“These interest charges could be astronomical on a big purchase,” says one credit-card expert.

Source link

Credit

‘I’m Sure I’m Going To Die Penniless’ — Almost Half Of Gen X, The ‘Lost Generation,’ Has More Credit Card Debt Than Savings — Even the ‘Broke’ Millennials’ Are Faring Better

Generation X, often referred to as the “Lost Generation,” finds itself in a precarious financial situation, wedged between the money struggles of millennials and Gen Z on one side and the relative stability of baby boomers on the other. According to a recent Bankrate survey, 47% of Gen Xers (ages 44-59) have more credit card debt than emergency savings.

This statistic paints a picture of Gen X falling behind all generations, with millennials (ages 28-43) faring only slightly better at 46% having more debt than savings, and Gen Z (ages 18-27) at 32%. On the other end of the spectrum, baby boomers (ages 60-78) appear to be in a more comfortable position, with 68% having higher emergency savings than credit card debt — the highest percentage among all generations surveyed.

Don’t Miss:

-

The average American couple has saved this much money for retirement — How do you compare?

-

For many first-time buyers, a house is about 3 to 5 times your household annual income – Are you making enough?

The survey data highlights the financial tightrope that Gen X is walking, sandwiched between the debt burdens of millennials and Gen Z, often referred to as the “broke” generations, and the comparatively well-prepared boomers. This Lost Generation moniker takes on new significance as Gen Xers struggle to build a financial safety net amid competing demands of supporting their children and aging parents.

Greg McBride, chief financial analyst at Bankrate, points out the strain many households are facing, stating, “Financing purchases at 20% interest rates is a sign of the financial strain millions of households are feeling.”

The survey also revealed that Gen Xers were the most likely generation to report having less emergency savings than they did a year ago, with 34% admitting to a decline in their financial cushion.

Pew Research Center’s examination of Generation X highlights their significant role as a bridge between the notably different baby boomers and millennials. Despite their critical economic and social position, Gen Xers have often been overlooked in discussions about demographic, social and political changes. Their financial outlook is notably more pessimistic compared to other generations, partly because of the economic stresses associated with middle age.

Trending: If the average American household is a millionaire, why do people feel so broke?

This bleak reality was echoed on Reddit, which posted an article about Gen X having the largest wealth gap. In the comments, one user wrote, “I feel like I did everything they told us to do and be successful, and I’m sure I’m going to die penniless.”

Another lamented, “I myself have been a casualty of multiple economic downturns, notably the 2008 recession … and, well, it’s not looking good for me.” A third user pointed out, “There’s no safety net under capitalism, but millennials are not the enemy. They’re allies.”

As the generational divide widens, Gen X finds itself at a crossroads, caught between the financial challenges of their children’s generations and the looming retirement prospects of their parents’ cohort. Navigating this middle ground will require a concerted effort to prioritize both debt reduction and consistent savings — a balancing act that many Gen Xers are still struggling to master.

it is never too late (or too early) to start working toward financial stability. Consulting with a financial adviser can play a pivotal role in helping people across all generations to assess their current financial situation, set realistic goals and create a plan to achieve these goals.

Financial advisers can offer tailored advice on a range of strategies to reduce debt, increase savings and plan for retirement, ensuring that individuals are taking proactive steps toward financial health. Whether it’s exploring options to consolidate debt to lower interest rates, setting up an emergency fund to avoid future debts or investing wisely for long-term growth, a financial adviser can provide guidance tailored to each person’s unique circumstances.

Read Next:

*This information is not financial advice, and personalized guidance from a financial adviser is recommended for making well-informed decisions.

Jeannine Mancini has written about personal finance and investment for the past 13 years in a variety of publications including Zacks, The Nest and eHow. She is not a licensed financial adviser, and the content herein is for information purposes only and is not, and does not constitute or intend to constitute, investment advice or any investment service. While Mancini believes the information contained herein is reliable and derived from reliable sources, there is no representation, warranty or undertaking, stated or implied, as to the accuracy or completeness of the information.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article ‘I’m Sure I’m Going To Die Penniless’ — Almost Half Of Gen X, The ‘Lost Generation,’ Has More Credit Card Debt Than Savings — Even the ‘Broke’ Millennials’ Are Faring Better originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This fintech startup is targeting a gap in lending as banks tighten credit

With banks facing higher interest rates that bite into economic activity, not to mention their need to stockpile money for bad debts or unpaid credit-card bills, it has been harder to get a loan in the past year or so.

At least one startup sees an opportunity.

The founders of financial-technology company Nectar told MarketWatch this year’s market conditions are fueling its growth at a time when banks remain more selective with their loans.

“It’s a good time to be in this business because access to capital has dried up,” said Derrick Barker, 36, who co-founded Nectar with his wife, Brittany Mosely, 35.

Also read: New York Community Bancorp led increase in loan-loss reserves by big regional banks as lenders brace for potential downturn

With 92 loan deals and counting since its launch in 2021, Nectar now employs 12 people as a lender to real-estate investors and owners who often build housing for Black Americans and other people of color.

It’s worked on more than $500 million in transactions including apartments, multi-family buildings, single-family rentals, hospitality properties, assisted living facilities and commercial real estate.

Nectar’s success thus far illustrates the alternative ways capital is being provided to individuals and businesses even as banks grow more conservative.

The growth of private credit has pivoted to meet some of this demand, but fintechs such as Nectar are also ramping up.

