The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

Source link

criticizes

Former SEC chief criticizes NBA handling of controversial crypto partnerships

The National Basketball Association (NBA) should be held responsible for the alleged misconduct of its teams, according to a former official of the US Securities and Exchange Commission (SEC).

On Feb. 6, a proposed class-action lawsuit was filed against the sports organization concerning its marketing partnerships with the defunct crypto lender Voyager Digital.

The lawsuit asserts that the NBA demonstrated “gross negligence” by endorsing Voyager’s promotional agreement with the Dallas Mavericks. It further contends that the NBA should be accountable for approving Voyager’s unregistered securities.

Additionally, the plaintiffs argue that the NBA knowingly embraced the risks associated with collaborating with crypto entities like Voyager, Coinbase, and FTX.

They claim the NBA accepted “billions in promotional compensation” amidst challenges such as dwindling arena attendance and substantial television revenue losses due to the COVID-19 pandemic.

“The NBA violated their own written Crypto Currency Protocols, all solely for its own financial gain,” the lawsuit stated.

Former SEC official makes case against NBA.

A former SEC official argued that the NBA should be made to pay if it is complicit.

John Reed Stark, the former SEC Chief of Internet Enforcement, said:

“The NBA should be held responsible for Voyager-related and other similar kinds of alleged misconduct by NBA teams.”

Stark highlighted that the NBA, being a globally renowned and financially influential entity, likely exercises some degree of oversight on how its teams engage investors and navigate risky investments.

Therefore, the organization has to justify its actions or inactions, particularly as its teams continue to promote precarious NFT ventures, questionable crypto platforms, and other financially perilous investments.

The NBA has yet to respond to CryptoSlate’s request for comment as of press time.

While Stark suggested potential refunds for affected investors if NBA complicity in the Voyager matter is confirmed, he also emphasized the need for the NBA to establish a robust compliance framework for team advertising partnerships. Such measures, he argued, would prevent associations with questionable crypto firms and illicit businesses like heroin manufacturers.

Prominent crypto lawyer criticizes SEC overreach in Ripple lawsuit, advocates for financial freedom

John Deaton, a well-known crypto lawyer, said that regulatory actions against the crypto industry point to a significant government overreach and intrusion into the private sector.

Deaton made the statement on social media on Jan. 22, where he specifically called out the actions of various federal agencies, including the SEC, FBI, EPA, and the Federal Reserve — likening their operations to an Orwellian ‘Big Brother’ scenario.

His comments reflect a growing sentiment within the cryptocurrency community about the balance between regulation and financial liberty.

