PRESS RELEASE. [Singapore, April 12th 2024] Yala, a liquidity and stablecoin protocol, is excited to unveil its new vision for the future “to create a thriving, open ecosystem that unlocks the full potential of DeFi on Bitcoin”. This ambition reflects Yala’s dedication to catalyzing mass adoption of decentralized finance on the world’s most resilient blockchain, […]

PRESS RELEASE. [Singapore, April 12th 2024] Yala, a liquidity and stablecoin protocol, is excited to unveil its new vision for the future “to create a thriving, open ecosystem that unlocks the full potential of DeFi on Bitcoin”. This ambition reflects Yala’s dedication to catalyzing mass adoption of decentralized finance on the world’s most resilient blockchain, […]

Source link

DeFi

Xuirin Finance Set to Revolutionize DeFi With KYC-Free Debit Cards, P2P Lending and Much More

Looking to get involved with a platform that can change the face of decentralized finance forever? Xuirin Finance is revolutionizing the DeFi landscape through its innovative offerings like KYC-free debit cards, P2P lending, and so much more. Supporters can take part in the first stage of its presale right now. Xuirin Finance to Offer Futuristic […]

Looking to get involved with a platform that can change the face of decentralized finance forever? Xuirin Finance is revolutionizing the DeFi landscape through its innovative offerings like KYC-free debit cards, P2P lending, and so much more. Supporters can take part in the first stage of its presale right now. Xuirin Finance to Offer Futuristic […]

Source link

Defi Platforms Lose More Than $336 Million in Digital Funds in Q1 of 2024, Study Finds

In the first quarter of 2024, more than $336 million in digital assets were stolen from decentralized finance platforms across 61 incidents of hacking and fraud. During this period, criminals made off with digital assets valued at $144.48 million in two major hacking incidents. In contrast, centralized finance platforms reported no incidents of hacking or […]

In the first quarter of 2024, more than $336 million in digital assets were stolen from decentralized finance platforms across 61 incidents of hacking and fraud. During this period, criminals made off with digital assets valued at $144.48 million in two major hacking incidents. In contrast, centralized finance platforms reported no incidents of hacking or […]

Source link

Cosmos DeFi boosted as ‘rivals’ Osmosis and Astroport collaborate on programmable liquidity pools

Cosmos-based decentralized exchange Astroport is set to deploy its passive concentrated liquidity (PCL) pools on Osmosis, the largest Cosmos-based DEX by volume, following successful governance votes on both platforms. This move marks an alignment between two of the most active DEXes in the Cosmos ecosystem, aiming to improve the overall trading experience and capital efficiency for users.

PCL pools, which aim to provide the benefits of concentrated liquidity without requiring active management, will be offered alongside Osmosis’s existing “supercharged liquidity” pools. Astroport’s pools utilize an advanced repegging algorithm that automatically concentrates liquidity around the exponential moving average of ongoing trades. As Astroport core dev Andre Sardo explained,

“With PCL pools, you go and LP in a pool, and you can leave your tokens there for days, months or years, and have it automatically adjust to market conditions. Impermanent loss gets minimized, and fees get maximized.

And because your liquidity is passive, it’s truly programmable or composable. It can be tapped by apps and vaults and aggregators anywhere in the Cosmos.”

The deployment of Astroport’s PCL pools on Osmosis is expected to benefit both protocols. Standard PCL pool fees will flow back to xASTRO stakers, while all trades routed through Astroport’s PCL pools on Osmosis will generate a 0.1% fee for Osmosis, to be split between the Osmosis community pool and the OSMO staking pool. This move is anticipated to expand Astroport’s reach, grow its global trading volume and fee generation, and attract more passive liquidity to Osmosis.

Sunny Aggarwal, Co-Founder of Osmosis Labs, predicted the move could lead to record volumes within the first month.

“Competition is good, but aligning for the benefit of the greater community is even better — so it’s very exciting to see Astroport and Osmosis joining forces here… Only time will tell, but I predict that the Astroport deployment on Osmosis will become one of the biggest by volume within a month or so of the launch.”

While supercharged liquidity and PCL pools may appear to be competitors, the teams believe they are better viewed as complementary offerings catering to different types of LPs. Supercharged liquidity pools are best optimized by professional market makers and active LPs who run their own algorithms and programmatically readjust their liquidity to match market conditions. In contrast, PCL pools cater to more casual LPs who prefer a “deposit and chill” approach, according to the teams, allowing the pool’s algorithm to concentrate their liquidity automatically.

According to Jose Maria Macedo, Founder and CEO of Delphi Labs, this alignment between Astroport and Osmosis is a significant development in the Cosmos ecosystem. Macedo stated,

“It’s two massive DEXes that outsiders look at as rivals coming together and assimilating. And they’re doing it in ways that benefit both protocols. They’re leaning into their strengths and combining to improve liquidity for the entire Cosmos ecosystem.”

