“It could be something to remember him by, as they were close.”

Source link

Costs

Where home-insurance costs are rising the fastest in the U.S. — it’s not California or Florida

Homeowners across the nation are grappling with the rising cost of home insurance. But the sharpest hikes aren’t being felt in the most disaster-prone markets, according to a new report.

Most Read from MarketWatch

The states with the sharpest increases in premiums relative to the national average aren’t necessarily coastal, according to a report by Insurify, a Cambridge, Mass.-based insurance-comparison shopping website which looked at insurance quotes for typical single-family homes across the nation in 2023 and 2024.

The company expects a 6% average increase in the cost of homeowners insurance in 2024. The national average annual rate in 2023 was $2,377, and it’s expected to rise to $2,522 this year. The figure does not include flood insurance or wildfire insurance, which are typically considered to be additional coverage.

In Louisiana, homeowners should brace themselves for a much bigger bill, with a projected increase of 23% in 2024, bringing the average annual rate to $7,809.

Homeowners in Maine will likely see the second-steepest increase in premiums in 2024, at 19%, to $1,571 on an annual basis. And in Michigan, Insurify projects a 14% increase to $2,095.

And the blows to homeowners’ budgets will keep coming, Insurify warns: “Early weather forecasts predict a devastating hurricane season, which would cause further rate increases in 2025.”

Here are the top five states where insurance costs are rising the fastest, according to Insurify’s analysis:

|

State |

Average annual homeowners insurance rate in 2023 |

Projected annual insurance rate in 2024 |

Percentage change year-over-year |

|

Louisiana |

$6,354 |

$7,809 |

23% |

|

Maine |

$1,322 |

$1,571 |

19% |

|

Michigan |

$1,840 |

$2,095 |

14% |

|

Utah |

$1,369 |

$1,541 |

13% |

|

Montana |

$1,778 |

$1,997 |

12% |

To be sure, Florida homeowners are expected to pay the most for home insurance, with an average annual rate of $11,759 in 2024, which represents an increase of 7%. The Sunshine State was followed by Louisiana and Oklahoma, where homeowners pay the third-highest homeowners-insurance costs, at $5,711.

California homeowners are expected to see an 8% increase in premiums, to $1,921 in 2024.

Louisiana, Maine and Michigan homeowners are seeing the biggest hikes in insurance premiums because these are “areas where insurers have to catch up the most, in terms of getting prices to match the current climate risk,” Chase Gardner, head of data research at Insurify, told MarketWatch in an interview.

In Louisiana, costs are rising as “companies that have raised their rates in the past six months have done so substantially,” and are doing so to bring prices up to match the level of risk of damage that homes face in the state, Gardner explained.

Louisiana is seen as a higher-risk state due to its vulnerability to storms such as Hurricane Ida in 2021, which are becoming more frequent and destructive as a result of climate change. Storms have previously damaged properties in the state and increased reconstruction costs, which have resulted in increased expenses borne by insurers. Having adjusted their models, these companies are now passing those costs on to consumers.

And that’s become too much for some homeowners to bear. Local outlet WDSU News recently told the story of one homeowner who sold her dream home in New Orleans due to soaring insurance costs.

The effects of climate change have also not spared states less commonly considered to be disaster-prone.

For instance, in Maine, rising sea levels are pushing up insurance costs due to “increased flood and associated risks, such as storms, or even flooding causing more trees to fall and land on homes, leading homeowners to file expensive claims for their homes,” Gardner said. Because insurance companies have to pay out these claims, they’re raising prices.

In Michigan, which saw the third-biggest increase in home-insurance premiums, the price hikes are fueled mostly by the rising cost to rebuild damaged property, Insurify said. According to Insurify’s insurance experts, “it could just be that Michigan has just been underpriced over the past few years and insurers are catching up to the risk that they’ve been seeing,” Gardner said.

Overall, home-insurance premiums are rising not only because of the increased frequency of natural disasters, but also as “construction costs are up everywhere since the coronavirus pandemic,” Robert Dietz, chief economist at the National Association of Home Builders, told MarketWatch. Between 2020 and 2024, construction costs rose 38%, according to the NAHB’s analysis of data from the Bureau of Labor Statistics, after climbing 10% from 2016 to 2020.

