Carnival Corp.’s stock dropped Wednesday after the cruise operator reported an narrower-than-expected fiscal first-quarter loss but also provided an estimate for what the collapse of the Francis Scott Key Bridge in Baltimore would cost it this year.

Source link

collapse

Celsius looks to recover $2 billion withdrawn by 2% of accounts during its collapse

Bankrupt crypto lender Celsius Network is seeking the return of over $2 billion withdrawn by major customers shortly before its bankruptcy declaration in July 2022, according to a release shared with CryptoSlate.

The initiative, led by a committee appointed during the company’s Chapter 11 proceedings, is part of the firm’s restructuring efforts and targets individuals who extracted large sums from the crypto platform to mitigate potential legal confrontations and ensure the remaining assets are distributed fairly among creditors.

Favorable rate

The efforts are specifically aimed at accounts that withdrew more than $100,000 during the critical period leading up to the company’s bankruptcy filing. Such a collective action intends to replenish the funds available to repay the creditors left behind.

The withdrawals have raised concerns due to their preferential nature, as they benefited a small percentage of users at the cost of the wider Celsius customer base.

The committee said it is prepared to contact these customers directly, offering them an opportunity to settle at a “favorable rate” to avoid potential litigation.

A Litigation Administrator appointed by Celsius will focus on a select group of customers who collectively withdrew more than $2 billion from the platform during the 90 days leading up to its bankruptcy filing, a period now referred to as the Preference Period.

2% of accounts

This move is set to impact only about 2% of Celsius users, who are responsible for withdrawing approximately 40% of the platform’s assets within the 90 days preceding the bankruptcy declaration.

Celsius bankruptcy filings show the firm held around $6 billion in assets before its collapse — with a user base comprising 1.7 million registered and 300,000 active users, each with account balances exceeding $100.

The legal framework of bankruptcy law enables entities like Celsius to reclaim funds dispensed just before filing for bankruptcy, irrespective of the recipients’ innocence. This provision aims to ensure fair treatment for all creditors, preventing those who withdrew funds prematurely from gaining an advantage over those who did not.

Cam Crews, a member of the Litigation Oversight Committee (LOC), an independent committee the Bankruptcy Court approved to oversee the Litigation Administrator’s efforts and other related activities, emphasized the settlement offer’s intention.

Crews said:

“This offer aims to correct the imbalances caused in the days before our bankruptcy filing. It presents an opportunity for those who disproportionately benefited to contribute to the relief of the creditors who were most affected.”

The settlement strategy aims to simplify the recovery process and offers a practical alternative to the potential complexities of litigation. Account holders who opt for the settlement can return a part of the assets they withdrew, which have since increased in value, rather than the original amount.

Mentioned in this article

Latest Alpha Market Report

BitMEX Co-Founder Backs Solana Amidst Fears of Another US Bank Collapse

In a post on X, Arthur Hayes, the co-founder of the derivatives crypto exchange BitMEX, said it might be time for traders to double down on Solana (SOL) and altcoins in general. Hayes’s comments come at a time of heightened volatility in the broader crypto market, with Bitcoin (BTC) struggling to regain its footing and altcoins, including Ethereum (ETH), posting mixed results.

Time To Switch To Solana?

The co-founder noted that it could be time to get back on the Solana “train.” With this preview, Hayes is convinced that Solana and other altcoins could outperform Bitcoin in the days ahead.

The outlook could be anchored on the possibility of altcoins and Bitcoin rising in the coming sessions. Specifically, Hayes warns that a “few” major banks in the United States could “bite the dust.”

