Discussions about adjusting Ethereum’s issuance curve due to staking concentration and other factors are taking place on social media, with some developers in favor and some against this change. A recent article by Mike Neuder, an Ethereum Foundation researcher, highlights that Ethereum issuance should “preserve the viability and proportion of solo stakers.” Ethereum Issuance Curve […]

Discussions about adjusting Ethereum’s issuance curve due to staking concentration and other factors are taking place on social media, with some developers in favor and some against this change. A recent article by Mike Neuder, an Ethereum Foundation researcher, highlights that Ethereum issuance should “preserve the viability and proportion of solo stakers.” Ethereum Issuance Curve […]

Source link

crypto

Bitcoin Flash Crash Washes Out 81,000 Crypto Traders For Over $220 Million

Bitcoin has started out the new week on a rather bearish note after a flash crash sent the price below $69,000 once more. There has since been some recovery in the price of the largest cryptocurrency in the space. However, the damage has already been done as tens of thousands of crypto traders were flushed out of their leveraged positions as a result.

81,000 Crypto Traders Lose $220 Million

The Bitcoin flash crash hit support just above $68,800 but crypto traders are already feeling the brunt of the large move. In the last day, more than 81,000 traders have lost their leveraged positions and the volume of their liquidations have piled up.

According to data from Coinglass, the numbers have climbed above 81,400 crypto traders who were liquidated as a result of the crash. In total, over $223 million was also lost during this time from all of the flushed positions. Then, the single largest liquidation took place on the OKX exchange across the ETH-USD-SWAP pair. This trader alone lost $7 million when their position was liquidated.

As expected, the majority of the losses have come from long traders, with Coinglass showing a total of 70.01% of the liquidated positions being longs. This means that long liquidation volumes climbed above $156 million during the last 24 hours.

The crypto exchange with the largest liquidation volumes was the OKX exchange, accounting for 46.87%, or $104.61 million, of all liquidations. Binance came in second place with 38.72%, or $86.41 million. Meanwhile, Bybit saw the third-largest liquidation volume at 8.4%, or $18.75 million.

Bitcoin, Ethereum, And Dogecoin Lead Liquidations

Naturally, the crypto assets with the largest liquidation volumes have been Bitcoin and Ethereum, with $36.1 million and $28.98 million. However, meme coins such as Dogecoin and PEPE have seen their own numbers ramp up as well.

Dogecoin’s liquidation volumes came out at $10.4 million for the 24-hour period, which put it ahead of Solana with $8.3 million. Then coming up behind Solana is PEPE, with liquidation volumes climbing as high as $7.1 million.

Across all of these cryptocurrencies, long traders continue to suffer massive losses. Even in the shorter timeframe, the trends for long traders continue to look bleak. Coinglass data shows that in the last 12 hours, long traders accounted for 85.64% of liquidations. Then, in the 4-hour and 1-hour timeframes, they account for 6.182% and 72.62%, respectively.

As for the Bitcoin price, bulls continue to struggle as resistance at $69,500 mounts. The price is currently trading at $69,450 at the time of this writing, with a 1.1% decline in the last day, according to data from Coinmarketcap.

BTC price drops below $70,000 | Source: BTCUSD on Tradingview.com

Featured image from Coinpaprika, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Buterin, Yakovenko and Gün Sirer: Crypto Creators Take on the Meme Coin Phenomenon

The meme coin phenomenon, where communities produce tokens with no other support than a meme behind it, has given rise to opposing opinions. These range from the most positive ones, which regard them as value-affirming elements, to the negative ones, which state that there is no value behind them. Bitcoin.com News examines the views of […]

The meme coin phenomenon, where communities produce tokens with no other support than a meme behind it, has given rise to opposing opinions. These range from the most positive ones, which regard them as value-affirming elements, to the negative ones, which state that there is no value behind them. Bitcoin.com News examines the views of […]

Source link

Arrow Markets Secures $4M in Series A to Forge New Paths in Crypto Options Trading

On Friday, the Avalanche-based options protocol, Arrow Markets, unveiled its successful $4 million Series A fundraising initiative. The global project aiming to “revolutionize crypto options trading” garners support from prominent backers including Framework Ventures, Delphi Ventures, and the Avalanche Blizzard ecosystem fund. Crypto Options Platform Arrow Markets Bags $4M in Funding Arrow Markets, an options […]

On Friday, the Avalanche-based options protocol, Arrow Markets, unveiled its successful $4 million Series A fundraising initiative. The global project aiming to “revolutionize crypto options trading” garners support from prominent backers including Framework Ventures, Delphi Ventures, and the Avalanche Blizzard ecosystem fund. Crypto Options Platform Arrow Markets Bags $4M in Funding Arrow Markets, an options […]

Source link

Although the prices of crypto mining stocks and cryptocurrencies don’t always move in harmony, generally speaking, if cryptos are doing well so are the miners.