On the flip side, Insurify’s report found that Washington residents will see the smallest increase in homeowners premiums in 2024, followed by Texas and South Dakota.

Most Read from MarketWatch

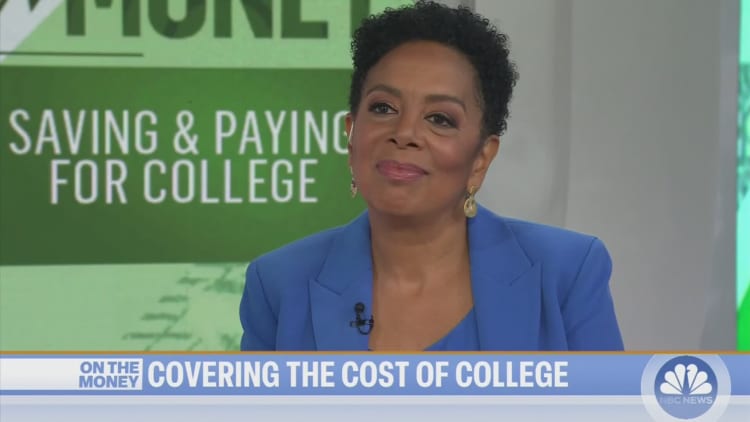

Costs at some colleges near $100,000 a year; many families pay a lot less

The price tag for a college education has never been higher — and it’s only going up.

The cost of attendance at some schools, including New York University, Tufts, Brown, Yale, and Washington University in St. Louis, is now nearing six figures a year, after factoring in tuition, fees, room and board, books, transportation and other expenses.

Among the schools on The Princeton Review’s “The Best 389 Colleges” list that have already set their costs for the 2024-25 academic year, eight institutions have a sticker price of more than $90,000 per year so far, according to data provided to CNBC.

Considering that tuition adjustments average roughly 4% a year, those institutions — and others — could cross the $100,000 threshold as soon as 2026, according to an estimate by Bryan Alexander, a senior scholar at Georgetown University.

However, that’s not what many families pay.

More from Personal Finance:

FAFSA fiasco may cause drop in college enrollment, experts say

Harvard is back on top as the ultimate ‘dream’ school

This could be the best year to lobby for more college financial aid

“Crossing a school off the list of consideration based on sticker price alone is a mistake,” said Robert Franek, editor-in-chief of The Princeton Review.

He said about two-thirds of all full-time students receive aid, which can bring the cost significantly down.

Net price: Your net price is tuition and fees minus grants, scholarships and education tax benefits, according to the College Board.

The Princeton Review even ranked colleges by how much financial aid is awarded and how satisfied students are with their packages. These are the colleges that came out on top.

At Washington University in St. Louis, for example, the average scholarship award is just over $65,000 per year, The Princeton Review found, which brings the total out-of-pocket cost closer to $26,000.

In fact, when it comes to offering aid, private schools typically have more money to spend, Franek said.

“When you factor in the average grant, these schools become some of the most affordable in the country,” he said.

What college really costs

The amount families actually spent on education costs in the 2022-23 academic year was, on average, $28,026, according to Sallie Mae’s annual How America Pays for College report.

While parental income and savings cover nearly half of college costs, free money from scholarships and grants accounts for a more than a quarter of the costs, and student loans make up most of the rest, the education lender found.

The U.S. Department of Education awards about $120 billion every year to help students pay for higher education. And beyond federal aid, students could also be eligible for financial assistance from their state or college.

But students must first fill out the Free Application for Federal Student Aid, which serves as the gateway to all federal money, including loans, work-study and grants.

This year, problems with the new FAFSA have discouraged many students and their families from completing an application.

As of the last tally, 6.6 million FAFSA forms have been submitted. That’s a fraction of the approximately 17 million students who use the FAFSA form in ordinary years. And under the new aid formula, an additional 2.1 million students should be eligible for the maximum Pell Grant, according to the Department of Education.

“You cannot get away from the value of the FAFSA form even in these difficult times,” Franek said. “This is the key for unlocking the majority of financial aid dollars.”

