GameStop’s stock ended Monday’s session up 15.4%, registering its largest daily percentage increase since Dec.13, 2023.

Source link

December

Shares of AMC Entertainment Holdings Inc. ended Monday’s trading up 4.1% as the stock extended its winning streak to three days — its longest-such run since a four-day streak that ended on Dec. 28, 2023.

The stock is up four of the past five days, and short interest as a percentage of AMC’s

AMC,

public float of shares was 10.91% on Monday.

Related: AMC’s stock rallies more than 10% for biggest gain since August

The movie-theater chain and original meme stock has hit a series of record lows recently but rallied last week. On Feb. 6, the stock ended the session up 10.9%, registering its biggest single-day percentage gain since Aug. 30, 2023.

AMC shares hit a record-low close of $3.67 on Feb. 5 — a far cry from the heady days of the meme-stock frenzy, during which the stock surged to an all-time closing high of $339.05 on June 2, 2021, according to Dow Jones Market Data.

Related: AMC’s bonds find buyers while original meme stock slides

Last month, AMC Chief Executive Adam Aron described the recent decline in the company’s share price as “so frustrating.”

AMC shares have fallen 89% in the last 52 weeks, compared with the S&P 500 index’s

SPX

gain of 21.4%.

2-, 10-year Treasury yields at highest levels since December after CPI revisions

Treasury yields finished higher on Friday, after minor revisions to U.S. inflation data reinforced investors’ economic optimism.

What happened

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

rose 3.2 basis points to 4.486%, from 4.454% on Thursday. For the week, the rate climbed 11.8 basis points. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

advanced 1.7 basis points to 4.186%, from 4.169% on Thursday. It rose 15.6 basis points this week. -

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

was marginally higher at 4.380%, versus 4.376% on Thursday. It rose 15.4 basis points this week. - Friday’s levels for the 2- and 10-year rates were the highest since Dec. 12, based on 3 p.m. Eastern time figures from Dow Jones Market Data. The 2-,10- and 30-year rates each posted their biggest weekly advances since the period that ended on Jan. 19.

What drove markets

Friday’s round of data brought only small adjustments to the consumer-price index for the final months of 2023.

The reading for December was revised down by a tenth, to 0.2%, while November’s was upwardly revised by the same magnitude, to 0.2%. Meanwhile, the annual core inflation rate for the fourth quarter remained the same at 3.3% after seasonal factors.

Analyst regarded the CPI revisions as rather minor, considering the risk of changes that could have showed inflation was running hotter than initially reported.

Dallas Fed President Lorie Logan, during an appearance on Friday, said she sees no urgency for the Federal Reserve to lower interest rates.

What analysts are saying

“The focus next week will be the CPI report” for January released on Tuesday, said U.S. economist Michael Reid of RBC Capital Markets.

“Our forecast calls for a [month-over-month] rise of 0.2% in headline and 0.3% in core,” Reid wrote in a note on Friday. “This would bring the [year-over-year] pace to 2.9% and 3.8% for headline and core, respectively. While the progress in core on a [year-over-year] basis is sluggish, a monthly 0.3% print is consistent with the ‘more good data’ that the Fed wants to see.”

An important inflation gauge released Friday showed that the rate of price increases cooled as 2023 came to a close.

The Commerce Department’s personal consumption expenditures price index for December, an important gauge for the Federal Reserve, increased 0.2% on the month and was up 2.9% on a yearly basis, excluding food and energy. Economists surveyed by Dow Jones had been looking for respective increases of 0.2% and 3%.

On a monthly basis, core inflation increased from 0.1% in November. However, the annual rate declined from 3.2%. The 12-month rate is the lowest since March 2021.

Including volatile food and energy costs, headline inflation also rose 0.2% for the month and held steady at 2.6% annually.

The release adds to evidence that inflation, while still elevated, is continuing to make progress lower, possibly giving the Fed a green light to start cutting interest rates later this year. The central bank targets 2% as a healthy annual inflation rate.

Markets took little notice of the data, with stock futures indicating only a slight change at the open and Treasury yields mostly lower.

“Inflation dynamics inside the metric that the Fed uses to formulate policy strongly imply that the central bank will hit its inflation target in the near term,” said Joseph Brusuelas, chief economist at RSM. “This will create the conditions in which it makes [its] policy pivot and begins a multiyear campaign in which it reduces the policy rate towards a range between 2.5% and 3%.”