That was the dynamic this week, as the Great Crypto Rally of 2024 powered full steam ahead, and miners came along for the ride. According to data from S&P Global Market Intelligence, CleanSpark (CLSK -8.22%) rose by nearly 9% over that stretch of time, Cipher Mining (CIFR -3.38%) advanced by almost 12%, and Hut 8 (HUT 11.97%) had quite the trajectory with a gain of just under 27%.

The halving should boost Bitcoin demand

We’re getting very close to the latest halving of Bitcoin (BTC 0.04%). For those unfamiliar, a halving is an event in which the rewards for mining a cryptocurrency are, yes, cut in half.

The main goal of a halving is to reduce the supply of a coin or token, especially in the case of Bitcoin, whose supply will eventually be capped at 21 million coins. A halving occurs with the coin every time 210,000 blocks, representing sets of transactions, are created.

Specifically, miners will receive 3.125 Bitcoin for every new block on the chain they complete, down from the current 6.25. Most likely, the halving will occur at some point in April.

As any investor of any type of asset well knows, when the supply of a desirable good, service, or investment declines, demand tends to rise. This is the basic formula behind price rises.

So it’s no surprise to learn that Bitcoin’s price climbed notably just after its three previous halvings. In the most recent one in May 2020, six months after the event Bitcoin’s price was up by 79%. One year following the halving, it traded an eye-watering 547% higher.

Following the leader

There are no guarantees in the world of investing, of course, and we’ve all heard the warnings that past performance is no guarantor of future success. Right now, though, Bitcoin and any asset associated with it look like very solid bets.

The rush into spot Bitcoin exchange-traded funds has cooled, but their coffers are still bulging and helping to support the elevated price levels of the coin. The U.S. and global economies are continuing to provide gusty tailwinds, with inflation becoming less of a worry seemingly every day and Federal Reserve officials still apparently determined to cut interest rates, although not immediately.

Finally, for more than a few investors, Bitcoin is not only the asset representing the crypto space; it’s the only one they’re willing to buy. It helps that investing in those spot ETFs is quick and easy.

All this very much supports the work of Bitcoin miners. As long as investors continue to believe in Bitcoin, the price of those digital earth-diggers should keep defying gravity.

Crypto Analyst Predicts 600%-1000% Return For XRP, Here’s The Target

A cryptocurrency analyst has predicted a massive price surge for XRP, anticipating the cryptocurrency to witness a more than 600% increase. Despite its historically sluggish growth, XRP has begun to gather momentum, showing potential to experience major price growth during the 2024 bull run.

Price Projected To Soar Above $5

A crypto analyst identified as Egrag Crypto has taken to X (formerly Twitter) to predict an exponential price surge for XRP. According to Egrag Crypto XRP is “guaranteed” to experience a 600% to 1000% increase to new all-time highs around $5.5.

Basing his predictions on XRP’s historical data from 2017, the analyst shared a chart illustrating XRP’s price movements over the years. He delved into the cryptocurrency’s minimum and shortest price pumps observed when the 21 Exponential Moving Average (EMA) crosses the 55 Moving Average (MA).

The crypto expert disclosed that in 2017, the altcoin witnessed a significant price surge of approximately 902.85%, driving its price to $0.0646 at the time. Around 2021, the cryptocurrency recorded another pump, surging by about 585.29% to trade above the $1 price mark.

Following historical trends, XRP is anticipated to undergo a substantial surge of 585.20%, reaching a price level of about $3.26 in 2024. The analyst has revealed that if XRP manages to achieve a 900% or 585% price pump, it could potentially rise even further to $5.5 or $4, respectively.

On the flip side, Egrag Crypto has disclosed that if XRP fails to achieve an all-time high of $5 to $10 during the 2024 bull cycle, the cryptocurrency may not experience a bullish surge until the next bull run. Despite this, the analyst has remained confident in XRP’s potential to attain triple-digit gains and reach new all-time highs soon.

When Will XRP Witness A $5.5 Price Surge?

When asked by a crypto community member about the timeline for the price of XRP to potentially rise to $5.5, Egrag Crypto boldly affirmed that the window of uptick lies between April and July 2024. He urged the XRP army to brace themselves for this potentially bullish period, emphasizing a strong belief for XRP to surge to unprecedented heights.

