In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

In the last 12 days of April, the stablecoin sector expanded by $4.46 billion, reaching a current valuation of $155.86 billion. Additionally, the top five dollar-pegged cryptocurrencies experienced an increase in their supplies over the last 30 days. Top Dollar-Pegged Cryptos See Growth Amid April’s First 12 Days As of Friday, April 12, 2024, the […]

Source link

days

From days to months: How Bitcoin holder behavior predicts price peaks

Quick Take

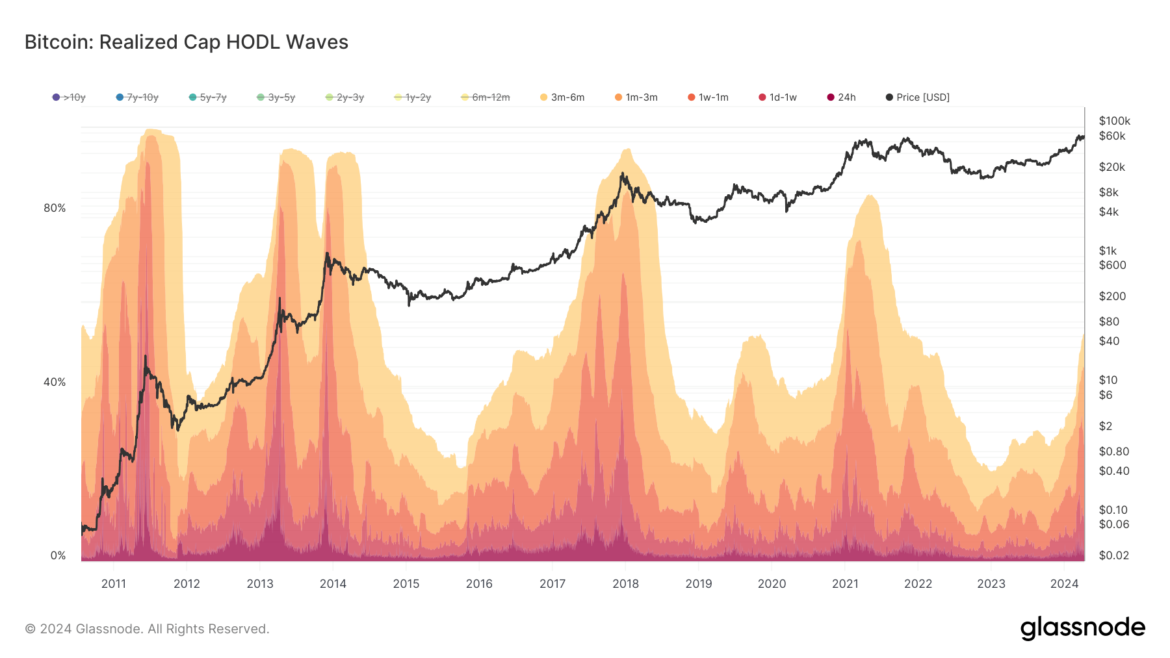

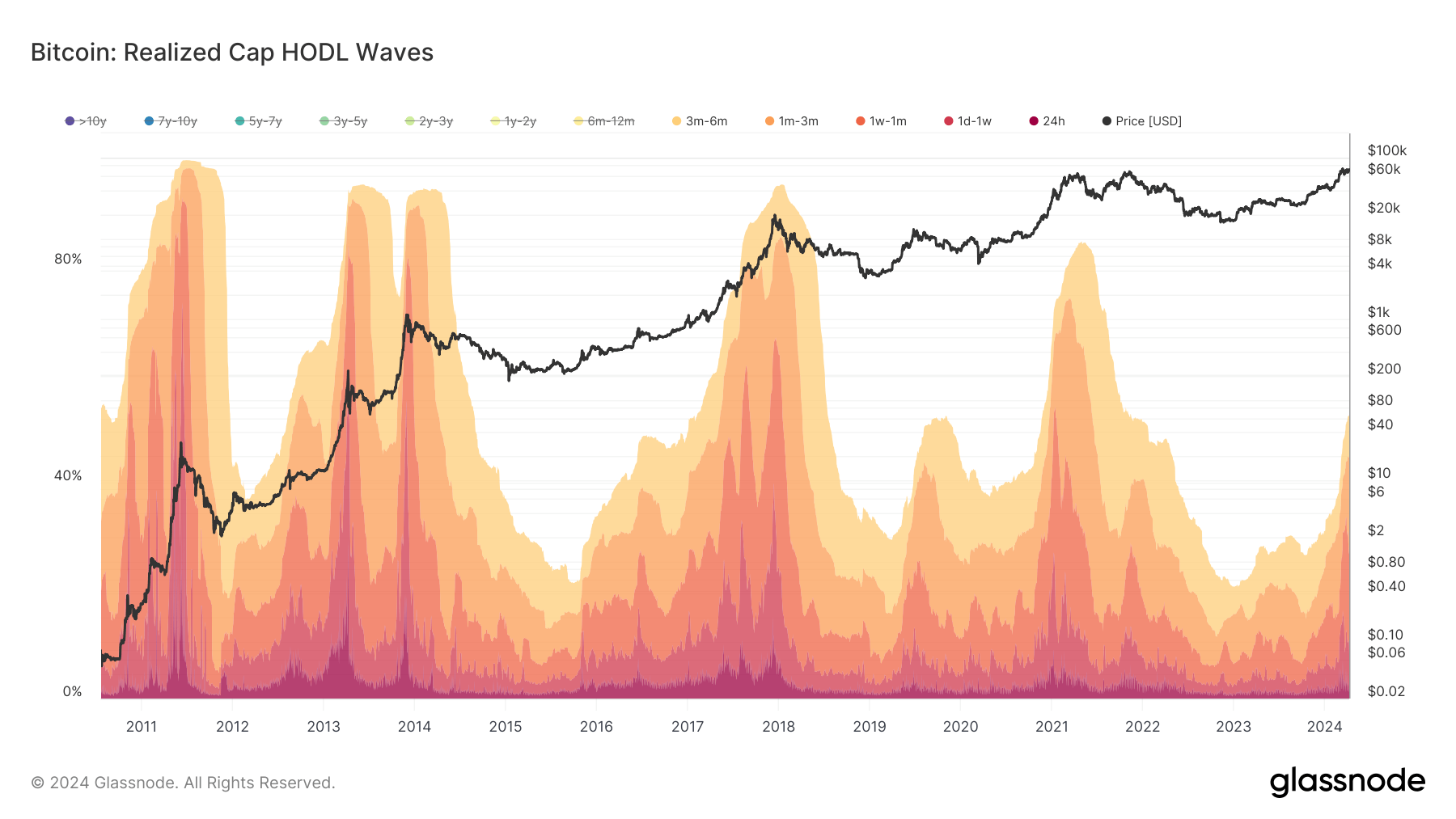

Bitcoin’s price cycles are often influenced by the behavior of short-term holders (STHs), defined as investors who have held the digital asset for less than 155 days. According to Glassnode data, during market peaks, STHs typically possess 80% or more of the Bitcoin supply, with the prevailing cohort transitioning from shorter to longer holding periods in each subsequent cycle.

Data from Glassnode shows that at the peak in 2011, STHs commanded 96% of the supply, primarily comprising holders of one-day to one-week durations. By the 2013 peak, 90% of the supply was held by STHs, predominantly those holding for one-day to one-week periods. Moving to the 2017 peak, STHs still dominated over 90% of the supply, but the principal cohort shifted to one-week to one-month holders, indicating a slightly maturing market.

In March 2021, at the peak, 85% of the supply was held by STHs, with the predominant group being holders of one-month to three-month durations, according to Glassnode.

Currently, with Bitcoin hovering near all-time highs, STHs control 54% of the supply, which suggests potential for further growth. The gradual transition in dominant STH groups from shorter to longer durations implies an evolving market maturity.

The post From days to months: How Bitcoin holder behavior predicts price peaks appeared first on CryptoSlate.

The recent approval of Bitcoin exchange-traded funds (ETFs) by the SEC sent jitters through the financial world. Initial concerns about fading demand seem unfounded as Bitcoin ETFs continue to shatter trading volume records. This is further bolstered by three consecutive sessions of net inflows into these investment vehicles.

Bitcoin ETF Inflows Signal Long-Term Investor Appetite

A recent dip in ETF activity sparked fears that the initial excitement might be short-lived. However, those fears have been quelled by a resurgence in inflows.

According to data from SoSoValue, yesterday saw a net inflow of $203 million into Bitcoin spot ETFs, marking the third straight day of positive inflow.

