The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

The United States, United Kingdom, and Germany rank among the top countries holding cryptocurrencies at the government level, according to data from Arkham Intelligence. The crypto analytic firm’s onchain analysis shows that the U.S. government holds 212,847 bitcoins while El Salvador has been purchasing one bitcoin daily as announced by its president. Top Government Holders […]

Source link

data

Bitcoin Tumbles on Hot CPI Data, But This Analyst Stays Ultra Bullish: Here’s Why

The better-than-expected United States Consumer Price Index (CPI) released on April 10 is already sending shock waves through the financial market. Bitcoin and most crypto assets are trading lower, extending losses recorded on April 9, weighing negatively against optimists.

United States CPI Data Came In Hot

According to Trading Economics data on April 10, CPI, a key economic metric for gauging inflation, rose 0.4% in March, pushing the annual inflation rate to 3.5%. Notably, this surpassed economist predictions and, most importantly, dashed hopes for the United States Federal Reserve (Fed) to slash rates aggressively this year.

However, amidst the market jitters, Matt Hougan, the CIO of Bitwise Asset Management, offered a contrarian perspective as fear permeated the Bitcoin and crypto market. In a post on X, Hougan downplayed the influence of the CPI data on Bitcoin’s long-term trajectory.

The executive argues that investors and traders should track other market factors like spot Bitcoin exchange-traded fund (ETF) inflows and rising government deficits. In Hougan’s assessment, these can strongly influence price, even lifting Bitcoin higher since they are currently aligned.

Time To Buy The Bitcoin Dip?

As such, even with the fall in BTC, the drop could offer potential buying opportunities for long-term holders. Some supporters believe the “hot” CPI data only exposes the vulnerabilities of fiat currencies. This would potentially drive investors to use Bitcoin as a hedge.

Moreover, this upbeat sentiment is backed by solid demand for gold, a store of value asset preferred by traditional finance investors. Analysts anticipate Bitcoin will follow a similar path as investors seek to protect value amid rising inflation.

Further bolstering the bullish sentiment is the possibility of a spot Bitcoin ETF launch in Hong Kong before the end of April.

The Hong Kong Securities and Futures Commission (SFC) has been assessing various applications. Leading Chinese asset managers have submitted some. If the product is approved, it could further channel more capital to BTC, boosting inflows from the United States.

When writing, BTC is steady but under pressure. April 9’s losses have been confirmed. The coin might track lower if bulls fail to push prices above all-time highs of around $74,000.

Bitcoin remains in a broader bullish formation, technically moving inside a rising wedge. This bullish outlook will only be invalidated if prices tank below $61,500 in the sessions ahead.

Feature image from DALLE, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

73 Million AT&T Users’ Data Leaked As Hacker Said, ‘I Don’t Care If They Don’t Admit. I’m Just Selling’ Auctioned At Starting Price Of $200K

Telecommunications giant AT&T Inc. (NYSE:T) recently disclosed a significant data breach dating back to 2021 that resulted in the exposure of sensitive information belonging to 73 million users and is now circulating on the dark web.

The leaked data includes a wealth of personal details such as Social Security numbers, email addresses, phone numbers and dates of birth, affecting both current and former account holders. AT&T revealed that among the impacted people, 7.6 million are current account holders.

“Currently, AT&T does not have evidence of unauthorized access to its systems resulting in exfiltration of the data set. The company is communicating proactively with those impacted and will be offering credit monitoring at our expense where applicable,” AT&T said in its press release about the situation.

Don’t Miss:

The hacker behind this brazen cyberattack is ShiningHacker, a notorious figure known for previous data breaches targeting platforms such as Wattpad, Tokopedia, and Microsoft Corp.’s GitHub, according to Bleeping Computer.

Initially, AT&T denied any internal data breach when a small portion of the stolen data surfaced in 2021, claiming no knowledge of leaked information from their servers or vendors.