Despite its recent price drops, the sentiment surrounding XRP has remained positive, with many crypto analysts predicting bullish price movements for the cryptocurrency. At the time of writing, XRP is trading around $0.61, reflecting a decline of 1.77% over the last 24 hours and 3.93% over the past week, according to CoinMarketCap.

While the cryptocurrency has successfully crossed resistance levels above $0.5, it is still a long way from surpassing its all-time high of $3.84 recorded in 2018.

Token price trending at $0.62 | Source: XRPUSDT on Tradingview.com

Featured image from Bitcoin News, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

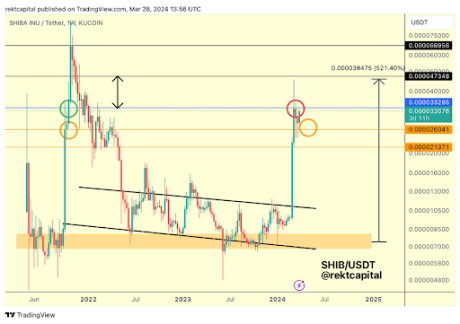

Crypto expert Rekt Capital has suggested that Shiba Inu (SHIB) could follow a similar trajectory to its move back in 2021. If so, this sets up the crypto token for a parabolic move that could see it hit its all-time high (ATH) and even surpass it.

2024 Shiba Inu To Mirror 2021 Action

Rekt Capital mentioned in an X (formerly Twitter) post that SHIB’s retest was successful and that history was repeating itself. According to him, SHIB needs to break above the $0.000033285 price range to begin its uptrend continuation. In a previous post, the crypto analyst raised the possibility of SHIB’s price action mirroring the one from 2021.

He noted how SHIB came close to that price range but couldn’t break this resistance level. This was the same thing in late 2021, as Shiba Inu didn’t break that resistance level on the first attempt. That forced the meme coin to retest the $0.000026041 price level as a new support before confirming further upside.

Source: X

This time, Shiba Inu also retested that $0.000026041 price level during its recent price dip, which was partly caused by a wave of profit-taking. The meme coin showed great resolve and somehow managed to hold above that level, and it has since made a good recovery.

Now, it needs to break above the $0.000033285 price range to confirm that history is repeating itself and that a price surge to the one in 2021 is on the horizon. 2021 was SHIB’s breakout year when it enjoyed a mouth-watering gain of 46,000,000% on its way to an ATH of $0.00008845 in October 2021.

Analysts Optimistic About Shiba Inu’s Future Trajectory

Rekt Capital isn’t the only one optimistic about SHIB’s future trajectory. Crypto analyst and trader Xanrox recently predicted that SHIB could rise to $0.00008854 by July, representing a new ATH for the meme coin. Interestingly, that looks to be only the starting point for the meme coin, as other analysts have predicted that SHIB could shed another zero.

One of them is crypto investor and analyst Oscar Ramos, who expressed his bullish sentiment about the meme coin when he predicted it could rise to $0.0001. Technical analyst Javon Marks also echoed similar sentiments when he suggested that SHIB could rise to as high as $0.0001553.

Meanwhile, crypto analyst Ali Martinez once suggested that SHIB’s price gain in 2021 could be nothing compared to what lies ahead for the meme coin. Specifically, Martinez predicted that Shiba Inu could see a historic 122,000% price surge to $0.011.

At the time of writing, SHIB is trading around $0.00003116, up over 3% in the last 24 hours according to data from CoinMarketCap.

SHIB price at $0.00003 | Source: SHIBUSDT on Tradingview.com

Featured image from Coinpedia, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Court rules in favor of Apple in class action over crypto payment policies

A California judge dismissed a class action lawsuit against Apple that accused the tech giant of imposing restrictions on third-party crypto payments on March 26.

District Judge Vince Chhabria said the complaint contained “several fatal problems,” including inadequately alleged agreements between Apple and other payment services.

He expressed doubts that the agreements restricted decentralized crypto transactions as alleged, asserting it is not clear that such an agreement would be unlawful under the Sherman Antitrust Act.

Meanwhile, the allegations of antitrust standing were found to be inadequate because any links between Apple’s alleged anticompetitive behavior and alleged injury were speculative. The plaintiffs claimed they paid overinflated fees to certain third-party apps because of Apple’s agreements.

Furthermore, the case had problems with its relevant market definition because Zelle — a payment app mentioned by the plaintiffs — was excluded from the definition.

