Shares of the company are up roughly 1% Monday and hovering around all-time highs.

Source link

continues

Meta’s dramatic turnaround continues. Why bulls say the stock surge isn’t done yet.

Meta Platforms Inc.’s stock was boosted Thursday after the social-media company’s earnings showed at least one analyst that Meta has “simply done everything right.”

All of Meta’s

META,

initiatives seem to be clicking right now, according to Bernstein’s Mark Shmulik, helping the company post 11% growth in revenue during the latest quarter and deliver a “monster guide heard around the Street,” which implied 15% to 24% growth in overall third-quarter revenue. The company is benefiting from rising engagement, momentum in Reels monetization and resonance with advertisers.

Also see: Zuck beats Musk at his own game with Meta’s year of efficiency

Meta shares are up nearly 10% in Thursday’s premarket trading after leaping 148% on a year-to-date basis through Wednesday’s close. That surge captures the dramatic change in sentiment on the stock, which about nine months ago was “the most hated name in Internet,” in Shmulik’s view, thanks to out-of-touch spending plans. Now, “it’s hard to find a more beloved stock and cleaner story in the sector.”

Read: Why Snap is ‘running to stay in the same place’ while its rivals thrive

“We make no secret that while we love all our children equally, we’ve always loved Meta the most,” he wrote, while keeping his market-perform rating and lifting his target price to $375 from $350. “Here’s a founder-led company that just finds a way to work through every obstacle in its path, and if Mark hasn’t earned the benefit of the doubt yet, we’re not sure what it takes to prove his ability to execute, to pivot, and to deliver.”

SVB Moffett Nathanson’s Michael Nathanson was similarly effusive.

“While Mark Zuckerberg has often been mocked for the massive (and yet to be proven) investments in the Metaverse – which included a new corporate name – many of his other recent actions have worked nicely to turn around META’s narrative on META and the perception of his leadership of the company,” he wrote.

Nathanson said Meta was early to the game in seeking to address Apple Inc.’s privacy-related change, helping to “accelerate the focus of Meta engineers

on rebuilding lost signal that now seems to be paying dividends.”

Don’t miss: Alphabet earnings remind Wall Street of Google’s AI prowess

The latest upbeat sign of Meta’s execution is the company’s recent launch of Threads, developed quickly and by a small team. Though user interest has trailed off, the company is optimistic about it, and Nathanson said its rollout “has opened up a potentially new mass-market product to fuel future revenue growth.”

“Taken all together, these decisions have created one of the most startling turnarounds in company performance and market sentiment that we have ever witnessed,” he continued, while keeping his outperform rating on the stock and boosting his target price to $370 from $295.

Ken Gawrelski of Wells Fargo joined him in the bull camp, beginning his note to clients by saying: “We were wrong on META.”

He upgraded the stock to overweight from equal weight, lifting his price target to $389 from $313 and saying that the company’s “blowout” forecast for the third quarter “appears sustainable.”

