In an unprecedented surge, crypto funds around the globe registered record inflows totaling $2.45 billion last week, marking a significant uptick in investor interest. This influx has propelled the total assets under management (AUM) back to levels not seen since December 2021, signaling a strong resurgence in the crypto investment space. Record $2.45 Billion Inflows […]

In an unprecedented surge, crypto funds around the globe registered record inflows totaling $2.45 billion last week, marking a significant uptick in investor interest. This influx has propelled the total assets under management (AUM) back to levels not seen since December 2021, signaling a strong resurgence in the crypto investment space. Record $2.45 Billion Inflows […]

Source link

CoinShares

CoinShares leverages Valkyrie acquisition to enter US Bitcoin ETF arena

Europe-based asset management firm CoinShares has exercised its option to acquire Valkyrie’s crypto-focused exchange-traded funds (ETF) investment advisory business, expanding its business into the U.S.

In a Jan. 12 statement, CoinShares explained that the deal follows the recent approval of Valkyrie’s spot Bitcoin ETF, the Valkyrie Bitcoin Fund (BRRR), by the U.S. Securities and Exchange Commission (SEC).

According to the asset manager, this move would allow it to expand its digital asset offerings to the U.S. market and align with its vision of becoming a global leader in the digital asset space through strategic acquisitions. CoinShares secured the exclusive option to purchase Valkyrie Funds last November.

As such, CoinShares will integrate Valkyrie’s ETF portfolio, comprising the Valkyrie Bitcoin Fund (BRRR), the Valkyrie Bitcoin and Ether Strategy ETF (Nasdaq: BTF), and the Valkyrie Bitcoin Miners ETF (Nasdaq: WGMI, into its existing assets under management (AUM). The firm stated that these 3 ETFs will add approximately $110 million to CoinShares’ AUM, which currently stands at $4.5 billion.

However, the acquisition still requires legal agreements and board approval. Upon completion, Valkyrie Funds will retain its operational independence.

Jean-Marie Mognetti, CEO of CoinShares, expressed commitment to extending the firm’s European success into the U.S. market. He further emphasized the significance of these acquisitions in supporting the company’s global leadership ambition.

“Our expertise has enabled us to dominate the European market, commanding over 40% of all assets under management in crypto ETPs. Exercising our option to acquire Valkyrie Funds aims at extending our European success in the U.S, offering unparalleled access to regulated digital asset products to American investors,” Mognetti said.

Leah Wald, CEO of Valkyrie Funds, acknowledged CoinShares’ standing as a premier player in the industry and expressed excitement about leveraging the European firm’s capabilities and expertise to advance digital asset investment in the American market.

CoinShares Predicts $141,000 Bitcoin Price, Forecasts $14.4 Billion Inflows From ETFs

In a recently published report by CoinShares, analyst James Butterfill delves into the relationship between inflows into Bitcoin exchange-traded funds (ETFs) and changes in the Bitcoin price.

The report addresses the critical question of how much inflow into ETFs could be anticipated upon launching a Bitcoin spot ETF in the US and the potential impact of these flows on the Bitcoin Price.

Bitcoin ETFs Could Attract $14.4 Billion Inflows

Butterfill highlights Galaxy’s analysis, which estimates that the United States has approximately $14.4 trillion in addressable assets. Assuming a conservative scenario where 10% of these assets invest in a spot Bitcoin ETF with an average allocation of 1%, it could result in approximately $14.4 billion of inflows within the first year.

Per the report, this would mark the largest inflows on record, surpassing 2021’s inflows of $7.24 billion, which accounted for 11.5% of assets under management (AuM).

However, it is worth noting that in 2020, inflows reached $5.5 billion, representing a higher 21.6% of AuM, while Bitcoin’s price surged by 303% compared to 60% in 2021.

The report suggests a correlation between inflows as a percentage of AuM and price changes. Inflows coincide with rising prices, indicating that many ETF investors engage in momentum trading. Conversely, during periods of price stagnation, inflows have tended to moderate.

However, it is important to note that exchange-traded product (ETP) investors do not necessarily lead price action, as evidenced by volume data indicating that ETP volumes represent an average of 3.5% of daily Bitcoin trading turnover on trusted exchanges since 2018.