This sustained green streak suggests that investors remain interested in gaining exposure to the top crypto through ETFs, potentially anticipating a price surge due to the upcoming Bitcoin halving – a pre-programmed code update that cuts production in half, historically leading to price increases.

BlackRock’s Bitcoin ETF Leads The Pack

BlackRock, the world’s largest asset manager, has emerged as a frontrunner in the crypto ETF space. Their iShares Bitcoin Trust (IBIT) recorded the highest net inflow on a single day, exceeding $144 million.

BTC market cap currently at $1.3 trillion. Chart: TradingView.com

This impressive figure has pushed IBIT’s total net inflow over the past two weeks to over $14 billion. BlackRock’s commitment to Bitcoin ETFs is further underscored by their recent decision to include prominent Wall Street institutions like Goldman Sachs, Citigroup, Citadel Securities, and UBS as Authorized Participants (APs) in their spot Bitcoin ETF prospectus.

These additions position these banking giants as first-time participants in the ETF market, joining established players like JPMorgan and Jane Street.

The inclusion of such heavyweights is seen as a significant vote of confidence in the future of Bitcoin ETFs and a potential catalyst for further mainstream adoption.

Volatility On The Horizon For ETFs

While the recent surge in demand paints a bullish picture for Bitcoin ETFs, experts warn that volatility may be lurking on the horizon. CryptoQuant, a cryptocurrency analysis platform, points to signals in the futures market that suggest potential price swings in the near future.

A consistently high premium often signifies strong institutional buying pressure, particularly in light of the recent inflows witnessed in US Bitcoin ETFs. This increased institutional activity can contribute to price fluctuations, creating opportunities for both gains and losses.

Despite the potential for short-term volatility, the overall outlook for Bitcoin ETFs remains positive. The sustained demand, coupled with the backing of major financial institutions like BlackRock, suggests that these investment vehicles are poised to play a significant role in bridging the gap between traditional finance and the cryptocurrency world.

Featured image from Vegavid Technology, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

US Bitcoin ETFs See $85.7M Outflow After 4 Days of Gains; Grayscale’s GBTC Leads the Dip

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

After four days of consecutive inflows, the U.S. spot bitcoin exchange-traded funds (ETFs) experienced a downturn, with $85.7 million flowing out during Monday’s trading hours. U.S. Spot Bitcoin ETFs’ Momentum Halted With $85.7M in Outflows, Spotlight on GBTC Between March 25 and March 28, 2024, the U.S. spot bitcoin ETFs enjoyed an upward trend, amassing […]

Source link

Binance-backed HKVAEX shuts down, gives users 30 days to withdraw amid Hong Kong regulatory tightening

What is CryptoSlate Alpha?

A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more ›

Connected to Alpha

Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below.

Important: You must lock a minimum of 20,000 ACS

If you don’t have enough, buy ACS on the following exchanges:

Connect via Access Protocol

Access Protocol is a web3 monetization paywall. When users stake ACS, they can access paywalled content. Learn more ›

Disclaimer: By choosing to lock your ACS tokens with CryptoSlate, you accept and recognize that you will be bound by the terms and conditions of your third-party digital wallet provider, as well as any applicable terms and conditions of the Access Foundation. CryptoSlate shall have no responsibility or liability with regard to the provision, access, use, locking, security, integrity, value, or legal status of your ACS Tokens or your digital wallet, including any losses associated with your ACS tokens. It is solely your responsibility to assume the risks associated with locking your ACS tokens with CryptoSlate. For more information, visit our terms page.

Unlocking Crypto History: 2,000 ETH From Ethereum’s Genesis Days Suddenly Moved

In recent weeks, Bitcoin.com News has chronicled the significant number of dormant bitcoin addresses that have sprung to life in March after years, if not a decade, of inactivity. Similarly, we’ve observed a resurgence of activity from older ethereum addresses. This Saturday highlighted a noteworthy event: an individual who took part in the Ethereum initial […]

In recent weeks, Bitcoin.com News has chronicled the significant number of dormant bitcoin addresses that have sprung to life in March after years, if not a decade, of inactivity. Similarly, we’ve observed a resurgence of activity from older ethereum addresses. This Saturday highlighted a noteworthy event: an individual who took part in the Ethereum initial […]