Over 86% of unspent Bitcoin in profit as BTC continues to trade above $30k

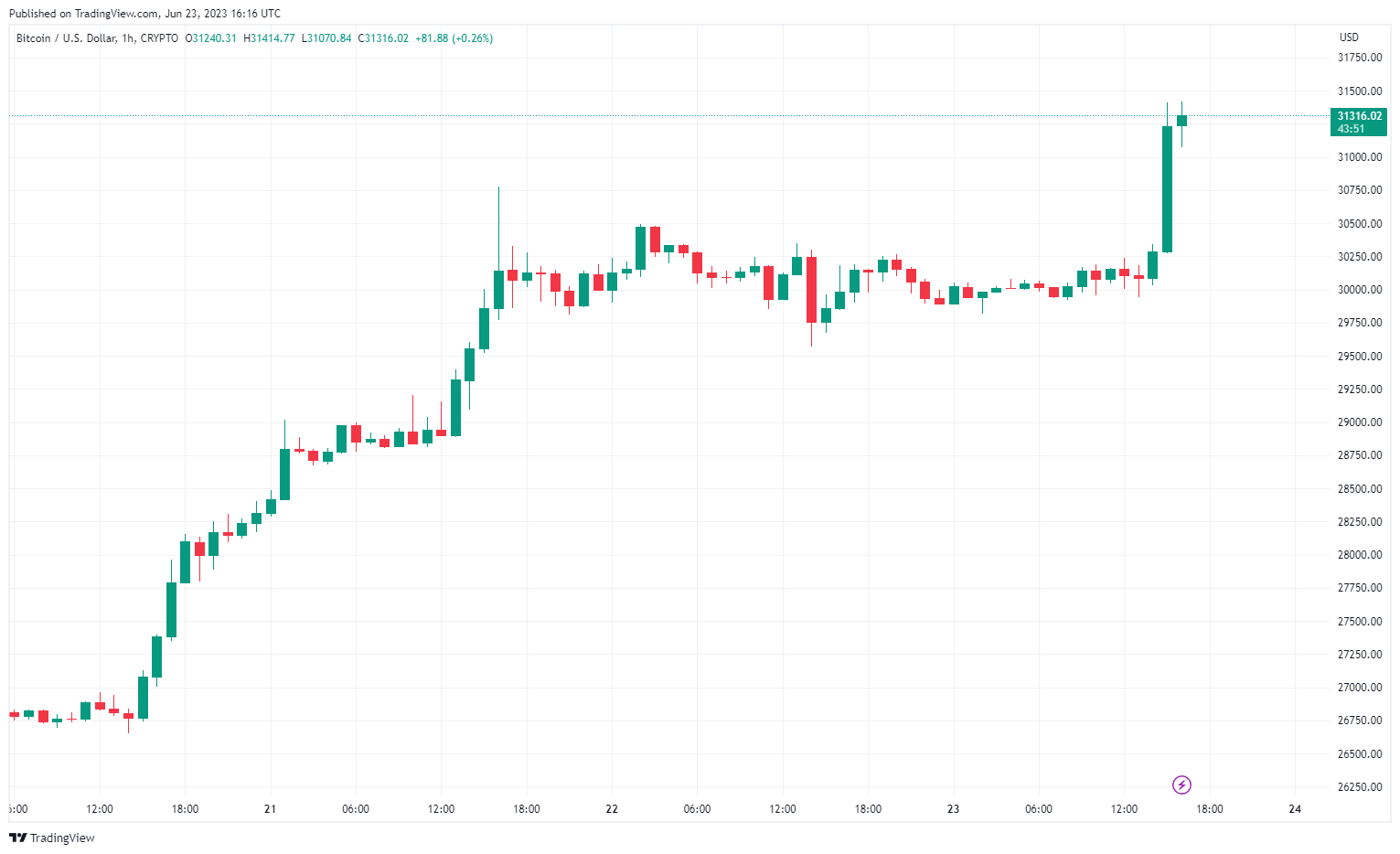

The cryptocurrency market has been a whirlwind of activity over the past week, with Bitcoin (BTC) seeing the most notable uptick, climbing over the $30,000 mark for the first time in two months, a crucial psychological milestone that could return much-needed confidence to the market.

At press time, Bitcoin is trading at $30,343.

Over the weekend, Bitcoin managed to maintain the $30,000 level, even briefly surpassing $31,000. This price jump was fueled by a wave of news regarding institutional adoption, which has been a key driver of Bitcoin’s price since the beginning of the year as it indicates growing mainstream acceptance and potential increased demand for the digital asset.