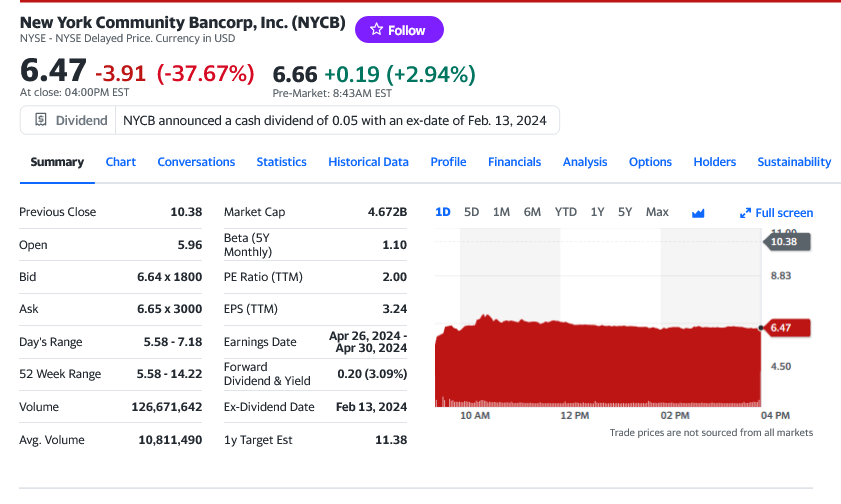

This comment also comes at a critical position in the United States banking landscape. On January 31, market analysts noted that NY Community Bancorp’s stock price plummeted 45% following a surprise quarterly loss and dividend reduction.

NY Community Bancorp is crucial in the United States regional banking sector. It also acquired assets from Signature Bank when it collapsed in March 2023.

Analysts say the bank’s decision to expand harmed its balance sheet. The acquisition of Signature Bank increased its regulatory capital requirements, impacting its dividends and provisions, as seen in its latest earnings report.

A Bank Crisis Is A Boon For Bitcoin, Altcoins

While Hayes’ comments are likely to fuel further speculation about the potential for another banking crisis in the United States, it is not immediately clear whether this might spark a crypto rally.

However, reading from past events, if indeed a major bank in the United States collapses and files for bankruptcy in the next few days, Bitcoin will likely rally. In March 2023, following the collapse of Signature Bank, among others, Bitcoin initiated a crypto rally that saw Ethereum and Solana record gains.

Considering the significant shift in Solana investor sentiment over the past few months, it is likely that SOL might snap back to trend. In that case, the altcoin might break above $125, extending 2023 gains.

When writing, SOL is pinned below $100 and under pressure. The local resistance is at $105. A break out might lift the coin towards $125 in a buy trend continuation pattern.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

‘Rich Dad Poor Dad’s’ Robert Kiyosaki Predicts Collapse Of The US Financial System — ‘We’re At The End Of An Empire. All Empires Always Come To An End’

Emphasizing the importance of financial education and preparedness, “Rich Dad Poor Dad” author Robert Kiyosaki expressed concerns about the current financial system and societal structures in the U.S. in a YouTube video titled “Robert Kiyosaki Exposes The System That Keeps You Poor & The Downfall of The USA.”

In the video, interviewer Rob Moore asked Kiyosaki, “Is the money system rigged?” Kiyosaki replied, “You want to get me in trouble, don’t you.”

He then elaborated, saying, “We’re at the end of an empire right now. It is the end; it’s the end of this, and all empires always come to an end.”

He provided historical examples to support his viewpoint, mentioning the Roman and Greek empires, and noting that the earliest Chinese civilizations were the first to use paper money. Kiyosaki concludes by asserting that what is being witnessed today is akin to the end of the American Empire, suggesting that this period is fraught with danger.

Don’t Miss:

He discussed the shift in 1964 when coins in the U.S. changed composition, indicating a deviation from backed currency to fiat currency, which he correlated with the downfall of empires.

Kiyosaki underscored the necessity of financial literacy and preparedness, urging the audience to consider the ramifications of the points he raised. He expressed concern about wealth disparity and its potential fallout, saying, “We are witnessing what could be the end of an empire if we don’t address these issues.” Kiyosaki didn’t predict doomsday but stressed the importance of being financially knowledgeable and flexible in times of uncertainty.