Already, high school graduates miss out on billions in federal grants because they don’t fill out the FAFSA, experts say.

In total, the high school Class of 2022 left an estimated $3.6 billion of unclaimed Pell Grant dollars on the table, according to a report from the National College Attainment Network.

Don’t miss these stories from CNBC PRO:

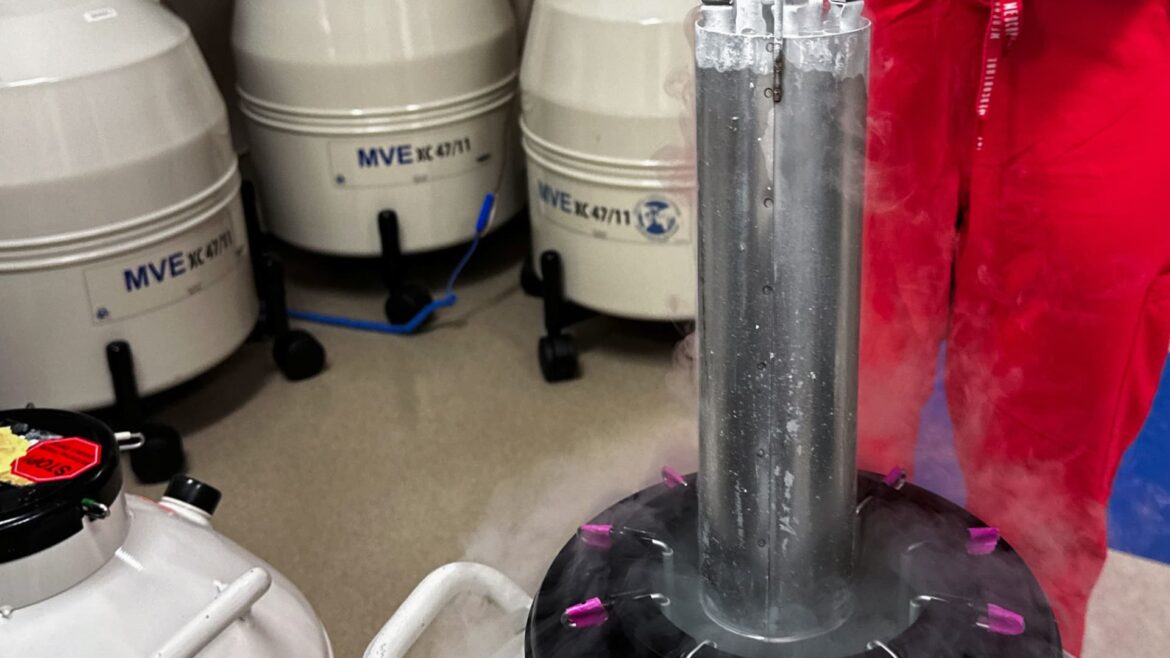

A look at why many women undergo egg freezing, and the costs associated with it

Lynn Curry, nurse practitioner for Huntsville Reproductive Medicine, P.C., lifts frozen embryos out of IVF cryopreservation dewar, in Madison, Alabama, U.S., March 4, 2024.

Roselle Chen | Reuters

As legal battles over reproductive rights increase across the U.S., one area that could be impacted is egg freezing.

In February, the Alabama state Supreme Court ruled that all embryos created through in vitro fertilization are considered children. This ruling could have far-reaching ramifications of civil and criminal liabilities for fertility clinics and their patients. Over 1 million frozen eggs and embryos are stored in the United States alone, according to biotech fertility company TMRW Life Sciences.

Women who choose to undergo reproductive technology procedures such as egg freezing face a long road riddled with obstacles. Here’s a look into the driving forces behind egg freezing and the financial, social and emotional costs that come with it — based on personal experiences from women across the country.

The ‘mating gap’: What’s driving egg freezing

There’s a notion that most women delaying motherhood are doing so to focus on other aspects of their lives, such as their careers. That’s not so much the case anymore, according to Marcia Inhorn, a professor specializing in medical anthropology at Yale University.

