Around 70% to 80% of transactions in the crypto secondary market transactions occur between crypto assets and stablecoins. The South Korean government’s welcoming stance, coupled with the high popularity of crypto assets in the country, are among the reasons why the won is now the second most-used fiat currency. Decline in 2021/2 Crypto-to-Stablecoin Volumes According […]

Around 70% to 80% of transactions in the crypto secondary market transactions occur between crypto assets and stablecoins. The South Korean government’s welcoming stance, coupled with the high popularity of crypto assets in the country, are among the reasons why the won is now the second most-used fiat currency. Decline in 2021/2 Crypto-to-Stablecoin Volumes According […]

Source link

crypto

Bitcoin, Altcoins Price Decline As Crypto Liquidations Approaches $900 Million In The Past Day

The crypto market took an unexpected hit on April 12 as a spontaneous decline in the price of Bitcoin and prominent altcoins resulted in massive liquidations. The origin of this widespread price dip remains largely unknown, among a plethora of plausible reasons, including a recent price correction in the US stock markets.

Almost $500 Million Liquidated In An Hour Amidst Crypto Flash Crash

According to data from CoinMarketCap, Bitcoin slipped by 4.49% in the last day, falling as low as $66,052. As expected, BTC’s decline reverberated through the market, with prominent altcoins Ethereum and Solana recording daily losses to the tune of 8.12% and 12.16%, respectively

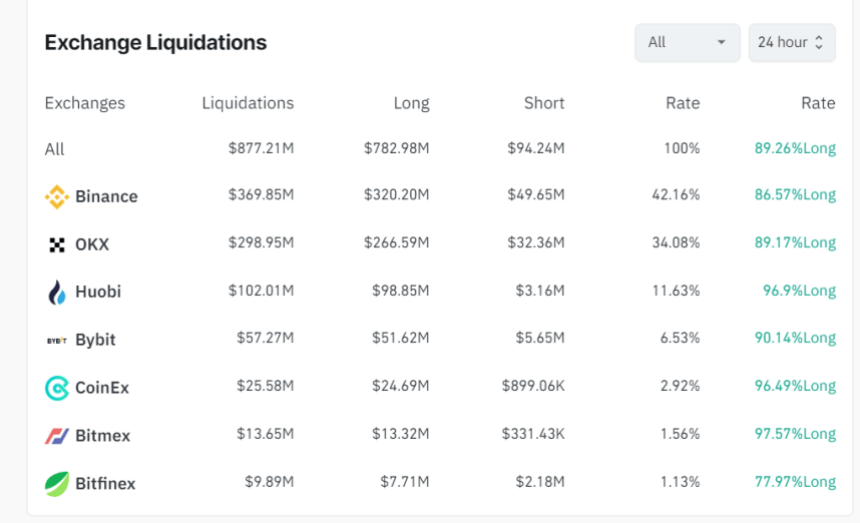

As earlier stated, these losses translated into 277,843 traders losing their leverage positions as total crypto liquidations reached $877.21 million in the last 24 hours based on data from Coinglass. Of these figures, long positions accounted for $782.98 million, with short traders losing only $94.24 million.

Notably, $467 million in leverage positions were closed within an hour as a result of a general price decline. The highest amount of liquidations at $369.85 million was recorded on Binance, while the single largest liquidation order valued at $7.19 million occurred in the ETH-USD market on the OKX exchange.

Source: Coinglass

Source: Coinglass

Interestingly, Bitcoin’s price decline correlated with a dip in the US stock market as the S&P 500 index declined by 1.6% to trade as low as $5,108. This market crash was preceded by recent CPI data, which showed that the inflation rate rose to 3.5% year over year in March.

Such reports only indicate that the US Federal Reserve (Fed) could not be implementing any rate cuts soon as it aims to force inflation down to its annual target of 2%. This prediction is quite bearish for the crypto market generally as Fed rate cuts allow investors to comfortably seek risky assets such as BTC with a potential of high yields.

Bitcoin Experiences Network Growth As Halving Approaches

On a more positive note, Bitcoin has recorded a rise in non-empty wallets on its network ahead of the Halving event on April 19. Blockchain analytics platform Santiment reported an increase of 370,000 BTC wallets holding active coins over the last six days. Interestingly, the analytic team is backing investors to maintain this accumulative trend all through the Bitcoin halving event.