The Fed’s benchmark overnight interest rate is currently targeted between 5.25%-5.5%.

As inflation drifted closer to the Fed’s target, consumer spending increased 0.7%, stronger than the 0.5% estimate. Personal income growth edged lower to 0.3%, in line with the forecast.

The data indicated that consumers are dipping into savings to pay for their expenditures. The personal savings rate fell to 3.7% for the month, down from 4.1% in November.

Within the inflation numbers, prices for goods declined by 0.2% while services prices rose by 0.3%, reversing a trend when inflation began to spike. As the pandemic forced people to stay home more, demand for goods spiked, adding to supply chain problems and exacerbating price increases.

Food prices increased 0.1% on the month while energy goods and services rose 0.3%. Prices for longer-lasting durable goods such as appliances, computers and vehicles decreased 0.4%.

Looked at in conjunction with a separate report Thursday showing that gross domestic product grew at a much faster-than-expected 3.3% pace in the fourth quarter, the most recent round of data shows an expanding economy and inflation at least moving back to the Fed’s 2% annual target.

“It is hard to say which is more remarkable: that GDP growth accelerated last year following the Fed’s most aggressive tightening campaign in decades, or that core inflation nevertheless fell back to the 2% target in annualized terms over the second half of the year,” wrote Andrew Hunter, deputy chief U.S. economist at Capital Economics.

“Either way, it is time for Fed officials to take the win and start dialing back the level of policy restrictiveness soon,” he added.

While the public more closely follows the Labor Department’s consumer price index, Fed policymakers prefer the PCE because it adjusts for shifts in what consumers actually buy, while the CPI measures prices in the marketplace.

Inflation has been a nettlesome problem since the early days of the Covid pandemic, when price increases surged to their highest levels since the early 1980s. The Fed initially expected the acceleration to be temporary, then responded with a series of interest rate hikes that took its benchmark rate to its highest in more than 22 years.

Now, with the inflation rate cooling markets largely expect the Fed to start unwinding its policy tightening. As of Friday morning, futures traders were assigning about a 53% chance the Fed will enact its first rate cut this cycle in March, according to CME Group data. Pricing points to six quarter-percentage point decreases this year.

Don’t miss these stories from CNBC PRO:

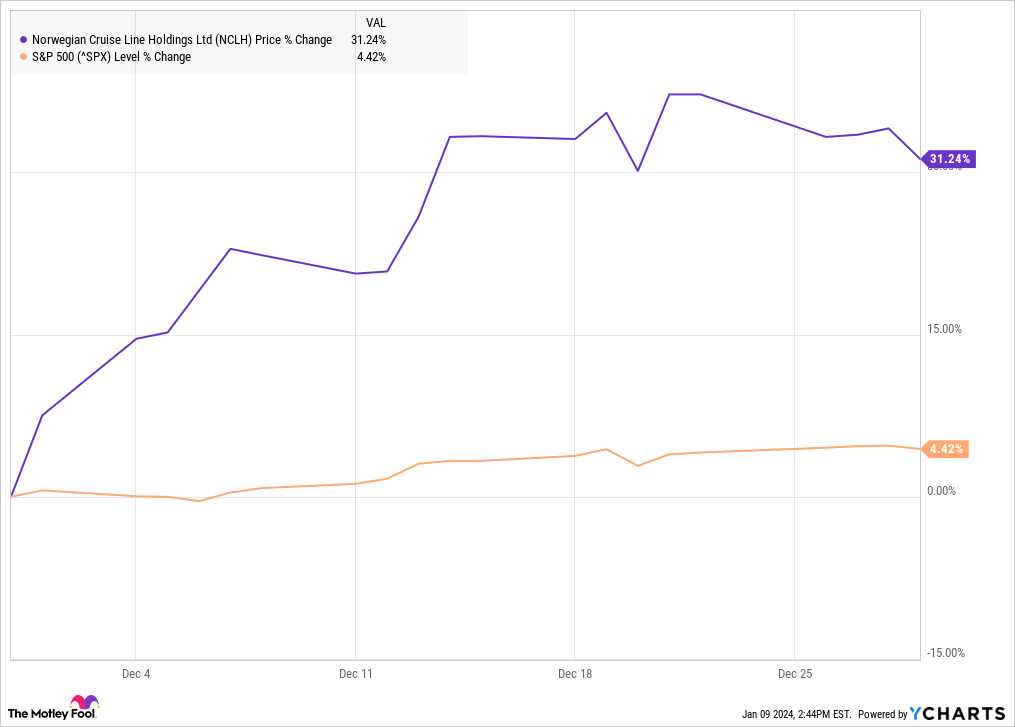

Shares of Norwegian Cruise Line Holdings (NCLH -2.14%) were cruising higher last month as the company benefited from expectations of lower interest rates from the Federal Reserve, bullish analyst notes, and a strong earnings report from Carnival, the world’s biggest cruise line.