To be sure, others offer quicker routes to capital than many banks. Capchase Inc., for example, specializes in loans based on annual recurring revenue for software-as-a-service companies in the business-to-business space.

Pipe Technologies Inc. operates a trading platform to connect institutional investors and companies with recurring revenue streams to get financing for growth.

For its part, Nectar saw revenue growth of 750% between 2022 and 2023 by focusing on an underserved part of the market, namely people with $50 million to $500 million in assets, typically in real estate.

“The supply chain for capital is … old, outdated and broken, specifically for people who aren’t large institutions,” Barker told MarketWatch. “We want to fix that. We can provide to those people who are medium-size and smaller who are making an impact with the capital they need, so they can build the housing that needs to be built.”

Nectar’s mezzanine debt deals focus on transactions of less than $5 million, much smaller than the $20 million cutoff from many major banks. The company uses existing assets and cash flow generated by rent and other payments as collateral for the loan. This structure allows real-estate owners to retain more of the equity in their own property than other types of financing.

“We can come in and look at their stabilized cash flow and their properties so they can keep doing the important work that they’re doing, which is creating affordable housing … across the country,” Barker said.

Barker and Mosely met while studying at Harvard University, got married in 2015 and went into different careers. She headed for the retail sector, while Barker worked as a bond trader for Goldman Sachs Group Inc.

GS,

During and after his time at Goldman Sachs, Barker built up his own $450 million real-estate portfolio by buying abandoned apartments and rehabilitating them.

Barker started working to solve the challenge of coming up with working capital and liquidity for real-estate properties with low leverage and positive cash flow, which is the core business of Nectar.

For her part, Mosely had seen property owners giving up equity to investors — the limited partners, or LPs, in a real-estate private-equity fund — to get capital.

“For me, it was about really being on the front lines and doing all the work that it took to acquire the property and actually manage the construction or the rehab and when it came time to sell, the LPs would take most of the profit,” Mosely said. “I felt there had to be a better way to grow without property owners having to give up equity — that was my drive to co-found Nectar.”

Many of Nectar’s lending deals are sub-institutional, and many of them are for housing.

These so-called Class C properties — defined as 30 years old, in fair to poor condition, and in less-desirable locations compared with Class A or Class B buildings — often house a greater proportion of Black Americans and people of color.

“They’re still the places where Black people live. If you look at the Class C apartments, they’re the apartments that more people of color are more likely to live in,” Barker said. “They’re also more likely to be owned

by smaller institutions with less access to [loans]. By providing access to capital, it helps … people who are creating housing for this part of the population.”

Nectar remains well capitalized after lining up venture-capital backing from RareBreed Ventures, J4 Ventures and Asymmetry Ventures. Nectar is also raising a private-equity real-estate fund to generate capital for deals called Nectar Fund 2, which has a $100 million target.

Nectar is able to approve financing in as little as seven days, once all underwriting due diligence has been handed in.

Nowadays, Nectar’s portfolio has a combined leverage below 60%. The company maintains more than 2x coverage for every $1 that’s borrowed.

“We do some detailed and deep underwriting. We get to focus on the cream of the crop,” Barker said. “Just because the loans are smaller doesn’t mean they’re not good.”

Also read: Why small-business loans are a win-win for women-run startups and smaller banks

Vita Coco started with a leap of faith, a $75,000 investment and “several” maxed-out credit cards.

Today, the bestselling coconut water company is worth $1.1 billion. But it wasn’t born out of a Silicon Valley startup lab. Rather, co-founders Michael Kirban and Ira Liran first thought about going into the coconut water business after a chance meeting in a Manhattan bar on a cold night in 2003, when two Brazilian women told them the beverage was what they missed most about their homeland.

Liran ended up falling in love with one of those women, and moving to Brazil. When Kirban visited them, he realized just how popular coconut water — which has a salty-sweet taste and high levels of hydrating electrolytes — was in the Southern Hemisphere, especially compared to the U.S.

The two friends decided to jump on what they saw as a once-in-a-lifetime opportunity.

“People in Brazil were drinking it for everything,” Kirban, 48, tells CNBC Make It. “They were drinking it at the breakfast table. They were drinking it on the beach. They were drinking it after a workout … We’re like, ‘There’s got to be a consumer in the U.S.'”

Liran and Kirban struck a deal with a supplier in Brazil to produce their first shipment, for $75,000. They paid mostly with Kirban’s money, which he’d obtained by founding and running a real estate software business after dropping out of college. That software business still exists, and Kirban still helps run it on the side, he says.

The shipment got held up at the border by U.S. officials. The co-founders hadn’t realized they needed to register it with the U.S. Food and Drug Administration, which meant they had to divert it to the Bahamas, where Kirban says he “sold it door to door” at bars, grocery stores and even “people’s homes.”

It was only the beginning of Vita Coco’s long journey to financial success, with more stumbling blocks along the way.

‘We started maxing out credit cards’

In the Bahamas, the friends recouped “most” of their money and repeated the process with the proper regulatory registrations, Kirban says. Once Vita Coco hit U.S. shelves, they discovered a nearly identical coconut water brand called Zico, which launched at roughly the same time.

The two companies competed throughout the 2000s for shelf space in stores across New York. The prolonged battle was marked by dirty tactics on both sides, from bombastic marketing and price undercuts to sales representatives removing their rival’s products from store shelves.