At the time of writing, Bitcoin was trading at $66,882, with a 44.80% increase in its daily trading volume, which is currently valued at $43.80 billion. However, Bitcoin’s price has generally been unimpressive in recent times, with a decline of 1.33% and 6.20% in the last seven and 30 days, respectively.

Bitcoin trading at $66,499.00 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Bitcoin trading at $66,499.00 on the daily chart | Source: BTCUSDT chart on Tradingview.com

Featured image from The Independent, chart from Tradingview

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Paraguayan Senate Supports Selling Power to Crypto Mining Companies, Criticizes Subpar Energy Agreements With Brazil

The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

The Paraguayan Senate has approved a resolution supporting selling the country’s energy surplus to crypto mining companies, given the price and guarantees that these institutions offer. The declaration criticizes the subpar agreements that sell energy to Brazil for 25% of the fees collected for mining activities, calling to direct this energy to 20 new contracts […]

Source link

Deutsche Bank Survey: Over Half Expect Crypto to Become ‘Important’ Asset Class and Payment Method

A new Deutsche Bank survey found that over half of respondents expect cryptocurrencies to become an important asset class and a method of payment. In addition, 10% of respondents expect the price of bitcoin to be above $75,000 by year-end. Deutsche Bank’s Crypto Survey A recent Deutsche Bank survey of over 3,600 consumers, published this […]

A new Deutsche Bank survey found that over half of respondents expect cryptocurrencies to become an important asset class and a method of payment. In addition, 10% of respondents expect the price of bitcoin to be above $75,000 by year-end. Deutsche Bank’s Crypto Survey A recent Deutsche Bank survey of over 3,600 consumers, published this […]

Source link

Top IRS official says ‘pure crypto tax crimes’ on the rise alongside scams

IRS criminal investigation chief Guy Ficco told CNBC on April 12 that taxpayers are increasingly committing tax crimes involving crypto.

Ficco said the IRS has seen an increase in “pure crypto tax crimes” that fall under Title 26 of the US Code, which includes federal income tax violations.

Crimes considered pure tax crimes involve failing to report income from crypto sales and hiding or shielding one’s actual basis in crypto.

The issue will likely persist. Ficco observed an “uptick” in tax-reporting crimes and expects the IRS to bring forward more charges this year and in the future.

Until recently, IRS investigations have primarily been a part of broader investigations into crypto crimes such as scams and embezzlement.

Ficco acknowledged that crypto is “becoming more pervasive” and will “maintain or probably have a larger part” in broader crimes such as phone scams, romance scams, and pig butchering. Crypto scams are distinct from tax-reporting crimes.

Reporting failures widespread

Ficco’s comments come after the IRS published a reminder that individuals must report taxes if they sold crypto, received crypto as payment, or engaged in other crypto transactions.

The IRS has included some form of tax reporting rules for crypto investors since at least 2014, but past reports suggest that reporting failures remain high.

A 2023 report from Divly found that in the US, just 1.62% of investors paid taxes on crypto as required. The US rate is only slightly above the global average of 0.53%.

IRS enforcement efforts around crypto could become especially strong starting this year. In February, the agency hired two experts to focus on crypto, and past reports from CNBC suggest that tax professionals are preparing for a “tidal wave” of scrutiny.

Ficco’s predecessor, Jim Lee, also suggested an increased focus on tax issues in December 2023. Lee said half of 2023’s then-active crypto investigations involved tax issues.

The post Top IRS official says ‘pure crypto tax crimes’ on the rise alongside scams appeared first on CryptoSlate.

The price of Cardano (ADA) has experienced a decline in recent weeks. Following a peak at a 23-month high at $0.808 on March 11, the price of ADA has fallen by over 28%, and it is now hovering just below the $0.60 level. Notably, Cardano has underperformed compared to its competitors, slipping to the 10th position among the largest cryptocurrencies by market cap.

However, a crypto analyst, known as Trend Rider (@TrendRidersTR) on X, has declared that ADA is showing clear signs of a bull run based on technical analysis of its Relative Strength Index (RSI) and Simple Moving Average (SMA) crossovers.