According to data from S&P Global Market Intelligence, the stock finished the month up 31%. As you can see from the chart, the stock’s gains came during the first half of the month.

Norwegian gets lifted by a rising tide

There was little company-specific news out on Norwegian last month, but the increasing belief among investors that the economy would achieve a soft landing helped lift the stock, as did another strong report from Carnival, boding well for the 2024 cruising season.

Norwegian stock got off to a strong start as the stock reacted positively to dovish commentary from Fed Chair Jerome Powell on Dec. 1, opening the door to possible interest rate cuts.

The stock jumped 7% on Dec. 1 and added another 7% on Dec. 4. Norwegian is carrying a heavy debt balance following the pandemic shutdown of the cruise industry, so it stands to benefit from lower interest rates. Additionally, falling rates would help encourage economic growth and discretionary spending, which would benefit Norwegian as well. Citigroup also raised its price target on Norwegian on Dec. 4, reflecting increased confidence in industry performance in 2024.

The stock got another jolt the following week when the Fed held interest rates steady and forecast three rate cuts in 2024, pleasing investors. Norwegian jumped 4% on Dec. 13 and climbed another 6% the following session on the news.

From there, the stock traded mostly flat for the rest of the month, even as Wall Street boosted its price target on increasing confidence in the industry performance in 2024. The stock also briefly popped on Dec. 21 after Carnival beat estimates on the top and bottom lines and gave positive commentary on 2024.

What’s next for Norwegian?

Norwegian shares have cooled off in 2024 as investors seem to be correcting for the earlier rally on lower interest rates. However, if rates come down and the Fed achieves a soft landing, Norwegian is likely to be a winner, especially as demand for cruising has been strong.

Norwegian has returned to generally accepted accounting principles (GAAP) profitability, and the company’s financial results should improve as it pays back its debt.

With the stock trading at a reasonable valuation and still down roughly 70% from pre-pandemic levels, Norwegian looks to have a lot of upside potential ahead.

Citigroup is an advertising partner of The Ascent, a Motley Fool company. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.

