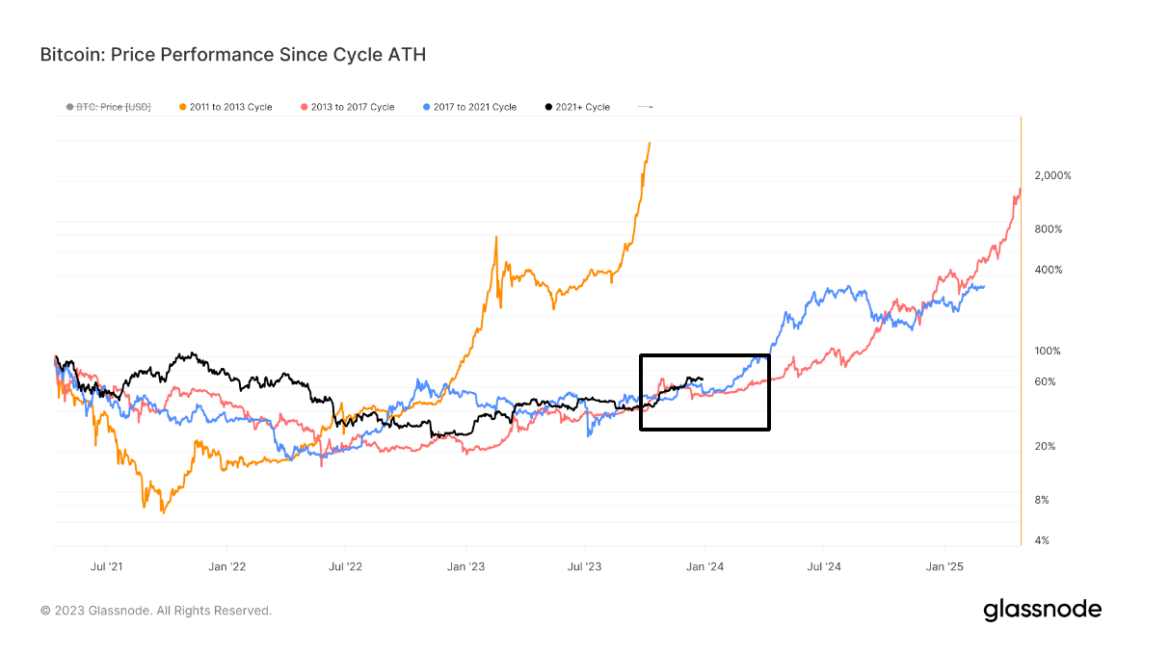

Over the past six months, bitcoin’s value has seen a substantial increase, soaring over 160% in comparison to the U.S. dollar during this period. Despite these significant gains, a considerable number of individuals are of the opinion that this upward trend is just beginning. Yet, the exact start of this crypto bull market is still […]

Over the past six months, bitcoin’s value has seen a substantial increase, soaring over 160% in comparison to the U.S. dollar during this period. Despite these significant gains, a considerable number of individuals are of the opinion that this upward trend is just beginning. Yet, the exact start of this crypto bull market is still […]

Source link

Current

Speculation Rises on Whether Bitcoin’s Halving Is Reflected in Current Prices

Bitcoin has witnessed new highs in its price lately, with the premier cryptocurrency experiencing an over 60% increase since the beginning of the year. Meanwhile, the crypto community is abuzz with debates on whether the impending halving event is already reflected in the price. There’s a prevailing suspicion that despite bitcoin’s climb against the U.S. […]

Bitcoin has witnessed new highs in its price lately, with the premier cryptocurrency experiencing an over 60% increase since the beginning of the year. Meanwhile, the crypto community is abuzz with debates on whether the impending halving event is already reflected in the price. There’s a prevailing suspicion that despite bitcoin’s climb against the U.S. […]

Source link

As Bitcoin (BTC) is currently in a bull run, eclipsing the $60,000 mark once again, the spotlight has turned to ADA performance in comparison. With a history that mirrors Ethereum’s (ETH) early days, ADA’s journey through the market’s ups and downs has prompted a closer examination of its potential trajectory.