Further, Astroport core developer Donovan Solms highlighted the portability of Astroport’s codebase, comparing it to a “magic suitcase” that can be deployed on any Cosmos chain. Solms explained,

“We can go wherever there’s a need for liquidity in the Cosmos. And thanks to IBC, each deployment is interconnected. It’s part of a bigger whole, which is this backend layer of truly passive, truly infinite liquidity.”

Preparations for the deployment are underway, with PCL pools expected to go live on Osmosis in the coming weeks. This historic alignment between Astroport and Osmosis is poised to improve capital efficiency for those who swap or have trades routed through Osmosis while also potentially “defragmenting” liquidity spread across other automated market makers throughout the Cosmos ecosystem.

Mentioned in this article

Latest Alpha Market Report

Vibrant Finance leverages Neon EVM for groundbreaking DeFi exchange innovation

Decentralized exchange (DEX) Vibrant Finance has launched on Neon EVM, a Solana-based platform, marking its foray into the non-Ethereum DeFi landscape, according to a Feb. 23 press release.

The DEX utilizes the Discretized-Liquidity Automated Market Maker (DL-AMM) model to overcome existing limitations within traditional DeFi exchanges.

Vibrant Finance CEO Jimmy Yin expressed enthusiasm about this deployment on Neon, emphasizing its potential to bridge Ethereum’s vibrant DeFi ecosystem with Solana’s robust liquidity and transactional efficiency.

“With our latest deployment on Neon EVM, we aim to make liquidity more efficient and foster cooperation between chains and ecosystems,” Yin remarked.

The DL-AMM model, renowned for offering discrete liquidity for each price movement, facilitates precise liquidity allocation at specific fixed prices. This innovative approach addresses challenges in DeFi exchanges and optimizes liquidity management for users. Additionally, it introduces advanced trading features such as limit orders, enriching the trading experience for users.

Vibrant Finance is supported by iZumi, a multi-chain DeFi protocol that provides DEX-as-a-Service (DaaS).

Neon EVM growing ecosystem

Neon EVM facilitates scaling Ethereum decentralized applications (dApp) on Solana, making it an ideal choice for Vibrant Finance to expand beyond Ethereum.

Neon essentially simplifies the deployment of EVM-compatible dApps with minimal code adjustments. The platform operates as a smart contract on Solana and processes requests through public PRC endpoints.

Several DeFi protocols, including deBridge and MeredianFi, have integrated with Neon, showcasing its growing success in the industry, primarily on the back of Ethereum and Solana’s rising prominence.

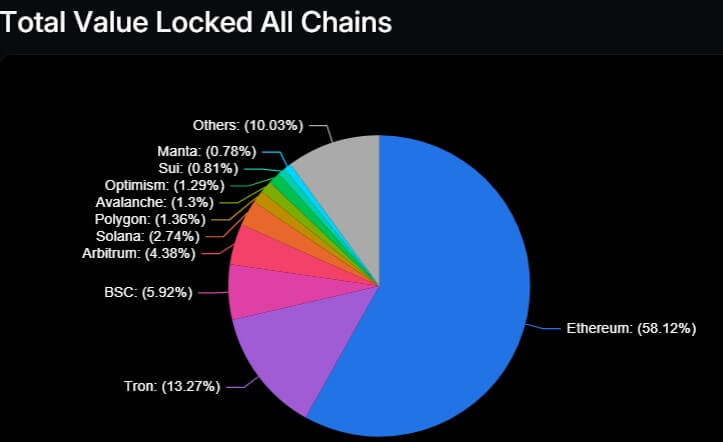

DeFillama data shows that Ethereum is the largest DeFi blockchain, with $45.87 billion in total value locked (TVL) on the network, while Solana’s TVL recently climbed above the $2 billion mark.

