Quick Take

When assessing the performance of assets or currencies, it is essential to consider both nominal and real returns, the latter of which accounts for inflation. Inflation can be gauged through different metrics, such as the consumer price index (CPI) or indicators related to the money supply (e.g., M2). While the money supply is not a direct measure of inflation, it can play a role in shaping it. However, when evaluating an asset’s performance in a local currency, such as the British Pound (GBP), it is often useful to benchmark it against the US Dollar.

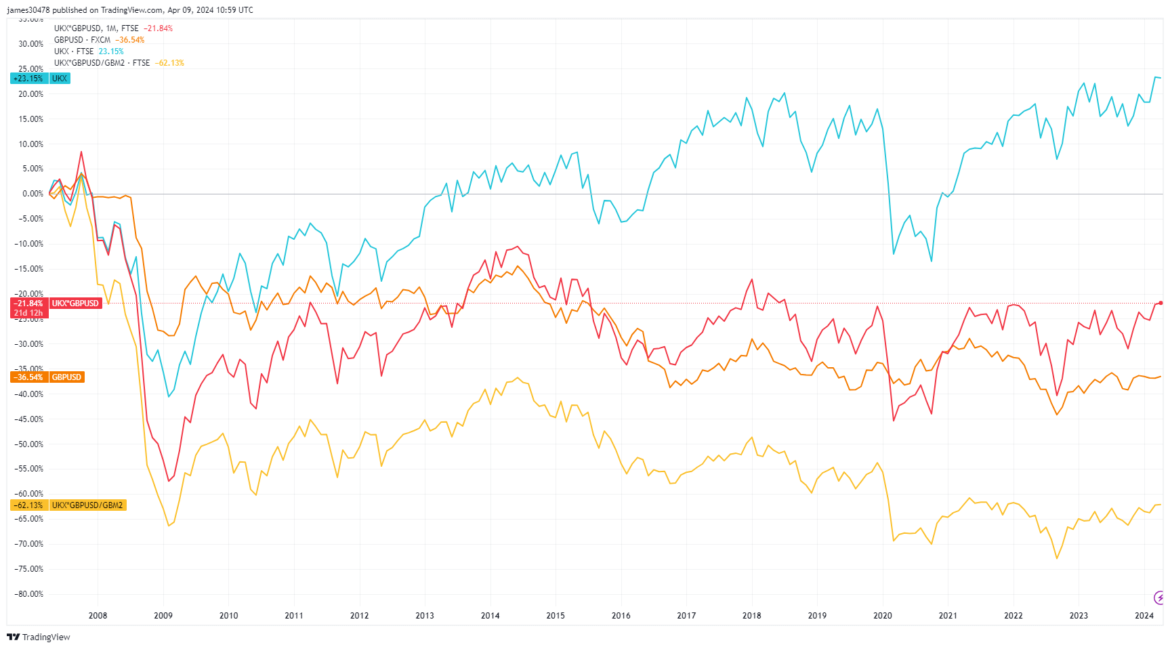

A prime example is the FTSE 100, which has risen approximately 23% since 2007 and recently achieved an all-time high, surpassing 8,000 in GBP terms. At first glance, this may appear impressive. However, when converted to US Dollars, the FTSE 100 has actually declined by 22% over the same period, while the GBP has fallen 37% against the Dollar. The situation becomes even more alarming when measured against the UK’s M2 money supply, revealing a staggering 62% decrease.