He maintained a balanced approach throughout the video, steering clear of sensationalism and alarmist rhetoric. Instead, Kiyosaki asked viewers to contemplate the economic challenges ahead and strategies for safeguarding their financial futures.

Kiyosaki touched on the role of debt in wealth creation, contrasting the perspectives of average people with those of real estate investors like himself and former President Donald Trump. He pointed out how leveraging debt has facilitated wealth accumulation for some, while others, adhering to traditional financial advice, find themselves struggling.

Addressing global issues, Kiyosaki reflected on the geopolitical tensions and the shifts in the global economic landscape, including the rise of China and the potential consequences of the U.S. losing its status as a dominant economic power.

The video also includes Kiyosaki’s anecdotes and opinions on topics ranging from sports to politics. He emphasized the importance of understanding the changing nature of money and investing in assets like gold and silver instead of relying solely on fiat currency.

Read Next:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘Rich Dad Poor Dad’s’ Robert Kiyosaki Predicts Collapse Of The US Financial System — ‘We’re At The End Of An Empire. All Empires Always Come To An End’ originally appeared on Benzinga.com

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Banks are increasingly tapping a Fed facility set up after SVB’s collapse

Usage of a new Federal Reserve facility set up in the wake of the collapse of SVB Financial is starting to pick up after months of little change.

The Bank Term Funding Program allows banks to borrow for up to one year by pledging collateral at par even when they’re trading at a loss, and it has seen week-over-week gains since the autumn. What’s more, the pick-up in the facility coincides with a few recent spikes in the Secured Overnight Financing Rate.

“So, there’s definitely some evidence that banks are getting short on cash, and they’re having to pay more to get it,” says Moses Sternstein, who wrote about the phenomenon in his Random Walk blog.

He speculates the reason has less to do with the lagged effects of the Federal Reserve interest-rate hike campaign and more with the increased borrowing from the Treasury Department.

“All that cash flying to Treasury leaves less and less for everyone else,” he writes.

There could be a seasonal impact as well. Ryan Plantz at Nomura, who commented on the spikes in the SOFR rate, noted signs of deteriorating liquidity and tighter funding into the year end.

An ETF tracking the regional banks, the SPDR S&P Regional Banking ETF

KRE,

has surged over the last month, rising 17%, though it’s still down 11% year-to-date.

Tiger Woods of the United States and Rory McIlroy of Northern Ireland walk to the 11th fairway during a practice round prior to the 2023 Masters Tournament at Augusta National Golf Club on April 03, 2023 in Augusta, Georgia.

Christian Petersen | Getty Images Sport | Getty Images

Tiger Woods and Rory McIlroy’s indoor golf league, TGL, has postponed its inaugural season by a year until the start of 2025, the organization said Monday.

The decision comes after the roof of the new arena slated to host TGL matches collapsed last week. The league said the power system used during construction of the SoFi Center in Palm Beach Gardens, Florida failed, causing a dome structure to deflate.

The accident did not cause injuries or damage the league’s golf simulators and other technology, TGL said. But TGL delayed the season, which was expected to start in January, after speaking to key partners.

“This decision came after reviewing short-term solutions, potential construction timelines, player schedules, and the primetime sports television calendar,” the league said in a statement. “We are confident that the extension will only improve our delivery.”

TGL, which counts the PGA Tour as a partner, was founded by McIlroy, Woods and former NBC executive Mike McCarthy. The trio wants to create a primetime indoor golf league to attract new fans to the sport at as the emergence of the Saudi-backed LIV Golf, and then its proposed merger with the PGA Tour, left golf at a crossroads.

Woods was optimistic about the league’s future despite the delayed launch.

“Although the events of last week will force us to make adjustments to our timelines, I’m fully confident that this concept will be brought to life by our great committed players,” Woods said in a statement Monday.

TGL has drawn some of the best golfers in the world as part of its lineup. It’s unclear how the new timeline could affect player participation.