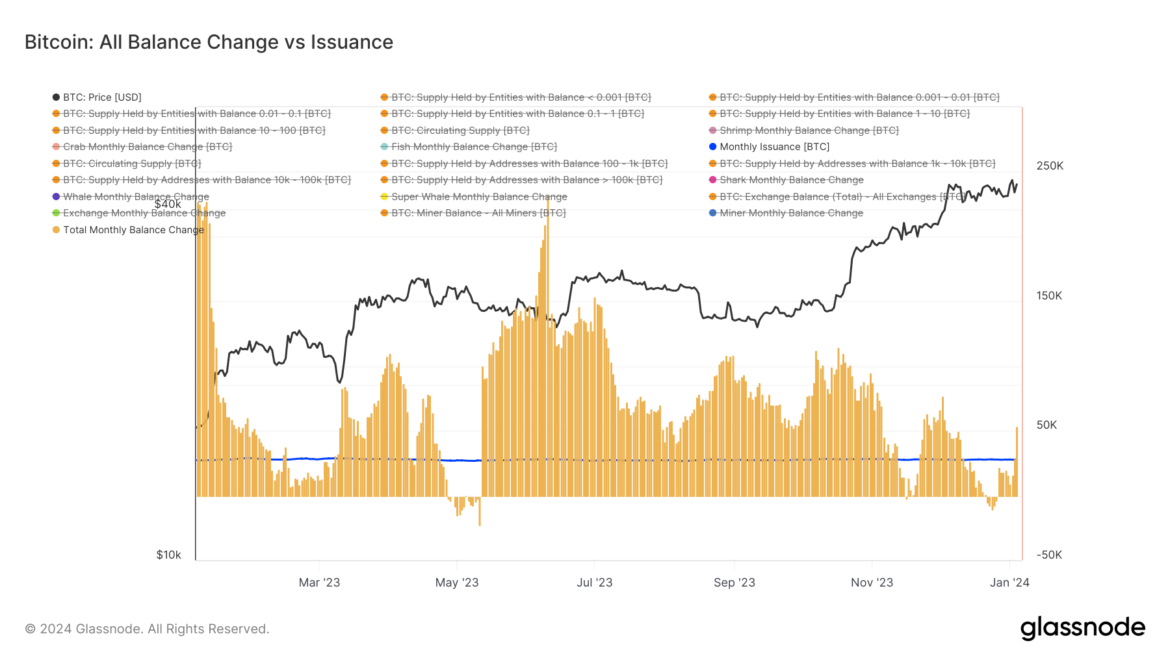

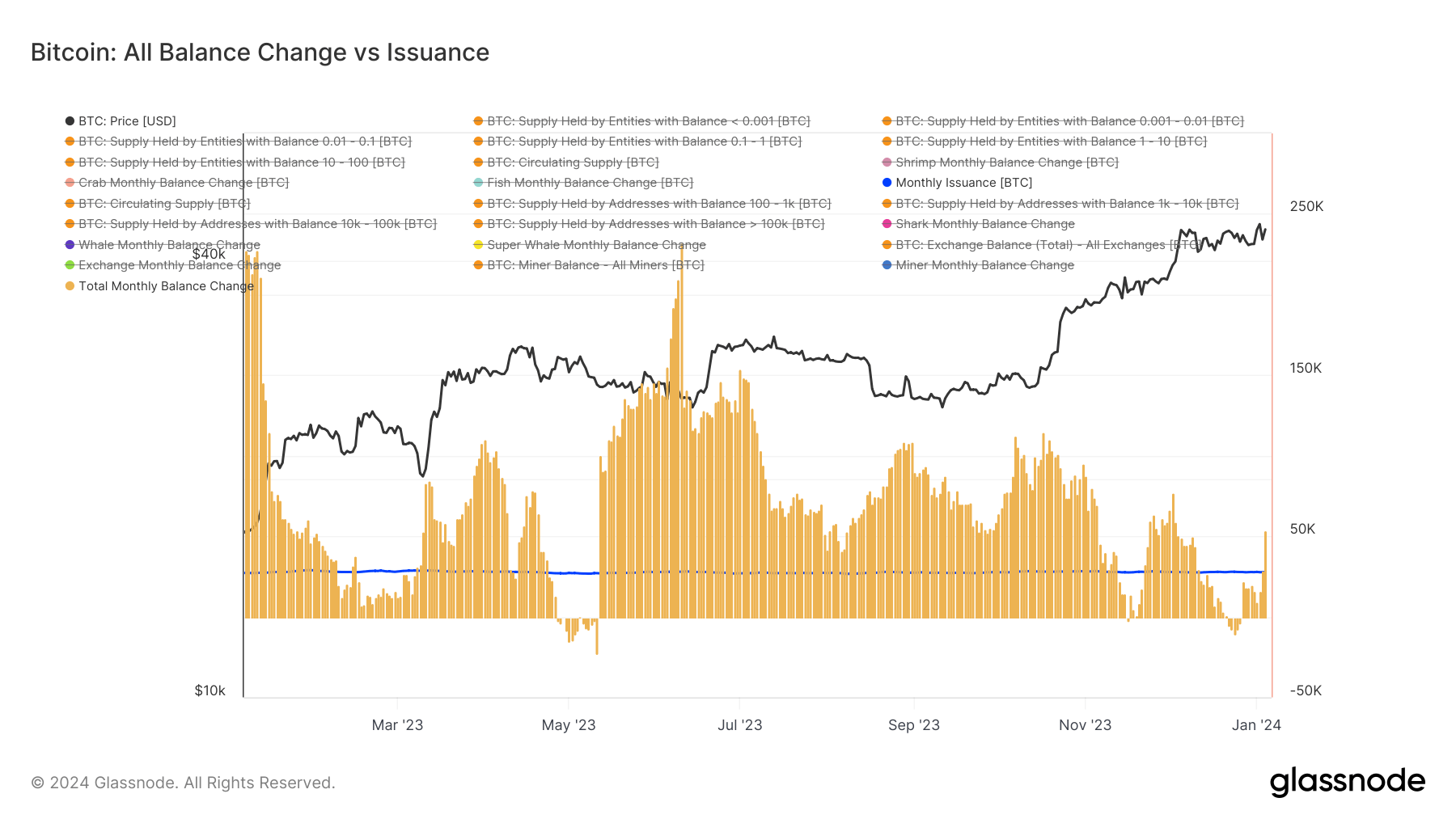

Investor cohorts outpace Bitcoin’s monthly mined supply for the first time since early December