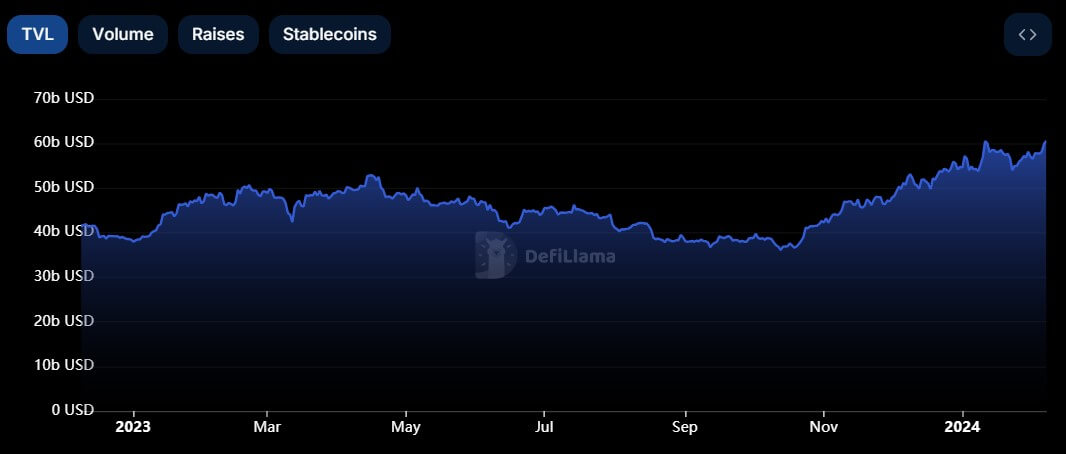

DeFi ecosystem rebounds to 18-month high of $60 billion in assets, signaling investor confidence resurgence

The decentralized finance (DeFi) ecosystem has hit a significant milestone as the total value of assets locked (TVL) surpassed $60 billion, marking a return to levels last seen in August 2022.

According to data from DeFiLlama, the sector surged by an impressive 68% to $60.72 billion from November 2023, when the TVL stood at around $36 billion.

The upward trajectory of a TVL signals robust investor confidence, with more users entrusting their assets to partake in decentralized financial activities.

Market analysts attribute this growth to the recent surge in crypto asset prices, fueled by buzz surrounding Bitcoin exchange-traded funds (ETFs). This rally, capturing the interest of both retail and institutional investors, propelled Bitcoin to nearly $50,000 and Ethereum, the leading DeFi blockchain network, above $2,000.

Ethereum leads

Ethereum remains the dominant force in DeFi, claiming over 58% of the market share across blockchains, boasting a TVL of $35.3 billion. Tron blockchain is second, commanding a 13% market share with a TVL of $8 billion.

Beyond Ethereum and Tron, other blockchain networks such as Solana, Binance Smart Chain, Polygon, and Arbitrum also wield considerable influence, hosting many projects and boasting substantial TVL figures.

Meanwhile, the emergence of the Sui blockchain is noteworthy as it has rapidly ascended the ranks in the DeFi space, securing a spot among the top 10 in TVL and surpassing well-established competitors like Cardano and Bitcoin.

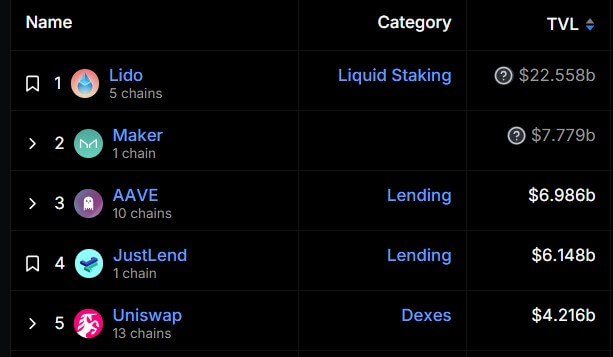

Lido dominate protocols

Lido Finance, a leading liquid staking protocol, commands a significant 37% market share, boasting a TVL of $22.58 billion.

Lido is poised to exceed 10 million ETH staked through its platform, operating across prominent blockchain networks such as Ethereum, Solana, Moonbeam, and Moonriver.

The other top five protocols include notable entities like the DAI stablecoin issuer Maker, lending platforms Aave and Justlend, and the decentralized exchange Uniswap. These protocols collectively hold TVLs of $7.7 billion, $6.98 billion, $6.14 billion, and $4.21 billion, respectively.

Trading resurgence

Concurrently, decentralized exchanges (DEXs) have experienced a surge in daily trading volumes, witnessing a 3.29% increase over the past week alone, facilitating trades worth approximately $22 billion, according to DeFillama data.

Furthermore, a Dune Analytics dashboard curated by rchen8 shows a resurgence in the sector’s user base, with more than 3 million users returning to previous highs. Over the past two months, the ecosystem has welcomed 3.6 million new addresses, pushing its total user count close to 50 million.

Layer1 blockchain network Sui is ending the month as one of the best-performing digital assets, according to CryptoSlate’s top gainers list.

According to the list, SUI gained around 75% during the past 30 days to post a new all-time high of $1.64 on Jan. 30, surpassing its previous high of $1.43. However, its value has declined 3.5% to $1.58 as of press time.

This price performance reflects the overall improvements the network has enjoyed since the beginning of the year, allowing it to outperform major cryptocurrencies like Bitcoin and Ethereum during the reporting period.

Sui DeFi metrics improve.