At the time, Kirban desperately wanted to avoid taking on too much debt while funding Vita Coco’s early growth, so he developed a credit card strategy not for the faint of heart.

“We started maxing out credit cards … [to] operate the business,” he says, adding: “I would go get a new credit card with no interest for 90 days [or] six months, and just transfer everything to the new credit card. I did that several times.”

The tactic helped Vita Coco avoid business loans, which required immediate repayments with interest, and enabled the co-founders to delay seeking outside investments. That gave them more control of the business and helped them hold onto more of their ownership stakes long-term, says Kirban.

“We never paid any interest and didn’t need to start paying down the credit card until, I don’t know, a year or a year and a half into the business,” he says.

A risky strategy that paid off

Kirban’s strategy was incredibly risky, both personally and professionally. Even if you eventually pay off every card you’ve opened, you can severely damage your credit score, especially if you max out multiple cards, according to experts.

Eventually, Vita Coco did take on outside investors — starting in 2007, when Belgian investment company Verlinvest invested an undisclosed amount. When Zico sold a 20% stake to beverage behemoth Coca-Cola two years later, Kirban found a group of celebrity investors, led by Madonna, and signed a 2010 distribution deal with Keurig Dr. Pepper that still allowed the co-founders to keep a majority stake.

Vita Coco now controls roughly half of the U.S. coconut water market. Zico’s founder later expressed regret over selling the rest of his business to Coca-Cola in 2013, and bought it back in 2021.

Last year, for the first time, Vita Coco cracked more than a billion coconuts to make its signature product — a rate of roughly 3 million per day. Kirban hopes to keep growing his brand across North America, and soon expand into Europe and Asia.

“We see a big opportunity to continue to expand across the globe,” he says.

Want to land your dream job in 2024? Take CNBC’s new online course How to Ace Your Job Interview to learn what hiring managers are really looking for, body language techniques, what to say and not to say, and the best way to talk about pay. Get started today and save 50% with discount code EARLYBIRD.

As Donald Trump made his victory speech after Iowa’s caucuses, the front-runner in the 2024 Republican presidential primary couldn’t resist taking a shot at electric vehicles while praising a supporter from Missouri.

That supporter “comes all the way from Missouri, which isn’t that far. You can’t drive an electric car that far, though,” the former president said Monday night, drawing laughs from his audience in Des Moines.

It’s the type of criticism of EVs that Trump has offered often during his 2024 White House campaign, breaking sharply with President Joe Biden’s approach. The Democratic incumbent has made support for EVs

DRIV

KARS

a key part of his speeches and his economic policies, saying the car industry’s future “is electric, and there’s no turning back.”

From the archives (September 2023): Trump attacks Biden over EVs as he makes pitch to auto workers

So the result of the 2024 presidential race, which looks increasingly likely to be a Biden-Trump rematch, is expected to have an outsize impact on the Biden administration’s incentives and regulations that aim to boost adoption of EVs. The election has been described as a “referendum” on EVs by analysts at Beacon Policy Advisers, even as they acknowledge the issue won’t drive voters as much as top-tier topics such as inflation or abortion rights.

“It’s not necessarily what people are going to be voting on, but the future of EVs is nevertheless very election-dependent on what happens in 2024,” Beacon analyst Maxwell Shulman said.

There are expectations that widely used tax credits that can take as much as $7,500 off the cost of a new EV will be targeted by Trump or any Republican president — especially if the GOP keeps its grip on the U.S. House of Representatives and takes control of the Senate. The credits already have been pared back as of Jan. 1, with some car models losing out due to new anti-China rules for battery materials. They could be reduced further after the 2024 elections, as even Democratic-run chambers of Congress might support closing a “leasing loophole.”

Washington will have to decide in 2025 how much of the Republican tax overhaul of 2017 should be extended vs. being allowed to expire. If Republicans are in control of the White House and both chambers of Congress, they’re likely to look during that process at the EV credits, established by Biden’s Inflation Reduction Act, according to Beacon’s Shulman.

“If you’re going to do tax cuts, you need the revenue offset from somewhere, and what’s better than the marquee legislative package that your opponents passed the prior term?” he said.

Related: As Biden touts his Inflation Reduction Act, analysts size up how Trump might repeal it

Courtney Rosenberger Gelman, managing director of policy research at Strategas Securities, said the EV tax credits are “the most at risk” part of the Inflation Reduction Act, if Republicans score wins in the 2024 elections. She said she thinks it’s going too far to say this fall’s voting in the U.S. looks like a referendum on EVs, but it does have the potential to have an impact on the growing industry.

Democratic control of one chamber of Congress probably would prevent a full rollback of the EV tax credit, but there still could be changes, according to Gelman. “Even with Democrats, because of how bipartisan going after China is,” there could be additional sourcing requirements, she said. And with “continuously building populist momentum on both sides of the aisle, things like the leasing loophole could be targeted,” she said.

That loophole refers to how it’s possible to get $7,500 off any EV at any price if it’s leased, with no limits on the driver’s income level. For buying rather than leasing, the subsidy comes with more rules, such as an income cap of $150,000 for individual tax filers buying new vehicles, as well as North American sourcing.

Beyond the EV tax credit, Beacon’s Shulman expects a Republican administration would aim to roll back Biden regulations such as a proposed tailpipe-emissions rule that’s intended to push all-electric options to making up as many as two out of every three new passenger vehicles sold in the U.S. by 2032.