However, subsequent investigations revealed a different story. While AT&T refuted the claims initially, ShiningHacker admitted to the breach, dismissing AT&T’s stance with the assertion, “I don’t care if they don’t admit. I’m just selling,” according to Bleeping Computer.

The hacker attempted to monetize the stolen data by offering it for sale on the RaidForums data theft forum, setting the starting price at $200,000 and accepting incremental offers of $30,000. ShiningHacker indicated a willingness to immediately sell the data for $1 million, underscoring the severity and audacity of the cybercrime.

Trending: Long overdue disruption in the moving industry is underway. Here’s how to invest in it with just $100.

Telecommunications providers have become recent targets of cyberattacks, with T-Mobile facing a breach in 2023 affecting 37 million customers, and Verizon Communications Inc. experiencing a leak impacting 63,000 customers and employees.

In December, the Federal Communications Commission (FCC) adopted a new role to ensure that “providers of telecommunications, interconnected voice over internet protocol (VoIP) and telecommunications relay services (TRS) adequately safeguard sensitive customer information.”

The same ruling expanded the definition of “breach” in this context, to include inadvertent access, use or disclosure of customer information, except in cases where such information is acquired in good faith by an employee or agent of a carrier or TRS provider and such information is not used improperly or further disclosed.

Read About Startup Investing:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Stock Market Game with the #1 “news & everything else” trading tool: Benzinga Pro – Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article 73 Million AT&T Users’ Data Leaked As Hacker Said, ‘I Don’t Care If They Don’t Admit. I’m Just Selling’ Auctioned At Starting Price Of $200K originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Composable Data Assists Dapp Developers in Unlocking Rich Data Applications – Swaroop Hegde

Composable data, a flexible and modular approach in the field of data analytics, benefits decentralized application (dapp) developers constrained by the limitations of current data protocols. Swaroop Hegde, co-founder of Powerloom, explains that composable data maintains a decentralized database of data points verified through a consensus mechanism. Clean Insights Versus Actionable Intelligence Hegde, a thought […]

Composable data, a flexible and modular approach in the field of data analytics, benefits decentralized application (dapp) developers constrained by the limitations of current data protocols. Swaroop Hegde, co-founder of Powerloom, explains that composable data maintains a decentralized database of data points verified through a consensus mechanism. Clean Insights Versus Actionable Intelligence Hegde, a thought […]

Source link

Portugal’s National Data Protection Commission (CNPD) said on March 26 that it will ban Worldcoin from collecting biometric data for three months.

The CNPD said that the limitations apply for 90 days until an investigation is concluded and a final decision is reached. The ban applies to biometric data on the iris, eyes, and face.

Ban details

CNPD imposed the ban for several reasons. First, Worldcoin allegedly has “no mechanism for verifying the age of members” and allegedly collected data from minors without parental permission.

Additionally, Worldcoin did not provide sufficient information to users on some matters, leaving users unable to delete their data or revoke consent.

CNPD said that the General Data Protection Regulation (GDPR) includes special protections for both biometric data and minors. It also mentioned other possible violations of GDPR standards and said that all of these factors justified urgent intervention against Worldcoin.

Paula Meira Lourenço, President of the CNPD, called the new measures “an indispensable and justified measure” at the moment as they will protect the rights of the public and minors.

Worldcoin denies wrongdoing

According to a separate report from Reuters, Worldcoin has denied any wrongdoing and claimed that it does not allow minors to register through the ORB.

Worldcoin Foundation’s data protection officer, Jannick Preiwisch, said Worldcoin is “fully compliant with all laws and regulations in its operating areas.

Preiwisch said that Worldcoin had not previously heard from the CNPD about the issues. He asserted that Worldcoin has “zero tolerance” for registrations by minors and said the project is addressing the reports.

Worldcoin emphasized that it recently introduced a user-controlled Personal Custody model, giving users greater control over their data. It initially announced the new model on March 22 as it released its Orb software under an open-source license.