The eighth-largest cryptocurrency by market cap, ADA has seen its fair share of highs and lows, with a recent uptick in price sparking both interest and speculation about its future.

Particularly, Cardano’s current trading level, lingering below the highs of the March-April 2021 bull run, has raised eyebrows, especially when juxtaposed with Bitcoin’s bullish momentum.

During the last peak period when BTC hit $60,000, ADA traded above $1. Yet, as Bitcoin revisits its former glory, ADA’s valuation stands around $0.6, presenting a curious case for analysis.

Dan Gambardello, a crypto analyst have drawn parallels between ADA’s price action and Ethereum’s historical performance, suggesting that ADA may be on the cusp of a “significant breakout”, akin to ETH’s journey post-2017.

CARDANO Bull Indicator Almost ACTIVATED! (Truth Behind ADA Price!)

Intro 00:00

Cardano price concern 00:50

Is Cardano price lagging this cycle? 1:30

Ethereum offers helpful context 2:30

Cardano is within a normal move 8:00

Cardano bull indicator almost triggered! 9:25 pic.twitter.com/8tRlwEj8AO— Dan Gambardello (@cryptorecruitr) March 1, 2024

ADA Historical Echoes With Ethereum

Dan Gambardello’s comparison of ADA to Ethereum’s past trajectory sheds light on the developmental parallels and market behavior between the two cryptocurrencies.

Gambardello points out that ADA’s entry into the market towards the tail end of the 2017 bull run placed it in a different starting position than ETH. Despite this, both currencies achieved notable highs during that period.

The subsequent bear market phases for both ADA and ETH were marked by substantial corrections and periods of foundational development, crucial for their long-term viability, according to Gambardello. The analyst added that the emergence of Decentralized Finance (DeFi) projects on both platforms, with Uniswap for ETH and SundaeSwap for ADA, underscores the parallel paths of “innovation and growth.”

This historical perspective suggests that ADA’s current position and 78% dip from its peak might not be as dire as it appears. Instead, it could indicate a maturing phase that precedes significant growth, much like Ethereum experienced after its initial setbacks.

The comparison offers a hopeful outlook for ADA, positioning it as a digital asset with the potential to recover and surpass its previous highs as it follows in Ethereum’s footsteps.

Cardano’s Potential Unfolding

Crypto analysts Trend Rider and Ali’s recent analysis has also amplified the optimism surrounding Cardano’s future. Trend Rider’s alert on a potential new all-time high for ADA, backed by a significant increase in the Trend Strength Indicator, echoes the sentiment of a pending rally reminiscent of ADA’s climb to $3.6.

🚨 $ADA Bull Run loading.

Both our Moving Average Ribbon and our Money flow oscillator are bullish again after 200 Weeks!

These are undenieable macro facts.

Enjoy the ride, I will monitor the chart each week in case there are warning signals

PS: Free trading course… pic.twitter.com/sC3fhRZGl0

— Trend Rider (@TrendRidersTR) February 29, 2024

Furthermore, Ali’s projection of ADA hitting $8 in the upcoming bull run, based on a breakout pattern in the weekly price charts, adds to the growing consensus of Cardano’s untapped potential.

The #Cardano breakout may come earlier than expected! Still, if history repeats itself, we are anticipating $ADA to rise to $0.80, retrace to $0.60, and then enter a bull run toward $8 by January 2025! pic.twitter.com/HuVAxFEg9Y

— Ali (@ali_charts) February 15, 2024

Featured image from Unpslah, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Peter Brandt Raises Bitcoin Price Target to $200,000 for the Current Bull Market Cycle

Veteran trader Peter Brandt has provided an update on his bitcoin price prediction. He explained that the price target for “the current bull market cycle” scheduled to end in Aug/Sep next year has been raised from $120,000 to $200,000. Peter Brandt on Bitcoin Bull Market Cycle Peter Brandt provided an update on his bitcoin price […]

Veteran trader Peter Brandt has provided an update on his bitcoin price prediction. He explained that the price target for “the current bull market cycle” scheduled to end in Aug/Sep next year has been raised from $120,000 to $200,000. Peter Brandt on Bitcoin Bull Market Cycle Peter Brandt provided an update on his bitcoin price […]

Source link

Is The Trade Desk’s Business Momentum Good Enough to Justify Its Current Stock Price?