The GOP-run House passed a bill in December on that exact issue, with Republican lawmakers describing Biden’s rule as an EV mandate, but it’s not expected to find any traction this year in the Democratic-controlled Senate.

Forecasts for the EV industry’s growth would have to be reduced if such regulations were nixed in 2025, because it’s not only carrots, or subsidies, that would go away, “but also because the sticks forcing industry in that way are sort of getting removed as well,” Shulman said.

Companies ‘can’t make a long-term investment plan’

The share of U.S. car sales that are EVs is likely to be 8% in 2024, up from 6.9% in the first 11 months of 2023, according to Jessica Caldwell, head of insights at Edmunds. She describes the market for the vehicles as experiencing a “wake-up call” after earlier projections proved too optimistic, with some of the struggles coming from elevated interest rates for car loans.

Losing the $7,500 EV tax credit would be a hit to the industry, especially as buyers now are no longer as likely to be early adopters, she said. “It definitely would affect it, just because if we are going to more of a mass-market consumer, that person has a lower income level than an early adopter, generally speaking.”

Related: Hertz cites weak demand, high damage costs in decision to downsize EV fleet

Car makers and their allies have indicated they’re tracking the political risks. The CEO of Chrysler and Fiat parent Stellantis

STLA,

Carlos Tavares, recently told Automobilwoche that the U.S. elections are important, and his company may have to change its strategy “if political and public opinion tends toward fewer EVs.” In a similar vein, executives from General Motors

GM,

and Nissan

7201,

told the Financial Times that eliminating incentives would hurt EV sales.

“What I worry about the most on behalf of American business is just the lack of certainty,” said the U.S. Chamber of Commerce’s president, Suzanne Clark, during a news conference last week when she was asked about repealing parts of the Inflation Reduction Act.

“This every two or four years having a big guardrail-to-guardrail shift means we’re seeing companies say, ‘I don’t know how to invest in the United States. I can’t make a long-term investment plan.’ “

Related: Both Trump and Biden ‘threatening for the markets’, says Ray Dalio

Voters show big partisan divide on EVs

While there’s a war of words over EVs between Biden and Trump, there also appears to be a partisan divide over these products between rank-and-file Democrats and Republicans.

Some 71% of GOP voters say they would not buy an EV, according to a Gallup poll conducted last year. Among Democrats, only 17% feel that way. Among independent voters, it’s 38%.

To be sure, Gallup has noted that Americans aren’t the best forecasters of what they’ll end up buying, as nearly a quarter of respondents to a 2000 survey said they would never buy a cellphone. What’s more, while an E&E News tally last year showed that members of Congress with EVs are overwhelmingly Democrats, GOP Rep. Thomas Massie of Kentucky has said he was the first U.S. lawmaker to have a Tesla

TSLA,

on Capitol Hill, as he got one of Elon Musk’s products a decade ago.

Still, what gives with the party split on EVs?

“I think it comes down to partisan viewpoints on energy

XLE

generally, where Republicans are generally more pro–fossil fuel

RB00,

and Democrats have been generally viewed as anti-drilling, anti-oil

CL00,

anti-coal,” said Gelman at Strategas.

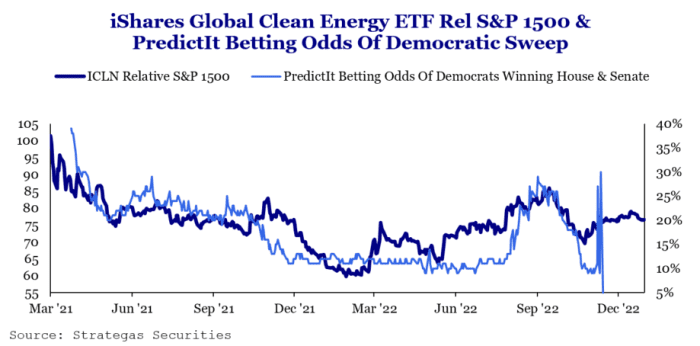

Green-energy stocks

ICLN

could end up tracking Democratic prospects in the 2024 elections, according to Gelman.

“You’re going to see EVs and other renewable-energy names potentially trading off of the odds of Republicans vs. Democrats doing well in the election,” she said. She noted that her shop found that type of relationship ahead of the 2022 midterm elections, as shown in the chart above.

Now read: Want to buy a new car? You should probably be making $100,000 a year.

Clearpool Introduces Credit Vaults to Provide Blockchain Loan Efficiency for Lenders and Empower Borrowers

Credit Vaults empower borrowers by allowing them to customize loan terms according to their specific requirements. The increased interest rates provided by the solution encourage more lenders to join.

Clearpool, a decentralized finance (DeFi) lending protocol, has introduced a groundbreaking product called Credit Vaults. With this solution, the network aims to optimize lending efficiency and flexibility, bringing private credit efficiency onto the blockchain. This innovative offering allows borrowers to have more control over loan terms while attracting additional lenders with higher interest rates. Ultimately providing the potential to significantly expand Clearpool’s lending ecosystem.

What Are Credit Vaults and How Do They Work?

Credit Vaults are customizable lending pools designed for individual borrowers. It gives them the freedom to modify various parameters, such as interest rates, repayment schedules, pool caps, and know-your-customer (KYC) requirements, to suit their specific needs.

When lenders contribute funds to a Credit Vault, the capital goes directly to the borrower’s wallet in exchange for tokenized pool shares known as cpTokens. These tokens accrue interest in real-time, providing lenders with continuous yields.