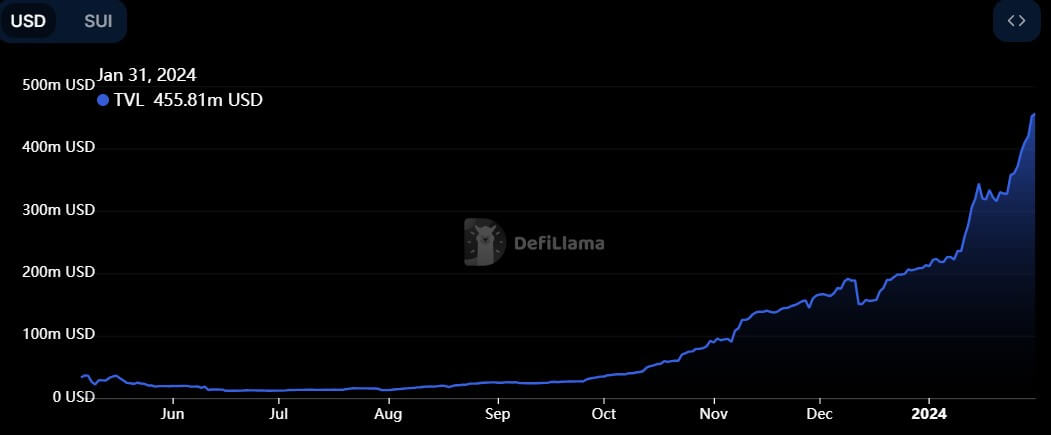

The improved price follows Sui’s brief entrance into the top 10 decentralized finance (DeFi) projects in terms of the total value of assets locked (TVL).

According to a Jan. 30 statement shared with CryptoSlate, SUI’s TVL surged past the $430 million milestone less than a year after its mainnet launch. The rapid increase in Sui’s TVL is attributed to various protocols and applications leveraging its strength, including liquid staking platforms, decentralized exchanges, and lending protocols like Scallop Lend, Navi Protocol, and Cetus.

Greg Siourounis, Managing Director of the Sui Foundation, said:

“What we are seeing in these numbers is developers on Sui [are] building products that people are using to address real-world challenges. That dynamic will form the basis of a sustainable decentralized network that lasts well into the future.”

The TVL has now risen to $444m as of press time, but it now sits as the eleventh largest DeFi blockchain network, per DeFiLlama data.

In addition to the TVL growth, the network’s on-chain activities have exploded, with weekly DeFi volume rising 1,200% since October 2023.

Despite these achievements, the protocol is poised for further development with co-founder Adeniyi Abiodun revealing that the network aims to introduce internet-less transactions before the end of the year.

Notably, Abiodun’s disclosure aligns with a similar prediction made by Mysten Lab’s co-founder, Kostas Chalkias, who stated:

“I predict that Sui will support internet-less transactions in the next 12 months.”

In this article, we will explore the finest Web3 and DeFi wallets that offer substantial advantages to crypto users. While Web3 wallets and DeFi wallets share a strong connection, it’s important to understand their distinctions. By highlighting the top wallets in both categories, we aim to provide users with valuable insights into the wallets that can enhance their Web3 and DeFi experiences.

Web3 wallets are specifically crafted to engage with decentralized applications (DApps) on blockchain networks, empowering users with the essential tools to securely oversee their digital assets and participate in the realm of decentralized web.

Essential Aspects To Note Regarding Web3 Wallets

Cross-Chain Support: Most Web3 wallets support multiple blockchain networks, allowing users to access and manage various DApps and different cryptocurrencies from a single interface.

Seamless DApp Interaction: Web3 wallets allow users to seamlessly connect and interact with a wide range of DApps. They provide a convenient way to authenticate with DApps, sign transactions, and manage account balances.

Enhanced Security Features: Web3 wallets optimizes security measures, such as encrypted storage of private keys and protection against phishing attacks. They often offer features like two-factor authentication and recovery options to ensure the safety of user funds.

Essential Features Of DeFi Wallet

DeFi wallets are a specialized category of Web3 wallets designed specifically for the decentralized finance ecosystem. These wallets offer advanced functionalities and specific features essential for engaging in diverse DeFi protocols like lending, borrowing, yield farming, and staking. By catering to the unique requirements of DeFi, these wallets empower users to seamlessly participate in the decentralized financial landscape. These wallets provide supplementary features specifically designed to cater to the needs of DeFi users.

Here are some characteristics of DeFi wallets:

Token Swapping and Yield Farming: DeFi wallets often include built-in features for token swapping and yield farming. Users can swap tokens directly within the wallet interface and participate in yield farming to earn rewards.

DeFi Protocol Integration: DeFi wallets integrate with popular DeFi platforms, enabling users to easily access and interact with lending protocols, decentralized exchanges (DEXs), yield farming platforms, and more.

Gas Optimization: Gas optimization features enable users to estimate and adjust transaction fees, ensuring cost-efficient interactions with DeFi protocols.

Note: DeFi and Web3 share some common features, as they both operate within the broader context of blockchain technology and decentralized applications (DApps).

