A senior executive at Binance, who was detained by Nigerian authorities in late February, has since escaped from custody. The executive Nadeem Anjarwalla is believed to have left the country using a Kenyan passport. The Nigerian government confirmed Anjarwalla’s escape and said it would ask Interpol to issue an international arrest warrant. Binance Executive Departs […]

A senior executive at Binance, who was detained by Nigerian authorities in late February, has since escaped from custody. The executive Nadeem Anjarwalla is believed to have left the country using a Kenyan passport. The Nigerian government confirmed Anjarwalla’s escape and said it would ask Interpol to issue an international arrest warrant. Binance Executive Departs […]

Source link

custody

House Financial Services Committee Advances Bill to Repeal SEC Bulletin Preventing Banks From Offering Crypto Custody Services

The House Financial Services Committee of the U.S. Congress has advanced a resolution that seeks to disavow SEC SAB 121, a bulletin that leaves banks and financial institutions out of the cryptocurrency custody provider market. However, the resolution, advanced with bipartisan support, is unlikely to be passed at a vote on the House floor, according […]

The House Financial Services Committee of the U.S. Congress has advanced a resolution that seeks to disavow SEC SAB 121, a bulletin that leaves banks and financial institutions out of the cryptocurrency custody provider market. However, the resolution, advanced with bipartisan support, is unlikely to be passed at a vote on the House floor, according […]

Source link

Ping Exchange’s hybrid cold storage redefines standards for crypto exchange custody

The launch of Ping Exchange signals a potential new stage in digital assets trading. The hybrid platform merges robust security protocols with user-focused asset control, setting a high bar for how exchanges should safeguard user assets. Ping’s standout feature is an unconventional model using a hybrid custodial cold storage to redefine crypto exchange security.

Ping leverages the unique CorePass ID application for streamlined user authentication. Traditional username and password vulnerabilities and cumbersome two-factor authentication (2FA) methods are gone. Instead, CorePass utilizes blockchain-secured identity information, rapid QR code scanning, and Core Blockchain encryption for secure, decentralized login and withdrawals.

Furthermore, while assets deposited onto the platform are placed into Ping’s custody, withdrawal of any assets remains tied to the user’s CorePass ID. Ping cannot withdraw deposited funds without authorization from the user, only allowing trading of assets within the exchange. This streamlined, self-custodial approach places an unprecedented level of access control into users’ hands, merging the benefits of DeFi and CeFi into a new opportunity for users.

So much exchange-focused content references the failures of FTX, Celsius, BlockFi, etc., while claiming to “do better” by offering more secure custody methodologies and promising not to comingle funds. Proof-of-reserve attestations are a fantastic first step; however, Ping’s model puts a flag in the ground in a different, much more substantial way.

With Ping, the CoDeTech team is offering a way to trade digital assets in an exchange environment without signing away the rights to your assets or your identity. Using CorePass, you, the user, remain in control of the data attached to your KYC verification and can revoke it from the exchange at any time. Further, the assets you deposit can be traded across any of the supported trading pairs with other users through a standard exchange order book. Yet, the exchange cannot withdraw your funds without your permission. While not impossible, an FTX scenario would be much more complex with Ping when compared to many traditional exchanges.

In order to facilitate trades Ping has the ability to swap assets between users. Ping also is required to retain the ability to freeze assets to be compliant with AML/KYC regulations. Like traditional exchanges, when it creates the deposit wallet it retains the associated private keys. However, these keys are then required to do anything with deposited funds not already approved by the user.

I’ve often touted that FTX wasn’t a crypto problem but a people problem. Many exchanges don’t rely enough on blockchain technology for their day-to-day operation. I’m so excited to see products like Ping come to market, which put blockchain verification and validation at its core.

Balancing Speed with Uncompromising Security

Moreover, Ping’s focus on cold storage is a cornerstone of its security framework. While many centralized exchanges rely on a less secure mix of hot and cold wallets, Ping’s air-gapped CorePass ID wallets isolate crypto holdings. CorePass ID allows for offline signing through QR codes, creating an air-gapped approach to custody. This strategy significantly reduces the surface area for hackers, minimizing the risk of costly breaches.

The meticulous offline transaction creation and signing process on these air-gapped devices demonstrates Ping’s commitment to safeguarding user funds. Moreover, integrating the ICAN standard with crypto wallets helps prevent sending and receiving errors while supporting various blockchains through network prefixes.

Despite this uncompromising stance on security, Ping also offers exceptional transaction speeds, particularly on the Core Blockchain, with confirmation times as low as a few seconds. This speed comes without sacrificing security. Additionally, near-instant withdrawal processing, typically achievable in under a minute, aligns with Ping Exchange’s pledge to enhance the user experience.