Spain also imposed a three-month ban on Worldcoin’s data collection activities on March 6 for identical reasons. The biometric data collection has raised concerns among regulators in several other countries as well, with Kenya labeling it “espionage.”

The post Portugal imposes 3 month data collection ban on Worldcoin appeared first on CryptoSlate.

A month after the U.S. stock market suffered its worst consumer-price index release day in over a year, investors are worrying about a reprise when the latest inflation data arrives on Tuesday morning — data that could shake up the Federal Reserve’s monetary-policy expectations and test stocks’ 2024 bull run.

Source link

Historical data suggests that no Bitcoin cycle has peaked without experiencing significant double-digit corrections. These downturns, while daunting, have historically presented lucrative ‘buy-the-dip’ opportunities for investors.

As Bitcoin continues its ascent, with its price hovering above $62,000, the anticipation of a potential correction looms large, offering a window into the cyclical nature of cryptocurrency markets.

Market Maturity And Correction Patterns

Seasoned investor CryptoJelleNL recently shared a post on X earlier today pointing towards an imminent correction in the 20-25% range for Bitcoin.

Based on cycle analysis, this predicted dip indicates a potential drop to the $46,500 range, earmarking an opportunity for investors to bolster their positions in the leading crypto.

Corrections are an essential part of a #Bitcoin bull market — but with each passing cycle, the dips become shallower.

This cycle, it looks like ±20-25% will be the sweet spot for dip-buying.

Your job is to be ready to take advantage when it comes. pic.twitter.com/xrI7iKfiPR

— Jelle (@CryptoJelleNL) March 1, 2024

This perspective gains further credence when examining the diminishing severity of corrections as the market matures; the 2016-2017 Bitcoin cycle was characterized by seven substantial corrections, with an average pullback of 32%, significantly impacting investor sentiment and portfolio values.

In the subsequent cycle that propelled BTC to its current all-time high of $69,000, the market conditions were considerably more lenient for bullish investors: experiencing five downturns, the average decline was limited to 24%.

Fast forward to the present cycle, and the landscape appears somewhat different. With only four notable corrections recorded so far and an average pullback of 21%, Bitcoin should see a notable pullback, though not as harsh as previous ones. This indicates the market’s growing maturity.

Additionally, this evolution suggests that while corrections remain a staple of the Bitcoin experience, their capacity to deter the asset’s long-term trajectory diminishes.

Navigating Bitcoin Upcoming Corrections

The potential correction for Bitcoin, as indicated by CryptoJelleNL is echoed by other market observers. Galaxy Digital Holdings CEO Michael Novogratz has also highlighted the possibility of a temporary dip, attributing it to factors such as excessive leverage among younger investors.

Despite these forecasts, Bitcoin’s current momentum remains strong, with recent price action showing a near 2% increase in the past 24 hours, underscoring the asset’s sturdy appeal.

In addition to speculative analysis, real-world examples of investor success stories provide tangible evidence of Bitcoin’s enduring allure. A notable instance is a smart whale who, per lookonchain analytics, invested $1.39 billion in Bitcoin in July 2022 at an average price of $21,629 per BTC.

With BTC price now surging past the $62,000 mark, this investor’s unrealized profit is a testament to the strategic potential of timely market entry and the value of patience in the face of volatility.

A smart whale has accumulated 22,670 $BTC($1.39B) at an average price of $21,629 since $BTC entered the bear market in July 2022.

He currently has an unrealized profit of more than $900M! pic.twitter.com/BTcijZB0IA

— Lookonchain (@lookonchain) March 1, 2024

Featured image from Unpslah, Chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Treasury yields end at roughly three-week lows after new U.S. economic data

U.S. government debt rallied on Friday after a mixed batch of U.S. economic data, giving 2- and 10-year yields their biggest weekly declines in at least a month.