Ripple lawsuit

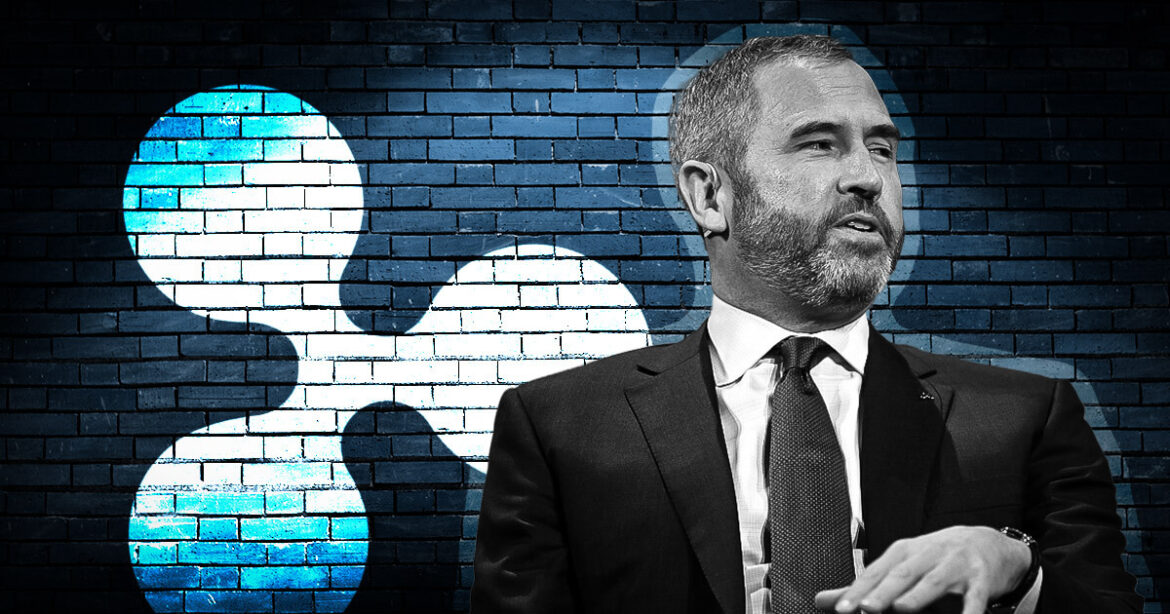

Deaton’s criticism was particularly pointed towards the SEC’s lawsuit against Ripple Labs Inc., CEO Brad Garlinghouse, and co-founder Chris Larsen. Initiated in December 2020, the lawsuit accused Ripple of conducting an unregistered securities offering through the sale of XRP.

He criticized the SEC’s broad classification of XRP tokens as illegal securities, suggesting it was an unconstitutional expansion of the watchdog’s authority. Deaton added that the dismissal of charges against Brad Garlinghouse and Chris Larsen demonstrates the regulator’s misuse of its power.

Deaton also pointed out that before the lawsuit, major players like Coinbase and MoneyGram had conducted due diligence on XRP without any objections from the SEC, which indicates a lack of clarity and consistency in the regulator’s approach toward cryptocurrencies.

The recent developments in the case bolster his argument. Judge Analisa Torres partially ruled in favor of Ripple Labs, determining that XRP sales on digital asset exchanges do not constitute a security.

Deaton has suggested that the lawsuit was used as a weapon against Ripple, a stance he has maintained since filing a Writ of Mandamus against the SEC shortly after the lawsuit was announced.

Attack on financial freedom

Deaton, who has initiated legal action against the SEC on behalf of XRP investors, users, and developers, explained that his lawsuit was motivated by the broader implications of the SEC’s actions rather than personal financial interest.

He stated that his holdings in XRP are minimal compared to other investments like Bitcoin and Ethereum. For Deaton and 75,000 others, the lawsuit represents an assault on a crucial liberty: financial freedom. He argued that in America, people should have the autonomy to own legal assets beneficial to their lives without government interference.

The attorney also criticized the Accredited Investor Rule, viewing it as a tool for the elite to restrict financial mobility for the majority of the population. He said the rule is a mechanism to maintain dependency on the government and restrict access to financial opportunities.

Garlinghouse emphasized the need for the SEC to reassess its regulatory approach, moving away from a pattern of enforcement through lawsuits.

During the just-concluded Ripple’s Swell conference in Dubai, the company’s CEO Brad Garlinghouse shared his views regarding the United States Securities and Exchange Commission’s (SEC) role in protecting consumers against bad actors.

In an interview with CNBC’s Dan Murphy, Garlinghouse stated that, in his opinion, the SEC has strayed from its commitment to investor protection, questioning the agency’s priorities in the process.

“I think the SEC, in my opinion, has lost sight of their mission to protect investors. And the question is, who are they protecting in this journey?” Garlinghouse told CNBC.

Ripple’s Win Is a Positive Step for the Industry

Garlinghouse’s opinion stemmed from the SEC’s enforcement actions against the crypto industry, as the agency has chosen a litigious approach to regulating the emerging economy instead of working with Congress to introduce befitting regulations for the crypto space.

In 2020, the financial watchdog sued Ripple alongside two executives, including the CEO, for orchestrating a $1.3 billion securities fraud by selling XRP to retail investors in the US.

The lawsuit centered around Ripple’s failure to register the continuous sale of XRP tokens, leaving investors without essential information about the digital asset and Ripple’s business activities.

After over two years of court battles between the SEC and Ripple, US District Judge Analisa Torres in Manhattan finally ruled in July that XRP is not a security and possesses no qualities of a security token.

The SEC’s request for an interlocutory appeal was subsequently denied, and in October, the agency dropped securities law violation charges against Garlinghouse and another Ripple executive, Chris Larsen.

