On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

On Wednesday, bitcoin’s trade volume and overall value provided insights into its current technical situation. With a daily trading volume reaching $45.30 billion and a total market value of $1.29 trillion, the cryptocurrency’s liquidity and market breadth still stands strong. However, recent downturns have left traders wary. Currently, bitcoin has declined by 6% this week […]

Source link

Consolidates

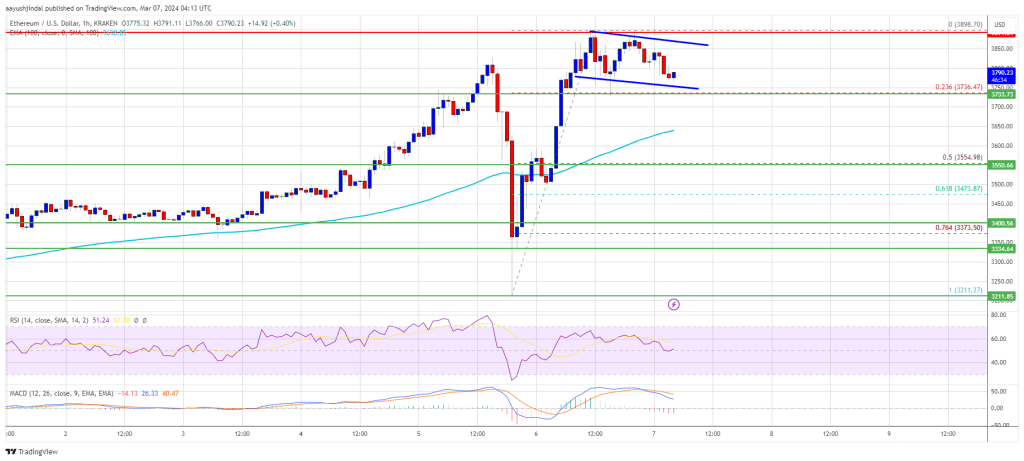

Ethereum price extended its increase toward $3,900. ETH is now consolidating gains and might aim for a move above the $4,000 resistance.

- Ethereum traded to a new multi-month high above $3,880.

- The price is trading above $3,700 and the 100-hourly Simple Moving Average.

- There is a short-term bullish flag pattern forming with resistance at $3,850 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair could resume its increase if it clears the $3,850 resistance zone.

Ethereum Price Aims Higher

Ethereum price extended its rally above the $3,750 level, like Bitcoin. BTC failed to extend gains above the $69,200 zone, but ETH cleared the $3,850 level.

It traded to a new multi-month high above $3,880 and recently started a consolidation phase. There was a pullback below the $3,800 level. The price tested the 23.6% Fib retracement level of the recent wave from the $3,211 swing low to the $3,898 high.

Ethereum is now trading above $3,700 and the 100-hourly Simple Moving Average. Immediate resistance on the upside is near the $3,850 level. There is also a short-term bullish flag pattern forming with resistance at $3,850 on the hourly chart of ETH/USD.

Source: ETHUSD on TradingView.com

The first major resistance is near the $3,880 level. The next major resistance is near $3,920, above which the price might gain bullish momentum. The next stop for the bulls could be near the $4,000 level. If there is a move above the $4,000 resistance, Ether could even rally toward the $4,080 resistance. Any more gains might call for a test of $4,120.

Another Decline In ETH?

If Ethereum fails to clear the $3,850 resistance, it could start another downside correction. Initial support on the downside is near the $3,740 level.

The first major support is near the $3,650 zone. The next key support could be the $3,550 zone or the 50% Fib retracement level of the recent wave from the $3,211 swing low to the $3,898 high. A clear move below the $3,550 support might send the price toward $3,400. Any more losses might send the price toward the $3,320 level.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 level.

