Higher U.S. inflation is dashing investors’ hopes for multiple Federal Reserve rate cuts this year, while opening the door to 5% Treasury yields across the board and cleaving the stock market into distinct categories of winners and losers.

Source link

Cuts

Tesla cuts price FSD premium driver assistance option by half in U.S.

Drivers charge their Teslas in Fountain Valley, CA, on Wednesday, March 20, 2024.

Jeff Gritchen | Medianews Group | Getty Images

Tesla said on Friday that it’s cutting the subscription price of its premium driver assistance system for customers in the U.S.

Marketed as its Full Self-Driving, or FSD, package, Tesla customers will now pay $99 per month, down from $199 previously.

The price cut is at odds with previous promises from CEO Elon Musk, who has repeatedly said that the cost of FSD would only go up as Tesla adds features and functionality to the system.

“The FSD price will continue to rise as the software gets closer to full self-driving capability with regulatory approval,” Musk wrote on Twitter, now known as X, on May 18, 2020. He said at that point “the value of FSD is probably somewhere in excess of $100,000” per car.

Despite its brand name, the company’s FSD option today doesn’t make Tesla vehicles autonomous or functional as robotaxis.

Musk has promised shareholders and customers a robotaxi for years, and has said their existing vehicles would soon become self driving after an over-the-air software update.

He told investors on a call in 2019 that autonomous driving would transform Tesla into a company with a $500 billion market cap, up from around $42 billion at that time. (The company is worth over $500 billion today even without having developed an autonomous car.) Tesla raised over $2 billion through debt and equity after the call.

In a notice that’s now shown to some drivers through the touchscreen displays in their cars, Tesla says:

“Full Self-Driving (Supervised) can drive your Tesla almost anywhere. It will make lane changes, select forks to follow your navigation route, navigate around other vehicles and objects, and make left and right turns. It must be used with additional caution and an attentive driver. It does not make your vehicle autonomous. Do not become complacent.”

The company uses sensors in the steering wheel and cabin cameras, positioned above the rearview mirror, to determine if a driver is attentive or not, and will audibly alert drivers to keep their eyes on the road or hands on the wheel.

In 2022, the California Department of Motor Vehicles formally accused Tesla of engaging in deceptive practices around the marketing of its driver assistance systems, including its standard package Autopilot and FSD in the U.S., according to filings with a state administrative agency.

Meanwhile, Alphabet-owned Waymo is now operating commercial robotaxi services in several U.S. cities. The company also recently struck a partnership with Uber Eats for driverless food delivery. In China, Didi’s autonomous unit operates commercially in markets including Guangzhou. Companies including Bill Gates-backed Wayve in the U.K. and Amazon’s Zoox in the U.S. are testing robotaxis as well.

In a push for end-of-quarter sales last month, Musk mandated that all sales and service staff install and demo FSD for customers before handing over the keys. He wrote in an email to employees, “Almost no one actually realizes how well (supervised) FSD actually works. I know this will slow down the delivery process, but it is nonetheless a hard requirement.”

After that, Tesla also announced it would give away a one-month free trial of FSD to all customers in North America. Owners’ responses to the latest version of FSD have been mixed with some fans impressed, and many safety-conscious drivers switching off the free FSD trial, viewing it as inconsistent and unsafe.

Musk also recently promised to “unveil” a new dedicated robotaxi on Aug. 8. Tesla unveilings are marketing events, and don’t indicate a date for the start of production and deliveries. For example, Tesla unveiled a new version of the Roadster, and a fully electric heavy-duty truck called the Semi in 2017 and didn’t begin Semi deliveries until December 2022. It still hasn’t produced the new version of the Roadster.

Tesla didn’t respond to a request for more information, including whether the price cut announced Friday is permanent or temporary.

WATCH: Musk is trying to highlight the value that robotaxis could bring

A high dividend yield can be alluring. However, a sky-high payout is often a warning sign that the market believes the company won’t be able to maintain its dividend much longer. Because of that, investors need to be careful when buying stocks with big dividend yields.

Take Annaly Capital Management (NLY 1.29%) and Medical Properties Trust (MPW -0.42%). The real estate investment trusts (REITs) currently offer double-digit yields. Those big-time payouts are likely too good to be true. Here’s why investors shouldn’t fall for them.