What happened

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

fell 11.3 basis points to 4.531%, from 4.644% on Thursday. The yield declined 15.6 basis points for the week, the biggest weekly decline since the period that ended Jan. 12. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

dropped 7.1 basis points to 4.180%, from 4.251% on Thursday. It finished 7.8 basis points lower for the week, the biggest weekly decline since the period that ended Feb. 2. - Friday’s levels were the lowest for the 2- and 10-year yields since Feb. 12, based on 3 p.m. Eastern time figures from Dow Jones Market Data.

-

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

fell 4.9 basis points to 4.326%, from 4.375% on Thursday. Friday’s level was the lowest since Feb. 7. The yield declined 5.3 basis points this week.

What drove markets

Friday’s U.S. economic-data releases brought a pair of mixed reports on manufacturing.

The Institute for Supply Management’s manufacturing index showed that activity contracted in February for a 16th straight month. But the final reading of S&P Global’s manufacturing purchasing managers’ index inched up to 52.2 in February versus an initial reading of 51.5, signaling a quicker pace of improvement in that sector.

Separately, consumer sentiment moved sideways in February, slipping from levels seen in January but holding on to gains from over the past three months, according to the University of Michigan. And construction spending fell in January for the first time since December 2022.

Treasury yields had ended February with their biggest monthly gains since 2023, following a series of data that pointed to continued persistent inflation. On Thursday, the Fed’s preferred inflation measure, the PCE price index, was in line with expectations for January, but still hot.

Read: ‘The Fed will not cut rates this year,’ says Wall Street economist

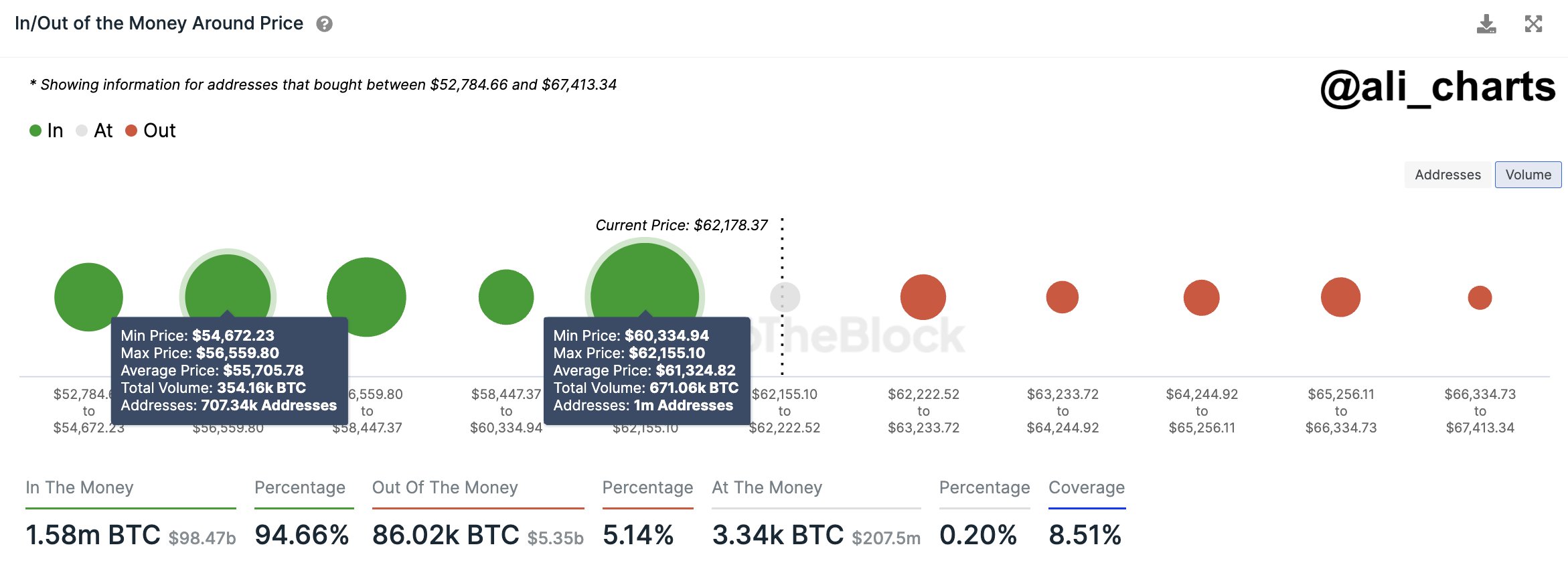

On-chain data shows Bitcoin currently has a thick supply wall between the $60,300 and $62,155 levels that may prevent the asset from falling lower.