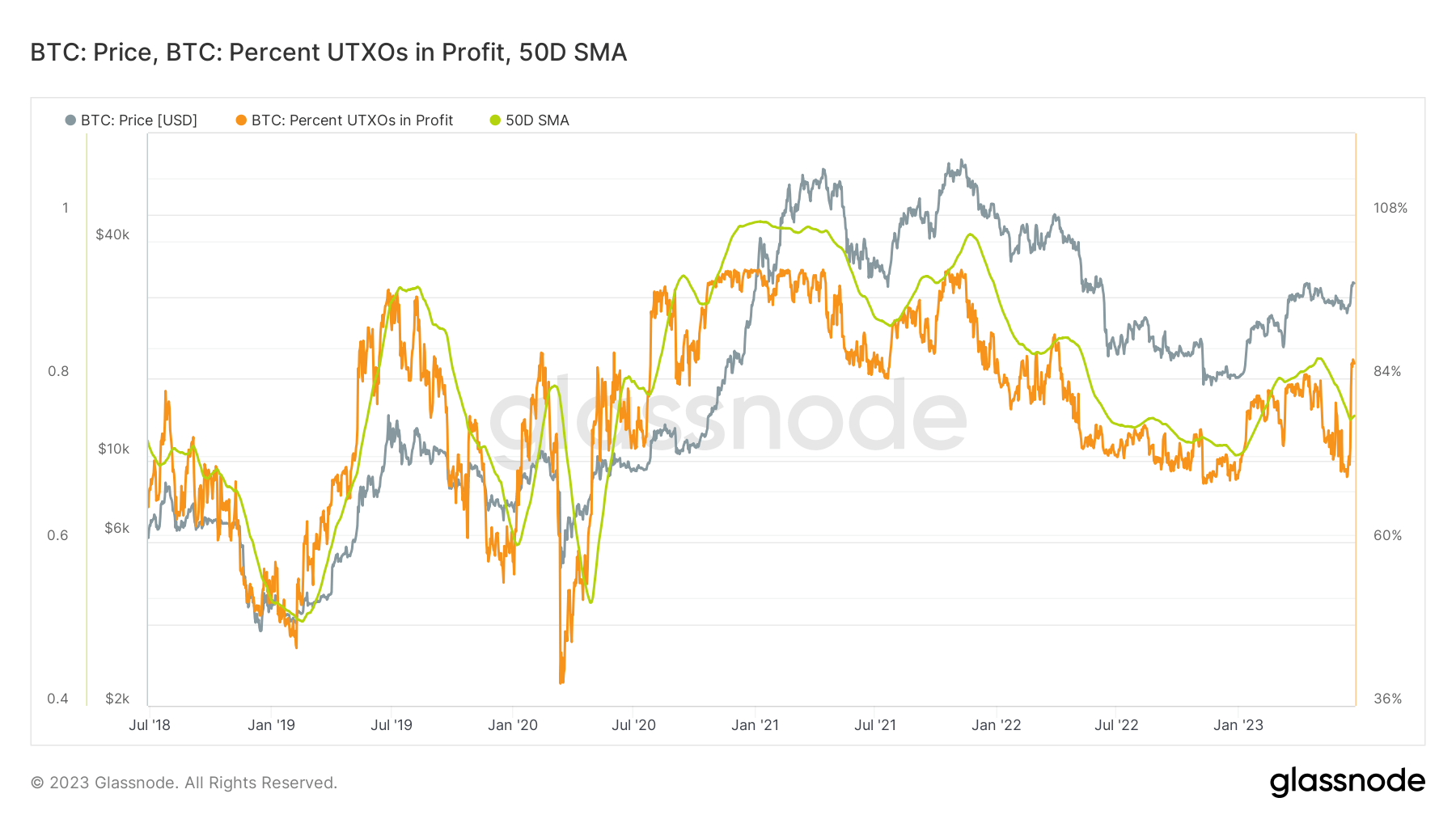

This surge in Bitcoin’s price has increased the profitability of most holders. This is evident when analyzing on-chain data, especially UTXOs in profit. Unspent Transaction Outputs (UTXOs) are the outputs of Bitcoin transactions that have not been spent and can be thought of as individual ‘coins’ or pieces of coins that reside in a Bitcoin wallet. They are crucial when analyzing the market because they provide a snapshot of the economic activity on the Bitcoin network.

Estimating the profit and loss of Bitcoin’s supply is important as it provides insight into the market sentiment and potential future price movements. One way to assess this is by analyzing the number of current UTXOs that are in profit or loss.

Glassnode calculates the number of UTXOs in profit/loss by counting all existing UTXOs whose price at creation time was lower or higher than their current price. To account for the increasing number of UTXOs over time, the data is normalized by the size of the UTXOs to obtain the relative number of UTXOs in profit/loss, i.e., the percentage.

The percentage of UTXOs in profit approaches 100% every time a previous all-time high is broken. According to Glassnode, applying the 50-day simple moving average (SMA) to the data fits the historic data optimally and creates a much better signal that indicates both global and local Bitcoin cycle tops.