Likely on the cutting board again

Annaly Capital Management currently yields more than 13%, about 10x the S&P 500‘s dividend yield. The mortgage REIT can currently afford its monster dividend. It recorded $0.68 per share of earnings available for distribution (EAD) during the fourth quarter, covering its $0.65 dividend outlay.

The REIT recently declared its next dividend payment, maintaining the $0.65 per-share level for the first quarter. That’s not a surprise. The company’s CEO David Finkelstein stated on the fourth-quarter call that the REIT expected to earn enough to cover the dividend in the current quarter.

However, the dividend’s future beyond that payment remains uncertain. One factor driving that view is that Annaly tightened its return expectations due to the current market conditions. Those market conditions have caused its EAD to fall from $0.89 per share at the end of 2023 to a low of $0.66 per share in the third quarter of 2023.

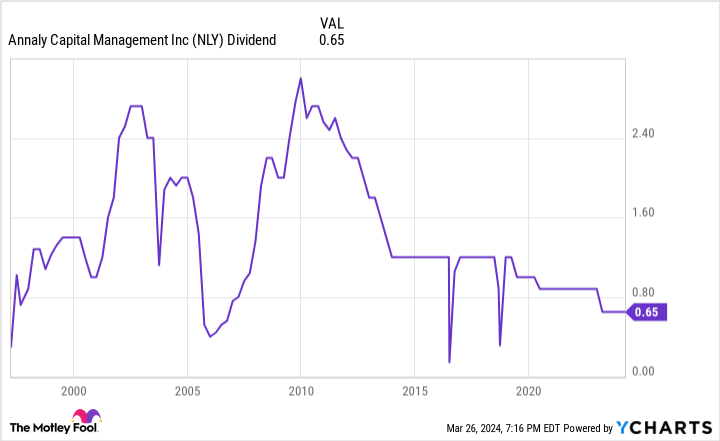

That decline has already caused the REIT to cut its dividend early last year, from $0.88 per share to its current level. A further deterioration in its EAD would likely force Annaly to cut its dividend again, which it has done many times over the years:

NLY Dividend data by YCharts.

Finkelstein seemed to leave the door open on another dividend cut this year. He stated on the fourth-quarter call that while management’s view at the time was not to recommend a dividend adjustment to the Board of Directors, they would “see how things progress throughout the rest of the year.” If the company’s earnings fall any further, it might need another downward adjustment in the dividend payment.

Still not healthy

Medical Properties Trust currently yields around 15%. The hospital-focused healthcare REIT has already slashed its dividend once in the past year. Last August, it updated its capital allocation strategy, which included cutting its quarterly dividend from $0.29 to $0.15 per share. That move better aligned the payout with its adjusted funds from operations (FFO) following a string of asset sales.

The REIT needed to sell properties to repay debt, which it couldn’t refinance at an attractive rate due to surging interest rates and tenant troubles. It has been working directly with two tenants to help them get back on a firmer financial foundation. Unfortunately, while one tenant has finally resumed paying rent, another only pays some of what it owes the REIT. Because of that and its balance-sheet issues, Medical Properties Trust plans to sell more assets.

The hospital owner’s continued issues could cause it to cut its dividend again. CEO Ed Aldag noted on the fourth-quarter call that maintaining the company’s current dividend level isn’t dependent on its tenant resuming rent since it has a cushion that’s big enough to cover its payout. However, it’s contingent on closing some of the transactions it’s pursuing to boost liquidity. If the company can’t close those deals, it might cut or suspend its dividend to retain additional cash for debt reduction.

Not sustainable income stocks

Annaly Capital Management and Medical Properties Trust might offer enticing yields but unfortunately, they don’t look sustainable. Because of that, income-focused investors should avoid these REITs for now since another round of cuts seems to be coming soon.

Matt DiLallo has positions in Annaly Capital Management and Medical Properties Trust. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Nissan looks to address ‘extreme market volatility’ with 30 new models, EV cost cuts

Nissan is targeting an additional 1 million vehicle sales over the next three years and a 30% reduction in electric vehicle production costs by 2030, the Japanese carmaker announced Monday.

