The termination of the project led to a significant drop in Trekki NFT floor prices and sparked frustration among NFT holders and enthusiasts.

Zeta Markets, a decentralized exchange (DEX) built on Solana, will launch its governance Z token today, according to a statement shared with CryptoSlate.

The DEX revealed that the token’s debut aligns with its commitment to “becoming a fully community-centric protocol” and empowers its community members to influence its decisions.

Zeta has enjoyed considerable interest and adoption from the crypto community thanks to the rising popularity of the Solana ecosystem. The DEX stated that its monthly trading volumes crossed a new all-time high (ATH) of over $1.2 billion, traded by more than 71,000 monthly active users in March.

Data from DeFillama shows that the total value of assets locked on the platform has soared to a new high of over $21 million as of press time.

Z token has a total supply capped at 1 billion. Zeta Markets plans to allocate 10% of the tokens through airdrops, with 5% earmarked for Zeta traders and community members based on their Z-Score.

The platform revealed that 1% of the airdrop would be reserved for other Zeta users affiliated with strategic communities within the Solana ecosystem. In comparison, the remaining 4% will be allocated to Z stakers.

Upon launch, approximately 30% of the token supply will be allocated to incentivize maker and taker trading activities, acknowledging their pivotal role in maintaining liquidity on the exchange.

Tristan Frizza, the founder of Zeta Markets, stated that the token launch is part of the protocol’s long-term vision. This vision includes pioneering a novel vote escrow model on Solana and incorporating a staking mechanism that enables holders to earn additional rewards.

Additionally, Zeta plans to introduce the first layer-2 rollup on the Solana network before the end of this year.

According to Frizza:

“With a platform that has already stood the test of time and facilitated billions in volume for tens of thousands of traders, we’re excited to launch $Z, the governance token of Zeta, to closely align the long-term interests of users with the protocol. This will empower the community to shape the future trajectory of the protocol and weigh in on important decisions as we collectively strive to deliver the ultimate DEX experience.”

The post Zeta Markets launches governance token to steer Solana-based DEX toward community rule appeared first on CryptoSlate.

Discussions about adjusting Ethereum’s issuance curve due to staking concentration and other factors are taking place on social media, with some developers in favor and some against this change. A recent article by Mike Neuder, an Ethereum Foundation researcher, highlights that Ethereum issuance should “preserve the viability and proportion of solo stakers.” Ethereum Issuance Curve […]

Discussions about adjusting Ethereum’s issuance curve due to staking concentration and other factors are taking place on social media, with some developers in favor and some against this change. A recent article by Mike Neuder, an Ethereum Foundation researcher, highlights that Ethereum issuance should “preserve the viability and proportion of solo stakers.” Ethereum Issuance Curve […]

Source link

The Internet Computer Protocol (ICP) appears to be ushering in a new era of decentralized cloud computing innovation, as evidenced by the vibrant ecosystem of developers and projects showcased in the recent CryptoSlate Twitter Space. Hosted by CryptoSlate’s Akiba, the space featured insightful dialogue with key figures from the ICP community, including Isaac from the ICP Code & State team, Max from Bitfinity, Kyle from The Swop, and Darren, an ICP content creator. Listen back to the recording on X.

As Isaac explained in the space, ICP is a decentralized cloud at its core, bridging the gap between Web2 and Web3. By providing decentralized website hosting with lightning-fast load times and enabling smart contracts to act as decentralized users on other blockchains, ICP is unlocking new possibilities for developers. The protocol’s advanced cryptography allows for the secure splitting of keys across nodes without ever reconstructing the full key, ensuring an unparalleled level of decentralization.

One of the most exciting aspects of ICP is its seamless integration with the Bitcoin blockchain. ICP smart contracts, or “canisters,” can function as decentralized users with their own Bitcoin addresses, paving the way for groundbreaking applications such as the first decentralized Bitcoin mining pool and gasless ordinal marketplaces. This integration makes it easier for developers to build sophisticated smart contracts and applications that leverage the power of Bitcoin while also providing a decentralized infrastructure layer to enhance other blockchains.

The ICP community is a testament to the protocol’s resilience, with a thriving ecosystem of developers and projects spanning various sectors, including DeFi, NFTs, gaming, and social media. After launching within the top 10 crypto projects in 2021, the ICP token fell over 90% amid controversial circumstances. However, the core ICP community continued to build through the bear market, and the fruits of their labors are now revealed.

