El Salvador has been buying one bitcoin a day since 2022, according to President Nayib Bukele, who confirmed that his country’s “1 bitcoin a day program” will continue until the cryptocurrency “becomes unaffordable with fiat currencies.” The bitcoins acquired from El Salvador’s daily purchases are also deposited into the same wallet address used for the […]

El Salvador has been buying one bitcoin a day since 2022, according to President Nayib Bukele, who confirmed that his country’s “1 bitcoin a day program” will continue until the cryptocurrency “becomes unaffordable with fiat currencies.” The bitcoins acquired from El Salvador’s daily purchases are also deposited into the same wallet address used for the […]

Source link

currencies

In July, the American state of Wyoming shared an open job position for the head of its Stable Token Commission.

The executive will work alongside Wyoming’s governor, state auditor, state treasurer and four expert appointees to bring the state’s very own stablecoin to life.

While Wyoming was the first to pass a law on a state stablecoin, it isn’t the only state considering launching its own digital currency.

In April, a similar initiative was proposed in Texas, where lawmakers introduced bills for creating a state-based digital currency backed by gold.

However, the idea of state stablecoins raises many questions: How would they affect the monetary stability of fiat money and the power of the Federal Reserve? Could they be compatible with a central bank digital currency? Do people really want to return to a system with state banks printing their own monetary notes?

The Wyoming experiment

The Wyoming Stable Token Act was originally introduced in February 2022, in the midst of the crypto market crisis. The bill defines the Wyoming stable token as a virtual currency representative of and redeemable for one U.S. dollar held in trust by the state of Wyoming. Basically, the state would tokenize the federal currency on a 1:1 ratio with deposits.

NEWS–bipartisan group of top #Wyoming legislators proposed a bill for State of Wyoming to issue a #stablecoin, 100% backed by USTreasuries, where the State keeps the float. I see pros & cons (didn’t know it was coming) but❤️that Wyoming continues to explore cool #crypto ideas! https://t.co/BXbELukUQE

— Caitlin Long ⚡️ (@CaitlinLong_) February 17, 2022

Explaining why state lawmakers took such an interest in the digital token project, Chris Rothfuss, the minority leader in the Wyoming State Senate, told Cointelegraph:

“Wyoming needs to be able to transact in a digital currency — to accept payments, to make payments, and to do so without risk. The Wyoming stable token is the solution to that challenge.”

A notable reservation in Section 2 of the Stable Token Act makes the state’s attorney general responsible for monitoring the startup phase of the token’s issuance. Should the attorney general believe it contradicts federal or state law, the project would be frozen.

The bill also sets a deadline for the project: The commission’s director shall provide their report on the doability of the stable token no later than Nov. 1, 2023.

Recent: Privacy prevails and cypherpunks write code at Baltic Honeybadger

Other than that, the document doesn’t specify much; instead, it establishes the Stable Token Commission with the authority to craft further details.

The legislation’s path wasn’t easy. In March 2022, Governor Mark Gordon vetoed the bill, saying he was “unconvinced” that the state’s Treasury was ready to implement the project safely.

Gordon criticized the lack of information and the cost of accounting services, blockchain development and other necessary expenses, and he was skeptical of the project’s purported benefits.

A year later, the governor applauded the effort made by legislators to enhance the document, but voiced new reservations:

“First and foremost, there was no overall plan (a ‘business plan’ for lack of a better term) or, if a plan exists, it did not appear to have been used to guide the legislators in crafting the legislation.”

On March 22, 2023, the Stable Token Act was passed into law without Governor Gordon’s signature. Gordon recognized the state stable token’s potential to “nurture Wyoming’s reputation as a leader in the digital asset world” and deemed the improvements made by the bill’s authors enough to allow it to become law.

The era of multiple stablecoins?

Neither the U.S. Federal Reserve nor any crypto-focused legislators have reacted publicly to the Wyoming project, but it is hard to imagine any kind of affirmative response, given that the American dollar was established precisely to provide a countrywide monetary standard and bring the currency under the purview of the federal government.

So, in principle, any state token project could contradict the logic of central bank currency to a similar degree as private cryptocurrencies.