In a new medium-term business plan, Nissan also said it would launch 30 new models by fiscal 2026, with 16 of these electrified. It’s aiming for EV and combustion engine costs to reach parity by 2030.

“This plan will enable us to go further and faster in driving value and competitiveness,” Nissan President and CEO Makoto Uchida said in a statement.

“Faced with extreme market volatility, Nissan is taking decisive actions guided by the new plan to ensure sustainable growth and profitability.”

The automaker also said it is targeting an operating profit margin of more than 6% by the end of fiscal 2026, as well as “long-term profitable growth.”

‘A lot of uncertainty’

A Nissan Ariya electric car is on display during 2020 Beijing International Automotive Exhibition (Auto China 2020) at China International Exhibition Center on September 27, 2020 in Beijing, China.

Vcg | Visual China Group | Getty Images

To address this, Nissan plans to develop EVs in “families,” integrate powertrains and focus on battery innovations as it looks to cut the cost of its next-generation fleet by 30% when compared with the current model Ariya crossover.

“In order to do that, we have to have a great partnership with our suppliers to work on from the app stream earlier with the scale that we have to provide,” Uchida told CNBC’s “Squawk Box Europe.”

“Otherwise, I think the next five years, there’s a lot of uncertainty that we are facing. The scalability will be most important, and how are we going to make that as a Nissan collaboration with a partnership is going to be one of the key items.”

Nissan’s plan: The Arc

Under the two-part plan dubbed The Arc, Nissan said it will aim to ensure volume growth through a “tailored regional strategy,” and prepare for an accelerated EV transition by balancing its portfolio between EV and combustion cars, growing volumes in major markets, and financial discipline.

This will be supported by “smart partnerships, enhanced EV competitiveness, differentiated innovations and new revenue streams.”

Nissan said this strategy could yield potential revenues of 2.5 trillion yen ($16 billion) from new business opportunities by fiscal 2030.

Bank of England set to hold rates, but falling inflation brings cuts into view

The Bank of England in the City of London, after figures showed Britain’s economy slipped into a recession at the end of 2023.

Yui Mok | Pa Images | Getty Images

LONDON — The Bank of England is widely expected to keep interest rates unchanged at 5.25% on Thursday, but economists are divided on when the first cut will come.

Headline inflation slid by more than expected to an annual 3.4% in February, hitting its lowest level since September 2021, data showed Wednesday. The central bank expects the consumer price index to return to its 2% target in the second quarter, as the household energy price cap is once again lowered in April.

The larger-than-expected fall in both the headline and core figures was welcome news for policymakers ahead of this week’s interest rate decision, though the Monetary Policy Committee has so far been reluctant to offer strong guidance on the timing of its first reduction.

The U.K. economy slid into a technical recession in the final quarter of 2023 and has endured two years of stagnation, following a huge gas supply shock in the wake of Russia’s invasion of Ukraine. Berenberg Senior Economist Kallum Pickering said that the Bank will likely hope to loosen policy soon in order to support a burgeoning economic recovery.

Pickering suggested that, in light of the inflation data of Wednesday, the MPC may “give a nod to current market expectations for a first cut in June,” which it can then cement in the updated economic projections of May.

“A further dovish tweak at the March meeting would be in line with the trend in recent meetings of policymakers gradually losing their hawkish bias and turning instead towards the question of when to cut rates,” he added.

At the February meeting, two of the nine MPC decision-makers still voted to hike the main Bank rate by another 25 basis points to 5.5%, while another voted to cut by 25 basis points. Pickering suggested both hawks may opt to hold rates this week, or that one more member may favor a cut, and noted that “the early moves of dissenters have often signalled upcoming turning points” in the Bank’s rate cycles.

Berenberg expects headline annual inflation to fall to 2% in the spring and remain close to that level for the remainder of the year. It is anticipating five 25 basis point cuts from the Bank to take its main rate to 4% by the end of the year, before a further 50 basis points of cuts to 3.5% in early 2025. This would still mean interest rates would exceed inflation through at least the next two years.

“The risks to our call are tilted towards fewer cuts in 2025 – especially if the economic recovery builds a head of steam and policymakers begin to worry that strong growth could reignite wage pressures in already tight labour markets,” Pickering added.