It would be difficult to criticize The Trade Desk‘s (TTD -0.58%) recent business performance. Everything seems to be going right for the company. Revenue is growing at robust double-digit rates, customer retention remains extremely high, and the company has a debt-free balance sheet and plenty of excess cash flow.

This financial success, of course, isn’t too surprising for those following the company closely. The programmatic advertising specialist’s product execution has been astounding in recent years. The Trade Desk’s fourth-quarter results were just more of the same. But there’s a looming question: Is the company living up to its current valuation?

Here’s a close look at some of the ways this tech company continues to impress investors.

Market share gains

One of the biggest things that stands out about The Trade Desk’s recent business performance is its market share gains. As The Trade Desk CEO Jeff Green pointed out in the company’s most recent earnings call, the ad tech specialist has grown its revenue faster than the rest of the digital advertising space in each of the last eight consecutive quarters.

In one specific example of its momentum relative to major peers in the space, The Trade Desk’s full-year 2023 revenue increased 23% year over year — and that’s on top of 32% growth in 2022. Compare that to Meta Platforms‘ and Alphabet‘s 16% and 9% year-over-year revenue growth rates in 2023, respectively.

Looking ahead, Green said in the company’s fourth-quarter earnings call that he expects top-line momentum to persist.

While there is much to celebrate about 2023, I’m even more excited about 2024 and beyond, I’ve never felt more confident heading into a new year. I believe we are uniquely positioned to grow and gain market share not only in 2024 but well into the future.

Product execution

Another aspect of The Trade Desk’s business worth applauding is its rapid pace of innovation.

The company’s biggest innovation in 2023 was its overhauled buy-side platform, Kokai. Green said that his product team recently visited nearly 1,000 clients and almost all of them said Kokai was a significant platform upgrade for them.

The Trade Desk also made notable progress in retail media (partnerships with retailers in which they bring data to its platform to share with advertisers). This is “one of the fastest-growing areas” of The Trade Desk’s business, Green said during the fourth-quarter earnings call.

But many other innovations are playing a key role in The Trade Desk’s customer approval. Some key innovations gaining steam with customers include The Trade Desk’s identity solutions UID2 and EUID, its direct pipeline to advertising inventory called OpenPath, and its connected television (CTV) integrations.

All of these factors help contribute to The Trade Desk’s high customer retention rate, which has remained above 95% for 10 years straight.

Robust financials

Lastly, The Trade Desk is a cash flow machine. Free cash flow, or the cash flow left after capital expenditures are accounted for, totaled $543 million in 2023. Such strong cash flow, combined with a debt-free balance sheet, means the company can fund its business growth while also returning cash to shareholders. The Trade Desk repurchased $220 million worth of its stock during Q4 alone and said in its earnings release last week that it has authorized $700 million for repurchases going forward.

All of these factors combine to help justify the stock’s current valuation of approximately 73 times free cash flow. With this said, shares certainly aren’t cheap. It might be wise for investors interested in buying the stock to wait and see if shares pull back to a valuation that leaves more room for error. But given the company’s strong execution, it would also be tough to call the stock overvalued at this point.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Daniel Sparks has no position in any of the stocks mentioned. His clients may own shares of the companies mentioned. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and The Trade Desk. The Motley Fool has a disclosure policy.

Taking to X on January 5, Antonio Juliano, the founder of dYdX, a decentralized exchange (DEX), expressed skepticism regarding the current crypto bull run. Juliano attributed the recent price surge to “light trading volumes.” This formation might, despite the overall confidence, not sustain the uptrend.

Founder: This Bull Run Is Different, Participation Is Low

Juliano asserted that a true bull cycle is not defined solely by price action but by participation and community enthusiasm. The founder continued that this “does not seem to be happening yet.”

The founder attributed the lack of widespread adoption to the absence of “groundbreaking” products that have captured the attention of a “broader” audience. However, releasing these “products” to the market could revive activity, driving crypto trading volume.