Bitcoin Price Surge Predicted

By analyzing weekly ETP flows and their percentage of AuM, the report identifies a trend with a coefficient of determination (R2 ) value of 0.31, suggesting a discernible relationship between flows and price changes.

Utilizing this trendline, the report estimates that the aforementioned $14.4 billion of inflows could potentially drive the price of Bitcoin up to $141,000 per coin.

Nevertheless, accurately predicting the precise level of inflows upon the launch of spot ETFs remains challenging. The report acknowledges the difficulty in determining the exact magnitude of inflows.

It emphasizes that regulatory approval and corporate acceptance are gradual processes due to Bitcoin’s perceived complexity, which may require corporations and funds to build knowledge and confidence before committing to investment.

The potential wall of demand that could materialize following the introduction of a spot-based ETF is uncertain. While such ETFs offer portfolio diversification and enhanced Sharpe ratios, regulatory approval and corporate adoption may take time due to perceived complexities associated with Bitcoin.

Ultimately, CoinShares believes that Corporations and funds may require an extended period to familiarize themselves with the asset class and gain confidence before entering the market.

All in all, the CoinShares report sheds light on the potential impact of Bitcoin ETFs on the price of BTC. While it is challenging to precisely determine the level of inflows and their subsequent effect on the market, the report suggests that launching a Bitcoin spot ETF in the US could potentially drive the price of Bitcoin to US$141,000 per coin.

Currently, Bitcoin (BTC) is consolidating above the significant psychological level of $36,000. Over the past 24 hours, it has experienced a minimal decrease of 0.2%, while showing a 1.3% increase within the 1-hour time frame.

Featured image from Shutterstock, chart from TradingView.com

This acquisition will prepare CoinShares to position itself in the US markets ahead of the upcoming launch of spot Bitcoin ETFs.

Europe-based crypto asset management firm CoinShares has obtained an exclusive option to acquire the ETF unit of Valkyrie Investments. This will help CoinShares strategically position itself in the US market amid expectations of the Securities and Exchange Commission approving a spot bitcoin ETF.

The option, valid until March 31, offers CoinShares the opportunity for the acquisition, with specific financial details undisclosed. Currently, Europe offers spot crypto exchange-traded products, but the United States has yet to introduce them. However, there is ongoing speculation about the possibility of a spot Bitcoin ETF coming in 2024, potentially expanding access to Bitcoin investment for a broader audience. Speaking on the development, CEO of CoinShares, Jean-Marie Mognetti, said:

“The global ETF market is fragmented. The establishment of crypto spot ETPs in Europe since 2015, a development about to be mirrored in the US, is the perfect illustration. This disparity in market evolution presents both challenges and significant opportunities. The option to acquire Valkyrie is accelerating our expansion into the US market and the deployment of our digital asset management expertise globally.”

CoinShares is enthusiastic about the prospect of exploring the acquisition option of Valkyrie Fund. The deep understanding of the US market and a successful track record in creating investment products for crypto exposure by Valkyrie Fund align perfectly with CoinShares’ vision and operational ethos. If the acquisition moves forward, CoinShares aims to collaborate with Valkyrie’s founders to introduce high-quality digital asset products to American investors, said Mognetti.

CoinShares’ Growing Market Clout

For the past decade, CoinShares has been a key player in Europe’s crypto exchange-traded product market. They have the largest market share and manage over $3.2 billion in assets as of now. Now, CoinShares is looking to expand into the US market.

Also, they have the exclusive right to buy 100% of Valkyrie Funds, along with all associated rights related to the Valkyrie Bitcoin Fund and other ETFs held by Valkyrie Investments. However, this acquisition depends on getting regulatory approvals, consents, completing due diligence, and finalizing legal agreements.

Until the completion of the acquisition, Valkyrie Funds will continue to operate independently. This move follows CoinShares’ recent launch of CoinShares Hedge Fund Solutions in September 2023. Leah Wald, CEO of Valkyrie said:

“At the heart of our mission is to expand high-quality digital asset investment opportunities, joining CoinShares through this move underscores this shared ambition and vision. Together, with Valkyrie’s established US presence and existing offerings, alongside CoinShares global reach and infrastructure, we’re poised to deliver groundbreaking products aimed at solving investors’ needs.”