Heading the right way, but not ‘home and dry’

A key focus for the MPC has been the U.K.’s tight labor market, which it feared risked entrenching inflationary risks in the economy.

January data published last week showed a weaker picture across all labor market metrics, with wage growth slowing, unemployment rising and vacancy numbers slipping for the 20th consecutive month.

Victoria Clarke, U.K. chief economist at Santander CIB, said that, after last week’s softer labor market figures, the inflation reading of Wednesday was a further indication that embedded risks have reduced and that inflation is on a path towards a sustainable return to target.

“Nevertheless, services inflation is largely tracking the BoE forecast since February, and remains elevated. As such, we do not expect the BoE to conclude it is ‘home and dry’, especially with April being a critical point for U.K. inflation, with the near 10% National Living Wage rise and many firms already having announced, and some implemented, their living wage-linked pay increases,” Clarke said by email.

“The BoE needs data on how broad an uplift this delivers to pay-setting, and hard information on how much is passed through to price-setting over the months that follow.”

Santander judges that the Bank could decide it has seen enough data to cut rates in June, but Clarke argued that an August trim would be “more prudent” given the “month-to-month noise” in labor market figures.

This sentiment was echoed by Moody’s Analytics on Wednesday, with Senior Economist David Muir also suggesting that the MPC will need more evidence to be satisfied that inflationary pressures are contained.

“In particular, services inflation, and wage growth, need to moderate further. We expect this necessary easing to unfold through the first half of the year, allowing a cut in interest rates to be announced in August. That said, uncertainty is high around the timing and the extent of rate cuts this year,” Muir added.

Laid-off techies struggle to find jobs with cuts at highest since 2001

The Google office in New York on February 2, 2023.

Ed Jones | Afp | Getty Images

Allison Croisant, a data scientist with about a decade of experience in technology, was laid off by PayPal earlier this year, joining the masses of unemployed across her industry. Croisant has one word to describe the process of looking for a job right now: “Insane.”

“Everybody else is also getting laid off,” said Croisant, who lives in Omaha, Nebraska, where she worked remotely for PayPal.

Her sentiment is reflected in the numbers. Since the start of the year, more than 50,000 workers have been laid off from over 200 tech companies, according to tracking website Layoffs.fyi. It’s a continuation of the predominant theme of 2023, when more than 260,000 workers across nearly 1,200 tech companies lost their jobs.

Alphabet, Amazon, Meta and Microsoft have all taken part in the downsizing this year, along with eBay, Unity Software, SAP and Cisco. Wall Street has largely cheered on the cost-cutting, sending many tech stocks to record highs on optimism that spending discipline coupled with efficiency gains from artificial intelligence will lead to rising profits. PayPal announced in January that it was eliminating 9% of its workforce, or about 2,500 jobs.

For the tens of thousands of people in Croisant’s position, the path toward reemployment is daunting. All told, 2023 was the second-biggest year of cuts on record in the technology sector, behind only the dot-com crash in 2001, according to outplacement firm Challenger, Gray & Christmas. Not since the spectacular flameouts of Pets.com, eToys and Webvan have so many tech workers lost their jobs in such a short period of time.

Last month’s job cut count was the highest of any February since 2009, when the financial crisis forced companies into cash preservation mode.

CNBC spoke to a dozen people who have been laid off from tech jobs in the past year or so about their experiences navigating the labor market. Some spoke on the condition that CNBC not use their names or write about the details of their situation. Taken together, they paint a picture of an increasingly competitive market with job listings that include exacting requirements for qualification and come with lower pay than their prior gigs.

It’s a particularly confounding situation for software developers and data scientists, who just a couple of years ago had some of the most marketable and highly valued skills on the planet, and are now considering whether they need to exit the industry to find employment.

“The market isn’t what it once was,” Roger Lee, creator of Layoffs.fyi, said in an email. “To secure a new position, many salespeople and recruiters are leaving tech entirely. Even engineers are compromising — accepting roles with less stability, a tougher work environment, or lower pay and benefits.”

Lee said tech salaries have “largely stagnated” in the last two years, citing data from Comprehensive.io, a compensation tracker he recently helped launch.

Croisant’s job search involved applying for some positions that had racked up hundreds of applicants. She could see that data using LinkedIn’s Talent Insights platform, which shows how many people are vying for an open role.