Juliano’s comments come ahead of the potential approval of the first spot Bitcoin exchange-traded fund (ETF) by the U.S. Securities and Exchange Commission (SEC). Among several applicants are Fidelity, Grayscale, and BlackRock. Insiders claim the agency could approve the first product in the coming days.

A spot Bitcoin ETF may open the floodgates to institutional investors, allowing them to gain exposure to the Bitcoin and crypto market in a regulated manner. As it is currently structured, willing institutions regulated by the SEC can only get exposure through Grayscale’s products, including the GBTC.

Along the same line, some commentators have speculated that the SEC’s approval of a spot Bitcoin ETF could lead to the approval of a spot Ethereum ETF in 2024. An Ethereum Futures ETF was approved in 2023 and is currently available for trading. Even so, the product, like Bitcoin Futures ETFs that are widespread, tracks an Ethereum index price, not the Ethereum spot rate. Even so, whether the SEC will greenlight a spot Ethereum ETF remains to be seen.

Will A Bitcoin ETF Approval Revive DYDX Demand?

Trading volume is a critical metric for measuring participation and, thus, interest in a particular asset. The higher it is, the more liquid the asset is.

Depending on the prevailing sentiment, this might support prices or lead to a sell-off. As the crypto community eagerly waits for the SEC to decide on the flagship product, altcoins, including DYDX, have been firm.

Looking at the DYDX price chart in the daily chart, prices are moving horizontally but relatively high from the October 2023 lows.

The coin is up roughly 50% but remains under pressure in the short term. DYDX is down 40% from November 2023 peaks, trading below December 2023 lows in a bearish breakout formation.

Feature image from Canva, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Current Bitcoin cycle outpaces previous market trends while cautiously eyeing historical retracement risks

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Ben Armstrong, a well-known crypto analyst and YouTuber has recently offered an intriguing perspective on XRP’s current trading value.

XRP, a token closely watched in the crypto community, particularly after its legal battle with the US Securities and Exchange Commission (SEC), currently trades at around $0.60. While this figure might not represent an all-time high, Armstrong highlights why this price point might be pivotal for XRP.

The Bigger Picture: Institutional Interest And Market Dynamics

Armstrong’s analysis begins with the “adamantium” support level of $0.60 for XRP. Drawing an analogy with the fictional character Wolverine, who famously recovers from severe damage, Armstrong sees XRP’s resilience at this price as a sign of robustness.

Each time XRP’s value dips, it seemingly rebounds from this critical support level, suggesting a strong market faith in the token.

Armstrong goes beyond price analysis to consider broader market dynamics in his video. He notes that XRP’s previously traded price level of $0.62 has become particularly attractive to institutional and corporate investors.

Whale transactions involving substantial quantities of XRP have increased significantly, indicating heightened interest from large-scale investors. This trend aligns with a broader global crypto market cap increase, suggesting ample liquidity for significant investments.

Armstrong also touches upon the strategic aspect of XRP’s price following Ripple’s legal victory over the SEC. He posits that a post-verdict price surge might have limited the token’s accessibility to a broader audience.

However, the current steadier price range, a retrace of the previously seen $0.72, allows for a more extensive accumulation of XRP, potentially setting the stage for a bigger bull run.

XRP Latest Price Action

XRP’s market performance has recently shown a notable decline, with its price falling by over 10% in the past two weeks. At the time of writing, XRP is trading at approximately $0.605, reflecting a 2.3% decrease in the past 24 hours.

Despite a significant bullish trend earlier this year, where it surged by 70.3% year to date, XRP remains substantially lower, down by 82.20%, from its all-time high of $3.40 in 2018.

This downward trend extends beyond just XRP’s price. The past two weeks have also decreased the asset’s daily trading volume, descending from highs of around $2.5 billion early last week to roughly $1.1 billion in the past 24 hours.

This decline in trading volume may signal a decrease in investor interest or market activity surrounding the asset, contributing to its reduced price.

Moreover, the broader crypto market has seen a mix of volatility and bearish trends, which might influence XRP’s performance. So far, Bitcoin has also declined by 2% in the past 24 hours, resulting in the drawdown of the global crypto market cap of 1.3% over the same period.