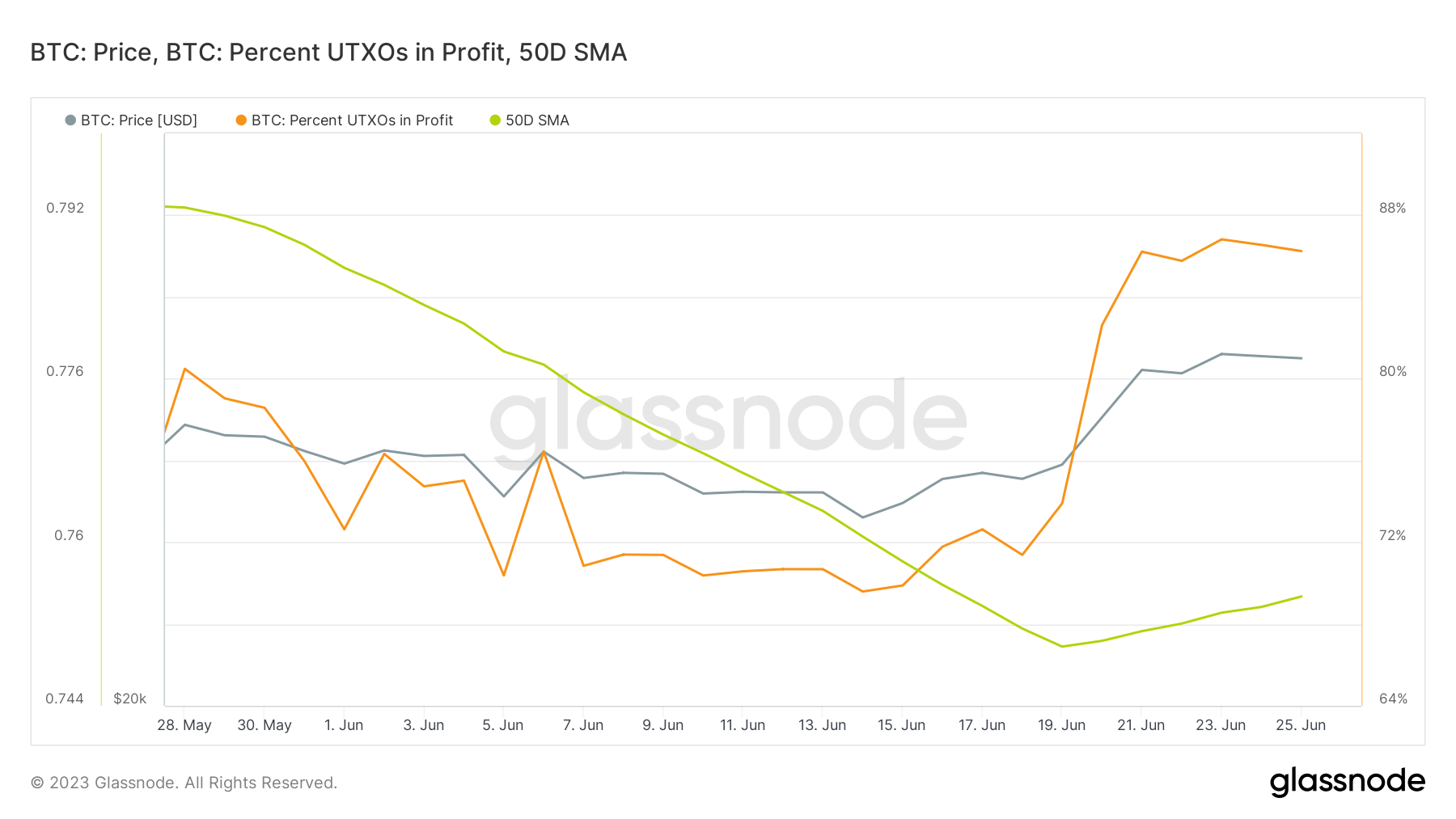

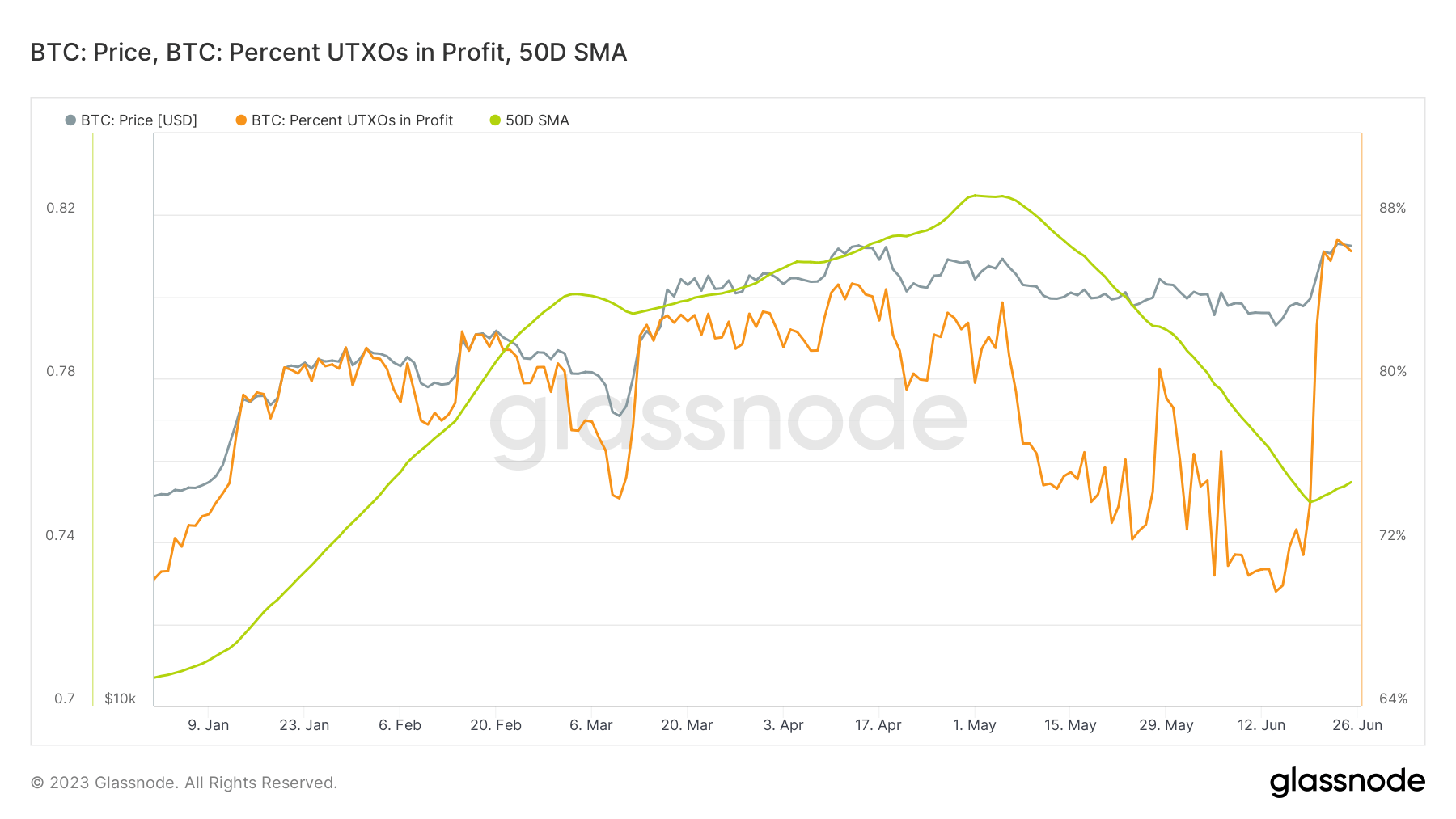

CryptoSlate analysis found that 86.24% of Bitcoin UTXOs are currently in profit. This is a sharp spike from 69.59% recorded on June 14 and a slight drop from the 14-month high of 86.8% recorded on June 23. This indicates that most Bitcoin holders are currently profitable, which could significantly affect the market’s future trajectory.

However, the 50-day simple moving average (SMA) for Bitcoin UTXOs in profit currently stands at 75%, a significant drop from the 82.4% level recorded in May.

The SMA is a commonly used technical indicator that helps smooth out price data by creating a constantly updated average price. In this context, it provides a clearer picture of the overall trend in the profitability of Bitcoin UTXOs over the past 50 days. The drop in the SMA suggests that despite the recent surge in Bitcoin’s price, the overall profitability of UTXOs has been on a downward trend over the past two months.