The league has also attracted a number of high-profile team owners and investors including hedge funder Steve Cohen, Atlanta Falcons owner Arthur Blank, Fenway Sports Group, tech founder Alexis Ohanian and tennis stars Serena and Venus Williams. Other investors in the league include basketball great Stephen Curry, race car driver Lewis Hamilton, women’s soccer player Alex Morgan, singer Justin Timberlake and pro football’s Tony Romo and Josh Allen.

TGL signed a multi-year media rights deal with ESPN in October to broadcast its events.

ESPN said it fully supports the decision to postpone the 2024 season.

“We have believed in them and their vision from the beginning, and that has not changed. The additional time to plan, test and rehearse will only make it better, said Rosalyn Durant, executive vice president, programming and acquisitions at ESPN.

The cryptocurrency’s historical trends indicate that significant gains often occur a year and a half after the bottom, suggesting a rapid price surge in the coming years.

A year after the crypto market saw the collapse of the now-defunct FTX Derivatives exchange and two years after Bitcoin (BTC) saw an all-time high of $69,044, the narrative of “Crypto is dead” has been unequivocally debunked.

Crypto Market: Post-FTX Collapse

The collapse of FTX was a turning point for the crypto market, leading to widespread skepticism and calls for its demise. However, the past year has seen a remarkable shift in sentiment. As highlighted in a recent blog post from Coinbase Global Inc (NASDAQ: COIN), institutional interest in cryptocurrencies has surged, with the filing of Exchange-Traded Funds (ETFs) and increased participation from financial titans.

Additionally, the user base for crypto assets has grown to an estimated 420 million globally, with 52 million in the United States alone. This growth far surpasses the adoption rates of electric vehicles and union memberships, signaling a profound shift in public perception.

Despite the difficulties posed by FTX’s demise, the crypto market has seen continued innovation driven by a dedicated developer community. Moreover, the technology behind cryptocurrencies, especially blockchain and Web3 projects, has evolved significantly.

Over half of the Fortune 100 companies have engaged in crypto-related initiatives, recognizing the importance of crypto investment for competitive advantage. Payment integration with mainstream services like PayPal and Visa has further bridged the gap between crypto and traditional finance.

The regulatory environment for cryptocurrencies has also seen substantial progress. Approximately 3% of the G20 and major financial hubs have either passed national crypto legislation or have legislation in progress.

Notably, the passing of MiCA, a unified framework for crypto across 27 countries in the European Union, is a significant step towards providing a clear regulatory environment. The increasing regulatory clarity has contributed to the legitimacy and acceptance of cryptocurrencies in mainstream financial markets.

Justice for Bad Actors

The crypto market in the past year witnessed a reckoning for individuals who engaged in unethical practices during the previous bull cycle. Notable figures like Sam Bankman-Fried, Alex Mashinsky, Do Kwon, and Su Zhu are facing consequences for their actions. Bankman-Fried’s conviction, in particular, serves as a symbolic moment in holding bad actors accountable.

As the crypto industry moves forward, it is crucial to remember the core principles of decentralization, self-custody, and the power of digital assets like Ethereum (ETH) and Bitcoin. The industry must remain vigilant against bad actors and uphold the principles of Decentralized Finance (DeFi).

The recent bullish crypto market sentiment, boosted by the prospect of regulated ETFs, points to a bright future. Looking ahead, Bitcoin is projected to enter an “acceleration phase,” with some analysts expecting prices to surpass the previous All-Time High (ATH) record of $69,044 by mid-2024.

The cryptocurrency’s historical trends indicate that significant gains often occur a year and a half after the bottom, suggesting a rapid price surge in the coming years.

next

Bitcoin News, Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Bankman-Fried says he was unaware of FTX’s missing $8B until just before collapse

FTX founder Sam Bankman-Fried insisted Tuesday that he was unaware that $8 billion of customer money had disappeared until just before his crypto exchange collapsed.

As both the prosecution and defense rested in the criminal fraud case against him in federal court in Manhattan. Bankman-Fried said he had long stepped away from day-to-day decision-making at FTX’s sister firm Alameda Research which is accused of squandering the missing money on risky investments.