Garlinghouse, reflecting on the developments, expressed optimism not only for Ripple but for the entire industry. He sees the SEC being put in check as a positive step, hoping it will pave the way for the crypto industry to flourish in the United States.

“I think it is a positive step for the industry, not just for Ripple, not just for Chris and Brad, but for the whole industry, that the SEC has been put in check in the United States. And I’m hopeful this will be a thawing of the permafrost in the United States for really seeing an amazing industry that has immense potential to thrive in the largest economy in the world,” Garlinghouse told CNBC.

Ripple to Hire 80% of Employees Outside the US

In criticizing the SEC’s regulatory strategy, Garlinghouse drew parallels with other legal battles in the industry. The Ripple CEO referenced Grayscale’s victory regarding a Bitcoin exchange-traded fund (ETF), where a federal judge accused the SEC of being “arbitrary and capricious.”

Garlinghouse emphasized the need for the SEC to reassess its regulatory approach, moving away from a pattern of enforcement through lawsuits.

“Generally, judges tend to be pretty down the middle and try not to be dramatic — those are damning words. So I think at some point the SEC has to step back and realize that their regulatory approach through enforcement, let’s bring lawsuits, has to break,” said he.

Garlinghouse, influenced by the SEC’s regulatory style against the industry, asserted that Ripple had redirected its recruitment focus to other jurisdictions.

During a September interview at the Token2049 conference in Singapore, he outlined the company’s strategy to recruit 80% of its workforce from countries he deemed more proficient in crypto regulation.

Expressing his dissatisfaction, Garlinghouse pointed out the contrast in markets like Singapore, where governments collaborate with the industry, provide explicit regulations, and witness substantial growth.

“It’s super frustrating to see markets like we have here in Singapore … where the governments are partnering with the industry, and you’re seeing leadership providing clear rules and growth. And frankly, that’s why Ripple is hiring there,” explained the CEO.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

Ripple CEO criticizes SEC for stifling crypto innovation with aggressive enforcement

Ripple CEO Brad Garlinghouse said the U.S. SEC’s actions toward the crypto industry have failed in protecting investors and needs to reassess its regulatory strategy.

Speaking to CNBC’s Dan Murphy at the Ripple Swell conference in Dubai, Garlinghouse expressed concern about the SEC’s focus and questioned:

“Who are they protecting in this journey?”

The CEO said the watchdog’s enforcement approach to regulating the crypto industry has only stifled growth. He added that the industry needs a new tailor-made regulatory framework that properly considers the nuances of digital assets.

Court ruling against SEC

The criticism comes after a multi-year legal battle between Ripple and the SEC, which accused the blockchain company and its executives of conducting a $1.3 billion securities fraud by selling XRP to retail investors.

However, in a pivotal victory for Ripple in July, a judge ruled that XRP is not a security, marking a significant development in the ongoing case.

The CEO also referenced a recent victory for Grayscale, a digital asset manager, in the context of a Bitcoin ETF application. He highlighted that the federal judge presiding over the case had criticized the watchdog for being “arbitrary and capricious.”

According to Garlinghouse:

“Generally, judges tend to be pretty down the middle and try to not be dramatic — those are damning words.”

Garlinghouse said that the watchdog may finally reassess its regulatory strategy as the enforcement approach of only filing lawsuits has not worked in its favor and only led to stifling innovation in the U.S.

Federal laws needed

Garlinghouse expressed hope that the regulatory stance toward the digital assets industry will shift to a more positive note following these legal developments. He said the government needs to take a more proactive approach toward supervising the industry, starting with new digital asset laws.

He added that the U.S. must move beyond a situation where crypto regulation is determined through litigation if the industry is to thrive in the country. He called for the introduction of federal laws governing digital currencies by Congress, emphasizing the need to break away from the current regulation pattern through enforcement.

Garlinghouse reiterated that XRP should not be considered a security, emphasizing that federal laws could provide clarity and stability for the industry.

As the legal battle continues, the next key step in the Ripple-SEC case is the remedies discovery process, with the SEC having 90 days from Nov. 9 to conduct related discovery, according to a proposed schedule.