A Large Amount Of Bitcoin Was Bought Near Current Prices

As explained by analyst Ali in a new post on X, BTC has a major support wall just below it right now. In on-chain analysis, the strength of support and resistance levels is gauged through the amount of Bitcoin that the investors bought at them.

The chart below shows how the distribution of the investor cost basis has looked like for BTC across the price ranges near the current spot value:

The amount of Bitcoin that the holders bought at the various price ranges | Source: @ali_charts on X

Here, the size of the dot represents the number of tokens that the addresses bought between the corresponding price levels. From the graph, it’s apparent that the $60,300 to $62,100 range has a particularly high density of coins right now.

Most of the price levels in this range lie just below the current spot price of the cryptocurrency, meaning that the investors who bought here would be making some profit, albeit only a slight one.

Generally, when the price retests the cost basis of such investors who were in profit prior to the retest (meaning that the price has approached their cost basis from above), a buying reaction may be produced by these addresses.

This is because holders like these may have reason to believe that if they were able to get into profits before, they might be able to do so again in the near future, so they may just accumulate on this “dip.”

Such a reaction can naturally provide support to the cryptocurrency. The scale of this support, however, is naturally not anything significant if only a few investors bought at the level to begin with. Narrow ranges that are thick with addresses, on the other hand, might just prove to be a source of noticeable support.

In the aforementioned price range near the current spot price, one million addresses acquired a total of about 671,000 BTC. “This accumulation zone highlights strong investor confidence and could serve as a crucial level of support for BTC, potentially cushioning against further drops,” notes the analyst.

While the price ranges under the current price are heavy with coins, it’s visible in the chart that this isn’t the case for the ranges above. Just like how supply wallets below can be a source of support, they can instead act as resistance when above.

The fact that the supply walls above are quite thin suggests that there wouldn’t be too many investors waiting to quickly exit at their break-even, and thus, selling pressure due to them should be low.

That said, it doesn’t mean there isn’t any impedance at all. Bitcoin is approaching all-time highs at this point, meaning that the vast majority of the supply is in profit. At these levels, mass selling for harvesting these gains can be the main challenge preventing the run from continuing.

BTC Price

At present, Bitcoin is trading around the $62,000 level, meaning that it’s right on the edge of the major support wall.

Looks like the price of the coin has been sharply going up recently | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, IntoTheBlock.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