“In retrospect, our oversight of that was very poor,” he said in his third and final day of testimony before the jury. “I deeply regret not taking a deeper look into it.”

FTX ultimately collapsed in late 2022, largely as a result of the billions in loans it had extended to Alameda, which prosecutors alleged was siphoned from customer accounts. Earlier Bankman-Fried and others had testified how borrowing limits placed on FTX customers had been lifted for Alameda, allowing it to fall into a deep hole.

Federal prosecutors have alleged that Alameda was effectively granted carte blanche to use FTX customer money to make risky bets and that customer money was used to finance luxury real estate purchases, private jets, investments and political contributions.

Both sides are expected to present their closing arguments on Wednesday and the jury could begin deliberating on Thursday.

Bankman-Fried made the risky decision to take the stand after weeks of damning testimony from several former FTX and Alameda executives who had pleaded guilty in the case and had agreed to testify against him.

Through much of his testimony, Bankman-Fried said he couldn’t recall details of many public statements he had made to the media and elsewhere, but stood firm that he had been out of the loop on how big of a hole had formed on FTX’s balance sheet and how much money Alameda had been allowed to borrow.

Prosecutor Danielle Sassoon peppered Bankman-Fried for hours over two days about discrepancies between his prior public statements and what he testified, in an effort to damage his credibility with the jury.

Terraform co-founder Shin blames protocol for collapse during trial in S. Korea

The trial of payment platform developer Terraform Labs co-founder Shin Hyun-Seong, also known as Daniel Shin, and seven others got underway in Seoul Southern District Court in South Korea on Oct. 30, according to local news reports. Shin is accused of defrauding investors. Also at issue was whether or not LUNA (LUNA) is a security.

Shin left Terraform in 2020 “for business reasons,” his lawyer told the court. Shin was the CEO of Chai, a payments technology company that partnered with Kwon to form Terraform in 2019. According to Chosun Biz, the lawyer added:

“The cause of the slump [that led to Terraform’s bankruptcy] was due to the unreasonable operation of the Anchor Protocol and external attacks carried out by Do-hyung Kwon after the breakup [between business partners Shin and Kwon]. […] It has nothing to do with the defendant.”

Anchor Protocol was the algorithm used to maintain the value of the dollar-pegged TerraUSD (UST) coin.

The defendants face multiple charges under at least four laws, including the Information Act. The prosecutor claimed, “They took advantage of the fact that investors had difficulty accessing information and had a low understanding of it.”

The prosecutor also said, “A business using virtual assets as a payment method cannot be established,” but the defense lawyer disputed that statement, saying there were no regulations on using virtual assets for payment when Terraform was founded.

The prosecution referred to the United States Securities and Exchange Commission case against Ripple as the basis for several charges relating to violations of South Korea’s Capital Markets Act, comparing the sale of XRP (XRP) to investors to the actions of Terraform in South Korea.

Related: SEC seeks to question Terraform Labs co-founder Daniel Shin in Korea

The defense responded that American law does not apply in South Korea and that “the government has announced several times since 2017 that virtual assets do not fall under the category of financial products (securities),” adding that the Capital Markets law could not be applied retroactively in any case.

The SEC sued Terraform and Kwon for fraud in February.

Korean prosecutors have summoned Terra co-founder Daniel Shin to attend an investigation into insider trading, price manipulation, and breach of duty to Chai customers. Prosecutors allege that Shin illegally cashed out over $100m from LUNA in violation of local securities laws. pic.twitter.com/H6Ysf7se0b

— FatMan (@FatManTerra) November 14, 2022

In November 2022, South Korean authorities seized 140 billion won, worth around $105 million at the time, from Shin. They alleged that Shin had sold LUNA worth that amount, knowing their value would fall. Defense lawyers denied that charge as well.