Additionally, some listings required applicants to have advanced degrees or professional experience in machine learning and artificial intelligence, a new development in Croisant’s experience on the job market.

During five weeks of job hunting, Croisant said she applied to 48 openings and landed two interviews. She finally opted to accept a lower-level data analyst role and a roughly $3,000 reduction in her base pay to take a contract role starting next month at a financial technology company.

“This was an absolutely terrifying experience for me, and I’m not sure if I’ll ever truly feel secure in a job again,” Croisant said. “But I’m still one of the lucky ones in the end. I have friends who’ve been looking for months and still haven’t found anything.”

More CNBC news on layoffs

‘It’s humbling’

Krysten Powers was laid off in January from travel tech startup Flyr after two years in marketing at the company. She said navigating the current labor market is like a full-time job, “sometimes even harder.”

“You’re putting out resumes and getting almost immediate rejections,” said Powers, who’s worked in marketing for a decade. “It does take a toll on your confidence and you get this sort of imposter syndrome.”

Powers lives with her husband and two kids in the small town of Natchez, Mississippi. A month before she lost her job, her family bought a new house. Powers said moving isn’t an option, and she’s only considering remote roles in marketing. However, she is willing to accept a pay cut.

“It’s humbling for sure,” she said.

Google Headquarters is seen in Mountain View, California, United States on May 15, 2023.

Tayfun Coskun | Anadolu Agency | Getty Images

The same dynamics are playing out across the industry, even for former employees of Google, which was long considered the home of Silicon Valley’s elite talent.

Christopher Fong, who worked at Google from 2006 to 2015, is the founder of a group called Xoogler.co, which seeks to provide help for people laid off from the internet company. The 9-year-old organization, consisting of thousands of Google alumni and current staffers, offers peer support and hundreds of in-person events.

In January, Google eliminated several hundred positions across its hardware, central engineering and Google Assistant teams. A year earlier, the company cut 12,000 jobs, or roughly 6% of its full-time workforce.

Fong said the “biggest challenge” today for many ex-Google employees is finding a job that maintains their previous level of pay.

Michael Kascsak, who was laid off by Google in March of last year, took a different approach to his job search.

Kascsak said he welcomed a pay cut to start as head of talent acquisition for veterinary business CityVet in January after applying for hundreds of jobs. He acknowledged that his previous employer had set exceptionally high compensation expectations.

“I went into this knowing I had been fortunate to work at a company that paid at the top percentile and I’m a realist. I prepared myself to be flexible,” said Kascsak, who lives in Austin, Texas, and previously worked in talent sourcing for Google. “I’m fine with the pay now because I’m in the environment I want to be in with great people.”

Tech is a notable outlier in a labor market that’s been largely steady over the past two years. Nationwide, the unemployment rate ticked up to 3.9% in February from 3.7% each of the prior three months. It’s been mostly in that range since early 2022. The U.S. economy added 275,000 jobs in February, topping 200,000 for a third straight month.

Booming market for AI engineers

Sentiment indexes are mixed. Job review website Glassdoor’s Employee Confidence Index, which gauges how employees feel about their employer’s six-month business outlook, sank to its lowest level in February since its sentiment data first began in 2016. Among tech workers, discussions about layoffs on Glassdoor have more than quadrupled in the past two years, and were up 12% last month compared with a year earlier.

However, ZipRecruiter’s Job Seeker Confidence Index has been rising since mid-2023, and increased to its highest level in the fourth quarter since the second quarter of 2022.

Even within tech, there’s a vast divide in the current market. Lee of Layoffs.fyi said AI is driving a “return to rapid hiring and expansion,” even as layoffs continue elsewhere. Salaries for AI engineers rose 12% from the third to fourth quarter last year, and the average salary for a senior AI engineer nationally is more than $190,000, according to Comprehensive.io.

Amit Mittal was laid off from AI lending company Upstart

Amit Mittal

Amit Mittal has been on both sides of the employment market — previously as a hiring manager and now as a job seeker.

In November, Mittal was laid off from AI lending company Upstart, where he worked as a software engineering manager, often overseeing interviews. Mittal said he witnessed the hiring process become “a lot more demanding” as layoffs surged.