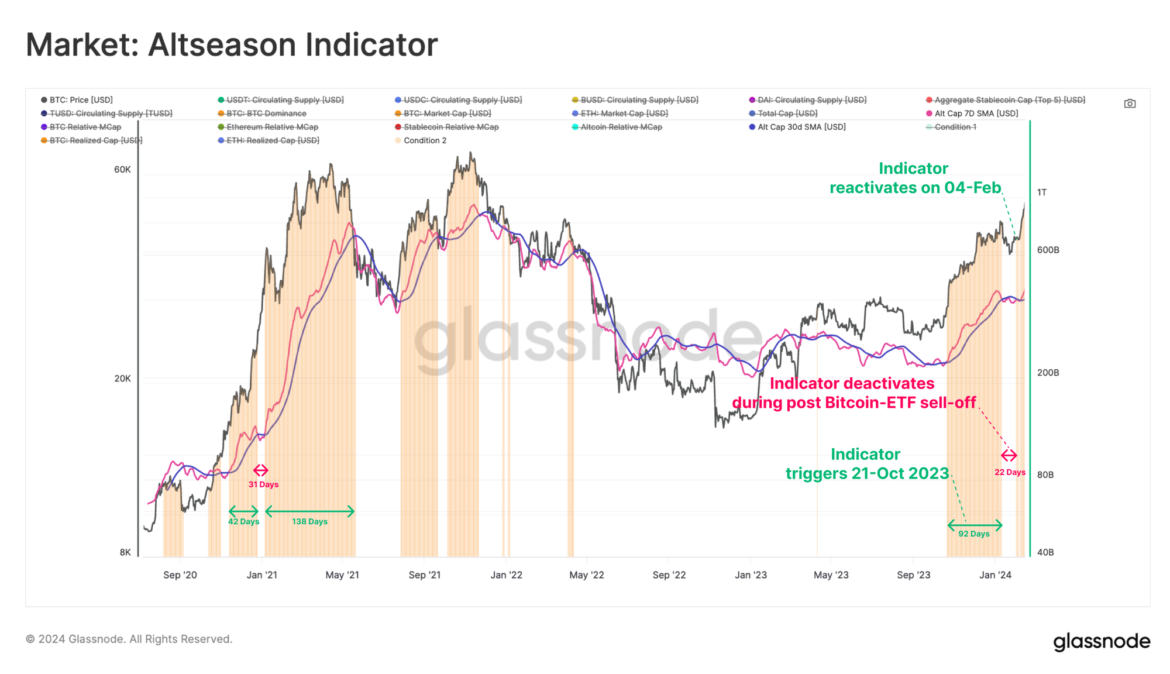

Here’s what the “Altseason Indicator” from the on-chain analytics firm Glassnode says regarding if an Altcoin season is currently going on or not.

What Altseason Indicator Says Regarding The Altcoin Season

In its latest weekly report, Glassnode has discussed what the Altcoin season status for the cryptocurrency market has looked like recently. To check whether the “altseason” is on, the analytics firm has devised its Altseason Indicator.

This metric judges if the investors are in a risk-on mode based on how capital rotations are occurring in the sector. There are two conditions the indicator checks for.

First, the Altseason Indicator looks at the capital netflows involving the three major asset classes in the sector: Bitcoin (BTC), Ethereum (ETH), and stablecoins.

For the former two assets, netflows are gauged using their “realized caps.” The realized cap is a capitalization model that calculates any asset’s total valuation by assuming that the real value of any token in circulation is the price at which it was last moved rather than the current spot price.

The last transfer for any coin was likely the last point at which it changed hands, so the price at the time of that transaction would be its current cost basis. As such, the realized cap sums up the cost basis of every holder in the sector.

Put another way, the realized cap measures the actual amount of capital the investors have put into the asset. Thus, changes in the metric would reflect the amount of capital flowing into or out of the asset.

For the stablecoins, net flows can be judged based on the supply or market cap alone, as the stables’ value remains tied to $1 at every point, so the magnitude of the market cap and realizes cap would be equal (both of these would also equal the supply, except for the unit).

For the Altcoin Season to be active, all three asset classes should have positive netflows. This is because capital generally enters the cryptocurrency sector through these coins and only then rotates into altcoins as investors’ appetite for risk rises.

The other condition the Altseason Indicator checks for is the momentum in the altcoin market cap itself. In particular, the metric confirms whether or not the altcoin market cap is currently over its 30-day simple moving average (SMA).

The data of the Altseason Indicator over the past few years | Source: Glassnode's The Week Onchain - Week 8, 2024

The chart shows that the Altseason Indicator first started flashing the risk-on signal in October of last year. However, the signal turned off when the market cooled off following the launch of the Bitcoin spot ETFs.

After staying off for 22 days this month, though, the Altseason Indicator seems to have been saying that the Altcoin season is back on.

BTC Price

At the time of writing, Bitcoin is trading around the $50,900 level, down 1% in the past week.

Looks like the price of the asset has gone down over the past day | Source: BTCUSD on TradingView

Featured image from Shutterstock.com, Glassnode.com, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.