“The majority of women who freeze their eggs are doing it because they have not found a partner. I call that the mating gap — the lack of eligible, educated, equal partners,” Inhorn, who last year authored the book “Motherhood on Ice: The Mating Gap and Why Women Freeze Their Eggs,” told CNBC.

This problem stems from the fact that today, women are receiving higher education at greater rates than men. Inhorn noted that women are outperforming men in higher education in 60% of countries, and that in the United States alone there are 27% more women than men in higher education.

“The result is that, for women who are highly educated in America and of reproductive age — between 20 and 39 — there literally are millions too few college-educated men,” Inhorn added.

Another reason women freeze their eggs is the sense of empowerment the procedure brings them. Fundamentally, Inhorn believes that this freedom that egg freezing allows is what ultimately draws increasingly younger women to the procedure.

“It gives you a little reprieve, a little extra time,” she said.

This statement is one that reproductive endocrinologists and fertility specialists Drs. Nicole Noyes and Aimee Eyvazzadeh agree with.

Noyes, who has worked in the fertility industry since 2004 and is based in New York, has seen a noticeable shift in her patients’ ages and attitudes in the last two decades. In the beginning, her patients tended to be older, in their early 40s and viewed egg freezing as a last-ditch procedure as they hedged the end of their reproductive lives. Now, women as young as their late 20s come in to see Noyes.

Eyvazzadeh, who has also worked in the field for 20 years and lives in California, has noticed a trend towards younger patients who are choosing to freeze their eggs while they’re at their most viable.

This is the case for social media influencer Serena Kerrigan, who just recently turned 30. Despite being in a relationship, egg freezing was a procedure she willingly undertook while focusing on growing her business, she told CNBC.

Kerrigan, who has more than 800,000 followers between her Instagram and TikTok and is based in New York, began sharing her egg freezing journey last year. She wanted to remove some of the stigma around egg freezing and give her followers an inside look at the arduous process.

Kerrigan has paid for all her procedures on her own, she told CNBC, and recently partnered with her clinic, Spring Fertility, to donate a round of egg freezing to one of her followers. Eventually, she hopes egg freezing can be less stigmatized.

“There’s a layer of shame or taboo that I actually don’t understand. To me, this is science, and this is incredible, and this is a huge advancement,” she said. “This is a way of putting the power back into women and having control of their lives.”

The benefits are high, but so are the costs

While the benefits of egg freezing are certainly enormous, so too are the associated costs.

The average price for a single egg freezing cycle in the U.S. clocks in at $11,000. Many women need multiple egg freezing cycles, especially as they grow older and egg number and quality begin to deteriorate. That’s not to mention additional charges like hormone medication and yearly storage fees, which could respectively clock in at around $5,000 and $2,000.

Nutrition health coach Jenny Hayes Edwards froze her eggs in 2010 at 34 years old and was one of the first women in the U.S. to undergo the procedure. Despite it still being labeled an “experimental” procedure in the U.S., Hayes Edwards was certain she wanted to try. She wasn’t dating anybody at the time and was “working like crazy” while running her restaurant businesses in Colorado.

But high costs were her number one obstacle. Her restaurants had taken a hit after the 2008 financial collapse, when many consumers began foregoing their expensive ski vacations in Colorado.

Hayes Edwards remembers it being a tough decision to make. But her mother eventually helped sway her in favor of the procedure.

“It’s just money, and the opportunity that you might be missing is so much bigger,” Hayes Edwards recalled her mother saying. “I was so grateful that she pushed me over the edge.”

She was able to scrape together the $15,000 needed through maxing out a credit card, selling some jewelry and liquidating a bond in her inheritance.

Hayes Edwards now has a healthy three-year-old daughter, conceived nearly a decade after she froze her eggs, and is still appreciative for the extra time egg freezing bought her to meet her now-husband.

Employer benefits

In recent years, egg freezing, fertility and family planning services have increasingly popped up as employer benefits, especially among technology companies. A 2021 study from Mercer showed 42% of large companies — those with at least 20,000 employees — covered in vitro fertilization services in 2020, up from 36% in 2015. Nineteen-percent of these companies had egg freezing benefits, more than triple the 6% offering these benefits in 2015.