What This Means For Cardano Price

According to Trend Rider’s recent post on X, Cardano’s current market behavior mirrors a rare pattern in the one month chart (ADA/USD) observed only once before, which led to a significant price surge from $0.05 to $3.00.

The analyst emphasized, “ADA’s undeniable bull run is here. With its second RSI crossover in history, it’s reminiscent of when prices soared from $0.05 to $3. This rare event, marking a potential trend shift as the RSI crosses its SMA, has flawlessly predicted past cycles shifts at it’s early stages.”

The analysis presented by Trend Rider focuses on the RSI, a momentum oscillator that measures the speed and change of price movements, and its crossover with the SMA, a common trading signal interpreted as a potential bullish or bearish market indicator.

The post details three critical phases in Cardano’s recent market activity. The first crossover occurred shortly after the COVID-19 pandemic onset when ADA traded at $0.19, marked by a substantial price increase following the crossover event.

At the end of the 2021 bull run, a bearish crossover took place that heralded a prolonged bear market. “Notice how perfect the bearish crossover anticipated the bear market. This is an extremely strong validation for this indicator. Making it very relevant to predict ADA long term cycles,” the analyst states.

The second bullish crossover of the RSI with the SMA occurred in October and November 2023, this event was initially met with market rejection a few months earlier, adding credibility to the indicator’s reliability in predicting long-term market trends.

Trend Rider concludes, “The RSI and its SMA crossovers are an extremely reliable source to identify ADA bull runs and bear markets at its early stages.” This analysis suggests that Cardano is currently entering a bull market phase, reinforcing the optimistic outlook for ADA.

Moreover, the analyst warned the one-month chart reflects a macro perspective for holders, “each candle represents one month, so you can expect huge volatility within each candle.” Furthermore, he cautioned of the inherent risks in crypto investments, noting the importance of a personalized investment strategy to navigate potential market volatility and unforeseen events, often referred to as ‘black swan’ events.

“VERY IMPORTANT: Personally, these macro charts help me see the bigger picture, but I always use my own process to secure profits and protect myself from any black swan event,” Trend Rider added.

If history is any indicator, the current patterns could spell a lucrative phase for Cardano holders, but as always in crypto markets, caution remains a critical companion to enthusiasm.

Featured image from Biztech Africa, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Experts Predict Massive Price Surge For XRP Price, Is $20 Possible?

Crypto experts continue to be bullish on the XRP price despite the poor performance that the altcoin has exhibited in recent times. Some of these experts see the cryptocurrency’s price rising higher from its current level, with one analyst expecting XRP to rise as high as $20 in the coming bull market.

XRP Price On The Verge Of Breakout

One of the crypto experts that has shown incredibly bullish sentiment toward the XRP price is Matthew Dixon, the CEO of crypto rating platform, Evai. Dixon took to X (formerly Twitter) to share with the crypto community that the XRP trading volume had been seeing positive headwinds in recent times.

At the time, the Evai chart shared by the the crypto CEO showed that XRP had recorded an approximately 42% increase in its daily trading volume to cross $2.1 billion. Using this increase in trading volume, Dixon believes that it shows the rising interest in the altcoin.

Naturally, increased interest often translates to increased demand, which can be bullish for a cryptocurrency’s price. This was the thought shared by the Evai CEO who believed the surge in trading volume and interest meant that the XRP price was on the verge of a breakout.

However, this does not seem to be the case, at least in the short term, since the XRP price continues to trend around the same level since Dixon first made the post. It is hovering around $0.61 at the time of this writing, with a0.96% gain in the last 24 hours.

Can Price Get To $20?

Predictions for the XRP price going into the next bull market have had a wide variety, from very conservative to very ambitious. For many, though, the expectation is that the XRP price will rise very quickly as regulatory clarity from the Ripple vs SEC case is fast approaching.

Crypto analyst Armando Patoja takes the ambitious route with his own prediction, forecasting an over 3,000% price increase for XRP. According to Patoja, the predictions that put XRP’s future price at $5 severely underestimate the ability of the altcoin.

On his own, the crypto analyst believes that the XRP price has the potential to rise even further to reach between $10 to $20. Patoja posits that saying XRP will reach just $5 is like expecting Bitcoin to top out at $1,000 in 2015.

There people saying #XRP will reach $5 are significantly underestimating.