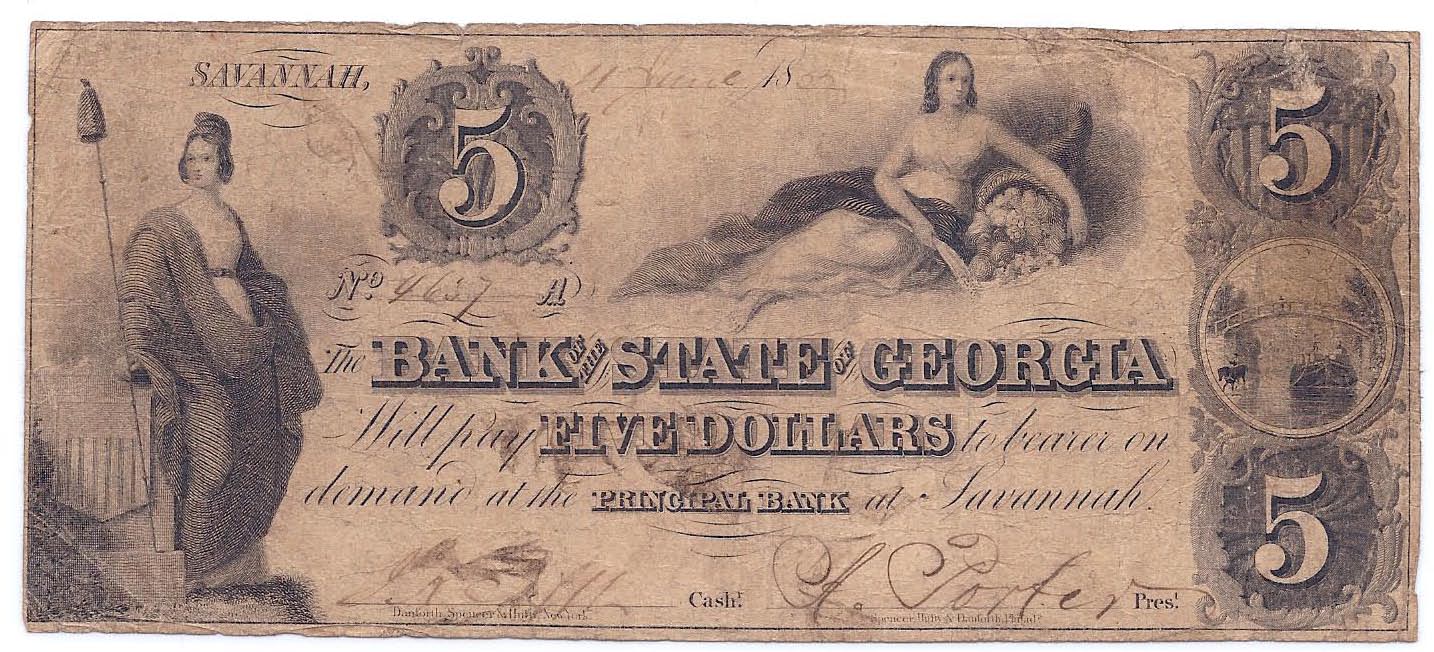

At the same time, the potential value of Wyoming’s stable token is rigorously tied to the same old American dollar, which makes it less of a separate currency and more of a state-issued financial asset, similar to the state-issued notes for specie of the 19th century.

Rothfuss clarified, “We are not issuing a new currency. The Wyoming stable token is a digital representation of a U.S. dollar held in trust by the state of Wyoming on behalf of the tokenholder. We are not competing with the Federal Reserve — we are enabling a technology.”

Some observers still see a potential conflict between the states and the Fed. “Certainly, there will be a tussle between states and the federal government over the former attempting to issue their own stablecoins,” Brent Xu, CEO of Web3 bond-market platform Umee, told Cointelegraph.

But there could be a compromise in which the Federal Reserve allows states to issue stablecoins under a particular framework, he believes, noting the discussions concerning a national framework for stablecoins.

Zachary Townsend, CEO of Bitcoin-based life insurance provider Meanwhile, doesn’t see any potential problems with state stablecoins, as he believes that the very concept of a stablecoin is open to almost any entity, political or corporate, as the recent example with PayPal’s initiative has shown.

Magazine: Big Questions: What’s with all the crypto deaths?

He told Cointelegraph, “There are going to be tons of private stablecoins. If I just looked at my life and all the companies I have ‘accounts’ or ‘wallets’ or ‘balances’ with, those are going to transform to become stablecoins within a few years.”

This is something Peter Herzog, state policy lead at the Crypto Council for Innovation, can agree with. “There are a variety of models for stablecoins that involve different decisions around underlying collateral, governance and more,” he explained to Cointelegraph. For Herzog, it comes as no surprise that individual states with an active interest in crypto are continuing their experiments with new initiatives:

“Until we see a federal regulatory framework, it is likely that states continue to step in to create rules of the road to promote innovation and protect consumers.”

Chinese court contradicts government’s stance on virtual currencies, declares them to be legal property

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

BlackRock CEO Larry Fink has delivered fresh remarks supporting cryptocurrencies’ role in democratizing investing worldwide, pointing to growing interest among the companys clients in digital assets.

“More and more of our global investors are asking us about crypto,” Fink said during an interview with CNBC’s Squawk on the Street on July 14. BlackRock is the world’s largest asset manager, with over $8 trillion in assets spanning all types of investment products.

In Fink’s view, cryptocurrencies have a “differentiating value versus other asset classes” in helping diversify portfolios. “It’s so international it’s going to transcend any one currency,” noted the executive.

Despite Fink’s pro-crypto remarks during the interview, he declined to comment on BlackRock’s application for a spot Bitcoin exchange-traded fund (ETF) in the United States, as the filing is still pending with the Securities and Exchange Commission.

“We are working with our regulators because, as in any new market, if BlackRock’s name is going to be on it, we’re going to make sure that it’s safe and sound and protected,” Fink added.

Several applications to list a Bitcoin (BTC) ETF on the spot market have been rejected by the SEC in past years. However, BlackRock’s filing has sparked renewed hopes of imminent approval, given the asset manager’s overwhelming success in getting ETFs approved. According to Bloomberg Intelligence’s Eric Balchunas and James Seyffart, BlackRock has filed for 550 ETF applications and has only been rejected once.

“We believe we have a responsibility to democratize investing. We’ve done a great job, and the role of ETFs in the world is transforming investing. And we’re only at the beginning of that,” Fink stated in the interview.

BlackRock’s application has been followed by several refilings for similar ETF products in the United States. Asset managers in line for a green light include Fidelity, Bitwise, 21Shares, WisdomTree and Investco, among others.

While American money managers wait for the SEC’s decision, Europe’s first spot Bitcoin ETF is set to debut later this year by London-based firm Jacobi Asset Management. The product was scheduled to launch in 2022 but was postponed due to the bear market. According to Jacobi, the demand has been gradually shifting since last year.

Collect this article as an NFT to preserve this moment in history and show your support for independent journalism in the crypto space.

Magazine: Should you ‘orange pill’ children? The case for Bitcoin kids books