“There was a lot more pressure on us to basically raise the bar higher and higher,” he said. “Somebody with a four-year experience in the past would have had a pretty good chance at getting a good job. But now they’re competing against people who have six, seven, eight years of experience for the same position.”

Mittal, who’s from India and has lived in the Chicago area since 2007, has lately been subject to a very different kind of pressure. Under his H-1B visa, Mittal had only 60 days from the official end of his employment to find a new job in the tech industry in order to stay in the country.

“If for four months, I have to pay my bills by driving an Uber or working at McDonald’s flipping burgers, that’s fine,” he said. “But that mechanism doesn’t exist for me.”

Mittal has now successfully petitioned to obtain a separate B-2 tourist visa, giving him an extra six months to find new employment. It wasn’t a cheap effort, though. He estimated he spent around $8,000 on legal and administrative costs tied to his submission.

All the while, Mittal said he’s applied for about 110 jobs to no avail. He attributed the dearth of success to employers’ reluctance or inability to sponsor visa holders.

“It seems like the possibilities are pretty slim right now, even though I see hundreds of postings every single day,” Mittal said.

Bill Vezey was laid off by eBay in January following a 13-year career as a software engineer at the online retailer. He said he’s learning the rules of the “new game,” and they’re much different than he remembers.

“Attainability is not just a numbers game,” said Vezey, 64, who lives in Santa Cruz, California. “It is a combination of how well you brand yourself, about your access through networking to any given position — to the hidden job market.”

Vezey said he hopes to be rehired at his longtime employer and wants to remain in tech.

“I am kind of an incurable optimist, despite what 60-odd years of living have brought,” he said.

Like many of those who spoke to CNBC, Powers said she spends her days tailoring her resume for openings, scanning online job boards and applying for newly posted positions. She networks by contacting a recruiter or hiring manager connected to each role, though she said some recruiters have ghosted her as quickly as they’ve expressed interest.

She’s had a few interviews, and turned down one job offer. That position would’ve required her to go to an office while taking a more than 50% pay cut from her previous job. And she’d have to find child care.

“There’s a sense of impending doom,” Powers said. “There is a point where the money runs out and the options become really bleak.”

Still, Powers said she’s trying to stay optimistic, “because giving up is not going to get me a job.”

— CNBC’s Jennifer Elias contributed to this report.

WATCH: Why widespread tech layoffs keep happening despite a strong economy

Jerome Powell says ‘the housing market is in a very challenging situation right now’ and interest rate cuts alone won’t solve a long-running inventory crisis

The housing market has a problem—millions of them. The country is short between 3.5 and 5.5 million housing units, according to various estimates. The roots of the shortage go back to the aftermath of the Global Financial Crisis, when cautious developers were hesitant to invest in new construction and set a precedent of undersupply that’s continued to now. Jerome Powell.

On Thursday, the Federal Reserve chair testified to the Senate Banking Committee against the backdrop of his recent decision not to cut interest rates, the big question investors and homebuyers are asking. Potential rate cuts have given investors hope about some much-needed relief for the housing market, which has struggled to cope with soaring mortgage and refinancing rates, but Powell testified that the housing market’s real problems run much deeper—and it will take more than just monetary policy to fix them.

“The housing market is in a very challenging situation right now,” Powell said on Capitol Hill on Thursday. “Problems associated with low rate mortgage [lock-in] and high [mortgage] rates and all that, those will abate as the economy normalizes and as rates normalize,” he said, referring to the mismatch between something approaching 90% of homeowners with mortgage rates below 6% and the current market offering above 7%. “But we’ll still be left with a housing market nationally, where there is a housing shortage.”

‘There are a ton of things happening’

Powell explained the current problems facing homebuyers and sellers to the committee: “You have a shortage of homes available for sale because many people are living in homes with a very low mortgage rate and can’t afford to refinance, so they’re not moving, which means the supply of regular existing homes that are for sale is historically low and a very low transaction rate,” Powell said. “That actually pushes up the prices of other existing homes, and also of new homes, because there’s just not enough supply.”

But it’s a bigger issue than buyers and sellers being locked in, he said. “There are a ton of things happening … because of higher rates, and those in the short-term are weighing on the housing market … it’s more difficult [for builders] to get people [labor] and materials,” Powell said. “But as [mortgage] rates come down, and that all goes through the economy, we’re still going to be back to a place where we don’t have enough housing.”