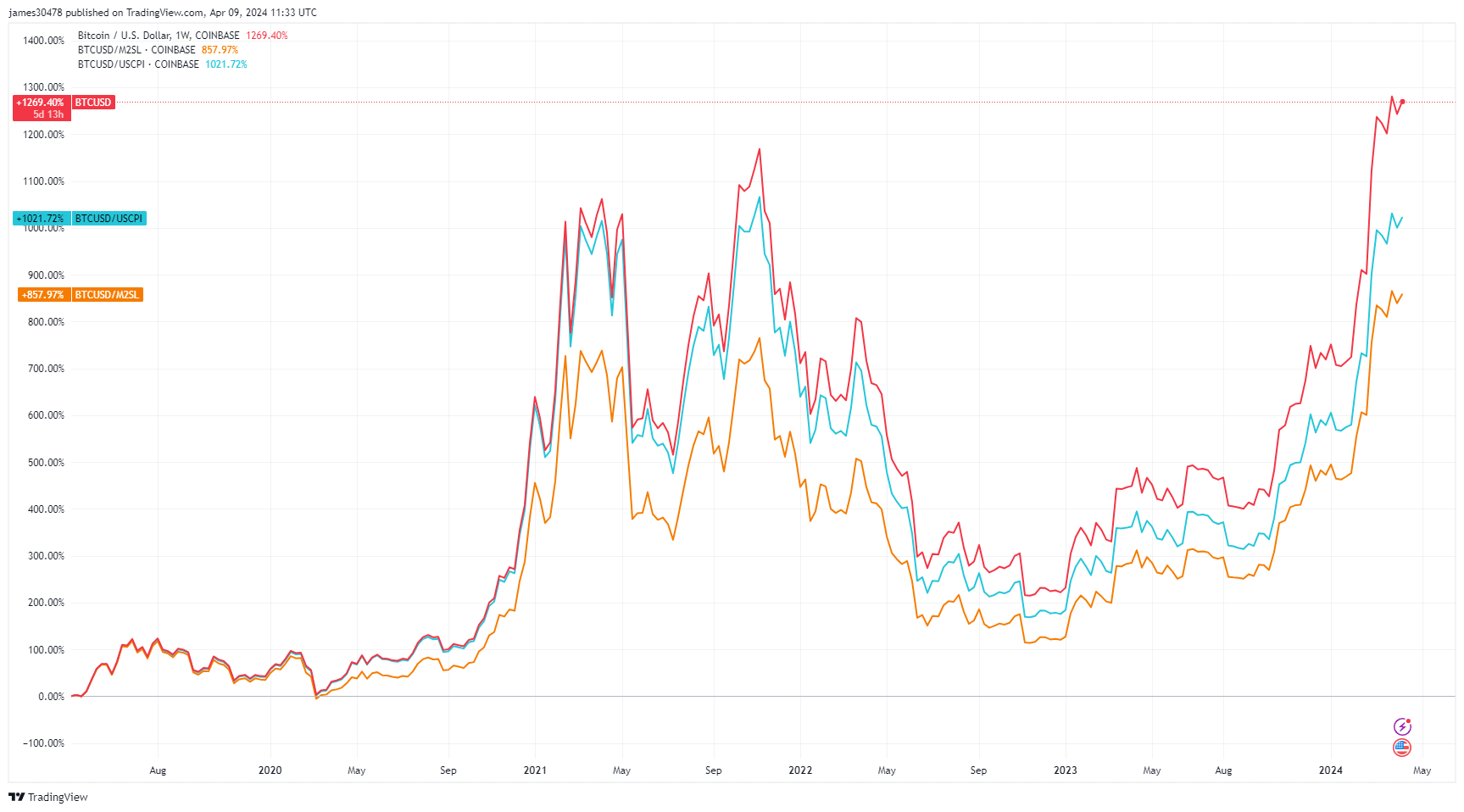

Bitcoin, over its historical trajectory benchmarked in USD, has consistently surged to new highs with each cycle, surpassing a remarkable 1200% increase in the past five years. Furthermore, it has demonstrated the capacity to outperform the M2 money supply and is nearing record highs relative to the US Consumer Price Index (CPI).

To gain a comprehensive understanding of an asset’s true performance, I believe it should first be converted into US Dollars (if measured in a local currency) and then adjusted for local CPI inflation and money supply changes. This approach provides a more accurate and holistic view of the asset’s real value and performance over time.

The post FTSE 100’s illusion of growth unmasked by currency and inflation adjustments appeared first on CryptoSlate.