Quick Take

When juxtaposed with the volume of newly mined BTC, the balance change of Bitcoin investor cohorts offers intriguing insights into the dynamics of the digital asset markets’ ecosystem. This analysis reveals a relative measure of new Bitcoin issuance absorbed by all different investor cohorts. Impressively, values above the blue line indicate a cohort’s aggregate balance increasing beyond the total coins mined in a given month, acting as a net absorber.

Contrarily, values on the blue line suggest a relatively flat balance for the cohort over a month against issuance, while negative values indicate a reduction in the cohort’s aggregate balance, indicating a distribution along with fresh coin issuance. A daily mining rate of approximately 900 BTC translates into a monthly volume of around 27,000 BTC.

For the first time since Dec. 4th, the aggregate balance of all cohorts is surpassing this monthly issuance. As of Jan. 4th, the total monthly balance change stood at 53,800, implying roughly 25,000 Bitcoins plus issuance were absorbed from the market. This absorption marks a halt in the preceding distribution phase, a phenomenon only previously seen in May 2023.

The post Investor cohorts outpace Bitcoin’s monthly mined supply for the first time since early December appeared first on CryptoSlate.

The U.S. labor market beat expectations again in December, adding 216,000 jobs to close out the year while the unemployment rate held steady at 3.7%.

Yet the job gains were slower than the same period a year ago, with the three-month average gain dropping to 165,000 a month compared with an average of 284,000 in December 2022, according to Nick Bunker, director of economic research for North America at the Indeed Hiring Lab.

“After entering 2023 with a sonic boom, the US job market is headed into 2024 at a comfortable cruising speed,” Bunker said. “The pace of job creation is strong but not overwhelming, unemployment is low and stable, and job openings are plentiful.”

Bunker noted that just a few sectors – education and health services, government, and leisure and hospitality – accounted for more than 75% of the job growth in December. He cautioned that “turbulence lurks on the edges of the radar” with labor force participation dropping toward year-end while wage growth accelerated.

“While labor demand may still be high, labor supply may be struggling to keep pace,” Bunker said. Nevertheless, the report should alleviate short-term recession fears, he said.

“If there’s any surprise emerging in this report, it’s that the labor market might have more momentum than previously thought,” he said.

The public sector led the way last month with 52,000 jobs, overwhelmingly in local government, according to the Bureau of Labor Statistics.

Health care also saw solid growth with nearly 38,000 jobs added, primarily in ambulatory care and hospitals. Job growth was strong in the sector throughout 2023, adding 55,000 positions a month on average compared with monthly gains of 46,000 in 2022.

Social assistance positions rose by 21,000 in December, with jobs gains averaging 22,000 per month in 2023, slightly more than the 19,000 average monthly increase in 2022.

The leisure and hospitality industry was little changed in December, adding 40,000 positions, with employment in the sector remaining below its pre-pandemic level by 1%, according to the Bureau of Labor Statistics.

The retail sector added 17,000 jobs to end the year, also little changed, with gains offset by a loss of 13,000 positions in department stores. Employment in the industry has struggled to gain speed since recovering from pandemic losses in 2022, according to the data.

Construction also trended upward with 17,000 new positions in December. The sector saw monthly gains of 16,000 in 2023 on average, compared with 22,000 in 2022.

Employment was little changed last month in mining, oil and gas, manufacturing, wholesale trade, information, financial activities, and other services, according to the Bureau of Labor Statistics.

Don’t miss these stories from CNBC PRO:

Shares in positioning and workflow technology company Trimble (TRMB -0.49%) rose nearly 15% in December, according to data provided by S&P Global Market Intelligence. The move comes as the market took a brighter view of growth prospects in 2024 on the back of the potential for lower interest rates.

After almost hitting 5% in October, the 10-year Treasury yield has been in a steady downtrend that continued through December as the market began pricing in the potential for the Federal Reserve to cut interest rates in 2024. That’s good news for companies with economically sensitive revenue streams.