This is similar to predicting #Bitcoin would cap at $1,000 in 2015. XRP is on a trajectory akin to Bitcoin’s in 2015, with a rapidly growing network effect.$XRP prediction: $10-$20. Thoughts?

— Armando Pantoja (@_TallGuyTycoon) April 6, 2024

Despite the growing XRP community, it is no doubt that Patoja’s prediction has been received with a grain of salt. One community member responded to the post saying XRP could not possibly rise that high because major projects who were building on the XRP Ledger have been abandoning it for other chains because it is a dead chain. Due to the lack of builders, they do not believe that XRP has the steam to run that high.

XRP trading at $0.61 | Source: XRPUSDT on Tradingview.com

Featured image from Watcher Guru, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

GOP says Biden administration is using crypto as a ‘scapegoat’ for foreign-policy failures

The digital-asset industry and its allies in Congress on Tuesday criticized the Biden administration for blaming cryptocurrency for its failures to prevent the flow of funds to foreign adversaries supporting terrorism, drug trafficking and other illegal activities.

Source link

In a detailed analysis shared on X, Miles Deutscher, a renowned crypto analyst, cast a spotlight on the burgeoning sector of Real World Assets (RWA) within the crypto market. Deutscher’s discourse comes in the wake of BlackRock’s groundbreaking venture into tokenized funds, signaling a seismic shift in the digital asset landscape.

With projections indicating that tokenized assets are poised to reach a valuation of $10 trillion by 2030, Deutscher’s enthusiasm is palpable. “If you’re still sleeping on this sector, now is the time to wake up,” he declares, laying the groundwork for a deep dive into RWAs and their associated investment opportunities.

The Genesis And Essence Of Real World Assets (RWA)

Real World Assets (RWA) serve to bridge the tangible with the digital, tokenizing physical commodities such as gold, real estate, and various other commodities, thereby enhancing their efficiency and accessibility. This digitization process eliminates the need for traditional brokers, reduces entry barriers, and significantly cuts down on associated costs.

“RWAs represent a revolutionary step forward in democratizing access to investment in major assets,” Deutscher asserts. He further explains that RWAs not only unlock vast markets for participation—such as global bonds and gold—but also integrate real-world, income-generating assets into the DeFi yield ecosystem.

At their core, RWAs embody ownership rights over physical assets through the digital tokenization on blockchain platforms. Through smart contracts, issuers can mint these tokens, defining their value and the mechanics of their trade. This innovative approach has seen the market capitalization of tokenized public securities surpass $700 million, with the tokenized gold market nearing a $1 billion valuation, according to a report by Bank of America.

This growing demand underscores the sector’s potential, significantly buoyed by BlackRock’s recent foray into RWA with its digital asset fund focused on bonds. Within a mere fortnight, this fund ballooned to a $274 million market cap, capturing a 37.53% market share.

BlackRock’s pivot towards RWAs is not an isolated trend but a bellwether for the industry’s trajectory. “Larry Fink’s bullish stance on tokenization heralds a new era for securities,” Deutscher notes, highlighting the BlackRock CEO’s long-maintained belief in the transformative power of tokenization.

This movement is gaining momentum, with heavyweight TradFi players such as Citi, Franklin Templeton, and JPMorgan exploring RWA avenues. “The convergence of traditional finance and blockchain through RWAs is a testament to the sector’s viability and growth potential,” Deutscher adds, underlining the legitimization of RWAs by these financial titans.

Deutscher’s Curated List Of Top RWA Altcoins

Delving deeper into the specifics, Deutscher categorizes his top picks within the RWA ecosystem:

Layer 1 and Layer 2 Blockchains: Highlighting the significance of foundational blockchain platforms, Deutscher points to L1 and L2 chains that are pivotal in hosting RWA protocols. He emphasizes the strategic advantage of these chains in attracting liquidity and users, albeit noting the nuanced investment approach needed to maximize RWA-specific gains.

“Hyped narratives often drive a lot of liquidity and users to the main chain that powers the underlying dApp. […] The issue with this style of investing, despite its ability to hedge against downside, is the lack of direct upside. If you want capture more RWA-specific upside, RWA-focused chains like Redbelly Network & MANTRA offer more direct exposure,” Deutscher argues.