The solution offers several advantages, including higher utilization of lent funds compared to Clearpool’s existing Permissionless Pools. With 100% utilization, Credit Vaults achieve approximately 15% higher capital efficiency, resulting in a significant boost of up to 17.6% in potential returns for lenders. Additionally, borrowers can adjust rates based on predefined protocol rules, adding an extra layer of flexibility to their borrowing experience.

New Opportunities for Borrowers and Lenders

Credit Vaults empower borrowers by allowing them to customize loan terms according to their specific requirements. This flexibility opens doors for a wider range of borrowers, from institutions to individuals. For example, trading firms can increase pool caps and rates to attract more liquidity for launching new strategies. Moreover, the solution enables more real-world lending, providing access to DeFi opportunities for secured credit products and non-crypto companies.

The increased interest rates provided by Credit Vaults encourage more lenders to join. This improved capital efficiency leads to higher profits for lenders, creating a beneficial situation for both borrowers and lenders.

Clearpool’s decision to introduce Credit Vaults is driven by the success of its original Permissionless Pools. These pools were the first to offer flexible and liquid private credit lending in the DeFi industry, originating loans worth an impressive $460 million. However, as the demand for more personalized and stable lending opportunities grew, Clearpool recognized the need to develop a new product to meet the evolving needs of borrowers.

Plans for Future Expansion

To expand access and flexibility further, Clearpool plans to launch Credit Vaults on additional blockchain networks. This multi-chain approach will empower more borrowers while diversifying liquidity streams for lenders. As the DeFi network grows and establishes partnerships on different blockchain networks, the protocol is positioned to be a leader in decentralized private credit innovation.

Credit Vaults have already demonstrated their potential by offering a balance between customized lending options for borrowers and attractive returns for lenders. If the adoption of the solution follows the success of Permissionless Pools, it has the potential to revolutionize lending practices in the DeFi industry.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

I want to buy a Tesla and get my $7,500 tax credit, but I’m expecting an $18,000 tax credit from solar panels. Should I wait to buy the car?

I’m expecting a $15,000 tax bill this year. I installed a residential solar and battery system in the spring of 2023 for $60,000. This would entitle me to an $18,000 tax credit.

I am contemplating purchasing a Tesla Model Y

TSLA,

by the end of the year, which would entitle me to a $7,500 EV tax credit.

Would the EV tax credit be applied first to reduce my tax liability? Or would the tax credit for the solar installation go first to reduce my tax bill and make the EV credit irrelevant?

Slamming the Breaks

Dear Slamming,

If you are focused on the tax incentives, wait until next year to purchase the Tesla.

“It is correct that the solar credit would be considered first and would reduce the tax for 2023 to $0, rendering the credit for the Tesla null,” said Tom O’Saben, director, tax content and government relations at the National Association of Tax Professionals, an organization with 24,000 members.

If you purchase your car before the end of the year, “you’re throwing money away,“ he added.

As more people eye these credits, your question about timing is going to become more common, O’Saben noted.

The Inflation Reduction Act has been on the books for more than a year, and the law is using tax incentives to make the idea of going green extra alluring to Americans.

The Residential Clean Energy Credit is offering 30% credits toward the costs of solar panels installed through 2032. The credit falls to 26% of the total costs in 2033, and 22% in 2034.

Here, 30% of a $60,000 solar panel is $18,000.

Tax credit for electrical vehicles

Then there’s the tax credit for new EVs, which goes up to $7,500 for qualifying vehicles and income-qualifying households. They apply to individuals making up to $150,000 a year, and married couples filing jointly who make up to $300,000 a year.

Both of these tax credits are nonrefundable. The solar-panel credit is the only one where the unused tax credit carries forward to a new tax year. Unused money from the EV cannot be applied towards tax bills in coming years.

Tax credits shrink liability, but there’s a difference between refundable and nonrefundable tax credits.

A refundable tax credit reduces tax liability and the excess that isn’t used converts to a tax refund. The Earned Income Tax Credit is one example of a refundable credit.

Nonrefundable credits, like the two at issue, will reduce your tax liability though that excess will not turn into a tax refund.

Start with the big-ticket items

The money from a tax credit rewarding people who save energy with things like home energy audits, and improved insulation should also be applied before the EV tax credits, he said.

“Start with the big ticket items” in the array of Inflation Reduction Act tax incentives. “A lot of those are going to burn up tax,” O’Saben said.

The sequence matters.

If you bought a car this year, you’d get the $7,500 credit for qualifying EVs. But first, the $18,000 credit from the solar-panel installation would snuff the $15,000 tax bill. But then you would be left with a $7,500 credit in hand with no tax bill to reduce and no way to apply it to future tax years.

Now suppose you bought the EV next year. The remaining $3,000 is carried over and goes towards the tax liability before the $7,500 from the EV gets applied, O’Saben said.

In fact, if your 2024 tax liability is already down to $0 by the time your EV credit would apply, it might still be for naught.

Wait a few weeks to buy the Tesla

You could wait a few weeks, buy your Tesla in January and put the credit towards your 2024 income taxes. But who really has a firm understanding of what their tax liability will be in a year? “Nobody does,” O’Saben said.

That’s why planning is key and also acknowledging the chance that you “may have to wait until 2025,” O’Saben said.

Next year, people who are interested in EVs will find it easier to use the $7,500 tax credit. They can apply the tax savings at the point of sale to effectively reduce the price at the lot.