Major Support Level – $3,650

Major Resistance Level – $3,850

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Bitcoin Technical Analysis: BTC Consolidates Gains as Traders Eye $53K Resistance Level

As bitcoin weaves through its dynamic trading patterns, its valuation on Feb. 16, 2024, reveals pronounced bullish indicators. Floating within a 24-hour trading window of $51,364 to $52,884, the digital currency’s market worth firmly grips the $1.02 trillion mark. Bitcoin The volume of bitcoin’s global trades is cruising at $29.86 billion, showcasing a medium-to-high engagement […]

As bitcoin weaves through its dynamic trading patterns, its valuation on Feb. 16, 2024, reveals pronounced bullish indicators. Floating within a 24-hour trading window of $51,364 to $52,884, the digital currency’s market worth firmly grips the $1.02 trillion mark. Bitcoin The volume of bitcoin’s global trades is cruising at $29.86 billion, showcasing a medium-to-high engagement […]

Source link

Bitcoin Price Consolidates Losses, Why 100 SMA Is The Key To Recovery

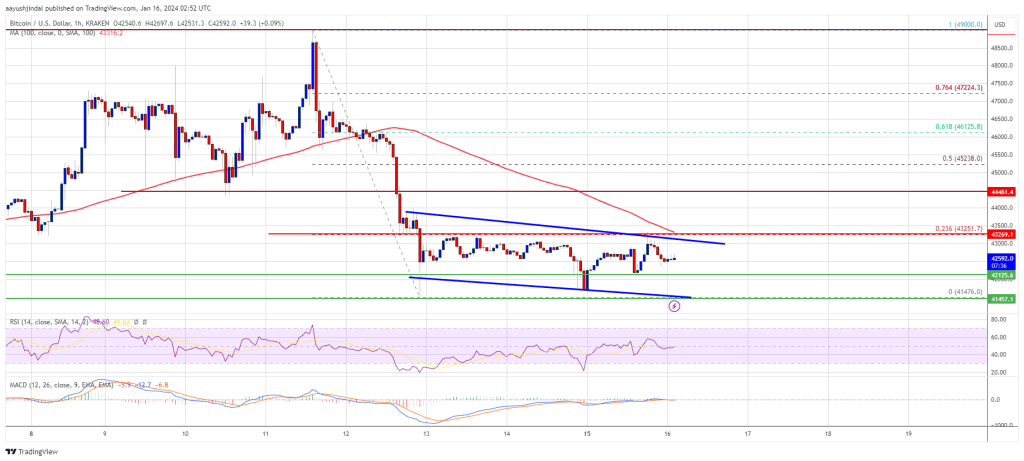

Bitcoin price is struggling below the $43,500 resistance zone. BTC could start another decline if it stays below the 100 hourly SMA.

- Bitcoin price started a major decline from the $49,000 resistance zone.

- The price is trading below $43,250 and the 100 hourly Simple moving average.

- There is a key declining channel forming with resistance near $43,050 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start a fresh decline if it stays below the $43,250 resistance zone.

Bitcoin Price Turns Red

Bitcoin price started a major decline from the $49,000 resistance zone. BTC traded below the $46,500 and $45,000 support levels to enter a short-term bearish zone.

The bears even pushed the price below the $42,500 support zone before the bulls appeared. A low was formed near $41,476 and the price is now consolidating losses. It recovered a few points above the $42,000 level. The price tested the 23.6% Fib retracement level of the key drop from the $49,000 swing high to the $41,476 low.

Bitcoin is now trading below $43,250 and the 100 hourly Simple moving average. There is also a key declining channel forming with resistance near $43,050 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $43,000 level and the channel zone. The first major resistance is $43,250 or the 100 hourly Simple moving average. A clear move above the $43,250 resistance could send the price toward the $44,450 resistance.

Source: BTCUSD on TradingView.com

The next resistance is now forming near the $45,250 level. It is near the 50% Fib retracement level of the key drop from the $49,000 swing high to the $41,476 low. A close above the $45,250 level could start a strong increase and send the price higher. The next major resistance sits at $47,000.