Examples Of Enhanced Web3 And DeFi Wallets

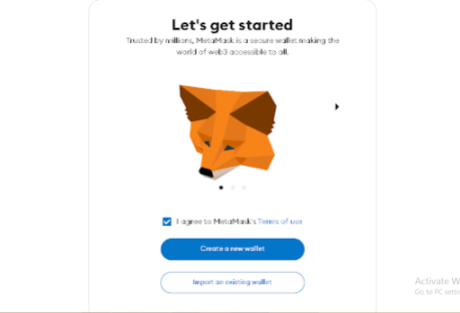

Metamask Wallet

MetaMask is a popular and user-friendly Web3 wallet that has garnered considerable recognition within the cryptocurrency community. Serving as a browser extension wallet that seamlessly integrates with the Ethereum network, users can easily manage their Ethereum-based assets, including Ether (ETH) and ERC-20 tokens.

MetaMask also features a built-in DApp browser, enabling direct access and interaction with a wide range of Ethereum-based decentralized applications (DApps). The wallet prioritizes security by implementing encrypted storage, password protection, and optional hardware wallet integration.

Additionally, MetaMask supports token swapping through decentralized exchanges (DEXs) like Uniswap and SushiSwap, along with integration with various DeFi platforms for lending, borrowing, yield farming, and other DeFi activities. It also offers compatibility with multiple Ethereum test networks for testing and development purposes.

MetaMask supports various networks in addition to the Ethereum mainnet. A few of the numerous networks supported by MetaMask are Binance Smart Chain (BSC), Arbitrum(ARB) and Polygon (MATIC), among others.

Straightforward Guide On How To Get The Metamask Wallet

The first step is to visit the authentic Metamask website and click on the “Get Chrome Extension” or “Get Firefox Add-On” button, depending on your browser choice.

See the Chrome browser Illustration below:

After clicking on the “Add to Chrome” button, a popup window will appear, asking for confirmation to add the extension. Click “Add Extension” to proceed.

Once the extension is installed, you will see the MetaMask icon in your browser toolbar. Click on the icon to launch MetaMask. You will be presented with the option to create a new wallet.

Once that is done, follow the on-screen instructions to create a new wallet.

In the final step, MetaMask will provide you with a unique seed phrase consisting of 12 or 24 words. Write it down and keep it securely offline. Confirm your seed phrase as prompted by MetaMask by selecting the words in the correct order, after which you can start using MetaMask to manage your Ethereum-based assets, interact with DApps, and participate in DeFi activities.

Keplr Wallet For Web3

Keplr is a web3 wallet primarily designed for interacting with decentralized applications (DApps) on the Cosmos network. However, it offers support for specific decentralized finance (DeFi) functionalities within the Cosmos ecosystem. The Keplr wallet is known to support networks like Celestia, Osmosis, Terra, and Secret Network.

How To Get And Set Up Keplr Wallet

To begin, you should install the Keplr extension with the appropriate extension store for your browser, such as the Chrome Web Store. To Download, click on the “ Add to Chrome” button as illustrated below:

When creating a new wallet, carefully follow the instructions displayed on your screen to establish a robust password and consent to the terms of use. Remember to store your password securely since it is essential for accessing your wallet (If you have an existing wallet, select the “Import Existing Wallet” option and follow the instructions).

Write down your recovery or seed phrase and store it securely. Remember, it is advisable to never store your seed phrase online due to the risk of being hacked.

After setting up or importing your wallet, connect to the desired network or blockchain supported by Keplr. Once connected, you can start interacting with Cosmos ecosystem DApps. Explore the available DApps and features, and follow on-screen instructions to use them with your Keplr wallet.

Phantom Wallets

Phantom is a widely used cryptocurrency wallet specifically created for the Solana blockchain. It provides an intuitive interface and smooth integration with Solana-based decentralized applications (DApps), enabling users to securely manage, transfer, and receive digital assets within the Solana ecosystem.

How To Get Phantom Wallet

To get started, install the Phantom extension from the relevant extension store for your browser, like the Chrome Web Store. Click on the “Add to Chrome” button, as shown in the illustration below:

To set up your Phantom wallet, simply click on the Phantom icon located in your browser’s toolbar, which will launch the wallet interface. From there, follow the on-screen instructions to either create a new wallet or import an existing one using your recovery phrase or private key.

Set a strong password you can remember and save recovery phrases offline (do not store on the device).

Once your wallet is set up, you can conveniently access it at any time by selecting the Phantom icon in your browser’s toolbar. This grants you the ability to manage your digital assets, engage with Solana-based DApps, and carry out various wallet-related tasks.