“The car dealership is not a tax professional,” O’Saben said.

One caveat: Starting next year, it’s “likely” that certain Teslas are not going to get the full $7,500 credit, according to the car maker’s website.

The tax credit falls to $3,750 “for Model 3 Rear-Wheel Drive and Model 3 Long Range on Jan. 1, 2024. Take delivery by Dec. 31 to qualify for full tax credit,” according to the site.

The issue is tied to government requirements for sourcing battery parts.

Maybe there’s non-tax reasons why you think it’s best to buy this car now. People have to get places, after all.

But if it’s about taxes, tap the brakes for now.

Despite record sales, Black Friday underscores Americans’ reliance on debt and credit

Quick Take

According to CNBC analyst Carl Quintanilla, a staggering $9.8 billion was spent on Black Friday, reflecting a 7.5% increment from the previous year, suggesting robust consumer behavior.

However, a source of concern lies in a parallel trend: many of these purchases appear to be financed through personal debt.

Experian reports that the average American household possesses 3.84 credit cards. In addition, as per the Kobeissi Letter, the ‘Buy Now Pay Later’ segment has observed a 20% growth year over year while credit card debt has hit an unprecedented $1 trillion.

This data places a question mark on the perceived consumer strength. Are we witnessing actual financial strength, or does the escalating debt merely underline a culture of deferring payments facilitated by easy access to credit?

The post Despite record sales, Black Friday underscores Americans’ reliance on debt and credit appeared first on CryptoSlate.

A rendering of a hydrogen energy storage gas tank for clean electricity solar and wind turbine facility.3d rendering

Vanit Janthra | Istock | Getty Images

One of the most generous tax credits in Biden’s landmark climate bill, the Inflation Reduction Act, is the production tax credit for making hydrogen, which is worth as much as $100 billion.

When hydrogen is used in a fuel cell to generate electricity, water is the only by-product. Generating energy from hydrogen this way does not create carbon dioxide, one of the primary greenhouse gases that causes global warming. Also, hydrogen is a vehicle for storing energy over long periods of time.

Hydrogen is already produced at scale for use in making fertilizer and in the petrochemical industry. But more recently, hydrogen is being seen as a way to decarbonize industries like maritime shipping, long-haul trucking, steel-making, industrial heating, and aerospace. Also, its capacity as an effective way of storing energy makes it attractive for renewable energy sources, like wind and solar, which are inherently intermittent — wind turbines make energy when the wind blows, and solar panels make energy when the sun shines.

However, the only way hydrogen can be a viable solution for reducing carbon emissions is if it can be produced without releasing greenhouse gas emissions. By and large, that’s not the case today.

The proposed tax credit, 45V, is meant to turbocharge the production of low-emissions hydrogen. It’s now up to the Treasury to figure out how to implement it — and that’s the tricky part. The debate centers around how best to write rules that make sure that the hydrogen produced is actually clean so that it can be used as a climate-mitigation tool.

“The IRA’s section 45V production tax credit is the most generous clean hydrogen subsidy in the world,” Jesse Jenkins, professor of macro-scale energy systems at Princeton University, told CNBC.

“But without proper implementation, 45V could backfire, wasting a tremendous opportunity for the United States to become a global leader in new clean industries and causing a significant increase in domestic emissions that imperil U.S. climate goals.”

An Hydrogen prototype GenH2 truck of the Daimler Truck Holding AG arrives at his destination in Berlin, on September 26, 2023, after completing 1047kms with one liquid hydrogen full tank.

John Macdougall | Afp | Getty Images

The adjudication of the hydrogen tax credit has become about more than just the hydrogen tax credit, too. It could also set important precedents for how the government decides electricity used from the grid is really “clean.”

“The hydrogen debate is at its surface level about defining clean hydrogen production, but more fundamentally it’s about what an individual actor needs to do to credibly claim that their electricity consumption is clean,” Wilson Ricks, who works in Jenkins’ Zero-carbon Energy systems Research and Optimization research lab at Princeton, told CNBC.

“Hydrogen is the first time the US government has been forced to directly address the question of verifying clean electricity inputs, so whatever framework it endorses here could set a very strong example for other emissions accounting systems going forward,” Ricks said.

There’s a lot of money on the line and while the details of the debate get a bit wonky, the debate itself represents a larger and more ideological fault line about how the United States should built its clean economy: One side says we should focus on emissions reductions from the outset, while the other says the foundation should be built and scaled quickly and perfected later.

“We have now entered a new phase in the clean energy transition, whereby new solutions and operational paradigms are necessary to accommodate an increasingly renewable grid and catalyze decarbonization. The clean hydrogen tax credits are a major opportunity, and juncture, to start shaping that new phase in the right way,” Rachel Fakhry, the policy director for emerging technologies at the Natural Resources Defense Council, told CNBC.

How clean is ‘clean,’ and how is that decided?

In the energy business, people refer to hydrogen by an array of colors to as shorthand for how it was produced. The different methods produce varying amounts of CO2.

The amount of the hydrogen tax credit, which is available for 10 years, depends on the emissions generated in making hydrogen. If hydrogen is produced without releasing any carbon emissions, the tax credit is maxed out at $3 per kilogram of hydrogen. The tax credit scales down proportionally based on the quantity of emissions released.