Oracles as the Backbone of RWA Tokenization: Oracles play a crucial role in ensuring the accurate reflection of real-world asset values on the blockchain. Deutscher is particularly bullish on Chainlink (LINK), citing its foundational role in secure, cross-chain information bridging. “Chainlink is indispensable for the RWA sector, offering real-time data verification that’s critical for the integrity of tokenized assets,” he explains.

Moreover, the crypto analyst points to Pyth Network (PYTH) if investor want to “move further down the risk curve.” He added, “whilst Chainlink serves more broader sectors, Pyth is interesting as a DeFi-centric bet, due to its wide L1 compatibility.”

RWA-Specific Protocols: Projects like Ondo Finance, Pendle Finance, and Frax Finance are lauded by Deutscher for their direct engagement with RWAs, each offering unique solutions to leverage real-world assets within the DeFi space. Deutscher applauds Ondo Finance for addressing liquidity challenges, Pendle Finance for its innovative yield-tokenization approach, and Frax Finance for its multifaceted DeFi offerings that include traditional investment avenues.

Emerging Stars in the RWA Space: Deutscher also sheds light on upcoming projects like Lingo and Truflation, earmarking them as ones to watch. With Lingo’s unique model of funding RWA pools for brand partner rewards and Truflation’s infrastructure play in decentralizing economic data, these platforms are at the forefront of RWA innovation, according to him.

At press time, ONDO had a market capitalization of $1.12 billion and was the 94th largest cryptocurrency by market cap. The price stood at $0.80.

Featured image created DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Crypto Expert Reveals What To Expect For Bitcoin, Dogecoin, And XRP In 12-16 Months

Crypto expert Ash Crypto has outlined his price predictions for several crypto tokens, including Bitcoin (BTC), Dogecoin (DOGE), and XRP, heading into this bull run. He also suggested that these price levels could be attained in the next 12 to 16 months.

How High Will Bitcoin, Dogecoin, And XRP Rise?

Ash Crypto predicted in an X (formerly Twitter) that BTC would rise between $100,000 and $250,000 by 2025. This prediction aligns with those made by other notable crypto analysts. One of them is Skybridge Capital CEO Anthony Scaramucci, who predicted in January that Bitcoin would rise to $170,000 18 months after the Bitcoin Halving.

Source: X

Meanwhile, some other crypto analysts will argue that Bitcoin hitting $100,000 could even happen this year rather than 2025. This includes Tom Dunleavy, the Chief Investment Officer (CIO) at MV Capital, who claims that Bitcoin will rise to $100,000 by the end of this year. Tom Lee, Managing Partner and Head of Research at Fundstrat Global Advisors, also predicted that Bitcoin would rise to as high as $150,000 this year.

Regarding his price target for DOGE, Ash Crypto predicted that the meme coin would rise to $1 in the next 12 to 16 months. This prediction is also a common sentiment shared by several other crypto analysts and members of the crypto community. Specifically, crypto analyst DonAlt once mentioned that “it isn’t too unlikely for Dogecoin to go to $1,” while crypto analyst Altcoin Sherpa stated that DOGE could do “something silly like go to $1 this cycle eventually.”

Ash Crypto also shared his price target for XRP, stating that the crypto token could rise between $3 and $5. This price prediction, however, seems conservative, considering other predictions that crypto analysts have made for the XRP token.

Crypto analyst CrediBULL Crypto recently mentioned that XRP could rise to as high as $20 in this market cycle. Meanwhile, Crypto analyst Egrag Crypto has repeatedly stated that XRP hitting $27 is possible.

Undervalued Altcoins Make The List

Crypto expert Michaël van de Poppe recently included Chainlink (LINK), Celestia (TIA), and Polkadot (DOT) in a list of ten crypto tokens he believes are undervalued. Interestingly, these three altcoins also made their way into Ash Crypto’s list of coins, for which he outlined price targets.

For LINK, Ash Crypto predicted that the crypto token could rise to between $250 and $500 by next year. LINK’s rise to such levels would undoubtedly be massive, considering it currently trades at around $17. Ash Crypto also predicted a parabolic surge in TIA and DOT’s prices, as he believes they could rise to as high as $150 and $120, respectively.

DOGE price rises above $0.2 resistance | Source: DOGEUSDT on Tradingview.com

Featured image from CoinGape, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.