The pandemic only made things worse. High inflation has made materials and labor costs far pricier, and ballooning mortgage rates have pumped the brakes on an already-slow sector. National Association of Realtors data showed that there were only 3.2 months of available housing supply as of the end of last year, about half as much as there should be in a balanced market.

Markets expect the Fed to announce rate cuts this year—but while that will offer some short-term relief, it won’t solve the housing market’s deep–set supply problems.

Powell noted that restrictive zoning laws play an important role in limiting new construction. He also pointed out that rising mortgage rates have discouraged longtime homeowners who locked in lower rates from moving, which has limited the number of existing homes on the market and left new homebuyers struggling to find affordable options.

Powell’s threading a tricky needle—the housing market is a big driver of the domestic economy, and overstressing it by keeping interest rates high for too long could threaten the rest of the economy. On the other hand, cutting rates too soon—or too quickly—in line with the industry’s demands could undermine the Fed’s yearslong attempts to stick a soft landing and keep inflation under control.

“Housing activity accounts for nearly 16% of GDP according to NAHB estimates,” wrote a group of housing industry trade organizations in a letter to Powell last fall. “We urge the Fed to take these simple steps to ensure that this sector does not precipitate the hard landing the Fed has tried so hard to avoid.”

This story was originally featured on Fortune.com

For years now, rumors have been flying that Social Security is on the verge of going away. But thankfully, those rumors are bogus.

Social Security is not in danger of disappearing completely for one giant reason — its primary source of funding is payroll tax revenue. And as long as workers continue to get taxed on their earnings to fund the program, Social Security can continue to exist.

That doesn’t mean that Social Security will be able to afford to keep up with scheduled benefits, though. In the coming years, the program is expected to owe more to retired and retiring seniors than what it collects via labor force contributions. And while Social Security can tap its trust funds to keep up with scheduled benefits for a while, in time, those funds are apt to run dry.

Image source: Getty Images.

In fact, recent projections have Social Security’s trust funds running out of money in 2034 — just 10 years from now. So lawmakers have limited time to come up with a solution to prevent those cuts from happening. That’s why it’s a good idea to come up with a plan for dealing with those cuts — whether you’re currently receiving Social Security or are still working.

Set yourself up with a game plan

Social Security cuts aren’t guaranteed to happen. But the fact that lawmakers have yet to arrive at a preventive solution doesn’t bode so well. So it’s a good idea to figure out how you’ll cope with less money from Social Security should that situation come to be.

If you’re already retired, one option to look at may be going back to work. Earnings from a part-time job could replace the portion of your monthly Social Security check that’s at risk of going missing.

Another option is to downsize your home, and possibly your lifestyle. If you’re able to sell a larger home and buy a replacement one at half the cost, you can pocket the difference and use it as income. Plus, downsizing might mean spending a lot less on expenses like property taxes and maintenance. Along these lines, cooking more at home versus dining out frequently could help you conserve cash.

You can also look to move to a part of the country where living costs are generally lower. Just be mindful of the fact that certain states tax Social Security benefits.

Meanwhile, if you’re still working, your best course of action for dealing with Social Security cuts is to save, save, and save some more. The larger a nest egg you manage to bring with you into retirement, the less likely you’ll be to struggle financially on a smaller Social Security benefit.

In fact, let’s say you’re 35 years old with $15,000 in savings to date. If you contribute $500 a month to your retirement plan over the next 30 years, and your portfolio delivers an 8% average annual return, which is a bit below the stock market’s average, you’ll end up with over $830,000.

Nothing’s set in stone

Social Security has been bailed out by lawmakers before in the context of potential cuts, so that may very well happen again this time around. But your best bet is to put a plan in place in case you end up with less money from the program than expected down the line.

New York Democrat Tom Suozzi wins special House election, cuts slim GOP majority

Democratic congressional candidate for New York’s 3rd district, Tom Suozzi, delivers his victory speech during his election night party, following a special election to fill the vacancy created by Republican George Santos’ ouster from Congress, in Woodbury, New York, U.S., February 13, 2024.