Innovation in Compliance

Ping’s technology also improves transaction security and compliance standards through its automated Know Your Customer (KYC) process. As mentioned in Core Corner Issue 1, CorePass ID allows users to complete a KYC process for their wallet and then essentially sell this data to any third parties, such as Ping, at a later date. This puts the power back in the hands of the user, giving them greater control over their data and who has access.

Ping aligns document submission with a tiered access system to streamline the process further, granting users personalized permissions appropriate to their verification level. This approach simplifies compliance with global regulations such as GDPR and CCPA, enhancing the overall security posture of the platform. Ping’s approach to compliance aims to be accepted as ‘best standard’ by regulators, according to people familiar with the matter.

More Than Just an Exchange

Beyond these novel custody methodologies, Ping Exchange offers real-time notifications, an AntiBot trading system, and multi-language support to cater to a wide spectrum of users, promoting broader inclusion.

While this innovative exchange showcases many groundbreaking features, it’s essential to exercise caution, as with any new platform. Time will ultimately determine its ability to deliver long-term stability and attract a significant user base. Nevertheless, with its innovative solutions to common exchange vulnerabilities, Ping Exchange warrants consideration from anyone seeking a new trading platform offering security and convenience.

In its first month of trading, it has processed volumes comparable to the top 200 DeFi platforms from CryptoSlate analysis. Further, thus far, it has done so without market makers adding liquidity. Instead, all trading through the platform has been peer-to-peer among the nascent Core Blockchain community.

Ping provides unparalleled access to these assets as the world’s first exchange to feature markets for Core Coin (XCB) and Core Token (CTN). Ping users enjoy unique trading opportunities while at the forefront of Core Blockchain developments. Other assets such as Ethereum, Bitcoin, Litecoin, and USDC are also actively tradeable.

The digital assets world is one of perpetual innovation. Ping Exchange’s novel approach to custody, compliance, and user experience could shape the future of exchanges and elevate the industry’s security standards.

Coinbase Custody reportedly now holds over 90% of all Bitcoin ETFs in the United States. This development was revealed by the crypto exchange’s CEO, Brian Armstrong, while appraising the company’s performance in the fourth quarter (Q4) of 2023.

Coinbase Emerges As Major Player In Bitcoin ETF Market

In an X post on February 16, Brian Armstrong shared specific highlights of Coinbase’s achievement in Q4 2023. In particular, He noted that the American crypto exchange has played a crucial part in facilitating the adoption of cryptocurrencies by traditional financial firms (TradFi).

A major part of this adoption is the Bitcoin ETF market which is worth $37 billion, ranking as the second largest commodity ETF market after Gold. Armstrong noted that Coinbase has played a significant role in this development, serving as custodian for 90% of the investment funds in the Bitcoin ETF market.

A few thoughts on our Q4 Earnings yesterday:

2023 was a great year for Coinbase and we’re in a strong financial position. We cut costs by 45% y/y and shipped products faster with a leaner team driving $95 million of positive net income for 2023, $964 million in positive Adj.… pic.twitter.com/XK8f0EQBdP

— Brian Armstrong 🛡️ (@brian_armstrong) February 16, 2024

For context, a custodian is a regulated financial institution that holds customers’ securities and assets, providing protection against any form of loss or theft. Notably, Coinbase is listed as the custodian for eight of the 11 recently launched Bitcoin spot ETFs. These include BlackRock’s IBIT, Ark Invest’s ARKB, Bitwise’s BITB, and Grayscale’s GBTC, among others.

These statistics indicate that Coinbase is well placed to record larger milestones as the top traditional financial institutions are tipped to finally invest in Bitcoin ETFs, especially upon the proven success and stability of the Bitcoin spot ETFs.

According to Armstrong, other notable Coinbase achievements in Q4 2024 include the launch of the exchange’s international wing, and the layer-2 blockchain solution Base. The crypto exchange also claimed to slash its annual costs by 45% while generating a total income of $3.1 billion.

Looking Forward To 2024

In retrospect to 2024, Armstrong stated that Coinbase will maintain focus on its international expansion and new derivatives products. In addition, they will aim to promote the adoption of crypto payments by transforming the Coinbase wallet into a super app.

Finally, the exchange CEO states that Coinbase will continue to advocate for a clear regulatory framework applicable to the crypto space. Armstrong says that Coinbase is committed to this course and is willing to explore all means, including legal processes as well as engaging the federal legislators.

COIN trading at $180.28 on the trading chart | Source: COIN chart on Tradingview.com

COIN trading at $180.28 on the trading chart | Source: COIN chart on Tradingview.com

Featured image from CNBC, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Binance allows customers to custody trading collateral off exchange as market share recovers

A Binance representative confirmed in a Jan. 30 email statement sent to CryptoSlate that the platform is now allowing institutional investors to secure their trading collateral through a third-party banking partner.

