Quick Take

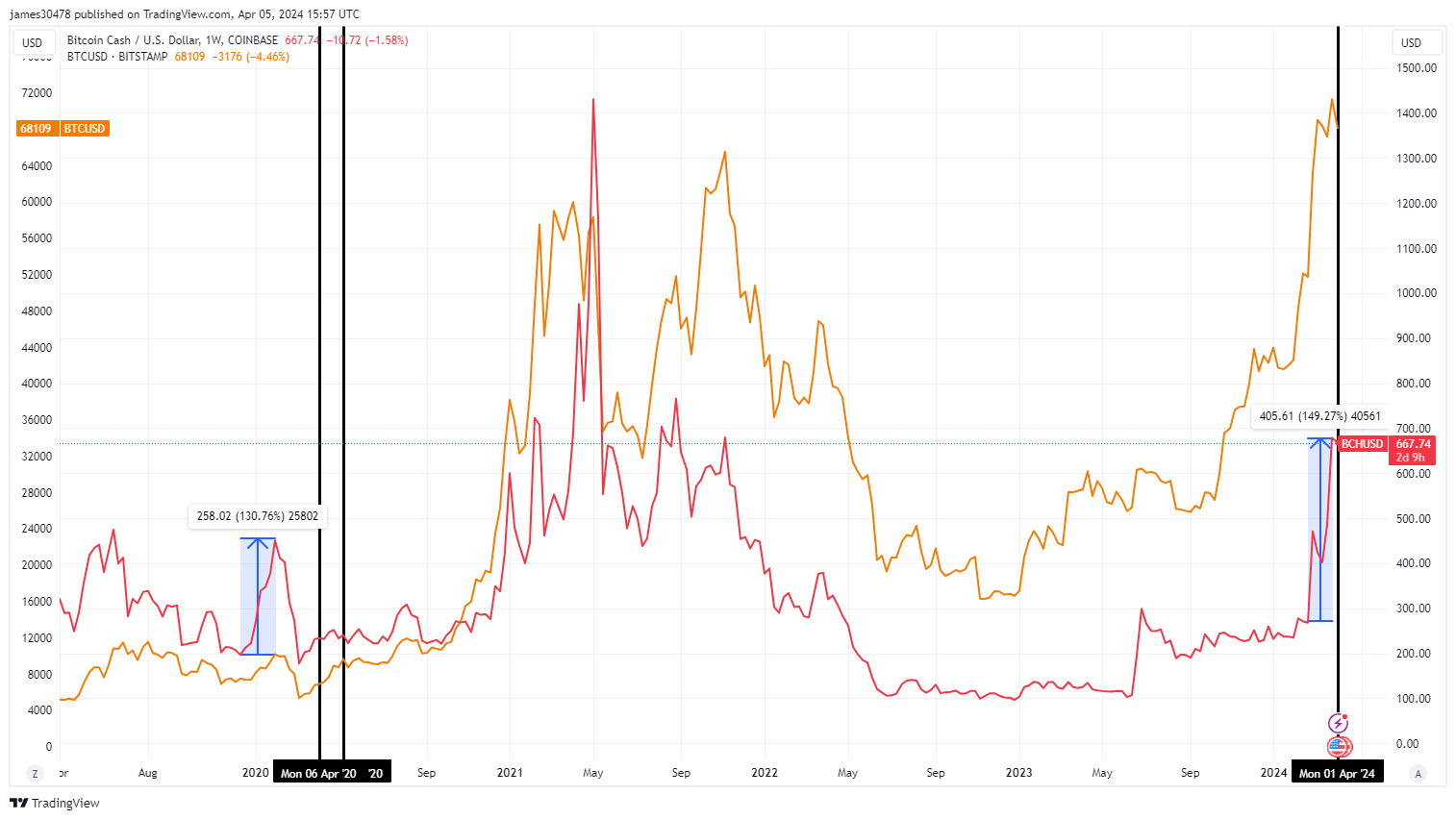

The recent Bitcoin Cash (BCH) halving has sparked a significant price rally, propelling the digital asset to its highest level since 2021.

Based on CryptoSlate research, an intriguing pattern has been observed in the lead-up to this halving event, potentially holding implications for the broader digital assets market.

In the months preceding the previous BCH halving in April 2020, BCH experienced a remarkable price appreciation of around 130%. However, BCH dipped just before the previous halving in April 2020.

It took roughly six months for Bitcoin (BTC) to lead BCH after its halving, which occurred in May 2020.

Ahead of its halving on April 4, BCH has surged by approximately 150%. Interestingly, Bitcoin has also seen unprecedented growth and reached a new all-time high in the last month weeks before its halving.

This raises the question: could the BCH price surge before its halving be a harbinger of a similar rally for Bitcoin?

The post Bitcoin Cash hits new peak since 2021, sparking debate over Bitcoin’s next move appeared first on CryptoSlate.

In a detailed letter to Judge Lewis Kaplan, the legal representatives for Sam Bankman-Fried, the embattled founder of cryptocurrency exchange FTX, have vehemently argued against the government’s recommendation for a 50-year prison sentence, labeling it as a “medieval view of punishment.” Legal Team Contests Proposed 50-Year Sentence for Sam Bankman-Fried as Unjust and Excessive In […]

In a detailed letter to Judge Lewis Kaplan, the legal representatives for Sam Bankman-Fried, the embattled founder of cryptocurrency exchange FTX, have vehemently argued against the government’s recommendation for a 50-year prison sentence, labeling it as a “medieval view of punishment.” Legal Team Contests Proposed 50-Year Sentence for Sam Bankman-Fried as Unjust and Excessive In […]

Comments on Lightning Network adoption, made by Russell Okung, a former NFL star who is among the first to receive part of his salary in crypto, sparked a discussion that highlighted the opposing opinions of the crypto community about the usage of bitcoin and stablecoins in emerging markets. Russell Okung Ignites Discussion on Bitcoin vs. […]

Comments on Lightning Network adoption, made by Russell Okung, a former NFL star who is among the first to receive part of his salary in crypto, sparked a discussion that highlighted the opposing opinions of the crypto community about the usage of bitcoin and stablecoins in emerging markets. Russell Okung Ignites Discussion on Bitcoin vs. […]