Source link

This week’s non-fungible token (NFT) sales have taken another nosedive, intensifying the downtrend that began with a 16.55% decline from March 9 to March 16, 2024. The last seven days have witnessed an even steeper drop, with NFT sales plummeting by 18.57%. Cryptopunk #7,804 Shines in a Week of Falling NFT Sales In line with […]

This week’s non-fungible token (NFT) sales have taken another nosedive, intensifying the downtrend that began with a 16.55% decline from March 9 to March 16, 2024. The last seven days have witnessed an even steeper drop, with NFT sales plummeting by 18.57%. Cryptopunk #7,804 Shines in a Week of Falling NFT Sales In line with […]

Source link

From Peak to Present: GBTC’s Bitcoin Holdings Decrease by 266,827 BTC in 71 Days

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

As of March 22, the bitcoin holdings of Grayscale’s Bitcoin Trust (GBTC) have diminished by 27,917.37 compared to its status three days prior, now amounting to 350,252 bitcoin valued at approximately $22.2 billion. Since evolving into an exchange-traded fund (ETF) listed on public exchanges, GBTC has shed billions in bitcoin over the preceding 71 days. […]

Source link

The memecoin BONK has faced a significant setback as its prices plummeted by 30% in the last week, sparking discussions about the need to reassess predictions for this meme token. This decline in value has been accompanied by a drop in BONK’s open interest to its lowest level in the past month, signaling potential challenges ahead for the token.

Market Performance And Price Predictions

The recent slump in BONK’s prices has raised concerns among investors and traders, with key technical indicators hinting at the possibility of further declines in its value. At present, BONK is trading at $0.000023, making it one of the cryptocurrencies with the most losses over the past week. The altcoin’s future trajectory remains uncertain as market dynamics continue to evolve.

BONK price down in the last seven days. Source: Coingecko

Following a rejection at $0.00004, the price of BONK lost momentum and had a 35% value adjustment. After then, there was a period of sideways trading for the memecoin. The bulls lost steam as the volatility increased and broke through the support level; the market has been trading sideways ever since.

The recent analysis of BONK’s price performance reveals a shift in sentiment towards bearish outlooks, with weighted sentiment turning negative and key technical indicators confirming the presence of bearish sentiments. This negative sentiment among market participants could potentially lead to further declines in BONK’s value unless there is a significant shift in market dynamics.

Source: Coinglass

Open Interest Plummets

Futures open interest in the cryptocurrency fell to its lowest level in one month, which led to a decrease in its price. The open interest in BONK began to fall on March 5th and has since fallen by 60%, according to statistics from Coinglass.

Traders’ interest or involvement in the derivative market for an asset declines as its open interest diminishes. This usually happens when there is a change in investor mood, leading to more people trying to cut losses or take profits.

Total crypto market cap at $2.4 trillion on the daily chart: TradingView.com

Impact On Investor Sentiment And Market Dynamics

The recent price slump in BONK has had a notable impact on investor sentiment, with many adopting a cautious approach towards the token’s future prospects. This shift in sentiment has also influenced trading volumes and market activity, as investors reassess their positions and strategies in light of BONK’s price movements.

Expert Price Predictions And Analysis

As market observers examine BONK’s price predictions, varying outlooks emerge regarding its future performance. While some forecasts suggest a bearish scenario with a price of $0.000018 in 2024, others paint a more optimistic picture, projecting an average price of $0.000067 by April 17, 2024. These contrasting predictions highlight the volatility and unpredictability inherent in the cryptocurrency market.

Featured image from Andrea Piacquadio/Pexels, chart from TradingView

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

Nigeria’s Binance Impasse: Senior Executives Detained at Government ‘Guesthouse’ for 14 Days

Tigran Gambaryan, a former U.S. federal agent, is one of two Binance executives being held without charge by Nigerian authorities. A local court approved the executives’ 14-day detention. Recent media reports suggest that Nigerian officials have requested Binance to disclose the identities and transaction histories of its top 100 users. Detained Executives’ Families Demand Their […]

Tigran Gambaryan, a former U.S. federal agent, is one of two Binance executives being held without charge by Nigerian authorities. A local court approved the executives’ 14-day detention. Recent media reports suggest that Nigerian officials have requested Binance to disclose the identities and transaction histories of its top 100 users. Detained Executives’ Families Demand Their […]

Source link