This could be due to a number of factors, including Bitcoin holders selling at a loss or the creation of new UTXOs at higher price levels. However, with the recent price surge pushing the percentage of UTXOs in profit to over 86%, it remains to be seen whether this trend will continue.

The post Over 86% of unspent Bitcoin in profit as BTC continues to trade above $30k appeared first on CryptoSlate.

As ongoing regulatory pressures ramp up towards several cryptocurrencies, Bitcoin (BTC)has shown impressive resilience, breaking the $31,000 barrier today and marking its highest close of the year.

This jump comes after a prolonged period of stagnant trading, with Bitcoin wavering between $25,000 and $30,000 since March 16.

The liquidation volumes for each cryptocurrency over the past 4 hours were $30.01 million in Bitcoin, $17.27 million in Ethereum (ETH), and $3.15 million in Bitcoin Cash (BCH), according to Coinglass data. These values contribute to the total 4-hour liquidation amount of $72.20 million, comprised of $13.01 million of long positions and $59.18 million of short positions.

Bitcoin was trading at $31,234 as of press time.

BTC surge after institutional interest

This Bitcoin surge follows a wave of institutional interest. Global investment giant BlackRock submitted an application last week to the U.S. Securities and Exchange Commission for a spot Bitcoin ETF. The regulator has yet to grant approval for a spot Bitcoin ETF.

Adding to the positive sentiment around Bitcoin, the launch of EDX Markets on June 20, which coincided with Bitcoin reclaiming the $28,000 mark, has been well-received by the market. Backed by heavyweights Fidelity, Charles Schwab, and Citadel Securities, EDX Markets is a promising institutional crypto exchange.

Bitcoin’s rise is a stark contrast to the rest of the cryptocurrency market, which has been struggling in the aftermath of the SEC’s unprecedented lawsuits against Binance and Coinbase. The SEC has alleged that several popular cryptocurrency tokens are, in their view, unregistered securities.

SEC Chair Gary Gensler has been explicit about his plan to take action against crypto firms that, in his view, operate outside U.S. law. Gensler has stated that all cryptocurrencies, with the sole exception of Bitcoin, qualify as securities under U.S. law. However, Gensler’s stance on Ethereum, the second-largest cryptocurrency by market cap, remains unclear.

The post Bitcoin breaks $31k as it continues to shake off recent slumps appeared first on CryptoSlate.

Virgin Galactic continues rally, boosted by plans for first commercial flight

Virgin Galactic Holdings Inc.’s stock rose 3% in premarket trades Tuesday, continuing its rally as the company prepares for its first commercial flight.

Shares of the spaceflight company ended Friday’s session up 16.5%, lifted by Virgin Galactic’s

SPCE,

plan for its first commercial flight later this month. On Friday, trading volume for Virgin Galactic was three times higher than the prior 30-day average, FactSet data show.

The commercial flight, Galactic 01, will be a paid scientific-research flight with the Italian air force. TD Cowen analyst Oliver Chen described the first commercial flight as an “out of this world innovation” in a note last month.

Related: Virgin Galactic shares rocket higher on plans for first commercial flight this month

The flight window for Galactic 01 is June 27 to June 30, according to Virgin Galactic. A second commercial flight, Galactic 02, will follow in early August. The company expects that monthly commercial spaceflights will take place after the Galactic 02 mission.

Last month Virgin Galactic’s VSS Unity spacecraft made its fully crewed return to space, the company’s first crewed mission in almost two years.

The Unity 25 mission, which was crewed by two pilots and four Virgin Galactic mission specialists, marked an important milestone for the company. It was Virgin Galactic’s first fully crewed spaceflight since July 2021, when VSS Unity carried founder Richard Branson and three company employees to space.

Related: Virgin Galactic’s VSS Unity makes fully crewed return to space

Last month Virgin Galactic reported a deeper-than-expected first-quarter loss and revenue that missed analysts’ estimates.

Virgin Galactic’s stock had been pressured by the struggles of Branson’s satellite-launch company, Virgin Orbit Holdings Inc.

VORBQ,

which filed for bankruptcy protection earlier this year and is now winding down operations and selling its assets.

Shares of Virgin Galactic have risen 15.4% over the last three months.