UniSat Wallet

UniSat Wallet is an open-source Chrome extension that provides a secure and user-friendly solution for storing and transferring bitcoins and Ordinals on the Bitcoin blockchain. It offers features like immediate access to unconfirmed transactions, enabling faster inscription operations without a full node. Additionally, it supports the storage and transfer of BRC-20 tokens, allowing users to manage both bitcoins and BRC-20 tokens in one wallet.

How To Get UniSat Wallet For Web3

To begin, install the UniSat extension from the relevant extension store for your browser, like the Chrome Web Store. Click on the “Add to Chrome” button, as shown in the illustration below:

For the next step, simply click on the UniSat icon located in your browser’s toolbar, which will launch the wallet interface. From there, follow the instructions to either create a new wallet or import an existing one using your recovery phrase or private key.

Once your wallet is set up, you can conveniently access it at any time by selecting the UniSat icon in your browser’s toolbar.

Trust Wallet

Trust Wallet is a versatile wallet that serves as both a decentralized finance (DeFi) and a Web3 wallet. It enables users to interact with decentralized applications (DApps) and protocols within the DeFi ecosystem, including decentralized exchanges, lending platforms, and yield farming protocols. Additionally, it integrates with the Web3 ecosystem, allowing users to interact directly with blockchain networks, sign transactions, and securely manage their digital assets on platforms like Ethereum and other compatible networks.

How To Get Trust Wallet For Web3

First, users can download the Trust Wallet app or install the Trust Wallet extension from the relevant extension store for their browser or mobile device, like the Chrome Web Store. Click on the “Add to Chrome” button, as shown in the illustration below:

Next, simply click on the Trust Wallet icon located in your browser’s toolbar, which will launch the wallet interface. From there, follow the instructions to either create a new wallet or import an existing one using your secret phrase as instructed in the image below:

Once you have meticulously set up your password and safely stored your secret phrase offline, you will gain access to your Trust Wallet. With these security measures in place, you can securely and confidently log into your Trust Wallet account and manage your digital assets.

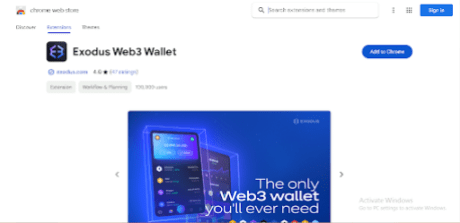

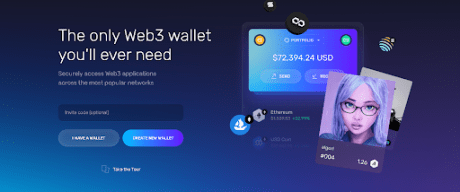

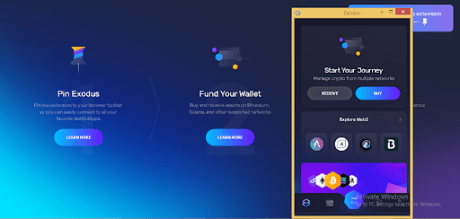

Exodus Wallet

Exodus Wallet is a widely used software wallet for cryptocurrencies, offering users a secure means to store, manage, and trade various digital assets. It is accessible as a desktop application compatible with Windows, Mac, and Linux systems, along with a mobile app for iOS and Android devices. Exodus Wallet provides support for multiple blockchain networks, enabling users to effectively handle and engage with diverse cryptocurrencies. Among the networks supported are Litecoin (LTC), Stellar (XLM), Ripple (XRP), and Bitcoin (BTC).

How To Set Up Exodus Wallet

To begin, download and install the Exodus Wallet extension from the appropriate extension store based on your browser, such as the Chrome Web Store. Locate the “Add to Chrome” button, as depicted in the accompanying image, and click on it to initiate the installation process.

To proceed, just click on the Exodus icon situated in the toolbar of your browser. This action will open the wallet interface, where you can then follow the provided instructions to either generate a new wallet or import an existing one using your recovery phrase or private key.

For new wallets, do not forget to write down your recovery phrase in a safe place and do not store it online. Additionally, it is advisable to not take screenshots as well.

Next, Click on the “Create New Wallet” and carefully set up your password or “I Have A Wallet” button using your secret phrase to get started.

Then, you can connect Exodus wallet to a network of your choice and start your trading journey:

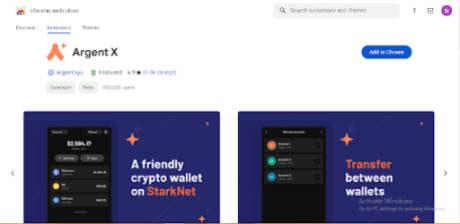

Argent Wallet For DeFi

Argent Wallet is a popular non-custodial cryptocurrency wallet that prioritizes simplicity, security, and usability. It serves as a Web3 wallet, offering users a convenient and user-friendly interface to engage with decentralized applications (DApps) and the broader Web3 ecosystem.