Michelle Parsons decided to freeze her eggs since the procedure was offered through her job. The various tech companies Parsons has worked for have offered anywhere between $10,000 to $75,000 in fertility benefits.

Parsons, who is a lesbian, had always known that she wanted to freeze her eggs — and undertook the procedure while working at Match Group as chief product officer of dating app Hinge. At the time, neither she nor her ex-partner were ready to have children, but it was one financial incentive Parsons didn’t want to miss out on.

Besides eggs, Parsons also chose to freeze her successfully fertilized embryos as another backup. Frozen embryos have a much higher likelihood of viable thawing. In fact, Parsons’ search for a sperm donor sparked one of the most-used features on the Hinge app — voice prompts.

“When we started to listen to all of these voice recordings of potential sperm donors, the lightbulb went off in my head and I was like, wow, this is what’s missing from dating right now,” Parsons told CNBC. “Because voice gives you so much nuance into personality, humor, vibe … we ended up building that feature called voice prompts on Hinge and it was a huge, wild success that led to rapid growth for Hinge and it became viral on TikTok.”

Still, Parsons noticed egg freezing taking a toll on her professional and personal life in other ways.

“You have to inject yourself with hormones for two weeks. You have to eat differently. You don’t really want to be in social settings. You can’t drink. There are all these other ramifications around just going through that process, even though we know it’ll be for this one month and then it’ll be over,” she said.

The process also doesn’t guarantee success.

Evelyn Gosnell underwent her first egg retrieval when she was 32, following by two additional cycles at 36 and 38 years old. By the time she was ready to have children with her now-partner, the New York-based behavioral scientist had many frozen eggs ready. But, she received no viable and normal embryos after her eggs had been thawed and fertilized.

Many people find that during their working years, housing is their largest monthly expense. But come retirement, healthcare might take the place of housing as the single expense you spend the most amount of money on.

As such, it’s in your best interest to do what you can to make your healthcare costs more manageable. Here’s how.

Image source: Getty Images.

1. Choose the right Medicare coverage

When it comes to enrolling in Medicare, you get a choice. You could stick to original Medicare, which is Parts A, B, and D. Or as an alternative, you could sign up for a Medicare Advantage plan.

Medicare Advantage plans often cover more services (such as dental care and eye exams) than original Medicare. But that doesn’t necessarily make them a more cost-effective choice for you. You’ll have to really research your options carefully to determine which is best for you.

Also, within the realm of Medicare Advantage, there may be a large number of plans to choose from in your area. Take the time to review what those different plans cost and cover. And also, look at plan ratings to get a sense of how satisfied enrollees tend to be with them.

If you decide to stick to original Medicare, consider Medigap coverage, or supplemental insurance. This could limit the amount you’re forced to spend on expenses like coinsurance and deductibles.

2. Stay on top of health issues

Letting health issues escalate could not only put your wellbeing at risk, but also, cost you more money. As such, it’s a good idea to keep up with doctor visits and make sure you’re scheduling diagnostic tests as per your providers’ recommendations.

If you’ll be signing up for Medicare, you should also try to take advantage of the program’s free health services. Enrollees are generally entitled to a wellness visit every year. And certain diagnostic tests are available at no cost as well.

3. Fund an HSA during your working years

You could always tap your 401(k) or IRA in retirement if you need money to pay for healthcare expenses. But when you’re also trying to pay for housing, groceries, transportation, and at least some entertainment, dipping into your limited cash reserves for medical bills could become stressful.

That’s why it’s a great idea to have separate, dedicated savings for healthcare spending in retirement. So if you have access to an HSA, or health savings account, during your working years, do your best to fund it.

However, what you’ll also want to do is leave your HSA balance alone while you’re still working. HSAs don’t require you to spend down your plan balance every year. Quite the contrary — savers are encouraged to invest unused funds and grow their balances. So if you follow that path, you may end up with a large sum of money in retirement that’s earmarked for healthcare spending. That could take a lot of the pressure off.

Healthcare is an unavoidable expense — in retirement and in general. But if you make these moves, you may find that covering your healthcare costs isn’t as difficult once your career comes to an end.