Featured image from Unsplash, Chart from TradingView

J.P. Morgan Is Looking for the Silver Lining in the Current Market Headwinds — Here Are 2 Stocks the Banking Giant Likes Right Now

Market legend Warren Buffett has said of investing, “If you aren’t thinking about owning a stock for ten years, don’t even think about owning it for ten minutes.” Like most of his bon-mots, this quip embodies a basic fact about the stock markets: it’s a long-term game.

There are serious headwinds in the market today, ranging from worries over the persistently stubborn inflation and the Fed’s high-interest rate policy to a steadily worsening geopolitical situation, and investor sentiment is getting wobbly in response.

But covering the situation from the investment bank J.P. Morgan, global investment strategist Madison Faller sees a reason for investor optimism. Acknowledging the headwinds, she meets them head-on, describing these uncertain times as times of opportunity – if investors will play the long game.

In her words, “When markets are volatile, it can help to re-focus on what you want from your portfolio in the long run. The world is in transition – from pretty much any lens you look: the economy, policy, world order, technology and climate. Navigating that uncertainty can be overwhelming, but it can also be empowering… Despite the headwinds, a world in transition may offer an attractive entry point for long-term investors.”

We can follow Faller’s lead, and look for a bright side despite today’s market headwinds, taking a cue from the JPMorgan stock analysts. They’ve been pointing out two stocks they see primed for gains; we are talking returns of at least 40% over the next 12 months.

We ran them through the TipRanks database to see if there’s widespread agreement on the Street that these are both worth leaning into right now. Let’s take a closer look.

Don’t miss

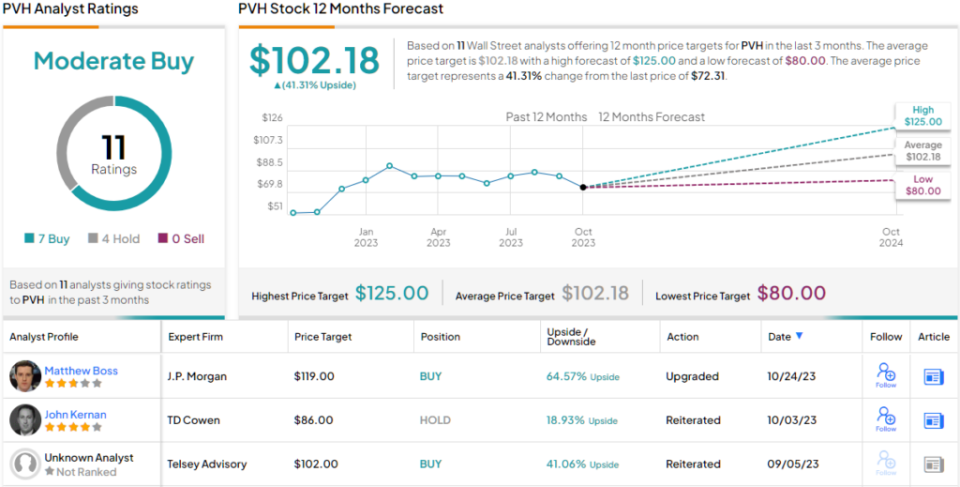

PVH Corporation (PVH)

We’ll start with PVH Corporation, a soft goods company and the owner of two of the fashion world’s best-known brand names: Calvin Klein and Tommy Hilfiger. Both are already giants in the industry, and PVH is always working to fine-tune the brands’ image and expand market share. The company’s goal is to make Calvin and Tommy the world’s most desirable lifestyle brands.

By the numbers, PVH has come a long way toward that goal. The company operates in more than 40 countries around the world and brought in nearly $9 billion in global revenue in the full year 2022. The company’s plan includes winning with its product, its customer engagement, and its digital marketing, and it does not shy away from using controversy to catch attention – as shown by its history of risqué ads for Calvin Klein.