One way of making hydrogen is with a process called electrolysis, when electricity is passed through a substance to force a chemical change — in this case, splitting H2O into hydrogen and oxygen. To make hydrogen with electrolysis, hydrogen producers may use electricity from the larger energy grid. The electricity on the grid comes from many sources, some clean, like a solar farm, and some dirty, like from a coal-fired plant. On the electric grid, all that electricity gets mixed together.

So the debate over the 45V tax credit has become acutely focused on accounting for how the electricity hydrogen producers use from the grid is accounted for. If the energy used to make hydrogen is not actually clean, then hydrogen is not really a climate solution.

Some hydrogen industry stakeholders want the Treasury to implement strict electricity accounting standards to maximize the likelihood that the tax credits only go to hydrogen that is produced with the least possible amount of emissions.

Others want the Treasury to implement very flexible standards so the hydrogen industry can grow as fast as possible as quickly as possible, then focus on emissions reduction once it’s scaled.

Energy used from the grid to power electrolysis to make clean, “green hydrogen” must meet three accounting standards in order to ensure that it is actually produced in a clean way, according to Jenkins from Princeton. These standards have become known as the “three pillars:”

- Additionality. The electricity has to come from newly-built sources of clean electricity, meaning it is additional clean energy being added to the grid for the purpose of making hydrogen.

- Regional deliverability. The clean electricity added to the grid has to be able to physically travel from the additional clean energy source to the electrolysis facility, meaning it is regionally deliverable electricity.

- Hourly matching. The additional and deliverable clean electricity that powers electrolyzers has to be accounted for on an hourly basis. If the electricity is accounted for on an annual basis, then electrolyzers used to generate hydrogen could be running when additional clean energy is not regionally available — when the wind isn’t blowing and the sun isn’t shining, for example. That means those electrolyzers could be powered by fossil fuels.

“We call these requirements ‘pillars’ because all three are structurally critical: remove any one and the whole ‘clean’ hydrogen house comes tumbling down,” Jenkins told CNBC.

“Peer-reviewed modeling work by our group and follow-up studies by other academics have shown that simply plugging electrolyzers into the grid would produce hydrogen with embodied emissions twice as bad as ‘grey’ hydrogen produced from fossil methane. In fact, even an electrolyzer getting just 2% of its electricity from natural gas plants or less than 1% from coal would violate the strict statutory emissions requirements to claim the $3 per kilogram subsidy,” Jenkins said.

Taking sides

Some companies in the hydrogen industry, including electrolyzer producer Electric Hydrogen, clean energy company Intersect Power, industrial heat and power company Rondo, and grid carbon data provider Singularity have publicly pleaded for the Treasury to adopt these “three pillars” of strict electricity accounting for the 45V hydrogen tax credit.

Digital generated image of wind turbines, solar panels and Hydrogen containers standing on landscape against blue sky.

Andriy Onufriyenko | Moment | Getty Images

Air Products, an 80-year old company that sells gases and chemicals for industrial uses, also supports the three pillars of additionality, regional deliverability and hourly matching for the 45V tax credits. Air Products operates in about 50 countries around the globe, has over 200,000 customers, over 110 production facilities around the globe for hydrogen, and already has over 700 miles of dedicated hydrogen pipelines.

“We’ve been producing, distributing, dispensing hydrogen for over 60 years,” Eric Guter, a vice president of hydrogen production at Air Products, told CNBC in a video interview at the end of August.

“If we don’t deliver on the emissions reduction, we will lose the confidence of society in hydrogen and the energy transition. And as a long-term provider of hydrogen, it’s important to us that we get it right and preserve the integrity of the energy transition and the hydrogen industry.”

Josef Kallo, founder and chief executive officer of H2FLY, beside the HY4 liquid hydrogen powered electric aircraft at Maribor airport in Slovenia, on Thursday, Sept. 7, 2023. The aircraft, developed by H2FLY and partners, uses liquid hydrogen to power a hydrogen-electric fuel cell system.

Bloomberg | Bloomberg | Getty Images

Air Products already has two projects under construction that will be compliant with the three-pillars approach. Air Products is part owner of the NEOM Green Hydrogen Company, which is currently building a plant at Oxagon, Saudi Arabia, and which will be three pillars complaint. It’s also part owner of a mega-scale renewable-power-to-hydrogen project in Wilbarger County, Texas.

The European Union will need to import hydrogen, and has already decided to institute the “three pillars” in its hydrogen accounting, Guter told CNBC. So Air Products wants hydrogen produced in the United States to meet international standards.

“Otherwise our products won’t qualify or they will be taxed at the EU border for imports,” Guter said. “We’re talking about a global liftoff, not just U.S. liftoff, of the hydrogen market.”

On the other side of the debate, utility company and energy giant NextEra wants the Treasury to accept annual — as opposed to hourly — matching RECs as sufficiently specific.

“Starting with annual matching would boost green hydrogen investment and lead to greater overall decarbonization potential, allowing the industry to develop the first wave of hydrogen projects and build industry knowledge. If an hourly matching is enacted too early, it will limit U.S. green hydrogen investment, production and the country’s ability to lower emissions, and stifle innovation,” Phil Musser, vice president of federal government affairs at NextEra Energy, told CNBC in a written statement from.

So, too, does the Clean Hydrogen Future Coalition, which is a trade group representing a diversity of stakeholders from BP to Duke Energy, Exxon Mobile, General Electric, Siemens Energy, American Clean Power, Shell and more. The Clean Hydrogen Future Coalition also says that no additionality should be required for companies looking to produce clean hydrogen, meaning companies do not have to be responsible for putting “additional” clean energy on the grid to get access to the tax credit.