Binance’s UK subsidiary withdraws FCA registration as European exodus continues

Binance said in a June 19 email shared with CryptoSlate that the exchange’s United Kingdom subsidiary, Binance Markets Limited (BML), has canceled its registration with the country’s Financial Conduct Authority (FCA).

Binance has no authorized entity in the UK

According to the spokesperson, BML held various FCA permissions for activities it never carried out or offered in the U.K. It added:

“As these permissions were unlikely to be required in the future, Binance Markets Limited decided that it would be prudent to cancel them in line with the FCA’s recommendations to keep these updated.”

The regulator’s website confirmed that the firm was “no longer authorized” as of May 30. FCA stated:

“This firm can no longer provide regulated activities and products but previously was authorized by the FCA and/or PRA.”

The FCA’s website further shows that Binance no longer has an authorized entity in the U.K.

Meanwhile, BML’s registration cancellation did not impact Binance since it had never operated in the country. The spokesperson said:

“This decision has no impact on Binance.com, which does not own or operate any crypto services in the UK and is only available to UK consumers on a reverse solicitation basis.”

In 2021, the FCA warned that Binance was prohibited from conducting business in the U.K. The regulator also expressed concerns about a partnership deal the exchange entered into in 2022.

European exodus

The latest withdrawal from the U.K. continues Binance’s spate of deregistration from various European markets.

Last week, Binance exited two European countries, Netherlands and Cyprus.

The exchange failed to secure registration as a virtual asset service provider (VASP) in the Netherlands. At the same time, it left Cyprus as part of its efforts to focus on its larger market in other European countries like France.

Binance’s sub-regional manager for growth in the U.K. and Europe, Ilir Laro, said the firm already has five regulated entities in France, Italy, Spain, Poland, and Sweden. Laro added:

“As MiCA kicks into force in 2024/5, we are moving focus to getting ready which means some consolidating in order to passport throughout Europe.”

The post Binance’s UK subsidiary withdraws FCA registration as European exodus continues appeared first on CryptoSlate.

Bitcoin and select altcoins show resilience even as the crypto market sell-off continues

A bearish trend formation has been pressuring cryptocurrency prices for the past eight weeks, driving the total market capitalization to its lowest level in more than two months at $1.06 trillion, a 2.4% decline between June 4 and June 11.

This time, the move wasn’t driven by Bitcoin (BTC), as the leading cryptocurrency gained 0.8% during the seven-day period. The negative pressure came from a handful of altcoins that plunged over 15%, including BNB (BNB), Cardano (ADA), Solana (SOL), Polygon (MATIC) and Polkadot (DOT).

Notice that the downtrend initiated in mid-April has tested the support level in multiple instances, indicating that an eventual break to the upside would require extra effort from the bulls.

The United States Securities and Exchange Commission tagged multiple altcoins as securities in separate lawsuits filed last week against crypto exchanges Binance and Coinbase.

Despite the worsening crypto regulatory environment, two derivatives metrics indicate that bulls are not yet throwing in the towel but will likely have a hard time breaking the bearish price formation to the upside.

Crypto exchanges are under severe constraints in the U.S.

Binance.US announced on June 9 the upcoming suspension of U.S. dollar deposits and withdrawal channels, besides delisting USD trading pairs. The exchange added that it plans to transition to a crypto-only exchange but maintains a 1:1 ratio for customer assets. The SEC issued an emergency order on June 6 to freeze the assets of Binance.US.

Also on June 9, the Crypto.com exchange announced it would no longer service institutional clients in the United States. Although the Singapore-based company alleged a lack of client demand, the curious timing matching the recent actions against Coinbase and Binance has raised suspicions, as pictured by UtilizeWeb3 founder CryptoTea.

The SEC will likely sue Crypto .com

they sued Coinbase and Binance for selling securities

specifically naming Solana, Cardano, Sandbox, Matic, CHZ, BNB, Mana, Algo and more

crypto .com also sells ALL of these cryptos

plus they launched their own CRO coin

plus they offer… pic.twitter.com/2nuqd5ljVY— Crypto Tea (@CryptoTea_) June 8, 2023

Despite being spared from the attacks coming from the SEC, the vice-leader Ether (ETH) traded down 3.5% between June 4 and June 11 after co-founder Vitalik Buterin stated that the Ethereum network would “fail” if scaling doesn’t go through. In a June 9 post via his personal blog, Buterin explained that the success of Ethereum depends on layer-2 scaling, wallet security and privacy-preserving features.