PVH has been in business since the 1880s and today operates more than 1,000 clothing factories and approximately 6,000 retail locations. In its last quarterly financial release, for 2Q23, the company reported results described as ‘strong,’ with $2.2 billion in revenue. That was up 3.8% year-over-year and came in $20 million ahead of the forecast. The firm’s bottom-line figure, a non-GAAP EPS of $1.98, was 23 cents better than had been anticipated. For 2023 as a whole, PVH is guiding toward a revenue increase in the range of 3% to 4%. PVH’s results were supported by an 11% increase in the company’s ‘direct-to-consumer’ revenue.

In his coverage of PVH for JPMorgan, analyst Matthew Boss bases his upbeat view on the company’s demonstrated ability to deliver on its plans. He writes, “We rate PVH Overweight – with a multi-year brand ‘unlock’ underway in our view as mgmt focuses on driving increased desirability of the Calvin Klein and Tommy Hilfiger brands w/ incremental opportunity in N. America (brand whitespace & bolstered partnerships, increasing Hero product focus, and inventory reduction).”

These comments back up Boss’s Overweight (i.e. Buy), and is price target, now set at $119, implies a 64% upside by this time next year. (Watch Boss’s track record)

Overall, there are 11 recent analyst reviews on file for PVH, and their breakdown of 7 Buys and 4 Holds leads to a Moderate Buy consensus rating for the stock. The shares are trading at $72.31 with a $102.18 average price target, for a 41% upside potential in the coming year. (See PVH stock forecast)

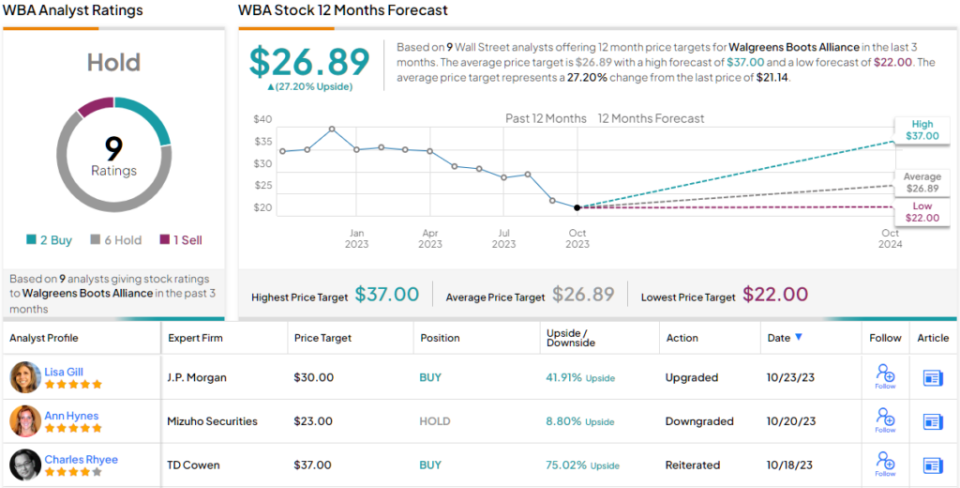

Walgreens Boots Alliance (WBA)

Now we’ll switch from clothing to the pharmacy industry, where the Illinois-based Walgreens Boots holding company is a major player in the retail pharmacy sector in both the US and the UK. The company name reflects its makeup; it is the owner of the US-based Walgreens chain and the UK-based Boots chain of retail pharmacy stores. In addition, the company owns several pharmaceutical manufacturing and distribution centers.

In all, Walgreen Boots has more than 13,000 retail locations across 9 countries, employing over 331,000 people – of whom more than 31,000 are pharmacists. The company’s largest presence is in the US, where it has 8,886 retail locations; there are another 3,989 locations in the international market.

This company has taken a hit in recent months due to the continued fading of the COVID pandemic emergency and related measures. In the firm’s recent report for fiscal 4Q23 and the full fiscal year 2023, the quarterly bottom line was down year-over-year and missed the forecast. The earnings figure, reported as 67 cents per share in non-GAAP measures, was down 18% from the year-ago period and was 2 cents below the estimates.