Image source: Getty Images.

Trimble is definitely one of those. Indeed, on the company’s last earnings call in early November, CEO Rob Painter acknowledged that the weakness in the global economy was weighing on the company’s growth prospects. He noted, “We see increasing signs of weakness and stress across many end markets and geographies, exacerbated by interest rates, war, and geopolitical tensions.”

The bullish case investors bought into in December is that lower rates in 2024 will benefit many of Trimble’s key end markets, including buildings and construction (notably residential) and transportation (notably the freight market).

Trimble’s slowing revenue growth

The current slowdown in Trimble’s markets is best seen in its product (hardware and perpetual license) sales growth. At the end of the third quarter, the trailing-12-month product revenue stood at $1.78 billion, compared to nearly $2 billion at the end of 2022 and $2.14 billion at the end of 2021.

Don’t be alarmed by these figures, because Trimble’s overall revenue is still growing. Moreover, the company’s revenue naturally transitions toward more subscription and recurring services revenue as part of Trimble’s “connect and scale” strategy. In other words, Trimble’s offerings aren’t just about precise positioning data anymore. The company’s technology is increasingly becoming a part of its customers’ planning, modeling, and analytical activity on a real-time basis.

Image source: Getty Images.

The critical number to monitor

In addition, the key metric to follow at Trimble isn’t revenue; it’s its annualized recurring revenue (ARR). The good news is management sees ARR growing at 13% in 2023 to around $2 billion, with double-digit growth in 2024 as well.

Recurring revenue is the key to generating cash-flow growth, and that’s why Wall Street analysts expect Trimble’s free cash flow to grow from almost $600 million in 2023 to $844 million in 2025. As a reminder, Trimble’s current market cap is $12.7 billion, making the stock look like an excellent value if it hits analysts’ expectations.

The icing on the cake would be some cyclical benefit to its growth from lower interest rates in 2024.

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool recommends Trimble. The Motley Fool has a disclosure policy.

Shares in industrial conglomerate 3M (MMM 0.35%) rose by slightly more than 10% in December, according to data provided by S&P Global Market Intelligence. The move comes as the market priced in a better growth environment in 2024 due to anticipated interest rate cuts in 2024.

A better growth environment for 3M?

While there’s no guarantee the Federal Reserve will reverse interest rate hikes this year, the market has merrily assumed it will, as 10-year Treasury yields fell from touching 5% in late October to slightly below 4% at the time of writing.

For several reasons, a better economic growth outlook is music to the ears of 3M shareholders.

First, the company has significant exposure to interest rate-sensitive sectors, such as consumer electronics, automotives, construction, and home improvement goods. Moreover, its adhesives, abrasives, advanced materials, and electronics materials are widely used across the industrial sector. These are all markets that rely on economic growth.

Second, 3M is on track to spin off its healthcare segment, Solventum, in the first half of 2024. 3M will retain a 19.9% stake in Solventum, which could be used to raise cash in the future. The spin-off will remove a stable and less economically sensitive earnings and cash-flow source. As such, the remaining 3M company will be more cyclical than the current version.

Is 3M a recovery stock for 2024?

The company is undoubtedly attractive as a turnaround play, not least as management is cutting costs and repositioning the company for growth. Indeed, as previously discussed, management is starting to turn around its lackluster performance on margins in recent years thanks to its restructuring activities.

That said, there are still some question marks around the stock. Unfortunately, its management does not have an excellent track record of meeting its sales guidance, let alone beating it. Moreover, buying a high-yielding stock (3M currently yields 5.6%) is always a mistake without carefully assessing just how sustainable the dividend is.

Image source: Getty Images.

For example, the trailing-12-month dividend payout is $3.3 billion , and Wall Street analysts are forecasting $4.5 billion in free cash flow in 2023 with $4.3 billion in 2024 and $4.7 billion in 2025.

While these figures (which include the healthcare segment) suggest the dividend is sustainable, 3M will spin off the healthcare segment in 2024 and has multibillion-dollar and multiyear cash calls coming from legal settlements relating to its production and use of PFAS chemicals and its combat arms earplugs.

Management probably will not want to cut the dividend, and it has the 19.9% stake in Solventum as potential firepower, but the 3M board may not feel the same way about matters. As such, it makes sense to wait and see 3M’s outlook for 2024 and its capital allocation policy before diving into the stock.