Binance’s solution, described as a “banking triparty” arrangement, has been under development for the past two years and directly addresses the primary concern of counterparty risk, a significant consideration for institutional investors. This model enables investors to manage risk effectively while optimizing capital efficiency by pledging collateral in traditional assets.

While details about the specific banking partners remain undisclosed, Binance emphasized active engagement with various banking entities and institutional investors expressing interest in the arrangement.

The platform introduced the pilot scheme for this solution last November, allowing collateral held with the banking partner to be in fiat equivalents, such as Treasury Bills.

Before this development, Binance clients were limited to holding their assets on the exchange itself or through its custodial service provider, Ceffu. However, concerns arose following the U.S. Securities and Exchange Commission’s lawsuit against Binance, questioning the exchange’s crypto wallet custody practices and its relationship with Ceffu.

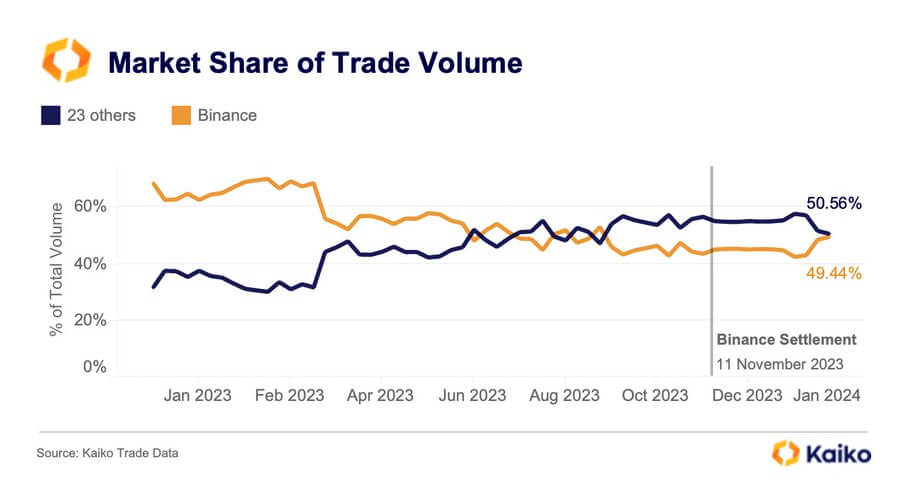

Binance market share recovers.

Binance market share is steadily growing to previous heights after its run-in with several financial regulators across different jurisdictions impacted its operations last year.

Last year, the platform strategically withdrew from Canada, the United Kingdom, and several European nations, including Austria, Cyprus, and the Netherlands, due to regulatory non-compliance issues.

Furthermore, it faced a substantial $4.3 billion settlement with U.S. authorities, leading to a market share dip to 44.5% by the close of the same year.

However, recent findings from Kaiko Research indicate a noteworthy comeback for Binance this year.

Data reveals that Binance’s trading volume has climbed to 49.44% from its previous multi-year low, while 23 other centralized exchanges collectively account for 50.56% of trading activities.

In response to this significant turnaround, Binance CEO Richard Teng expressed his optimism with a succinct “Keep Building” post on social media platform X.

The post Binance allows customers to custody trading collateral off exchange as market share recovers appeared first on CryptoSlate.

Coinbase Custody Head Departs As Crypto Giant Prepares For Bitcoin ETF Services

According to Bloomberg, Coinbase Global has recently experienced a change in leadership within its custody division. The departure of Aaron Schnarch, former CEO of Coinbase Custody, has been confirmed by a spokesperson, who also revealed that Schnarch was replaced by Rick Schonberg in August.

Per the report, the transition aligns with Coinbase’s efforts to offer services to applicants of spot Bitcoin (BTC) exchange-traded funds (ETFs).

Coinbase Affirms Readiness For Bitcoin ETF Approval

Rick Schonberg, who joined Coinbase in 2021, aims to provide experience to his new role, having previously worked at reputable financial institutions such as Goldman Sachs, State Street, and Tagomi, according to Bloomberg.

Coinbase on the other hand, has emerged as the preferred choice for custodial services among Bitcoin ETF applicants, including industry giants like BlackRock, Franklin Templeton, and Grayscale Investments.

Custody services play a crucial role for potential managers of spot Bitcoin ETFs, as investors rely on these providers to securely safeguard their digital tokens.

Notably, a Coinbase spokesperson emphasized the company’s preparedness for ETF approval, stating to Bloomberg:

We have extensively prepared for ETF approval. Our systems have been designed and tested to handle added trading volume, increased liquidity, and general increases in demand on our systems.

Coinbase Custody, operating as a trust company, falls under the regulatory oversight of the New York Department of Financial Services and undergoes auditing by Deloitte & Touche.