The judge observed other issues and said an amendment to the case was unlikely to change the outcome of the lawsuit. However, the court has given plaintiffs 21 days to amend the case.

The case will be dismissed without prejudice if the plaintiffs fail to make amendments by the deadline.

Centralization vs. decentralization

Initially filed in November 2023, the lawsuit alleged that PayPal‘s Venmo, Google Pay, Cash App, and Apple Cash all agreed to Apple’s store guidelines, thereby agreeing to terms preventing each app from supporting decentralized crypto transactions.

Apple asked for the class action lawsuit to be dismissed in February. That request made most of the same points confirmed in the judge’s current dismissal.

Aside from their broader legal arguments, Apple’s defense asserted that the plaintiffs’ claims were factually incorrect, writing:

“There are apps in the App Store that facilitate decentralized [crypto] transactions.”

The defense added that a particular rule, App Store Guideline 3.1.5, requires third-party apps to handle transactions through an approved exchange and “does not apply to, much less categorically prohibit” apps that offer decentralized crypto transactions.

Plaintiffs initially argued that the same section undermines decentralization by requiring the involvement of intermediary exchanges.

Mentioned in this article

Nigerian Central Bank Not in Charge of Crypto Regulation, Says Governor

According to the governor of the Central Bank of Nigeria, the Securities and Exchange Commission is responsible for regulating cryptocurrencies. However, the governor said the central bank will collaborate with law enforcement agencies and regulators overseeing the Nigerian crypto sector. The Central Bank’s Change of Heart In a surprise announcement, Yemi Cardoso, governor of the […]

According to the governor of the Central Bank of Nigeria, the Securities and Exchange Commission is responsible for regulating cryptocurrencies. However, the governor said the central bank will collaborate with law enforcement agencies and regulators overseeing the Nigerian crypto sector. The Central Bank’s Change of Heart In a surprise announcement, Yemi Cardoso, governor of the […]

Source link

The ever-vibrant Shiba Inu community is thriving once more as SHIB gains widespread recognition surpassing top cryptocurrency assets in the market to become the second most sought-after digital asset in the entire European continent, securing its stance in the crypto landscape.

Shiba Inu Takes Europe By Storm

XRP enthusiast and market expert Marcel Knobloch, also known as Collin Brown, reported the coin’s latest milestone on X. According to Brown, Shiba Inu has seen significant growth in its long-term investor base, taking Europe by storm by becoming the second most search crypto in the continent.

Brown noted that the milestone is reminiscent of the peak of 2021, having rallied a startling 300% in just 8 days. SHIB’s interest is not limited to Europe, and it has taken the top spot on search charts all the way from Italy to Nigeria.

As a result of the development, WazirX’s poll has crowned SHIB the king of meme cryptos. Thus, Collin Brown has urged the cryptocurrency space to watch out for Shiba Inu, noting that the Shiba pack is at the forefront of the race.

The rankings were determined following a comprehensive analysis of Google Trends data in the past 1 year in order to ascertain the cryptocurrency that, based on searches, each nation in Europe desires to invest in. After gathering collective data, the findings showed a noteworthy pattern that indicated changes in people’s interest in the crypto market.

Shiba Inu went past notable coins like Ethereum (ETH) – the second largest crypto asset, Cardano (ADA), and Dogecoin (DOGE) – the largest meme coin, securing the top pick in about 7 European countries. These include Russia, France, Italy, the United Kingdom, and among others.

Meanwhile, Bitcoin (BTC) – the largest crypto asset remains the most searched coin in the continent acquiring top choice in about 21 European nations, such as Poland, Germany, Belgium, Romania, etc.

Latest Milestone Buttresses SHIB’s Price

SHIB’s recent achievement displays a constant rise in its interest, reflecting the trust of its community members around the world. In addition to bolstering SHIB’s standing, this ranking indicates that European investors are considering adopting the token even more.

Following the project’s landmark, the Ethereum-based memecoin has managed to secure gains of over 18% in the past week. SHIB has experienced a rebound to the $0.000030 threshold, after falling as low as $0.000025 during the start of the week. With the memecoin market demonstrating momentum presently, SHIB might be poised for more significant gains in the coming months.

Consequently, SHIB’s rise to the aforementioned price has taken advantage of the market’s general recovery and its seven-day upswing. As of the time of writing, Shiba Inu was trading at $0.0000305, indicating a decline of 1% in the past day. Meanwhile, its trading volume and market cap have decreased by over 1% and 16%, respectively.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.