Near a 52-Week Low, This Dividend Stock Is Worth Buying in December and Holding Well Beyond 2024

Dominion Energy (D 1.02%) is up 24.1% from its 52-week low — which sounds like a lot until you realize the stock is still down 17.9% over the last year and 36.8% over the last five years compared to impressive gains in the S&P 500.

Still, the comeback is a big move in a short period of time from a stodgy, reliable, dividend-paying utility. But Dominion has been anything but that — cutting its dividend in late 2020 and only slightly raising it since then.

So how could a company that has disappointed investors through capital losses and lower dividend income be a good investment? The answer lies not in where Dominion Energy has been but in where it is going. Here’s why the future looks promising for this utility stock.

Image source: Getty Images.

Twists and turns

For the last four years, Dominion has been on an asset-selling spree. In September, Enbridge announced a $14 billion acquisition (including debt) of three natural gas utilities from Dominion Energy. A few months prior, Dominion sold its remaining 50% non-controlling interest in Cove Point LNG to Berkshire Hathaway Energy (BHE). In 2020, Dominion sold $9.7 billion in energy transmission assets to BHE.

The idea behind the asset sales was to make the company less reliant on volatile fossil fuel industries and transition toward renewables and regulated utility functions. The problem is that Dominion didn’t do a good job communicating its intentions to investors, leaving them to connect the dots to try to figure out what the new company would look like once the dust settled.

To be fair, Dominion did a good job of setting clear emissions reduction goals. The company had spent years transitioning from coal to natural gas and was now transitioning from gas to renewables. There was little doubt about the company’s multidecade plan, but plenty of question marks surrounded the short and medium terms.

A turnaround in the making

Dominion’s Q3 2023 earnings presentation clarified what investors can expect from the business for the rest of the year, in 2024, and even in 2025.

Its estimated 2023 earnings are $2.10, giving the company a 23 price-to-earnings (P/E) ratio. Factoring in $0.80 per share in adjustments — namely $0.50 from interest expense savings from pending asset sales — would bring 2023 earnings to $2.90 — giving Dominion an adjusted P/E ratio of 16.6. That’s a much more realistic valuation for a low-growth utility business.

The earnings presentation also provided insight into Coastal Virginia Offshore Wind (CVOW) — Dominion’s utility-scale wind energy megaproject. The company wants to find a noncontrolling equity financing partner by the end of 2023 or early 2024 to take some of the burden off of the project’s cost. Dominion expects to reach $3 billion on total project investment by year-end compared to a total current capital budget of $9.8 billion. Construction is expected to be completed by the end of 2026.

The project is decently efficient as far as offshore wind goes, with an estimated levelized cost of electricity of $77 per megawatt-hour (MWh). For context, the International Renewable Energy Agency estimates that 2022 levelized cost of electricity for offshore wind was $81 per MWh compared to $33 for onshore wind, $49 for solar PV, and $61 for hydropower.

On Oct. 31, the Biden administration approved the 2.6 GW project, which is currently the largest approved offshore wind project in the U.S. It’s even more massive when put into the context of the administration’s 2030 goal of 30 GW of installed offshore wind capacity — meaning CVOW alone would make up about 9% of the 2030 goal.

CVOW is expensive, but landing a partner and completing the project on time will reduce the financial burden while giving Dominion a cleaner source of electricity for its customers.

A reliable dividend

Dominion reassured investors that it is “100% committed to its current dividend” and is targeting a payout ratio in the 60% range over time. That’s a healthy target that allows earnings to support dividend payments without making the dividend too straining on the business.

Dominion is likely years away from a dividend raise. As mentioned, its forecast 2023 adjusted earnings per share are $2.90, while its dividend sits at $2.67 per year. The current payout ratio on adjusted earnings is 92%. So earnings are going to have to increase by quite a bit before it can justify a raise. In the meantime, the existing dividend appears safe, and that’s good enough, considering the stock yields 5.4%.

Dominion is worth buying now

Dominion deserved to fall, given its murky outlook. But now, Dominion is on track to look like a much better company.

The valuation could look reasonable very soon. The dividend is solid and has room to grow once earnings improve. And the utility is becoming safer and more dependent on clean energy, which is the right long-term move even if Dominion mishandled some of the steps to getting there.

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Enbridge. The Motley Fool recommends Dominion Energy. The Motley Fool has a disclosure policy.