By integrating with Ethereum and compatible networks such as xDai, Polygon (MATIC), and Ethereum (ETH), Argent Wallet empowers users to manage their digital assets and actively participate in various Web3 activities. With its focus on user experience and compatibility with multiple networks, Argent Wallet provides a versatile solution for individuals seeking a seamless and secure Web3 wallet experience.

How To Get And Set Up Argent Web3 Wallet

To get started, you’ll need to install the Argent extension for your browser by visiting the appropriate extension store, such as the Chrome Web Store. Look for the “Add to Chrome” button, which is depicted in the accompanying illustration. Click on that button to initiate the installation process.

Next, if you’re a new user, click on “Create a new wallet,” and you will be prompted to create a password.

To securely manage and interact with digital assets, decentralized applications (DApps), and the Web3 ecosystem, save your recovery phrase (write it down. do not store it on your device), and your Argent wallet will be ready to use.

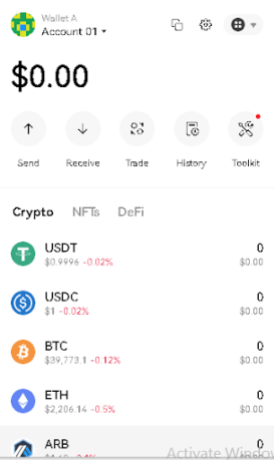

OKX Wallet For DeFi

OKX Wallet is a prominent non-custodial wallet that provides users with the ability to securely manage their cryptocurrencies, non-fungible tokens (NFTs), and digital assets within a unified platform.

With OKX Wallet, users have the capability to purchase, trade, earn, and oversee their digital assets across more than 50 blockchains, including Bitcoin, Ethereum, OKT Chain, Solana, BSC, and Aptos, all available in over a dozen languages.

How To Set Up OKX Wallet

To set up using the Chrome browser extension, click on the ‘Add to Chrome” button in the top right corner, as shown in the image below:

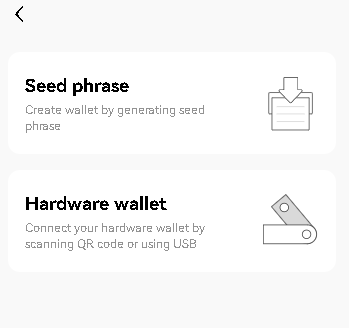

Next, select the “Create Wallet” option as shown below:

OKX will present users with the option of creating wallets with either seed phrases or hardware wallets. In the absence of hardware wallets, as in this case, select the “seed phrase” option.

Set the password, verify the seed phrase, and your OKX wallet will be ready to use. Write down your seed phrase and store in a safe place. Do not store online.

Downloading DeFi And Web3 Wallets On Mobile Phones

The wallets listed in this guide also have mobile versions which are available on the app stores of your mobile phone. Navigate to the Apple App Store for iOS or the Google Play Store for Android, input the name of the wallet you want to download in the search bar, make sure you have the correct app and click “Download.”

To set up the wallets on mobile phones, follow the same steps outlined in this guide to get started, and your wallets will be set up.

Conclusion

In conclusion, Web3 and DeFi wallets offer users enhanced digital asset management and participation in decentralized applications. Web3 wallets provide cross-chain support, seamless DApp interaction, and enhanced security features, while DeFi wallets cater specifically to the decentralized finance ecosystem with functionalities like token swapping and yield farming. Understanding these unique characteristics helps users make informed choices.

Examples of enhanced Web3 and DeFi wallets worth exploring have been mentioned in this article. Staying informed about the latest developments in this evolving technology is crucial for unlocking the full potential of decentralized applications and ensuring asset security.

Featured image from Blockbuild.africa

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.

EOS Network Ventures Awards NoahArk Tech Group $2.4M to Advance DeFi on EOS

With funding courtesy of ENV in place, Defibox and Noahark will be able to take these features to the next level.

EOS Network Ventures (ENV), the primary steward of the EOS network, has announced a major grant to accelerate DeFi adoption. $2.4 million has been invested by ENV into NoahArk Tech Group to allow decentralized applications on EOS to flourish.

The product of a joint enterprise between Defibox Technology and Hong Kong Noah Technology, NoahArk Tech Group is intent on growing the EOS ecosystem with a particular focus on DeFi. Decentralized finance has been slow to take off on EOS compared to other chains, but over the last 12 months, EOS Network Ventures has been making up for lost time.

More DEX, More DeFi

A good decentralized exchange is the foundation of all DeFi activity. Build it and everything else – lending platforms, liquid staking, perps, prediction markets – will follow. Ethereum has Uniswap. Avalanche has TraderJoe. Now EOS is determined to create some major DeFi protocols of its own which is why ENV has made such a considerable investment in NoahArk.