Web3 OS Lowers Operating Costs Without Sacrificing Blockchain Security – Brendan Cooper

According to Brendan Cooper, a core contributor at Andromeda, the widespread distribution and adoption of the Web3 operating system (OS) will likely result in the emergence of new business models, much like what happened with the Web2 OS. The Web3 OS is also likely to simplify “how developers and users interact with the resources provided […]

According to Brendan Cooper, a core contributor at Andromeda, the widespread distribution and adoption of the Web3 operating system (OS) will likely result in the emergence of new business models, much like what happened with the Web2 OS. The Web3 OS is also likely to simplify “how developers and users interact with the resources provided […]

Source link

I’m 68 and My Long-Term Care Insurance Now Costs $600 Per Month. Is This Too Much?

Imagine that you’re 68 years old and have a long-term care insurance policy in place that will help you pay for this all-important type of care later in life. You pay $600 per month in premiums and tell yourself it’s a good investment, considering how expensive long-term care can be.

Consider working with a financial advisor if you need additional help planning for long-term care and other needs you’ll have later in life.

The problem? Your premiums are well above the average monthly cost of long-term care coverage. Here’s what you should be thinking about if you’re interested in buying long-term care insurance or evaluating whether you’re paying too much for it.

What Is Long-Term Care Insurance?

Long-term care insurance helps pay for extended or residential treatment such as in-home care (like a home health aide) or residential/custodial care (such as a nursing home or assisted living).

Long-term care insurance generally doesn’t cover medical bills outside of the extended treatment itself. For example, if you stay in a nursing home and need to see the doctor, your long-term care insurance would pay for the nursing home while health insurance/Medicare would pay for the doctor’s appointment.

Health insurance and Medicare, on the other hand, don’t pay for residential care. This is what makes long-term care insurance so important for retirement planning. As the American Council on Aging found in 2021, staying in a nursing home can cost more than $100,000 per year. Meanwhile, the median cost of a private room in a nursing home is expected to reach $13,267 per month by 2034, according to Genworth. This is beyond the means of most households to pay out of pocket. While Medicaid can cover these costs you must fall below the program’s income and asset limits, which forces some middle-class retirees spend down their assets until they can qualify for care.

It is not uncommon for people to sell off family homes and liquidate their retirement portfolios to afford assisted living. This can be tragic, particularly if you want to come home someday or leave those assets to your children. Long-term care insurance can potentially prevent that and a financial advisor can help you plan for it.

What Determines the Cost Of Long-Term Care Insurance?

Long-term care is structured around a monthly or annual premium that’s set when you buy the policy. Then, if you need care, the insurer pays your costs up to the limit of your coverage. For example, if you have a $100,000 per year policy your insurer will cover the first $100,000 in care that you receive each year and you will pay for the remainder. Many, if not most, policies offer lifetime coverage, meaning that if you need permanent care the program will cover you indefinitely.

The costs of a long-term care policy are based on a few key factors, including:

-

Your age when you buy the policy

-

Your gender

-

The policy’s coverage amount

-

The duration of coverage (if it covers lifetime stays vs. a limited stay)

-

Inflation coverage (if the policy grows by a percentage each year)

The younger you are when you buy the policy the longer it will be until you will likely need it. As a result, your premiums will likely be lower. Women pay significantly more than men because they have a longer life expectancy, and so will likely use more care if they need assisted living.

Coverage growth protects your policy from inflation. At a 2% rate of inflation, prices will double roughly every 30 to 35 years, meaning that a policy you buy at 55 may lose half its spending power by the time you’re 85. If you need help assessing your options for long-term care insurance or even purchasing a policy, speak with a fiduciary financial advisor.

Is $600 Per Month Too Much For Long-Term Care Insurance?

The question is, what should your policy cost, and more specifically, is $600 per month too much for a 68-year-old single person to be paying? Long-term care insurance isn’t cheap, and it gets more expensive the later in life you purchase it but it doesn’t have to be this expensive.