The Reserve Bank of Zimbabwe has introduced a foreign exchange and gold-backed “structured currency” to replace the struggling local currency. The structured currency banknotes will be “fully convertible into the reserve currency on demand.” The central bank has also reduced the annual interest rate from 130% to 20%. Structured Currency Supported by Solid Fundamentals The […]

The Reserve Bank of Zimbabwe has introduced a foreign exchange and gold-backed “structured currency” to replace the struggling local currency. The structured currency banknotes will be “fully convertible into the reserve currency on demand.” The central bank has also reduced the annual interest rate from 130% to 20%. Structured Currency Supported by Solid Fundamentals The […]

India’s central bank has announced that it will enable non-bank payment system operators to offer central bank digital currency (CBDC) wallets. Noting that “necessary changes will be made to the system to facilitate this,” the Reserve Bank of India (RBI) said the initiative is expected “to enhance access and expand choices available to users.” Non-Bank […]

India’s central bank has announced that it will enable non-bank payment system operators to offer central bank digital currency (CBDC) wallets. Noting that “necessary changes will be made to the system to facilitate this,” the Reserve Bank of India (RBI) said the initiative is expected “to enhance access and expand choices available to users.” Non-Bank […]

Personal finance expert and best-selling author Dave Ramsey says he agrees with Berkshire Hathaway CEO Warren Buffett regarding bitcoin. Viewing the crypto as a currency whose value is based on “thin air,” Ramsey stressed: “I wouldn’t wish bitcoin investments on somebody I really dislike.” Dave Ramsey on Bitcoin: ‘It’s Still Thin Air’ Personal finance guru […]

Personal finance expert and best-selling author Dave Ramsey says he agrees with Berkshire Hathaway CEO Warren Buffett regarding bitcoin. Viewing the crypto as a currency whose value is based on “thin air,” Ramsey stressed: “I wouldn’t wish bitcoin investments on somebody I really dislike.” Dave Ramsey on Bitcoin: ‘It’s Still Thin Air’ Personal finance guru […]

Authorities in Egypt recently allowed the local currency’s exchange rate versus the U.S. dollar to decrease by more than 60%. Additionally, the central bank raised interest rates by 600 basis points. Both steps were key conditions set by the IMF which Egypt had to meet before the approval of a new financial aid package. IMF […]

Authorities in Egypt recently allowed the local currency’s exchange rate versus the U.S. dollar to decrease by more than 60%. Additionally, the central bank raised interest rates by 600 basis points. Both steps were key conditions set by the IMF which Egypt had to meet before the approval of a new financial aid package. IMF […]

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

In an email found within the motion by Digital Currency Group (DCG) and Barry Silbert to dismiss the lawsuit initiated by the New York Attorney General, discussions of a potential merger between Gemini and Genesis were revealed before Genesis ultimately opted to declare bankruptcy. “Combined Gemini and Genesis would be a juggernaut and would be […]

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

Bloomberg Intelligence’s senior commodity strategist, Mike McGlone, says bitcoin is “becoming an alternative currency on a global basis,” noting that “The world’s going towards intangible assets and bitcoin is the most significant in cryptos.” However, the strategist warned that as bitcoin’s price approaches $70,000, a key test for the cryptocurrency may come “when the U.S. […]

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

The European Central Bank (ECB) has published a blog post claiming that “bitcoin has failed to fulfill its original promise to become a global decentralized digital currency.” The ECB economists who authored the post added that bitcoin’s fair value is still zero and bitcoin transactions are “still inconvenient, slow, and costly.” Moreover, they asserted that […]

The crypto industry has responded to criticism from Hillary Clinton, who said that cryptocurrency can undermine the role of the U.S. dollar as the world’s reserve currency. Galaxy Digital CEO Mike Novogratz argued that the only thing that can undermine the U.S. dollar as a reserve currency is reckless spending by both U.S. political parties. […]

The crypto industry has responded to criticism from Hillary Clinton, who said that cryptocurrency can undermine the role of the U.S. dollar as the world’s reserve currency. Galaxy Digital CEO Mike Novogratz argued that the only thing that can undermine the U.S. dollar as a reserve currency is reckless spending by both U.S. political parties. […]