Derivatives markets show balanced leverage demand

Perpetual contracts, also known as inverse swaps, have an embedded rate that is usually charged every eight hours.

A positive funding rate indicates that longs (buyers) demand more leverage. Still, the opposite situation occurs when shorts (sellers) require additional leverage, causing the funding rate to turn negative.

The seven-day funding rate for BTC and ETH was neutral, indicating balanced demand from leveraged longs (buyers) and shorts (sellers) using perpetual futures contracts. Curiously, BNB, SOL and ADA displayed no excessive short demand after a 15% or higher weekly price decline.

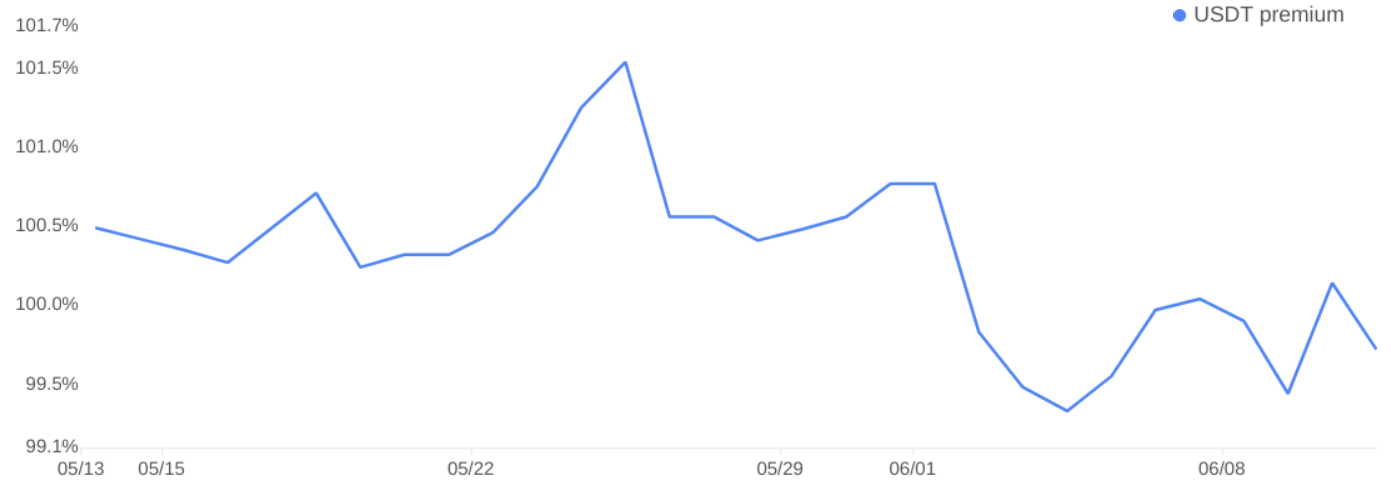

Tether demand in Asia shows modest resilience

The Tether (USDT) premium is a good gauge of China-based crypto retail trader demand. It measures the difference between China-based peer-to-peer trades and the United States dollar.

Excessive buying demand tends to pressure the indicator above fair value at 100%, and during bearish markets, Tether’s market offer is flooded, causing a 2% or higher discount.

Currently, the Tether premium on OKX stands at 99.8%, indicating a balanced demand from retail investors. Consequently, the indicator shows resilience considering the cryptocurrency markets dropped 17.7% over the last eight weeks to $1.06 trillion from $1.29 trillion.

Related: Democrats’ ‘war on crypto’ will lose its key voters, Winklevoss twins

Given the balanced demand according to the funding rate and stablecoin markets, bulls should be more than satisfied, given that the recent regulatory FUD was unable to break the cryptocurrency market capitalization below $1 trillion.

It is unclear whether the market will be able to break from the bearish trend. Moreover, there is no apparent rationale for bulls to jump the gun and place bets on a V-shaped recovery, given the uncertainty in the regulatory environment. Ultimately, bears are in a comfortable place despite the resilience in derivatives and stablecoin metrics.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice. The views, thoughts, and opinions expressed here are the author’s alone and do not necessarily reflect or represent the views and opinions of Cointelegraph.