Read other crypto-related news on Coinspeaker.

next

Bitcoin News, Blockchain News, Cryptocurrency News, Funds & ETFs, Market News

You have successfully joined our subscriber list.

European digital asset manager CoinShares secured the exclusive option to acquire Valkyrie Funds, the exchange-traded fund (ETF) unit of its United States competitor, Valkyrie Investments, which includes the Valkyrie Bitcoin Fund awaiting U.S. approval.

CoinShares said on Nov. 17 that the move helps it expand to the U.S., which could soon become the epicenter for ETF offerings. The firm’s CEO, Jean-Marie Mognetti, added that he hopes the Valkyrie acquisition will help it capitalize on what is currently a fragmented global ETF market.

“The establishment of crypto spot ETPs in Europe since 2015, a development about to be mirrored in the U.S., is the perfect illustration,” said Mognetti. “This disparity in market evolution presents both challenges and significant opportunities.”

Exciting update! @CoinSharesCo secures an option to acquire @ValkyrieFunds, uniting our strengths to create a global one-stop-shop in digital asset investments. This marks a strategic leap towards market leadership and bolsters our strong presence in the U.S.!… pic.twitter.com/0BPNGC518P

— CoinShares (@CoinSharesCo) November 16, 2023

The option will remain active until March 31, 2024. For now, Valkyrie Funds will continue to operate as an independent entity until an acquisition by CoinShares is finalized.

Big News! Valkyrie is set to join the @CoinSharesCo family! We’re thrilled about this partnership, uniting our U.S. market insights with CoinShares’ global expertise. Together, we’re redefining digital asset investment in the U.S. and beyond! pic.twitter.com/s5URikl8Ci

— Valkyrie (@ValkyrieFunds) November 16, 2023

The two crypto-centric firms also agreed on a brand licensing term where the CoinShares name would be used in future S-1 filings to the U.S. Securities and Exchange Commission — used to register a securities offering with the regulator when companies plan to go public.

Related: Bitcoin ETFs will drive institutional adoption in 2024 — Galaxy Digital’s Mike Novogratz

If the SEC approves the Valkyrie Bitcoin Fund, Valkyrie plans to incorporate the CoinShares name into the ETF.

Valkyrie filed for the spot Bitcoin (BTC) ETF on June 21, along with BlackRock and a host of other financial firms.

CoinShares, which oversees over $3.2 billion in assets under management, expressed its optimism toward the U.S. cryptocurrency ETF market in September and iterated that the economic powerhouse isn’t lagging on digital asset regulation.

Magazine: Bitcoin ETF optimist and Worldcoin skeptic Gracy Chen: Hall of Flame

OKX joins Komainu and CoinShares for institutional segregated asset trading

Crypto exchange OKX has partnered with custody provider Komainu and asset manager CoinShares to facilitate round-the-clock trading of segregated assets to push institutional adoption of digital assets forward.

According to OKX, CoinShares will trade on the OKX exchange, while Komainu, a third-party custody provider, holds the collateral assets. This is done to mitigate counterparty risks, such as the other party failing to fulfill its part of the deal in a trading transaction.

According to Sebastian Widmann, head of strategy at Komainu, this is a necessary step to attract institutions to adopt digital assets, as it mirrors traditional financial market infrastructure. “By acting as independent, trusted and regulated third-party custodians for collateral assets, we give our clients additional assurances throughout their trading lifecycle,” Widmann said in a statement.

Lennix Lai, the chief commercial officer at OKX, believes that the new development addresses one of the remaining hurdles for institutional traders, counterparty risks. He explained:

“Secure custody solutions are live. Regulatory frameworks are taking shape. Exchange liquidity is deepening alongside the development of the trading ecosystem. However, counterparty risk is a big remaining hurdle for institutional traders.”

According to Lai, this protection reinforces the trust and confidence of institutional traders and creates a more reliable landscape for them to transact in digital assets. In a previous interview with Cointelegraph, Lai stated it’s important to raise compliance standards to bring in more traditional finance investors within the crypto space.