The earnings miss came even as Walgreens Boots reported a solid gain in revenue. Quarterly revenue, at $35.4 billion, was up more than 9% year-over-year and came in $580 million over the forecast. For the full fiscal year, which ended on August 31, the company’s top line rose ~5%, to $139.1 billion.

Walgreens Boots pays out a solid dividend to shareholders, and on October 26 declared the next payment, set to go out on December 12, at 48 cents per common share. This annualizes to $1.92 per share, and gives a yield of 9%. In an impressive metric that dividend-minded investors should note, Walgreens Boots, and its predecessor, Walgreens Co., has not missed a dividend payment in 91 years.

5-star analyst Lisa Gill covers this stock for JPMorgan, and her positive outlook is based on a combination of factors, including good risk-reward, improved management, and a favorable valuation.

“We see the new leadership team and FY24 guidance as creating a relatively favorable risk/reward balance. Our rating is predicated on an upgraded management team executing vs an achievable bar from trough results and a valuation that appears to more than incorporate the uncertainty of the current situation. While this does require that WBA executes on a proof-of-concept and shows consistency and credibility in its guide, we think that there is upside to the current range based on this as the company progresses through FY24 and clears some overhangs around debt and the dividend,” Gill opined.

Quantifying this stance, Gill rates WBA an Overweight (i.e. Buy), and sets a price target of $30 to point toward a ~42% upside for the next 12 months. (Watch Gill’s track record)

While Gill’s outlook is bullish, the consensus from the Street is more cautious. WBA shares have a Hold (i.e. Neutral) consensus rating, based on 9 recent analyst reviews that include 2 Buys, 6 Holds, and 1 Sell. However, the $26.89 average target price suggests a potential one-year upside of 27% from current levels. (See WBA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

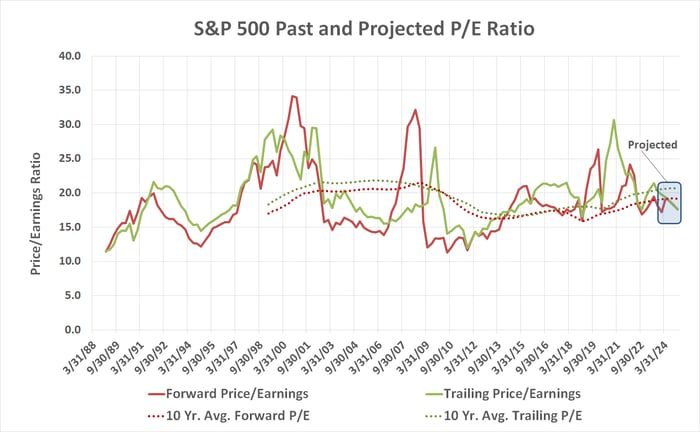

The market hasn’t exactly been firing on all cylinders recently. As of the latest look, the S&P 500 (^GSPC -0.48%) is down 8% from its late-July peak, mostly on fears that persistent inflation will push the world into a recession. And maybe it will.

We’re now into the third quarter’s earnings season with all of September’s economic reports in hand, however, and so far the numbers aren’t too bad. They’re pretty good, in fact, with the analyst community still calling for earnings growth rather than an earnings contraction. This leaves the market’s past and projected valuation in line with long-term norms.

Translation: You may want to stick with your stocks right now if you’ve been thinking about an exit here. Or, if you’re already out, you might want to use the recent sell-off as a reentry opportunity.

By the numbers

Cutting straight to the chase, the S&P 500 is currently valued at 20.2 times its trailing per-share profits, and right around 18.1 times its 12-month earnings projections. Both numbers are below their respective 10-year average price-to-earnings ratios, albeit just barely.

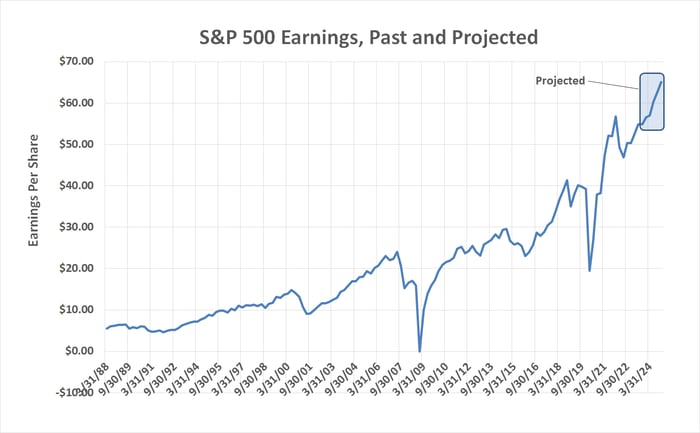

Data source: Standard & Poor’s. Chart by author.