Venture studios like Code State are actively supporting the ecosystem’s growth, while projects such as Bitfinity, The Swap, and numerous independent developers are pushing the boundaries of what’s possible with ICP.

The upcoming ICPCC24 conference is set to showcase the strength and diversity of the ICP ecosystem. This unique hybrid event, taking place on May 10, will feature a 9-hour main livestream with content from a wide array of ICP projects and ecosystem partners. Simultaneously, more than 25 in-person watch parties and meetups will be held worldwide, fostering a sense of community and collaboration.

Virtual and in-person attendees will have the opportunity to participate in interactive elements and unique airdrop opportunities, making ICPCC24 an unmissable event for anyone interested in the future of decentralized cloud smart contract technology.

Solana Labs Co-Founder Anatoly Yakovenko has seemingly taken a stand against Solana-based memecoins, calling for investors to “stop doing this” in relation to data showing the high volume of SOL being sent to memecoin pre-sale contracts.

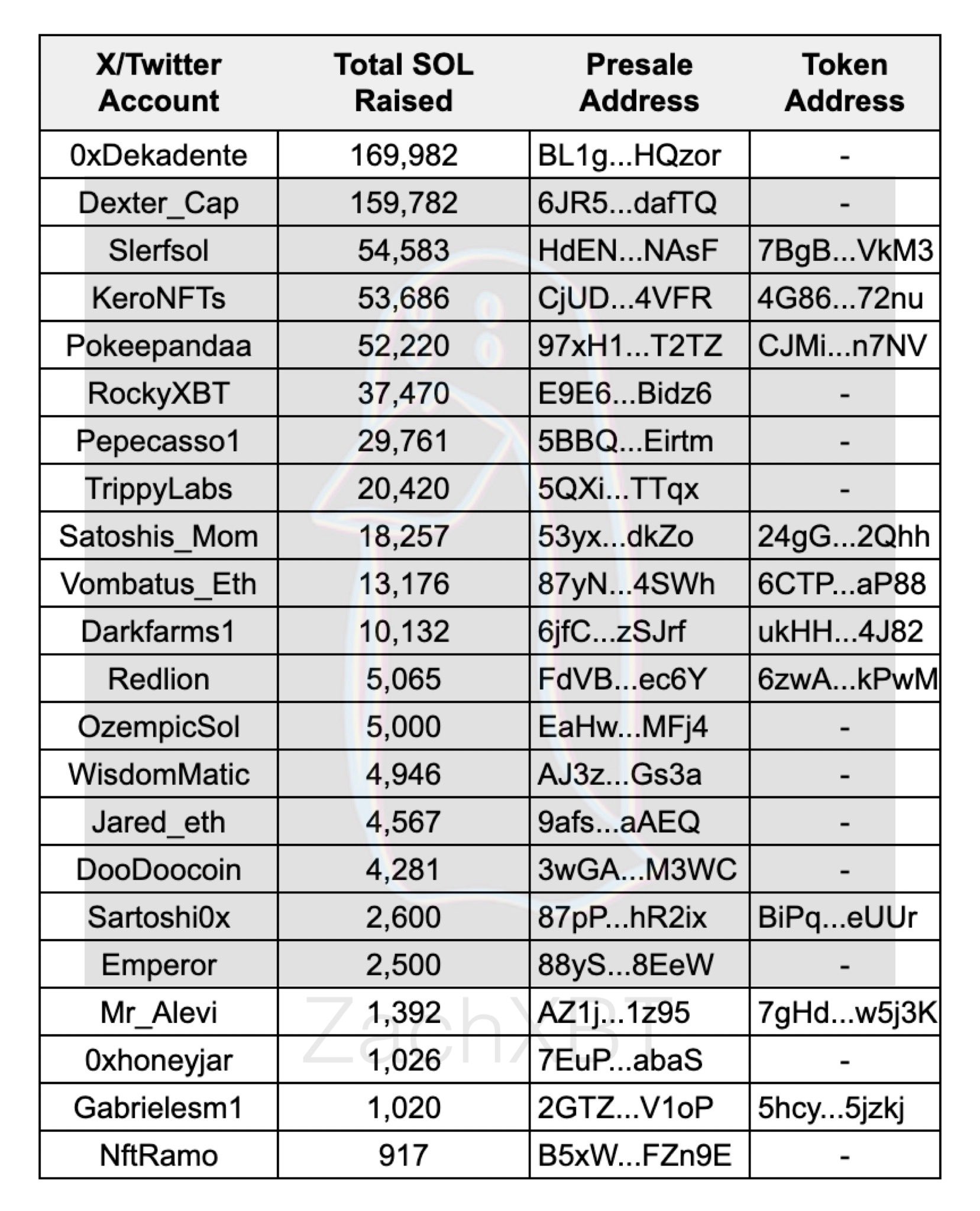

On-chain sleuth ZachXBT shared the image below detailing a list of social media accounts that had recently raised significant funding for memecoins on Solana. Top of the list 0xDekadente raised 169,982 SOL, approximately $30.5 million, while the lowest value project, NftRamo, raised roughly $165,060.

Anatoly quoted the above image and the phrase “stop doing this” with no other comment. Memecoin fervor recently helped drive SOL prices over $200 for the first time since the last bull market and mark a new all-time high market cap.

As of press time, 0xDekedente is attempting to airdrop tokens to pre-sale investors but is struggling due to network congestion. As a result, the account suggested launching the token before airdropping tokens to investors.

“The smolana network is extremely congested and it is impossible to airdrop at the same time as the LP in this moment… we try, but it’s impossible

So, you choose: Launch now and receive the $smole airdrop in the next few hours…

Launch the airdrop and the LP at the same time, this will take a few hours for the network to decongest… We don’t know how much exactly it will take due to the congestion, but we will do it ASAP whatever your decision.”

Currently, the online vote suggests the token will launch before the airdrop happens, meaning investors who contributed to the pre-sale will not have tokens available to sell when the token launches.

As of press time, SOL is down 15% from its local high to trade around $179. Memecoins, seen by some as exit liquidity gambling and important community innovation by others, potentially drive interest in Solana for the wrong reasons.