“We’re not suggesting that we should do this indefinitely,” Shannon Angielski, president of the Clean Hydrogen Future Coalition, told CNBC in a video interview at the end of August. “Rather, let the industry start to make investments in that full ecosystem, send signals throughout that supply chain to make investments, and enable an industry to get seeded with the tax credits, and then over time, become more restrictive.”

The Clean Hydrogen Future Coalition proposes becoming more restrictive in those electricity accounting standards starting in 2030. The electricity accounting systems for monitoring electricity usage on a more granular level is not robust and standardized enough on a federal level, Angielski said, for hourly matching electricity accounting to be required.

But technology does exist to allow hourly matching, Wenbo Shi, the CEO of Singularity, told CNBC. His company makes that technology.

“Hourly and even sub-hourly clean energy matching is not only technologically feasible, but it is already being implemented and used by many. The barrier to adoption is not technology, but policy,” Shi told CNBC.

There are also barriers to getting additional sources of clean energy on the electric grid, Angielski told CNBC. For example, interconnection queues, which are the lines power generators have to wait on to apply to get new sources of clean energy connected to the grid, are years long and make the additionality requirement a barrier for the hydrogen industry.

“What we don’t want to do is wait to be able to actually start investing in low-carbon hydrogen,” Angielski said.

But Ricks doesn’t think there needs to be such a rush.

“The ‘order of operations’ for the energy transition has always been a subject of debate in the policy world: should we use our resources to push rapid near-term decarbonization, or instead support scale-up of nascent technologies that we think we’ll need in the future? Supporters of lax rules for hydrogen subsidies have sought to frame the debate in this way, but in this case it is a false choice,” Ricks told CNBC. “The hydrogen subsidies are large enough to support scale-up even with strict rules, and the absence of these rules would likely drive significant excess emissions for decades — hardly a near-term impact.”

Fakhry from the NRDC says it’s very possible that the IRA is going to incentivize more hydrogen than needed for the clean energy transition, especially depending on how the Treasury dictates the rules.

“It’s really hard to say if there will be excess or not. What we can say for sure is if the rules are very, very lax and hydrogen production can happen anywhere without any guardrails, then yes, we will have a lot of hydrogen production that will go to fairly bad end uses,” Fakhry told CNBC.

Is the Prime Visa right for you?

Getty Images

Question: What’s the best card for spending a ton of money on Amazon? I spend thousands of dollars every month on Amazon, and I’m not currently getting any rewards. But it’s where I spend the majority of my money and I feel like I’m missing an opportunity to earn rewards on all the money I spend there.

Answer: If you pay your bill in full and on time — and shop a lot at Amazon or Whole Foods — the Prime Visa could prove lucrative for you. That’s because the cash-back perks for those shoppers are pretty great. Here’s what the card offers:

- Earn 5% cash back on items bought at Amazon.com, Amazon Fresh and Whole Foods, with an eligible Prime membership.

- Earn ecent cash back on other purchases: 2% back at restaurants, gas stations, and commuting/local transit, which includes ride-sharing; and 1% back on all other purchases.

- You may be eligible for a $100 Amazon gift card instantly upon approval, if you have a Prime membership .

- There is no annual fee or foreign transaction fees.

Both Ted Rossman, senior industry analyst at CreditCards.com and Matt Schulz, credit card expert at LendingTree, say the Prime Visa is very worth it for Amazon loyalists. Indeed, Schulz says that while most retail credit cards are generally best avoided, he doesn’t feel that way about the co-branded Amazon card. “This Amazon card is one of the very few exceptions and there’s a $100 signup bonus that’s available immediately after you’re approved for the card,” says Schulz.

Have a credit card question? Email us at picks@marketwatch.com.

MarketWatch Picks managing editor Catey Hill has the Prime Visa — but just uses it for Amazon and Whole Foods purchases because of the high cash back at those spots. Other cards have higher cash-back offers for other types of items.

What might those Prime Visa rewards look like? If you spend $1,000 per month on Whole Foods, Amazon.com and/or Amazon Fresh, you’d earn $600 back over a year. If you spend $500 monthly, you’d earn $300 annually. And that doesn’t include rewards of 2% cash back that you will get on restaurants, gas stations, and drugstores that could also top $1000 a year.

There are, of course, catches: This card works best for frequent Amazon and Whole Foods shoppers, and those that pay their credit card bills in full and on time. You’ll have to pay high interest if you don’t.

And you will need to be an Amazon Prime member, which costs $139 a year, to fully reap the rewards. And Nick Ewen, director of content at The Points Guy, says this card works best if you’re already a Prime member. This story can help you figure out if an Amazon Prime membership is worth it for you.

If you’re not an Amazon Prime member or you don’t spend a significant amount of money through Amazon or Whole Foods, you might be better off with a card that offers points or cash back through a different retailer or with more generalized rewards. Anyone with less-than-good credit should also look for an alternative card as interest rates for those with good credit tend to be on the high side for this card.

Have a credit card question? Email us at picks@marketwatch.com.

The content on this page is accurate as of the posting date; however, some of our partner offers may have expired.

The advice, recommendations or rankings expressed in this article are those of MarketWatch Picks, and have not been reviewed or endorsed by our commercial partners.