‘Ouch. You’ve screwed yourself. You’ve Really Made Yourself A Mess’ – Dave Ramsey Criticizes Caller For This Common Homebuying Mistake

In a recent episode of “The Ramsey Show,” renowned radio host and personal finance expert Dave Ramsey delivered a straightforward message to a young woman from Orlando, Florida. Ramsey bluntly stated, “Ouch. You’ve screwed yourself. You’ve really made yourself a mess.”

This response came after the woman, identified as 28-year-old Selena, shared her recent financial decision to withdraw $26,000 from her 403(b) retirement account to fund a down payment for home construction, with the intention of accommodating her growing family’s needs.

Ramsey’s reaction was laced with skepticism as he said, “I’m scared for you. I hope you get out of it with your skin intact, but I’m not positive you’re going to.”

While his remarks may sound harsh, it’s a reminder that financial caution is nonnegotiable — particularly when it comes to securing a future. While he advises protecting hard-earned assets, ZenniHome offers an exciting prospect for those who wish to invest wisely. By harnessing innovative and sustainable practices, ZenniHome is revolutionizing the housing market and providing avenues for smart investors to be part of this transformative journey.

Don’t Miss:

Selena and her husband had a combined household income of approximately $155,000. Recently, they welcomed a new baby into their family and faced a pressing need for more living space. While they had a home they intended to sell, the urgency of their situation prompted Selena to withdraw funds from her retirement account for a down payment on a new home. Seeking guidance on how to recover from this financial setback and looking for a set of gradual steps to take, Selena called Ramsey for advice.

Ramsey explained a critical time frame for Selena’s situation: If she didn’t replenish her retirement account within 60 days, she would face significant financial penalties, including the 10% early withdrawal fee and what he referred to as the “take rate.” That would result in a total loss of 40% of the withdrawn funds, equivalent to approximately $12,000 that would go to the government. Ramsey emphasized the importance of acting swiftly to avoid this substantial financial hit.

It’s important to highlight that Ramsey, despite his expertise in personal finance, is not a qualified tax professional. He directed Selena to seek advice from investment advisers through his website. Yet, people facing similar predicaments might consider consulting a certified public accountant or tax attorney for more comprehensive guidance.

What led to Selena’s financial predicament, according to Ramsey? He pinpointed several pivotal issues:

Impulse buying: Ramsey criticized Selena for impulsively tapping into her 403(b) retirement funds to finance her new home before selling her current one. He cautioned that surging interest rates could create a challenging selling market, potentially leaving Selena with two mortgage payments. Ramsey recommended a more cautious approach: selling her existing home first and temporarily residing in an apartment while transitioning to her next property. In Ramsey’s estimation, the retirement withdrawal was akin to taking out a loan with an astronomical 40% interest rate. He further indicated that Selena should anticipate a significant tax bill, amounting to approximately $12,000.

Tax implications: Ramsey briefly discussed the tax consequences of Selena’s decision, including a 10% early withdrawal penalty and income taxes levied on the withdrawn amount. He did not delve into potential exceptions to the 10% penalty or the impact of the standard deduction for married couples filing jointly, factors that could considerably influence Selena’s tax liability.

Fundamental rule: Ramsey underscored a fundamental financial guideline — retirement funds should exclusively serve retirement purposes. He cautioned that straying from this principle would result in substantial penalties.

Ramsey’s primary counsel to Selena centered on mitigating impending tax penalties by replenishing her 403(b) account. He advised Selena to explore all feasible sources of cash, including her daughter’s 529 education savings account, to restore the depleted funds.

Ramsey did not provide a clear resolution for covering Selena’s down payment once her 403(b) account was restored.

Ramsey’s guidance to Selena boils down to a fundamental financial principle: Stop buying things you can’t afford and buying them out of order.

See more on startup investing from Benzinga:

Don’t miss real-time alerts on your stocks – join Benzinga Pro for free! Try the tool that will help you invest smarter, faster, and better.

This article ‘Ouch. You’ve screwed yourself. You’ve Really Made Yourself A Mess’ – Dave Ramsey Criticizes Caller For This Common Homebuying Mistake originally appeared on Benzinga.com

.

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rep. Maxine Waters criticizes PayPal’s stablecoin, demands regulation on par with financial institutions

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.