The memecoin demand is at least acting as a stress test for the network, showcasing the pressure points for network congestion on high demand. Memecoins are struggling to launch liquidity pools and airdrop tokens, while tokens and dApps with actual utility have little to no exposure.

The post Solana co-founder Anatoly tells community to stop investing in memecoin pre-sales appeared first on CryptoSlate.

Dogecoin influencer Mishaboar has issued a vital warning to members of the Dogecoin (DOGE) community. This warning could prove timely as meme coin-related scams look to be on the rise in the crypto community.

Mishaboar warned community members in an X (formerly Twitter) post to be “extremely careful,” stating that there are several fake airdrops targeting the Dogecoin tag and other popular meme coins. The influencer also added that some of these scams are also deployed using the tags of popular AI tokens.

These scammers are said to promise airdrops to community members with the aim of solely stealing the tokens of unsuspecting users in the process. It is not surprising that these schemes are perpetuated using the tags of popular meme and AI tokens, as these categories of crypto tokens are two of the leading narratives for this bull cycle.

Therefore, using these token tags is likely to help these scammers gain more reach and attract more users. Mishaboar’s warning is no doubt crucial, especially for newbies in the crypto space who could easily fall prey to these scams in the bid to earn ‘airdrops’ that could give them more leverage entering into the bull run.

As part of his warning, the influencer advised his followers to report any account they suspected to be a scam. Mishaboar also noted that some of these accounts have a huge following and might seem legitimate, but users shouldn’t be deceived. Accounts with a significant following always tend to look more legit. That’s why these crypto users have to be extra vigilant.

Mishaboar is known to be very particular about the safety of crypto users. When the ‘MyDogeWallet’ Hack occurred, he advised members of the crypto community to enable two-factor authentication (2FA) on their X accounts using an authenticator application or a physical security key.

At the beginning of the year, Shiba Inu scam detector platform Susbarium drew the SHIB community’s attention to scams that were targeted at obtaining people’s identities and stealing their crypto holdings. Back then, Susbarium warned that one of the scams involved fake accounts promoting fake TREAT tokens to unsuspecting investors.

Like Mishaboar, Susbarium urged users to enable 2FA on all their crypto accounts. They also proposed using hardware wallets to help community members securely store their crypto tokens. Some scam accounts clone or impersonate official accounts, so the scam detector advised to be wary of unsolicited messages they might receive from these impersonators.