More Losses In BTC?

If Bitcoin fails to rise above the $43,250 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $42,120 level.

The next major support is $41,500. If there is a close below $41,500, the price could gain bearish momentum. In the stated case, the price could drop toward the $40,000 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bearish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now below the 50 level.

Major Support Levels – $42,120, followed by $41,500.

Major Resistance Levels – $43,050, $43,250, and $44,450.

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

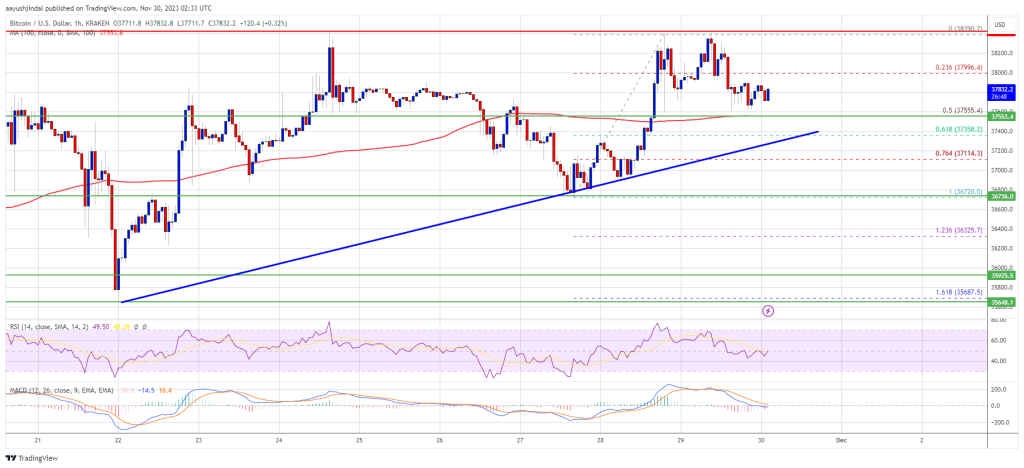

Bitcoin price failed again to clear the $38,500 resistance zone. BTC is consolidating above the 100 hourly SMA and might attempt another increase.

- Bitcoin is still facing heavy resistance near the $38,500 zone.

- The price is trading above $37,400 and the 100 hourly Simple moving average.

- There is a key bullish trend line forming with support near $37,350 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could make another attempt to clear the $38,500 resistance unless it breaks below $37,350.

Bitcoin Price Holds Support

Bitcoin price remained well-bid above the $37,500 support zone. BTC climbed higher above the $38,000 level and made another attempt to clear the $38,400 resistance zone.

However, the bulls failed to gain strength and the price peaked near $38,400. It is again correcting gains and trading below the 23.6% Fib retracement level of the upward move from the $36,721 swing low to the $38,390 high.

Bitcoin is now trading above $37,400 and the 100 hourly Simple moving average. There is also a key bullish trend line forming with support near $37,350 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $38,200 level. The first major resistance is forming near $38,400. The main resistance is still near the $38,500 level. A close above the $38,500 resistance might start a fresh rally.

Source: BTCUSD on TradingView.com

The next key resistance could be near $39,200, above which BTC could climb toward the $39,500 level. Any more gains might send BTC toward the $40,000 resistance.

More Losses In BTC?

If Bitcoin fails to rise above the $38,400 resistance zone, it could start another decline. Immediate support on the downside is near the $37,550 level or the 50% Fib retracement level of the upward move from the $36,721 swing low to the $38,390 high.

The next major support is near $37,350 and the trend line. If there is a move below $37,350, there is a risk of more downsides. In the stated case, the price could decline toward the $36,720 support in the near term.

Technical indicators:

Hourly MACD – The MACD is now losing pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now near the 50 level.

Major Support Levels – $37,550, followed by $37,350.

Major Resistance Levels – $38,400, $38,500, and $39,200.