Countdown To Historic Decision

The race to obtain regulatory approval for the first ETF directly investing in the largest cryptocurrency, Bitcoin, is entering a critical phase.

The US Securities and Exchange Commission (SEC) faces a deadline of January 10 to decide whether to approve a spot Bitcoin ETF application submitted by ARK Investment Management, led by Cathie Wood, and 21Shares, along with potentially other similar filings.

Overall, the departure of Aaron Schnarch and the subsequent appointment of Rick Schonberg within Coinbase Custody highlight the company’s strategy to the growing demand for custodial services from Bitcoin ETF applicants.

With the potential approval of spot Bitcoin ETFs on the horizon, the industry eagerly awaits the SEC’s decision, which will have far-reaching implications for the adoption and mainstream acceptance of cryptocurrencies.

Bitcoin, the largest cryptocurrency in the market, is currently trading at $42,100, representing a 1.1% decline over the past 24 hours.

In recent weeks, BTC’s price has been consolidating above $40,000, exhibiting sideways movement since the beginning of December. However, it has achieved a notable gain of over 11% in the last 30 days.

It remains to be seen how the price of BTC will react to the potential approval of these index funds by the largest asset managers in the world, and what other impact it will have on the overall crypto market.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Terraform Labs co-founder Do Kwon’s custody in Montenegro has reportedly been extended by two months, Barron’s reported on Dec. 12.

According to the report, Marija Rakovic, a spokesperson for the High Court, confirmed that the “extradition custody of Do Kwon [has been] expanded by two months.”

The report did not provide additional information on why Kwon’s custody was extended.

In March, the authorities in Montenegro arrested Kwon, alongside Terraform Labs chief financial officer Han Chang-joon, for traveling with forged documents. He was sentenced to a four-month sentence, which is gradually coming to an end.

However, the authorities would not release Kwon as a free man as he faces possible extradition to the United States or South Korea. A Montenegro Court determined that the necessary legal conditions for his extradition to either country have been met.

The disgraced crypto tycoon is wanted in both countries and has been criminally charged for his role in the shocking collapse of the Terra ecosystem.

Meanwhile, CryptoSlate reported that Kwon could likely be extradited to the U.S. despite his favoring an extradition to South Korea instead. However, the final decision on his fate lies with Montenegro’s Minister of Justice, who has yet to make a public statement about the decision.

Last year, Terra algorithmic TerraUSD (USTC, previously UST) stablecoin and its associated cryptocurrencies collapsed and wiped off about $40 billion worth of assets from the market. The incident shook the global financial scene and resulted in increased scrutiny of the emerging industry among regulatory authorities globally.

The post Do Kwon’s custody in Montenegro reportedly extended by 2 months appeared first on CryptoSlate.

Celsius initiates withdrawals for eligible custody users amid app glitches and login woes

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Crypto custodial firm BitGo reportedly secured a cryptocurrency custody license from the German Federal Financial Supervisory Authority (BaFin), Financial Magnate reported Nov. 1.

The licensing represents a significant milestone for BitGo in Europe and highlights the important role BaFin plays in setting crypto regulation, according to Dejan Maljevic, the managing director of BitGo Europe.

“BaFin is recognized as one of the world’s key trendsetters in crypto regulation. It enables the progress that digital currencies entail while creating a secure regulatory framework,” Maljevic reportedly said.

Before this licensing, BitGo had been assisting its customers in safeguarding their cryptocurrency holdings under BaFin’s supervision through a transitional arrangement established in 2019.

Meanwhile, this development continues BitGo’s recent positive streak. In August, the firm secured $100 million in a funding round that pushed its valuation to $1.75 billion. At the time, CEO Mike Belshe emphasized the importance of being licensed and regulated, stating that “regulatory safety is just on everybody’s minds right now.”

BitGo secured a New York Trust license in March 2021, allowing it to operate as an independent and regulated qualified custodian under the New York State Banking Law.

Germany’s role in Europe crypto ecosystem

Germany is recognized as one of the most friendly crypto-regulatory environments in Europe.

A recent study by Chainalysis has positioned the nation as Europe’s second-largest cryptocurrency economy. Additionally, a 2022 CoinCub ranking claimed Germany was the world’s most crypto-friendly country, citing its regulatory clarity and strong legal frameworks.

For context, the country introduced regulations allowing companies to issue crypto shares. Besides that, the country’s regulatory authorities have also formulated several measures designed to protect people under jurisdictions.

This has resulted in major traditional financial institutions like Deutsche Bank AG applying for crypto-related licensing with the authorities.

However, crypto firms like Binance and WorldCoin have struggled within the region despite its pro-crypto tendencies.

Bitfinex teams up with Zodia Custody in boost to institutional trading

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Oops…you must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.