According to the American Association for Long-Term Care Insurance, you should probably pay somewhere between $100 and $400 per month for your insurance. While there’s a lot of variability, if you’re an individual with $165,000 in coverage and 2% inflation protection, an average policy will cost:

-

$1,650 per year ($137.50 per month) for a male purchasing at age 55

-

$2,725 per year ($227 per month) for a female purchasing at age 55

-

$2,600 per year ($217 per month) for a male purchasing at age 65

-

$4,230 per year ($352.50 per month) for a female purchasing at age 65

Just going off these average premiums, a 68-year-old can pay a lot less than $600 per month for long-term care coverage. However, a premium that high isn’t completely out of the ordinary. For example, the average cost of coverage for a 65-year-old woman who wants an annual 5% inflation adjustment is $7,225 per year or just over $600 per month.

Like all insurance, long-term care policies tend to get more expensive the longer you wait to purchase one. Buying a new policy at 68 won’t be cheap, but it may be cheaper than doing so at 73. Consider working with a financial advisor to determine how much coverage you may need and how much you’ll be able to afford.

Bottom Line

A year at a nursing home can cost over $100,000, placing immense financial strain on the person who needs it and/or their family. While Medicare typically does not cover these costs, long-term care insurance can fill that gap. However, it isn’t cheap. If you can buy it well in advance, though, it can protect your future for a couple hundred dollars per month.

Retirement Insurance Tips

-

Insurance in retirement can be a very complicated subject. Among the many moving pieces here is the concept of life insurance as a savings account. Depending on the policy you hold, your life insurance policy can act as a retirement portfolio from which you can withdraw assets. See how these policies stack up against standard investments.

-

A financial advisor can potentially help you plan for your insurance needs. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Photo credit: ©iStock.com/Hailshadow, ©iStock.com/kazuma seki, ©iStock.com/brizmaker

The post I’m 68 and My Long-Term Care Insurance Now Costs $600 Per Month. Is This Too Much? appeared first on SmartReads by SmartAsset.

Ross Stores says that housing and food costs continue to pressure its customers

Ross Stores Inc. late Tuesday blew past expectations for its holiday quarter but spooked investors by saying that higher costs of living continue to pressure its customers.

While inflation has moderated, there is ongoing macroeconomic and geopolitical uncertainty, and “housing, food, and gasoline costs remain elevated and continue to pressure our low- to moderate-income customers’ discretionary spend,” the off-price retailer said.

“As a result, while we hope to do better, we believe it is prudent to continue to take a conservative approach to forecasting our business in 2024,” the company said.

Ross

ROST,

earned $610 million, or $1.82 a share, in the fourth quarter, compared with $447 million, or $1.31 a share, in the year-ago period.

Sales rose to $6 billion from $5.2 billion a year ago, and comparable-store sales were up 7% over the same period last year.

Analysts polled by FactSet expected the retailer to report earnings of $1.66 a share on sales of $5.8 billion. Same-store sales were forecast to be up 3.4%.

“Our above-plan sales were driven by customers’ positive response to our improved assortments of quality branded bargains throughout our stores,” Ross Chief Executive Barbara Rentler said in a statement.

Ross said it expects 2024 same-store sales to grow 2% to 3%, which would come on top of a 5% gain in 2023. It projected 2024 EPS between $5.64 and $5.89. First-quarter EPS was projected to be between $1.29 and $1.35.

The FactSet consensus calls for 2024 EPS of $5.40 a share and first-quarter EPS of $1.26.

Target Corp.

TGT,

earlier Tuesday beat Wall Street expectations for its fourth quarter but said that despite encouraging signs for the U.S. economy, some of its customers feel “stretched.”

Ross’s fourth-quarter operating margin rose to 12.4% from 10.7% year over year, thanks to “strong gains” in same-store sales and lower freight costs, which were partially offset by higher discounts, the company said.

Shares of Ross rose 1.8% in after-hours trading.

Ross said that its board authorized a 10% increase in the company’s dividend, to 36.75 cents a share. The dividend is payable on March 29 to stockholders of record as of March 15, the company said.

“As we move through the coming year, we remain focused on delivering a wide assortment of quality branded bargains for our customers. We believe this will be the most important driver of our ability to gain market share over both the short and long term,” Rentler said.