DOGE price at $0.17 | Source: DOGEUSD on Tradingview.com

Featured image from Securities.io, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto mixer Tornado Cash has reportedly fallen victim to a significant backend exploit that has put user deposits and sensitive data at risk.

The security breach was revealed in a Medium post by Gas404, a community member, on Feb. 26.

The exploit represents a critical vulnerability for Tornado Cash, whose trading volume already suffered a dramatic decline following sanctions from the US Treasury Department’s Office of Foreign Asset Control (OFAC) in August 2022.

The sanctions, which were part of broader measures targeting the crypto sector, had significantly reduced the mixer’s operational scale even before the exploit.

According to the Medium post, malicious JavaScript code was discovered in the protocol’s backend. It was reported injected through a compromised governance proposal submitted by an individual posing as a Tornado Cash developer on Jan. 1.

The code surreptitiously redirects user deposit information to a server controlled by the attacker, posing a dual threat — the exposure of deposit data and the outright theft of the deposits themselves.

One such theft has been confirmed through transaction records on Etherscan, highlighting the exploit’s immediate impact.

The exploit’s technical details were discussed at length in the community post, illustrating the sophisticated nature of the attack.

Specifically, the malicious code was designed to encode and exfiltrate private deposit notes, effectively breaching the anonymity and security that Tornado Cash users depend on.

In response to the crisis, Gas404 has proposed a solution to mitigate the damage: reverting Tornado Cash to a prior version of its IPFS deployment.

The move aims to secure the platform against the current vulnerability by utilizing a previously established and ostensibly secure infrastructure setup.

The proposed change emphasizes the urgency of addressing security flaws within decentralized platforms, where governance proposals can be manipulated for malicious purposes.

The Tornado Cash website and Discord channel were taken offline following the revelation and have yet to come back online — an indication of the exploit’s severity and the ongoing efforts to contain its repercussions.

Regional banks were hammered in early 2023, thanks to troubles at a small number of banks. New York Community Bancorp (NYCB -2.43%) was actually one of the better performers through that difficult and uncertain period. But when the bank reported full-year 2024 earnings, it shocked investors by cutting the quarterly dividend from $0.17 per share to just $0.05. That’s a 70% decline in the dividend — and a warning sign that this may not be the right dividend stock for conservative investors.

In early 2023, fast-rising interest rates created a timing problem for some banks. They had bonds on their balance sheets that were intended to be held to maturity, but the value of those bonds had declined because of the swift change in rates. If the assets had been held to maturity, there would have been no problem, but for various reasons a small number of banks experienced a high level of customer withdrawals. That required these banks to sell the bonds that had fallen in value and, thus, they were suddenly not as well capitalized as investors thought.

Image source: Getty Images.

Basically, there was a bank run, and it caused a few banks to go out of business. One of those banks was Signature Bank. New York Community Bancorp stepped in and bought parts of Signature Bank. This increased the size of New York Community Bancorp and, in turn, subjected the company to more regulatory scrutiny. The key here is that larger banks are required to better safeguard customer deposits.

At the same time, New York Community Bancorp has experienced trouble with a couple of material loans. Highlighting the risk, in the fourth quarter, management increased the allowance for credit losses to $992 million from $619 million just three months earlier, a 60% jump in a single quarter. That’s a fairly large change in a very short period of time. The takeaway from all of this is that the risks here are material.

Thus, New York Community Bancorp cut the dividend. That frees up cash it can use to shore up its capital structure and appease its regulators.

From the perspective of New York Community Bancorp, it is acting quickly and decisively to solve a problem. In fact, cutting the dividend was probably the right decision for the bank to make. And it should help to speed up the process of muddling through this rough patch. A more aggressive long-term investor interested in turnaround situations might find that appealing. And, assuming the worst is behind the bank, such an investor could collect a 4.4% dividend yield while waiting for management to get the bank back on track.

That said, for conservative dividend investors, it might make more sense to stay on the sidelines until there are more substantial signs of improvement. Such signs might include the allowance for credit losses stabilizing (or falling) or, even better, the dividend being increased again, among other things. The problem is that, right now, the bank is still in crisis mode. The issues it faces are so worrying that the company shifted the executive reporting structure. It elevated a board member to executive chairman and, effectively, gave him the power to make major decisions. That’s what you would normally expect the CEO to be doing.