Unlike Terraforms co-founder Do Kwon, Shin remained in South Korea after the collapse of Terraform Labs in May 2022. He made his first court appearance in November 2022 and was indicted on fraud charges in April. South Korea has issued an arrest warrant for Kwon, but he is currently in Montenegro.

Magazine: Korean crypto contagion, Bank of China on Ethereum, HK’s exchange red carpet: Asia Express

BlockFi CEO Zac Prince testifies to lending relationship with Alameda Research before its collapse

Zac Prince, the CEO of BlockFi, continued to provide testimony in the criminal trial of former FTX CEO Sam Bankman-Fried on Oct. 13.

In the previous day’s testimony, Prince described his firm’s lending relationship with Alameda Research. In current testimony, he described how Alameda began to dominate BlockFi lending activities and noted that he spoke to FTX and Alameda as loans grew larger.

Prosecutors: “Did you talk with Sam Bankman-Fried?”

Prince: “Yes, a CEO to CEO was suggested. So we did a call.”

Prince said that BlockFi had at one point lent out $5 billion to $10 billion to its clients overall. Alameda Research had initially borrowed $10 million circa early 2021, but that amount eventually rose to $50 million in May 2021 and to $1.1 billion in May 2022.

The BlockFi executive noted that his firm was also affected by other industry events, including the collapse of Luna and TerraUSD (which was followed by Three Arrows Capital’s default on its loan to BlockFi) as well as the bankruptcy of Celsius and Voyager.

Prince said that BlockFi, at one point, attempted to have FTX acquire it, as reported in mid-2022. Though the acquisition never occurred, Prince admitted that the arrangement with FTX influenced BlockFi’s decision to lend money to Alameda as a “data point.” He did not admit that BlockFi loaned to Alameda wholly because of that arrangement.

BlockFi was unaware of FTX’s wrongdoing

Prosecutors then presented Prince with Alameda’s Q2 2022 balance sheet. Though Prince was familiar with it, he said that he was told the loans detailed on the sheet were from other crypto lenders, as opposed to loans between FTX and Alameda.

Prince said that if he had known of FTX’s multibillion-dollar loans to Alameda, BlockFi would not have lent money to Alameda as it “would have been insolvent.” He added that if he had known that Alameda was using money that belonged to FTX customers, BlockFi would not have lent money as that practice is “not appropriate.”

Furthermore, Prince said that if he had known of Alameda’s loans to Sam Bankman-Fried, BlockFi would have been “concerned.” Early bankruptcy reports suggest that Bankman-Fried personally borrowed at least $1 billion from Alameda.

Prince also testified that when the price of FTX’s FTT token fell around the time of the companies’ collapses, BlockFi attempted to call certain loans.

Prince said that, at the time of the collapse, $650 million of loaned funds were still outstanding and said that BlockFi had $350 million on FTX, leaving $1.1 billion affected. He testified that Alameda and FTX led to BlockFi’s own bankruptcy.

Cross-examination addresses finer points

During cross-examination, Bankman-Fried’s lawyer seemingly attempted to draw attention to the fact that both BlockFi and FTX lent out customer assets. Prince emphasized that BlockFi lent customer funds “if they agreed to.”

Also during that period, Cohen asked Prince whether BlockFi’s team had advised against increasing exposure to FTT tokens. Prince replied that the entire team had not advised this and said that BlockFi had made more loans when it required more collateral.

Earlier, Prince had noted BlockFi had received Grayscale Trust and Robinhood shares as collateral. Cohen asked whether Prince was aware of who owned those Robinhood shares. Prince replied that he “wasn’t aware of the nuances.” Robinhood recently purchased those shares from the U.S. government after they were seized from Bankman-Fried. In late 2022, BlockFi had attempted to lay claim to the shares itself.

Finally, Cohen asked whether Prince was ever concerned about whether BlockFi might go bankrupt. Prince answered that a CEO “must think of possibilities.”

Cohen’s cross-examination concluded at that point. The trial will continue next week, with FTX associates Nishad Singh and Ramnik Arora providing testimony.