Related: Brad Garlinghouse jabs at maximalists: ‘It will be a multichain world’

Meanwhile, Lewis Fellas, head of hedge fund solutions at CoinShares, said the partnership creates a “legally robust mechanism” for the mutual management of assets. According to Fellas, the partnership also demonstrates the company’s expertise in “negotiating complex tripartite agreements that cover collateral, security and legal risks,” which are important for institutional investors.

Magazine: Slumdog billionaire: Incredible rags-to-riches tale of Polygon’s Sandeep Nailwal

Crypto products see 4th week of inflows amid race for Bitcoin ETFs: CoinShares

Crypto investment products have recorded four weeks of inflows as the market eagerly awaits the possible approval of a spot Bitcoin (BTC) exchange-traded fund (ETF) in the United States.

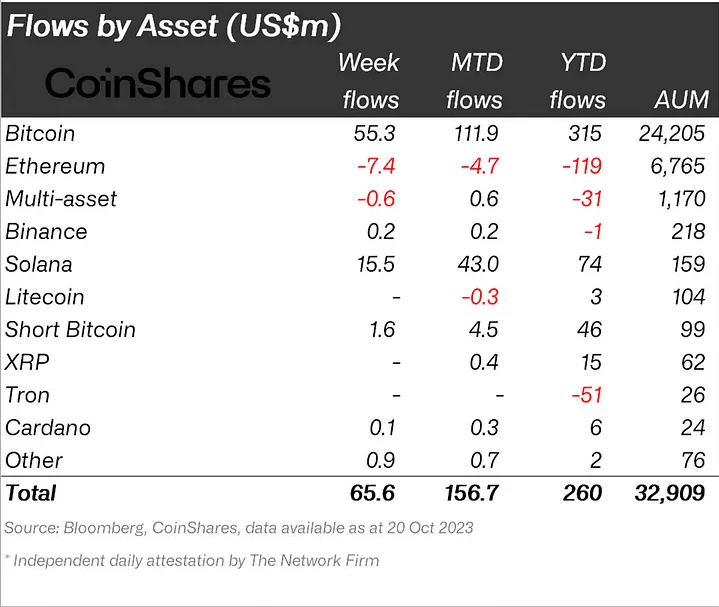

Asset management firm CoinShares’ Oct. 23 fund flows report revealed $66 million was added to digital asset investment products in the week ending Oct. 20, which has swelled the space’s assets under management to $33 billion.

Of the past week’s inflows, $55.3 million, or 84%, went to Bitcoin investment products, which has brought year-to-date Bitcoin product inflows to $315 million, it added.

It seems that the anticipation of a spot #Bitcoin ETF has prompted further inflows for the 4th consecutive week. Here is our analysis with @Jbutterfill.

Week 43 inflows: US$66m

Inflows are relatively low in comparison to June’s @BlackRock announcements, suggesting more… pic.twitter.com/6AkDGQJVOh

— CoinShares (@CoinSharesCo) October 23, 2023

CoinShares head of research James Butterfill, however, noted that the recent week’s inflows still haven’t reached the levels seen earlier this year when BlackRock first filed for a spot Bitcoin ETF.

“While the most recent inflows are likely linked to excitement over a spot Bitcoin ETF launch in the U.S., they are relatively low in comparison to the initial inflows following BlackRock’s announcement in June.”

Butterfill added that June’s four-week inflow run saw $807 million enter the sector, and the lower inflows recently “are indicative of investors adopting a more cautious approach this time.”

Meanwhile, Solana (SOL) products caught the second-largest share of inflows last week and the largest among all altcoins, netting $15.5 million. Ether (ETH) products saw outflows of $7.4 million — the only altcoin to suffer outflows last week.

Related: Bitcoin ETF to trigger massive demand from institutions, EY says

More recently, interest in a spot Bitcoin ETF surged late on Oct. 23 amid “positive signs” that BlackRock’s ETF was a step closer to approval and a U.S. appellate court issued a mandate to the Securities and Exchange Commission to review Grayscale’s spot Bitcoin ETF filing.

The moves sparked a Bitcoin rally, which saw it gain 14% over the past 24 hours and briefly hit $34,000 for the first time since May 2022.

The price jump also saw over $193 million in Bitcoin short liquidations in the past 24 hours, according to CoinGlass data.

Magazine: Web3 Gamer: Minecraft bans Bitcoin P2E, iPhone 15 & crypto gaming, Formula E