Surprised? The explanation is simple enough — earnings are growing rather than falling. The S&P 500’s earnings are projected to roll in at $54.82 per share for the third quarter, up 8.8% from its collective bottom line from the same quarter a year earlier, en route to new record levels next year.

Data source: Standard & Poor’s. Chart by author.

There’s no fortuitous accounting causing artificially elevated profitability levels, either. All sectors are turning about as much of their revenue into net income as they normally would (although the energy sector is doing measurably better than its average in this regard, thanks to frothy oil prices). All told, 11.8% of the S&P 500’s third-quarter revenue is expected to become net income, in line with long-term norms.

This reality doesn’t exactly jibe with the prevailing narrative, does it? Consumers are supposed to be buckling under the weight of rampant inflation. For-profit corporations are presumed to be struggling with sky-high borrowing costs. Everyone’s supposed to be unable to cope with this challenging economy. Ergo, stocks are supposed to be dangerously overvalued.

Except… they’re not.

It’s a bigger-picture, forward-looking kind of thing

There is one reasonable argument that the S&P 500’s trailing and forward-looking price-to-earnings ratios are still too frothy at their current levels. That’s interest rates.

See, the market tends to support steeper valuations when interest rates are low and borrowing is cheap, which was the case for years between 2008’s subprime mortgage meltdown and 2022’s end to the COVID-19 pandemic. Conversely, when interest rates reach multiyear highs as they have this year, valuations could be expected to slump. That’s because the reward for holding fixed-income investments like Treasury bonds and bills is higher in these environments, so the relative attractiveness in holding stocks is lowered. That means valuation figures could — and some say should — contract.

Be careful when it comes to making decisions based on such valuation models, though. They’re complex, and yet incomplete in that they don’t consider and then quantify every factor that might impact a stock’s or a broad market’s fair valuation. More often than not a simpler approach to stock-picking is a superior solution if only because it’s easier to implement and maintain.

In other words, don’t get bogged down by details that may or may not matter. Rather, take note of the fact that earnings have been consistently rising since last year, and are expected to continue growing at least through 2024 against a backdrop of waning inflation. That dials back much of any risk linked to excessive valuations.

That’s according to JPMorgan Chase‘s U.S. Head of Investment Strategy Jacob Manoukian, anyway. He noted in early October: “Earnings expectations are still climbing, while the drawdown has brought valuations back in line with the 10-year average level. From here, we think … positive seasonal trends and stabilizing bond yields will help equities start to rally again.” Manoukian concludes, “Looking out, we think the chances are better than not that the S&P 500 makes a new all-time high by the middle of next year due to decent earnings growth and valuation expansion as inflation fades further.”

And Manoukian is hardly alone in his optimism. David Lefkowitz, chief of UBS‘ U.S. equity investing, penned in mid-October, “While valuations are high relative to history, they are reasonable in the context of low unemployment and falling inflation.” Lefkowitz is calling for “a soft-ish landing in the U.S. economy, which should drive a recovery in earnings growth and close to a double-digit total return in U.S. large-cap stocks over the coming year.”

Don’t overthink it

Will the S&P 500 make a straight-line move to UBS’ mid-2024 target of 4,500? Not likely. The index could even lose more ground before starting to make its way to that level, which is 7% higher than its present price. It’s also sure to remain volatile between now and then no matter what’s in the cards.

If you’re still on the sidelines because you fear stocks can’t justify their current and forward-looking valuations in the shadow of inflation, fear not. Actual earnings still justify the S&P 500’s present price, and most of its stocks’ prices too. There’s even room for some near-term upside.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.