Funds will be directed at Defibox.io and Noahark.io, two of the leading DeFi platforms on EOS EVM. The EOS EVM, which runs in tandem with the main EOS chain, is ideally suited to decentralized finance thanks to its Ethereum compatibility. This makes it easier for users to bridge ERC20 tokens from other EVM chains. It also makes it easier for Solidity devs to create applications on EOS EVM or to port existing ones.

Bringing Deep Liquidity to EOS

For DeFi to be widely utilized on any network, several properties are desirable. Firstly, liquidity needs to be deep enough for users to trade with size. DEXes that can absorb large market orders without buckling will ensure that prices don’t get significantly out of sync with the rest of the market any time a whale enters the game.

The second property required for DeFi to flourish is good tooling and protocols that allow crypto assets to be used to full effect. Defibox and Noahark have already provided a foundation for economic activity to take place on the EOS EVM. Both platforms support swaps, lending, and flexible EOS staking. With funding courtesy of ENV in place, Defibox and Noahark will be able to take these features to the next level.

As NoahArk Tech Group CEO Eason explains:

“This investment from EOS Network Ventures, coupled with the reorganization of Defibox.io and Noahark.io, marks a transformative phase for the EOS DeFi ecosystem. In this new phase, the EOS EVM will significantly enhance our operational capabilities, making it easier for established products and developers to participate and enabling the fluid movement of various assets through cross-chain bridges.”

This calls for a combination of the right tech and the right talk. In other words, messaging needs to accompany the infrastructure improvements, so that users are aware of what they can do on EOS EVM and how this compares to other EVM chains.

Or as ENV’s Yves La Rose puts it:

“This move is more than just financial support; it’s a commitment to driving growth and new developments in DeFi. We see NoahArk Tech Group as a key player in enhancing decentralized exchanges and our strategic vision is to support the creation of more interconnected and user-friendly DeFi services, benefiting the entire sector.”

What’s good for NoahArk Tech Group should prove good for EOS users in 2024.

next

Blockchain News, Cryptocurrency News, News

You have successfully joined our subscriber list.

A new report released by the CFTC’s Digital Assets and Blockchain Technology Subcommittee has released a comprehensive report — “Decentralized Finance” — outlining the risks inherent in the burgeoning field of Decentralized Finance (DeFi).

Spearheaded by CFTC Commissioner Christy Goldsmith Romero, the report raises critical concerns about the lack of clear responsibility and accountability within DeFi systems. Its release aligns with previous concerns raised by the Department of Treasury regarding the potential for illicit finance risks in the DeFi space.

Romero has positioned the report as a critical tool to foster dialogue between policymakers and industry leaders, aiming to shape an informed and effective regulatory approach to DeFi.

Core Findings and Implications

The report stands as a comprehensive analysis of the DeFi sector, revealing how its benefits and risks are heavily influenced by the design and operational features of specific systems. A central concern identified is the lack of clear lines of responsibility and accountability in some DeFi systems.

According to the report, these gaps pose substantial threats to consumer and investor protection, financial stability, and market integrity while increasing the sector’s vulnerability to illicit activities, such as cyber hacks and financial crimes.

The report calls for urgent government and industry collaborative action to better understand and manage these emerging challenges. It marks an essential step in addressing the complexities of DeFi and serves as a wake-up call for the industry and policymakers.

The report also recommends specific actions to strengthen anti-money laundering (AML) and counter-terrorism financing (CFT) protections within the DeFi ecosystem. This involves assessing how identity information is collected in DeFi systems, identifying compliance gaps and requirements, and evaluating options for regulating and imposing identity information discoverability and verification requirements.

Policy recommendations

According to the report, the global nature of DeFi calls for enhanced monitoring, data gathering, compliance assessment with financial regulations, and identification of regulatory gaps. It outlines several recommendations to achieve these goals.

The report suggests increasing technical capacity and understanding of the DeFi sector. This involves developing continuous data gathering, monitoring, information sharing, and forming regulatory partnerships to comprehend DeFi systems’ operational nuances better.

Given the global nature of DeFi, the report emphasizes the importance of engaging and collaborating with domestic and international standard-setters, regulatory bodies, and DeFi developers. This international cooperation is crucial for harmonizing regulatory efforts and ensuring a cohesive approach to DeFi governance globally.

A significant part of the recommendations involves identifying and assessing various risks associated with DeFi. These include risks posed by asymmetric information, conflicts of interest, operational and security vulnerabilities, liquidity mismatches, over-leverage, and other forms of market manipulation. The report also highlights the need to address the financial and technological complexities of DeFi compositions and their inherent risks.

The CFTC suggests evaluating a range of potential policy responses to mitigate the identified risks. These responses might include implementing disclosure requirements, regulatory reporting, third-party auditing, entry restrictions, regulatory supervision, governance regulation, product regulation, balance sheet regulation, activity restrictions, structural regulation, and resolution planning.