Of course, all this activity could lead to a brighter future. But right now the signs are worrying, and probably only the most aggressive investors should be looking at New York Community Bancorp. What’s going on isn’t the end of the world for the bank, but it biases the risk/reward profile more toward the risk side of the equation — and that’s just not appropriate for more conservative dividend investors. And mending the capital structure is unlikely to be a quick process.

What’s been going on at New York Community Bancorp has been headline-grabbing news, and it is very interesting to see the drama unfold. But drama and dividends aren’t two things that most investors want going together if they are trying to live off the income their portfolios generate. If you are looking at New York Community Bancorp thinking that it won’t get any worse, you might be right. But you could also be wrong. Further deterioration would make things even more bleak for dividend investors. That won’t be worth the risk for most income seekers.

Reuben Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The crypto industry has responded to criticism from Hillary Clinton, who said that cryptocurrency can undermine the role of the U.S. dollar as the world’s reserve currency. Galaxy Digital CEO Mike Novogratz argued that the only thing that can undermine the U.S. dollar as a reserve currency is reckless spending by both U.S. political parties. […]

The crypto industry has responded to criticism from Hillary Clinton, who said that cryptocurrency can undermine the role of the U.S. dollar as the world’s reserve currency. Galaxy Digital CEO Mike Novogratz argued that the only thing that can undermine the U.S. dollar as a reserve currency is reckless spending by both U.S. political parties. […]

Source link

While regional-bank stocks continue to be dragged down by the troubles assailing New York Community Bank, their bonds are holding up — suggesting bondholders view NYCB’s issues as isolated.

NYCB’s

NYCB,

sole traded bond tumbled last week as its stock shed more than 40% of its value after the bank posted a surprise quarterly loss and disclosed trouble with its commercial real-estate loans. The company also slashed its dividend to build up capital to meet regulatory requirements.

The stock is now down almost 60% in the year to date, and its bonds are trading at around 75 cents on the dollar after Moody’s Investors Service downgraded the credit to junk status.

On Thursday, D.A. Davidson downgraded the stock to neutral from buy and said it is trading “untethered from fundamentals.”

Analyst Peter Winter cut his price target for the stock to $5 from $8.50 after the downgrade and the company’s disclosures about a rise in deposits and its plans to hire a new chief risk officer in the near future.

The bank confirmed that both its chief risk office and main audit executive had left the bank, stirring unhappy memories of Silicon Valley Bank and its March 2023 collapse. That bank also had no chief risk officer when it was hit by a run on deposits last year that sent shock waves across the regional-bank sector.

NYCB raised its loan-loss reserves by 790%, or $490 million, in the fourth quarter, the most of any regional bank — although others also made sizeable hikes, as MarketWatch’s Steve Gelsi reported.

The following chart from data-solutions provider BondCliQ Media Services shows how select community-bank bonds have performed over the past two weeks, with NYCB’s floating-rate notes that mature in 2028 showing the most dramatic decline.

Don’t miss: New York Community Bancorp looks to sell rent-regulated commercial real estate after surprise quarterly loss

Those bonds actually rose about 5 basis points on Thursday, as the chart indicates.

NYCB is followed by Valley National Bancorp’s

VLY,

3.0% notes, which mature in June 2031 and have fallen to 78 cents on the dollar. That bank, which operates as Valley Bank, is a regional lender based in Morristown, N.J., with about $61 billion in assets.

BondCliQ Media Services

As the chart shows, the bonds of other small lenders have remained steady as the selling of NYCB’s bonds has picked up. These include Western Alliance Bancorp.

WAL,

a Phoenix-based lender with $70.9 billion in assets as of Dec. 31.; Zions Bancorp N.A.

ZION,

a Salt Lake City-based bank with $87.2 billion in assets; First National Bank of Pennsylvania

FNB,

a Pittsburgh-based lender traded as F.N.B. Corp. with $34.74 billion in assets; and Webster Financial Corp.

WBS,

a Stamford, Conn.-based lender with $74.95 billion in assets.

The bonds have also seen net buying over the past two weeks, even as the drama at NYCB has unfolded.

BondCliQ Media Services

The bond market “seems to think this is an isolated problem and there’s no contagion,” one market source told MarketWatch.

The SPDR S&P Regional Banking ETF

KRE,

an exchange-traded fund tracking the sector, was down 0.3% on Thursday and has fallen 11% in the year to date, while the S&P 500

SPX

has gained 4.6%.