Eduardo Munoz | Reuters

Democrat Tom Suozzi has won the New York special election to replace expelled former Rep. George Santos, NBC News projects, flipping a red seat blue and further narrowing Republicans’ slim House majority.

The seat representing New York’s 3rd Congressional District had been vacant since Santos was ousted from Congress late last year under a cloud of scandals and criminal charges.

Suozzi, who previously represented the district, is projected to defeat Republican Mazi Pilip.

Surveys conducted before Election Day showed a tight race between Suozzi and Pilip in the district, which covers parts of Long Island and Queens. But NBC and other outlets projected the outcome of the race less than 90 minutes after polls closed.

“Let’s send a message to our friends running the Congress these days: Stop running around for Trump, and start running the country,” Suozzi said in a victory speech.

As Suozzi took the stage, a pro-Palestinian protester confronted him and screamed, “You support genocide!” The protester was swiftly taken of the stage.

The special election, conducted in spite of a major snowstorm that barreled through the northeast Tuesday morning, could have a major impact on the balance of power in Congress.

Suozzi could be sworn into Congress within days, raising the number of House Democrats to 213 — a relative hair’s breadth from the chamber’s 219-member GOP majority. That means that if the full House is voting, Republicans can only allow two defectors to break ranks and still pass legislation along party lines.

Both parties poured millions of dollars into the contest, but Democrats have spent twice as much as Republicans on advertising — $13 million in total over just 10 weeks, according to The New York Times.

Congressional candidate for New York’s 3rd District Mazi Melesa Pilip campaigns with Brandon Judd, President of the National Border Patrol Council, on February 7, 2024, opposite Creedmoor migrant center in the Queens borough of New York City.

Adam Gray | Getty Images

Pilip, a Nassau County legislator, tried to make the race a referendum on immigration, a galvanizing issue for Republicans across the country, and one that has rankled New York leaders in recent months.

But Suozzi took a harder line on immigration than many of his fellow Democrats running for Congress, and he countered Pilip’s attacks by blasting her as an extremist for opposing a bipartisan border deal.

Democrats throughout the race sought to tie Pilip to Santos, who had been shunned by his own constituents long before he was booted from his seat.

Some observers have been tempted to view Tuesday’s matchup as a bellwether for the November general election, believing a concrete result in a competitive race offers more clarity about the political landscape than a series of ever-changing polls.

But special election turnout shares little DNA with the general electorate, according to a New York Times analysis earlier this month. Special election voters tend to be more engaged, and more partisan, than those in general elections, the Times found.

That hasn’t stopped Republicans and Democrats alike from holding up Suozzi’s win as a warning sign for the coming election, including the likely rematch of President Joe Biden and former President Donald Trump.

“Let’s just say the quiet part out loud. Donald Trump continues to be a huge weight against Republican candidates,” said the presidential campaign of former United Nations ambassador Nikki Haley, Trump’s last GOP primary challenger.

Biden’s reelection campaign, meanwhile, declared, “Donald Trump lost again tonight. When Republicans run on Trump’s extreme agenda – even in a Republican-held seat – voters reject them.”

Suozzi won’t have too long to celebrate his victory: He will have to run again in November to be elected to a full two-year term. Both Suozzi and Pilip have already committed to campaigning in the general, no matter who wins on Tuesday.

In addition to fighting each other, Suozzi and Pilip had to contend with another challenge: a major storm that began overnight and has already dumped multiple inches of snow on New York City.

A snowplow clears Main Street as snow falls in Tappan, New York, on February 10, 2024.

Kena Betancur | AFP | Getty Images

NBC News reported low turnout at several polling locations in the morning, including some identified as “popular” sites by the Nassau County Clerk’s Office. Just 199 voters cast ballots at the Syosset site between 6 a.m. and 11:25 a.m., for instance, and volunteers there blamed the storm for the lower-than-expected numbers.

Read more CNBC politics coverage

Last year, a federal grand jury in Long Island charged Santos with an array of crimes, including spending campaign contributions on personal luxury goods and lying on his House financial disclosure forms.

He pleaded not guilty to those charges and another raft of allegations that was added to his case five months later.

Santos had served just 11 months in Congress by the time he was expelled. His criminal trial is set for mid-September.

Don’t miss these stories from CNBC PRO: