’ sector witnessed a decline of 3.4%, impacting major cryptocurrencies across the board. During the reporting period, stalwart privacy coins like Monero and Zcash dipped by 2.4% and 9.37%, respectively.

Other tokens to be delisted by OKX include Dash, Powerpool, and Horizen, which fell by as much as 14% during the reporting period.

“We will delist the above-mentioned trading pairs at the delisting times listed above. We advise users to cancel orders pertaining to these trading pairs before the delisting. Otherwise, the system will automatically cancel these orders. The cancellation may take 1-3 working days,” OKX added.

Concurrently, OKX has halted deposits for the affected cryptocurrencies and intends to cease withdrawals by March 5, 2024, allowing holders adequate time to withdraw their assets. Nevertheless, once the delisting process is complete, trading these digital assets will become impossible.

Curiously, certain privacy coins like MINA remain listed on the exchange, experiencing a 7.5% increase following this delisting announcement.

However, it’s worth noting that OKX is not exclusively delisting privacy tokens. The exchange also included other trading pairs belonging to digital assets like Kusama, Flow, Kyber Network, and Aragon in the assets to be delisted.

Why is OKX delisting privacy coins?

While OKX hasn’t explicitly detailed the reasons behind its decision, observers have suggested that the move might have been influenced by the exchange’s effort to comply with regulatory measures.

Privacy coins have attracted regulatory scrutiny due to concerns about their potential use in illicit activities within the crypto space.

Earlier in the year, Binance said it would delist several privacy coins in compliance with local laws and regulations.

Avalanche Foundation Expands Culture Catalyst Initiative to Embrace Meme Coins

For the planned investments in selected meme projects on the Avalanche network, the non-profit has outlined specific requirements for eligibility in the program.

Avalanche Foundation, the non-profit group overseeing the development of the Avalanche blockchain, has announced its intention to allocate a portion of the Culture Catalyst Funds to support meme coins.

According to a statement on X (formerly Twitter), the move is aimed at acknowledging the cultural and entertaining aspects symbolized by meme coins, with the foundation planning to acquire select Avalanche-based meme coins to build a curated collection.

From NFTs to Meme Coins

The non-profit organization initially rolled out the Culture Catalyst initiative in March 2022 with $100 million funding to propel the adoption of the crypto ecosystem.

At its launch, the program was designed to foster innovation in the non-fungible token (NFT) sector by supporting and empowering creators on the Avalanche protocol.

However, as revealed in a recent announcement on X, a portion of the funds will now be redirected towards targeted meme coins within the network.

The protocol claimed meme coins “go beyond mere utility assets” and stand as a representation of the “collective spirit and shared interests of diverse crypto communities.”

The Avalanche Foundation said the move aligns with its ongoing engagements across the Avalanche blockchain, involving non-fungible tokens, real-world assets, and various undisclosed tokens deployed on the Avalanche ecosystem.

The foundation believes that allocating a portion of the Culture Catalyst fund to selected meme tokens with promising potential will enrich the network’s portfolio, embracing a more comprehensive spectrum of possibilities. This step, according to the group, positions the protocol to accommodate the myriad new forms of creativity, culture, and lifestyle enabled by blockchain technology.

Last year, the Avalanche Foundation launched Culture Catalyst, a program aimed at empowering creators, sparking innovation, and propelling the adoption of blockchains. This initiative seeks to better position Avalanche to cultivate and support the many new forms of creativity,…

— Avalanche 🔺 (@avax) December 29, 2023

Unveiled Requirements for Investments in Meme Projects

For the planned investments in selected meme projects on the Avalanche network, the non-profit has outlined specific requirements for eligibility in the program.

According to the foundation, the selection process for the planned collection will be based on a number of factors, including liquidity thresholds, project maturity, principles of a fair launch, the number of holders, and overall social sentiment.

The non-profit said it is open to supporting diverse and culturally significant initiatives as long as it meets the selection criteria. The group prides itself as an adaptable and inclusive participant in the Web3 space.

next

Altcoin News, Cryptocurrency News, News

You have successfully joined our subscriber list.